Entering the European market for dried lentils

Lentils are a versatile and nutritious legume that is used in a wide variety of food applications in Europe. Production is dominated by North America, but many countries in Asia, the Middle East, Africa, Latin America as well as Europe also cultivate lentils. In many countries a large part of production is consumed domestically. Smaller volumes go into export. To successfully enter the European market for lentils, your product should be of high quality and must fulfil stringent food safety requirements.

Contents of this page

1. What requirements must dried lentils comply with to be allowed on the European market?

All food products entering the European market must meet general food safety and quality requirements. You can check CBI’s summary of the requirements that suppliers of grains, pulses and oilseeds must comply with to put their products on the European market.

Also, the European Commission has set up My Trade Assistant. This search engine lets small businesses look up detailed information about product rules and import requirements, by country and on a product-by-product basis. To check the requirements for lentils, use the Harmonized System (HS) code 0713.40 for dried lentils.

Food safety and product quality will be the most important aspects, but some buyers will also require you to address Corporate Social Responsibility (CSR) issues.

What are mandatory requirements?

Food safety: limited presence of pesticides and contaminants

Consumer safety is the most important consideration for any food product sold in the European market. Failure to comply with food safety standards can result in stricter controls or even temporarily banning imports from your country. To meet these standards, you must apply the principles of the Hazard Analysis Critical Control Point (HACCP) system.

To guarantee that your lentils meet European Union (EU) food safety standards, you must ensure traceability throughout the supply chain. The country of origin is responsible for compliance with EU legislation. Controls take place at EU borders and on the market. Food safety requirements include limited or no pesticide residues and limited or no presence of contaminants such as metals or stones, or microbes such as salmonella or E. coli.

Another concern about lentils and other pulses is contamination with heavy metals. The European Commission has laid down maximum levels for cadmium and lead (see Table 1, lentils fall under pulses).

Table 1: Maximum allowed levels of heavy metals in lentils

| Relevant foodstuff categories | Maximum levels (mg/kg wet weight) |

|

| Lead | Cadmium | |

| Cereals and pulses | 0.20 | |

|

Pulses and protein from pulses: Pulses, except protein from pulses Protein from pulses |

0.040 0.10 |

Source: European Regulation (EC) No 1881/2006 setting maximum levels for certain contaminants in foodstuffs

Where a product contamination is detected, a filing is made in the EU Rapid Alert System for Food and Feed (RASFF).

Tips:

- Get acquainted with the EU food safety policy. Consult the EU Pesticides Database to learn about Maximum Residue Levels (MRLs) for pesticides (use codes 0260050 for fresh lentils and 0300020 for dried lentils) and aflatoxins.

- Conduct laboratory checks of your product for contaminants that are not visible to ensure that residue levels meet EU requirements. Use suitable equipment to remove larger impurities like stones.

- Use the HS code 0713.40 to check the ePing service platform for information about country-specific trade measures related to dried lentils.

- Visit the website of the Integrated Pest Management (IPM) Coalition. It provides several resources aimed at helping farmers reduce their use of hazardous pesticides.

Labelling of allergens

If you are supplying lentils directly to retailers in the European Union, your product will have to follow the Codex General Standard for the Labelling of Pre-packaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers.

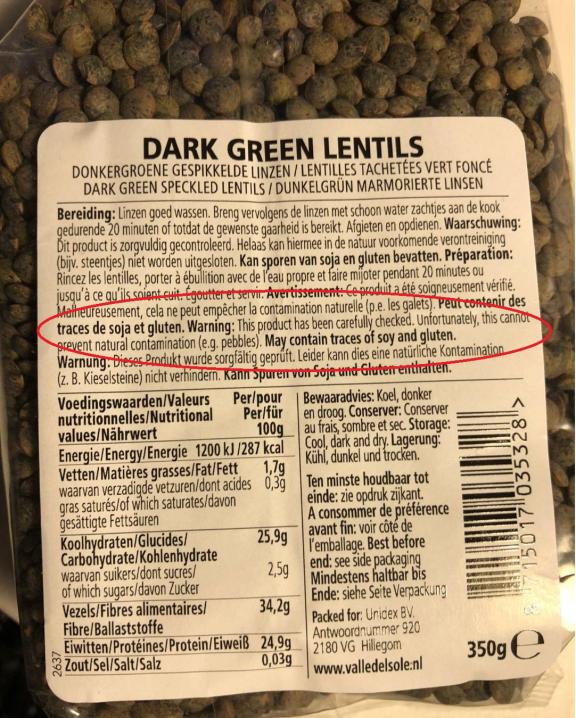

If the presence of allergens cannot be ruled out, the product label must clearly inform consumers about potentially present allergens. The allergen information should be highlighted, for example by using a different font, letter size or background colour. See Figure 1 for an example.

Figure 1: Example of dried green lentils in retail package highlighting potential presence of food allergens

Source: Profundo

Tips:

- Check the EU guidance on allergens. This is intended to help businesses apply EU Regulation 1169/2011 on food product labelling.

- Read the CBI buyer requirements for grains, pulses and oilseeds for additional information about product labelling.

Packaging

Lentils are commonly shipped in 25 kg or 50 kg polypropylene (PP) bags or in multi-layered paper bags. Two EU packaging regulations are relevant for lentil exports to Europe:

- Regulation (EC) No 1935/2004 requires that packaging materials do not release harmful levels of their components into foods. They must not change the taste, smell or composition of food either.

- Exporters using plastic materials like polypropylene must also observe Regulation (EU) No 10/2011 regarding plastic materials that come into contact with food.

Tips:

- Discuss with your buyers in Europe about their packaging needs and clearly explain what options you can offer. Poor packaging can result in buyers choosing a different supplier.

- Consider laboratory checks to ensure compliance with EU food packaging regulations.

- Check out this webinar by Eurofins about product packaging considerations and how to avoid failures.

What additional requirements and certifications do buyers ask for?

Quality standards

There are no specific EU food quality standards for pulses like lentils. As a general rule, food imports into the EU must be:

- Safe and suitable for human consumption;

- Free from abnormal flavours and odours;

- Free from dirt in amounts that may be harmful to human health. For example, your product should be free of dead insects and plant residues;

- Free from sand, living insects, mites or other impurities.

Proper storage of lentils is crucial to prevent loss of quality. Particular attention needs to be paid to moisture level.

Tips:

- Use the Codex Alimentarius standard (PDF) to get an idea of the quality requirements dried lentils should meet, for example regarding moisture content, defects and discoloration.

- Study Grains Canada’s list of grading factors for lentils to get an idea of criteria that importers may apply to purchases. Alberta Pulse has an overview of lentil storage and grading recommendations.

- Discuss their quality requirements with your existing or potential buyers and make sure to always comply with them. Failure to meet quality requirements can cause you to lose buyers.

Quality certifications

European retailers, food processors and other buyers often expect extra food safety guarantees from suppliers. Voluntary certification schemes are a popular way to show that products meet quality standards.

European food businesses must have a food safety management system based on the principles of Hazard Analysis and Critical Control Points (HACCP). Such a system identifies, evaluates and controls hazards to food safety. Traders, processors and retailers often require their foreign suppliers to follow the same system.

Food management and certification programmes recognised by the Global Food Safety Initiative (GFSI) are widely accepted on the European market. They include BRCGS Global Food Safety Standard, FSSC 22000, GLOBALG.A.P. and International Featured Standard (IFS).

Tips:

- Involve your buyers in the selection of a certification scheme for your product.

- Learn about the advantages of quality certification schemes by reading CBI tips for organising your export and CBI buyer requirements for grains, pulses and oilseeds.

Social and environmental sustainability

Practices related to social and environmental sustainability play an increasingly important role in entering the European market. Also, small buyers may demand this. Buyer conditions may require you to provide extra information to prove reasonable conduct and to prove that you adhere to a code of conduct.

Becoming certified under a voluntary scheme can help you meet those expectations. Examples of widely recognised standards and codes of conduct are:

- Business Social Compliance Initiative (amfori BSCI)

- Ethical Trading Initiative (ETI)

- GLOBALG.A.P. Risk Assessment on Social Practice (GRASP)

- Rainforest Alliance

- SAI Platform – Farm Sustainability Assessment (FSA)

- Sedex Members Ethical Trade Audit (SMETA)

Tips:

- Compare your company’s principles against the labour principles set out in the amfori BSCI code of conduct (PDF).

- Consult the ITC Standards Map database to find and compare criteria of a large number of standards for environmental and social protection, economic development, quality and food safety, as well as business ethics.

What are the requirements for niche markets?

Fair trade

Fair trade practices, such as Fairtrade International and Fair for Life, apply to niche markets and are focussed on socially conscious consumers. While still a niche, fair trade products are increasingly offered in mainstream supermarkets in Europe. For example, discounter Lidl has a fair trade product line under its own brand.

Fairtrade International has standards for small producer organisations for Vegetables. Fairtrade sets minimum prices for certified pulses, at US$430/tonne for conventional and US$540/tonne for organic pulses. There is also an added premium of US$65 and US$80, respectively.

Certification for ethnic consumption

Lentils are an important ingredient in ethnic cuisines in Europe. Halal or kosher certifications for your lentils can increase the market reach of your product.

Organic certification

The market for organic food products continues to show strong growth. To sell organic products on the European market, you have to use organic production methods approved by European legislation. Regulation (EU) 2018/848, in force since January 2022, states that producers in third countries who want to supply the European market are subject to the same rules as those producing in the European Union. The Regulation also introduced stricter inspection of organic products to prevent fraud. To sell organic lentils in Europe, a certifying agency must verify that you meet EU requirements.

Note that getting a license to offer organic certified products in Europe through a certifying agency takes time and comes with costs.

Tips:

- Consult CBI buyer requirements for grains, pulses and oilseeds to learn more about the requirements for the organic market in Europe.

- If you want to sell organically certified lentils, it is a good idea to connect with buyers in Europe that specialise in organic food products, for example European organic wholesaler Vehgro or Dutch wholesalers Odin and Tradin Organic.

- Consult the list of control bodies and authorities operating in third countries that can confirm equivalence with EU standards.

2. Through what channels can you get dried lentils on the European market?

How is the end market segmented?

Several product segments can be distinguished on the European market for lentils. These include traditional use in local cuisine, ethnic food segments, health food and innovative segments.

Table 2 gives an overview of the different segments for lentils on the European food market. Prices depend on factors like variety (common or specialty lentils), level of processing, and whether the lentils come from conventional or organic agriculture.

Lower-quality supplies with broken grains or inconsistent colour can be used in food processing, for example in ready-made dishes like lentil soup or for lentil flour.

Table 2: European market segments for dried lentils

| Market segment | Product examples |

| Traditional and ethnic consumption |

|

| Health-food segment, dishes and products based on plant proteins |

|

| Animal feed |

|

Traditional and ethnic consumption

The most important segments for food-grade lentils in Europe are traditional and ethnic consumption. Both have well-established supply chains for dried lentils. Lentils are partly in demand as an affordable, basic food product. However, price is less important for specialty lentil varieties as local heritage foods, for example in Spain, Italy and France. This origin-specific demand is met by local production.

Throughout Europe, supermarkets as well as ethnic stores offer a variety of lentils for traditional cooking as well as cuisines from Middle Eastern and Asian origin. Brands include Müller’s Mühle (Germany), Pedon (Italy), Merchant Gourmet (UK) and Unidex with its Valle del Sole legume line (the Netherlands).

Health-food segment

In recent years, products containing grain legumes such as lentils or beans have seen a rapid surge in Europe. Use of protein-rich lentils is expanding to healthy meals like salads, soups, veggie burgers and ready-to-eat vegetarian or vegan dishes. This includes increasingly successful meat replacements, which may contain lentil grains as well as flour or protein isolates. The market for alternative protein products is expected to grow from US$1.4 billion in 2019 to US$3.5 billion in 2027. Producers include private-label supplier Schouten Europe (the Netherlands) and Garden Gourmet (Nestlé, Switzerland). Whitworths (UK) puts a particular emphasis on the high protein content of its ready-to-eat Indian lentil dhal.

Lentil flour is increasingly used in products that are traditionally made from wheat, potatoes or maize. This development is also driven by the trend towards healthier eating, including gluten-free and low-carb diets. Leading Italian pasta producer Barilla stresses that its lentil pasta is certified gluten-free and non-GM.

The EU sprouted seeds market is a highly specialised niche segment of the fresh produce market. Sprouts are used as a healthy ingredient in salads, soups and stir-fry dishes. Mung beans dominate the sprouts business in Europe, but some producers also offer lentil sprouts, like Evers Special (the Netherlands). Around 120 sprouts producers operate throughout Europe and are organised in the European Sprouted Seeds Association (ESSA).

Figure 2: Lentil sprouts

Source: Pixabay, Mario

Non-food market for dried lentils

Non-food use of lentils in Europe is a niche. Broken lentils that are not suitable for consumer products are used in animal feed. However, these tend to be sourced from domestic European production. Small volumes of lentil flour and lentils are used in pet food, for example by Greenwoods.

Through what channels does a product land on the end market?

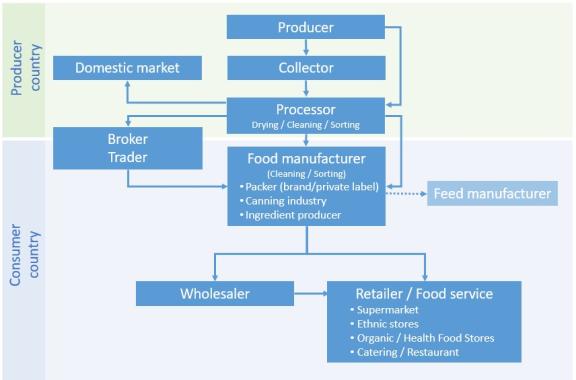

There are different ways to reach the European market. Your path may go via middlemen, like traders or brokers, or directly to companies that process, package or market lentils and lentil products (Figure 3). Importers usually prefer longer contracts and short supply chains, where collector and exporter are the same.

Figure 3: Simplified overview of key European market channels for dried lentils

Source: Profundo

The type of payment terms that you agree on with customers can vary. Options include letters of credit, payment in advance or after delivery, bank guarantees or documents against payment or acceptance.

Importers and commodity traders

Importers and traders with different specialisations play an important role in bringing products like lentils to the European market. They match the demand for a product with supply that fits the requested criteria. The product may directly go to the end user, or first go to resellers. Many of the important European trading houses are traditionally located in Germany, the Netherlands and Belgium (see Table 3).

Some of the leading importers offer a broad selection of agricultural commodities while others focus on pulses. One specialised importer is Schlüter & Maack from Germany. The company supplies the European food industry with lentils, beans and peas, sourced from Canada as well as the USA, China and Turkey. ETG World from the Netherlands trades and processes various pulses, including a large selection of lentil varieties. ETG is present in all key pulse-producing countries/regions including Canada, China, Eastern Europe and India. It procures around 70% of African pulse production. In Africa and Asia, most of its sourcing is directly from farmers. Examples of important organic importers are Do-It and Tradin Organic.

Sometimes the importer is also the food manufacturer. Some large packers import dried lentils and pack them in retailer-sized packs, either under their own brands or for retailers’ private labels. An example is German-based Müller’s Mühle, a market leader in the European dried legumes trade. It mostly markets products under its own brand but also packs under private labels.

Table 3: Examples of lentil importers in Europe

| Company name | Country | Type |

| Agrifood Trade | the Netherlands | Conventional, also for sprouting |

| Casibeans | Belgium | Conventional and organic |

| Do-It | the Netherlands | Organic |

| ETG | the Netherlands | Conventional (raw and processed) |

| Jonas | the Netherlands | Conventional |

| NRG Imports | the Netherlands/Europe | Conventional (Indian brands) |

| Müller’s Mühle | Germany | Conventional |

| Schlüter-Maack | Germany | Conventional and organic |

| Talianis | Greece | Conventional |

| Tradin Organic | the Netherlands | Organic |

| Unidex | the Netherlands | Conventional |

| Voicevale | UK/France/Germany | Conventional |

Brokers with links to European customers

Brokers or agents can help link your product to trading companies, millers and processors in Europe. For example, Cogeser is based in France with connections across all major production regions, while Agricore focuses on Europe and the Black Sea region. Through a broker you can access a larger number of buyers. They know market conditions and prices and can help with logistics. The commission they charge depends on the type of agreement.

Moving away from the traditional way of trading, DCX Pulses launched in 2022, offering an online platform based on blockchain. It aims to connect exporters, importers and other actors on the market for pulses transparently and efficiently.

Food producers

Food producers are looking for a consistent and reliable supply of raw materials. The sourcing model depends on the size of the company and the required volumes. Small and medium-sized companies are more likely to make use of the services of importers and wholesalers. If large volumes of lentils are required, a company may also source directly and be open to investing in longer-term arrangements with direct suppliers that can ensure consistent quality and sufficient volumes.

Table 4: Examples of European food companies marketing lentils and lentil products

| Company name | Country | Lentil products |

| 3alfa | Greece | Dried lentils |

| Asseman Deprez | France | Dried lentils |

| Barilla | Italy | Red lentil pasta |

| Bonduelle | France | Preserved lentils |

| Cidacos | Spain | Preserved lentils |

| Coroos | the Netherlands | Preserved lentils (private label) |

| Davert | Germany | Dried lentils (organic) |

| Denree | Germany | Dried lentils (organic) |

| Evers Specials | the Netherlands | Lentil sprouts |

| Haudecoeur | France | Dried lentils |

| Ingredion | Germany | Plant-based proteins and flours |

| Legumbres Luengo | Spain | Dried lentils, preserved lentils, lentil dishes |

| La Cochura | Spain | Dried lentils |

| Patak’s | UK | Papadums (Indian crisp breads from lentil flour) |

| Pedon | Italy | Dried lentils, lentil pasta, lentil snacks |

| Proper | UK | Lentil chips |

| Rapunzel | Germany | Dried lentils (organic) |

| Riberero | Spain | Preserved lentils |

| Schouten | the Netherlands | Plant-based products (private label) |

| Suntat | Germany | Dried lentils (Turkish) |

| TRS | UK/Europe | Dried lentils (Indian) |

Ingredient producers

Lentils are increasingly finding their way into new products. This includes plant-based protein products and lentil flour. While the volumes of these products are growing, they are still small compared to sales of conventional lentil products. Therefore, suppliers will rely on the established importing channels for now. Producers include AGT Foods, Müller’s Mühle, BakeRite and Bolognami.

Tip:

- Follow FoodDive or New Food Magazine to track developments around plant-based protein.

Retail channel

Dried lentils are sold in retail packages across Europe, commonly weighing 500g. Retailers source from private-label product suppliers or from branded producers. In line with the growth of convenience food, lentils are increasingly sold cooked and canned or in ready-made meals.

All leading European retailers sell lentils, with choice and varieties depending on local consumer preferences. Important supermarket chains are Ahold Delhaize (Delhaize, Albert Heijn and several other brands in the Netherlands, Belgium and other European markets), Tesco (UK), Edeka (Germany), Rewe (Germany), Carrefour (France), and discounters Lidl and Aldi (both from Germany with presence across Europe).

Tips:

- Visit international trade fairs to meet potential European buyers and their requirements. Important annual food fairs in Europe include Anuga (every two years in October with the next fair in 2023 in Cologne, Germany), Biofach (the world’s largest organic trade fair, every year in February in Nuremberg, Germany), and Food Ingredients Europe (every year in November in Paris, France).

- Consider joining an online sourcing platform that connects producers and buyers. Selina Wamucii is an African platform that provides services for agricultural cooperatives, farmer groups, exporters and processors. It also provides information about market and price developments for agricultural commodities, including lentils. Another platform is Tridge.

- Check the website of the German Import Promotion Desk (IDP) if you are based in Ethiopia, India, Egypt, Sri Lanka, Colombia, Ivory Coast, Peru or Ecuador. These are partner countries of the IDP. It may be able to support you in getting in touch with European importers.

What is the most interesting channel for you?

The market for dried lentils is well developed and competitive, with established actors and trade relationships. However, the still-growing market for pulses and developments on world markets open opportunities for new suppliers. Importers and companies specialised in dried legumes are the most interesting partners for entering the European market as they will have a network for distribution into marketing channels. Check out Casibeans (Belgium) or Asseman Deprez (France). If the processing facilities in your country are not yet up to European standards, we recommend you find an importer that has its own cleaning facilities.

To find a place on the market, consistent quality and sufficient volumes are important. Well-organised and fully certified exporters that can guarantee a reliable supply and quality product can target a wider range of ingredient importers. Once you are familiar with the specific market requirements, you can consider approaching food manufacturers to establish direct relationships.

Tips:

- Consider working with a specialised broker or trader for your first entry to the European market. Before making an agreement, research the broker’s track record and reputation.

- Make sure to fulfil the additional buyer requirements outlined above. Being able to supply sufficient volumes at a consistent quality will make it easier to find more clients.

- Check the tips for finding buyers on the European grain, pulses and oilseeds market for more ideas.

3. What competition do you face on the European market for dried lentils?

The main competition on the lentil market comes from the large producers in North America and from Turkey. With the large Canadian production as well as sizeable production in the USA, North America accounted for around 50% of global output. The two countries are also among the top suppliers to the European market. South Asia contributed around 25% to world production, with India, Nepal and Bangladesh as important producers. Smaller volumes are produced in many countries around the world, especially in Asia and the Middle East (see Figure 4). Outside of North America, a large share of the lentil output is consumed in the production countries while exports to international markets account for a smaller share.

Which countries are you competing with?

Canada, Turkey and the USA are the main exporters of lentils to Europe (see Figure 5). The three countries supplied around 90% of lentils to the European market in 2021. Canada and the USA benefit from high yields and low production costs plus their ability to provide stable supplies. The dominant role of North America means that developing countries so far account for a relatively small share of European imports. The exception is Turkey, which was the second-largest supplier to Europe in 2021. However, a significant share of Turkish shipments are re-exports of lentils sourced from origins like North America and Kazakhstan.

Looking at other regions, Asian (5% in 2021) and African suppliers (<1%) currently play a small role in the supply of lentils to Europe. African suppliers play a somewhat larger role in the UK (2%). Latin America is a small producer of lentils and plays a negligible role on the European market.

After the coronavirus peak in 2020, imports from all the important suppliers dropped in 2021. The year-on-year fluctuations show the volatility of the global market.

When focussing on developing country suppliers, Turkey has taken a leading role in the last five years (Figure 6). In 2021, it supplied 22% of the total lentil imports to Europe (50,000 tonnes). However, the total market share of developing countries is small. Together, the top-6 developing country suppliers of dried lentils to Europe accounted for less than one-third of the market.

Canada and the USA: large volumes and high quality

Canada, and to a lesser extent the USA, are the main competitors for any new supplier trying to enter the European market for lentils. Canada is the world’s largest lentil producer, with production reaching 2.2 to 2.9 million tonnes in the last ten years. Canada is also the largest supplier to the world market, accounting for 50 to 60% of global exports in recent years. Top destinations include India, Europe and Turkey. Canada is also investing in the domestic processing of lentils, and is aiming to take a leading role in the booming market for value-added plant protein ingredients. The USA is a smaller lentil producer with almost 400,000 tonnes in 2020, but was nonetheless the third-largest supplier to the European market.

Both countries produce mostly red and green lentils, and have a reputation for their high and consistent quality. The dominant role of North America as well as Turkey as suppliers to the European market means that in order to compete you must offer comparable quality, quantity and prices. Companies that can ensure consistent quantities while meeting quality criteria can find opportunities in the growing European market. Political developments in Turkey and the Russian war in Ukraine may lead to lower European imports from these countries in the coming years.

Turkey: export ban likely to reduce role as European supplier

Turkey is one of the top-4 importers, exporters and producers of lentils globally. Its production typically reaches up to 350,000 tonnes of red lentils and 30,000 tonnes of green lentils per year. However, weather conditions can sharply reduce production, as shown by a 50% drop in production in 2019. On the other hand, the recent currency devaluation and high fertiliser prices make a switch from wheat to legumes like lentils or chickpeas attractive for Turkish farmers.

In addition to its own production, Turkey imported around 535,000 tonnes of lentils in 2021, making it one of the top lentil importers globally. Key suppliers were Canada (74%, especially red lentils) and Russia (9%). Around one-third of the total available volume was exported, including re-exports from major lentil origins. It is unclear how much of the exports from Turkey were in fact produced in the country. The top-3 export markets for dried lentils from Turkey in 2021 were Europe (26%), Iraq (21%) and Sudan (9%). Turkey is also an important supplier of organic lentils to the European market.

In February 2022, Turkey (PDF) imposed a temporary export ban on more than a dozen agricultural products. The ban affects vegetable oils, meat and legumes, including red lentils. The aim is to stabilise local market conditions and counter high inflation. There is growing concern about disruptions to domestic agricultural supply chains due to the war in Ukraine. These measures are likely to affect trade with Europe. Data for the first six months of 2022 suggests a drop in imports of dried lentils from Turkey by 22% compared to the same period in 2021.

Russia: war on Ukraine likely to affect exports to Europe

Production of lentils in Russia more than tripled during the ten years leading to 2020. Still, with 115,000 tonnes in 2020 it remains a marginal legume compared to production of peas at 2.7 million tonnes. A large part of the country’s lentil production, mainly consisting of green lentils, is exported. Key export markets are Turkey (59% in 2021) and Europe (10%). At the same time, small quantities of red lentils are imported.

Foodstuffs are not affected by the European sanctions imposed against Russia in reaction to the war in Ukraine. However, disruptions to Black Sea ports and customers reducing sourcing from Russia may reduce trade to Europe in the coming months or years. For grains and oilseeds, experts foresee a 25% drop in exports due to restrictions and higher costs of trade.

China: stagnating supplies to the European market

In the last five years, China exported less than 10,000 tonnes of lentils annually to Europe. This is about one-third less than the volume reported in the previous five-year period. It reflects an overall drop in Chinese exports, largely driven by increased domestic food demand.

Europe is by far the most important export destination for Chinese lentils, with a share of over 90%. This relationship is also shaped by China’s role as a producer of organic legumes. However, with stagnating production there is little room for China to increase exports.

Kazakhstan: new supplier sees fluctuating production after a short peak

Kazakhstan saw a surge in lentil production between 2014 and 2018, increasing from just 8,000 tonnes to 253,000 tonnes. And yet in the following two years output dropped, to around 50,000 tonnes in 2020. As lentils are not a traditional ingredient in Kazakhstan’s local cuisine, the expansion was clearly targeted at export markets. The most important destination is Turkey, with export shares of 65-85% in recent years. Germany, Poland and other European countries started importing small volumes of lentils from Kazakhstan in 2015.

The growth in production of pulses like lentils and chickpeas presented a diversification of agricultural production away from the focus on wheat and barley. This development was also driven by the adoption of no-till farming, which requires regular crop rotation. The instability in lentil cultivation can be explained by fluctuating prices, inefficient production methods and unfavorable weather conditions. These circumstances reduced farmers’ returns and made them switch to other crops.

India: world’s largest lentil consumer focusses on domestic market

India is the second-largest producer and the top consumer of lentils globally. This means that its public policy and local supply-and-demand conditions have a strong influence on the global lentil trade. In 2020, Indian lentil production reached 1.2 million tonnes, or 18% of global output. The productivity of Indian lentil production is 847 to 1,000 kg of lentils per hectare. This is considerably lower than the global average of 1,260 kg per hectare. Drier years due to climate change are one factor for declining yields from local varieties.

On average, Indian consumption is around 50% higher than production. In line with fluctuating production, imports also vary, reaching 1.1 million tonnes in 2020 and 700,000 tonnes in 2021. The top suppliers are consistently Canada (78% in 2021) and Australia (20%). The high domestic demand means that India is only a small exporter with around 10,000-18,000 tonnes annually, depending on the supply situation.

In Europe, India is only a small supplier, accounting for less than 1% of imports in the last five years. The UK, with its large Indian community, receives around half of the volume. It is unclear whether these imports are from Indian production or re-exports from other origins.

Ukraine: war leads to production and trade disruptions

Lentil production in Ukraine has shown strong fluctuation in recent years. Coming from close to 3,000 tonnes in 2016, production reached 20,000 tonnes in 2018 and then dropped back to 2016 levels. In international trade, Ukraine plays a small role with exports of 3,400 tonnes and imports of 2,000 tonnes in 2021. In the trade with Europe, Ukraine supplied less than 1% in the last five years and volumes dropped after a peak in 2020.

The war in Ukraine has already impacted exports of lentils to Europe. In the first six months of 2022, volumes dropped by almost 30% compared to the same period in 2021. While some export routes remain, trade disruptions continue. Agricultural production is expected to drop by 50% as a consequence of the war.

Tips:

- Inform yourself about the different market categories of lentils and which markets prefer the type of lentil you produce (or can produce).

- Keep track of pulse market news to identify market opportunities. Pulse Pod publishes articles on current developments as well as interviews with suppliers from various countries (some articles require a login).

Which companies are you competing with?

To enter the European market, you must focus on presenting a high-quality product and understand the demands of different national markets and market segments. Volatile supplies and a growing consumption of lentils and other pulses create market opportunities, but competition from existing suppliers is strong. Product quality (moisture content, share of broken grains, etc.) and food safety play a very important role on the European market.

Some large, multinational traders play an important role in connecting the main supplying countries to the European market. These large companies focus on bulk trade. One of the leading pulse traders globally is the Canadian AGT Foods with more than 40 production facilities in growing regions in Canada, Turkey, Australia, China and South Africa. AGT Foods Europe is based in the Netherlands. Also based in the Netherlands, ETG World is another large exporter with a presence in the top lentil-supplying countries.

The following sections briefly look at the important North American lentil suppliers, then provide examples of local companies in developing countries that deliver to the European market. Most if not all of these companies trade in various agricultural products, including pulses and lentils.

North American lentil suppliers

North American, and particularly Canadian lentil exports, dominate the world market. In addition to the large global traders, suppliers to Europe include Columbia Grain, George F. Brocke & Sons and Maviga. Sunrise Foods International promotes high-quality Canadian and American organic and non-GM lentils on its website. Both criteria are important on the European market due to the growing demand for organic foods and low acceptance of GM foods.

Turkish lentil suppliers

As one of the leading traders in lentils globally, various international traders are present in the country. Also, many local companies are involved in the trade in pulses. Turkish suppliers exporting to European markets put particular emphasis on the sustainability of their operations and meet various standards and certifications.

Armada Foods imports, exports, processes and packs various pulses, including red lentils. The company’s biggest markets are European countries, including Germany, the Netherlands and the UK, as well as North Africa and the Middle East. Products are offered in both conventional and certified organic qualities, including EU and Biosuisse Organic certifications. Emphasising its international orientation, the company also lists various other standards and certifications, such as kosher and halal, BRC Global and Sedex. Yayla Agro is another large Turkish exporter of lentils and other legumes with international certifications including BRC, FDA and the IFS Global Food Safety standard. On its website, Yayla Agro mentions different corporate policies on social responsibility, sustainability and risk management. Memişler Group also exports lentils (red, green and yellow split) to the EU and the UK. Its approach towards business is described as environmentally conscious, socially responsible and ethical. Other suppliers are SUNTAT, Otat Bakliyat and Göze Agricultural Products.

Russian lentil suppliers

Russian exporters typically trade in a range of agricultural commodities, including various pulses, spices and grains. They themselves produce pulses but may also source from farmers.

AgroChiminvest stresses the quality and safety of its products and dedicates a webpage to the beneficial qualities of lentils. Agro Alliance is a producer but also has a purchasing network among farmers. It offers a variety of Russian-produced lentils. The trader AgroRostExport points to its location in the European part of Russia as an advantage to ensure fast delivery. Ufenal stresses that its production is in line with European organic standards and that it has certification from an EU-accredited body.

Chinese lentil suppliers

Gansu Zhongshida International Trade Co. is a trading company engaged in exports and imports of agricultural commodities, including lentils, to the European market. The company prioritises customer service, quality products, favourable prices and fast logistics. Gansu Yusheng Agricultural Products also exports a range of lentil products to the European market. It presents various certifications on its website, including ISO9001, BRC, and kosher and halal certification. Other lentil exporters to European markets are Gansu Longao Agricultural Products Co. and Hunyuan Jinchang Grain & Trade Co.

Kazakh lentil suppliers

Kazakhstan is a relatively new player on the lentil market. Companies exporting to Europe focus more on efficient operations and logistics than quality or sustainability certifications.

KZ Export is engaged in the cultivation and export of agricultural commodities to countries in Europe and Asia. The current product offer is presented on their website. SP Kokshe Trade is another producer and exporter of agricultural products that exports to countries in Europe and Central Asia. The company stresses efficient operations, attractive conditions and fast delivery. Tobol Trade is a producer and exporter of lentils to regional and international markets including Germany, England, Italy and Slovakia. The company attributes its success to its qualified personnel and established logistics and warehouse automation systems.

Indian lentil suppliers

Indian suppliers serving the European market emphasise their certifications as well as advanced processing technologies.

Nature Bio Foods (NBF) is an important exporter of organic pulses including lentils, mung beans and pigeon peas. They offer whole, split and de-husked varieties, plus provide detailed product specifications including product details, physical parameters, food safety information, and organic standards such as NPOP and Fairtrade. On its website, NBF lists its various organic, food safety and social certifications in India, the Netherlands and the USA. NBF has set up local subsidiaries in the Netherlands and the USA to better cater to its local customers. The Kogta Group supplies lentils and other pulses. The company lists its various awards and recognitions on its website. It also mentions steps taken to ensure quality in the production process, such as maximising automation. Nima Enterprises is another exporter of pulses including lentils, mung beans and pigeon peas. On its website, Nima provides information about its certifications and its processing and manufacturing setup. Other exporters are Jayaco, M.K. International and Agronic Food. Additional lentil exporters with links to the European market are Raj Foods International, Fazlani Exports, Rajmakal Agro Industries and SRSS Agro.

Ukrainian lentil suppliers

Agroforce is a Ukrainian producer and exporter of lentils and other agricultural products to European markets. GSSE Group is another Ukrainian exporter of commodities, like grains and pulses. Agrofirma Pole is a leading producer and supplier of organic products, such as lentils. On its website, the company details specifications of the product along with relevant certifications. RSM Plus puts an emphasis on its longstanding experience in exporting to the UK and the European Union.

Tips:

- Present your company, product types and specifications on an organized and regularly updated website. A well-maintained website increases the visibility and reach of your company and creates a platform to promote your products. Include information about your approach to fulfilling food safety requirements. Listing the website on producer platforms helps increase awareness about your company.

- Visit your competitors’ websites to see how they present their products and how you can compete. You can find company websites via services like Europages.

Which products are you competing with?

Within the overall market for lentils, different varieties provide options for consumers. In traditional dishes, a specific variety of lentil is usually preferred. However, other pulses, like beans and chickpeas, can replace lentils as a nutritious, protein-rich and affordable ingredient. Compared to dry beans, lentils do not need to be soaked, which reduces cooking time. Dry lentils in consumer packages are increasingly competing with pre-cooked lentils, either in a can, glass or pouch. Even though they are less shelf-stable than dried legumes, the convenience of these products means that this segment is expected to grow further.

In plant-based protein applications, protein isolated from other legumes, like soybean, pea, lupin or fava bean, is more commonly used than lentil protein. The number of gluten-free flours has continuously increased in recent years, with lentil flour as one of several alternatives.

Tip:

- Match your product with a specific supply channel or target group in Europe. Visit the Global Pulses website to find relevant events where you can talk to industry representatives about current channels and trends.

4. What are the prices for dried lentils on the European market?

The price for dry lentils is influenced by the variety (for example, common or specialty varieties). Product quality and compliance with food safety requirements, production and certification standards are other important factors. Price fluctuations depend on varying supplies and the overall volatility of commodity markets. Prices are heavily influenced by the supplies of major exporters like Canada and Turkey and the sourcing of major importers like India. Lower availability leads to price increases. Geopolitical developments, like the war in Ukraine, also play a role as transport routes can be blocked or trade relationships may be affected by sanctions. Given drastically rising energy and transport costs, origin plays an increasingly important role in pricing.

Looking at the last five years, average import prices to the European Union varied between €724 and €929 per tonne (see Figure 7). In the first five months of 2022, the average value of imported lentils reached €1,122 per tonne. The price increase since 2020 can be linked to several factors. During the COVID-19 pandemic demand for pulses increased. At the same time, container freight rates spiked. On common trade lanes from Asia to Europe, the price for shipping a standard container increased more than sixfold compared to 2019. Rising energy costs also affected the prices of processed products. Moreover, harvests in major lentil-producing regions in North America and Turkey shrank due to severe droughts in 2021.

The higher prices for lentils from Turkey and China seen in Figure 7 may be due to their role as suppliers of organic pulses to the European market.

European retail prices for dried lentils vary between €2.50 and €4.50 per kg. Prices for specialty lentils, like the du Puy variety, can reach up to €10 per kg. Retailers achieve the highest margins in the chain (Figure 8). Canned products are sold for similar prices as dried lentils. The additional weight of water makes up for the higher processing costs.

Tip:

- Create a free account on Tridge.com to obtain basic lentil market information. The paid service includes more detailed pricing and market intelligence insights. Mundus Agri is another paid service with regular updates on the market for pulses.

Profundo carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research