Entering the European market for mung beans

The demand for mung beans and mung bean products is growing among European consumers, following trends around healthy, organic and plant-based foods. Mung beans are also becoming more popular in the sprouting sector and among other food manufacturers in Europe. Europe relies on imports from third countries to meet its demand for mung beans. The main suppliers to Europe are Myanmar and Tanzania. To compete with these suppliers, you must prove that you are a committed supplier of quality mung beans.

Contents of this page

1. What requirements must mung beans comply with to be allowed on the European market?

Mung bean imports to Europe are growing in response to an increasing demand for healthy, organic and plant-based foods. Mung beans have long been used in the European sprouting sector, but their popularity is mainly growing because of increased demand from health-conscious consumers. Because Europe does not produce mung beans, it relies on imports from third countries to meet its demand. Myanmar and Tanzania are Europe’s main suppliers of mung beans. To compete with these suppliers, you must prove that you are a reliable supplier of quality mung beans.

What are mandatory requirements?

Food safety: traceability, hygiene and control

As with any food product sold on the European market, consumer safety is the most important requirement that food suppliers must meet. To guarantee that your mung beans comply with European food safety standards, you must make sure that there are limited or no pesticide residues, no contaminants such as metals, and no micro-organisms such as salmonella or E. coli. To meet these standards, you must apply the principles of the Hazard Analysis Critical Control Point (HACCP) system.

In 2011, an E. coli outbreak originated in a German facility producing seed sprouts. The outbreak was so serious that the European Food Safety Authority (EFSA) determined that sprouted seeds are ready-to-eat foods and, as such, the presence of pathogens represents a serious health risk. To ensure proper protection of public health, EFSA required that seeds intended for the production of sprouts must comply with the requirements in Regulation (EC) No 852/2004.

This regulation requires that every person working in a food-handling area must maintain a high degree of personal cleanliness and wear suitable, clean and, where necessary, protective clothing. In the context of mung beans exported for sprouting to the EU, regulation (EC) No 852/2004 must be implemented at every segment of the supply chain: from field to fork. To prove compliance with this regulation, third-country exporters of mung beans for sprouting must obtain a Certificate for the Import of Sprouts or Seeds Intended for the Production of Sprouts, as laid down in Regulation (EU) No 211/2013.

Regulation (EU) No 211/2013 requires that inspections be conducted along the supply chain (mung bean growers, aggregators, processors and exporters). These inspections are to be conducted by a national verifying authority, which in turn is certified by the EU under Regulation (EC) No 882/2004 on official controls. In addition to complying with EU regulations, the national authority must implement national legislation to control the safety of sprouting seeds for export to Europe.

In short, mung bean exporters cannot sell their products to European sprouts producers on their own. To access the European sprouts markets, mung bean exports must be subjected to a certification system that is verified by the EU. Setting up a national control system that is certified by the EU is not easy. There must be dedicated staff to implement controls and certifications, and continuous training is needed for all actors along the mung bean supply chain.

Another concern in pulses is contamination with heavy metals. The European Commission has laid down maximum levels for cadmium and lead (see Table 1, mung beans fall under pulses).

Table 1: Maximum allowed levels of heavy metals in lentils

| Relevant foodstuff categories | Maximum levels (mg/kg wet weight) | |

| Lead | Cadmium | |

| Cereals and pulses | 0.20 | |

|

Pulses and protein from pulses: Pulses, except protein from pulses Protein from pulses |

0.040 0.10 |

Source: European Regulation (EC) No 1881/2006 setting maximum levels for certain contaminants in foodstuffs.

Tips:

- Before engaging in the export-oriented production of mung beans for sprouting, make sure that a system of certification already exists in your country. Remember that only certified mung beans can be sold in Europe for sprouting.

- Check the website and overview of EU legislation of the European Sprouting Seeds Association.

- Check ePing for an overview of country-specific measures that affect trade as well as contact persons per country defined by WTO. Search for mung beans.

Packaging

There are several regulations that control food packing in the EU, but two are relevant for mung beans exports to Europe. Regulation (EC) No 1935/2004 requires that packaging materials must not release harmful levels of their components into foods and that they must not change the taste, smell or composition of food.

Mung beans are most commonly transported in a sea freight dry container, lined with kraft paper or corrugated cardboard. Moisture control packs are used to absorb condensation during transit. The recommended packaging is 25 kg (50 lbs) polypropylene bags or bulk tote bags. If you are selling directly to retailers in Europe, most likely you will be using plastic bags to package your product. In that case, you must comply with Regulation (EU) No 10/2011 on plastic materials intended to come into contact with food. Some European sprouters have begun to work directly with suppliers of mung beans in third countries. These sprouters will indicate the type of packaging necessary for sprouting seeds.

Tips:

- Ensure appropriate temperature, humidity/moisture and ventilation conditions during transportation and take all necessary measures not to expose mung beans to humidity.

- Discuss with your buyers in Europe about their packaging needs and explain clearly what options you can offer. Poor packaging can result in buyers choosing a different supplier.

- Check out this webinar by Eurofins about product packaging considerations, changing packaging regulations and top reasons for import retentions.

Labelling

Food labelling requirements exist to ensure that food products sold on the European market are safe for consumers. In this context, Regulation (EU) No 1169/2011 gives clear information.

Information required by EU Regulation 1169/2011

- name of the food

- list of ingredients

- allergens (e.g. soy, nuts, gluten, lactose)

- quantity of certain ingredients or categories of ingredients

- net quantity of the food

- date of minimum durability or use-by date

- any special storage conditions and/or conditions of use

- name or business name and address of the food business operator

- country of origin or place of provenance

- instructions for use if it would be difficult to make appropriate use of the food in the absence of such instructions

- a nutritional declaration

Tips:

- Check the additional requirements in the Codex General Standard for the Labelling of Prepackaged Foods (PDF) or Regulation (EU) No. 1169/2011 (pdf) on the provision of food information to consumers in Europe if your product is pre-packed for retail.

- Read the CBI buyer requirements for grains, pulses and oilseeds for additional information about labelling.

- Consider engaging a labelling audit to see if your product complies with EU labelling standards. Trade-e‑bility offers such services for a low fee.

What additional requirements do buyers often have?

Quality standards

Other than regulations for sprouting seeds, there are no specific EU food quality standards for pulses like mung beans. Different buyers and market channels may require different quality grades. However, as a general rule, food imports into the EU must be:

- Safe and suitable for human consumption;

- Free from abnormal flavours and smells;

- Free from dirt in amounts that may be harmful to human health (for example, there should be no dead insects or plant residues in your product);

- Free from sand or living insects.

Tip:

- Learn your buyers’ quality requirements by discussing their expectations with them. Make sure to always deliver products that comply with these requirements. Failure to meet buyers’ quality requirements can be a reason to lose buyers and can damage your country’s reputation as a supplier of quality products.

Certifications

Certification schemes have become a common means to assure European buyers that products meet quality standards. Most European buyers accept food management and certification programmes recognised by the Global Food Safety Initiative (GFSI), including BRCGS Global Food Safety Standard, FSSC 22000, GLOBALG.A.P. and International Featured Standard (IFS).

Choosing a suitable certification scheme will depend on whether you are involved in the production, distribution or processing of mung beans. Generally, sellers who are involved in the processing of foodstuffs are advised to apply a recognised food safety standard, such as ISO 22000.

Tips:

- Involve your buyer in your selection of a certification scheme for your product.

- Learn about the advantages of quality certification schemes by reading CBI tips for Organising your export and CBI buyer requirements for grains, pulses and oilseeds.

What are the requirements for niche markets?

Organic certification

The European organic market has been growing for many years now, a trend which is likely to continue. Organically produced mung beans are therefore a good alternative for third-country suppliers looking to enter the European market. However, organically produced mung beans can only be sold in Europe if they have an organic certificate issued by an accredited certifier. Accredited organic certifiers will verify that you follow Regulation (EU) 2018/848.

In general, the market for organic mung beans is still a niche segment. If you choose to obtain a certificate for organic production, find out more about legislation for Organic production and labelling.

Tip:

- Read the CBI buyer requirements for grains, pulses and oilseeds to learn more about the requirements for the organic market in Europe and find a full overview about organic farming on the EU webpage Organics at a glance.

Gluten-free certification

Gluten-free is a niche market segment that continues to grow. Mung beans are naturally gluten-free, unless they are mixed with grains containing gluten, such as wheat. To sell your mung beans in Europe as gluten-free, you must follow the guidelines outlined in Regulation (EU) No 828/2014. In particular, the statement ‘gluten-free’ may only be made when the food that is sold to the end consumer contains no more than 20 mg of gluten per kg of product.

Moreover, companies selling foodstuffs to consumers are legally obliged to provide correct information about the reduced presence or absence of gluten in food products.

Tip:

- While processing mung beans, make sure you have no cross-contamination from crops that contain gluten, such as wheat, rye, barley, spelt or even oats (oats are often mixed with other grains).

Sustainability and social compliance

European buyers are paying more attention to corporate social responsibility (CSR) in response to consumer demands to lessen the impacts of business on people and the environment. But buyers cannot guarantee that products that come from outside Europe also comply with sustainability and social standards. Therefore, they will often demand compliance with a code of conduct or that your product obtains CSR certification. The most important CSR certification schemes are:

- The Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct (PDF) and the Ethical Trading Initiative (ETI);

- Sedex Members Ethical Trade Audit (SMETA), GLOBALG.A.P. and GLOBALG.A.P. Grasp;

- Consumer labels for fair trade practices, such as Fairtrade International and Rainforest Alliance, are increasingly adopted by businesses but remain a niche segment.

The EU launched the EU Green Deal (EGD) in 2019 as a first step to meet its climate goals for 2050. In the rollout of the EGD policies, environmental and sustainability standards are likely to become stricter in coming years. Stay ahead of the curve and learn about the possible impacts of the EGD on imports from non-European countries by checking CBI’s publication EU Green Deal: how will it impact my business?

Also, in the context of the EGD, the EU adopted a proposal for a Directive on corporate sustainability due diligence, which means that for many EU companies social compliance will not be an option but an obligation. This legislation currently applies to large companies and their global supply chains. Small and medium-sized enterprises are not included, but this could change in years to come.

Tips:

- Use the ITC Standards Map to learn about the different sustainable and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct (PDF). You can also find many practical tools on the amfori BSCI platform.

Fair trade

Obtaining fair trade certification can give your product a competitive advantage among consumers in Europe and around the world. However, this market segment remains a niche. To obtain fair trade certification you may want to rely on Fairtrade Labelling Organisations International (FLO), the leading standard-setting and certification organisation for Fairtrade, or Ecocert Fair For Life (FFL) for ECOCERT.

Depending on whether you are involved in production, processing or export, a different standard will apply. As of now, there are no standards that specifically apply to mung beans. But there are fair trade standards for vegetables that can be applied to pulses for sprouting, including mung beans. Fair trade has minimum prices for certified pulses, at US$430/tonne for conventional pulses (plus a premium of US$65) and US$540 for organic (plus a premium of US$80).

Tip:

- Sustainability labels are expensive. Before contracting a verifying agency to obtain fair trade certification, make sure to check (in consultation with your potential buyer) that this label has sufficient demand in your target market and whether it is worth the investment.

2. Through what channels can you get mung beans into the European market?

How is the end market segmented?

The global market for mung beans is segmented by quality and application. Supplying grade-A mung beans and finding the right distributor are crucial steps for entering the European market. Unlike some Asian countries where weathered mung beans are fed to livestock, mung beans are not yet mainstream in the European animal feed industry. Therefore, lower-quality mung beans are unlikely to enter the European market.

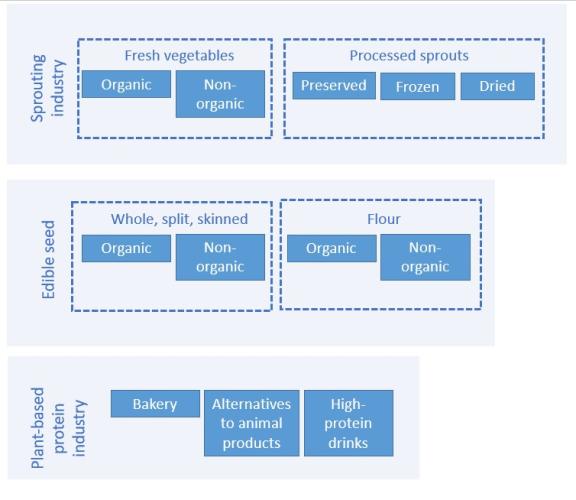

Figure 1: End-market segments for mung beans in Europe

Source: Profundo

In Europe, three segments are distinguished:

- Sprouting industry: A considerable share of mung beans entering the European Union go into sprouting (about 25% of imports). While there are no recent figures on the production of mung bean sprouts in Europe, Europe’s largest mung bean sprouts producer reports a daily output of 75,000 kg.

- Edible seed industry: Within this industry, whole, split or skinned mung beans are sold for direct human consumption, mostly in the ethnic cuisine segment. Mung bean flour is also sold as a food ingredient or processed into Italian-style pasta.

- Plant-based protein industry: This industry had already been growing, but during the COVID-19 pandemic the demand for plant-based alternatives to animal products boosted the development of food applications from isolated pulse protein, including mung beans. Mung bean protein isolate is used as an ingredient for food applications such as plant-based egg replacements, high-protein drinks and baked goods (e.g. biscuits, baked goods, rolls, pastries, cookies).

In both the sprouting industry and the edible seed industry, the market is further segmented into organic and gluten-free. In terms of distribution channels, mung beans, either as a cooking ingredient or processed into sprouts and other consumer goods, are sold online and offline.

Additionally, mung beans are sold in Europe through two segments worth paying attention to: the sprouted seeds segment and the low-carb, high-protein segment.

Low-carb, high-protein segment

Low-carb, high-protein diets are driving the demand for high-protein baked goods and pasta, even though many health professionals discourage this type of weight-loss diets. The reason is that they can lead to serious health problems because people who follow these diets tend to eat too much meat and too few fruits and vegetables. Despite this, an increasing number of food processors, small and large, are isolating protein from pulses and using this isolate for a variety of products that are traditionally made with starchy grains. In Europe, Explore Cuisine (a German-Swiss venture) is one of the frontrunners in this market segment, offering a range of high-protein pasta products. Likewise, Fuji Europe Africa B.V. (an Amsterdam-based subsidiary of the Fuji Oil Group) is producing mung bean protein isolate for bakery applications as part of its plant-based food solutions.

Figure 2: Mung bean penne (Italian-style pasta)

Source: Profundo

Sprouts

Mung bean sprouts can be used as a healthy ingredient in salads, soups and stir fries. Mung bean sprouts are also a versatile product that can be preserved, frozen or dried as an ingredient for instant foods. According to the European Sprouted Seeds Association (ESSA), the European sprouted seeds market is a highly specialised niche segment of the fresh produce market, with approximately 120 professional production establishments throughout Europe.

Figure 3: Sprouted mung beans

Source: Pixabay

Through what channels does a product land on the end market?

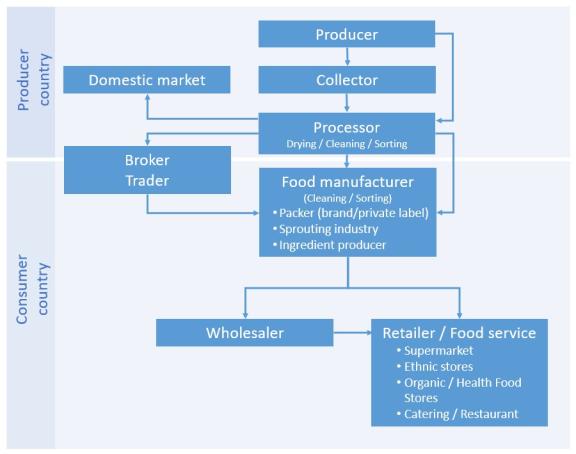

Compared to other grains and oilseeds, the European market for mung beans is still small. Nonetheless, the trade channels and businesses that distribute mung beans are well-established. Mung beans enter Europe mostly through importers that are specialised in sourcing, trading and/or managing local brands. To have more control over the safety of mung beans for sprouting, some European sprouters engage in direct trade with mung bean producers in third countries.

Figure 4: Current channels for mung beans

Source: Profundo

Traders: importers and brokers

Many multinational companies are active in the trade of mung beans. These pioneers have more or less integrated their supply chain and sell their brands directly to specialised stores and users. Cleaning and packing can be easily outsourced.

Sometimes agents or brokers are involved, often individuals or small companies that link your product to buyers in Europe and take a commission on the sales. Their function is purely commercial, and as a supplier you will remain responsible for most of the logistical processes.

The top European companies that work with mung beans are:

- Do It Organic (the Netherlands): importer and processor of organic food and food ingredients;

- AgriFoodTrade (the Netherlands): importer of organic and non-organic food and feed commodities, including pulses and sprouting seeds;

- ETG (the Netherlands): provider of logistical services and importer of agricultural inputs and commodities, including whole, split and skinned mung means;

- Sante Miatello & C. (Italy): importer of various turfgrass seeds, animal feed and foods, including pulses and sprouting seeds;

- AGT Poortman (UK): trader of pulse ingredients, including pulse proteins, concentrates and isolates, pulse flours, high starch flours, and fibre;

- LenersanPoortman (the Netherlands): trader of feed and food ingredients, including pulses.

Processing industry (sprouters)

Most European mung bean sprouters buy their beans directly from suppliers in third countries. Mung bean sprouts are grown in nurseries under controlled light, water and temperature conditions. Sprouting market-quality mung beans takes about a week. European producers have several production chambers where batches of sprouts are kept at different growing stages. That way it is possible to harvest mung bean sprouts almost daily. Once they reach the desired size, mung bean sprouts are sent to buyers in the processing industry, supermarkets and suppliers of Asian restaurants.

Major mung bean sprouters in Europe include Evers Specials (the Netherlands), Deiters + Florin (Germany), Sprossenparadies (Germany), Vitalfa (France), J PAO (UK) and Munka Grodden (Sweden).

Tip:

- Check the webpages of the different ESSA members to find potential buyers of mung beans for sprouting.

Food manufacturers

Food manufacturers use mung beans as an ingredient to produce different kinds of products. For many of these companies sourcing of ingredients is not their core business, so they use the service of importing companies. Manufacturers that use mung beans in large volumes or as a major ingredient in their business sometimes have direct contracts with producers.

Some European food producers using mung beans as a food ingredient are Terrasana (the Netherlands), Smaakt (the Netherlands), Explore Cuisine (Germany), Felicia (Italy) and Govinda (Germany).

Retail

Whole mung beans dominate the retail segment, and split and skinned mung beans as well as mung bean flour are commonly found in ethnic food shops. Italian-style pasta made from mung bean flour is increasingly sold in supermarkets and webshops. A small proportion of mung bean-based processed foods (such as those containing mung bean protein isolate) are hardly found in supermarkets – rather, they are sold through vegan and health food webshops.

European retailers selling mung beans include Ahold Delhaize (Delhaize, Albert Heijn and several other brands in the Netherlands, Belgium, Luxembourg, Czech Republic, Greece, Portugal and Romania), Edeka (Germany), Carrefour (France) and Tesco (UK).

Tips:

- Plan you market entry strategy well. It helps to study the profiles of potential buyers and decide whether your product can meet their needs.

- Before engaging in international trade, make sure your supply chain is well set-up with reliable farmers and good primary processing facilities for drying and cleaning the mung beans. Buyers will expect you to prove that you are capable of providing a steady supply of quality seeds.

What is the most interesting channel for you?

For new exporters, the best way to enter the European market is to find a specialised importer or broker of seeds and food ingredients. They can facilitate your market entry and get your product into the distribution and manufacturing channels. In the Netherlands, pulses trader AgriFood Trade B.V. keeps stock of 5,000 tonnes that are continuously sent out to business-to-business and business-to-consumer companies.

If the processing technology in your country is not yet up to European standards, it is best to find an importer that has their own cleaning facilities. Well-organised and fully certified exporters that can guarantee a reliable supply and quality product can target a wider range of ingredient importers.

The export pathway for sprouting beans is much less straightforward. Exporting seeds for sprouting to Europe will depend less on finding a buyer and more on meeting the required food safety standards, including obtaining the right certificates from your country’s government. Companies like Evers Specials in the Netherlands sprout mung beans to supply a variety of outlets, including supermarkets, restaurants and the processed foods industry.

Tips:

- Before engaging in export-oriented production of mung beans for sprouting, make sure that a system of certification already exists in your country. Remember that only certified mung beans can be sold in the EU for sprouting.

- Meet with importers of special ingredients and organic foods at large food trade fairs like SIAL, Anuga, Biofach, Food Ingredients Europe or smaller, specialised events like the Free From Functional & Health Ingredients Exhibition or iba, a leading trade fair for baking and confectionery.

3. What competition do you face on the European mung bean market?

Which countries are you competing with?

Myanmar: the world’s largest producer and exporter of mung beans

Myanmar is both the largest producer and the largest exporter of mung beans globally. While the country has remained the single most important supplier of mung beans to Europe, its exports have fluctuated in the past five years. Overall, mung bean exports from Myanmar have been increasing. Its exports to Europe rose by 60% in 2021, reaching almost the same volume as five years before that. Climatic factors such as drought have negatively affected Myanmar’s mung bean production. With climate change increasingly affecting agricultural production worldwide, it is uncertain how much longer Myanmar will remain Europe’s main supplier of mung beans. Myanmar is also Europe’s largest supplier of mung beans for sprouting.

Tanzania: increasing share of exports to Europe

After a modest entry into the European market with 750 tons in 2020, Tanzania’s mung bean exports to Europe skyrocketed to almost 6,500 tons in 2021. While Tanzania experienced an increase in production of mung beans from 2000 to 2010, this growth stalled from 2015 onwards. The reasons for this are low productivity due to poor agricultural practices, a period of droughts and floods in 2015-2016, and another prolonged period of drought starting in 2019. It is therefore not certain whether Tanzania will sustain its recently gained place as a top exporter of mung beans to Europe.

United Arab Emirates: growing role as global trader

Exports of mung beans from the United Arab Emirates (UAE) to Europe had been modestly increasing between 2017 and 2020. In 2021, their exports increased by 566%. Mung beans are not grown in the UAE. Rather, exports coming from that country are the result of trade with South Asian countries, notably India and Indonesia.

Thailand: most potential in volume

Thailand is not among the world’s top-10 producers of mung beans. However, in 2021 it was Europe’s fourth most important supplier of mung beans. While its supply of mung beans to Europe had been modest and stable, between 2020 and 2021 it grew by 354%. This growth is likely due in part to Thailand’s consistent efforts to improve its mung bean productivity, which has led to higher-quality beans that appeal to export markets.

China: growing potential in volume

Most of China’s mung beans are destined for the domestic market, but overseas exports have gradually increased in recent years. In 2021, China was the world’s second-largest exporter of mung beans with 78.56 thousand tonnes. After a dramatic decline in production between 2002 and 2018, China’s mung bean production has been recovering. The share of land cultivated with this crop grew in the past five years, as have yields, which had previously been low. The country has launched a series of preferential agricultural policies that will benefit the mung bean industry. Moreover, China is stepping up its mung bean breeding research (PDF) to improve output.

Argentina: a reliable supplier of mung beans

Argentina is among the top-10 exporters of mung beans worldwide. The country’s mung bean export value grew by 21% between 2017 and 2021. Its main mung bean export market is in Asia, with Vietnam receiving up to 25% of those exports. In March 2022, India (Argentina’s top-third mung bean export destination) introduced restrictions on the import of mung beans. At the same time, Argentina’s second most important mung bean export market, Sri Lanka, boosted its production of the bean and is set to resume exports in 2022. This will likely push Argentina to look for other export markets, and Europe, with its increasing demand for mung beans, could become an important export destination.

Unlike most Argentinian agro-industrial exports, mung beans are not subject to export duties or shipment registrations. Moreover, in the context of its SME Exporter Federal Development Plan, the Argentinian Ministry of Industry, Commerce and Mining has been supporting SMEs to increase their export capacities. This makes Argentina a reliable supplier of mung beans internationally.

Tips:

- Look for the best logistical route for your supply. Think carefully about the location for collecting and processing the mung beans and choose the best port for export. If your company is further away from production sites or logistical hubs, you will have to compensate in another way, such as product price, to be competitive with better-located exporters.

- Track demand trends in different European countries by checking FoodDrinkEurope, and choose countries with the most potential for your product.

- Put your company in the spotlight by contacting international trade media and news outlets, and discuss the possibility of publishing advertorials.

Which companies are you competing with?

Thailand

Thai World Import & Export Co., Ltd is an exporter of a wide variety of products, including whole mung beans and mung bean vermicelli, packed under its brand name COCK. In its 25 years of existence, Thai World has developed trade relations with customers in 70 countries across Europe, the Americas and Oceania. Thai World is one of the many companies of the Chan Brothers Group.

Sunlee Group is a supplier of whole, split and skinned mung beans and other dried and processed Asian food products to international markets, including Europe and the United States. Sunlee Group has established Sunlee Europe with the aim of providing better services to its customer base in the region. Sunlee’s products are channelled worldwide through distributors, wholesalers, large franchise retailers, food services suppliers, hotels and restaurants. The company has obtained various certifications, including BRC, GMP/HACCP and ISO 9001. Check out their product catalogue online.

Argentina

Cono Agriculture is an Argentinian-based agricultural company that is part of the family-owned Cono Group. Cono Agriculture cultivates a variety of crops in over 30,000 hectares of land across northern Argentina. The company produces non-GMO pulses, including mung beans for culinary uses other than sprouting. Cono Agriculture products are certified under the following schemes: BRCG, USDA Organic, EU Organic, ASC and kosher. Cono Agriculture’s product range can be found online.

Las Martinetas SRL is an Argentinian agricultural commodity trader and broker that specialises in pulses, including mung beans. The company has a processing plant with an installed capacity of eight tonnes per hour. Las Martinetas’ main markets in Europe include Romania and Spain. Other international trade partners of the company are based in South Asia, South America and the Arabic Peninsula. In an effort to stay connected to its customers, Las Martinetas takes part in fairs like Anuga (Germany) and SIAL (Paris).

Myanmar

Pyei Phyo Aung Co., Ltd. is a trader of agricultural commodities established in 2019 and located in Yangon, Myanmar. Among many other products, Pyei Phyo Aung supplies the international market with three types of mung bean (each from a different region in Myanmar). The company has three factories and is certified under ISO 9001 and GMP/HACPP.

Paing Family International Co., Ltd is another Burmese trader of grains and oilseeds, including mung beans. The company was founded in 2004 as a local trader and quickly began to expand its coverage to other South-East Asian countries. In 2013, it began to export to Europe.

Tanzania

R.V. Exports Ltd. is a Tanzanian exporter of agricultural commodities that include mung beans. The company was established in 2006, procuring agricultural products from farmers and markets in Tanzania. R.V. Exports delivers its products to clients around the world. Check out their product catalogue online.

Afrisian Ginning Ltd (AGL) is a Tanzanian exporter of agricultural commodities that started business as a cotton ginner in 1997. The company has now expanded its operations to include oil seed crushing, rice milling, and cleaning and export of grains and pulses, including mung beans. Check out their product range online.

China

Gansu Long All Agriproducts Co., Ltd. (formerly Lanzhou Long All Trading Co., Ltd.) is a producer, processor and exporter of agricultural products located in North-West China. The company’s product range encompasses 100 different products, including other pulses, grains and oilseeds. Gasu Long All Agriproducts is engaged in global trade, including customers in some European countries.

Gansu Zhongshida International Trade Co., Ltd. is a trading company engaged in exports and imports of agricultural commodities, including lentils and mung beans. Founded in 1997, the company prioritises customer service, quality products, favourable prices and fast logistics.

Which products are you competing with?

Mung beans are part of the pulses group, which includes lentils, kidney beans and chickpeas.

Mung beans, used as a healthy and vegan food ingredient, can be compared to other pulses like urad beans, adzuki beans, pigeon peas and lentils. Those competitors are all similar to mung beans in their nutty, earthy flavour. Lentils are found much more easily in Europe’s supermarket and convenience stores, whereas urad and adzuki beans and pigeon peas, like mung beans, are still more common in specialty shops.

As fresh vegetables, sprouted mung beans are consumed for their nutty flavour and crunchy texture. In terms of flavour, sprouted alfalfa is similar to mung beans. In terms of texture, sprouted soybeans come close to mung bean sprouts. In fact, in Germany and Belgium mung bean sprouts are incorrectly called soy sprouts (Sojasprossen in German, sojascheuten in Flemish). Snow peas, although not a sprouted grain, resemble the texture of sprouted mung beans, except their flavour is sweeter and more herbal.

Protein isolated from pea, lupin, fava bean, soybean and rice, amongst others, are sources of plant-based proteins for vegan food applications. Soy in particular is a well-established value chain and can be sourced relatively easily. Lupin, peas and fava beans are produced in Europe and their grain yield is among the world’s highest in some parts of the continent.

Tip:

- Offer your mung beans to manufacturers of mung bean applications, including Fuji Europe Africa B.V. and Explore Cuisine.

4. What are the prices for mung beans on the European market?

The price you get for mung beans depends on whether they are suitable for sprouting or for other uses, their quality, the level of processing, and whether they have obtained sustainability certification.

Generally speaking, mung beans are relatively expensive compared to other commodities, but international trade dynamics also influence prices. The price for mung beans has risen in the last three years. Cost fluctuations in FOB in the country of origin are closely related to the US dollar gaining strength against the euro. As of September 2022, FOB prices at origin are between US$1,000 and US$2,500 per tonne. Higher container costs (linked to supply chain disruptions and rising energy prices) are also influencing price developments. In this context, FOB and unloaded prices at the Port of Rotterdam have increased from US$1,000–1,200 to US$8,000.

Mung beans for sprouting are more expensive than mung beans for direct consumption. This is because it is difficult to obtain food safety certification. As a result, the number of suppliers to the EU of mung beans for sprouting is very limited. In addition, prices for sprouting quality mung beans destined for the EU can fluctuate between 20 and 25% above or below the average price.

Tip:

- Create a free account on Tridge.com to obtain mung bean market information. The paid service includes more detailed pricing and market intelligence insights.

Profundo carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research