Entering the United Kingdom market for fresh fruit and vegetables

The British market is a very retail-oriented market. When exporting to the British market, you will likely have to deal with specific retail standards. There is potential for diversifying the supply, in particular since the UK is no longer part of the European Union. However, the strongest competitors have already integrated themselves into the UK market well.

Contents of this page

- What requirements and certification must fresh fruit and vegetables comply with to be allowed on the UK market?

- Through what channels can you get fruit and vegetables on the UK market?

- What competition do you face on the UK market?

- What are the prices for fresh fruit and vegetables in the UK market?

1. What requirements and certification must fresh fruit and vegetables comply with to be allowed on the UK market?

Most of the requirements in the United Kingdom are aligned with those in the European Union. You can find these in the general buyer requirements for fresh fruit and vegetables on the CBI market information platform. You can also stay up to date on developments in trade and regulation with the information on GOV.UK. The UK versions of the EU legislation can be found on legislation.gov.uk.

What are mandatory requirements?

Avoid pesticide residues and contaminants

Food safety is one of the main concerns in the United Kingdom and is monitored by the Food Standards Agency (FSA). Pesticide residues and contaminants are one of the crucial issues for fruit and vegetable suppliers.

The United Kingdom follows the EU guideline on Maximum Residue Limits (MRLs) and import tolerances. But since the UK is no longer part of the European Union, it can authorise or ban certain pesticides based on the national policies. In Northern Ireland, EU law will continue to apply for the majority of food hygiene and safety law.

Tips:

- Find the adjusted EU legislation for the United Kingdom on legislation.gov.uk, such as Regulation (EC) No 178/2002 with the general principles and requirements of food law, Regulation (EC) No 1881/2006 setting maximum levels for certain contaminants in foodstuffs, and Regulation (EU) 2019/1793 on the temporary increase of official controls and emergency measures.

- Use the extensive information available on the European Commission websites, such as the EU pesticide database and EU legislation on MRLs, but be aware that these may change.

Follow phytosanitary regulations

For most fresh fruit and vegetables, you must get a phytosanitary certificate for each consignment from the plant health authority in your country. The certificate is a statement from the plant health authority that the consignment:

- has been officially inspected

- complies with legal requirements for entry into GB

- is free from quarantine pests and diseases

The phytosanitary inspection must take place no more than 14 days before the consignment is dispatched from your country. And it must be signed by someone in the inspecting plant health authority within the same 14-day period.

There are certain fruits and vegetables that do not require a phytosanitary certificate (see table 1).

Table 1: Fresh fruit and vegetables that do not require a phytosanitary certificate

| Botanical name | Common name |

| Fruit of Ananas comosus | Pineapple |

| Fruits of Actinidia spp. Lindl, | Kiwi |

| Fruits of Cocos nucifera L | Coconut |

| Fruit and leaves of Citrus spp. L. | Citrus |

| Fruit of Fortunella spp. Swingle | Kumquat |

| Fruit of Poncirus L. Raf | Bitter orange |

| Fruit of Diospyros spp. L. | Persimmon |

| Fruits of Durio zibethinus Murray | Durian |

| Fruits (bolls) of Gossypium spp. | Cotton (bolls) |

| Leaves of Murraya spp. | Curry leaves |

| Fruits of Musa spp. | Banana and plantain |

| Fruits of Mangifera spp. L. | Mango |

| Fruits of Phoenix dactylifera L. | Dates |

| Fruits of Passiflora spp. L | Passionfruit |

| Fruits of Psidium spp. | Guava |

Tips:

- Make sure your plant health authority is able to comply with the phytosanitary requirements before planning your export. Get in contact with the National Plant Protection Organisation (NPPO) in your country and make sure they can issue a phytosanitary certificate on time.

- Use the GOV.UK guidance on Import plants and plant products from non-EU countries to Great Britain and Northern Ireland to see if your product requires a phytosanitary certificate.

Maintain high quality standards

All fruit and vegetables imported to or exported from the UK must meet the relevant quality and labelling rules (marketing standards). The United Kingdom follows mostly the EU guidelines on marketing standards.

There are specific marketing standards for 10 types of fresh produce. These products are graded on their quality in ‘Extra’ Class, Class I and Class II (see table 2).

All goods that have to meet the Specific Marketing Standard (SMS) need a Certificate of Conformity before they can enter Great Britain. The importer is responsible for getting the certificate. Some approved countries are allowed to issue their own Certificate of Conformity, such as India, Israel, Kenya, Morocco, New Zealand (for apple, pear and kiwi), Senegal, South Africa, Switzerland (all but citrus fruit) and Turkey.

Table 2: Products, guidance and grading regarding specific marketing standards

| Products with specific marketing standards: | Grading according the specific marketing standards: | Interpretation of grading, and guidance on the specific quality requirements and allowed defects: |

|

|

Other fresh fruit and vegetables must be according to the general marketing standards. Products under the general marketing standards do not need to be graded into quality classes, but they must be:

- intact

- sound (for example, not rotten, severely bruised or severely damaged)

- clean (as is practically possible)

- free from pests (as is practically possible)

- free from damage caused by pests affecting the flesh (as is practically possible)

- free of abnormal external moisture

- free of foreign smell or taste

- sufficiently developed or ripe but not overdeveloped or overripe

In addition, the Codex Alimentarius provides a set of voluntary food standards, guidelines and codes of practice in the international trade of food and agricultural products. These can be handy for exporters as a guidance, but the food standards in the United Kingdom generally go beyond the Codex standards. See also the additional requirements that buyers often have.

Tips:

- Contact the Animal and Plant Health Agency (APHA) CIT Helpdesk on phone number +44 (0)345 607 3224 if you have questions on the quality and labelling requirements for fruit and vegetables.

- Contact the Department for Environment, Food and Rural Affairs (Defra) by E-mail (codex@defra.gov.uk) for questions on the Codex standards in the UK.

- Use the GOV.UK guidance on fresh fruit and vegetable marketing standards to find more details on the matter.

- Use the GOV.UK guidance on importing and exporting fresh fruit and vegetables to read more about the rules for importing, exporting and moving fresh fruit and vegetables to, from and around the UK.

- Read the CBI Buyer Requirements for fresh fruit and vegetables on the European market for additional requirements such as packaging and labelling, or the product studies for product-specific requirements.

What additional requirements do buyers often have?

Understanding British communication

Fundamental values for British businesses are politeness, discipline and punctuality.

In the fresh produce industry it is important to communicate clearly and directly. However, British courtesy may sometimes be mistaken for friendliness or genuine interest. This disguises their actual opinion or disagreement. For example, when a Brit says “very interesting” it may mean that they find your offer not interesting at all, or “your product quality is almost right” could mean you are still far off.

The British are also known to be tough negotiators. Prepare yourself for this, but remain calm and pragmatic throughout the negotiation.

Tips:

- Avoid communication issues and confirm by writing the specific requirements such as size, quality, packing, branding. Make sure your product is uniform in quality and size.

- Maintain strict compliance with quality requirements and deliver the quality as agreed with your buyer. Being careless with product requirements or stretching the minimum standards will give buyers a reason to claim on quality issues. Be open and transparent when resolving issues and dealing with quality claims.

- Prepare yourself for the UK market and doing business in the European fresh produce sector by reading CBI’s tips for doing business with European buyers. This document also provides information about payment and delivery terms. Prepare yourself for tough purchase conditions, certainly in a country such as the United Kingdom.

UK’s climate policy: Prepare for environmental actions

The United Kingdom has left the European Union (EU) and no longer takes part in the European Green Deal. Nevertheless, the country maintains similarly high ambitions concerning environmental policies. The Climate Change Act commits the UK government by law to reducing greenhouse gas emissions by at least 100% by 2050.

The integration of the climate goals with international trade has been inconsistent. But as an exporter you can expect further alignment in the future. Trade experts published a detailed proposal for a UK green trade strategy in October 2021, addressing environmental issues in their trade agreements. This could affect suppliers in terms of plastic reduction, sustainable production and transport methods, and voluntary eco-labels.

Initiatives such as the UK Plastics Pact will help reduce the amount of plastic packaging on supermarket shelves. For suppliers of fresh fruit and vegetables this can be a good moment to innovate and explore sustainable packaging options.

Obtain commonly used certifications

The United Kingdom can be a difficult market in terms of certifications and additional requirements. This is because the fresh fruit and vegetable sector is largely dominated by big retailers. Private retail standards and social compliance are considered to be more strict than in other European countries. As a supplier you must comply to these strict standards and obtain the most common certifications.

GlobalG.A.P.

Unless you are supplying a typical niche or ethnic market, GlobalG.A.P. will be a minimum requirement for imported fresh fruit and vegetables into the UK. GlobalG.A.P. was initiated by mainly British retailers and is now the most common standard to guarantee ‘Good Agricultural Practices’. It includes product traceability, environmental measures and responsibility for the health and safety of employees.

BRCGS

To ensure good practices in food safety, suppliers need to have a HACCP-based food safety management system. This is particularly important for packing and processing facilities. Management systems should be recognised by the Global Food Safety Initiative (GFSI). The most common system and certification for the UK is BRCGS (British Retail Consortium Global Standards).

Apply additional sustainability and social standards

The UK is dominated by large retail chains. Retail buyers have a strong focus on social and environmental circumstances. Therefore, you can expect additional standards and certifications you need to comply with. The list of standards has expanded over the years.

SMETA

Sedex is a leading ethical trade membership organisation and originates in the United Kingdom. The Sedex Members Ethical Trade Audit (SMETA) has become a main ethical audit to show the social conditions in your supply chain. It has become almost a standard audit to get your product up to retail standards. There is also a trend towards even more demanding audits such as Rainforest Alliance.

Ethical Trade Initiative

Many retail buyers in the UK are a member of the Ethical Trade Initiative (ETI), including Aldi, Asda, Co-op, Marks & Spencer, Morrisons, Sainsbury’s and Tesco. All these members have adopted the ETI Base Code. For example, the ETI Base Code is one of the foundations for Sainsbury’s Supplier Policy on Sustainable Sourcing, while they use SMETA as auditing tool. Greencell, a major avocado importer, is also an ETI member.

Private standards

In addition to common standards, you will find private standards for different food companies and retail chains.

One of the examples is Tesco Nurture. The Tesco NURTURE programme has become an additional NURTURE Module to the GLOBALG.A.P. audit.

All direct suppliers to Marks and Spencer (M&S) are expected to sign up to the M&S Global Sourcing Principles, which stipulates their minimum standards for people working in the supply chain. Their M&S Field to Fork farming standards cover labour standards, sustainable sourcing and contains the M&S Farm Environment standard, which was written in partnership with LEAF.

Another example comes from Unilever, a multinational food company that sources large quantities of vegetables and fruits for processing. The Unilever Sustainable Agriculture Code (SAC) and the Unilever Regenerative Agriculture Principles (RAPs) provide the basis for Unilever’s sustainable sourcing programme.

Tips:

- Get familiar with the ETI Base Code and read the GOV.UK Guidance on Ethical Trading Initiative (ETI) to see what kind of labour practices your company must respect.

- Implement the social and environmental standards that you need for specific clients. Take these standards seriously: Besides being a requirement, it is also an important aspect to build your relationship with important clients.

- Support the demand for convenience products, but try to avoid plastics. Look for alternative packaging options to make your product more sustainable.

What are the requirements for niche markets?

There are a few environmental and fair trade labels that are currently applicable for a limited number of products or suppliers. Among these labels are the LEAF marque, Rainforest Alliance and Fair Trade International.

The LEAF Marque

The LEAF Marque (Linking Environment And Farming) is an assurance system for sustainably farmed products with an integrated farm management (IFM) approach. The marque has had the most impact on British farms, but is expected to become more significant for global growers as well. For example, Tesco is implementing the LEAF Marque to improve environmental standards with 14,000 growers worldwide by the year 2025.

Other retailers such as Aldi UK and Waitrose have certified large part of their UK-grown produce. In January 2022, the British branch of supermarket Lidl announced plans to help all British suppliers of fresh produce achieve LEAF Marque certification by the end of 2023. For produce grown outside of the UK, Lidl remains with the GLOBALG.A.P scheme.

Rainforest Alliance

For some buyers of fresh fruit and vegetables, the current sustainability standards do not go far enough. Rainforest Alliance has already built a name in the banana trade, but new products are being added, such as avocados. With an office in the UK, Rainforest Alliance may become an increasingly important new standard.

Fairtrade

Fairtrade labels are mainly related to the banana trade. One in three bananas bought in the UK is Fairtrade certified. Nearly all large retailers in the UK sell Fairtrade bananas. In other products the Fairtrade label is less developed, but can be an interesting niche market for certain fruits and vegetables. According to the Fairtrade Foundation, Co-op sells Fairtrade tomatoes, green beans, oranges and grapes, Ocado sells Fairtrade tomatoes and Sainsbury’s sells fairtrade green beans.

Tip:

- Find an overview of available standards by selecting the United Kingdom in the ITC Standards Map and your origin country. Here you can find detailed information what the standard is all about.

Use organic certification to increase product value

With a market share of less than 2% in 2019, organic food in the UK is still very niche and smaller than most northern European markets. However, according to the Soil Association Organic Market Report the organic market has grown with 5.2% in 2021.

All organic goods imported from non-EU countries must have a valid GB Certificate of Inspection (CoI). To certify organic products you will need to find a recognised control body that is active in your country.

Tips:

- Strive for residue-free fruit and vegetables, and certify your production as organic if possible. It will broaden your market opportunities, but remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process.

- Read GB Certificate of Inspection (CoI) explanatory notes and the Guidance on Importing organic food from non-EU countries to Great Britain on GOV.UK. Here you will find more about the obligations of your company, the importer and the certifying body.

- See the list of control bodies and control authorities that are recognised in Great Britain as certifying organic food to equivalent EU organic standards (up to 31 December 2022). These control bodies and control authorities must have reapplied for recognition from the 1st of January 2023 to certify to an equivalent British organic standard.

2. Through what channels can you get fruit and vegetables on the UK market?

The United Kingdom is a large consumer country in Europe with both mainstream and specialised market channels. Supermarkets predominate the fresh fruit and vegetable market. More specific target groups can be reached by other segments that are supplied through specialised importers and wholesalers.

How is the end-market segmented?

The retail sales of fresh fruit and vegetables in the United Kingdom is dominated by large supermarket chains. Convenience stores and specialised retail represent a much smaller share in the fresh market, but still have their purpose and target audience. The COVID-19 pandemic accelerated the growth of online sales and the interest in local produce.

Supermarkets dominate the fresh sales

Over three quarters of the fresh retail sales can be attributed to supermarket chains. The supermarkets with the largest market shares in groceries are Tesco (28%), Sainsbury’s (15%) and ASDA (14%).

Discount stores such as Lidl and Aldi have a market share of around 14%. Their presence is expected to expand at the expense of hypermarkets and conventional supermarkets. Through direct sourcing and low budget concept, they are able to maintain lower prices than other supermarkets.

The strong competition between (discount) supermarkets will keep pressure on the price level. Low prices do not affect the requirements, which remain very strict. This is something to keep in mind as a supplier.

Tips:

- Try to establish a direct relationship with large retailers. Supply programmes with retailers are not easy to get, but they can provide some stability in your export and profit margins.

- See the List of supermarket chains in the United Kingdom on Wikipedia to find more background information on the leading supermarket formulas in the UK.

Fruit and vegetables contribute to the success of convenience stores

Next to supermarkets, there are smaller convenience stores oriented on local neighbourhoods. Some of the well-known stores are Budgens, Spar and Londis.

These stores are not a leading segment in fresh products. Still, older publications on the website of Convenience Store suggests that fruit and vegetables do contribute to the success of 85% of the convenience stores. British shoppers buy an estimated 12% of their fruit and vegetables in a convenience store.

Tip:

- Go to the Wikipedia List of convenience shops in the United Kingdom to find a complete overview, characteristics and ownership of convenience stores. Some of these are part of larger retail groups with centralised purchasing that can be interesting for foreign suppliers.

Specialised shops are relevant for specific target groups

Specialised and independent retail outlets, such as green grocers, street markets and farm shops nowadays only represent a relatively small share in selling fresh fruit and vegetable to consumers. The number of specialised retailers for fresh fruit and vegetables has been declining in the last decade. While there were 3,467 greengrocers in 2011, their number decreased to 2,481 in 2019.

Although the number of independent and specialised shops is becoming smaller, they can still be relevant for certain fruit and vegetables or specific target groups. For example, much of the ethnic vegetables are sold by small shops, and older generations still prefer to find a good deal on street markets.

Figure 2: Borough Market in London, UK

Online groceries are becoming a new normal

The United Kingdom is one of the leading countries in Europe for online groceries. The COVID-19 pandemic has taken online shopping to new heights. According to eMarketer e-commerce accounted for 14.8% of the total grocery sales in the UK. Most supermarkets have a web shop with delivery, but there are also fully online grocery stores such as Ocado, Fresh Direct and Amazon Fresh. Also, after the COVID-19 pandemic people have stated they intend to continue their online shopping. The expectation is that the online grocery segment will continue to grow to 19.5% in 2025. With online sales you can expect new distribution centres to arise, and other potential clients to supply.

Organic as specialisation

In the premium and organic segment, independent and online retail are well represented. Supermarkets sell most of the organic produce (64.5%), but home delivery and independent retail make up almost a third of the organic supply. Retailers that are specialised in organic food are, for example, Planet Organic, an organic supermarket that sells online and through shops in London, and RealFoods, an organic, natural food retailer in Edinburgh. Food service still seem to have a low adoption of organic food.

Post-COVID food service goes local

Food service (restaurants, catering, etcetera) was a healthy segment until the COVID-19 pandemic hit. Due to several lockdowns, the sector was hit hard and the turnover was temporarily reduced by nearly 50%. Restaurants remain an important segment for fresh fruit and vegetables. However, there is a tendency to focus more and more on seasonal and British-grown produce.

Tips:

- Find a unique selling point compared to British grown fruit and vegetables, for example by offering better supply reliability, focusing on superior varieties or including social projects into your operations.

- Strengthen your chances in the UK by operating more locally and using local marketing experience. Work together with a dedicated partner or open your own sales office to supply different segments, including the ones that are hard to reach from far away.

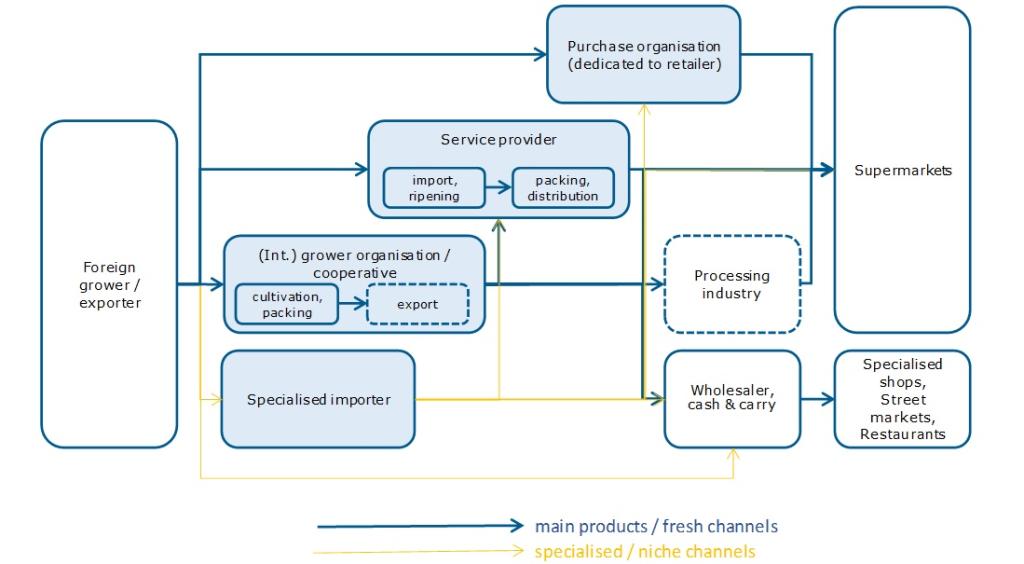

Through what channels does a product end up on the end-market?

The UK has a diversity of supply channels, varying from specialised importers to major service providers and grower organisations. But most fruit and vegetables end up at the same end market, namely supermarkets. Importing companies play a crucial role in organising the supply chain for supermarkets.

Figure 4: UK market channels for fresh fruit and vegetables

International purchase organisations

Some supermarkets have their own purchasing organisations. Large retailers prefer to buy as close to the source as possible with a direct line to the producer. This helps them to cut costs, but also ensures transparency and control in their supply chain.

For example, Asda supermarket chain has arranged this through their own sourcing and purchasing company IPL (International Procurement & Logistics). In West Yorkshire they focus on a number of products including grapes, salads and stone fruit, and in Kent they pack berries, citrus, melons and top fruits.

Service providers and integrated fruit companies

Service providers also provide access to supermarkets through supply programmes. They organise the supply chain according to the needs of their retail clients, from sourcing to (re-)packing and branding. You can become part of this supply chain if you are able to offer the quality and logistics that a service provider and supermarket require.

Service providers are usually well-integrated companies, offering a wide range of products and services. Some of the largest fresh fruit and vegetable companies in the United Kingdom include Total Produce, Fresca Group, FESA, Greencell and Minor, Weir and Willis.

Total Produce is one of the largest fresh companies in the UK, and also a big player in the rest of Europe through various subsidiaries and offices. They are headquartered in Ireland and part of the Dole group.

Fresca Group is a parent and holding company for a mix of wholly owned and joint venture trading businesses. They source, supply, prepare, pack and deliver fresh produce all over the UK. They supply all major UK multiple retailers in the food sector.

FESA UK Ltd has a partnership with grower cooperative Anecoop in Spain for a range of fresh produce. For more exotic products and to ensure a year round supply, they source in Africa, the Americas and Australia.

Greencell specialises in ripening avocados and sources other products as well. Since becoming part of the Westfalia group in 2008, Greencell has become a vertically integrated supply chain from grower to customer. They have partnered with supermarkets such as Tesco.

Minor, Weir and Willis Ltd (MWW) specialises in produce from around the world. They work with suppliers from international supplier to small family farms in over 70 countries worldwide. They have their own logistics, ripening and refrigerated facilities. For example, they have a daily truck running from Heathrow airport to supply fresh green beans, tenderstem broccoli and chillies to the British market.

International grower organisations

Large farmers and cooperatives have grown into international producer organisations. They can provide an international network of growers with a year-round supply. Companies such as Barfoots of Botley and Angus Soft Fruit find their foundation in British agriculture.

Barfoots of Botley is an international grower of vegetables, such as sweetcorn, squash, beans, peas, and sweet potato. They have own farms and associated farms in countries on all continents, for example in Peru, Senegal and Spain.

Angus Soft Fruits was originally established by three UK growers. Today, they market berries to the UK market from their own production in (mainly) Scotland, and import off-season from Dutch greenhouses, Morocco, Egypt, South and Central America.

Specialised importers

A large number of importers specialise in specific products, segments or services. Selling fresh produce requires knowledge, and specialisation is a way to differentiate in the competitive UK market. These importing companies range from small to large.

Companies can specialise in specific products, for example in exotic and tropical fruit and vegetables, such as the company Wealmoor. But there are also specialisations in target markets. The company Poupart is a specialist supplier to the non-supermarket sector.

When supplying to a specialised company you know they have experience with your product, or they target a specific market that is relevant for your product.

Added value and processing companies

Fresh produce companies also try to differentiate by adding value, not just in additional services such as packing and ripening, but also in processing fresh fruit and vegetables. Added value is important for the demand for convenience products.

Examples are Blue Skies that sells freshly cut fruit and fruit salads to retailers, and Natures Way Foods, a leading manufacturer of fresh convenient food such as bagged salads. Besides retailers, they also supply McDonalds.

Wholesalers

Wholesalers have an important role in supplying gastronomic businesses, street merchants and independent shops. Traditional fruit wholesalers cover the spot market and move according to the fluctuations of the fresh trade.

In the case of more niche products, wholesalers also tend to import themselves. There are a large number of specialised and ethnic importing wholesalers present on wholesale markets such as New Covent Garden Market and New Spitalfields Market in London. Several other wholesale markets are spread out over the country.

Non-specialised, “cash & carry” wholesalers, such as Bestway Wholesale, Eurofoods, Booker or Makro cater to a similar end-market (especially restaurants and catering) but usually work with service suppliers or import partners. Just like supermarkets, they are able to work with long-term contracts.

Tip:

- Secure your supply by giving preference to clients that can offer you a stable demand or a long-term contract. Retail programmes provide some stability, but are hard to get. Alternatively, you can also diversify your market with stable clients in other European countries.

What is the most interesting channel for you?

The United Kingdom is not an easy market. Due to a dominant supermarket sector, you will likely depend on partnerships with service providers or other companies with a good connection to the major retailers. More specialised suppliers may find better opportunities in the wholesale channel. See the examples above.

You can try to find a direct, or almost direct relationship with supermarket buyers when you are big enough and when you supply a main product. Take your time to build relationships. To supply large buyers and service suppliers to retailers you must have a uniform and reliable quality, complying with strict retail standards and certifications. Supplying to supermarkets can give very good returns. But if your product is not according the quality specification, a cancellation will bring back the return to almost nothing. After Brexit, products that are not suitable for the UK market can no longer be easily re-shipped to mainland Europe.

Smaller suppliers and suppliers of niche products are best off with a specialised importer or even importing wholesalers. Purchase conditions vary, and there may be more risk involved when supplying the spot market. But these specialised buyers can be a step up to the bigger channels.

Tips:

- Select the type of buyer that fits your company and product. There are different target groups to choose from, but each will have its own preferences. Remember that it is better to have one or two stable clients, than a handful irregular buyers.

- Visit trade fairs to find buyers. The most important trade fair in the United Kingdom is the London Produce Show. Other relevant fairs can be found in mainland Europe, such as the Fruit Logistica in Berlin and the Fruit Attraction in Madrid.

- Use the CBI tips for finding buyers on the European fresh fruit and vegetables market for more ideas how to introduce yourself to potential buyers.

3. What competition do you face on the UK market?

British companies already deal with a large number of supply countries. Some of the foreign suppliers have local offices or close partnerships in the UK market. Despite the strong competition, changing trade flows and renewed trade agreements due to Brexit has created opportunities for new suppliers, in particular from countries close to Europe.

Which countries are you competing with?

Morocco has gained significant market share since Brexit and is the largest in vegetable export to the UK. South Africa remains the leading supplier of fruits.

Brexit has made non-European suppliers more competitive

Due to the Brexit, the UK has established new customs requirements for the fresh fruit and vegetable export sector. As of January 2021, fruit and vegetables from the European Union to the United Kingdom must be accompanied by a customs declaration (DUA) and a certificate of conformity with marketing standards. Since July 2022, EU fresh fruit and vegetables shipments must also be accompanied by a phytosanitary certificate.

With these requirements EU countries have no specific advantage over other supplying countries. Therefore, suppliers from nearby countries such as Morocco and Egypt have become more competitive.

Morocco

Morocco is the largest non-European supplier of vegetables to the United Kingdom. The country seems to have taken advantage of Brexit (Britain leaving the EU). Not only vegetables, but also the trade of fresh fruit has increased significantly. Morocco offers an excellent climate for a wide range of produce. With increased controls between the UK and the EU, Moroccan growers can now better compete with EU suppliers.

Tomatoes are the main product. The UK imported as much as €146 million of tomatoes from Morocco in 2021. This is twice the value of three years ago. Only the Netherlands exported more tomatoes to the UK. Other imported vegetables were green beans (€13 million), sweet corn (€9 million), fresh peppers (€6 million) and courgettes (€4 million).

Morocco also increased its supply of fresh fruit to the UK in 2021. Preliminary data suggest that the UK imported €204 million fruit in 2021, a sharp increase from the €75 million the year before. Most of these were soft fruit such as raspberries and blueberries.

South Africa

South Africa is the largest supplier of fresh fruit to the UK. It is a typical counter seasonal supplier. The UK imported all kinds of citrus fruit with a total value of €186 million, grapes (€148 million), apples (€85 million), blueberries (approximately €40 million), stone fruit (€47 million), among other fruit. Most of the UK’s fruit import from South Africa is gradually growing.

Apart from fruit, there is an interesting growth of sweet potato trade. British imports increased from €334,000 in 2017 to €4.8 million in 2021. But the highest (and most stable) value for vegetables is still pumpkins with €6.7 million in 2021.

South Africa is a large grower of fresh produce and fresh fruit accounts for approximately 50% of South Africa’s agricultural exports. The main strength of South Africa is the opposite season with the United Kingdom.

South Africa and the UK have good trade relations. Big fresh companies from South Africa such as Cape Five (apples, citrus, stone fruit) and Westfalia (avocado and other fruits) will make sure that these relations are kept strong.

Peru

Over the years, Peru has become one of the largest suppliers of fresh produce in the world. Peru has pushed itself to become the second largest fruit supplier to the UK. This is mainly thanks to the growing supply of avocados, blueberries and grapes. In 2021, the UK imported from Peru a value of €73 million worth of avocados, €59 million of blueberries (vaccinium and such), €61 million of grapes. The import of citrus fruit from Peru is stable, at just over €40 million.

The vegetable trade is more stable. The vegetable import concerns asparagus in particular, with a value of €49 million in 2021, and peas such as sugar snaps and snow peas with a value of €11 million.

Peru will continue to dominate some of the fruit and vegetable supply to the UK. Large fresh companies in Peru export quality products. And due to the huge volumes, pricing is competitive. Some of these companies are strengthening their ties with the UK by establishing joint ventures or local offices. See also the companies that you are competing with below.

Colombia

The United Kingdom is the third most important destination for Colombian fruit exporters. Just like Costa Rica, the main fresh export product from Colombia to the UK are bananas. Colombia exported a total value of €175 million to the UK. However, the banana trade shows a decreasing trend. This is opposite to the growing value of avocados. Colombia tripled its avocado supply to the UK in five years’ time to €30 million in 2021. Colombian growers will attempt to grow further in the avocado business and focus on the UK as one of its prime export markets.

The location and sub climates make Colombia an interesting partner for the United Kingdom. For example, avocado growers are able to fit in between different production seasons. The climate is also very suitable for a wide range of exotic fruits such as yellow pitahaya and physalis.

Kenya

For Kenya, the United Kingdom is an important export market. According to British authorities the UK market accounts for 43% of total exports of vegetables from Kenya. A new economic partnership agreement has entered into force recently.

Kenya has a favourable climate to produce both tropical and counter seasonal vegetables for the UK market. In additional, the country has a good logistical route for air-flown produce. Air-freight is common for example for fine beans and passion fruit.

Kenya is mainly known for horticultural vegetables. In 2021, they supplied the UK with €58 million of fine green beans. Other vegetables included sugar snaps, snowpeas, and broccoli (including baby broccoli or Bimi®). The Kenyan avocado export is also booming, although the export to the UK is still modest with a value of €3.5 million in 2021.

Egypt

Similar to Morocco, Egypt has an excellent position to produce and supply the UK with fresh produce. It is relatively close to the market and can compete with Spain in an overlapping season. For the UK it is a supply country with lots of potential.

Its main strength for the UK market is in onions, green beans and sweet potatoes. Each of these had an import value in the UK of between €16 million and €32 million in 2021.

As a fresh fruit supplier Egypt is not among the top suppliers to the UK. Still, the UK imports high values of Egyptian grapes, strawberries and oranges with a value of between €40 million and €54 million. The import value of strawberries went up from €8 million in 2020 to €50 million in 2021.

Trade agreements and support for developing countries

Developing countries usually have preferential trade schemes. Suppliers from these countries benefit from reduced or zero tariffs for the fresh fruit and vegetables they export to the UK. All of the leading supply countries mentioned above have a trade agreement with the UK.

There is also UK government support for businesses trading and investing between UK and African markets. The UK government encourages and supports businesses in Africa that want to export to and invest in the UK.

Tips:

- Contact the Growth Gateway’s UK-Africa trade team to find out about the support provided for exporters and investors in the UK and African countries.

- Check if your country has a trade agreement with the UK in the guidance document on UK trade agreements with non-EU countries. See also the guidance document on Trading with developing nations for more details on the UK’s Generalised Scheme of Preferences and the specific benefits for individual countries.

- Look up commodity codes, duty and VAT rates in the Trade Tariff database and use the Guidance on Tariffs on goods imported into the UK to see how the import duties compare to your competitors.

Which companies are you competing with?

You can expect strong competitors on the UK market. The most successful companies are those that have strong partnerships or a subsidiary in the UK. Among these companies you will find Cartama from Colombia and Beta from Peru. Other companies have integrated their activities to supply UK supermarkets directly such as the Vegpro group in Kenya.

Vegpro Kenya Ltd

Vegpro Kenya Ltd is specialised in cultivating and preparing vegetables such as fresh beans for export, in particular to the United Kingdom. It is an example of a large-scale operation with big farms and several outgrower schemes. The company has integrated several activities, including the management of their own freight forwarding business, shipping around 550 tonnes of vegetables per week.

This large and integrated company has the advantage of scale, but can also invest in the post-harvest and product quality needed to supply British supermarkets.

Cartama (Colombia)

Cartama has become one of the principle avocado exporters of Colombia. In 2017, they formed the joint venture Cartama UK together with the Fresca Group in the United Kingdom, one of the leading fresh companies in the country. This joint venture followed after an eight-year trading relationship. This has given Cartama a broad market access.

The company is able to produce avocados almost year-round. But now they also have a base in the UK where they can ripen and distribute them.

Beta Complejo Agroindustrial (Peru)

The Peruvian company Beta has 5,500 hectares in the north and south of Peru for the cultivation of asparagus, grapes, blueberries, pomegranates and avocados. This makes them one of the larger growers and exporters in Peru.

To the UK, they supply mainly asparagus and avocados. They already have close ties with companies in the UK such as Flamingo. But the company also plans to operate hubs in the Netherlands and the UK to gain a stronger market presence and work more directly with the end buyers. By focusing more on supply programmes they will reduce their reliance on the spot market.

Tip:

- Define well your strengths as a company and your competitive advantage before entering the UK market. Think what you can offer in a partnership and to whom this would be interesting. Try to talk with different British companies. This process will take time, but it is important to develop a strong relationship to compete on the UK market.

Which products are you competing with?

The United Kingdom wants to become more self-sufficient in fresh fruit and vegetables. There are attempts to increase the local production. There is a growing interest in local and seasonal fruit and vegetables from the consumer side.

This means that within the UK production season, there could be more competition for products that can also be grown in the UK. This includes apples, soft fruit and a wide range of common vegetables such as onions, carrots, lettuce, cabbage, cauliflower and broccoli.

Tips:

- Find the right time to supply your product to the UK. Use the online tool on the EUFIC website to Explore seasonal fruit and vegetables in Europe and see when different fruit and vegetables are in season in the UK.

- Try to associate yourself with British growers or grower associations and organise together a year-round supply. For example, check out the major berry companies that are members of British Berry Growers. Go to the British Growers website to see an overview of associations and producer organisations.

4. What are the prices for fresh fruit and vegetables in the UK market?

The market prices for fresh fruit and vegetables depend mainly on their availability, the quality and the added value such as basic processing or packaging. As an exporter it is relevant to know how much the different supply countries will harvest. This can vary per season, but also per month or week. Climate plays an increasingly important role.

Recently with COVID-19 (2020 onwards), Brexit (2021) and the war in Ukraine (2022), the costs for inputs and logistics have risen. This has led to price increases. This does not mean that growers and exporters are getting more money for their products. In fact, there may be more pressure on the margins to compensate for the higher costs and keep prices level.

For domestic products there is a clear price inflation for fresh fruit: 42.7% in one year (see table 3). Vegetables have been spared from the inflated prices, and even showed a decrease between February 2021 and February 2022.

Table 3: Price indices for fresh fruit and vegetable outputs to February 2022 (2015 = 100), and 12-month (year-over-year) and 1-month (month-over-month) inflation rate

| Category | February 2021 | January 2022 | February 2022 | 12-month rate (%) | 1-month rate (%) |

| Fresh vegetables | 126.6 | 121.4 | 119.7 | -5.4 | -1.4 |

| Fresh fruit | 173.4 | 246.8 | 247.5 | 42.7 | 0.3 |

Source: Historical statistics notices on agricultural price indices, 2022, Figures to February 2022 (published 21 April 2022) on GOV.UK

Despite rising prices, the UK is still a leader in retail promotions. Promotions play a key role in grocery retail. On average, some 25-30% of the product ranges offered by retail chains such as ASDA, Tesco and Waitrose are on promotion. This is not much different for fresh produce. Products are promoted with ‘2 for £4,’ ‘£1 packs’ and ‘half-price’ offers. Even discounters such as Lidl have a ‘Pick of the week’ with attractive deals for fruit and vegetables.

These price offers are most common when a local product is in season, but also exist for imported produce. As a supplier to supermarkets you are obliged to cooperate with promotions. A supply programme with a supermarket usually includes your commitment with one or two promotions. This means you may have to accept a lower margin during certain periods if you want to benefit from the secure supply of a seasonal contract.

Tip:

- Find weekly prices for wholesale fruit and vegetables on GOV.UK. These are averages of the most usual prices charged by wholesalers for selected home-grown fruit and vegetables from selected wholesale markets, but it gives you an idea of the price developments in the UK.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research