The European market potential for yams

In Europe, ethnic communities mostly purchase fresh yams. The market for fresh yams shows steady and regular growth. This trend should continue over the coming years thanks to sales in supermarkets. The main European countries that import fresh yams from developing countries are the United Kingdom, the Netherlands, Belgium, France, Italy and Germany.

Contents of this page

1. Product description

The Dioscorea family to which the yam belongs includes more than 600 different species. The differences between the species can be significant. Yams are identified in the Harmonised System (HS) under code 07 14 30.

The species the most commonly available on the European markets are:

- Dioscorea rotundata: also known as ‘White yam’, African yam’ or ‘Pona Yam’ (puna or poona). It has a brownish-like skin covered in small lumps. It has a cylindrical or slightly curved shape. It can range in size from small to very large. Its flesh can be white or yellowish, although the most available varieties in Europe have white flesh and a firm, dry texture. It has a nutty flavour. White flesh D. roundata, sold in Europe come from Brazil and Africa (Ghana, Côte d’Ivoire, Nigeria). They have a high level of dormancy, which improves their shelf life providing they are harvested ripe and well-cured before being shipped (see Figure 1).

- Dioscorea alata: also known as ‘Greater Yam’, ‘Water Yam’ or ‘Purple Yam’. This species is available in different shapes. It can be long and cylindrical or round and bulbous. Its skin colour can range from light brown to dark purple and is rather rough with a slightly waxy texture. The flesh colour of this yam can range from white to dark purple. It has a moist, slightly fibrous texture with a sweet, sometimes nutty flavour. Costa Rica has a white flesh variety of this yam, which is rather small in size. Purple-coloured flesh varieties of this yam mainly come from Papua New Guinea and can weigh up to 40kg. Some also come from Nigeria (see Figure 1).

- Dioscorea cayenensis: also known as ‘Yellow yam’ or ‘Guinea Yam’. Its shape is typically elongated and cylindrical. It can range in size from small to large. It has brownish-like skin covered in small lumps. Its flesh can be white or yellowish, depending on the variety, with a slightly fibrous texture. However, D. cayenensis yams sold in Europe generally have yellow flesh. It is less sweet than D. alata, and it has a mild earthy flavour. This yam is mainly produced in the Caribbean (e.g. Jamaica), although it is also grown in African countries. It is rather fragile due to its rapid oxidation, which leads to it having a short shelf life (see Figure 1).

Figure 1: White yam (1), Purple yam (2), cush-cush yam (3), Chinese yam (4) and yellow yam (5)

Sources: Pierre Gerbaud (1,3); Remi Tournebize, CC BY-SA 3.0, via Wikimedia Commons (2); Tomwsulcer, CC0, via Wikimedia Commons (4); Tomwsulcer, CC0, via Wikimedia Commons (5)

Other species less available can also be found on markets:

- Dioscorea opposita or Dioscorea polystachya: also known as ‘Chinese yam’ or ‘Cinnamon vine’. It has an elongated and cylindrical shape. The skin is typically brown or tan and can be rough or scaly. The colour of the flesh is usually white or cream-coloured. It is firm and has a dense texture. It is the only variety adapted to mild climates. France also produces this species (see Figure 1).

- Dioscorea dumerotum: also known as ‘Bitter yam’ or ‘Trifoliate yam’. It has an elongated shape with a slightly curved appearance. The skin is usually brown or reddish-brown and can be smooth or slightly rough. The tubers can be medium to large in size. Flesh aspect: The flesh of Dioscorea dumerotum is usually pale yellow to white. It is firm and crisp, similar to a potato or jicama.

- Dioscorea esculanta: also known as ‘Lesser yam’. It has a brownish, rough skin that is covered in small nodules. The shape is typically elongated and cylindrical. It can range in size from small to very large. Its flesh is white or yellowish and has a soft and moist texture. It is less fibrous than some other yam species and has a slightly sweet and nutty flavour (see Figure 1).

- Dioscorea trifida: also known as ‘Cush-cush yam’, ‘Sweet yam’, ‘Yampi yam’ or ‘Indian yam’. It has a brownish, rough skin that is covered in small nodules. The shape is typically elongated and cylindrical, and it can range in size from small to very large. Its flesh is white or pale yellow and has a firm, fibrous texture. It is less sweet than some other yam species and has a slightly earthy and nutty flavour (see Figure 1).

2. What makes Europe an interesting market for yams?

In Europe, yams are usually marketed through ethnic distribution channels. The European market is an interesting one for yams because it has been growing steadily for several years.

Growing niche market offers opportunities for small suppliers

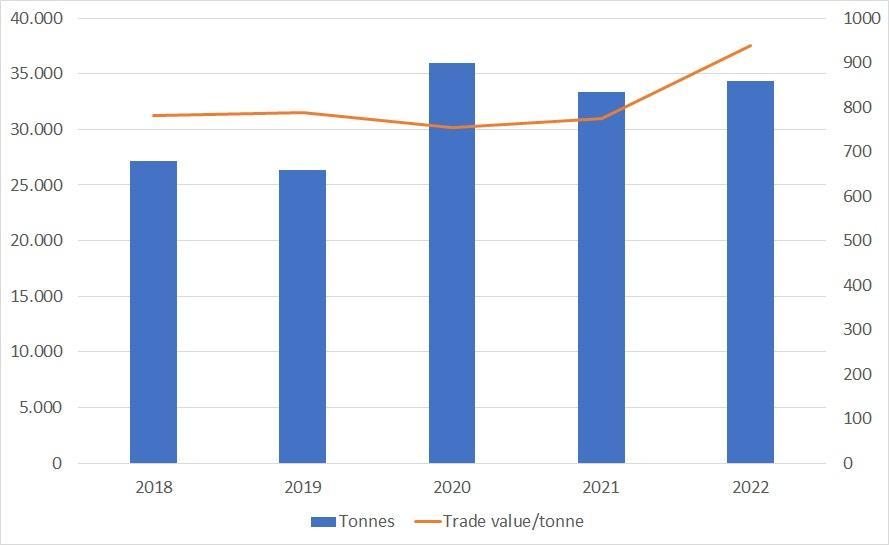

Over the past five years, the volume of yams imported into Europe has increased from 27,000 tonnes in 2018 to over 34,000 tonnes in 2022. This is an increase of 28%. The market continues to develop due to growing interest in yams in supermarkets. Until recently, yams were mainly available in shops and supermarkets with specialty assortments. In France, yams were first available in speciality supermarkets like Grand Frais. They are now also available in traditional supermarkets (e.g. Carrefour, Au Chan). In the United Kingdom, they have been part of a traditional food market and offered by ethnic stores, such as Afrifoods and Afrobuy. But here too, they are more regularly found on online fresh grocers, such as Fresh 4U and regular supermarkets like Tesco. This development will increase demand and sales.

In Europe, the yam market remains niche. This means it gives exporters from developing countries an advantage. The ethnic populations that mainly buy yams are willing to pay more for good quality yams. If you can supply good quality products, you will be able to achieve premium prices easily.

Suppliers and volumes of fresh yams are still limited currently: less than 40,000 tonnes of fresh yams were imported into Europe in 2022. This presents an opportunity for small business owners in developing countries, as they do not face competition from large international corporations. If you supply good quality products to your niche market, you are more likely to win the loyalty of satisfied customers. European buyers are very keen to buy organic products, for which they are willing to pay more. So, if your product is certified organic, you will probably find new opportunities too.

Yams are mainly imported into Europe by sea. Although sea freight has become more expensive because of the war in Ukraine, it is still cost effective. Before 2021, the average cost (CIF) of a tonne of fresh yams imported into Europe by sea freight was slightly below €800 per tonne. In 2022, this was slightly over €900 (€939/tonne), which represents an increase of about 21% (see Figure 2).

Figure 2: European import and average cost of a tonne of yams, in euro/tonne CIF (2018–2022)

Source: Eurostat/Trade map 2022

A consistent and year-round supply capable of attracting large retailers

The supply of yams is varied and available throughout the year in Europe. The consistency and good quality of supplies have attracted the interest of supermarkets that source yams from several origins depending on their seasonality.

Apart from a limited production of yams grown in France and harvested during autumn, most of the yams imported into Europe originate from developing countries. This provides a significant opportunity for these nations to enter the European market.

In 2022, the yams imported into Europe mainly came from Africa. African origins accounted for approximately 86% of the European market’s supply of yams. Ghana is responsible for nearly the entire African yam supply to Europe. It was followed by Latin American (10%) and Asian (3%) origins.

Source: Eurostat/Trade map 2022

Sea freight is the most cost-effective transport for yams

Since yams are bulky and heavy products, sea transport is the cheapest way for suppliers to deliver to the European market. Yams benefit from an extended shelf life, providing they are cured enough after harvesting. This allows them to be stored for a long period of time before being sold. By allowing large volumes to be shipped at the same time, sea transport lowers the cost per unit of the boxes of yams sent by containers. Suppliers can ship large volumes at the best price to niche markets.

Sea transport provides suppliers with two shipping capacities that are either 20 or 40-foot containers. This is far more than is available in air transport. Moreover, in terms of sustainability, shipping by sea has lower carbon emissions than air freight, making it a more eco-friendly way to supply distant markets.

Tips:

- Be thorough in your post-harvest procedures: cure yams in a dry place a few weeks before exporting them. This will improve their shelf life.

- Shipping by sea means using containers. Be sure to have enough volume to make using a container cost-effective.

- Be sure to work with a buyer that has the capacity to market such volumes.

- Use the translator function in your web browser if you have difficulty reading the information of websites provided in this study.

3. Which European countries offer most opportunities for yams?

Ethnic markets are the main places fresh yam imports are sold in Europe. As a result, the potential of the European market largely depends on the size of the ethnic population. The European countries that import fresh yams into Europe are the United Kingdom, the Netherlands, Belgium, France, Italy and Germany.

Source: Eurostat/Trade map 2022

The United Kingdom: the largest importer of fresh yams

The United Kingdom is the largest importer of fresh yams in Europe. In 2022, its imports of fresh yams from non-European countries represented 40% of the global volumes of yams imported into Europe.

The demand for fresh yams has been very strong and consistent over the past five years in the UK. The UK has always imported more than any other European country.

Raw yam imports fell by around 9% from 2021 to 2022, but the UK’s total imports were still significantly higher than other European countries.

Ghana remains the main origin that supplies the United Kingdom with fresh yams. In 2022, Ghana’s yam exports to the United Kingdom made up 93% of the market, followed by Brazil (2%) and Jamaica (2%).

The demand for fresh yams is fuelled by an active multicultural middle class. These consumers can be sensitive to ethical and sustainable sourcing. They are also willing to pay more for certified products (organic or fairtrade). Middle-class ethnic populations can benefit from a wide choice of convenience stores and supermarkets that offer a variety of ethnic products.

Source: Eurostat/Trade map 2022

In the United Kingdom, traders and buyers are conscious of being able to trace products, and environmental and social issues. This has enabled the UK to create online and e-commerce platforms, leading to higher consumption. Consumers have several ways to buy fresh yams too, like home delivery for online purchases. The e-marketing system has been very important in increasing fresh yam sales in this market. Imports are expected to return to pre-Brexit levels within three years.

Tips:

- Think about certifying your yams to reach a wider public. Being certified as organic can give you an advantage on a market like the UK where online trade is well developed.

- Focus on the regions where there is more ethnic consumption. The most active ethnic markets in the UK are located in London, Bristol, Birmingham, Bradford, Manchester, Leicester and Sheffield.

The Netherlands: a regular and steady growing market for fresh yams

The Netherlands is the second largest importer of fresh yams in Europe. In 2022, the Dutch market accounted for slightly less than 21% of European imports.

Imports of fresh yams are on the increase. Over the past five years, imports of fresh yams have risen by almost 34%.

The Netherlands plays a key role in the marketing of yams in Europe. The Netherlands is a hub country: it re-exports around 30% of the volumes it imports to other European countries. Your Dutch importer will most likely request that you comply with the basic common traceability procedures. For example, you could be asked to have completed your GLOBALG.A.P. certificate before supplying this market. This will allow your importer to easily re-export your goods to other European buyers.

In 2022, the Netherlands mainly imported yams from three countries: Ghana, China and Brazil. They respectively represented 79%, 10% and 8% of Dutch yam imports. The Dutch market is a trade hub for exotic vegetables. This means it is a good entry market for yam sub-varieties from different origins.

Source: Eurostat/Trade map 2022

As a hub country, the Netherlands will continue to play a leading role in supplying other European markets as exports grow.

Tip:

- Make sure you have GLOBALG.A.P. certification. This will give you better chances of supplying this important ‘hub market’.

Belgium: the most active hub country in Europe for marketing fresh yams

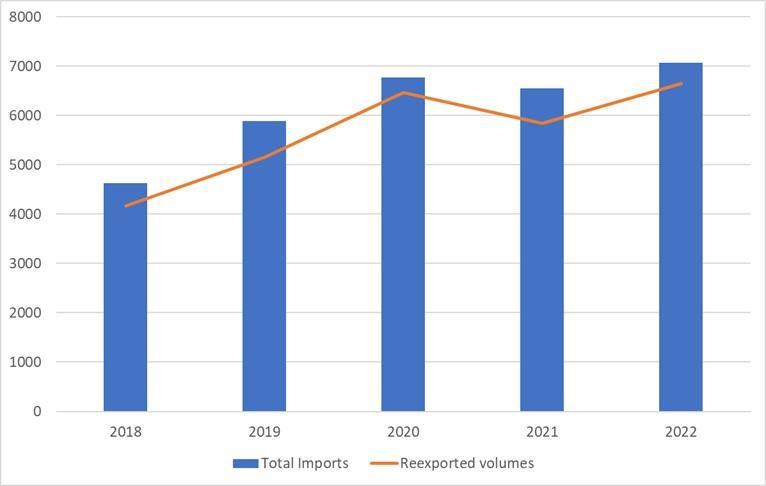

Belgium is another key player in the European fresh yam market. It closely follows the Netherlands, making up 20% of the global volumes of fresh yam imports. Belgium, like the Netherlands, is a hub country that benefits from well-developed infrastructure, allowing it to re-export significant amounts of goods to other European countries. However, while the Netherlands only re-exports 30% of its imports, Belgium is different. It typically re-exports between 87% and 94% of all the fresh yams it imports.

Figure 7: Volumes of fresh yams re-exported from Belgium, in tonnes (2018–2022)

Source: Eurostat/Trade Map 2022

The large volumes of fresh yams re-exported from Belgium confirm the weakness of domestic demand. You can expect your buyers to ask you to be GLOBALG.A.P. certified because this will allow them to easily re-export your goods to other European countries.

The market for fresh yams is dominated by supplies from Ghana, which make up 99% of market shares. Although countries like Cameroon and Costa Rica also export fresh yams to Belgium, they only do so in very limited volumes. Re-export sales thus mainly concern Ghanaian yams re-exported by road to other destinations.

France: the market putting fresh yams into mainstream supermarkets

France takes fourth place among European countries importing yams. It accounts for 11% of the yams imported into Europe. Generally, imports of fresh yams on the French market have increased for five years. Periods of growth have often alternated with decreases, without this overall trend really being affected.

Costa Rica dominates yam imports in France, accounting for 75% of the market share. Ghana follows at 17%, although this share is growing.

The volumes of re-exported fresh yams are very limited because of significant local demand. France appears to be a market with undeniable potential. The Dioscorea opposita variety, also known as ‘Chinese yam’ or ‘Cinnamon vine’ was imported to the ‘Loir et Cher’ region more than a hundred years ago. This variety is currently grown and harvested during autumn and sold throughout the year in various marketplaces.

Source: Eurostat/Trade map 2022

French supermarkets have started showing slightly more interest in yams. Yams were first available in fresh specialised supermarkets, like the Grand Frais chain. This chain specialises in selling high-end, exotic, niche products sourced from different origins. Now, conventional supermarkets like Carrefour and Au Chan are also showing growing interest in yams. Unlike Grand Frais, conventional supermarkets do not sell yams throughout the year. They often sell them during the Muslim fasting period and during end-of-the-year celebrations. This shows that the demand for yams can evolve from ethnic retail stores to mainstream supermarkets and grow in visibility.

The adoption of yams by mainstream supermarkets will also require stricter compliance with sustainable production methods. You should expect certification like GLOBALG.A.P. to become more important.

Tip:

- Pay special attention to your packaging. Although yams are sold in bulk, people who source products for supermarkets pay close attention to the quality of the packaging used.

Italy: noticeably increasing imports

Overall, imports of fresh yams into Italy remain limited compared to the previous countries. Still, you might notice how much demand for fresh yams has increased over the past five years. In this period, imports have risen considerably by more than 153%.

Source: Eurostat/Trade map 2022

This increase is driven by strong demand among ethnic populations originating from refugees in camps instead of ethnic populations buying in ethnic retail stores. Ghana and China were the main two direct yam exporters to Italy in 2022. Ghana’s exports (1740 tonnes) to Italy accounted for 97% of the market.

The increase of yams imports to Italy is linked to the fact that the country has become one of the main entry points for refugees in Europe. Since yams are tubers, they can be used to feed large populations at relatively low costs. This is the main reason they are used to prepare many dishes in refugee camps. Any surplus or leftover imports are re-exported to either France or Spain, although Spain receives less.

Germany: a market losing momentum

The German market is the sixth largest importer of fresh yams in Europe. Overall volumes imported in 2022 barely reached 200 tonnes. Of all the markets presented, the German market is the only one that shows a clear drop in imports (-53%) over the past five-year period. The ethnic market is quite large in Germany. It seemed steady with imports that ranged between 350 and 560 tonnes depending on the year. The significant drop of exports from Ghana to Germany (-68%) between 2021 and 2022 is the main reason for this strong drop.

In 2022, imports of fresh yams seemed fairly balanced between the different origins supplying the German market, even if Ghana still stands out as the main supplier of the market. Ghana holds 40% of the market share, followed by Uganda (20%), India (18%) and Sri Lanka (9%). In Germany, yams are sold through the ethnic market channel.

Source: Eurostat/Trade map 2022

4. Which trends offer opportunities or pose threats on the European yams market?

The demand for yams is steadily increasing, although they are still considered a niche product. The availability of fresh yams in convenience stores and supermarkets increases their visibility. They are more accessible to consumers with higher buying power who are sensitive to sustainable and ethical sourcing.

Sustainably and ethically sourcing fresh yams

Yams should be sourced in an ethical and responsible way. You should ensure good employment conditions, for example. Suppliers must be able to ensure that environmental and social aspects are taken care of when producing yams. European consumers are increasingly concerned with social and environmental issues.

As a supplier, holding certificates like GLOBALG.A.P., Organic and Fairtrade is a way to differentiate yourself from your competitors and attract new buyers. All of these certificates include aspects surrounding traceability. For example in Ghana, the Ghana Yam Producers and Exporters Association (GYPEA) ensures the movement of GLOBALG.A.P. certified yams from its members to foreign markets, such as the Netherlands and the UK.

Online retail and e-commerce of fresh yams

Online retail is already well developed in Europe. Online sales of fresh and exotic produce are also growing, in particular in northern Europe. Online sales and e-commerce were boosted during the COVID-19 pandemic.

Buyers in the Dutch and UK market can shop for yams online and have them delivered to their homes. Several specialised retailers, such as Fresh4U, Veenas and Afrifood, provide these services in the UK. In the Netherlands, vers-bestellen.nl and groentebroer.nl offer exotic vegetables. The growth of online retail goes hand in hand with traceability. The online fresh segment is best developed in these two markets. However, in the near future, other European countries may also move to sell more exotics online, including existing supermarkets.

Online sales give retailers with exotic vegetables greater flexibility. They can easily supply national markets, and not only stock yams in certain high demand areas. This gives yams the chance to grow beyond ethnic consumption.

Figure 11: Presentations of Ghanaian yams sold at Grand Frais supermarkets (left), yams from Brazil (middle), yams from Ghana (right)

Photos by Thierry Paqui

Tips:

- Actively work on sustainable cultivation and show potential buyers your actions. Seeking GLOBALG.A.P. certification is a must for creating opportunities in the main retail channels. With this certificate, you will be better prepared for yam sales in mainstream fresh markets.

- Read more about what trends offer opportunities on the European fresh fruit and vegetable market on the CBI market intelligence platform.

Thierry Paqui and ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research