Entering the European market for tomatoes

Food safety certifications, combined with frequent and reliable laboratory tests, make tomato exporters more attractive when exporting to Europe. Having no or very low amounts of pesticide residues is important in the European market. Spain and the Netherlands are the leading European competitors. Morocco and – to a lesser extent – Turkey are the main non-European suppliers. The best opportunities can be found in corporate social responsibility (CSR) and environmental certifications, as well as in working with established suppliers of European retail chains.

Contents of this page

1. What requirements must fresh tomatoes comply with to be allowed on the European market?

Obtaining the GLOBALG.A.P. certification is needed to enter the European tomato retail market. Having lower pesticide residues than legally allowed is also important. To keep up with the European market, tomato suppliers should invest in sustainable production methods. Having a sustainable supply chain is very important. The main sustainability requirements are related to low carbon emissions and transparent supply chains.

What are the mandatory requirements?

All foods sold in the European Union must be safe. This also applies to imported products. The levels of harmful contaminants, such as pesticide residues and microbiological contaminants, must be limited.

Be aware of tariff barriers

Tariffs are one of the main trade barriers for non-European exporters of tomatoes to Europe. In order to protect its own tomato producers, the European Union has set up a system of entry prices for suppliers from non-European countries. This means that the applied tariff level depends on the tomato price and the export date. However, there are big differences between supplying countries, depending on specific free trade agreements with the European Union. The table below shows some basic information about the minimum applied tariff.

Table 1: Conditions for the minimum applied tariff for non-European tomato suppliers

Ad valorem tariff (percentage of value) | Period | The lowest price limit |

| 8.8% | 1 January – 31 March | € 0.846 |

| 8.8% | 1 April – 31 April | € 1.126 |

| 8.8% | 1 May – 14 May | € 0.726 |

| 14.4% | 15 – 31 May | € 0.726 |

| 14.4% | 1 June – 30 September | € 0.526 |

| 14.4% | 1 October – 31 October | € 0.626 |

| 8.8% | 1 November – 20 December | € 0.626 |

| 8.8% | 21 December – 31 December | € 0.676 |

Source: Autentika Global compilation based on the (EU) 2022/1998 regulation

The table above is only a summary of the tariffs if the exporting country has no free trade agreement with the European Union. The rates are only applicable for the prices above set limits. If the prices are lower, a specific duty is added according to the weight. This added duty depends on the price difference. The lower the prices, the more duty is added, and vice versa. This system is making prices of non-European suppliers higher during the summer season in Europe.

Separate tariff calculation rules and minimum prices are applied for cherry tomatoes and other tomatoes. Tariffs are normally paid by the European importer. To calculate the tariff rate, the importers can use invoices as well as the Standard Import Value. The Standard Import Value is the comparison of all imports coming from a given country and it is calculated on a daily basis.

Tip:

- Use the Acces2Market Trade Assistant tool to calculate the applied tariffs for tomatoes exported from your country to Europe.

Obtain an official phytosanitary certificate

The European Union looks at food products to protect citizens, animals and plants from diseases and pests. Two common ways in which it does this are through food inspections and by issuing a phytosanitary certificate before export. Phytosanitary certificates are issued for plants or plant products that can be reproduced within Europe after import, including tomatoes.

The regulation for the trade in plants and plant products from non-EU countries states that a phytosanitary certificate for tomatoes must guarantee that the area where tomatoes are grown is free from fruit borer (Neoleucinodes elegantalis) and tomato pinworm (Keiferia lycopersicella).

For tomatoes from Australia, New Zealand, South or North America, the phytosanitary certificate must also guarantee that the production area is free from potato psyllid (Bactericera cockerelli). For tomatoes from Bolivia, Colombia, Ecuador, Peru or the United States, the area must be free from bud midge (Prodiplosis longifila)

Tip:

- Verify with the National Plant Protection Organisation (NPPO) which authority in your country is authorised to inspect food products and issue phytosanitary certificates.

Contaminant control in fresh tomatoes

The European Commission Regulation (EU) 2023/915 sets a maximum for certain contaminants in food products. This regulation is frequently updated. Apart from the limits set for general foodstuffs, there are a number of specific contaminant limits for specific products. The most common requirements about contaminants in tomatoes are related to pesticide residues, microbiological organisms and heavy metals.

Regularly check pesticide residues

The European Union has maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticide residues than allowed will be withdrawn from the European market. The majority of European importers will request a detailed test on the presence of pesticides. Sometimes, more than 500 different types are tested.

Pesticide residues are one of the main reasons that tomatoes are rejected at the border. The European Union regularly publishes a list of approved pesticides (Regulation (EU) No 540/2011) that are used in the European Union. This list is frequently updated. In 2022 and 2023, several pesticides were banned from the European market. Specifically for tomatoes, the insecticide oxamyl is banned. Oxamyl played a large role in the rejection of tomatoes at the European borders in the past years.

An important point is the level of the insecticides Chlorpyrifos and chlorpyrifos-methyl. These two insecticides are banned in the European Union but are still used in other countries. From November 2020, an MRL is set to 0.01ppm for imports. However, there are still many cases in which the Chlorpyrifos residue levels in tomatoes are above this level. Other pesticide residues that are frequently found in tomatoes are Flonicamid and Chlorothalonil.

In 2020, the European Union implemented a set of policies and actions called the European Green Deal. Its aim is to make the European economy more sustainable and climate neutral by 2050. The action plan includes a 50% reduction in the use of pesticides and a commitment that 25% of the share of agricultural land is used for organic farming by 2030. This means that many pesticides will be banned, and residue levels will decrease over the next years.

Control heavy metals, metalloids and chlorate levels in your tomatoes

Tomatoes can be contaminated with heavy metals from the soil in which they are grown. Therefore, it is important to test for the presence of heavy metals. The limits for heavy metals are set to 0.05 mg/kg for Lead and 0.02 mg/kg for Cadmium.

The levels of chlorates and perchlorates have been set at 0.05 mg/kg for tomatoes. Chlorate is no longer approved as a pesticide, but it can come into contact with tomatoes through the use of chlorinated water during washing. Another source may be chlorinated detergents used to clean facilities and packaging equipment.

Waxing is not allowed

Waxing the tomato fruit can make it glossier and increase its shelf life. It is used in some countries, but it is not allowed to be used for tomatoes in Europe (Regulation (EU) No 1147/2012).

Follow marketing standards

Part 10 of Annex I in Regulation (EU) No 543/2011 and the Regulation (EU) 2019/428 amendment lay down the marketing standard for tomatoes. A similar marketing standard for fresh tomatoes is also described in:

- The UNECE Standard FFV-36 concerning the marketing and commercial quality control of tomatoes (2017 edition);

- The FAO Standard for Tomatoes (CXS 293-2008) in the Codex Alimentarius.

Along with those standards, individual countries can also have their own marketing standards.

Every set of standards classifies tomatoes into 3 quality classes: Extra, Class I and Class II. European retailers almost always require ‘Extra Class’ or ‘Class I’ tomatoes as a minimum for retail sales. Tomatoes in those classes must be of a uniform colour typical for the cultivar, and almost without any visible defects in shape and skin appearance.

Also, ‘Extra Class’ and ‘Class I’ tomatoes must be classified by size: either by diameter, by weight or by count. However, sizing is not obligatory for cherry tomatoes below 40 mm in diameter and for ribbed tomatoes of an irregular shape.

Packaging and labelling requirements

The contents of the packaging must match with the quantity indicated on the label. However, there is some tolerance to weight due to weight loss. Tomatoes lose moisture during storage and transport, resulting in weight loss. You should communicate this expected weight loss with your buyer in advance. Weight loss also depends on the level of ripeness and the cultivar. It can be reduced by the type of packaging and the temperature inside the cooling chambers.

Figure 1: Example of export labelling

Source: Autentika Global

The export-packaging label should indicate:

- the name of the product (‘tomatoes’);

- a description (for example, ‘Cherry Roma’);

- the name and physical address of the packaging company;

- the country of origin;

- the class;

- the size;

- the lot number.

It is also common practice to put the name or code of the grower and the name of the variety on the label.

Comply with the sustainability requirements to be competitive on the European market

Some of the most relevant European laws and legislation related to environmental sustainability are incorporated into the European Green Deal (EGD). The EGD is a set of policies with the aim to make Europe climate neutral by 2050. Climate neutrality means reaching a balance between greenhouse gas emissions and removals, which is expected to limit global warming. This state is known as zero emissions and can be reached if global warming is limited to 1.5°C.

The most important impacts of the EGD for tomato suppliers are:

- Stimulation of organic production and consumption – One of the aims of the Farm to Fork Strategy is to increase the share of organic agricultural land in Europe to 25% by 2030.

- Introduction of the environmental footprint methodology – In line with ‘sustainable food systems’, the European Commission will publish official methods for ‘green claims’ to prevent ‘greenwashing’ and better inform consumers about the food choices they make.

- Endorsing greater corporate responsibility and sustainability standards through the Corporate Sustainability Due Diligence Directive.

- Reducing packaging waste – The main aim of the packaging waste directive is that ‘All packaging in the European Union must be reusable or recyclable in an economically viable way by 2030’. Some countries are aiming to reduce plastic even faster than proposed by the EGD. For example, France has already imposed a ban on plastic packaging for fresh fruit and vegetables in containers of less than 1.5 kg.

- Reducing the usage of pesticides by 50% by 2030 – A proposal for the directive of Sustainable use of pesticides has been adopted.

Tips:

- Be sure to perform laboratory tests only in ISO/IEC 17025:2005-accredited laboratories.

- Review your treatment practices to ensure that your tomatoes do not contain pesticide residues above the set limits.

- Refer to the Codex Alimentarius for the Code of Hygienic Practice and the Code of Practice for Packaging and Transport of Fresh Fruit and Vegetables to meet the requirements of European food safety legislation.

What are the additional requirements that buyers often have?

Many private requests have become just as important as mandatory requirements. These include compliance with food safety, quality and sustainability standards.

Specific quality requirements

Specific buyer quality requirements for fresh tomatoes can be related to the following:

- Level of ripeness (ripeness index) – To influence shelf life and the post-harvest ripening time, your buyers may request a specific level of ripeness. Usually, the level of ripeness is determined by colour charts, colorimeters and a sampling of cut tomatoes. For example, it is common to harvest red cultivars when the green colour starts to turn pink. Another, equally important ripeness criterion that influences the time of harvest is the firmness of the skin. This is measured with specific instruments.

- Use of ripening regulators – The ripeness of tomatoes can be delayed or accelerated by using ripening regulators. Usually, 1-Methylcyclopropene (1-MCP) is used to delay the ripening process. Meanwhile, Ethylene is used to accelerate it. Although both substances are authorised in Europe, they are not allowed to be used for the organic farming of tomatoes. You should discuss the use of ripening regulators with your buyer. The development of new environmentally friendly regulators is in progress.

- Brix level – The Brix level is expressed as the sugar level of tomato juice. It is an important indicator of ripeness, sweetness and taste. It is also one of the most important quality parameters for tomatoes used for processing. It is measured by refractometers. In ripe tomatoes, it usually varies between ºBrix 5–7.

- Other biochemical parameters – Some buyers may request specific chemical quality parameters such as dry matter, soluble solids, titratable acidity, water content, carotenoid content and lycopene content. Although those parameters are sometimes included in the product specification, they are usually not limitation factors compared to other requests. Only titratable acidity is used in relation to the Brix level to determine ripeness. This is done through the Maturity Index formula.

- Aroma, flavour and texture – Although the taste and mouthfeel of tomatoes is a subjective quality factor, it is of extreme importance for tomato consumers. Skilful testers can be hired to suggest specific descriptive characteristics for different tomato cultivars.

- Storage and transport temperature – It is important to properly instruct shipping companies, buyers, and packers about the ideal temperature and humidity during storage and transport. A higher degree of ripeness requires lower temperatures and vice versa. Precise instructions must be given for specific cultivars and times of transport. For storage and transport, a common temperature range is 8–10 C° and the relative humidity should be around 90%. It is important to monitor the ethylene concentrations in storage rooms.

- Specific cultivar and agricultural practices requests – Some buyers may subcontract you in advance. In those cases, they may provide you with tomato seeds and give specific farming instructions related to integrated pest management. Instructions can contain a list and frequency of pesticide implementation. Those pesticide limits can be stricter than the legal limits.

Export packaging requirements

Bulk packaging of tomatoes for export is agreed upon with the buyer. Tomatoes can be repacked in the importing country. Alternatively, the buyer can request specific packaging according to the instructions from retailers. Due to sustainability concerns, it is now common that strong corrugated carton trays make up the main bulk of packaging. These trays can be filled with tomatoes directly, but they can also contain smaller individual packs inside. The tray depth is customised to the level of ripeness and weight to avoid potential damage by pressure.

The common weight for carton trays is 6 kg. Depending on buyer requests, plastic can also be used. In such cases, reusable packaging containers are increasingly requested (such as IFCO). This trend is also present in pallet handling, where reusable pallets are increasingly used (such as CHEP).

Get food safety certified

Although food safety certifications are not obligatory under European legislation, they have become a must for almost all European food importers. Most established European importers will not work with you if you cannot provide some type of food safety certification. Most European buyers will request the GLOBALG.A.P. certification, but they may also request other certification schemes recognised by the Global Food Safety Initiative (GFSI).

For packaging operations, the most popular certification programmes are:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

Although the different food safety certification systems are based on similar principles, some buyers may prefer a specific management system. GLOBALG.A.P. is commonly accepted by buyers in all of Europe, but requests for packaging houses may be different. For example, British buyers often require BRCGS, while IFS is more common for German and French retailers. Note that food safety certification is only a basis to start exporting to Europe. Serious buyers will usually visit or audit your farming and packaging facilities before a potential cooperation.

Apply additional social and environmental sustainability standards

Companies have different requirements for corporate social responsibility (CSR). Some companies require adherence to their code of conduct or request audits. Common audits focused on labour conditions are by:

- Supplier Ethical Data Exchange (SEDEX)

- Ethical Trading Initiative (ETI)

- Business Social Compliance Initiative (amfori BSCI)

The GLOBALG.A.P. certification developed several add-ons related to sustainability. The most famous is the GRASP assessment on labour and human rights at farm level, which is used in combination with the Integrated Farm Assurance standard. Other GLOBALG.A.P. add-ons focusing on different sustainability aspects include the Sustainable Program for Irrigation and Groundwater Use (SPRING), the SIZA Environmental Standard (relevant for producers in South Africa) and the GLOBALG.A.P. Farm Sustainability Assessment Add-on (in cooperation with SAI Platform).

Fairtrade is the most famous ethical certification worldwide. However there are still only a few Fairtrade-certified producers in the tomato sector. In June 2023, there were 11 Fairtrade (FLOCERT) certified tomato suppliers in total from the following developing countries: Morocco (3), Uzbekistan (3), India (2), Sri Lanka (1), Tunisia (1) and Thailand (1). Fairtrade-certified products that carry the label indicate that producers are paid a Fairtrade premium in addition to the minimum price. The Fairtrade premium is 15% added to the commercial price.

Comply with the additional requirements of the European retail chains

As most imported tomatoes in Europe are aimed at retail sales, it is important to comply with their requirements. One of the common requirements is the reduction of pesticide usage. For example, in several European countries, Lidl MRLs limits are 33% lower than official regulations. These pesticide reduction programmes are even stricter for some other retail chains, such as REWE and Edeka in Germany (70%) and ALDI in the Netherlands and Germany (80%). Some retailers have banned certain pesticides, such as Marks & Spencer.

Along with pesticide residues, suppliers of fresh fruit and vegetables must be additionally audited or certified to supply specific retail chains. Several European chains have developed special certification modules in addition to the GLOBALG.A.P. certification. Examples of these audit schemes are the Tesco Nurture Module (by Tesco), the Pesticide Transparency Add-on (by Coop Italia) and the AH-DLL GROW Add-on (by Albert Heijn and Delhaize).

In addition to food safety requirements, many European retailers request transparency and sustainable practices throughout the entire supply chain. It is common that retailers have their own code of conduct for suppliers. Some examples are Lidl and Kaufland (the Schwarz Group), Rewe, Carrefour, Tesco and Ahold Delhaize.

Tips:

- Get a food safety certification. Carefully select a certifying company and consult with your preferred buyers about their certification preferences.

- For general and other additional requirements, see the CBI Buyer Requirements for fresh fruit and vegetables, the CBI Tips to Go Green and the CBI Tips to become a Socially Responsible Supplier.

- Consult the OECD-FAO Guidance for Responsible Agricultural Supply Chains to make your supply chain more sustainable.

What are the requirements for niche markets?

Organic tomatoes

Organic certification schemes are increasingly popular in Europe. Although organic production was reserved for niche markets until recently, organic products are now becoming mainstream. However, certain types of organic certifications can still be considered niche requirements, such as ‘biodynamic’ (Demeter or BDA).

To market tomatoes as organic in Europe, they must be grown using organic production methods. Farmers and packaging facilities must be audited by an accredited certifier before exporters can put the EU organic logo and the logo of the standard holder on their packaging. Examples are Soil Association in the United Kingdom, Naturland in Germany and Agriculture Biologique in France.

If you are aiming to produce and export organic tomatoes to Europe, be aware of important new rules that may affect your business. The New organic regulation (Regulation (EU) 2018/848) entered into force on 1 January 2022. The application of the new regulation can have a significant impact on exporters from non-European countries. Countries that have an agreement on trade in organic products with the European Union will have to make changes in their organic standards to be recognised as compliant with new regulations.

The new organic regulation is accompanied by more than 20 secondary acts that regulate the production, control and trade of organic products in more detail. Some of the important acts to be aware of are:

- the detailed organic production rules;

- the list of authorised substances for plant protection;

- the rules on documentation requirements for imports.

Ethnic certification

Islamic dietary laws (Halal) and Jewish dietary laws (Kosher) propose specific dietary restrictions. If you want to focus on the Jewish or Islamic niche markets, you should consider implementing Halal or Kosher certification schemes.

Tips:

- Read the CBI study on Trends on the European Fresh Fruit and Vegetables Market for an overview of the developments of sustainability initiatives in the European market.

- Stay up-to-date on new sustainable initiatives and innovations through participation in the Sustainability Initiative Fruit and Vegetables (SIFAV).

- Consult the Standards Map database for information on a wide range of sustainability labels and standards.

- Read the training materials on the new organic regulation by the Alliance for Product Quality in Africa project to timely prepare for the new legislation.

- Read more about payment and delivery requirements in the CBI Tips for organising your export and Tips to do business with the European buyers of fresh fruit and vegetables.

2. Through what channels can you get tomatoes on the European market?

How is the end market segmented?

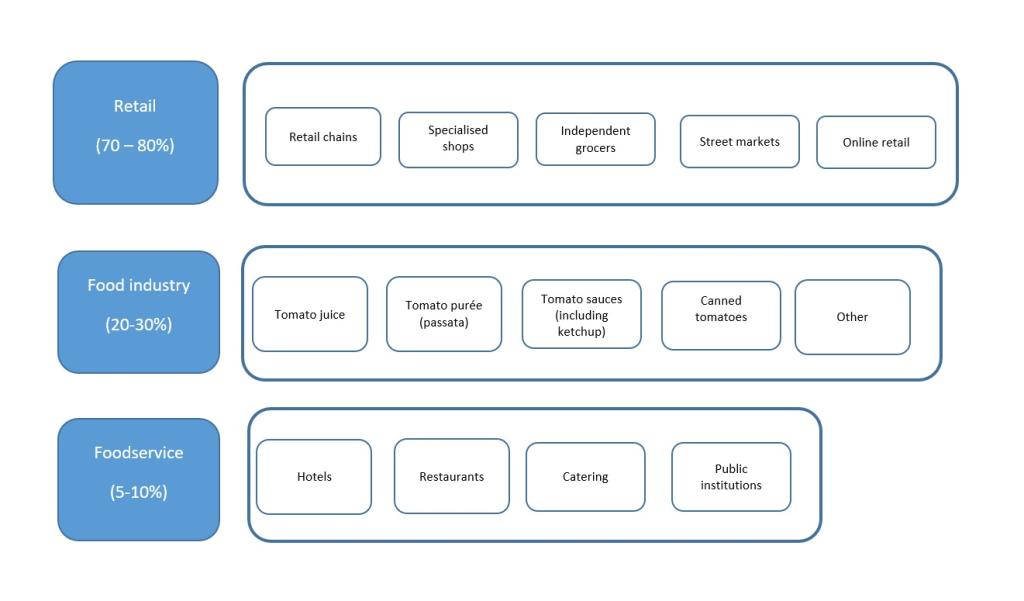

In Europe, tomatoes are mostly used for home consumption, so retail sales have the largest share. In addition, the consumers produce the same quantities themselves. Up to one-quarter of tomatoes supplied to Europe is used for processing (Figure 2). The remaining share of the market is consumed by the foodservice sector. As this study covers the market for fresh tomatoes, the food industry segment will not be elaborated on.

Figure 2: End-market segments for tomato products in Europe

Source: Autentika Global

Retail segment

Retailers rarely buy directly from developing country exporters. In the majority of cases, tomatoes are supplied via intermediaries such as specialised packaging and distribution companies. The main development of the tomato retail segment is the increasing share of discounters. Consolidation, market saturation, strong competition and low prices are key characteristics of the European tomato retail market.

Several types of subsegments of the European tomato retail segment include:

- Retail chains – the main developments for the leading mainstream retails are an increasing share of private label tomatoes and the introduction of own organic and more luxury tomatoes, such as black, extra-large and mixed colour varieties. The companies that hold the largest market shares in Europe are the Schwartz Gruppe (Lidl and Kaufland brands), Carrefour, Tesco, Aldi, Edeka, Leclerc, Metro Group, Rewe Group, Auchan, Intermarché and Ahold (Delhaize, Albert Heijn and several other brands).

- Specialised shops – includes organic food and ethnic shops. Mainstream retailers regularly sell organic tomatoes, but they are also sold (mostly unpacked) through specialised organic food retail chains. These chains are often independent, such as Alnatura or Biomarkt, but they can also belong to an already existing retail chain, such as Carrefour Bio. Specialised shops provide specific opportunities for entering the market, but they often source tomatoes from specific origins. This is the case with Turkish groceries in Germany, for example.

- Ethical stores – a niche segment. They provide opportunities for Fairtrade and ethically-certified suppliers. Sales of Fairtrade-certified products are strong in Germany, France, the United Kingdom and the Scandinavian countries.

- Online retail – often part of existing retail traders or specialised shops. Since the start of the COVID-19 pandemic and the lockdown measures, online retail orders have dramatically increased. Most leading retail chains in Europe offer online purchasing, and some are online-only stores. The most notable example is the British online-only retailer Ocado. It is expected that online sales will continue to rise after 2021 compared to the previous years.

Foodservice

World cuisines, healthy food and food enjoyment are the major driving forces in the food service channel in Europe. Foodservice sales in Europe have decreased due to the influence of the COVID-19 pandemic but the market started recovering in 2022 and 2023. A major impact of COVID-19 on the foodservice segment is the strong development of catering services. Many restaurants offered catering and home-delivery services during 2020 and 2021.

The foodservice channels (hotels, restaurants and catering) are usually supplied by wholesalers. However, there is a trend of retailers supplying this segment. A notable example is the German headquartered company Metro AG, which operates under the brands METRO and MAKRO. The store network comprises more than 600 stores in more than 20 countries. The company specialises in supplying hotels, restaurants and catering companies. A part of Metro is Rungis Express, which is also specialised in foodservice supply.

The European market for tomatoes can be segmented into common and more luxury varieties. However, all those varieties are usually sold in all types of retail formats. There is almost no specialisation in tomato sales according to price levels. Discounters as well as mainstream supermarkets sell both cheap and expensive cultivars. Figure 3 below illustrates the sales of more ‘luxury’ tomato varieties, but cheaper cultivars are also sold in the same place.

Figure 3: Local tomato cultivars in a Spanish supermarket

Source: Autentika Global

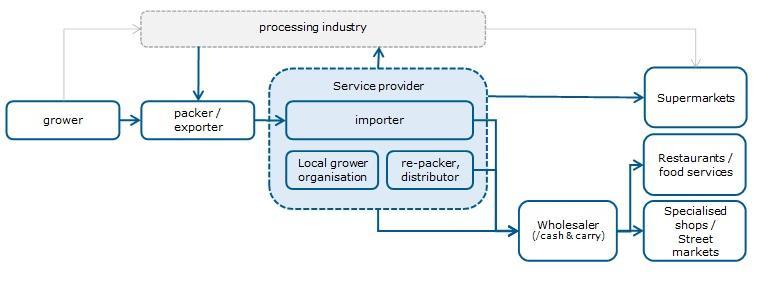

Through what channels do tomatoes end up on the end-market?

The most reliable channel is that of service providers that supply supermarkets. Consider that many specialised importing companies have integrated producers into their business.

Figure 4: European market channels for tomatoes

Source: ICI Business

Importers

In most cases, importers act as wholesalers. Importers play a central role in the distribution of tomatoes. They can sell tomatoes to packaging companies, who pack them for consumers. However, many importers also have vegetable conditioning, storage and packaging facilities themselves. They are familiar with all the different buyer requirements and can distribute to different market channels, such as wholesalers and supermarkets.

Some specialised importers integrate their supply chain to make supply and product quality more reliable. For example, the French company Azzura Group sources tomatoes from Morocco, but they supervise producers. Tomato growers willing to supply Azzura are provided with high-quality grafted plants from the company’s own nursery. Another example is the Compagnie Fruitière, which sources cherry tomatoes from its own plantations in Senegal.

Still, most importers in Europe are specialised in intra-European import. Some of them have a long-term cooperation with Spanish suppliers and may not be interested in new tomato origins. Importers of tomatoes commonly import other types of vegetables as well, so offering other products in addition to tomatoes can increase your competitiveness.

The position of importers and food manufacturers is put under pressure by retail. The higher requirements from the retail industry determine the supply chain dynamics from the top down. This pressure is translated into lower prices. But it also affects added-value aspects such as ‘sustainable’, ’natural’, ’organic’ and ’fair trade’ products. As a result, transparency is needed in the supply chain. To achieve this, many importers develop their own codes of conduct and build long-lasting relationships with preferred suppliers.

Service providers provide access to supermarkets

Successful suppliers to supermarkets often position themselves as service providers. They organise the supply chain according to the needs of their clients, from sourcing to packing and branding.

Supermarkets usually work with supply programmes and want to buy as close to the source as possible. This gives them control and transparency within their supply chain. They require volume and reliable quality all year round, and they look for partners that can organise this and unburden them. You can become part of this supply chain if you are able to offer the quality and logistics that service providers and supermarkets require.

Companies that can guarantee a year-round supply often combine local production and different import sources, working closely together with growers. There are many such companies in Spain and the Netherlands. Examples are Eminent (the Netherlands, sourcing from several origins including local production), Juan Garcia Lax (Germany, sourcing from different origins), Greenery (the leading cooperative in the Netherlands) and Horticola Ikersa (Spain, sourcing from Spain but also from Morocco).

Tip:

- Read more about traceability requirements in the CBI study on Buyer Requirements for fresh fruit and vegetables.

Wholesalers (spot market)

The wholesale channel is crucial for gastronomic clients. Traditional wholesalers cover the spot market and move according to the fluctuations of the fresh trade. Many wholesalers also display their assortment on wholesale markets, such as New Spitalfields market in London and Rungis in Paris.

What is the most interesting channel for you?

Choosing the most suitable channel for your fresh tomatoes depends on your profile as a supplier. If you have a very special offer (such as an attractive and tasty cultivar) and food safety and social certifications, your chances are higher. However, be aware of the strong competition from Spain and the already existing supply channels, such as from Morocco.

The best way to arrange a reliable supply chain is by working together with major service suppliers in supply programmes or by integrating your production and cooperating with European partners. This is doable if you have a large and high-quality production volume. Several import companies with cultivation projects in North Africa manage their own production with Western investment and management. These integrated supply chains can make it difficult for other producers and exporters to enter the main channels.

When working with many small growers, it will also be difficult to access the larger retail chains. You will need to do product testing and have certifications in place for every grower. This requires a lot of paperwork, and the complexity of this is often underestimated. When you cannot compete in the major supply chains, focus on reliable traders and importing wholesalers. Give preference to buyers that have a regular demand and reasonable purchase conditions.

Tips:

- Study lists of exhibitors for large trade fairs, such as Fruit Logistica or Fruit Attraction to find potential buyers and partners for your supply. If you aim to supply private labels of supermarkets, explore subcontracting opportunities at PLMA.

- To reach the food service segment, look for suppliers at specialised food service events, such as SIRHA or Internorga.

- Retailers need sustainable products. Make yourself more competitive by investing in different certification schemes related to corporate social responsibility (CSR), organic and food safety.

- Visit wholesale markets in Europe to see what is on offer and who is buying fresh tomatoes.

3. What competition do you face on the European tomato market?

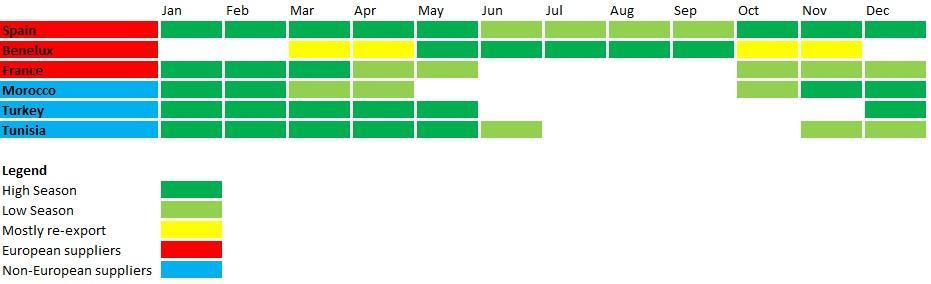

The European tomato market is very competitive, with the largest supply coming from local producers. Spain has an enormous market share and supplies most of Europe, except during the summer months (see Figure 7). Germany and Dutch suppliers also provide logistical services for Spanish tomato traders. There are very few non-European suppliers. Morocco is the leading exporter to Europe, followed by Turkey.

Which countries are you competing with?

The main competitors for emerging tomato suppliers within Europe are Spain, the Benelux (especially the Netherlands and Belgium) and France. These countries supply more than 60% of all tomatoes. The leading non-European suppliers, Morocco and Turkey, supply nearly 30%. The remaining 10% is imported from other countries, such as Tunisia, Senegal and countries in Eastern Europe.

Source: ITC TradeMap and Eurostat

The Netherlands is the leading supplier to other European countries in terms of exported quantities, but it should not be considered as a main competitor. In fact, the Netherlands is a much smaller producer than Spain. Statistical export figures show the position of the Netherlands as a transit country. Tomatoes imported from Spain and Morocco are re-exported via the Netherlands together with the locally-produced tomatoes. Therefore, the Netherlands can be seen as a potential import market and competitor at the same time.

Source: ITC TradeMap and Eurostat

There is a continuous supply of fresh tomatoes in Europe. During the European summer months (approximately June–September), most tomatoes that are consumed are from domestic production. During this period, production in Central, South and Eastern Europe is almost self-sufficient and import is minimal. However, in the winter (October-May) most tomatoes are supplied by Spain or imported from non-European countries. Suppliers from developing countries should focus their offer on winter sales and understand the competition of Spain, Morocco and Turkey.

Figure 7: Supply season of fresh tomatoes in Europe

Source: Autentika Global

Spain, the leading European supplier of tomatoes

Spain is the world’s fifth largest and Europe’s largest producer of tomatoes for fresh consumption. Although Italy produces more tomatoes than Spain, most Italian tomatoes are used for processing.

Spanish tomato production is showing a continuous decline. Over the last five-year period, Spanish production decreased by an annual rate of -5%, reaching 1.65 million tonnes in 2022. The main reasons for this lower production are high labour and energy costs. Some farmers are switching to less labour-intensive crops like aubergines, courgettes and peppers. Water scarcity is another problem, especially in the main tomato region, Andalusia. Tomato viruses and leaf miners have also contributed to the decline.

However, the sector is showing the first signs of recovery. After a significant reduction in the tomato production area over the past few years, the planted area for the 2022/23 season has increased by 1000 ha in the largest producing area, Almeria.

In line with the production, Spanish export is also decreasing. Spanish tomato export in 2022 was 610,000 tonnes. This is a decrease of 200,000 tonnes compared to more than 813,000 tonnes in 2018. Almost all quantities were exported to other European countries, with an insignificant share exported out of Europe. The main export destinations for Spanish tomatoes in 2022 were Germany with a 28% share, followed by France (14%), the Netherlands (12%) and the United Kingdom (8%).

Almeria is the most concentrated greenhouse tomato production area in Europe. More than one-third of the tomatoes produced in Spain are produced in Almeria, followed by Murcia, Alicante, Granada and Las Palmas. Thanks to its subtropical-Mediterranean climate, greenhouse production can be maintained throughout the whole year without heating. Almeria is also home to the first Spanish tomato type with a protected designation of origin, the Tomate La Cañada. Most tomatoes in Spain are produced by relatively small farmers with a cultivation area under 2 ha.

The main three tomato types of Almeria are long-life tomatoes (like Daniela, Larga Vida, Royesta), vine tomatoes (Rama) and small plum tomatoes (Pera). Tomato farmers are usually united into cooperatives. Integrated pest management with biological pest control, drip irrigation, and pollination with bumblebees, is used in more than 60% of tomato-cultivated areas. This is more than 5,000 ha. To promote Andalusian products, several certification bodies are authorised to audit producers and issue a Producción Integrada Andalucía label.

First-class tomatoes are sold either through the auction system, to brokers or to large purchasing centres. A smaller share of second-class products can be sold for processing, although this is more the case in Murcia than in Almeria.

Figure 8: Greenhouse tomato and other vegetable production in Almeria

Source: Autentika Global/Google Maps

Although Almeria is often called ‘The Orchard of Europe’, it also faces environmental challenges. The most important challenge is the large amount of plastic waste generated for greenhouse covers and packaging materials. To solve this problem, there are emerging investments in plastic recycling facilities around the area. Other environmental challenges are deforestation and water scarcity.

Morocco, the leading non-European supplier

According to the official FAO data, Morocco ranks as the 18th global producer of tomatoes. However, many of the leading producing countries consume tomatoes locally with a very limited export capacity. In terms of exports, Morocco is the third largest exporter, after Mexico and the Netherlands. Since the Netherlands also acts as a transit country, it can be claimed that Morocco is the second-largest exporter of tomatoes for fresh consumption. Tomatoes are the most exported food in Morocco.

Most tomato production in Morocco is concentrated in the Souss Massa region, which currently has more than 20,000 ha of greenhouses. More than 80% of Moroccan exported tomatoes are produced in Souss Massa. The Moroccan government is supporting Moroccan agricultural production and export, which resulted in a high increase in tomato exports. Morocco has several competitive advantages in the tomato export to Europe:

- Financial support – continuous investing in Moroccan agriculture in line with a long-term Green Plan.

- Transport advantages – Moroccan investment in the largest African industrial port Tanger-Med provides easy access to European ports. Tomatoes can be shipped to any of the European ports. Transport time can also be cut by using the Spanish high-speed rail corridor in Andalusia, which connects Southern and Northern Europe.

- Water availability – the Agadir desalination plant is supplying sufficient water quantities for greenhouses. However, groundwater is also used intensively, which poses an environmental threat.

- Tariff advantages – thanks to a free trade agreement with the European Union, Morocco enjoys an almost duty-free export of tomatoes. Between 1 October and 31 May, the tariff duty is zero for the quota of 257,000 tonnes. However, the country can export an additional 28,000 tons if there is an excess of production in certain months. If the quota is exceeded, a duty of 3.52% must be paid. Still, this duty is 60% lower than for other developing countries that have no free trade agreement with the European Union.

- Competitive labour costs – the seasonal wages for tomato pickers in Morocco are significantly lower than the wages in Europe. Compared to Spain, Moroccan pickers are paid 8 times less per hour. Although this provides high price competitiveness, it does not always provide a good image for Moroccan suppliers in terms of corporate responsibility. According to Fairfood International, labour issues in the Moroccan tomato supply chain include low wages, a lack of freedom of association and gender discrimination.

Since 2018, the Moroccan export of tomatoes has increased by an annual rate of 7%, reaching 740,000 tonnes in 2022 and a value of more than €980 million. More than half of the Moroccan tomatoes are exported to France, followed by the United Kingdom (19%), the Netherlands (11%), Spain (8%), Mauritania (3%) and Portugal (3%). Moroccan tomatoes gained the most market share in the United Kingdom and the Netherlands. Since 2018, the export to the United Kingdom increased 5 times and to the Netherlands more than 6 times.

Morocco has turned to the production of snack tomatoes, cherry tomatoes and plum tomatoes instead of round conventional tomatoes. Classical round tomatoes account for less than 50% of the total Moroccan tomato exports.

Turkey: the leading supplier to Eastern Europe

Turkey is the third largest tomato producer in the world, after China and India. The Turkish tomato production is increasing. In 2021, it reached 13 million tonnes, with more than 80% being used for fresh consumption.

The leading tomato production area in Turkey is located in the west provinces of Antalya, Manisa, Bursa and Izmir. The centre of the Antalya production is in the Kumluca region. Around 800,000 tonnes of tomatoes are produced annually in Kumluca in 3000 ha of greenhouses. The Greenhouse Association of Turkey (SERA BIR) represents the interests of greenhouse growers.

Turkish tomato export was showing a strong increase until 2021. In 2020, exports reached 616,000 tonnes before decreasing to 520,000 tonnes in 2021. The main reason for the lower production is low profitability due to the energy crises. In 2022, the main export destinations for Turkish tomatoes were Syria (19%), followed by Ukraine (13%), Romania (11%) and Bulgaria (9%). Export to Western and Northern Europe is growing. There is an especially high increase in export to Germany, from 5,800 tonnes in 2018 to 23,000 tonnes in 2022.

The main reason for a lower export to Western and Northern Europe compared to Eastern Europe is a lack of food safety and social certification, especially GLOBALG.A.P. and GRASP. Another issue is the frequent incidents of pesticide residues that exceed EU limits. Some buyers from Eastern Europe, particularly Bulgaria and Romania, still do not require the GLOBALG.A.P. and GRASP certifications, which explains the high export share to those countries. Currently, Turkish exporters base their competitiveness on low prices. Turkish tomato prices are 2 to 3 times lower than those of Spanish or Moroccan tomatoes.

Tip:

- To learn more about Turkish tomato exporters, search the member list of the West Mediterranean Export Association (Sectoral Information Network).

Tunisia, a tomato processor

Tunisia is the 17th largest global tomato producer. It has reached a production of 1.4 million tonnes on more than 20,000 ha of land. Less than a third of tomatoes is used for fresh consumption. Tomatoes for fresh consumption are grown in greenhouses. The aim is to ripen the fruits for the European winter months, which is the early season in Tunisia. Late-season tomatoes are grown through open-field cultivation. Most tomatoes are industrially processed into double tomato concentrate.

Most tomatoes in Tunisia are grown in the areas of Nabeul and Kef-Béja-Séliana, which cover nearly three-quarters of the total tomato production. However, the availability of fresh spring water and geothermal resources make the oases in the Gabès Governorate the most attractive area for greenhouse cultivation. Although production has been increasing, in 2023, farmers failed to plant as many tomatoes as in previous years. This was due to drought, water scarcity and increasing energy costs.

The Tunisian export of tomatoes has been increasing at an annual rate of 13% since 2018. In 2022, exports reached 23,800 tonnes at the value of €43.9 million. The main export destination for Tunisian tomatoes is the Netherlands (60%), followed by Germany (20%), Libya (8%), France (5%), Russia (3%) and Italy (2%). Export to the Netherlands is constantly increasing. Tunisian export to the Netherlands increased almost 3 times from the 5,100 tonnes in 2018, reaching 14,300 tonnes in 2022.

Senegal: the cherry tomato specialist

Most tomatoes in Senegal are produced in an open field for the processing industry and for local consumption. The total production varies between 130,000 and 150,000 tonnes. Approximately half of it is used for processing. Of this half, up to 40% is for domestic consumption and 10% is used for export. It must be underlined that there are not many export-oriented players in Senegal. Most of the export comes from one company, Compagnie Fruitière.

Most of the Senegalese production aimed at export focuses on cherry tomatoes. Almost all cherry tomatoes are exported to Europe. In 2022, Senegal exported 4.5 tonnes of tomatoes, at a value of €6.6 million. This was a sharp decline compared to the previous 4 years, when the average export was over 9,000 tonnes. The main export market for Senegalese cherry tomatoes was the Netherlands (53%), followed by France (27%), Spain (14%) and Germany (6%).

Competition from Eastern Europe and other European producers

Spain, Morocco and Turkey account for around half of the tomato supply to Europe. However, there are several Eastern European suppliers that are gaining market share. In addition, there are European tomato producers that supply local markets as well as export locally-produced tomatoes. Countries such as the Netherlands, France, Italy and Greece are also supplying other European countries in addition to local markets.

Albania is an emerging supplier, with an export of nearly 70,000 tonnes. The main destinations for Albanian tomatoes are the Balkan countries, such as Serbia and Bosnia-Herzegovina. Albania is also increasing its tomato export to the European Union, with Italy and Greece as its main markets. In 2022, Italy and Greece imported more than 10,000 tonnes of tomatoes from Albania.

Another emerging supplier is North Macedonia. North Macedonia exports more than half of its tomatoes to Serbia, but is also increasing its supply to the European Union, especially to Bulgaria and Poland.

Along with the emerging suppliers from Eastern Europe, there is strong internal competition. The Netherlands is the leading producer of greenhouse-produced tomatoes. The country is also the most advanced producer of tomatoes, as it constantly invests in modern production technology and innovative solutions. The Netherlands has several knowledge transfer centres and many experts dealing with new pests and disease-resistant cultivars, digital greenhouse technologies, smart agriculture and sustainable energy solutions.

For example, the Wageningen Food & Biobased Research has created a team of experts specifically dedicated to the improvement of the postharvest technology of fruit and vegetables, known as Fresh Knowledge.

Which companies are you competing with?

Many tomato exporters are companies that subcontract production with local farmers. They act as grading, sorting, conditioning and packaging companies. Some tomato exporters also have their own fully integrated production chain, although most of them combine their own production with external purchasing. Below are examples of leading tomato exporters.

Companies in Spain

There are three main types of Spanish tomato suppliers:

- Agricultural cooperatives – Owners of cooperatives are farmers who sell tomatoes through the cooperatives. Large cooperatives usually have their own packaging facilities and are able to supply retail chains directly. Cooperatives manage packaging and postharvest operations on behalf of farmers and share the profit. Some cooperatives are specialised in certain types of tomatoes. For example, cherry tomatoes are a specialty of Coprohníjar and La Palma. Vicasol is famous for its plum tomatoes.

- Wholesalers with packaging facilities – These companies purchase tomatoes directly from farmers through a network of brokers or through auction. Many of them also participate in the auctions of retail chains and supply chains directly.

- Purchasing and packaging centres owned by large European retailers – With this integrated approach, retailers ensure a continuous supply and direct quality control. The largest purchasing centres are Socomo (Carrefour group), Edeka Fruchtkontor (Edeka) and Alcampo (Auchan).

Cooperativa Agrícola San Isidro (CASI) is probably the largest fresh tomato producer and exporter in Europe, with over 3000 members. Although the cooperative is export-oriented, it sells around half of its tomatoes locally. CASI uses Integrated Pest Management with biological control in all its tomato production. Along with tomatoes, its members also produce other fruit and vegetables, such as aubergines, courgettes, peppers and melons. CASI growers produce around 200,000 fruits and vegetables (mostly tomatoes annually).

CASI is a strong supplier of supermarkets in Spain, constantly introducing new cultivars adapted to consumer demands, such as cherry tomatoes, cocktail tomatoes or plum tomatoes. Some of the cultivars are trademarks of the company. Examples are the long-lasting ribbed cultivar ‘Rebel’, the Marmande type cultivar ‘Raf’, the black tomato (CASI Negro) and the plum cultivar of the San Marzano type (‘Flamenko’). In 2015, the company expanded to the Netherlands and opened a new distribution centre to handle the production of local growers.

Coprohníjar is another large cooperative with more than 200 members and an annual production of nearly 40,000 tonnes of tomatoes. Cooperative members grow tomatoes and other vegetables in greenhouses in an area of around 400 ha. The specialities of this Almeria-based cooperative are the small-sized tomato segment and organic production. Some new cultivars are launched in cooperation with partners. ‘Flou’, for example, which is promoted in cooperation with Vicasol.

Cooperativa La Palma/Granada La Palma is the largest Spanish producer of cherry tomatoes and mini-vegetable specialities. The cooperative is composed of more than 700 farmers and has over 800 ha of cultivation land that produces 73,000 tonnes of tomatoes and other vegetables. It focuses on sustainable supply with its production methods, sustainable packaging and new marketing concepts.

Just for illustration, some other notable examples are:

- Agroponiente Group – invests in low residue production

- Unica Fresh – introduced the new Wabi-Sabi and Nippo varieties

- Hortofrutícola Costa de Almería – recently joined the largest Spanish cooperative Anecoop

- San Lucar – a strong supplier of the German market

- Vicasol – famous for plum tomatoes

- Tomates de Autor – operates under the Valley brand

- Horticola Ikersa – a producer of ‘hanging’ tomatoes

- Grupo G’s Spain – operates under the Pascualprestige brand

- Eurocastell (Gruppo La Caña)

- Cualin Quality – operates under the ‘Divino Imperial Brand’, among others

Companies in Morocco

Most Moroccan export-oriented companies source tomatoes from greenhouse production. Significant quantities are also sold on local markets, but local markets usually sell Class II tomatoes and tomatoes grown outside. There are many players in the Moroccan tomato supply chain, but the three main types of exporters are:

Large producers with own packaging facilities – These companies pack their own tomatoes in significant quantities but sometimes also purchase tomatoes from other producers. Very often, these companies are foreign investors based in Europe. An example of a foreign investor is the large French company Idyl, which sources different fruit and vegetables from South America, Africa and New Zealand.

A notable example of a large producer is the Delassus Group. The company has a long history of growing different crops. It is now organised in five business segments: citrus, snacking tomatoes, grapes, avocados and flowers. Duroc, a member of the Delassus Group, is responsible for the production of tomatoes. Duroc produces most of its tomatoes on its own farms and packs tomatoes in their modern packaging houses. Duroc producers 65,000 tonnes of snack tomatoes on 600 ha of land between Agadir and Dakhla.

According to Duroc, it is a leading supplier of tomatoes to the United Kingdom and Germany, with an export share of 32% in the United Kingdom and a 12% share in Germany. The company has a strong focus on environmental sustainability. It invests in the reduction of packaging waste and promotes the rational use of water and recycling of organic waste. It is also investing in social sustainability through the Fairtrade project in the United Kingdom in cooperation with Coop and Keeling’s. Duroc is also about to build a kindergarten for 300 children of its employees and neighbouring communities.

Another example of an integrated large producer is Moroccan French Maraissa, which belongs to the Azura Group. The company has its own distribution centre in France and also sells under its own brand in Europe. Maraissa sells almost all of its tomatoes to the European retail sector. It uses only grafted tomatoes produced in its own nurseries and grows tomatoes on almost 1000 ha. The company focuses strongly on sustainability. They are carbon neutral because they produce only 1.26 kg of CO2 per kg of tomatoes.

The third example of a large integrated exporter to Europe is Lymouna – Matysha group. The company is located in France and has high-level refrigerated warehouses and a laboratory. To control its product quality throughout the whole value chain, Matysha invested in own nurseries and a modern packaging facility. Lymouna – Matysha is a strong supplier of several European retail chains.

Packaging and logistical companies that purchase tomatoes from individual farmers – They usually purchase tomatoes through a network of brokers. Brokers sell tomatoes to packaging companies, adding a margin for their service. According to industry sources, there is a negative image of brokers. This is based on the opinion that they increase the final price for consumers without adding value to the tomatoes. Some of the packaging companies are foreign investments, mostly from France and Spain.

An example of a company with several packaging houses and an integrated production is Les Domaines Exports. It belongs to Les Domaines Agricoles, the largest agribusiness company in Morocco. The company partners with a Dutch tomato company, RedStar.

Agricultural cooperatives that have their own post-harvest treatment and packaging facilities – These cooperatives purchase tomatoes from their own farmers. An example of a tomato agricultural cooperative is Coopérative Agricole Toubkal.

Companies in Turkey

There are many tomato suppliers from Turkey. Most of them act as packaging facilities and buy tomatoes from farmers without having a significant production themselves. However, some producers combine their own production with purchasing from farmers.

The largest fresh fruit and vegetables exporter in Turkey is Uçak Kardeşler Gida. It has processing and packaging facilities installed on an area of 131,000 m2 and cold storage facilities with a capacity of 50,000 tonnes. In addition, the company has around 450 ha of fully automated greenhouses in Antalya. The company was the first exporter from Turkey.

Some packaging companies are specialised in tomatoes, such as Sülekoğlu Komisyon. Others export a wide range of fruit and vegetables, such as iliri DIŞ Ticaret, Ayetar, Hüdaverdi Food Agriculture, Babacanlar, Demre Fresh or Önder.

Along with companies that are not involved directly in production, the number of packaging companies with their own greenhouse production is increasing. One example is Elika Global, which has 100,000 m2 of vegetable production, mostly focusing on tomatoes, as well as a packaging facility of 5,000 m2.

Some Turkish companies have started to invest in soilless tomato production using know-how from Western Europe and Israel. An example is Koyuncy Agriculture, which is part of the Koynucu Group, the largest salt producer in Turkey.

Companies in Tunisia

Some of the leading Tunisian suppliers are foreign investors and companies already integrated into the European market. One of the leading suppliers is San Lucar. San Lucar is a famous European retail supplier headquartered in Spain, with many distribution centres in other countries. In 2008, San Lucar, together with its partner HBG Holding, invested in a tomato farm covering more than 40 ha in the ‘La Cinquième Saison’ oasis in the south of Tunisia. The oasis has geothermal water, which contributes to saving energy for greenhouses.

Another example of the Moroccan-European partnership is Desert Joy. In 2012, a Dutch tomato grower, Agro Care, started the Desert Joy project in El Hamma, Tunisia. In 2014, the company was the first African tomato nursery to receive a Fairtrade certificate.

The Tunisian government also supports foreign investments in the tomato industry. In 2022, the Tunisian government allocated a 200 ha site in Gabes to the Farhet El Hicha company for the implementation of a horticultural project. The project is expected to be realised in five years and should lead to a production of up to 40,000 tonnes of tomatoes per year. This investment, which is part of a Tunisian-Dutch partnership, will also use geothermal water as a source of energy to heat greenhouses.

Companies in Senegal

The tomato supply from Senegal is dominated by a single company, La Compagnie Fruitière. The company is internationally famous for its fresh bananas and pineapples. In Senegal, La Compagnie Fruitière produces cherry tomatoes under the brand Doona, as well as sweetcorn and mangoes under the name ‘Grands domaines du Sénégal’ (GDS). The production of cherry tomatoes is estimated at 10,000 tonnes and most of the production is targeted at export to Europe. The company is one of the largest employers in the region.

Companies in other tomato supplying countries

When talking about other companies, it is important to mention tomato growers, cooperatives and companies from the Benelux, especially the Netherlands and Belgium. Dutch tomato production is based on state-of-the-art heated and lit greenhouse technology. Due to increasing energy costs, many Dutch companies are investing in growth in other countries to prolong the supply season and increase their own production. Those investments are mostly related to Morocco, but there are increasing investments in Tunisia and Spain too. There are many Dutch and Belgian suppliers that sell tomatoes to the largest European retailers.

Examples of companies in the Benelux are:

- Growers United Maasdijk operating under the Prominent Tomatoes brand

- Agro Care

- Harvest House

- Stoffels

- Looye Kwekers

- RedStar

- Frankort & Koning, of which 50% is owned by Total Produce

- EFP International B.V.

Which products are you competing with?

Most retail-purchased tomatoes in Europe are consumed fresh. As tomatoes are the most consumed fresh vegetable in the world, consumers are very familiar with its taste and it is impossible to find a substitute. Although some vegetables, like tamarillos and kakis, are similar to tomatoes, they are not real competition.

For consumers, the price can be a deciding factor to replace tomatoes with a cheaper vegetable. In terms of price, consumers could perhaps replace tomatoes with cucumbers, although it is not a real substitute.

Another form of competition stems from the grower’s side. Currently, greenhouse production is becoming more expensive, and some producers may replace tomatoes with a less labour-intensive vegetable, such as cucumbers, aubergines, courgettes or peppers.

Source: ITC TradeMap

For fresh tomatoes used in home cooking, the main competition is processed tomatoes. Tomato sauces, purees, juices and canned tomatoes are an easy addition to many meals. They are convenient and sometimes provide better taste in the final dish than fresh tomatoes. This kind of competition is obvious from the increasing import of processed tomatoes to Europe (Figure 9). The import of fresh tomatoes, on the other hand, is decreasing.

Tip:

- Read CBI’s Processed Fruit and Vegetables studies to better understand the competition from fresh fruit.

4. What are the prices for tomatoes on the European market?

Calculating margins according to the final retail price is not very reliable, as the entire sector has varying prices for different varieties, origins and packaging. For example, cherry tomatoes and vine tomatoes commonly are more expensive than round tomatoes. Some cultivars, especially those sold as trademarks of certain companies, also reach higher prices than cultivars that are free to reproduce.

Also, there are common differences between tomatoes from different origins. In the range of major suppliers, locally-produced tomatoes in Western and Northern Europe are often more expensive than imported tomatoes. Among leading European suppliers, Dutch tomatoes are more expensive than Spanish ones. In the range of imported tomatoes, Moroccan prices are significantly higher than Turkish prices.

The price breakdown given below is a very rough indication. Many factors contribute to the price, such as quality, variety, origin, food safety certification costs, consultants, social security, taxes, sales and network margins.

Table 2: Indicative price breakdown for tomatoes in Europe, in euro per kilo

| Steps in the export process | Type of price | Price breakdown | Example |

| Farmgate price | Farmer price | 10% | € 0.3 |

| Aggregator/ broker price | Collectors fee | 13% | € 0.4 |

| Conditioning and packaging | Ex-Works/Packaging house price | 43% | € 1.3 |

| Transport to the port and loading | FOB price | 47% | € 1.4 |

| Import and customs clearing | CIF price | 50% | € 1.5 |

| Wholesale | Wholesale price | 67% | € 2 |

| Retail sales | Retail price (incl. VAT) | 100% | € 3 |

Autentika Global for ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research