Entering the European market for cowpeas

If you want to enter the European market for cowpeas, there are a number of requirements you need to meet regarding quality and food safety. Exporters should be careful because their shipments to Europe may be subject to increased inspection rates. This happened to cowpeas from Madagascar because of Chlorpyrifos issues. Importers, traders and brokers that specialise in dry ingredients are the most relevant channels for cowpea exporters.

Contents of this page

1. What requirements and certifications must cowpeas comply with to be allowed on the European market?

If you want to export cowpeas to Europe, you have to comply with general requirements for the European grains, pulses and oilseeds sector. The most important requirements for exporting cowpeas to Europe concern food safety, quality and pesticide residues – Chlorpyrifos in particular.

What are mandatory requirements?

Mandatory requirements for cowpeas or black-eyed beans concern food safety and quality. Both names are commonly used, but black-eyed beans are a variety of cowpeas, strictly speaking. The requirements include legal rules, quality requirements and packaging and labelling requirements.

Official food controls: non-compliance leads to stricter requirements

Food imported into the European Union (EU) is inspected regularly. Inspections can be carried out on imports at the border or later on in the value chain (e.g. on the importers’ premises). The checks ensure that the products meet the legal requirements for cowpeas.

Non-compliance with European food legislation is reported via the Rapid Alert System for Food and Feed (RASFF). In 2023, 12 issues with cowpeas were reported through the RASFF, a few more than the nine issues in 2022. All the issues in both years related to the presence of pesticide traces that exceeded the Maximum Residue Limits (MRLs).

If imports of a certain product from a specific country repeatedly fail to meet the requirements set by European food legislation, more official border checks are performed. The origins of cowpeas or black-eyed beans are listed in Annex 1 of the regulation on the temporary increase of official controls and emergency measures.

Black-eyed beans from Madagascar have more official checks upon entry into the EU. 30% of all shipments of black-eyed beans from Madagascar are subject to official checks for pesticide levels. This is a temporary measure.

Tip:

- Use My Trade Assistant of Access2Markets, which provides an overview of market access requirements for cowpeas per country, using HS code 071335.

Control of pesticide residues

The EU Regulation on maximum residue levels of pesticides specifies the maximum residue levels (MRLs) for pesticides in and on food products. When no specific level is given in relation to a product, there is a general default MRL of 0.01 mg/kg. Products that contain more pesticide residues than allowed are removed from the European market.

For cowpeas, almost all the issues involve the cowpeas having higher Chlorpyrifos residues than the official permitted maximum of 0.01 mg/kg.

Tips:

- Select your product (beans without pods or code 0260020) or the pesticide that you use in the EU pesticide database to see the list of relevant MRLs.

- Reduce the level of pesticides by applying integrated pest management (IPM) during production. IPM is an agricultural pest control strategy that uses natural control practices as well as chemical spraying.

Quality requirements

You have to meet common quality standards if you want to export cowpeas to Europe. It is best to follow your buyer’s indications and the FAO International standard for certain pulses (PDF) in the Codex Alimentarius. The Codex includes quality requirements for cowpeas (Vigna unguiculata (L.) Walp., syn. Vigna sesquipedalis Fruhw., Vigna sinensis (L.) Savi exd Hassk.). Also refer to Table 1 below.

Table 1: General quality standards for cowpeas according to the Codex Alimentarius

| General |

|

| Purity and defects |

|

| Moisture |

|

| Discolouration |

|

Source: FAO/Codex Alimentarius standard for certain pulses (PDF), June 2024

Use correct labelling and packaging

Food imported into the EU must meet the legislation on food labelling. The label of bulk packaging must contain:

- Name and variety of product (e.g. ‘Cowpeas’)

- Batch code

- Net weight in the metric system

- Shelf life of the product or best before date and recommended storage conditions.

- Lot identification number

- Country of origin

- Name and address of the manufacturer, packer, distributor or importer

Identification marks can be used to replace the lot identification number and the name and address of the manufacturer, packer, distributor or importer. Labels can also include details like brand, drying method and harvest date. The batch details can also be included in the technical data sheet. Organic food and genetically modified food require additional labelling.

25 kg and 50 kg polypropylene bags are often used to package cowpeas. Smaller bags and multi-layer paper bags are particularly common for organic cowpeas, but they are also increasingly being used for conventional cowpeas.

The packaging must protect the product and comply with Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food.

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Check additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods (PDF) or Regulation (EU) No. 1169/2011 (PDF) on providing food information to consumers in Europe.

What additional requirements and certifications do buyers often have?

European buyers often have additional requirements in addition to legal obligations. These often relate to food safety and sustainable and ethical business practices.

Certification as a guarantee for food safety and beyond

Food safety is key in the European market. Although legislation addresses many potential risks, it is not enough on its own. For this reason, importers prefer to work with producers and exporters who have Global Food Safety Initiative (GFSI) recognised food safety system certificates.

For cowpea exporters, the most popular certification programme is Food Safety System Certification (FSSC 22000). FSSC 22000 is based on the ISO methodology, and it offers the most structured and logical approach to a Food Safety Management System.

Sustainability compliance

Ever more European buyers are demanding social and environmental compliance. This means you often need to undersign your buyer’s code of conduct or a third-party one. You can also opt for third-party certification schemes, such as B Corp or SMETA, set up by the Supplier Ethical Data Exchange (Sedex).

Tips:

- Check with your buyer to determine which certification scheme is the most relevant for your target market.

- Read the CBI’s buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform for more insights into the advantages of certifications.

Organic certification

Organic certified food products are the norm in several European supermarkets in countries like Germany, the Netherlands, the United Kingdom and Scandinavia. Most organic certified cowpeas in Europe are sold by brands that specialise in the organic segment, and they are mostly sold through organic specialised retail channels.

Figure 1: Organic cowpeas from Turkey available from a British online retailer

Source: GloballyCool, July 2024

If you want to export organic cowpeas to Europe, you should comply with Regulation (EU) 2018/848. It describes the rules for production and labelling for organic products. Organic cowpeas should not contain any chemical traces.

What are the requirements for niche markets?

The strong ethnic consumption of cowpeas in Europe makes Kosher and Halal certifications interesting because they are important for certain consumer groups. These ethnic food management practices also carry through to final processed products that contain your cowpeas as an ingredient.

Tips:

- Consider organic certification if your situation and location allow it. Remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process to market organic products.

- Read the CBI buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform for more detailed insights into the process of organic certification.

- Explore the ITC’s Standards Map to learn about the different voluntary sustainable and social standards and see which ones are available in your country.

2. Through which channels can you get cowpeas on the European market?

Cowpeas reach the European end market through multiple channels. There are two main pathways. First, dried cowpeas are repacked in the European market for retailers and the food service sector. Second, dried cowpeas go to canning companies that produce pre-cooked cowpeas, which are then offered in cans or jars in the retail and food service segments.

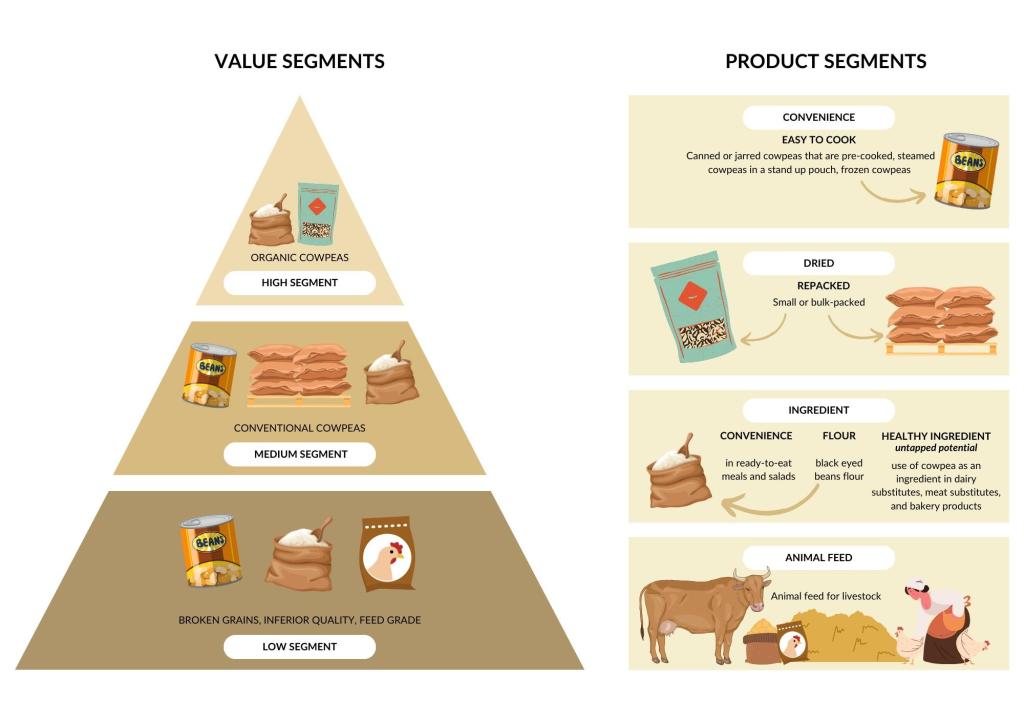

How is the end-market segmented?

The cowpea market can be segmented into high, medium and low segments. It can also be segmented into product categories. Figure 2 gives an overview of the different value and product segments that can be found in the European market.

Figure 2: Market segments for cowpeas in Europe

Source: GloballyCool, June 2024

Convenience

The convenience segment is an important segment in the European market. Due to consumers’ busy lifestyles, they do not always have much time to cook. As dried cowpeas take longer to prepare, consumers want alternatives. For their convenience, supermarkets sell pre-cooked cowpeas in cans and jars. More recently, pouches with pre-steamed cowpeas have been introduced, which can either be used in dishes or eaten directly as snacks.

Dried

There are two main types of consumers who use dried cowpeas: traditional consumers who use them in local traditional dishes (e.g. Portugal) and ethnic consumers (e.g. from Africa) who use them in a traditional way.

Ingredient

In the convenience category, processing companies often use cowpeas in ready-to-eat meals, catering to modern consumers with busy lifestyles who want quick and healthy food options.

Cowpea flour is also commonly used in ethnic communities as a thickener for soups, sauces and gravies, as well as for making dips and bean cakes. Cowpea flour has untapped potential as a functional ingredient, especially given the growing interest in incorporating cowpeas into dairy and meat substitutes, as well as bakery products. This opens opportunities to target new customers: the health-conscious, plant-based, and sustainability-oriented.

A promising recent development is cowpea protein concentrate, which is suitable for the alt-dairy industry (the name of the industry that produces alternative dairy products) to make plant-based milk and yoghurt. Recent research and innovations that use cowpeas as an ingredient may further expand their role in the plant-based food segment.

Animal feed

While cowpeas are mainly used for human consumption, they can also be used as livestock feed – particularly lower-grade cowpeas.

Conventional versus organic cowpeas

The vast majority of cowpeas sold in Europe are conventional cowpeas, which belong to the mainstream mid-segment. The organic segment is small but growing. Organic products are considered premium so are sold in the higher segment.

Tip:

- Watch USA Pulses’ webinars on how to use pulse ingredients and proteins in value-added food products.

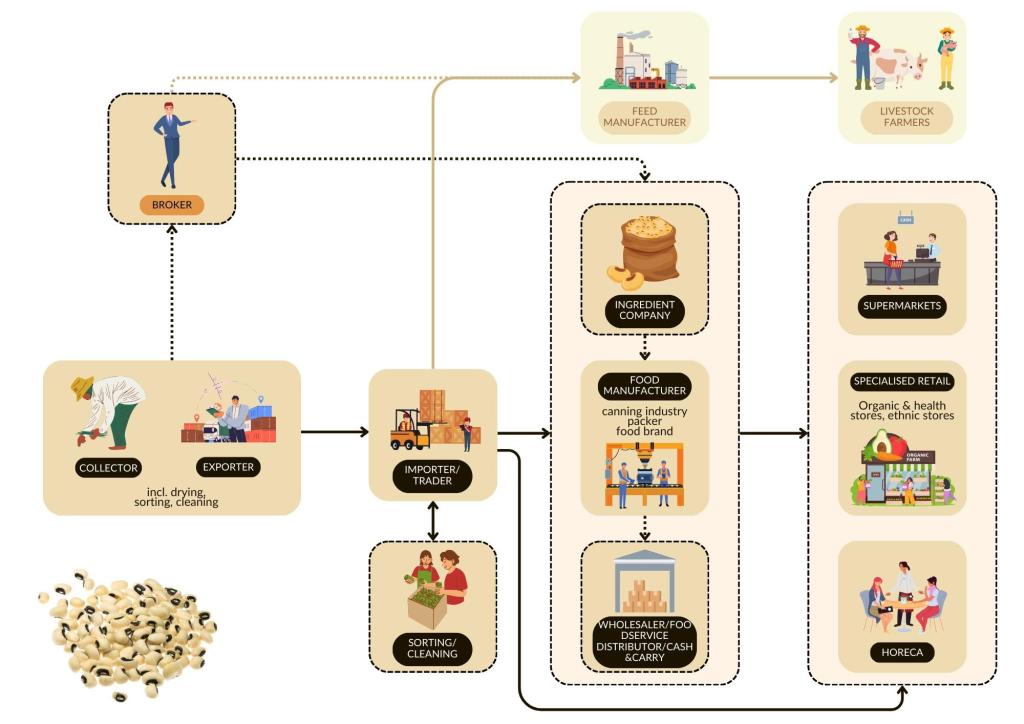

Through which channels do products end up on the end-market?

Cowpeas can enter the European market through several channels. Figure 3 shows these channels, starting with the exporter in the country of origin and ending with the end market. The most important market channels are explained in more detail below.

Figure 3: European market channels for cowpeas

Source: GloballyCool, June 2024

Importers and traders

European importers and traders play an important role in supplying cowpeas to the European market. Importers that purchase cowpeas often specialise in trading dried pulses, grains, seeds, nuts and fruit. Their primary responsibility is to guarantee a high-quality and reliable supply of cowpeas. This involves balancing supply and demand, ensuring food safety and quality, managing the supply chain, and verifying compliance with sustainability standards.

Importers can offer their customers cowpeas in bulk packaging or retail packaging, and under private label or their own brand, depending on the customer’s requirements. Some importers do the packaging themselves, while others outsource it. For example, Brandwijk Holland has modern packaging lines and weighing facilities. It also offers products in big bags, bulk bags (e.g. 10 kg and 25 kg) and small packages (e.g. 500 g and 1 kg). Chelmer Foods works with packers and processors to offer their customers tailor-made products.

You can reach different end markets through importers. They sell to a broad client base, including food processors, food manufacturers, packagers, food (service) distributors, wholesalers, cash and carry, trading companies, the food service sector and retailers (i.e. supermarkets, independent stores, and ethnic stores). Some importers supply both the food and feed industry, such as Brandwijk Holland, SkaneGroup and AgriFoodTrade. Other importers focus on the ethnic market, such as Sabora Mundo from Portugal and Lotus Foods Trading Company from the United Kingdom.

Brokers

Brokers can serve as intermediaries. They do not take ownership of the product but earn a commission from their clients when they complete a sale. They are often active with small companies. For example, Alons-Gar is a broker and consultancy company that specialises in dried pulses, cereals and dried nuts.

Food manufacturers

Food manufacturers add value by either re-packing dried cowpeas or processing them. The simplest form of processing involves repackaging dried cowpeas for retail. More extensive processing is done by canning companies, which turn dried cowpeas into pre-cooked products sold in cans and jars to the retail and food service sectors. Some food manufacturers mix cowpeas with other ingredients to create ready-to-eat meals for the convenience market. Some cowpeas are processed into flour.

Food manufacturers typically buy dried cowpeas from importers to ensure a stable, reliable and convenient supply. This especially holds for smaller companies. Larger companies may buy cowpeas from foreign exporters and suppliers directly. Once processed by the food manufacturer, the value-added products end up in the retail or food service sectors, either directly or through intermediaries like wholesalers.

Table 2: Examples of food manufacturers that process cowpeas

| Company | Products in the portfolio | Country |

| Compal da Horta | Canned pulses, fruit juices and fruit snacks | Portugal |

| Ferbar | Canned and jarred legumes and fruits, preserves, spices and herbs, nuts and dried fruits and other products | Portugal |

| Caçarola | Dry and jarred pulses, pasta, rice and crackers | Portugal |

| Ramirez | Canned fish, including canned tuna with black-eyed beans | Portugal |

| TRS Food | Ethnic foods, including dried and canned black-eyed beans | The United Kingdom |

| La Cesenate / Alce Nero | Range of organic and conventional food products, including organic jarred cowpeas | Italy |

| Bioitalia | Range of organic food products, including organic canned black-eyed beans | Italy |

| Valle del Sole | Ethnic foods, including dried and canned black-eyed beans | The Netherlands |

| COROOS | Processed pulses, fruits and vegetables, including black-eyed beans in dried, puree and paste form | The Netherlands |

| Barba Stathis | Frozen vegetables, legumes, and salads, including frozen black-eyed beans | Greece |

| 3alfa | Rice, legumes, superfoods, including dried and steamed black-eyed beans | Greece |

| Paliria | Ready-to-eat food and meals | Greece |

| Legumbres Luengo | Dried and canned pulses | Spain |

Source: GloballyCool, June 2024

Ingredient companies

Ingredient companies produce intermediary products, like ready-made concentrates used in the food processing industry. Due to the demand for plant-based and protein-rich products, there is an more interest in exploring the use of pulses in a variety of products. As mentioned before, some companies and institutions have started researching using cowpea flour and cowpea protein concentrate. These products have the potential to be used in the alt-dairy, bakery and meat substitute industries.

Although this is currently not an important channel for you as an exporter, it is important to monitor product developments and innovations in this area. In the future, there may be more business opportunities in this channel.

Tips:

- Get familiar with the market channels for canned cowpeas by reading our study on entering the European market for canned beans.

- Visit the Food Ingredients Europe trade fair for insights into the latest trends in the use of pulses as an ingredient.

What is the most interesting channel for you?

The most effective way for an SME exporter to enter the European market is through traders, importers or brokers that specialise in trading pulses. These are the primary entry point for cowpeas into the European market. Since these buyers are specialised, they know a lot about the European pulses market and have well-established networks. They are also constantly searching for reliable suppliers.

When choosing importers and traders, you have to understand which channels they serve and look for buyers that are well-connected with your target market. Some larger importers and traders have a wide client base and supply pulses to wholesalers, the processing industry, retailers and the food service sector (e.g. Brandwijk Holland). Other importers and traders cater to specific segments. For example, Jaggoe Import focuses on importing tropical fruits and vegetables, and it supplies ethnic shops, the catering segment and wholesalers.

European buyers choose suppliers primarily on their compliance with EU regulations and product quality. For instance, AgriFoodTrade inspects incoming goods, looking at food safety criteria, including pesticide residues, mycotoxins and heavy metals. Other aspects important to buyers include product availability and supply stability. When you want to enter the European market, make sure you understand buyers’ needs and can comply with their them.

Tips:

- When searching for and selecting importers, evaluate which aligns with your target market best. Importers can have a specific client base, so make sure you select one that best matches your product.

- Connect with buyers by visiting relevant trade fairs, such as SIAL (France), Anuga (Germany) and BIOFACH (Germany, organic).

- Find potential buyers through the member lists of sector associations. For example, the member area of the Global Pulse Confederation contains 24 national associations and more than 600 private sector members.

- For more guidance, check our tips for finding buyers on the European grain, pulses and oilseeds market.

3. What competition do you face on the European cowpeas market?

The cowpea originates from West Africa and, as such, is widely produced and consumed across the African continent. The world’s largest producing countries are in Africa, like Nigeria and Niger. However, they do not export much to Europe because of their large domestic consumption and their use of genetically modified cowpea varieties. Instead, you should expect competition from Myanmar, Brazil, Madagascar and Peru.

Which countries are you competing with?

Overall, the exported volume of the supplying countries is relatively volatile and can differ from one year to another. After strong growth in 2023, Myanmar has become Europe’s leading cowpea supplier with a market share of 27%. Madagascar was previously the top supplier of cowpeas, but it has dropped to third place, with a 20% share. Brazil takes second place with a market share of 22%.

Source: UN Comtrade, June 2024

*The EU, Switzerland, Norway, and the United Kingdom

Argentina managed to increase its exports from 60 tonnes in 2019 to 700 tonnes in 2023. As a result, it became the fourth largest player. Peru, on the other hand, experienced a large drop and fell to fifth position. However, in 2019–2022 Peru’s exports were much higher than Argentina’s. This makes Peru a more relevant competitor.

Myanmar

Myanmar’s exports to Europe vary significantly from one year to another. In 2019–2020, the exported volume was about 1,800 tonnes. Then, exports dropped to a mere 340 tonnes. In 2023, exports increased tremendously by 463% to a volume of 3,000 tonnes. This made Myanmar the leading exporter of cowpeas to Europe.

Most of the country’s cowpeas go to the United Kingdom (24% in 2023), Italy (22%), the Netherlands (18%), and Spain (12%). In these countries, Myanmar is the leading supplier. However, Europe is a relatively small cowpea export destination for Myanmar. According to FAOSTAT, the country produced 107,000 tonnes of cowpeas in 2022. Their main destinations are countries in Asia, such as China.

Brazil

Brazil’s exports of cowpeas to Europe have been very volatile over the past five years. In 2021, the country supplied a mere 550 tonnes. In 2022 exports grew sharply to 3,800 tonnes, only to drop again in 2023 to 2,400 tonnes. Overall, Brazil showed a significant average growth of 14% from 2019 to 2023. Its main European market for cowpeas is Portugal (82%). The remainder goes to Italy (17%).

Cowpeas are the second most cultivated bean in Brazil, mostly produced in the north and northeast – especially in the semi-arid regions. In 2023, these regions accounted for 83% of the total production. Production is aligned with local consumption. Thanks to the crop’s strong performance, producers from regions like the central-west have also begun cultivating cowpeas in recent years.

For the 2022/2023 harvest year, Conab estimates that 643,000 tonnes were produced. The crop is cultivated on 1,298,000 hectares of planting areas and has an average yield of 496 kg/ha. There are three harvest periods per year. The largest production occurs in the second harvest, followed by the first. The third harvest has fewer hectares but a higher production yield.

In Brazil, the IBRAFE institute represents and develops the bean and pulse sector. It brings together different stakeholders in the value chain, such as researchers, seed growers, producers, brokers, packers and exporters. They facilitate access to knowledge and support their members through an integrated market information system, courses, seminars and forums. With this, they aim to strengthen the sector in Brazil.

Madagascar

From 2019 to 2022, Madagascar was Europe’s leading supplier of cowpeas with relatively stable volumes of between 2,900 and 3,300 tonnes, peaking at 4,800 tonnes in 2022. However, in 2023, its exports dropped sharply by 54% to 2,200 tonnes in 2023. This translates to an average annual decline of 8.6% over the past five years. This could be related to recent phytosanitary compliance issues, particularly traces of the prohibited substance chlorpyrifos. The EU warned Madagascar about exceeding pesticide MRLs and raised concerns about its quality, sanitary and phytosanitary control system.

Due to the high non-compliance rates during EU checks, the EU intensified official border control checks for cowpeas from Madagascar in 2023. The frequency of identity and physical checks was raised to 30, as laid down in Regulation (EU) 2025/286. Malagasy stakeholders need to improve to avoid potential sanctions. In 2023, the country initiated a consultation meeting with all the relevant stakeholders and developed a proposal for a roadmap that outlines urgent measures that should be taken to secure access to the European market.

According to FAOSTAT, Madagascar produced 22,000 tonnes of cowpeas in 2022. Its main export destinations are Asian markets (India and Pakistan), followed by Europe and the United States of America. In Europe, Madagascar exports mainly to Italy (22%), Portugal (21%) and the United Kingdom (20%). It is the second largest supplier in these countries. Madagascar also exports cowpeas to Greece (17%) and France (12%). Madagascar is the largest exporter to these markets.

Peru

Peru’s cowpea exports to Europe fluctuate annually. They peaked at 3,300 tonnes in 2021, making Peru the leading supplier that year. However, exports since then have significantly declined, reaching 530 tonnes in 2023. Peru’s export volume has decreased by 16% on average over the past five years.

Peru’s production levels are somewhat comparable to Madagascar’s. The country produced 19,000 tonnes of cowpeas in 2022, primarily in the northern and central coastal regions. The United States and Colombia are its top markets. In Europe, Peru mainly exports cowpeas to the United Kingdom (38%) and Spain (25%).

Tip:

- Stay up to date on developments in competing countries by reading relevant news articles. For example, Pulse Pod publishes the latest news on the global pulse industry.

Which companies are you competing with?

Your main competitors come from Myanmar, Brazil, Madagascar and Peru. Below are short profiles of several companies based in these countries that have experience with exporting cowpeas to the European market.

Pyei Phyo Aung: all kind of beans for the Asian market in the first place

Pyei Phyo Aung Co., Ltd from Myanmar is a trading company that specialises in the export of agricultural products, including cowpeas (brown bean), black-eyed beans and brown-eyed beans. It ships globally to markets in Japan, China, the United States and Europe. Committed to providing high-quality products that meet food safety standards, the company holds GMP/HACCP certifications and is ISO 9001 certified.

Coperaguas: range of beans with cowpeas predominantly exported to Portugal

Coperaguas is Brazil’s largest bean exporter. It is a large cooperative with 371 associated members. To meet market demand, the cooperative has an extensive infrastructure with 12 plants throughout Brazil and an advanced logistics system that ensures quality and consistency in its deliveries. It exports beans and pulses all around the world. In Europe, it exports to key markets, such as Portugal, Italy, Spain and France.

It offers multiple varieties in the Vigna uniculata group, such as:

The black-eyed pea is a subspecies of cowpea and is the most prevalent variety.

- Cowpea other than the black-eyed bean: size 450–600 / 100g

- Black-eyed bean: size 400–450 / 100g

- Brown-eyed bean: size 520–540 / 100g

- Super brown-eyed bean: size 450–470 / 100g

- Jumbo brown-eyed bean: size 450–470 / 100g

SCRIMAD Group: sustainably-certified cowpeas from Madagascar

The SCRIMAD Group exports a wide range of products, including fruits, spices and grains. It positions itself as an exemplary company in the agro-alimentary sector and holds multiple certifications, such as GlobalG.A.P., Fairtrade, organic, FSSC22000 and Halal. The company is active in major European markets like France, Germany, Spain and the Netherlands.

It exports black-eyed beans and red cowpeas of grade I quality. The export season for these products lasts from May/June to August. Cowpeas are packed in polypropylene bags of 25 and 50 kg, with a minimum order quantity (MOQ) of 24 tonnes.

Andes Alimentos: high quality and certified cowpeas from the Andes region

Andes Alimentos from Peru has more than 30 years of experience in exporting agricultural products (superfoods, beans, corn and processed products) to the international market. To promote its products, the company participates in multiple trade fairs like Anuga (Germany), BIOFACH (Germany) and SIAL (Paris). The company attributes its success to several aspects:

- Building long-term business relationships with their clients

- Complying with established standards (such as HACCP, BRCGS, EU organic, Kosher, Halal)

- Providing excellent service to their clients

- Offering high-quality products

In addition, Andes Alimentos promotes care for the environment and local communities. They offer training and supervision to the farmers, guiding them to use organic methods that do not harm crops, people’s health or the environment.

Which products are you competing with?

As European consumers are increasingly interested in convenience foods, dried cowpeas compete with pre-cooked cowpeas sold in cans and jars, and steamed cowpeas. These options save consumers time as they are ready to use.

Cowpeas also compete with other types of products, mainly in the pulses category. For example, chickpeas are a good substitute for cowpeas. They are also a good source of protein and rich in fibre. They can be used in a variety of dishes, such as soups, salads and stews. Chickpeas have a firmer texture than cowpeas, which makes them easier to use in a wider range of dishes. The advantage of chickpeas is that they are well-known and widely consumed in Europe and available in most supermarkets.

Likewise, lentils – which are available in different types – can be used as a substitute for cowpeas in salads, soups and curries. They do not need to be soaked, which reduces the cooking time. Looking environmental sustainability, cowpeas are better than lentils as the GHG emissions for the production of cowpeas are lower: 0.48kg CO2eq/kg versus 1.03kg CO2eq/kg.

Tips:

- Clearly differentiate cowpeas from other, more widely available pulses like lentils. Highlight their environmentally sustainable production.

- Think of promoting cowpeas as an alternative to chickpeas, showing examples of recipes and applications where cowpeas are better suited than chickpeas.

4. What are the prices of cowpeas on the European market?

Prices for cowpeas in Europe are available at the retail level and at the import stage.

Consumer prices

Consumer prices for dried cowpeas in large European supermarkets vary between €1.98 and €5.76 p/kg. They are the lowest in Portugal, at €1.98–3.18 p/kg. The package size affects the final consumer price per kilogram.

Table 3: Consumer prices of cowpeas in large European supermarkets

| Dried black-eyed beans (price in €/kg) | Cooked black-eyed beans sold in can or jar (price in €/kg) | |

| Portugal | €1.98–3.18 | €2.00–3.88 |

| The United Kingdom | €3.54–4.96 | €1.45–1.92 |

| Italy | €5.38 | €5.25–12.50 |

| The Netherlands | €3.06–5.18 | €2.98–4.53 |

| Greece | €2.58–5.76 | €5.11–7.00 |

| Spain | €2.50–5.53 | €3.98 |

Source: GloballyCool, June 2024

Canned and jarred black-eyed beans cost between €1.45 and €12.50 per kg. They are particularly cheap in the United Kingdom, at €1.45–1.92 p/kg. In Portugal and the Netherlands, prices for processed beans are somewhat similar to dried cowpeas. The additional water weight compensates for the higher processing costs. The highest prices are found in Greece, where a 200 gram jar of organic black-eyed beans sells for €2.50.

Figure 5: Canned black-eyed beans in Dutch supermarket

Source: GloballyCool, July 2024

Import prices

The import price of cowpeas has increased in the past five years, from €0.84 p/kg in 2019 to €0.96 p/kg in 2023. The highest prices were observed in 2021 and 2022, averaging €1.13 and €1.15 p/kg respectively across Europe.

Source: GloballyCool, June 2024

Portugal, the largest importing country, has the lowest import price by far. In 2023, it amounted to €0.72 p/kg. In contrast, import prices are higher in Greece (€1.21 p/kg) and Spain (€1.10 p/kg).

Price breakdown

Figure 7 shows the margins of various actors in the value chain, using an average consumer price of €3.87 p/kg and an average import price of €0.96 p/kg. Retailers have the highest margins in the chain.

Source: GloballyCool, June 2024

Tip:

- Find consumer prices of dried and canned cowpeas in the online stores of leading supermarkets in your European target markets, like Pingo Doce (Portugal), Tesco (the United Kingdom), Albert Heijn (the Netherlands), Sklavenitis (Greece) and Alcampo (Spain).

GloballyCool carried out this study on behalf of the CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research