Entering the European market for fresh yams

When getting your yams ready to export to Europe, you should expect strong competition. Depending on the market you will be targeting, you will face competition from African, Latin American and Asian countries. However, you are most likely to find Ghanaian yams in your target market.

Contents of this page

1. What requirements must yams comply with to be allowed on the European market?

There are no specific European standards for yams. Products not covered by a specific marketing standard are supposed to comply with the general marketing standards (GMS) in Annex I, Part A of EU Regulation No 543/2011. Codex has developed a marketing standard for yams (CXS 340-2020) that you may find useful. For more information about the requirements your products must comply with before being exported to the EU market, please check the EU trade assistance platform: My Trade Assistant of Access2Markets. The HS Code for fresh yams is 071430. You can also visit CBI’s website for buyers’ requirements for fresh fruit and vegetables.

What are mandatory requirements?

Avoid pesticide residues and contaminants

Yams can be affected by a wide range of diseases if good agricultural practices are not implemented on your farm. Yams can suffer from fungal, nematode and viral attacks. The EU legislation on MRL (Maximum Residue Levels) sets limits for the chemicals that can be used on yams. To find an updated list of all the pesticides that you can use on yams, please check the EU database for pesticide residues. Select the crop in the ‘Product box’. The database lists all the pesticides that can be used on the crops as well as their MRLs.

Please note that some countries apply stricter levels depending on the chemicals used. A table that summarises the most commonly used pesticides on yams and their MRLs is given below.

Table 1: EU MRLs of pesticides most commonly used on yams

| Active substance | EU MRL | Approval expiration date | Type of pesticide |

| Deltamethrin | 0.01 | 31 October 2023 | Insecticide |

| Fludioxonil | 10 | 31 October 2023 | Fungicide |

| Lambda-cyhalothrin | 0.01 | 31 March 2024 | Insecticide |

| Azadirachtin | 1 | 31 May 2024 | Insecticide/Nematicide |

| Copper compounds | 5 | 31 December 2025 | Fungicide/Bactericide |

| Cypermethrin | 0.05 | 31 January 2029 | Insecticide |

| Thiabendazole | 0.01 | 31 March 2032 | Fungicide |

Source: Thierry Paqui – compilation based on interviews and EU database for pesticide residues (July 2023)

If the MRL is set at 0.01 in the EU, this generally means that the pesticide can be used, but the MRL is set to the lowest possible value. This is also called the lower limit of analytical quantification. This means that when checked for, MRLs must only be found in trace amounts.

Tips:

- When talking to potential buyers, please refer to the Codex standard (CXS 340-2020) to agree on the specifications of your yams. This can help you agree on the expected quality.

- Confirm with your importer if the chemicals you are using to grow your yams are allowed in their country or in the countries they want to export to.

Phytosanitary regulation

You need a phytosanitary certificate to be allowed to export yams as indicated in Annex XI, Part A and Part B of Regulation (EU) 2019/2072. Since yams are grown in soil, there are other requirements. These may include inspection, treatment or a declaration that certain pests are not there, made by the authorities of the exporting country.

Root and tuber vegetables also need an official certificate from the exporting country’s plant inspection department that shows the shipment or lot does not contain more than 1% of the net weight of soil and growing medium. See Annex VII of Regulation (EU) 2019/2072.

Fundamentally, the yams you ship must be free from pests. EU authorities are very strict when it comes to pest control. The presence of quarantine pests can lead to the destruction of a whole consignment.

Tips:

- When exporting yams, take care to avoid sending dirty lots or lots with a lot of soil as this could harm your image and the marketing of your lot.

- Your buyer’s clients may need some specific things. Always check with your buyer to see what you have to do before exporting to market the best products possible.

- Read the CBI buyers’ requirement guidelines for useful tips on what you need to do to export to European markets.

Adapt your quality standards

Yams must comply with the European General marketing standard (GMS). However, it is best if you adapt the quality of your product to the marketing standard for yams developed by Codex (CXS 340-2020). This can help you understand what the minimum marketing requirements are. You do not need the Codex standard to access the European market, but it can help you adapt your yams to the market better.

The provisions found in the Codex standard for yams are similar to those found in all product-specific standards. These provisions address issues about quality, size, tolerances, presentation and labelling.

In terms of quality, the Codex standard for yams establishes three classes (Extra, Class I and Class II). The most commonly used classes for yams are Extra and Class I (see table 1). The Codex standard also describes the minimum requirements for all yams.

Yams in all classes must be:

- whole or transversely cut pieces, provided that the cut surface is sufficiently cured;

- sound;

- produce affected by rotting or deterioration that makes it unfit for consumption should be excluded;

- firm;

- clean, practically free of any visible foreign matter, excluding coconut fibre, saw dust and other materials used for protective packaging;

- practically free from pests;

- practically free from damages caused by pests;

- free from abnormal external moisture, excluding condensation following removal from cold storage;

- free from any foreign smell and/or taste;

- free from damage caused by low or high temperature;

- practically free from sprouting.

The development and condition of the yam must be such that it enables them to withstand transportation and handling, and to arrive in satisfactory condition at their destination, free of any foreign smell and/or taste.

Table 2: Summary of quality requirements per class as determined by Codex standard for yams

| ‘Extra’ class | Class I | Class II |

Yams in this class must be:

Free from defects with the exception of very slight superficial defects, provided these do not affect the general appearance of the produce, the quality, the keeping quality and presentation in the package:

| Yams in this class must be:

The following slight defects, however, may be allowed, provided these do not affect the general appearance of the produce, the quality, the keeping quality and presentation in the package:

| This class includes yams that do not qualify for inclusion in the higher classes (Extra or I) but satisfy the minimum requirements for all yams (see above). The following defects may be allowed provided that the yam retains its essential characteristics with regard to the quality, the keeping quality and presentation in the package:

The defects must not affect the yams’ pulp under any circumstances. |

Tolerances: 5% by number or weight of yams not satisfying the requirements of this class but meeting the requirements of Class I. 1% tolerance for decay, soft rot and/or internal breakdown is included in this. 1% of dirt and impurities. | Tolerances: 10% by number or weight of yams not satisfying the requirements of this class, but meeting those of class II. 2% tolerance for decay, soft rot and/or internal breakdown is included in this. 1% of dirt and impurities. | Tolerances: 10% by number or weight of yams not satisfying the requirements of this class. 2% tolerance for decay, soft rot and/or internal breakdown is included in this. 1% of dirt and impurities. |

Source: Codex standard for yams

Maturity

The yams must have reached an appropriate degree of development and/or maturity in accordance with the characteristics of the species, the time of harvesting/picking and the area in which they are grown.

Tips:

- Avoid proposing Class II products as most suppliers of the European market offer Extra Class or Class I products.

- Always aim for Extra Class products. Your buyer will have better chances of selling them against those offered by your competitors.

- Carefully cure your yams to increase their shelf life and give your buyer the time to sell them.

Handling and transport

Yams are transported by sea in containers. They are very sensitive to temperature and variations in humidity. Containers should be properly ventilated to avoid damage and maintain the quality of the yams. The BMT Cargo Handbook states transporting and storing yams at 16°C is best for well-cured yams. The best humidity parameters for transport and storage are between 70% and 80%.

Check product size and uniformity

Usually, buyers do not request specific sizes of yams. The Codex standard also contains an optional sizing guide. However, yams are sold per box weight, not according to size.

Table 3: Sizing guide proposed by Codex

| Size Code | Weight (range in kg) |

| A | >6 |

| B | >4–6 |

| C | >2.5–4 |

| D | >1.5–2.5 |

| E | >1.0–1.5 |

| F | >0.75–1 |

| G | >0.5–0.75 |

| H | >0.25–0.5 |

| I | >0.1–0.25 |

| J | 0.05–0.1 |

Source: Codex standard for yams

Packaging

Yams from Africa are packed in 20 kg boxes while those from Latin America or Asia are packed in 18 kg boxes. Sometimes, importers ask for packaging of 15 kg. You need to check what type of packaging suits your importer best.

Yams must be packed so the produce is protected. The materials used inside the package must be of food-grade quality, clean, and not cause any external or internal damage to the produce. The use of materials, particularly of paper or stamps bearing trade specifications, is allowed, provided the printing or labelling is done with non-toxic ink or glue.

Tips:

- Yams for export should be packed in ventilated boxes allowing air to circulate during storage.

- Discuss specific size and packaging requirements with your buyer.

- For other requirements, such as labelling, payment and delivery terms, see the CBI reports on buyer requirements for fresh fruit and vegetables and tips for doing business with European buyers. Also check the legal requirements for materials that come into contact with food in Regulation (EC) No 1935/2004 (consolidated version of 27/3/2021).

What additional requirements do buyers often have?

Obtain commonly used certifications

As is the case for most vegetable producers exporting to Europe, more and more yam producers that target the European market are achieving the GLOBALG.A.P. certification. This certification also has a traceability component, which is now considered essential for exporting to Europe. This private certification is based on good agricultural practices and limited use of chemical pesticides. Products that are GLOBALG.A.P. certified can move easily from one European country to another, increasing their chances of selling quicker.

Apply additional sustainability and social standards

Although yams are mainly sold through the ethnic market channel, complying with sustainable and social standards is also recommended for yam producers as their commodities are now also available in ‘regular supermarkets’, where customers are very sensitive to issues related to sustainability and social considerations. Besides GLOBALG.A.P. to ensure good agricultural practices, a social certificate, such as Sedex Members Ethical Trade Audit (SMETA) is highly recommended to get your product up to retail standards.

Comply with the sustainability requirements to be competitive on the European market

Some of the most relevant European laws and legislation related to environmental sustainability are incorporated in the European Green Deal (EGD). The EGD is a set of policies that aims to lead Europe to climate neutrality by 2050. Climate neutrality means reaching a balance between greenhouse gas emissions and removals, which is expected to limit global warming. This state is known as zero emissions. It can be reached if global warming is limited to 1.5°C.

The most important impacts of the EGD for yam suppliers are as follows:

- Stimulation of organic production (and consumption): One of the aims of the Farm to Fork Strategy is to increase the share of organic agricultural land to 25% in Europe by 2030.

- Introduction of the environmental footprint methodology: In line with ‘sustainable food systems’ the European Commission will publish official methods for ‘green claims’ to prevent ‘greenwashing’ and better inform consumers about the food choices they make.

- Endorsing greater corporate responsibility and sustainability standards through the Corporate Sustainability Due Diligence Directive.

- Reducing packaging waste: The main aim of the packaging and packaging waste directive is that ‘All packaging in the EU is reusable or recyclable in an economically viable way by 2030’. Some countries aim to reduce plastic even faster than proposed by the EGD. For example, France has already imposed a ban on plastic packaging for fresh fruit and vegetables in containers less than 1.5 kg.

- Reducing the usage of pesticides by 50% by 2030: A proposal for the directive of Sustainable use of pesticides has been adopted.

Tip:

- Review your treatment practices to ensure that your yams do not contain pesticide residues above the set limits.

What are the requirements for niche markets?

Buyers look for consistent and reliable sources of supply

The market for yams is a niche one that is steadily growing. Ethnic populations were the main ones buying this vegetable. With its specific taste and almost constant supply, the Dioscorea rotundata, also known as the ‘White yam’, ‘African yam’ and ‘Pona Yam’ (Puna or Poona), is the most available variety in Europe. Mainly exported by Ghana, this variety seems to be very popular among buyers, creating mainstream demand next to the wide number of varieties marketed in ethnic retail stores. It is also the consistency of the supply that allows yams to be more available in supermarkets because without consistent supply it is difficult to raise large distributors’ interest (see picture 3).

Organic certification and sustainable sourcing: a way to stand out

There is a growing middle class among buyers of ethnic products that is increasingly interested in buying organically grown products. As yams are now growing in visibility, certifications like organic or Fairtrade can help buyers differentiate your supplies from what is not yet a mainstream demand in this niche market. Being able to stand apart can also help you and your buyer earn more.

2. Through what channels can you get fresh yams on the European market?

Ethnic community members are the main consumers of yams. Practically all yams reach their destination through specialised importers. This is due to the small size of the market and the larger sea freight volumes in which they are shipped to Europe.

How is the end market segmented?

Yams are mainly segmented into two consumer groups. On one side you will find traditional or ethnic consumers. On the other side there is a demand from consumers that are looking for exotic and culinary vegetables. These segments are often served by different types of retailers.

Figure 1: Segmentation of the yam market

Source: Thierry Paqui

Retail sales for different consumer groups

The retail sale is the final stage for selling fresh yams to the public. It can be divided into two levels. The largest segments include sales in wholesale markets, ethnic shops and open street markets. Customers who buy yams at this level pay less attention to certification. They care about cost. The smaller, more profitable segment includes sales in speciality stores, convenience stores and high-end supermarkets. At this level, exporters supplying GLOBALG.A.P. certified yams are more likely to establish their products. Yams sold at this level are targeted at customers with high purchasing power and can easily be re-exported to other European markets, thus facilitating commercialisation. Customers shopping in this segment are more likely to be attracted to yams with other certifications, such as organic and fair trade.

The differences between retail sales levels not only extend to the point of sale, but also to the type of customer being targeted. While open market and street stall sales target customers with medium to low purchasing power, speciality convenience stores (which offer online sales, such as Fresh4U in the UK) and French supermarkets Grand Frais, target customers with high purchasing power.

For ethnic consumers, the product needs to be traditional and authentic, so they first look to buy yams closest in taste to what they were used to buying in their native countries. This means that once they have found a species of yam or an origin that they like, it is very difficult for them to change. For consumers looking for an exotic vegetable, yams should be clean with an attractive appearance. Speciality supermarkets mainly target this type of consumer. These consumers have a high buying power and are often willing to pay higher prices for well-presented products. Organic yams are more appealing for customers with high purchasing power.

Prices in different segments

There is a strong correlation between the volumes imported, the type of retailer and the prices at which the yams are sold.

A relatively high volume passes the hands of importing wholesalers that supply ethnic shops and street markets. Here, regular consumers buy their yams for reasonable prices. Prices will change according to supply and demand. Consumers are used to paying specific prices depending on supply availability and seasonality.

Yams sold in speciality stores or speciality supermarkets target richer customers with higher purchasing power. This clientele is more sensitive to environmental and certification issues. They are ready to pay more. It is a clientele that works and sometimes does not have time to go shopping or that can instead buy products online. It is a wealthier clientele that buys small quantities of well-presented products. If the trade price goes up too much, supermarkets most likely stop selling yams as they are only a minor category for them.

Figure 2: Ghanaian yams sold in an Ethnic store (France)

Figure 3: Ghanaian yams sold in Grand Frais supermarket (France)

Source: Thierry Paqui

Tips:

- Pay attention to your post-harvesting and packaging. Making your product look better (packaging, cleanliness) could help your product get sold in high-end supermarkets.

- Always cure your yams correctly. This will give them a longer shelf life and allow them to be sold in the best conditions in terms of price, instead of being sold cheaply because of poor shelf-life issues.

- You can also read CBI’s Buyers’ requirement report to get ideas on what European buyers often look for.

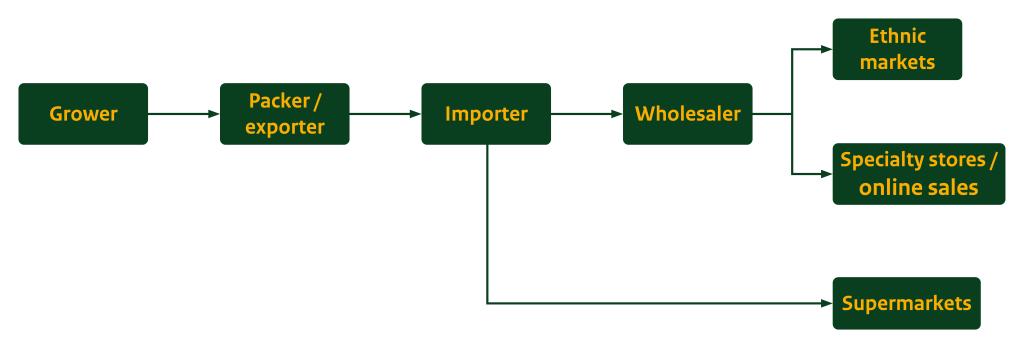

Through what channels does a product end up on the end-market?

Yams are mainly sold on ethnic market channels through specialised importers and wholesale markets.

Figure 4: European market channels for fresh yams

Source: Thierry Paqui

A limited range of importers specialise in importing yams

In Europe, importers are very important in marketing fresh yams. Yams are exported by sea so containers (20ft or 40ft) must be used when exporting. This means a large number of yams are delivered to the market at one time. Importers can handle larger volumes and distribute them to more wholesalers and other small buyers. They are also the first to check the quality of your product. Yams can be stored for a long time before being sold, but that also means your buyers should have access to people who can buy these quantities.

There are not many importers that specialise in yams. In France, companies like NETA, Exotica, and ABCD de l’Exotique are key importers of exotics. In the Netherlands, companies like Bud Holland and Exotimex usually import exotics. These companies source yams from Latin America and Africa, year-round.

Wholesalers have access to a large network of retailers

Wholesalers are an important step in the yam marketing chain. They are the main resellers of fresh yams in Europe and supply small retail shops that sell exotic or ethnic fruit and vegetables.

In many countries, the importer also plays the role of wholesaler. In France, for instance, they are known as wholesale importers. Your product is sold on wholesale markets to a variety of shops and merchants through these wholesale importers.

Rungis wholesale market is the largest in Europe with more than 12,000 registered companies.

New Covent Garden Market is the largest and most famous wholesale market in the UK.

Few supermarkets involved in the marketing of yams

In the UK, there are supermarkets and convenience stores that specialise in ethnic products. Regular supermarkets like Tesco often have yams in their assortment too. In France, yams are sold throughout the year in the chain Grand Frais. They can also be found occasionally in mainstream supermarkets that have an ‘exotic’ section. They are often sold during the Ramadan fasting period and during end-of-year celebrations.

Supermarket chains that sell yams are supplied by importers specialised in dealing with exotics. For supermarkets, yams are an addition to their assortment. Their supply is not programmed. Therefore, bulk transport limits your direct access to the main retail levels because retailers or sellers will not be able to manage the volumes of a whole container. Specialised importers are still a key element in successfully marketing your goods to supermarkets.

Online channels help access niche markets

In countries like the UK and the Netherlands, online sales boost demand and sales of yams. Marketing opportunities are more diverse with online shops such as Fresh 4U, Veena’s and Afrifoods in the UK, and Groenteboer in the Netherlands. These grocery stores offer yams year-round, and they have delivery services to complete their online shopping.

Tip:

- Target buyers that can import and re-sell larger volumes. This will increase your chances of landing a good deal.

What is the most interesting channel for you?

Yams remain a ‘niche’ product. The most interesting channel for yams is the wholesale markets that supply small retailers and all the ethnic markets. However, you cannot gain direct access to wholesalers when you are exporting from a developing country. You need to channel your products through an importer first.

Some importers also market products as wholesalers although this is not the core of their business. The core business of an importer is to import and sell your yams. Clients can be wholesalers or supermarkets.

Since yams are transported by sea, the amounts can be important as they are sent in containers. Your buyer must have access to lots of clients used to buying exotics from them.

Tip:

- Always try to work with importers that specialise in exotics. The market for exotics is a ‘speciality niche’, and few importers have the necessary networks to market your yams easily.

3. What competition do you face on the European yam market?

Different kinds of yams are grown all over the world. When exporting, you should expect competition from Africa, Latin America and Asia. Most yams come from Ghana.

Source: Eurostat/Trade-map

Which countries are you competing with?

In 2022, the largest supplier of fresh yams to the European market was Ghana (85%), followed by Costa Rica (8%), China (2%) Brazil (1.7%) and Jamaica (slightly less than 1%).

Ghana: the largest supplier of fresh yams to the European market for the past years

Ghana is the main supplier of the European yam market. In 2022, Ghana accounted for 85% of the market shares of fresh yam imports. The origin mainly exports African yams, also known as ‘Pona yams’, although it exports other varieties too.

Ghana has several advantages. It is close to Europe, so sea freight costs are lower than those of major non-African competitors. Ghana also has a well-developed maritime transport structure, which makes containers readily available for yam exports. Finally, Ghana has a very well-organised private sector, characterised by the Ghana Root Crops and Tubers Exporters Union (GROCTEU).

European importers regard Ghana as a benchmark for quality. Ghana has established itself as a benchmark in terms of quality and consistency of supply. It is highly appreciated by European importers who can rely on it to establish long-term import programmes.

Ghana enjoys a good political and economic environment, which has allowed it to develop its exports.

The country has consistently been the largest supplier of the market, and no noticeable changes can be anticipated in the near future.

Tip:

- Ghanaian exporters should try to improve their packaging to make them more resistant to transport and handling. This could help them attract high-end users’ attention.

Costa Rica

Costa Rica is the second largest yam supplier to the European market. In 2022, Costa Rica accounted for 8% of yams imported into European markets. Its yams, which are smaller than those from Ghana, are much appreciated.

Costa Rica enjoys a strong and well-developed sea freight infrastructure as it is the main exporter of fresh pineapples.

Since it is more distant from Europe, Costa Rican yams have relatively high freight costs.

The origin is appreciated for the quality of its yams. Importers appreciate the smaller tubers, which can more easily be sold in mainstream retail outlets.

China

In 2022, yam exports from China accounted for a little over 2% of the total yams imported into European markets. Over the past five years and despite the COVID-19 pandemic, China’s yam exports have increased steadily. In 2018, China exported 430 tonnes of yams to the European market. In 2022, China’s yam exports accounted for 790 tonnes, an increase of almost 84%.

Distance and cost concerns do not seem to affect China’s yam exports.

Brazil

In 2022, yam exports from Brazil accounted for 1.74% of the total yams imported into European markets. Exports from Brazil have increased over the years, even though they dropped during the COVID-19 pandemic. Brazilian yam exports are again on the rise, with an increase of 7% compared to their level in 2018.

The country benefits from a strong maritime logistics system, developed for its mango exports. Importers appreciate the quality of the boxes used by Brazilian exports that seem stronger than most.

Jamaica

In 2022, yam exports from Jamaica accounted for approximately 1% of the total volumes imported by European markets. The country mainly supplies the UK market of the strong Jamaican community in Britain. It is unlikely that exports will increase or that Jamaica will become a strong competitor in yams.

Tip:

- Check if your variety of yams is available on the market you are targeting and how it compares to the varieties available in terms of taste. You stand a better chance of attracting buyers if you supply something similar to what they source.

Which companies are you competing with?

Yams are a niche commodity. There are no specific brands that distinguish themselves as leading brands. Ghana is the main supplier of the European market and has developed generic boxes that promote the origin.

When exporting yams to Europe, you will almost certainly encounter yams from Ghana. Apart from the generic Ghana yam brand, there are a few Ghanaian brands that you could encounter:

- Cotton Weblink Portfolio LTD

- Maphlix Trust Ghana Limited

- Sambrimin Entreprise

- Yazz Yams

- Asante Farms Yams

- Juka’s Organic Co Yams

- Okyeman Premium Yams

- Quality Roots Yams

The strength of Ghanaian companies is how they have organised themselves into associations. In this way, they try keep their quality standards high. These associations are supported by an active trade promotion agency: the Ghana Export Promotion Authority (GEPA).

Tip:

- When packing your yams, adding a sticker of your brand to each yam can help increase your visibility to consumers and position you on high-end markets. Your presentation at the wholesale level is also important. It is common for importing wholesalers to copy suppliers from their competitors.

Which products are you competing with?

If you export yams to Europe, you will likely encounter one of the three dominant varieties.

- Dioscorea rotundata, also known as the white flesh yam, the African yam or Pona yam is the most popular. Yams of this variety mainly come from Africa (Ghana, Côte d’Ivoire and Nigeria), but they are also produced in Latin America (Brazil).

- Dioscorea alata, also known as Greater yam or Water yam, comes in different forms and shapes and has flesh of different colours. The white flesh varieties available in Europe mainly come from Costa Rica.

- Dioscorea Cayennensis, also known as Yellow yam or Guinea yam, can come with flesh colours that range from white to yellow. They are mainly produced in the Caribbean (Jamaica).

Yams could eventually compete with other edible root vegetables, although this is often a question of taste. Some people prefer cassava, others prefer yams. The taste is quite different even if the way in which they are cooked is similar. The big advantage of yams is that they have a longer shelf life than cassava. For many consumers for whom yams are an exotic vegetable, other familiar roots and tubers may also compete with yams, in particular potatoes and sweet potatoes.

Tip:

- Make sure you know what your potential buyers’ taste preferences are. The difference between yam varieties is in their taste. White flesh yams are the most popular in the ethnic markets.

4. What are the prices for fresh yams on the European market?

The prices for yams are rather stable year-round. However, they tend to be slightly higher at certain points when supplies are less available. For the time being, all the yams imported into Europe are transported by sea freight. Latin American exporters support higher freight costs than African ones, which are closer to the European markets.

The average sales prices for yams at the retail level fluctuate between €2.50 and €3.50 per kg depending on the origin and where they are sold.

Source: Calculations Thierry Paqui, based on different sources.

Tip:

- Find a price history for yams (Igname) in France on the French Market news service from wholesalers (‘grossistes’).

Thierry Paqui and ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research