Entering the European market for watermelon

You should expect strong competition when you prepare to export your watermelons to Europe. In Europe, watermelons are consumed when the weather starts to warm up, so their marketing period is concentrated from March to September. The supply of watermelons in Europe is varied. There is a large European production, generally from May to September depending on the producer country, but this is insufficient to meet demand. Complementary supplies come from Africa, Latin America and the Middle East.

Contents of this page

1. What requirements must watermelons meet to be allowed on the European market?

There is no specific European marketing standard for watermelons. Therefore, they must comply with the general marketing standards (GMS) in Annex I, Part A of EU Regulation No 543/2011. However, you can also use the UNECE standard and the OECD brochure developed following the UNECE standardto determine the specific quality criteria for your watermelons. The OECD brochure is an interpretative brochure with photos of varieties and the main quality defects.

For other information about the requirements your products must comply with before being exported to the European Union (EU), please check the EU trade assistance platform My Trade Assistant by Access2Markets. The HS Code for watermelons is 080711. You can also read our study on buyer requirements for fresh fruit and vegetables.

What are mandatory requirements?

The mandatory requirements mainly concern compliance with maximum residue limits. Please bear in mind that buyers will request phytosanitary certificates if you are exporting from specific country zones. Because of the strong competition, you should try to only export your best watermelons and always adapt their quality to your customer's requirements.

Avoid pesticide residues and contaminants

Watermelons are often affected by pests and insects and are can commonly be attacked by fungi. This is why you need to implement good agricultural practices to limit any losses due to insects or fungi. The EU legislation on MRLs (maximum residue levels) sets limits for the chemicals that are allowed to be used to grow watermelons. To find an updated list of all the pesticides that you are allowed to use on watermelons, please check the EU database for pesticide residues. Select the crop in the product box and the database will list all the pesticides allowed for that crop, as well as their MRLs.

Please note that some countries apply stricter levels depending on the chemicals used. Below is a table summarising the most commonly used pesticides for watermelons and their MRLs.

Table 1: EU MRLs on pesticides most commonly used for watermelons

| Active substance | EU MRL | Approval expiration date | Type of pesticide |

| ABAMECTIN | 0.01 | 31 March 2038 | Pesticide (Acaricide, Insecticide, Nematicide) |

| COPPER COMPOUNDS | 5 | 31 December 2025 | Fungicide/Bactericide |

| AZOXYSTROBIN | 1 | 31 December 2024 | Fungicide |

| BOSCALID | 3 | 15 April 2026 | Fungicide |

| DELTAMETHRIN | 0.02 | 15 August 2026 | Insecticide |

| IMAZALIL | 0.01 | 31 December 2024 | Fungicide |

| PIRIMICARB | 0.5 | 15 March 2025 | Insecticide |

Source: Thierry Paqui – compilation based on interviews and EU database for pesticide residues – (April 2024)

When the MRL is set at 0.01 in the EU, this generally means that the pesticide is allowed to be used. When the MRL is set to the lowest possible value (also called the ‘lower limit of analytical quantification’), this means that if the products are checked for MRLs, no traces may be found.

Tip:

- Please confirm with your importer if the chemicals you are using to manage pests and fungal attacks are allowed in their country or in the countries to which they plan to export your watermelon.

Phytosanitary regulation

The European Union requires watermelons to go through plant health checks before entering the European Union. The plant health inspection must take place in the country the product was produced in. The shipment must be accompanied by a phytosanitary certificate, guaranteeing that the products are:

- Properly inspected;

- Free from quarantine pests, within the requirements for regulated non-quarantine pests and practically free from other pests;

- In line with the plant health requirements of the EU, laid down in the Regulation (EU) 2019/2072 (updated June 2023).

Tips:

- If you are exporting watermelons grown in open fields, take special care to avoid sending dirty batches or batches with soil on, as this could negatively impact your image and the marketing of your batch.

- Your buyer’s clients may have some specific requirements. Always check with your buyer to see what you have to do before exporting to market the best products possible.

- Read the CBI Buyer requirement guidelines to get useful tips on what is required to export to European markets.

- Check the list of the National Plant Protection Organizations (NPPOs) on the FAO website to find the recognised phytosanitary authority in your country. The organisations in this list are members of the International Plant Protection Convention (IPPC). All fruits require a phytosanitary certificate, except the ones mentioned in Annex XI, part C of the Implementing Regulation (EU) 2019/2072.

Adapt your quality standards

Watermelons must comply with the European General Marketing Standard (GMS). However, we recommend that you adapt the quality of your product to the marketing standard for watermelons developed by the UNECE (FFV-37). This UNECE standard can help you understand what the minimum marketing requirements are that your watermelons must comply with. The OECD has developed an interpretative brochure for the UNECE standard. The photos in this brochure can help you to identify your partners' expectations regarding the quality of watermelons sold in Europe.

The provisions laid out in the UNECE standard for watermelons are similar to those found in all product-specific standards. These provisions cover aspects related to quality, size, tolerances, presentation and labelling.

Regarding quality, the UNECE standard for watermelons establishes three classes (Extra, Class I and Class II). These are described in the table below (see Table 1). The classes apply to watermelons of the Matsum. et Nakai varieties (cultivars) grown from the species Citrullus lanatus (Thunb.) to be supplied fresh to the consumer.

In all classes, the watermelons must be:

- intact;

- sound, produce affected by rotting or deterioration that makes it unfit for consumption must be excluded;

- firm;

- clean, practically free of any visible foreign matter;

- practically free from pests;

- free from damage caused by pests affecting the flesh;

- free from abnormal external moisture;

- free from any foreign smell and/or taste.

The development and condition of the watermelons must enable them:

- to withstand transportation and handling;

- to arrive in at the place of destination in good condition.

Table 2: Summary of quality requirements per class as determined by the UNECE standard for Watermelons

| Extra class | Class I | Class II |

Watermelons in this class must be:

| Watermelons in this class must be:

The following slight defects, however, may be allowed, provided these do not affect the general appearance of the produce, the quality, the storage quality and presentation in the package:

| This class includes watermelons that do not qualify for inclusion in the higher classes but satisfy the minimum requirements specified above. The following defects may be allowed provided that the watermelons retain their essential characteristics as regards the quality, the storage quality and presentation in the package:

|

Tolerances: A total tolerance of 5 per cent, by number or weight, of watermelons that do not satisfy the requirements of this class but still meet those of Class I is allowed. Within this tolerance, no more than 0.5 per cent in total may consist of produce that only satisfies the requirements of Class II. | Tolerances: A total tolerance of 10 per cent, by number or weight, of watermelons that do not satisfy the requirements of this class but still meet those of Class II is allowed. Within this tolerance, no more than 1 per cent in total may consist of produce that does not satisfy either the requirements of Class II quality or the minimum requirements, or of produce affected by decay. | Tolerances: A total tolerance of 10 per cent, by number or weight, of watermelons that do not satisfy either the requirements of the class or the minimum requirements are allowed. Within this tolerance, no more than 2 per cent in total may consist of produce affected by decay. |

Source: UNECE standard for watermelons

Maturity

The watermelons must be sufficiently developed and show sufficient maturity and/or ripeness. The colour and taste of the flesh should conform to a sufficient state of ripeness.

To satisfy this requirement, the ‘refractometric index’ of the flesh, which is measured at the middle point of the fruit flesh at the equatorial (middle) section, must be equal to or greater than 8° Brix.

Tips:

- Avoid offering Class II products, as most suppliers of the European market offer Extra Class or Class I products.

- Always aim for Extra Class products. Your buyer will have better chances of selling them on versus those offered by your competitors.

Handling and transport

Watermelons are generally transported in refrigerated trucks or reefer containers. Because watermelons are fragile fruits, it is recommended to transport them in corrugated cardboard boxes. They are sensitive to temperature and variations in humidity. Containers should therefore be properly ventilated to avoid possible damage and preserve the quality of the watermelons. Depending on the variety and the maturity, temperatures recommended for transport can range from 5° to 10° Celsius and have a relative humidity of 85-90%.

Product size and uniformity

Size is determined by the weight per unit. To make sure that your batch is uniform in size, the range in size between watermelons in the same batch should not be larger than 2 kg or 3.5 kg, if the lightest watermelon is over 6 kg. This uniformity in weight is not compulsory for watermelons presented in bulk in pallet boxes/bins or in the transport vehicle. The number of watermelons per box/package is optional.

In practice, whole watermelons sold individually are classified as small/medium (between 4 and 8 kg), medium-large (between 7 and 12 kg) or very large (between 10 and 20 kg). The weight of mini watermelons, which represent a niche segment, is between 1 and 4 kg.

Packaging

The watermelons must be packed in a way that protects the produce properly. The materials used inside the package must be clean and must not cause any external or internal damage to the produce. You are allowed to use materials like paper or stamps that display the trade specifications, as long as the printing or labelling is done with non-toxic ink or glue.

Stickers that are individually stuck on the produce should not leave visible traces of glue when removed, nor lead to defects on the watermelon rind. Information that is lasered on a single fruit should not cause any flesh or rind defects.

Payment and delivery terms

The payment methods used most often depend on the volumes you export. There is no specific rule. The most common method of payment used is the open account. Following this method, the exporter ships the goods and provides all the necessary documents directly to the importer via a forwarding agent. The exporter and importer then agree on a deadline for the payment to be made to the exporter. This deadline may be 30, 60 or 90 days. The longer the period, the greater the risk is for the exporter, who may have made several exports before receiving any payment. For test shipments, it is recommended to wait to receive payment for your first shipment before you decide to send any more shipments. Just like any business, relationships based on trust can only be built over the long term.

FOB or CIF incoterms are the most often used delivery terms. But above all, it depends on your financial base. These issues are not fixed and are must be discussed on a case-by-case basis.

Tips:

- Watermelons for export should best be packed in corrugated cardboard boxes.

- Always discuss the specific requirements for weight, number and packaging with your buyer.

- For other additional requirements, such as labelling, payment and delivery terms, see our study on Buyer requirements for fresh fruit and vegetables and our Tips for doing business with European buyers. Also check the legal requirements for materials that come in contact with food in Regulation (EC) No 1935/2004 (consolidated version from 27 March 2021).

What additional requirements do buyers often have?

Your buyers may have additional requirements. These usually relate to certifications that will make it easier for your products to circulate on the European market, such as GLOBALG.A.P. certification.

Obtain commonly used certifications

Just like most fruit producers who export to Europe, you are expected to achieve at least GLOBALG.A.P. certification. This private certification that is based on good agricultural practices encourages limited use of chemical pesticides. It also has a traceability aspect, which is now considered essential for exporting to Europe. Products that are GLOBALG.A.P.-certified can move easily from one European country to another. Watermelon imports from non-European countries are rarely consumed in the European country of import. They are most often re-exported to other European countries. Achieving GLOBALG.A.P. certification will help with the trade of your watermelons, which will increase their chances of being sold more quickly.

Apply additional sustainability and social standards

It is important for fruit collectors and exporters to show that they care about the well-being of their production sources, both socially and environmentally. This is a growing concern for many buyers and retailers. The best way to do this is by complying with social and environmental standards, such as Sedex Members Ethical Trade Audit (SMETA) and GLOBALG.A.P..

You can expect new environmental and social initiatives in the near future, with standards that become more extensive and with regular audits. For example, the Sustainable Trade Initiative for Fruit and Vegetables (SIFAV), which is a private agreement between European importers and retailers, has set new goals for 2025 that include a fair living wage and reducing the carbon footprint.

Retail chains sometimes have their own standards, such as Tesco’s Tesco Nurture programme, an add-on module to GLOBALG.A.P..

Comply with the sustainability requirements to be competitive in the European market

Some of the most relevant European laws and legislation related to environmental sustainability are incorporated into the European Green Deal (EGD). The EGD is a set of policies with the final aim of achieving climate neutrality in Europe by 2050. Climate neutrality means reaching a balance between greenhouse gas emissions and removals, which is expected to limit global warming. This is also known as zero emissions and can be reached if global warming is limited to 1.5 C°.

The most important impacts of the EGD for watermelon suppliers are the following:

- Encouragement of organic production (and consumption) – One of the aims of the Farm to Fork Strategy is to increase the share of organic agricultural land to 25% in Europe by 2030.

- Introduction of the environmental footprint methodology – In line with ‘sustainable food systems’, the European Commission will publish official methods for companies to declare themselves as being environmentally friendly (‘green claims’), in order to prevent superficial or false claims (‘greenwashing’) and to better inform consumers about the food choices that they make.

- Endorsing greater corporate responsibility and sustainability standards through the Corporate Sustainability Due Diligence Directive.

- Reducing packaging waste – The main aim of the packaging and packaging waste directive is that all packaging in the EU must be reusable or recyclable in an economically viable way by 2030. Some countries are aiming to reduce plastic even faster than proposed by the EGD. For example, France has already imposed a ban on plastic packaging for fresh fruits and vegetables in containers weighing less than 1.5 kg.

- Reducing the usage of pesticides – The European Commission withdrew a proposal to reduce the usage of pesticides by 50% by 2030 in March 2024. The Sustainable Use of Pesticides Directive (2009/128/EC) still applies.

Tip:

- Review your treatment practices to ensure that your watermelons do not contain pesticide residues above the set limits.

What are the requirements for niche markets?

There are opportunities to stand out in terms of the varieties you produce. To qualify as organic, it is not enough to produce without the use of chemicals. You need to obtain a certification that proves and validates the organic nature of your products.

Speciality varieties as a means to distinguish your supply from the mainstream ones

Watermelon supplies in the European market come from a large variety of suppliers. However, you can stand out from traditional offers by offering specific varieties, such as watermelons with a different flesh colour (Orangeglo, Yellow Crimson or Cream of Saskatchewan). These products are not widely available, but with the right partner, you can develop a niche market.

You can also offer seedless varieties. Although the seedless watermelon range already exists and is making good progress, in a market where consumers want more convenience in their food, the seedless watermelon range (Crimson Sweet seedless or Jubilee seedless) is an interesting opportunity.

Finally, because consumers are increasingly aware of the need to avoid food waste, mini watermelons are also a promising niche opportunity.

Organic certification and sustainable sourcing: a means to create differentiation

European consumers are increasingly interested in products grown without pesticides or chemicals. Concerns about health and well-being are important in their decision to make a purchase. The demand for organic-certified products is therefore growing steadily in Europe. For the moment, the supply of organic watermelons is still limited, and because of this, organic watermelons are a high-potential niche market.

To market crops that are labelled organic in Europe, you must have achieved the organic certification that is relevant to your product. Imports of organic products are regulated by Regulation (EU) 2018/848. Please note that this regulation now sets stricter controls on these products. Your European partner must be able to provide detailed documentation to various control agencies at all times, to demonstrate the organic integrity of imported products. The control authorities must also be able to trace all of the growing processes.

Tips:

- Consider producing organic watermelons if you are already not using many chemicals. In Europe, there is a growing demand for organic products, which are highly valued. If you succeed in getting organic certification, it will be a way for you to access a higher value-added market.

2. Through which channels can you get watermelons on the European market?

In Europe, watermelons are mainly sold in supermarkets and hypermarkets. They are also sold at street markets or by vendors. Speciality and grocery stores play a less important role in the marketing of watermelons.

How is the end market segmented?

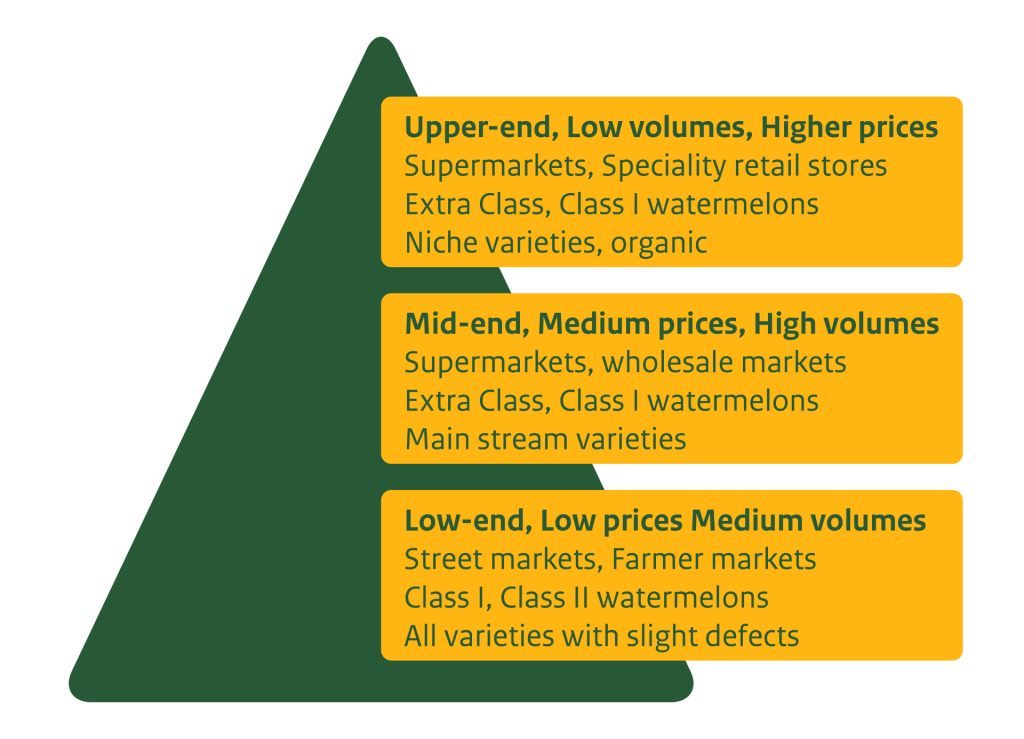

Figure 1: Segmentation of the watermelon market

Source: Thierry Paqui

High segment: Seedless, fresh cut and mini watermelons

The fruit in this segment is all Extra class or Class I. But this segment also includes freshly cut watermelon for consumers who do not want to buy large watermelons and prefer to buy ready-to-eat watermelon quarters. This is also the segment that contains seedless and mini watermelons, which are valued at a fairly high price because of their convenience and small size. They are mainly sold in supermarkets and speciality retail stores.

In this top segment, you can find varieties with different coloured flesh, as well as organic watermelons. They are valued for the special colour of their flesh, which can brighten up fruit salads. Because they are not commonly available, they are a niche of limited supply compared to the mainstream segment. They are mainly sold in speciality retail stores, as well as in supermarkets.

Main segment

The main segment of watermelons are the Extra class and Class I watermelons of the most popular red flesh varieties (Crimson Sweet, Jubilee, Sugar Baby). Class II watermelons are not common in the main segment. This biggest volumes in this segment are generally sold in supermarkets. Wholesale markets also play a key role in this segment.

Low-end segment

Fruits in this segment are Class I or Class II. They can have some defects in shape and can be of all varieties, although varieties with different coloured flesh are not common. They are mostly sold at street markets or farmers’ markets.

Figure 2: Spanish watermelons sold in Tonus Fresh stores (France)

Source: Thierry Paqui.

Figure 3: Bulk packaging for Moroccan watermelons seen in Grand Frais supermarket (France)

Source: Thierry Paqui

Tip:

- Pay attention to your post-harvesting and packaging. If your product is presented well (packaging, cleanliness), this could help your product being sold in high-end supermarkets.

Through what channels does a product end up on the end-market?

Watermelons are sold through various channels, such as supermarkets, wholesale markets, speciality stores and street markets.

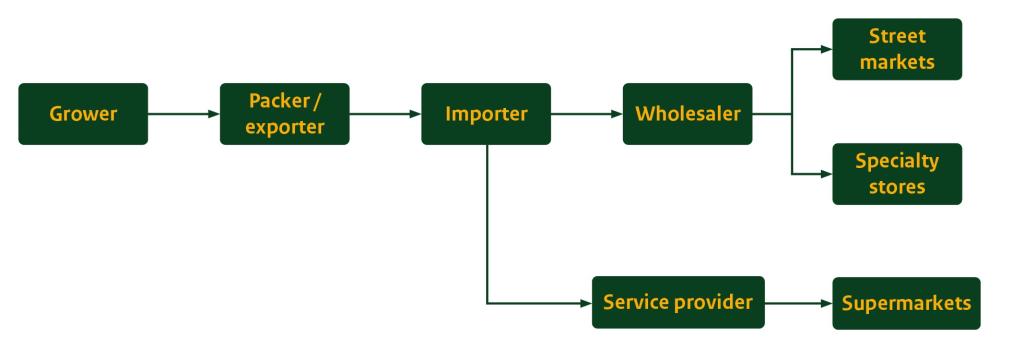

Figure 4: European market channels for watermelons

Source: Thierry Paqui

Importers and service providers

Service providers and importers are key in supplying the European watermelon market. Initially, they are the primary points of contact or middlemen between European producers and supermarkets, which is the main source of sales for European watermelon production. For instance, service providers such as the Greenery or Hillfresh in the Netherlands play a key role in importing and marketing watermelons.

However, as European production is not enough to supply the full demand, importers provide watermelons during the gaps in European production. Importers therefore play a key role in supplying the market, as they source production, depending on the origin, and enable supermarkets to have watermelons available before and after the European season.

Supermarket and wholesale markets

Supermarkets and wholesale markets are the two main marketers of watermelons. Together, they are the main watermelon marketing segment. Because of the size of the volumes sold, supermarkets and their network of shops have become key players in watermelon marketing. The same applies to wholesale markets, which supply other outlets (grocery shops, specialist shops, etc). For example, supermarkets such as Grand Frais or Carrefour in France are main outlets for watermelons.

Tip:

- Target buyers that are able to import and re-sell larger volumes. This will increase your chances of landing a good deal.

What is the most interesting channel for you?

Watermelons are a mass-market product. Because of the large volumes available on the European market, watermelons are mainly sold in supermarkets. Significant volumes are also sold via wholesale markets and street markets. Because of the nature of the watermelon market, it is better for non-European exporters to sell to wholesale markets or to importers who supply supermarkets.

However, you cannot gain direct access to wholesalers or supermarkets when you are exporting from a third country. You need to channel your products through an importer first.

Some importers also market products as wholesalers, even though this is not the core of their business. The core business of an importer is to import and then sell your watermelons. Their clients can be wholesalers or supermarkets.

Tip:

- Before partnering with an importer, confirm that the importer has direct access to large outlets, like supermarkets or their suppliers. This will reduce the number of contact points between your products and the final outlets, which could be much more financially rewarding for you.

3. What competition do you face on the European watermelon market?

The European watermelon market is highly competitive. Europe’s own watermelon production of around 3 million tonnes is not enough to meet the market demand, so Europe relies heavily on imports from non-European countries to cover its needs. When you export to supply this market, you can expect to face various competition from Africa, Latin America and the Middle East.

Source: Eurostat/FRUITROP 2023

Which countries are you competing with?

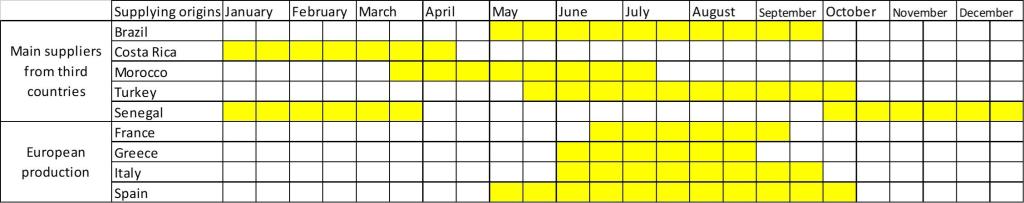

In 2023, the supply of watermelons to the European market was supplemented by four main non-European countries. These were Morocco, Turkey, Brazil and Costa Rica. These countries accounted for around 77% of non-European watermelon supplies to the market. Morocco, with almost 45% of imported volumes, is the leading non-European supplier of watermelons. It is followed by Turkey (14%), Brazil (12%) and Costa Rica (6%). Senegal is in fifth place, at 4%.

European watermelons are available during the summer. However, watermelons are sold throughout the year, thanks to an off-season supply from non-European countries.

Figure 6: indicative supply calendar of watermelon

Source: Thierry Paqui

Morocco is the largest non-European supplier of watermelons to Europe

In 2023, Moroccan watermelon exports made up 45% of the non-European watermelon exports to Europe. Two markets, Spain (42%) and France (42%), share direct imports of Moroccan watermelons almost equally.

Morocco has several advantages that make it a serious competitor. Its close distance to the market (via Spain) means that it can transport large volumes to this country by land, which considerably reduces its transport costs. The same applies to its exports to France, which it can also reach by land or sea at a lower cost.

Morocco has optimum climate conditions for watermelon production. It exports a wide range of seeded and seedless varieties, as well as varieties with different flesh colours. The season for Moroccan watermelons means that they are available early on the European market (late March/early April), at a time when European watermelons are not yet available.

Moroccan watermelons have a good quality and taste reputation amongst European buyers. Over the years, the country has succeeded in establishing itself as a benchmark, and this reputation is strengthened by the wide choice of varieties it offers its customers. Morocco offers seeded varieties (Crimson Sweet), seedless varieties (Sugar Baby), mini melons (Mini Love) and varieties with flesh colours other than red (Yellow Doll).

Morocco is well-represented at all marketing levels due to its high watermelon production. We can reasonably expect this country to develop an offer of specialised varieties with high added value.

Tip:

- If your seasonality allows it, you should also try to market your watermelons when European production is less available, just like Morocco does. This could help to improve your visibility in this market.

Turkey is a strong supplier to eastern European markets

In 2023, Turkish watermelon exports accounted for almost 14% of European imports from non-European countries. Four European countries were the main receivers of these exports: Bulgaria (35%), Austria and Romania (15% each) and Poland (13%).

Turkey is one of the world's leading watermelon producers. It shares a land border with Bulgaria, which is the main destination for its exports. Most of Turkey’s watermelon exports are therefore transported by road. Some of its exports to Romania are also shipped by sea via the Black Sea, at an attractive cost. Turkey exports a wide range of varieties (seeded and seedless) to a variety of destinations.

Because of its geographical location, Turkey is ideally placed to serve the countries in eastern Europe (Bulgaria, Romania and Poland). Turkish watermelon production is highly appreciated in this part of Europe, where the fruit is valued for its excellent taste.

Turkish watermelon exports also benefit from a good seasonal pattern. Because of this, they are available from mid-May to the end of September, and sometimes even in October, when European watermelons are no longer available in large quantities.

Like many of its competitors, Turkey exports fairly popular varieties that have won the hearts of their customers over the years. These are mainly seeded varieties (Charleston Gray), seedless varieties (Crimson Tide), mini melons (Tiger Baby) and varieties with a flesh other than red (Orangeglo).

Turkish watermelons are sold at all stages in eastern European markets. Because of Turkey’s close distance to and knowledge of the European watermelon market, some importers expect Turkey to develop its organic watermelon supply a little more over the next few years.

Brazil is the main Latin American supplier of watermelons

In 2023, Brazilian watermelon exports to Europe accounted for 12% of imports from non-European countries. The Netherlands and the United Kingdom were the main receivers of these exports, importing 53% and 43% of these volumes respectively.

Over the last three years, Brazilian exports have been fairly stable. Brazil relies almost exclusively on sea freight for its exports to Europe. Despite its high level of production, Brazil faces strong competition from countries closer to the European markets, which have much lower transport costs. Nevertheless, Brazil is holding its place on market thanks to its policy focused on quality.

Brazilian watermelons are often present on the European market between May and September, at a time when European watermelons are fairly available.

The good quality reputation of Brazilian watermelons means that they can be sold at fairly high prices, even though Brazil offers the same varieties as its main competitors. Even though Brazil’s production is currently well-priced, Brazil could consider improving the transport time of its goods to Europe, as this is currently one of Brazil’s weak points.

Global demand for watermelons is expected to continue to grow, especially as temperatures continue to rise. To stay competitive, Brazilian products will have to continue to rely on efficient sea shipping, which will enable them to continue to offer quality products at competitive prices. This is even more important given that the Brazilian season overlaps with the European season. European customers are increasingly aware of environmental issues, and the fact that Brazilian production is exported by sea could prevent its development on the European market.

Costa Rica is an atypical supplier

In 2023, Costa Rican watermelon exports to Europe accounted for just over 6% of imports from non-European countries. Two markets were the main recipients of these exports: the Netherlands, which imported 72% of these volumes, and the United Kingdom, which imported 23%.

The availability of Costa Rican watermelons stands out, because Costa Rican watermelons are available on the market from January to April, when the demand for watermelons is fairly low. Costa Rica specialises in the production of small, seedless varieties of watermelon. Costa Rica also offers several Rain Forest Alliance-certified fruits.

The image of Costa Rica is above all that of an off-season origin country. This is appreciated by distributors because it makes it possible to offer off-season watermelons when demand for watermelons is fairly low. However, consumers appreciate the variety by the Costa Rica, which is recognised for offering small, seedless watermelons.

The end of the Costa Rican season, which corresponds to the arrival of the first sunny days in Europe, should help it to be a little more present on the market when temperatures start rising in Europe and European production is not yet available.

The fact that several producers are Rain Forest Alliance-certified shows their interest in using sustainable means of production. As environmental issues becoming increasingly important, certifications like this can help in the marketing of Costa Rican watermelon supplies.

Which companies are you competing with?

As we have already mentioned, there is a large watermelon production in Europe. As a result, when you export your watermelons to Europe, your products will face competition both from European and non-European countries.

Branding is not very important to consumers in deciding whether or not to buy watermelons. Buyers are more likely to focus on varieties (seeded or seedless), size and flesh colour.

Rika pushing for sustainability

Rika is a brand of Moroccan producers. This brand produces and exports watermelons between the months of February and April, which means it is present on the European market very early with an off-season offer (from February). It stops exporting in April, which means it is not competing with the main European watermelon producers during the summer period. Rika is specialised in sourcing, so it can offer a range of products and not just watermelons (which are a very seasonal product). It strongly benefits from its efforts to work with growers who are committed to sustainable water and crop management. Rika is also certified by GRASP and uses a SMETA auditing system, which helps it to comply with strict retail requirements. The company has announced a production of 677,000 tonnes of watermelons, of which it exports just over 38% (26,2000 tonnes).

Tip:

- As a non-European producer, choose the best time to export your watermelons to avoid competition from European products with lower transport costs.

Aksun: A diversified range of products including watermelons

Aksun is a Turkish brand that offers a wide variety of products, delivered by land, air and sea. The company has several production and growing sites, which allow it to grow different varieties and cover a wide supply window. Because of Turkey's location on the Black Sea, it can serve over 50 different destinations. It produces to and serves the European market, especially during the peak European watermelon season.

The Turkish watermelon supply is mainly available in eastern European countries, where buyers primarily look for Turkish products for their overall image of quality and freshness.

Here is a list of some of the watermelon brands that are most widely available on European markets:

Tips:

- When packing your watermelons, add a sticker of your brand to each watermelon to help increase your visibility to consumers and position you in high-end markets. Your presentation at the wholesale level is also important. It is common for importing wholesalers to copy suppliers from their competitors.

- Laser marking your watermelons either as part of barcodes or simply for your brand is a more sustainable way of identifying your products and helping to access the mass distribution markets.

- For your exports, always prioritise watermelons with as few rind defects as possible.

Which products are you competing with?

The supply of watermelons available on the European market is very diverse. Because of their weight and size, watermelons are often sold in pieces. In practice, watermelons are cut into quarters, which means that a slice or a quarter of a watermelon weighs between 2kg and 3kg depending on the size of the whole watermelon.

Demand is growing for mini or seedless watermelons, which are quite practical. There is also growing interest in watermelons with a flesh colour other than red. Finally, the organic watermelon range is also growing strongly.

If you export your watermelons to Europe, all these varieties can compete with your products.

Watermelon growers often also produce other melons. If the supply of other melons is high, it could affect the demand for watermelons, because they could be put on sale at the same time. Because other melons are smaller and more convenient to prepare, this could therefore limit the demand for watermelons. The same goes for prices; if the supply of other melons is high, promotional offers on melons that are available at the same time could affect the demand and consumption of watermelons.

Tip:

- Check the taste preferences of your potential buyers. They are best suited to let you know about the varieties that are most interesting to their buyers.

4. What are the prices of watermelons on the European market?

The price per tonne of imported watermelons from non-European countries is generally quite low, at under €1,000 per tonne. This is due to the distance of exporting countries to the European market, but also to the means of transport used. The closer a watermelon-exporting country is to the European market, such as Turkey, the less it will have to pay to export its watermelons. Vice versa, the greater the distance between the producing country and the market, the higher the transport costs.

The three countries that are used as examples below to compare the costs per tonne export watermelons from Africa, the Middle East and Latin America. The quality, difference in varieties and timing of the supply in the season can also impact the cost per tonne of watermelon, as is the case for Moroccan exports, for example.

Source: Eurostat

The range of watermelons available for retail sale is very varied. Supermarkets sell both whole watermelons and watermelons cut into quarters or pieces. The prices of seeded watermelons sold in quarters in supermarkets do not vary that much.

But this is not the case for seedless watermelons or those with a flesh colour other than red. These watermelons are considered to be niche products and trade at much higher prices in supermarkets.

The same applies to organic watermelons. European buyers' interest in healthy products grown without pesticides is helping to develop the organic range, which is a growing niche.

Source: Calculations Thierry Paqui, based on different sources

Tips:

- Find a price history for watermelons on the French Market News Service. You can use this database on prices to see how your production costs fit in this market, where demand for watermelons is high.

- Where possible, choose to produce rare products, such as seedless varieties of watermelon, or organic products, which are more valuable.

Thierry Paqui and ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research