The United Kingdom market potential for fresh fruit and vegetables

The British market welcomes convenience fruit and vegetables such as (easy-to-eat) apples, bananas, grapes and easy peelers. There is also a growing berry market and a good demand for oriental vegetables. COVID-19 and Brexit have resulted in new opportunities for production countries near to Europe and suppliers of healthy, sustainable and well-priced products.

Contents of this page

1. Product description

This market report focuses on fruit and vegetables with Harmonized System (HS) codes that start with 07 and 08, excluding (coco)nuts, fruit peel, frozen or preserved fruit and vegetables, certain dried fruit and dried vegetables.

Table 1: Products that are included in this market report and statistics

| HS code | Description |

| 0701 | Potatoes, fresh or chilled |

| 0702 | Tomatoes, fresh or chilled |

| 0703 | Onions, shallots, garlic, leeks and other alliaceous vegetables, fresh or chilled |

| 0704 | Cabbages, cauliflowers, kohlrabi, kale and similar edible brassicas, fresh or chilled |

| 0705 | Lettuce "Lactuca sativa" and chicory "Cichorium spp.", fresh or chilled |

| 0706 | Carrots, turnips, salad beetroot, salsify, celeriac, radishes and similar edible roots, fresh or chilled |

| 0707 | Cucumbers and gherkins, fresh or chilled |

| 0708 | Leguminous vegetables, shelled or unshelled, fresh or chilled |

| 0709 | Other vegetables, fresh or chilled (excluding potatoes, tomatoes, alliaceous vegetables, edible brassicas, lettuce ""Lactuca sativa"" and chicory ""Cichorium spp."", carrots, turnips, salad beetroot, salsify, celeriac, radishes and similar edible roots, cucumbers and gherkins, and leguminous vegetables) |

| 0714 | Roots and tubers of manioc, arrowroot, salep, Jerusalem artichokes, sweet potatoes and similar roots and tubers with high starch or inulin content, fresh, chilled, frozen or dried, whether or not sliced or in the form of pellets; sago pith |

| 0803 | Bananas, incl. plantains, fresh or dried |

| 0804 | Dates, figs, pineapples, avocados, guavas, mangoes and mangosteens, fresh or dried |

| 0805 | Citrus fruit, fresh or dried |

| 0806 | Grapes, fresh or dried |

| 0807 | Melons, incl. watermelons, and papaws (papayas), fresh |

| 0808 | Apples, pears and quinces, fresh |

| 0809 | Apricots, cherries, peaches incl. nectarines, plums and sloes, fresh |

| 0810 | Fresh strawberries, raspberries, blackberries, back, white or red currants, gooseberries and other edible fruits (excluding nuts, bananas, dates, figs, pineapples, avocados, guavas, mangoes, mangosteens, papaws "papayas", citrus fruit, grapes, melons, apples, pears, quinces, apricots, cherries, peaches, plums and sloes) |

Source: Trade Map

2. What makes the United Kingdom an interesting market for fresh fruit and vegetables?

The British fresh fruit and vegetable market has an attractive size and a large dependency. Since it is no longer part of the European Union, it offers opportunities for competitive suppliers outside of Europe.

The UK market is large and competitive

The United Kingdom (UK) is the third biggest importer of fresh fruit and vegetables in Europe. Only Germany and the Netherlands import more - the Netherlands being the main trade hub to mainland Europe. The total import value in the UK was over €7.5 billion in 2021. With this, the country represents about 12% of the entire European fresh fruit and vegetable import.

However, the market value has had limited growth over the past years. It is a mature and stable market with very dominant supermarket formulas. Market maturity and strong retail dominance may be the reasons why price levels are relatively low compared to other European countries. The prices for fruit and vegetables were (only) 89.8% of the EU average in 2020. As an exporter you need to prepare for demanding customers in a very competitive landscape.

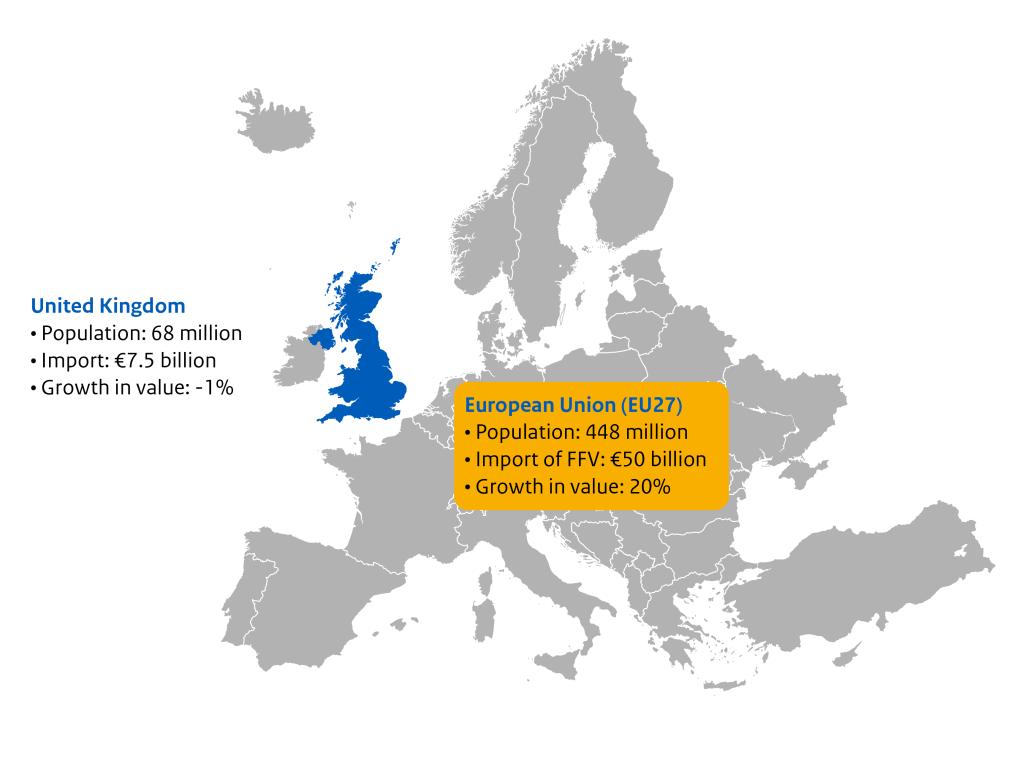

Figure 1: The fresh fruit and vegetable market in the UK, compared with the European Union (EU-27)

Consumption is growing gradually thanks to public attention

The British are not known to be exceptional consumers of fruit and vegetables. But all kinds of initiatives are helping to increase the current consumption.

The government’s Eat Well Guide recommends 5 portions of fresh fruit and vegetables a day. Currently, UK consumers only eat an average of 3 portions per day. Vegetables such as peas, carrots, potatoes and cabbage are some of the most typical vegetables in the British cuisine.

According to data gathered by Statista, in 2021 British households purchased approximately 10.55 billion British pounds worth of fruit and approximately 15.83 billion British pounds worth of vegetables. This is less than in 2020, when COVID triggered an increased demand for healthy food. On the long-term consumption progresses slowly, but will be helped by a variety of public initiatives.

The ambitions from public organisations and the horticultural industry to improve consumption are high. A diverse group of producer organisations and charities have united in the Fruit and Vegetable Alliance. They aim to get the nation eating more fruit and vegetables and increase the local production. Government and retailers have also pledged to stimulate the consumption of vegetables. Also the School Fruit and Veg Scheme has been re-instated after a suspension due to Covid-19. Higher consumption will not only benefit British growers, but also a large number of foreign suppliers.

Case study

In 2020, Sainsbury’s supermarket launched the ‘Great Big Fruit and Veg Challenge’ to encourage and reward customers for buying more fruit and vegetables. Customers could collect loyalty card points (Nectar) for achieving personalised targets for their fruit and veg purchases. Card holders who took part in the challenge took home an extra 3.6 portions of fruit and veg per week during the challenge. In the weeks after the challenge those who participated continued to purchase more vegetables, with weekly portions up by 2.7 portions compared to the pre-challenge period.

Source: The Food Foundation Peas Please – Progress Report 2021

UK depends on imported fruit and vegetables

The United Kingdom relies heavily on imported fruits and vegetables. This strong dependence is the reason why you will find opportunities for a wide range of fresh produce.

Although the UK is trying to boost local cultivation, the production has only declined in the past few years. The decrease was most notable for fruits. Only local cultivation of strawberries and dessert apples continued to grow up to 2019. With Britain leaving the European Union (Brexit), many migrant workers left the country. The current labour shortages make it difficult to increase production.

In 2020, the UK depended for about 44% on the import of vegetables. For fruits this was even close to 84%. Even for some of the main products that the UK produces, the import volume is relatively high. For example, against a production of 201,000 tonnes of apples there was an import volume of 338,000 tonnes. Self-sufficiency is low for many British-grown fruits and vegetables (see table 3). Meanwhile, the popularity of British-grown fruit and vegetables continues to grow.

Table 2: United Kingdom’s total supply of fruit and vegetables, in 1,000 tonnes

| CALENDAR YEAR | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 Provisional |

| VEGETABLES: | ||||||

| Home Production | 2.712,4 | 2.591,2 | 2.698,9 | 2.468,0 | 2.524,3 | 2.599,3 |

| Imports | 2.256,2 | 2.369,0 | 2.183,7 | 2.268,1 | 2.355,6 | 2.179,5 |

| Exports | 153,3 | 155,2 | 129,4 | 145,4 | 143,4 | 107,0 |

| Total Supply : | 4.815,3 | 4.805,0 | 4.753,2 | 4.590,7 | 4.736,6 | 4.671,9 |

| Home Production as % of Total Supply | 56,3 | 53,9 | 56,8 | 53,8 | 53,3 | 55,6 |

| FRUIT: | ||||||

| Home Production | 776,8 | 765,1 | 749,7 | 730,6 | 687,9 | 657,0 |

| Imports | 3.705,1 | 3.866,7 | 4.012,7 | 3.660,8 | 3.657,3 | 3.547,0 |

| Exports | 130,4 | 142,1 | 177,0 | 156,2 | 161,5 | 176,5 |

| Total Supply : | 4.351,6 | 4.489,6 | 4.585,4 | 4.235,2 | 4.183,7 | 4.027,5 |

| Home Production as % of Total Supply | 17,9 | 17,0 | 16,3 | 17,3 | 16,4 | 16,3 |

Source: Department for Environment, Food & Rural Affairs on GOV.UK

Table 3: Self-sufficiency in the United Kingdom in 2020

| Fruit | Vegetables |

Apples: 38.8% Pears: 19.4% Plums: 19.1% Strawberries: 69.4% Raspberries: 37.0% | Cabbage: 89.6% Cauliflower & Broccoli: 61.4% Carrots, turnips and swede: 96.6% Lettuce: 33.0% Tomatoes: 14.8% |

Source: Department for Environment, Food & Rural Affairs on GOV.UK

Post-Brexit opportunities for non-European supply

Since Brexit, there is no specific advantage for the UK to import fresh produce from the EU. From 1 January 2021, every import into the UK from the EU is subject to the same phytosanitary import prohibitions and requirements as other non-EU European countries. This leaves more opportunities for exporters to supply fresh produce that is normally imported from EU countries.

From 2020 to 2021, the fresh produce supply from Spain to the UK declined by 278,0000 tonnes and from the Netherlands it declined by 148,000 tonnes. At the same time, Morocco exported 70,000 tonnes more and Egypt 18,000 tonnes more. For example, the tomato import from Morocco boomed from 83,000 tonnes to 111,000 tonnes between 2020 and 2021. A similar development can be seen with berry fruits (strawberries, raspberries and blueberries) from Morocco and Egypt.

Many other countries also increased their supply to the UK, including overseas and off-season suppliers such as South Africa, Brazil and Peru. Because of this, the total import of fresh produce from developing countries increased in value (see figure 2).

British love berries

The United Kingdom has always been an important market for tropical fruit and vegetables from developing countries. The fruits with the highest import values in 2021 were bananas and table grapes. Tomato was the most important vegetable for import. However, berries registered the fastest import growth (see figure 3).

The UK is a berry loving country. Soft fruit is consumed in breakfasts or desserts, but is also very popular in jams. In particular the import of blueberries and raspberries has increased over the last 5 years. These valuable soft fruits are able to generate a high import value.

Blueberries recorded the highest trade value for developing country suppliers after banana, table grapes, mangoes and avocados. In the period between 2017 and 2021, the import value of blueberries, and other berries of the genus Vaccinium, increased by around 26% to €377 million. Raspberry imports even increased by 110% to €249 million.

Exporters can best find partnerships with leading berry companies that integrate different farms and origins. One of these companies is, for example, Driscoll’s.

*mainly blueberries

United Kingdom has interesting niche markets

As an exporter of exotic or ethnic products you can find interesting niche markets in the UK. Cultural influences make the country very receptive to foreign cuisines and new products.

There is a good market for ethnic products thanks to a diverse foreign population. Foreign communities such as Indian (2.3%) and Pakistani (1.9%) are well represented. The consumption of exotic and ethnic foods has also been adopted by British nationals. This results in a diverse market with exotic products such as Alphonso mango and okra from India, haricots verts and niche vegetables from Kenya and yams from Ghana.

In Europe, the United Kingdom is one of the main importers of leguminous and root vegetables. For example, the United Kingdom is responsible for 23% of the sweet potato import in Europe, around 20% of the leguminous vegetables and 46% of the yam import.

Some of the Asian vegetables have become less available, and prices are high. This can be an opportunity for growers that have access to efficient logistics. You can also expect more of these vegetables to be grown in the UK, such as Chinese broccoli, choy sum, celtuce and various oriental herbs.

Tips:

- Stay informed about the latest updates in the UK market through the Fresh Produce Consortium’s news and ‘fresh talk daily’, Produce Business UK, Fresh Produce Journal, and through international sources such as Freshplaza and FreshFruitPortal.

- Read more about the opportunities for Asian vegetables and blueberries in CBI’s reports on Exporting fresh exotic vegetables to Europe and Exporting fresh blueberries to Europe.

- Use the GOV.UK website and guidance on importing and exporting fresh fruit and vegetables to see the changes in trading protocols after Brexit, including import requirements and domestic prices.

3. Which trends offer opportunities or pose threats on the UK fresh fruit and vegetable market?

The multibillion convenience market in the UK is considered to be the biggest in Europe. Meanwhile, the demand for healthier and sustainable food keeps on growing. The economic development over the coming years will give further direction to these trends.

Strong demand for convenience

The United Kingdom is one of the frontrunners in Europe in convenience food. British retailers make it easy for consumers to purchase food for direct consumption or easy preparation. The possibility for exporters to tap into this market may be limited, but there are success stories.

Fruit and vegetables that are perceived as easy-to-eat are usually among the most popular purchases, such as apples, seedless table grapes, bananas and easy peeler oranges and mandarins. These easy-picks are complemented by well-packaged berries and ripened fruit. On the supermarket shelves you will find ready-to-eat fruit and pre-cut vegetables in various small package sizes.

The COVID-19 pandemic has also driven the growth of fresh food delivery and recipe boxes as well. Over a quarter of British consumers have signed up to a food and drink subscription box service. This market is expected to expand further in the next years with approximately 50% between 2020 and 2025. Popular services include Gousto, Mindful Chef, HelloFresh, Abel & Cole, SimplyCook, Riverford Organic, among others.

Some of these segments have mainly resulted in additional requirements for exporters, for example in terms of quality control and efficient supply chain organisation. For example, avocado exporters need to focus on perfect uniformity for ripening companies; and manual processors of fresh haricots verts need to spend extra attention on food safety.

One of the few companies that has succeeded in adding value at the source, is Blue Skies, a UK company that has part of its origin in Ghana. Blue Skies produces freshly cut fruit and fruit salads in the country where it is grown. Fruits are harvested and processed in different factories in Ghana, Egypt, South Africa, Benin and Brazil. It is a difficult operation, as the perishable products need to be airfreighted and arrive on the market shelves within 48 hours.

British people stay healthy with fresh fruit and vegetables

Health consciousness is not new, but the COVID-19 pandemic has further influenced purchasing habits. Consumers in the UK are making healthier choices and eat more vegan. Time will tell if these changes are permanent.

A survey commissioned in 2021 by the British Nutrition Foundation reveals that a third of the British consumers have included more fruit and vegetables in their diet since May 2020, the start of the COVID-19 pandemic. In particular the interest in fruits with specific health benefits spiked in 2020, such as avocados, mandarins, and also ginger was slightly higher than usual. According to The British Nutrition Foundation, 33% of the people state they have included more fruits and vegetables in their diets.

Veganism

Consumers are also downsizing their meat consumption, which could have a positive influence on the vegetable consumption over the next years. The number of vegans quadrupled between 2014 and 2019. Currently 1.16% of the British population claims to follow a vegan lifestyle. Vegetables that can complement a meatless diet are for example aubergine, mushrooms, beets, cauliflower, and jackfruit.

Sainsbury’s has seen an interest in jackfruit as meat replacement. The supermarket first introduced pulled jackfruit as a meat substitute in 2018. Since then it has expanded into nine other products. Their next innovation will be banana blossom as a plant-based fish-like alternative. According to Sainsbury’s Future of Food Report vegetarians (including vegans) could make up a quarter of British people in 2025, and flexitarians just under half of all UK consumers.

At the same time, obesity and unhealthy diets remain a reality in the UK. Research suggests that British people still want to indulge themselves. Therefore, fresh produce suppliers should not just focus on the healthiest fruit and vegetables, but also on varieties that provide the best taste and consumer experience.

Figure 4: Changing consumer behaviour in the United Kingdom (2021/2022)

Sources: The Economist Group (2022); The British Nutrition Foundation (2021); BRC/EY Future Consumer Index report (2022); Deloitte’s research in (2021); OC&C Strategy Consultants on Consultancy.uk (2022)

Preference for sustainable and ethical produce

According to The Economist Group the United Kingdom is the 16th European country in the Food Sustainability Index. However, the awareness for sustainable and responsible food is increasing. Consumers focus in particular on reducing plastics and purchasing local food products. Large retail chains are strict when it comes to ethics and traceability.

OC&C Strategy Consultants report online that 35% of the British consumers actively look for sustainable products, a group that represents £150 billion of retail spending. Another report of the BRC/EY Future Consumer Index states that 72% of UK consumers consider sustainability when buying fresh fruit and vegetables. In practice, consumers can be inconsistent. It is easy to choose local produce if it is available, but price is an important factor too. Another dilemma for consumers is the choice between convenience and reducing plastic packaging.

Sustainability and ethical trade are also a priority for retailers. In 2021, British retailers cancelled £7.1 billion in contracts with suppliers that do not meet their ethical and sustainability standards.

As a foreign supplier you will have to differentiate your product well, be price competitive and look for recyclable or biodegradable packaging options. Additionally, retailers will continue to press on traceability and responsibly grown fruit and vegetables. This will require specific quality standards and certifications.

Inflation can hamper existing trends

Recent events, such as the COVID-19 pandemic and the war in Ukraine, triggered inflation throughout Europe. In the United Kingdom these come on top of Brexit. A higher cost of living can put pressure on the existing consumer trends in health food and sustainability.

In April 2022, more than half of the British consumers were noticing increasing costs of their weekly groceries according to data from NielsenIQ. The growing consumer group that is willing to pay a premium for sustainable fruit and vegetables will be slowed down by the higher prices. Another 21% select the lowest priced product regardless of the brand. The economic circumstances increase the motivation in the UK to become more self-sufficient in the production of fresh produce.

Tips:

- Add different options for processing, packaging and labelling to your offer. The UK retail and convenience sector requires a high service level and marketing options towards consumers.

- Become a more valuable supplier to the United Kingdom by adopting additional sustainable standards. Use the ITC Standards Map and select your origin to find different standards and certifications.

- Visit the London Produce Show to learn about the latest developments in the United Kingdom and meet with local fresh produce professionals.

- Read more about the general trends in Europe that provide opportunities or threats in the CBI Trend study for fresh fruit and vegetables.

This study was carried out on behalf of CBI by ICI Business.

Please review our market information disclaimer.

Search

Enter search terms to find market research