The European market potential for table grapes

Being one the largest fruit categories, the table grape market in Europe is very mature. Grape companies that are anticipating on the trends such as seedless grapes and sustainable packaging will be most likely to participate on large markets such as the United Kingdom and Germany.

Contents of this page

1. Product description

The most imported grapes (scientific name: Vitis vinifera) are table grapes destined for fresh consumption. This factsheet focuses principally on fresh “table” grapes, unless the data is only available for all fresh grapes.

There are many different table grapes available, varying from white-green to red and dark blue. In Europe, the seedless varieties are most popular for consumption, such as the white-green Thompson and Sweet Globe, and the red Crimson, Flame Seedless and Ruby. There is a wide range of new varieties, complementing or replacing the older existing varieties. The majority of these grape varieties are produced under license. The seeded varieties are in decline (see trends below), but still widely cultivated and available, such as the white-green Italia, the red Globe and Victoria red.

Table 1: Product code and varieties

| Harmonised System (HS) code | 08061000 Fresh grapes 08061010 Fresh table grapes |

| Commercial cultivars (examples) | Seedless

Seeded

|

2. What makes Europe an interesting market for table grapes?

Table grapes are one of the most demanded fruit in Europe. The market is mature and consumption is relatively stable. Grape import takes place year-round and will gradually increase due to a declining production in Europe.

Grapes are a major fruit in Europe

Table grapes are among the most popular fruits in European consumption. The market for table grapes is mature, with large volumes and a relatively stable demand all year round. This means there are several supply windows throughout the year when you can step in and meet the demand.

With a value of 1.6 billion euros in 2021, table grapes have the highest import value after bananas and avocados. The import volume has gradually increased from 685,000 tonnes in 2017 to 787,000 tonnes in 2021 (see Figure 1). This reflects an average import growth of almost 4% per year. Prices can always fluctuate throughout the year, but the annual average of grape prices (import value per kilo) is very stable and often does not vary more than 5%.

Supply shortages in Europe can temporarily increase the need for external supply and oversupply is relatively easily absorbed. Retail promotions for (in-season) grapes are common. Over time the demand for grapes will continue to grow slowly, but no sudden big increases in consumption should be expected.

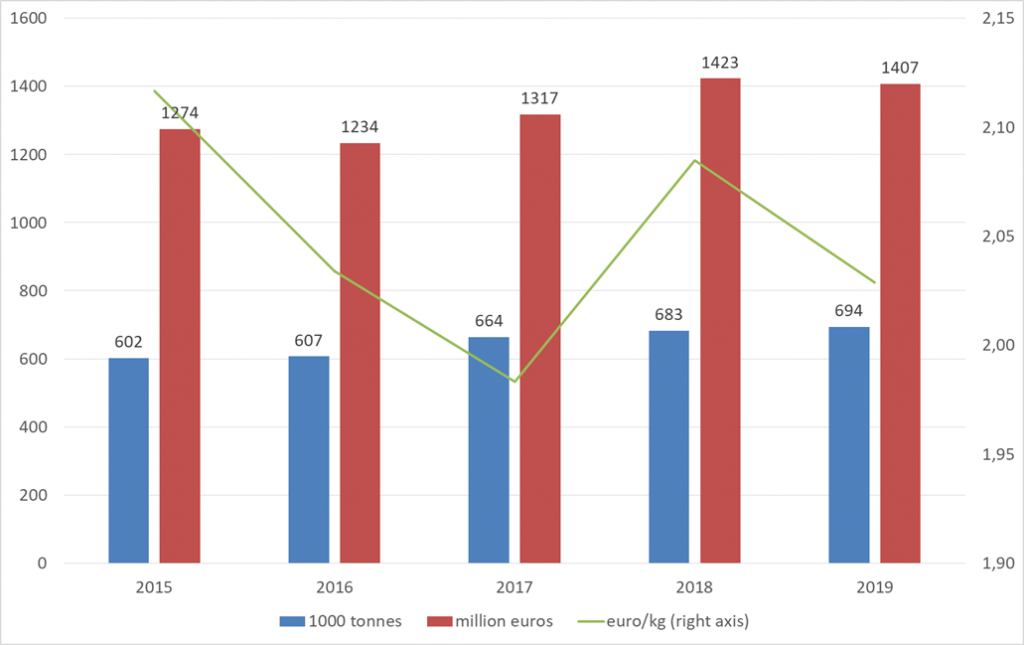

Figure 1: European imports of table grapes (from non-European suppliers)

Source: Eurostat / ITC Trade Map (calculations by ICI Business)

Tips:

- Stay up to date by subscribing to newsletters and reading news sites such as Eurofruit, FreshFruitPortal and Freshplaza with regular overviews of the global grape market.

- Visit the Fruit Logistica in Berlin, the largest trade fair for fresh produce in Europe. All the relevant traders of table grapes will be there.

The European table grape production is decreasing

Europe is the largest grape producer in the world, and a top-five producer of table grapes. But production costs in Europe are increasing and growing grapes is becoming less profitable. This creates opportunities for non-European suppliers that are competitive and overlap with the European season.

Europe produced almost 24 million tonnes of grapes in 2021. Only an estimated 1.7 million tonnes were table grapes for fresh consumption according to Eurostat. Other agricultural sources show even lower figures and a downward trend (see figure 2). Italy, Spain and Greece are the main producers of table grapes for the European supply. Italy is Europe’s main supplier with a stable production of around 1 million tonnes of table grapes per year.

In 2021, the Italian production in 2021 was slightly less due to very hot weather. At the same time, growing supply from Peru and Brazil pushed the sales of imported grapes in Europe. These foreign suppliers keep increasing and innovating to supply more to Europe.

Climate change will increasingly play a role in European grape production. But recently the production volumes have also been under pressure due to increasing costs and labour shortages. With European production decreasing, you can expect a growing need for imported grapes, especially early and later in the local season (June or November). Growers in Spain and Italy try to reduce this need by including late varieties that extend their seasons.

If Europe does well with production, it will have a positive trade balance and export volumes will be greater than imports – this happens most often in August and September. The bulk of the imported grapes arrive between December and May. This should be the main focus for most of the foreign suppliers.

Tip:

- See the different supply windows in the CBI study on Entering the European market for table grapes.

3. Which European countries offer most opportunities for table grapes?

Most imports from non-European suppliers are registered by the United Kingdom and the Netherlands. Unlike in the United Kingdom, the peak grape consumption in Germany and France takes place during the European season. Off-season imported grapes find their way into mainland Europe through the Netherlands. Spain may also become a better transit hub in the future for foreign suppliers.

The Netherlands: a logistical hub for table grapes

The Netherlands is an important logistical hub for long-distance table grapes. Therefore, you can use the Netherlands either for its logistics or for finding different trading companies that can distribute your grapes throughout Europe.

The Netherlands is the principal entrance point for table grapes into Europe. From here, a large volume is re-exported to the rest of Europe. This is especially true for table grapes from South Africa, India and South American countries. The supply from Egypt and Namibia has also increased in the past five years. From the 413,000 tonnes of imported table grapes, Dutch traders re-exported 340,000 tonnes. The Netherlands exports more foreign grapes than any other European country. Germany is the main destination for re-exported grapes.

The Netherlands usually offers a good reflection of what is happening in Europe. South Africa continues its growth as the principal supplier to the European market. Peru, Brazil and India have clearly increased their exports of competitive, seedless grapes at the expense of Chilean grape growers (see Table 2).

Table 2: Dutch imports of table grapes, in 1,000 tonnes

| 2017 | 2021 | change in % | |

| Total non-European supply | 251 | 413 | 64% |

| South Africa | 83 | 154 | 85% |

| Peru | 29 | 81 | 177% |

| India | 51 | 71 | 39% |

| Chile | 39 | 33 | -17% |

| Brazil | 17 | 29 | 69% |

| Egypt | 22 | 27 | 20% |

| Namibia | 7 | 17 | 162% |

Source: ITC Trade Map

Tips:

- Make use of Dutch traders when you have difficulties in entering different European markets. Dutch importers often have wide experience in trading and are familiar with the different European preferences. Dutch fruit companies have a no-nonsense mentality, so calling or visiting them often works better than e-mailing.

- Find some of the table grape traders on the member list of the Dutch Fresh Produce Centre, the organisation that looks after the interests of the fresh fruit and vegetable sector in the Netherlands.

United Kingdom: mature table grape market

The United Kingdom is probably the most mature import market for grapes in Europe. The market is saturated and the best way to enter this market is by replacing other suppliers with better prices or through new varieties, original packaging and other innovations (see trends below).

United Kingdom is a typical destination market with large imports and high consumption. The country imported a total volume of 266,000 tonnes of table grapes in 2021 and exported close to nothing (see figure 5). The British consumer eats on average over four kilos of grapes per person per year. So you can find a wide variety of grapes on the market. Seedless grapes are the common standard.

The British market is very stable, but the import from non-European suppliers has grown. For growers in Egypt and Morocco this has been a favourable side effect of Brexit. But is does not mean that the returns are better. The British market has become a price fighting market. Today, discount retailers Lidl and Aldi are absorbing an increasing share in table grape promotions. Retailers also look for more sustainable packaging options (see trends below).

For competitive suppliers the United Kingdom remains an important market. A main advantage of the United Kingdom is that most grapes are imported directly from diverse origins. Suppliers from South Africa, Chile, Egypt, Peru and India all successfully export grapes to the British market.

Figure 6: Retail promotion of seedless green grapes

Photo by kiliweb per Open Food Facts

Tips:

- Invest in product innovation to stand out on the British market, for example in special grape varieties or packaging options. Get inspiration by seeing what kind of grapes are already on the British market, for example in the assortment of the Tesco or Waitrose supermarkets.

- Read more about the characteristics of the UK market in Exporting fresh fruit and vegetables to the United Kingdom.

Germany: attractive market size

In absolute numbers, Germany is the largest consumer market in Europe for table grapes. Your main challenge in supplying the German market are regional and indirect imports (via trade hubs) as well as the high standards of retailers.

From the total import volume of 326,000 tonnes in 2021, 93% stayed in the country (see figure 5). This makes Germany the largest European market for fresh grapes. Whereas the United Kingdom imports directly from countries such as South Africa, Egypt and Peru, Germany sources large part of its grapes from Italy, Spain and through logistical hubs in the Netherlands. Germany’s consumption peaks during the European season.

The German market does not offer much growth, but there are opportunities for companies with premium varieties as well as organic grapes. Several Italian growers have already entered the organic niche market. But most of the grape market is driven by price and volume.

Discounters are increasingly dominating the market working with smaller margins. Most large food retail chains have a discount concept, such as Netto of the Edeka-Group, Penny of the Rewe-Group and Lidl of the Schwarz-group. To give an idea about the size of these discounters, the largest formulas have more than 3,000 outlets.

As a supplier, it is important to realise that supermarkets and discounters in Germany have high requirements but at the same time expect a reliable economic offer. This means you can potentially sell significant volumes to these retailers if your product meets all the requirements. The largest part of the overseas imports for supermarkets concerns seedless table grapes. Among the things you can expect to see in the near future is sustainable and plastic-free packaging. To supply the German market, it is important come prepared and show buyers how you reduce residues and unsustainable packaging.

Tips:

- Try to get into a supply contract with a supermarket or discounter for a reliable supply and a stable price. But be prepared for extensive paperwork such as filling in your actions on food safety and sustainability. You also may have to submit your pesticide spraying registers.

- Adopt different quality and sustainability standards to enter the German market. Read more about these standards in the buyer requirements for fresh fruit and vegetables and in the study about exporting fresh fruit and vegetables to Germany.

France: third-largest end market

A preference for local and in-season fruit makes France a smaller market for foreign grapes than Germany or the United Kingdom. But with a population of over 66 million consumers, it is the third-largest destination market for imported grapes. Most grapes are sourced in Europe.

France is one of the larger grape producers in Europe. In 2021 French vineyards produced almost 4.5 million tonnes of grapes. This was historically low due to frost. Most grapes were destined for the winery industry. Only 38,000 tonnes were sold as table grapes for fresh consumption. The import on the other hand was 134,000 tonnes. In table grapes France is not very competitive. French growers lack a wider variation of commercial cultivars for export and their climate is not as ideal for table grapes as further south in Europe. For that reason, the French consumption of fresh table grapes depends partly on the supply from Italy and Spain.

Like in Germany, the peak consumption in France takes place during the European season. Locally produced table grapes such as the black muscat and chasselas (both used for wine and fresh consumption) get higher prices in retail. But there is competition from other local fresh fruit such as peaches, apples and pears. These fruits have a higher production than fresh table grapes and are cheap to buy.

Competition of local fruit and a dominant supply from European growers make it difficult to find ample opportunities during the European season (July to November). Off-season, France sources most table grapes from South Africa, Peru, Chile and Morocco.

Tips:

- Learn about which table grape varieties are commonly grown and sold in France; look at grape varieties on AOP Raisin de table and the grape offer in supermarkets such as Carrefour. Discuss with potential buyers in France which varieties they think have potential – share samples if your variety is still unknown.

- Check out the market prices (in French) on the Market News Network of France Agrimer. Search for ‘raisin’ (grape).

Poland: offers opportunities for eastern suppliers

Surprisingly Poland is among the largest importers of table grapes. Because of its geographic location, Poland offers most opportunities for suppliers from the east.

Together with Romania and Austria, Poland is forming an eastern corridor for grapes from origins such as Turkey, Moldova and North Macedonia. In 2021 Eurostat registered a direct import of table grapes of 4,005 tonnes from Turkey and 2,586 tonnes from Moldova (see figure 7). The total grape import from these origins will be even higher when including indirect trade.

Grapes with other non-European origins, such as Peru, Chile and India, are often imported via the Netherlands or Germany. If your country is located far from Poland, traders in these countries can help getting your grapes on the Polish market.

Tip:

- Consider going to the Bronisze wholesale market where much of the Moldovan grapes are sold. This can be a good starting point to get contacts in the Polish grape market.

Spain: potential to become a trade hub

Spain is the second-largest producer and net exporter of table grapes after Italy. But recent years also show increasing imports. This provides new opportunities for suppliers of counter-seasonal grapes or nearby countries that can fill in supply gaps early in the Spanish season.

Spain produces roughly 300,000 tonnes of table grapes per year. On top of that the country imports another 70,000 tonnes of grapes. The imports from developing countries have tripled between 2017 and 2021 to 35,000 tonnes with a value of €74 million. Peru, Chile and Brazil supply the highest volume, and Peru and Brazil are responsible for most of the import growth. These increasing imports show that Spain is positioning itself as a trade hub for counter-seasonal grapes in Europe.

Tip:

- Find potential production and trade partners in Spain during the Fruit attraction trade fair.

4. Which trends offer opportunities or pose threats on the European table grape market?

By seizing the opportunities of important trends like convenience, new grape varieties and reducing the use of plastic you can stay ahead of competition and strengthen your relationship with European buyers.

Seedless and taste become leading factors for grape consumption

The European consumer has an increasing preference for convenience. This trend is positive for table grapes, because they are easy to consume and ideal as a fresh snack. To further improve the consumer experience seedless grapes are setting the new standard and are most appealing to consumers.

Seedless

Seedless grape varieties have become more dominant over the past years and their market share is expected to grow further. The United Kingdom was at the forefront of this development, but now they are the preferred variety in most of northern Europe. For example, the German market is close to 80% seedless. Southern and Eastern European markets have a more traditional consumption, including local grape varieties. Taste and price often drive the consumer purchase, but these markets will also follow the seedless trend in the next years.

Grape growers in Spain and increasingly in Italy and Greece have started a transition towards seedless grape production to meet the growing demand. Also in counter-seasonal regions such as Peru, Chile and South Africa, many growers are shifting to more seedless varieties. For example, until a few years ago Peru primarily produced Red Globe grapes, but now many producers such as Ecosac, Pampa Baja and Pedregal also produce seedless varieties such as Crimson, Flame, Timson, Magenta or Sugraone and continue to find new improved varieties.

Seeded grapes will not disappear from the market, but their demand will depend more on attractive pricing or distinction in taste.

Taste

Because grapes are often consumed as a snack and as a product of indulgence, you must consider consumer experience as an important success factor for your product. Especially when dealing with experienced buyers, who appreciate premium quality, you can distinguish yourself with superior quality and taste. For example, there is a growing niche for highly aromatic varieties such as the Sable Seedless or Cotton Candy.

Specific preferences can differ per region and buyer. Most importantly, besides offering seedless grapes, your product must be fresh, sweet and crisp.

Competition drives variety renewal

Competition and production costs in the grape industry are on the rise. The increasing costs of inputs, logistics and labour have affected grape suppliers globally. Producers today not only look for varieties with the best taste, but also those that are high-yielding with the minimum amount of inputs.

There is a constant renewal of varieties. Companies such as the South African Exsa work with International Fruit Genetics (IFG) to evaluate and introduce new grape cultivars that offer the best combination of quality, taste and growing properties. A partnerships between Cornell AgriTech and Sun World International recently led to the release of two new, early-ripening varieties that have powdery-mildew resistance and cold-hardiness.

The inflation of costs may push growers towards the most efficient grape varieties. But industry stakeholders agree that quality must be protected. This is not always easy. Being a main category for European retailers, grapes must remain affordable. As a supplier you have to decide for yourself what will be the best strategy. One thing is certain: you must focus on innovation to cope with inflating costs and strong competition.

Tip:

- Work together with grape breeding companies and get information about new varieties from breeders such as International Fruit Genetics (IFG), Sun World International and SNFL group. Select the grape varieties that best suit your client’s market. Visit your export market regularly to update your market knowledge.

New movement drives sustainable and plastic-free packaging

Reducing plastic and making packaging more sustainable will be key for future table grape sales. It is very contradictory to the demand for convenience, but it will impact the packaging practices of all grape suppliers.

The abundant use of packaging was already an issue in the minds of many retailers and conscious consumers. But since the European Parliament approved the new law banning single-use plastics, companies are forced to take action.

Currently most grapes are sold in punnets or clamshell packages, for example 500g, but smaller snack-sized packages such as 250g or 170g are also increasingly available. These smaller packages do not increase the total volume of grapes, but it only adds to the plastic waste.

There is a need for more sustainable packaging and exporters must be prepared for this change. Grape packers were already using more and more top-sealed punnets to reduce the plastics of lids (clamshells). Now companies have started to implement new sustainable packaging such as biodegradable and compostable carry bags for grapes and cardboard punnets (adopted by retailer Waitrose). For organic grapes, sustainable packaging such as cardboard is a real selling point.

It is good to anticipate changes and be innovative with packaging solutions. But the developments in this field are not yet complete. It will be a challenge to evaluate and implement packaging options which are suitable and acceptable in your target market. Leading retailers and organic brands are probably first to demand sustainable or plastic-free packaging, but you can expect structural changes throughout the whole table grape sector.

Figure 8: Example of organic grapes in carton punnet, sold by Coop in Switzerland

Photo by torredibabele per Open Food Facts

Tips:

- Offer different packaging options to your client and anticipate developments in sustainable packaging and convenience products. Using attractive packaging will also help distinguish your product.

- Read more about which trends offer opportunities on the European fresh fruit and vegetable market on the CBI market intelligence platform.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research