Entering the European market for chickpeas

When you want to enter the European market for chickpeas, you must meet mandatory requirements regarding quality and food safety. Buyers often have additional requirements. Market channels are becoming more diverse because chickpeas are increasingly used by the food industry. Importers, traders, and brokers that specialise in dry ingredients are the most relevant channel for chickpea exporters. Most chickpeas enter the market through pulse traders, importers, or brokers. These include brands and packers that organise their own import.

Contents of this page

1. What requirements must chickpeas comply with to be allowed on the European market?

If you want to export chickpeas to Europe, you must comply with general requirements for the grains, pulses and oilseeds sector in Europe. The most important requirements when exporting chickpeas to Europe are requirements regarding food safety, quality, low levels of pesticide and metal residues and a contaminant-free product.

When we mention Europe in this study, we are referring to EU27+EFTA+UK.

What are mandatory requirements?

Food safety: traceability, hygiene, control, and residue limits

Food safety and traceability should be your top priorities. Non-compliance can lead to temporary import bans or to stricter controls on your country of origin.

To export dried chickpeas to Europe, you must comply with the General Food Law, which regulates food safety in the European Union.

To meet the safety standards, you must apply the principles of the Hazard Analysis Critical Control Point (HACCP) system. Moreover, EU food safety standards require you to ensure traceability of your product throughout the supply chain. Important food safety requirements include limited or no pesticide residues, limited or no presence of contaminants such as aflatoxins, and no microbes such as salmonella or E. coli and Listeria monocytogenes must be absent or within the limits set by European legislation.

There are maximum residue limits (MRLs) for pesticides that might be used on chickpeas. Be aware that the MRL requirements can change and are more stringent for organic chickpeas and baby food ingredients. Note also that use of Glyphosate, a commonly used herbicide, is currently only approved at a strict limit until December 2023. You would need to monitor upcoming decisions on this closely, you can do this by regularly checking the EFSA website.

Contamination with heavy metals is another concern in chickpeas and other legumes and pulses. The European Commission has laid down maximum levels for cadmium and lead in Commission Regulation (EC) No1881/2006 (pdf) which sets the limit for lead in pulses and legumes at 0,2mg/kg.

If you are located in a country where genetically-modified chickpeas exist, you need to know that the EU Food Law is very strict regarding this issue. GMOs can only be cultivated or sold for consumption in the EU after they have been authorised at the EU level. This process includes a scientific risk assessment. EU regulations require measures to avoid mixing of foods and feed produced from GM crops and conventional or organic crops, which can be done via isolation distances or biological containment strategies.

Figure 1: Chickpea crisps for sale in a German supermarket

Source: Globally Cool

Tips:

- Read about the general market requirements for the grains, pulses and oilseeds sector in our study about buyer requirements for grains, pulses and oilseeds in Europe. Or you can use the “My Trade Assistant” tool at EUAccess2markets. This provides an overview of export requirements for chickpeas using HS code 07132000 for chickpeas.

- Read more about pesticides, contaminants and micro-organisms on the website of the European Commission. Find out the MRLs for pesticides and active substances that are relevant for chickpeas seeds by consulting the EU MRL database. Search for peas (code number for chickpeas/Bengal gram: 0260030-003).

- Reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

Quality requirements

If you want to export chickpeas to Europe, you must meet the quality standards. It is best to follow the indications of your buyer and the FAO International standard for certain pulses (pdf) in the Codex Alimentarius, which includes quality requirements for chickpeas (Cicer arientinum L.). See also table 1 below.

Table 1: General quality standards for chickpeas according to the Codex Alimentarius

|

General |

|

|

Purity and defects |

|

|

Moisture |

|

|

Discolouration |

|

Source: FAO / Codex Alimentarius standard for certain pulses (pdf)

The largest chickpea producing countries have their own quality standards and grading systems that are often stricter or more specific than those of the CODEX. Consider exploring how to meet these requirements, instead of just the CODEX standard. Examples are Australia which uses the Australian Pulse Trading Standard 2023/24 (pdf), Canada which uses the class and grading system of their official grain grading guide for chickpeas and the United States which follows a USDA standard for beans (including chickpeas).

Tips:

- Always discuss quality requirements and product characteristics with your buyer.

- Make a product data sheet with the technical specifications of your chickpeas that include size grading, colour, purity, nutritional information, residue limits and microbiological information based on laboratory reports. Also ensure that you have continuous access to such laboratory tests for future shipments.

- Achieving 99% purity can involve a large investment in machinery that will detect impurities at this level of accuracy. Smaller players may not be able to match such investments with scale. A recommended practice in these situations is to resort to hand-picking whilst maintaining hygienic conditions.

Packaging

25kg or 50kg polypropylene bags are common packaging for (food grade) chickpeas. Smaller bags and multi-layer paper bags are also used, especially for organic chickpeas.

The packaging must be suitable to protect the product and must comply with the Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food.

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods (pdf) or Regulation (EU) No. 1169/2011 (pdf) on the provision of food information to consumers in Europe.

What additional requirements do buyers often have?

Buyer-specific quality specifications

Buyers in different markets will have their own specifications which revolve around three key parameters:

- size

- colour

- purity

In European markets, most buyers require very high levels of purity, but in some cases, they may accept lower purity levels, for example if they have their own cleaning plants.

On the premium market, size dictates price. For kabuli chickpeas, a large seed size of 9mm or more is important to attract premium prices. However, this is not what all buyers are looking for. The smallest sizes (below 7mm) are often destined for milling or canning.

Desi chickpeas are mostly traded by companies with Asian market channels in Europe. In contrast to kabuli, they can range quite significantly in terms of colour. They can be sold whole, polished or split, otherwise known by their Indian name ‘chana dal’. When sold as whole seeds, the larger sizes may have a small premium.

Tips:

- Maintain strict compliance with quality. Deliver the quality as agreed with your buyer. Being careless with your standards will give buyers a reason to file claims about quality issues.

- Use careful handling and storage. Be especially careful with managing the moisture when you are storing your chickpeas. The most desired levels are 14% at harvest and 12% for storing. Also be very careful with pest prevention. Use ventilation and cooling if necessary.

- You can find very useful information about storing pulses on the Storedgrain information hub.

Certifications as a guarantee

Importers, retailers, and food processors in Europe often expect extra food safety guarantees from their suppliers. Voluntary certification schemes are commonly used to ensure that products meet quality standards.

Food management systems and certifications that are recognised by the Global Food Safety Initiative (GFSI) are widely accepted throughout Europe. If you want to become a supplier to European buyers, a recognised food safety management system is important. You can still enter the market without it, as long as you meet the mandatory requirements, but your market reach will be very limited as only a few outlets, for example ethnic corner shops, may not insist on such additional quality standards.

The following certification schemes can be relevant depending on the role you play in the supply chain (production, distribution, or processing):

- ISO 22000 / FSSC 22000 (Food safety management). This is the most widely recognised certification programme that gives access to almost all countries in the world.

- ISO 9001 (Quality management system). Recognised by most importers. It is a sign you take your business seriously.

- BRCGS for Food Safety (Brand Reputation through Compliance Global Standard by the British Retail Consortium). It is the key standard for the United Kingdom, but also accepted worldwide. If you are not planning to export to the UK, it is recommended you only obtain this certification if your potential buyer specifically asks for it.

- IFS Food Standard (International Featured Standard). A widely recognised scheme that is preferred by retailers in Germany and France.

Tips:

- Check with your buyer to determine which certification scheme is most relevant for your target market. Please note that BRC, ISO 22000 and IFS are equally accepted.

- Read the CBI tips for organising your export and CBI Buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform to get more detailed insights into the advantages of certifications.

Organic certification

There is an increasing demand for organic-certified chickpeas. This is because European consumers increasingly appreciate organic-certified products: they find them healthier, tastier, and more sustainable. European authorities are also increasing their inspection methods to ensure that the chickpeas are indeed produced and semi-processed using genuine organic production methods.

To market organic products in Europe, you have to use organic production methods that comply with European legislation and apply for an organic certificate through an accredited certifier.

In January 2021, the new legislation Regulation (EU) 2018/848 about organic production came into force.

Tips:

- Apply for organic certification. An approved certifying agency must verify that you meet European requirements. Keep in mind that getting a license to supply organic-certified products to Europe takes time and costs money.

- Find a list of control bodies and authorities operating in third countries on the website of the European Union.

- Read more about organic certification in the CBI study on buyer requirements for grains and pulses in Europe. Find additional information in the study How to become a green exporter of grains, pulses, and oilseeds.

- Approach specialised buyers of organic produce serving the European market if you are a producer of organic chickpeas. Two such buyers are Tradin Organic and Naturz Organics.

Sustainability and social compliance

European businesses and consumers are paying more and more attention to corporate social responsibility (CSR), concerning the social and environmental impact of businesses. As an exporter, you are part of the supply chain and share this responsibility.

There are several schemes and initiatives that offer you a framework around which to do your part and to certify that you are indeed following such best practices. Initiatives that stakeholders in the European pulse industry would be familiar with include:

- The Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct (pdf);

- The Ethical Trading Initiative (ETI)

- Sedex Members Ethical Trade Audit (SMETA)

- GlobalG.A.P. and GlobalG.A.P. Grasp

- MyClimate

- PlanetProof

Tips:

- Find out more about social sustainability good practices in our Tips to become a socially responsible exporter of grains, pulses and oilseeds study.

- Use the ITC Standards Map to learn about the various sustainability and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct (pdf). You can also find many practical tools in the amfori BSCI resources.

Figure 2: Three different brands of hummus, made of chickpeas, in a European supermarket

Source: Globally Cool

What are the requirements for niche markets?

Fair trade labels

A consumer label for fair trade practices, ensuring fair prices are paid to small producers as well as fair terms of payment, such as Fairtrade International or Fair for Life, is a niche requirement in the chickpea business for which you need very specific buyers. One of the few examples are the organic white chickpeas, which are produced and canned in India under the Dutch Fairtrade Original brand.

Certification for ethnic consumption

The significant ethnic consumption of chickpeas in Europe, merits acquiring Kosher and Halal certifications that are important for certain consumer groups. These ethnic food management practices would also carry through to final processed products like falafel or hummus.

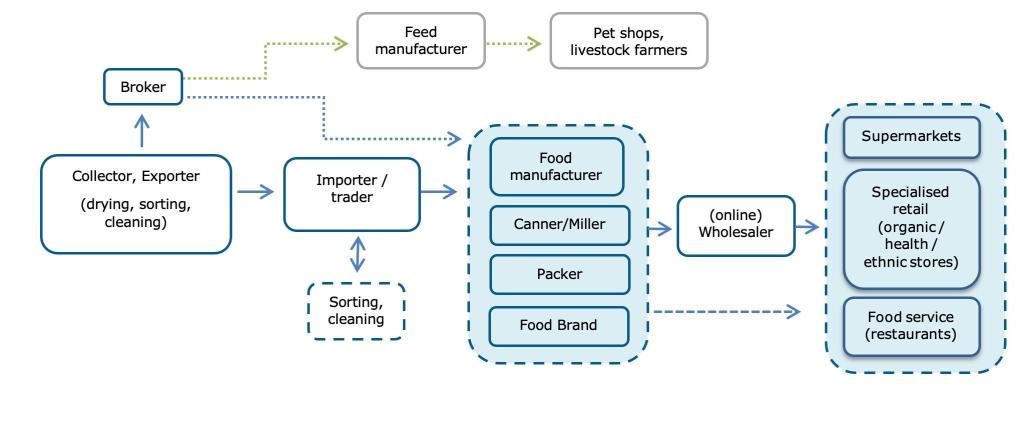

2. Through what channels can you get chickpeas on the European market?

Various channels exist on the market, extending from importer to retailer of chickpeas. The core transformation is canning or dry-retail packing, but the ingredient segment is growing the fastest and provides opportunities with large ingredient companies and food manufacturers.

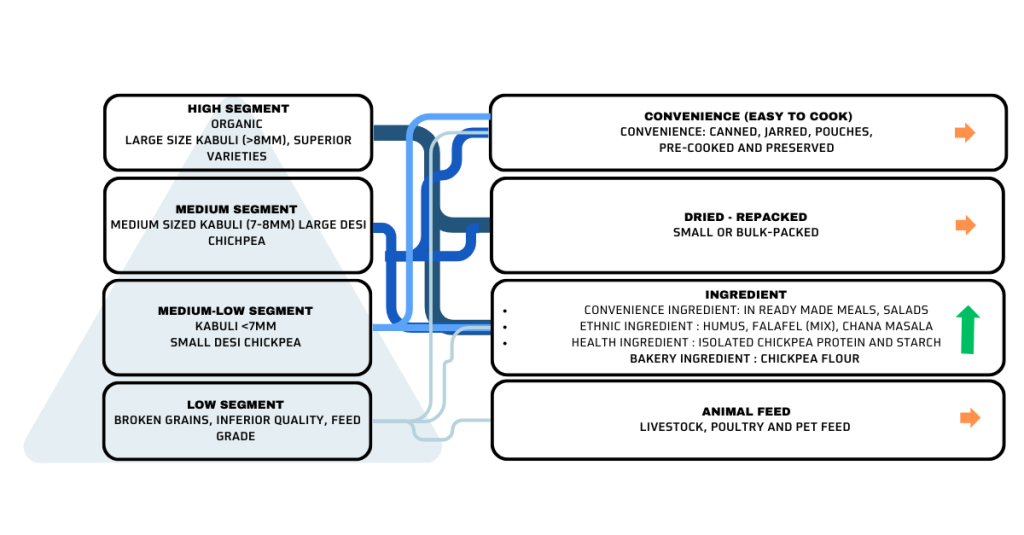

How is the end-market segmented?

Figure 3: Market segments for chickpeas in Europe (large arrows represent larger volume)

Source: Globally Cool

Size and quality determine the value and market segment

Organic and large-size chickpeas (>8mm) are considered special and make up the premium segment. Several superior varieties of chickpeas also belong to this higher-end segment. Larger sizes are sought by consumers of whole chickpeas, especially by ethnic consumers, while health-oriented consumers appreciate organic chickpeas the most. In the main segment, you will find medium-sized kabuli and desi chickpeas. The value of kabuli chickpeas is slightly higher than that of the desi variety.

Convenience is the largest segment

The largest segment in the European market for chickpeas is the convenience segment. Whereas dried chickpeas are harder to prepare, pre-cooked and preserved cans of chickpeas represent an easier option. In recent years, more modern looking stand-up pouches also started to appear on the shelves.

Sale of chickpeas in dried form purchased mainly by the traditional consumer

Traditional and ethnic consumers are more accustomed to traditional methods of preparing chickpeas and therefore find preparing dried chickpeas no hindrance. These consumers are the main buyers of dried chickpeas. However, this segment remains limited as most consumers prefer convenience.

The ingredient sector is increasing in importance

The food product industry is also an interesting market channel for chickpeas in Europe. This segment is growing fast. There is increasing demand for healthy, vegan, and sustainable foods and snacks for which chickpeas are a very suitable ingredient. These include food products such as ready-made meals, fresh salads, humus, health snacks, vegan products, and protein rich foods. Chickpea is also an important ingredient for plant-based meats.

In very recent research, an opportunity has been found where chickpea flour can be blended successfully with wheat flour in the bakery industry. This offers gluten reduction options as well as a significant opportunity to make the bakery industry more sustainable through the replacement of eggs and milk that have a higher carbon and water footprint. The discovery of the potential for chickpea flour in the bakery industry may lead to further expansion of the ingredient segment (use a web-browser auto-translator to read this article).

Animal feed is a minor segment

Lowest grades of chickpea may end up as animal feed. However, while chickpeas offer good nutrition for multiple animals, other pulses, like soyabeans, are available at lower cost and therefore this segment remains small.

Tip:

- Learn how to use pulses in product development by watching the webinar training offered by USA Pulses.

You can use several trade channels to enter the European market. Figure 2 provides an overview of the trade structure. This structure is more or less the same in every European country.

Figure 4: European market channels for chickpeas

Source: Globally Cool

Importers, traders handle supply chain management

Importers, traders, and brokers that specialise in dry ingredients (often including nuts, dried fruits, and pulses) are the most relevant channel for chickpea exporters to engage with. They mostly handle large volumes and have a role to ensure that the quality of the chickpea supply meets demand requirements for food safety, quality consistency and compliance with international standards.

The more established importers and traders will also strive to cater to the needs of specific channels, such as industry, wholesale, food service or retail. Chelmer Foods, for example, is well established to cater to the needs of specific client groups. Other traders have more of a singular segment focus, such as Casibeans in Belgium that focuses on the high-end food industry or Alons-Gar (Spain), an international broker, specialised in supplying to canners.

Some of these companies, such as the French Ciacam, add additional services such as seed cleaning, sorting or small packing, while others focus principally on trade or brokerage.

Large multinational ingredient companies such as ADM and Nestlé have a large enough demand for ingredients to purchase directly from producers.

Some companies specialise in organic such as Naturz Organics and Tradin Organic. Organic specialists, such as Smart Organic, can also be found further down the supply chain, at the wholesale level where processed organic foods are also traded. There are also companies in the market that specialise in ethnic brands such as Unidex and Surya Foods.

On the exporting side, the counterpart of an importing company is often a producer or a collector of chickpeas that can secure a certain supply and offer basic processing facilities (drying, cleaning, and sorting).

Food manufacturers and added-value brands require reliable sources

The food manufacturing industry consists first of canning companies that supply the bulk of the convenience segment canned or jarred supply. Other processing involves re-packing to retail, packs processing into products like flour or hummus, and other more sophisticated products such as plant-based foods.

These companies add value through transforming, canning, or packing chickpeas under private label or brand names, but also through mixing or adding ingredients, or by using chickpeas as an ingredient. Then the additionally processed, re-packed and branded products are distributed to retailers. In some cases, these products reach food service providers such as restaurants. This can be done either directly or through intermediaries such as wholesalers.

Food manufacturers require reliable sources and easy access to chickpeas to ensure continuity. Most food manufacturers purchase dried chickpeas without any additional processing. They do not all source from importers. Some food companies will buy chickpeas directly from local producers or foreign exporters, especially if the chickpeas are for a core product or are a core ingredient. Smaller companies will rely on importers or trading companies to handle their supply.

The leading brands and canning companies are often well-integrated with their suppliers and have processing plants in several countries. An example is Bonduelle (France). They work with 3,100 farmers and manage 56 processing facilities. These types of companies also maintain strict rules on compliance. Food manufacturers and brands also need a stable (contracted) price, reliable supply, and consistent quality.

Table 2: Examples of food manufacturers that process or use chickpeas

|

Company |

Products |

Brand / private label |

|

Müller’s Mühle (Germany) |

Dry chickpeas and chickpea flour |

Brand, industry |

|

Ingredion (presence in Europe) |

Chickpea flour, emulsifier |

Industry |

|

Unidex / Valle del Sole (the Netherlands) |

Ethnic food, dry and canned chickpeas |

Brand |

|

Maza Mediterranean Delicacies (the Netherlands) |

Ethnic food (hummus, falafel, salads) |

Brand |

|

Coroos (the Netherlands) |

Canned, preserved |

Private label |

|

Acico (Spain) |

Canned, jarred |

Private label / Brand |

|

La Bio Idea (the Netherlands) |

Canned, organic chickpeas |

Brand |

|

La Doria Group (Italy) |

Canned, including organic |

Brand |

|

HAK (the Netherlands) |

Canned, jarred, stand-up pouches |

Brand |

|

The Real Green Food (Spain) |

Canned and jarred chickpeas, mixes, salads, and soups, incl. organic |

Private label |

|

Sabarot (France) |

Dry chickpeas, sprouted, frozen, organic |

Brand, retail, trade |

|

Pedon (Italy) |

Dry chickpeas, mixes, pastas |

Brand |

|

Barilla (Italy) |

Chickpea pasta (gluten-free) |

Brand |

|

Bonduelle (France) |

Canned, preserved chickpeas and mixes, ethnic food (falafel) |

Brand |

|

Garden Gourmet (Israeli brand by Nestlé) |

Ethnic food (hummus), plant-based food (meat substitutes) |

Brand |

|

Schouten Food (the Netherlands) |

Plant-based protein, meat substitutes |

Private label / brand |

|

Bauckhof (Germany) |

Flour, falafel mix, plant-based burger mix |

Brand, retail |

|

B life (Italy) |

Organic chickpeas |

Industry |

|

Bergophor (Germany) |

Animal feed |

Brand |

Tips:

- Read the CBI study about Exporting canned beans and pulses to Europe to get more insight into the market channel for canned chickpeas. Remember that most canned chickpeas in Europe have been imported as dried pulses.

- To get a good understanding of who is where in the chain, you should map out the chain very extensively.

- Visit the Food Ingredients Europe trade fair to get the newest insights into the use of pulses as an ingredient.

Figure 5: different types of pasta in a German supermarket, one of which is made from chickpeas. Other varieties are pasta with green peas and pasta made with buckwheat

Source: Globally Cool

What is the most interesting channel for you?

Most chickpeas enter the market through pulse traders, importers, or brokers. These include brands and packers that organise their own import. Unless you have a multinational operation, this will be your main market channel. The major users and processors of chickpeas will have their dedicated supply chains or be supplied through large international pulse traders.

As pulses renew their status as a health food, you can expect more companies to experiment with chickpeas as an ingredient. This means that, in the future, there will be more business opportunities with ingredient companies that commercialise chickpea and chickpea derivatives.

As a chickpea exporter, it will be interesting to follow new product developments. While it will not be easy, innovative approaches that match specific processors’ needs might give you the opportunity to supply them directly without depending on the main importing channels.

Tip:

- Regularly visit food and food ingredient trade fairs in Europe. This will provide you with market knowledge and the opportunity to meet potential buyers. Relevant trade fairs in Europe are, for example, SIAL, Anuga, Biofach (for organic) and Food Ingredients Europe.

3. What competition do you face on the European chickpeas market?

Which countries are you competing with?

The leading six supplier countries include many developed-country suppliers with very modernised farming systems. Türkiye has recently made a big turnaround from being a net importer of chickpeas to a competing exporter. A previously significant player, Argentina, has recently experienced a significant drop and fell out of the list of leading suppliers to Europe. The country should however not be dismissed, and could make a comeback, especially considering how strong the country is in soya beans and maize.

The leading suppliers do differ to some extent and therefore do not always compete with all other leading suppliers regarding size and type of chickpea. Canadian chickpeas, for example, are smaller size and are very different from the Mexican larger size chickpeas, while Australian chickpeas are mostly of the desi type.

Source: UN Comtrade (July 2023)

Türkiye: from net importer to lead exporter

Chickpeas were first cultivated in Türkiye in ancient times. They have remained central to Turkish cuisine. It is therefore no surprise that Türkiye has one of the highest consumption rates of chickpeas in the world. Until recently, Türkiye was a net importer, but it increased its production and quickly became a strong exporter and competitor. In 2020, total production reached 630,000 tonnes (FAOSTAT) and exports reached 240,000 tonnes.

Table 3: Turkish import and export volumes, in tonnes

|

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

Total export in tonnes |

117,413 |

212,659 |

241,280 |

245,142 |

183,408 |

|

Total import in tonnes |

92,959 |

114,770 |

123,271 |

129,497 |

106,247 |

Source: ITC Trademap

Most of the Turkish-grown chickpeas are small or regular sized. For bigger sizes (calibre 11-12mm), Türkiye depends on imports from Mexico and India.

Exports to the EU and the United Kingdom are a small portion of its total export volume but reached 32 thousand tons in 2020 and 2021. Italy, Germany, and the United Kingdom are key destination markets. A ban on exports of Turkish produce, which was intended to curb inflation, affected 2022 exports. This ban has now been revoked.

Substantial domestic production and proximity should make Türkiye a competitive player for the European market. In fact, they were already the leading supplier in 2022. However, the lack of mechanisation and scale make Turkish chickpeas relatively expensive to produce. This will make it difficult for them to stay ahead of countries like Canada.

Mexico: good-sized kabuli chickpeas

Mexico offers good-sized kabuli chickpeas for export of up to 12mm (with the main range between 9-12mm). Some offers of smaller shipments even reach up to 14mm. Mexico’s main growing areas are Sinaloa, Sonora, and Bajo California. About 80% of Mexico’s Sinaloa white kabuli chickpeas are produced in these three areas.

Production is volatile because of weather shocks and farmers’ decisions based on prices. When prices are low, they switch to other crops, especially as the Mexican policy on local food security and farm subsidies favours the production of corn and beans.

Mexico’s production averaged around 160,000 tons over the years on an average planted area of 85,000 Ha. According to FAOSTAT, the 2021 output was 172 thousand tons. The country is a popular source for chickpeas, especially for traditional consumer countries in Europe, such as Spain and Italy. The supply fluctuates with the availability of stocks. In 2022, around 23 thousand tonnes reached the European markets. This was significantly less than in 2019, because the 2018/2019 crop did not produce large harvests. Bigger volumes go to Algeria, Türkiye and the USA.

In 2023, Mexico did not have a very successful harvest and market observers are estimating total export volumes of a mere 60,000 tonnes. The chickpeas are supplied to Europe by a few strong companies with large storage capacities. But the volumes will likely decline when carry-over stocks run out.

Canada: large farms gaining market share

Canada is a leading global producer of pulses. In chickpeas, the country is gaining market share. Especially in 2021 and 2022, the country increased exports to cover shortages in the global market supply. Canada mainly grows kabuli chickpeas. The size is small and this variety does not compete against, for example, Mexican chickpeas.

Large farm sizes create economies of scale. This enables Canadian farmers to compete strongly on the European market. Programmes such as “Keep Canadian Pulses Clean” are also strong image builders on quality-sensitive markets in Europe. Even though imports from Canada increased in 2021 and 2022, weather conditions affected the 2022 crop and 2023 forecasts are cautious. It remains to be seen if carry-over stocks will suffice to maintain Canada’s position.

In short, the country is a strong player with well-organised farms. However, its production volumes remain very sensitive to weather conditions and may lose some steam in 2023/2024.

The European Union and the United Kingdom combined imported 21.2 thousand tonnes of Canadian chickpeas in 2022. The United Kingdom, Spain and Belgium were the main destination markets in Europe.

Australia: world export leader, mainly desi chickpeas

Australia is the largest exporter of chickpeas in the world, reaching 922,600 tons in 2021. However, 90% of Australia’s chickpeas are desi type chickpeas, mostly destined for South Asia, primarily Pakistan, Bangladesh, and Nepal. The UK’s sizeable ethnic Asian population is also an important desi chickpea consumer group and as such the UK is Australia’s key chickpea export destination within Europe. The UK’s imports of chickpeas from Australia also grew strongly in recent years, climbing from 10,000 to 14,000 tonnes between 2019 and 2022.

Australia’s kabuli chickpeas are consumed locally and marketed mainly to buyers in the Middle East. A small amount is exported to Europe, mainly to France and Italy. The limited volumes of kabuli chickpea exports to Europe make Australia not much of a threat for suppliers of kabuli chickpeas. For desi chickpea suppliers, Australia is a strong competitor that also can offer competitive prices owing to its large scale of operations.

United States: more chickpeas for the local market

The United Stated is a modern agricultural producer of pulse crops and has become a large player in chickpea exports in recent years. The main variety is the kabuli type and in recent years, the country has also started producing larger calibre sizes.

Up to 2018, production was climbing fast to fulfil increased local and international demand, but that trend is reversing. High costs, lower margins and crop diseases have stimulated farmers to reduce their chickpea production. This will reduce the international competition from the United States.

Table 4: United States harvested area and production of chickpeas, Ha and tonnes

|

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

Harvested area |

247,260 |

342,570 |

183,490 |

101,500 |

142,050 |

|

Production |

320,100 |

580,010 |

282,910 |

185,380 |

129,770 |

Source: FAOSTAT

American chickpea exports are also significantly influenced by strong domestic demand for chickpeas. The trend towards plant-based food is especially strong in the United States. The country’s domestic market is expected to continue to demand supply. Already there are panicked media reports about hummus missing from the shelves.

Europe is an important destination for chickpeas from the United States, primarily Spain, but also Italy and Portugal. The European Union imported 46.5 thousand tonnes from the USA in 2019, but this was mainly due to import restrictions in India. Because of these restrictions, more chickpeas were diverted to Europe. In 2022, imports reduced to 16 thousand tonnes.

Table 5: Leading European destinations for chickpea exports from the United States, tonnes

|

|

2018 |

2019 |

2020 |

2021 |

2022 |

|

Total US Export |

86,687 |

153,947 |

155,656 |

115,233 |

66,728 (est.) |

|

Spain |

19,720 |

22,034 |

23,933 |

13,209 |

11,771 |

|

Italy |

1,815 |

6,105 |

7,204 |

5,723 |

2,455 |

|

Portugal |

3,206 |

13,886 |

7,123 |

464 |

254 |

Source: Trade Map

France: leading supplier within Europe

France is Europe’s leading internal supplier of chickpeas sourced from both its own production and from imports from outside the EU. Southern France’s Mediterranean climate is well-suited to legume production and the surface area has expanded significantly over recent years, reaching 50 thousand tonnes in 2019. This also includes a rapid expansion of organic chickpea production.

Main destinations within Europe include Belgium, the Netherlands, Italy, Spain, and the UK. France has a major competitive advantage because of its proximity to European markets, while supplying chickpeas at similar prices to other supplying countries from outside Europe.

The greatest strength of the French chickpea industry over competing suppliers from developing countries is in its own market. French consumers prefer local produce and there is strong integration within the food industry.

Bonduelle, for example, works with 3,100 farmer partners, of which 1,500 are located in France. Another French company, Épi & Co, has introduced vegetarian gourmet specialties based on chickpeas and wheat as meat substitutes. It uses locally-sourced chickpeas.

Which companies are you competing with?

You are competing with strong competitors, such as Granos La Macarena and Bennett’s Grain, that can work with large orders and store their chickpeas for long periods of time. Smaller, younger companies, like Aynira, have to find ways to differentiate by diversifying while still investing intensely in technology.

Granos La Macarena – a leading player in the Mexican pulses industry. The company is solely dedicated to one product – chickpeas - and concentrates primarily on export. They began in 1966 by promoting their Macarena chickpea variety and currently export 70,000 tons per year to over 50 countries. In Europe, the Italian market is a key destination.

Granos La Macarena has five processing plants spread across the three major producing areas of Mexico. They prioritise investment in technology for cleaning and sorting and continuously update their technology. Quality is a key area of focus in addition to their very large scale of operations. They are also ISO9000 and FCSSC22000-certified. The company recognises that quality assurance comes down to training. They therefore ensure that staff at all levels acquire extensive training every year.

Aynira is a young Turkish supplier of seeds and pulses, including a uniquely diversified range of kabuli chickpeas:

- 8mm chickpeas

- 9mm chickpeas

- Yellow roasted chickpeas

- Double roasted chickpeas

- Crispy crunchy chickpeas

- Sugar coated chickpeas

- Organic chickpeas

The unique range makes the company stand out. They also strive for high quality. They are working to achieve this by investing significantly in the latest machines, such as metal detectors, gravity-powered sorting machines, stone separators, colour sorters etc. On top of that, they have adopted advanced food safety management systems and recently became ISO 22000-certified. For their organic products, they are also EU and USDA-organic certified.

European markets are an important destination. Proximity to European markets is important and they offer quick and fast deliveries. As a new player, established in 2008, they are progressing well after betting on investing in advanced machinery, a unique product range, food safety quality assurance and fast delivery times.

Bennett’s Grain – a well-established processor and exporter of peas, beans and lentils from Canada. Their chickpea is produced and harvested at the Bennett's Grain facility in Alberta and Saskatchewan, which have favourable climate conditions for modern agricultural production of chickpeas. Sourcing is done from a range of producers and suppliers. The company has well-established grades of specific desi and kabuli sizes, as well as of special varieties like B-90. They export to 35 countries. Their core focus is on quality and sustainability. As part of the company’s environment policy, they opted to use only eco-friendly packaging, which is especially appreciated in European markets.

Which products are you competing with?

As mentioned previously, each chickpea variety and size has its own market. Therefore, competition between chickpeas is not so intense. Against other products, however, especially as a plant-protein, chickpeas compete against other pulse crops such as soybeans, peas and lentils. Nevertheless, chickpeas often win because of their great versatility of application in many food offerings.

The desi chickpea faces additional competition from the Canadian yellow field pea. When the difference in price between chickpea and yellow field pea is large, buyers in South Asian countries choose the yellow field pea as a substitute for a proportion of, for example, chickpea flour. Canada is the largest producer and exporter of yellow field pea.

Tip:

- Investigate which chickpea breeding varieties are available in your country and determine which is the best variety for your targeted market (canning, protein source, processing etc.).

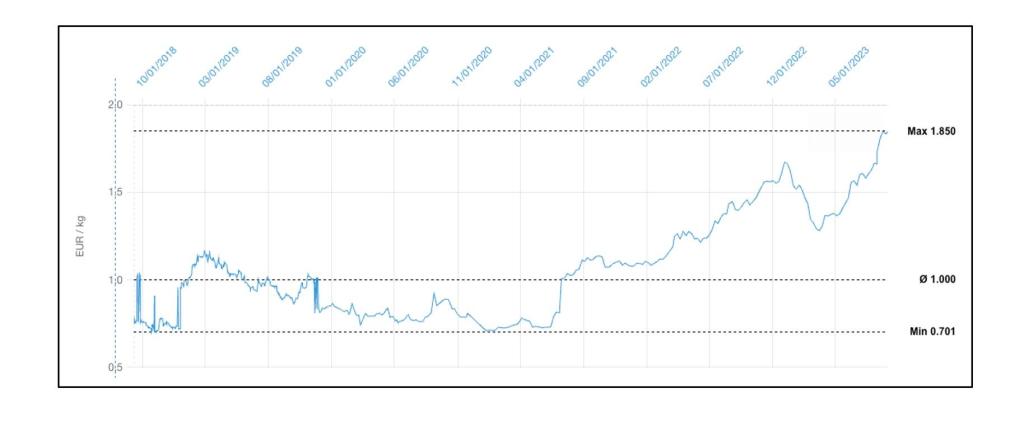

4. What are the prices for chickpeas on the European market?

Prices for pulse crops such as chickpeas mainly depend on availability in relation to global demand. Other price variations are often related to quality and variety. For example, the larger Mexican sizes collect higher prices and kabuli chickpeas are slightly higher priced than desi chickpeas.

India dominates the global chickpea market, producing more chickpeas than any other country in the world and having an unparalleled domestic demand. The country has a considerable influence on the global market. Therefore, Indian FOB prices are a good benchmark for prices.

Figure 4 shows the price progression for a 10mm Indian kabuli over the last 5 years. The price increase between September 2021 and September 2023 is very prominent, reaching the prices shown in Table 6. The price increase has been driven by unwavering demand while at the same time there were global shortages in supply. These shortages were caused by the unrest in Ukraine and Syria as well as crops affected by weather in various parts of the world.

Table 6: Indian FOB price kabuli chickpeas, 28 August 2023

|

Type |

USD/metric tonne |

|

42-44 (12 mm) |

2,030 |

|

44-46 (11 mm) |

2,015 |

|

46-48 (10 mm) |

2,005 |

|

58-60 (9 mm) |

1,950 |

|

60-62 (8 mm) |

1,940 |

|

62-64 (<8 mm) |

1,930 |

Source: Mundus Agri

Figure 7: Indian FOB price progression over last 5 years, 10mm kabuli chickpea

Source: Mundus Agri

Source: Trade Map

The average price of chickpeas imported into Europe dipped to €824 per tonne in 2020 and climbed to €1,390 per tonne in 2022. Based on the latest Indian prices, there is no sign of the upward pressure on prices abating in 2023.

In retail, regular dried chickpeas usually sell for €2 and €4 per kilo. Organic chickpeas retail significantly higher, between €5 and €6.50 per kilo. It is costly for retailers to hold stock as products like dried chickpeas do not necessarily move fast. Therefore, margins for retailers are high – up to 50% - and packers and traders tend to manage with a share of 15-25%. VAT is also included in the selling price, and can be quite high, for example in the Netherlands it is 21%.

Source: ICI Business (June 2023)

Tips:

- Monitor prices and global production news closely, because global production shifts affect prices. Go to, for example, Mundus Agri.

- Study websites comparing retail prices like supermarketscanner.nl.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research