10 tips for finding buyers on the European grain, pulses and oilseeds market

There are many ways to find European buyers of grains, pulses and oilseeds. You can find potential buyers through a variety of company listings from trade fairs, sector associations, online directories and trade platforms. Taking a pro-active approach and participating in trade fairs are usually most productive strategies. But it is equally important that buyers can find you, so invest in professional presentation and online visibility.

Contents of this page

- Be prepared when looking for buyers

- Visit trade fairs to connect with buyers

- Investigate the existing supply in your target market

- Find buyers through member lists of sector associations

- Register with trade directories

- Use online market places and trade platforms, but be selective

- Build a professional website to attract buyers

- Use social media for networking

- Ask for help from support organisations

- Structure your search for buyers

1. Be prepared when looking for buyers

Before reaching out to potential buyers, make sure you are fully prepared. This means understanding your opportunities in the market and knowing what types of buyers are out there.

Know your market opportunities

As an exporter of grains, pulses or oilseeds, you are not alone on the market. You have to compete with many other exporters who are all trying to get a piece of the market, and often end up contacting the same buyers. That is why it is important to evaluate your company to find its unique strengths:

- Does your product meet all the standards and requirements for the European market?

- Does your product fulfil a specific need in Europe?

- How much demand is there for your product?

- Why should someone buy your product and not a competitor’s product? What makes your product superior?

- What else can you offer besides a good product? What is your competitive advantage?

- What are your weaknesses? And how do you overcome these?

Understanding your position in the market is the first step towards finding a buyer. In addition to doing a self-analysis, it is equally important to know the size of the market and demand. For example, the demand for bambara groundnuts is very low compared to chickpeas or kidney beans. For low-grade products, such as quinoa with purity level <99%, there are fewer buyers and you should expect low prices. And if your product fails to meet maximum residue limits (MRLs), you will not have a market at all.

Know the types of buyers

There are many segments and types of buyers. As an exporter, you need to select potential buyers that are the logical target for your product. Choosing the right buyer depends on the characteristics of your business and your product.

Commodity buyers vs specialty buyers (product type)

Commodity buyers such as Cargill, ADM, Bunge and Olam focus on bulk trade for products such as soybean, maize or wheat. These companies operate on a global scale and are likely to buy your product before you export. They will be among your targets if you are focusing on high-volume, low-value crops.

Speciality buyers try to differentiate themselves from the commodity market in many different ways. They add unique value, focus on special ingredients or supply specific markets. You will find buyers of sesame, amaranth, quinoa, chia, pumpkin seed and other specific ingredients, such as Voicevale (UK), or organic specialists such as Tradin Organic (the Netherlands) and Delphi Organic (Germany). The ‘free-from’ segment is even more specific, and is represented by companies such as Freee by Doves Farm (UK) and Schär (Italy).

Social-value buyers (product value)

In Europe there are companies that have specific social objectives, such as Rapunzel or Fair Trade Original. With the right social values, you can tap into fair trade segments. It is important that your value chain is transparent and that you actively contribute to a fair income for farmers and the community.

Processors vs packers (product quality)

Different segments require different product quality or characteristics. You can use your specific product quality to target different market channels. For example, sesame seeds are classified into 3 main grades: 1) crushing grade 2) food grade and 3) bakery/confectionery grade.

Companies such as Pedon (Italy) or Antersdorfer Mühle (Germany) turn raw materials into retail products. Some of their ingredients are packed for direct consumption. To supply grains, pulses and seeds for direct consumption, your main focus must be on delivering clean, tasty and attractive looking products.

For the food processing industry, the ingredients do not always have to look attractive, but they do need to be competitively priced and have the right quality characteristics. For example, oilseed crushers such as Spack (the Netherlands) or AAK (Sweden) benefit from seeds with a high-oil content. The canning industry, with companies such as Bonduelle (France), uses beans that maintain their integrity and colour after being cooked. Companies such as Neupert Ingredients (Germany) use grains, pulses and seeds for their protein content or as functional ingredients, highlighting their nutritional advantage.

Direct vs indirect buyers (product volume)

Wholesalers, food brands and processors do not always buy directly from origin, especially if they do not need large volumes for every product. For that reason, your most likely buyer will be an importer. If you have difficulty finding the right market channel or buyer for your product, a broker can be a good option. Much of the high-volume trade in grains, pulses and seeds goes through intermediates. Brokers, such as Cogeser (pulses) or Schepens & Co (rice), can make a deal between you and the relevant buyers.

Unprocessed vs. processed (product service)

Most grains, pulses and oilseeds are imported unprocessed. To add value to your product, you can choose to turn your product into a semi-processed ingredient, a consumer product (private label) or even a consumer brand.

When you add processing as a service, you need to define the advantage for your buyer. Is it more cost-efficient? Does it lead to a better-quality product? Or are you solving a capacity problem in Europe? Potential buyers could include grain-import and packing companies without a grain-processing facility. Buyers of pulses may want their beans canned at origin to reduce the time from field to processing.

Consumer products from developing countries are not common on the retail shelves in Europe. When supplying retailers directly, you still have to organise the supply chain between your company and the retail buyer. You will need to fulfil strict supply contracts and meet planning and distribution responsibilities. Without a presence in Europe, it is difficult to maintain a high service level and compete with local brands.

The best way to find a buyer for a pre-packed or consumer product is through a partnership. Look for well-connected companies. For example, food brands can sell your product under their own label. Food distributors can represent your product as well. But launching your own brand will require a big investment in marketing.

Tips:

- Compare yourself to successful suppliers. Look for your competitive advantage; what makes you better?

- Spend time getting to know your markets and the different buyers. Supply chains are often integrated and activities overlap. Visit the websites of potential buyers, and think about how your product could fit in. Select your buyer based on the product and the process you offer.

- Do a background check on your buyer. Use credit reports and databases such as Dun & Bradstreet Business Directory or Graydon to check whether your future buyer is financially sound (‘due diligence’).

- Make food safety and clean production your key objectives for grains and seeds that are intended for direct consumption. The same goes for specialty ingredients, including organic and healthy superfoods. Read the CBI Buyer requirements for grains, pulses and oilseeds to see how to meet these food requirements.

- Demonstrate your knowledge and understanding of your product. When you approach buyers, show them the technical data for your product, as well as its nutritional and functional values. This is especially important for buyers of functional ingredients and additives such as proteins, starches or vegetable oils. See, for example, the product specifications of organic adzuki beans (pdf) from the company DO-IT BV.

2. Visit trade fairs to connect with buyers

Trade fairs are the best way to connect with potential buyers. You can use these events to introduce yourself in person. This creates confidence and will give you an advantage over suppliers that only approach buyers online.

Practically every European company that works with grains, pulses or oilseeds will have a presence at food-related trade fairs. You will find companies in different parts of the value chain, including importers, processors, food brands and distributors. Remember that most of your potential buyers are at trade fairs to sell and will therefore be less focused on buying. To get the most out of your visit, prepare well and try to make contacts and appointments in advance. The exhibitor list for the trade fair is a good starting point for this.

There are several food fairs that may be interesting for exporters of grains, pulses and oilseeds, either to visit or to exhibit at.

Most important trade fairs in Europe

- Anuga (Cologne, Germany): The biennial Anuga is one of the principal trade fairs for the food and drinks industry, with almost 8,000 exhibitors. The exhibitor and product search option provides you with names of exhibitors.

- SIAL (Paris, France): SIAL is also biennial, taking place in the years after Anuga. It presents a variety of food innovations and trends, and attracts over 7,000 exhibitors from the agri-food industry. SIAL uses the CXMP Business Platform as a 365-days-a-year market place with exhibitors.

- Biofach (Nuremberg, Germany) is the largest trade fair specialising in organic food products. You can search for nearly 2,300 companies in the exhibitor list.

- Food Ingredients (Fi) Europe (various countries): Fi Europe showcases a diverse range of innovative and new ingredients & services. It hosts around 1,200 exhibitors and also has a separate event for health ingredients. The events take place in various locations.

Figure 1: Pavilions at the Biofach fair in Germany

Source: ICI Business and CBI

Specialist trade fairs in Europe

Sometimes it can be interesting to visit smaller, more specialist trade fairs, although you should not expect the same exposure or number of companies. Most of these fairs are more locally oriented. If you are targeting a specific country or segment, it may be worthwhile to visit a smaller, more focused trade event. For example:

- Iba (Munich, Germany): Iba is a leading trade fair for the bakery sector, bringing together experts on baking, confectionery and the snack industry. The website allows you to search 800+ companies in the digital exhibitor list.

- International Food & Drink Event (IFE) (London, UK): The IFE can be an interesting event to reach buyers from the UK. The organiser claims that 73% of the 27,000 visitors have the power to purchase. In the exhibitor list you will also find many international companies.

- Natural & Organic Europe (London, UK): With 10,000 visiting buyers, this business event is smaller than IFE, but it can be interesting if you are looking for UK buyers of health foods.

- Natexpo (Paris/Lyon, France): A trade fair for organic products in France, where French exhibitors of organic food predominate. The Paris event attracts the most visitors

- PLMA International (Amsterdam, the Netherlands): The Private Label Manufacturers Association (PLMA) is devoted exclusively to the promotion of private label products. The international trade show in Amsterdam has over 2,600 registered exhibitors.

- Nordic Organic Food Fair (Malmö, Sweden): Almost 300 food companies exhibited at the Nordic Organic Food Fair. It is the largest organic food & drink trade event in the Nordic region.

- Free From Food Expo (Amsterdam, the Netherlands): A trade event that focuses on free-from, functional and health ingredients. It is a compact event that attracts over 9,000 visitors.

- BioCultura (various cities): A series of small trade events for organic products and responsible consumption in various Spanish cities. Discover BioCultura through their website to see how many exhibitors and visitors you can expect at each of these events.

Trade fairs outside Europe

Several trade fairs have launched globally, such as SIAL, Food Ingredients and Anuga. 1 of the strongest emerging fairs is Gulfood. You can meet potential buyers from Europe at larger international trade fairs. Always check the exhibitor lists to see if there are interesting companies for you to meet.

- Gulfood (Dubai): More than 5,000 exhibitors. A rapidly emerging event attended by many European exhibitors and visitors.

- SIAL: In addition to SIAL Paris, the SIAL network hosts events in the USA, Canada, China, India, Indonesia and Malaysia. SIAL China in Shanghai is 1 of the largest events with 4,500 exhibitors and 150,000 professionals from around the world.

- FOODEX Japan (Tokyo, Japan): 1 of the largest food fairs in Asia with over 2,500 exhibitors, including several pavilions from European companies.

- Food ingredients (Fi): The events and trade fairs of the global Food ingredients network reaches several markets including 8 Asian countries, Africa (Egypt) and Latin America (Brazil). Some of the fairs are still fairly unfamiliar to European buyers. For example, at Fi Africa in Egypt only 13 of the 350+ exhibitors were European, and these were mainly technology providers.

- Anuga: Anuga Worldwide hosts trade fairs, not only in Germany, but also in Asia, the Middle East and Latin America.

- Expo West and Expo East (USA): These trade fairs are mainly useful to target American companies, but you will find a handful of European companies as well. Expo East takes place together with Biofach America.

Tips:

- Browse for other global trade fairs and events on 10times and TradeFairDates. Search by category or country.

- Be prepared in order to get the most out of a trade fair. Use the Toolbox containing tips for successful participation in trade fairs prepared by the association of the German Trade Fair Industry.

3. Investigate the existing supply in your target market

You can find key players by investigating the range of products offered by supermarkets and other food retailers (possibly online). Look at what kind of consumer products they sell that use your ingredients. Then trace the supply chain back from the end-product to the importer and producer.

For example: Suppose you want to sell organic specialty rice in the French market.

- Find an organic store with an online range, for example Biocoop;

- Browse their range of products online and look for organic rice products (“riz” in French), for example Priméal organic basmati rice;

- Find out who is responsible for the brand. For the Priméal brand, this is Ekibio (a Léa Nature company);

- Contact the producer or food brand and find out if they import their ingredients themselves, or if they use an importer. In this case, Ekibio has its own fair-trade import partnerships.

Figure 2: Market research process from retail brand to potential buyer

Source: ICI Business. Photo Priméal by guiz82 per Open Food Facts, licensed under the Creative Commons Attribution-Share Alike 3.0 Unported license.

This research process can sometimes be time-consuming and difficult. But it will give you valuable insight into the value chain and names of importers you may have never heard of before. Browsing online retailers can also help you to find out about consumer prices, types of packing and presentation and the origin of products. This is especially important if you are planning to launch a consumer product, instead of bulk.

Tip:

- Browse online retailers to find interesting food brands. Find lists of supermarket chains in Europe on Wikipedia. Most of the larger chains show their products online.

4. Find buyers through member lists of sector associations

Sector associations can be an interesting way of finding leading companies, in particular for traditional and industrial grains, pulses and oilseeds. Multinational buyers such as ADM, Bunge, Cargill, Cofco, and Louis Dreyfus dominate the sector. But there are also other types of member organisations, such as IFOAM for organic food.

Sector associations play an important role in removing trade barriers and lobbying on food safety and policy-making at the national and European levels. These organisations rarely represent your interests as an exporter, but their market information and member lists can be very helpful.

You can browse the member lists of the associations below to find key buyers in various sectors:

Organic ingredients

- IFOAM Organics International is an organisation that aims to make agriculture around the globe more sustainable. You can explore the affiliates from Europe to see who supports the organic sector. These include a few companies, but also national associations with a link to buyers of organic food. Examples are BioNederland (the Netherlands), Organic Denmark, Organic Sweden, L’Agence Bio with an advanced search tool to find organic companies in France, and Bio Suisse where you can download the Database Bio Suisse Importers – licensed products.

Cereals and (oil)seed

- COCERAL is the European trade association for cereals, oilseeds, rice, pulses, olive oil, oils and fats, animal feed and agricultural supplies. They represent national and European trade organisations such as SYNACOMEX (France), GROFOR (Germany), Anacer (Italy) and the Royal Dutch Grain and Feed Trade Association ‘Het Comité’ (the Netherlands). You can find buyers of common cereals, oilseeds and fats through these member organisations.

- European Commodities Exchange (ECE) brings together 38 national Exchanges from 12 European countries, dealing with cereals, seeds, animal feed and other related products. They represent members such as the Grain traders association of the Hamburg exchange (VdG) (Germany).

Feed grains

- The European Feed Manufacturers' Federation (FEFAC) represents 28 national associations in 27 European countries.

Vegetable oil and protein meal

- FEDIOL is the EU industry association for vegetable oil and protein meal. They represent the interests of the European oilseed crushers, vegetable oil refiners and bottlers. The members of FEDIOL are ten national associations and 9 associated company members. These include for example OVID (Germany), fncg (France) and AFOEX (Spain).

Pulses

- The Global Pulse Confederation (GPC) represents all segments of the pulse industry value chain. Through its member area, you can access the 24 national associations and over 600 private sector members.

- Pulses UK is the trade association representing the processors and users of British-produced pulse crops. However, most of the exporting members also trade internationally in pulses.

- Asociación de Legumbristas de España (ALE) (Spain) consists of merchants and packers of pulses representing more than 80% of the volume of the pulses marketed in Spain.

Rice

- The Federation of European Rice Millers (FERM) represents 90% of the European rice milling industry. They have 22 member companies and rice milling associations.

Tips:

- Browse the websites above in your own language using the translator function in your internet browser.

- Focus on the associations in the countries that have the most potential for your company. Use the CBI product studies to identify the most promising markets for your product.

5. Register with trade directories

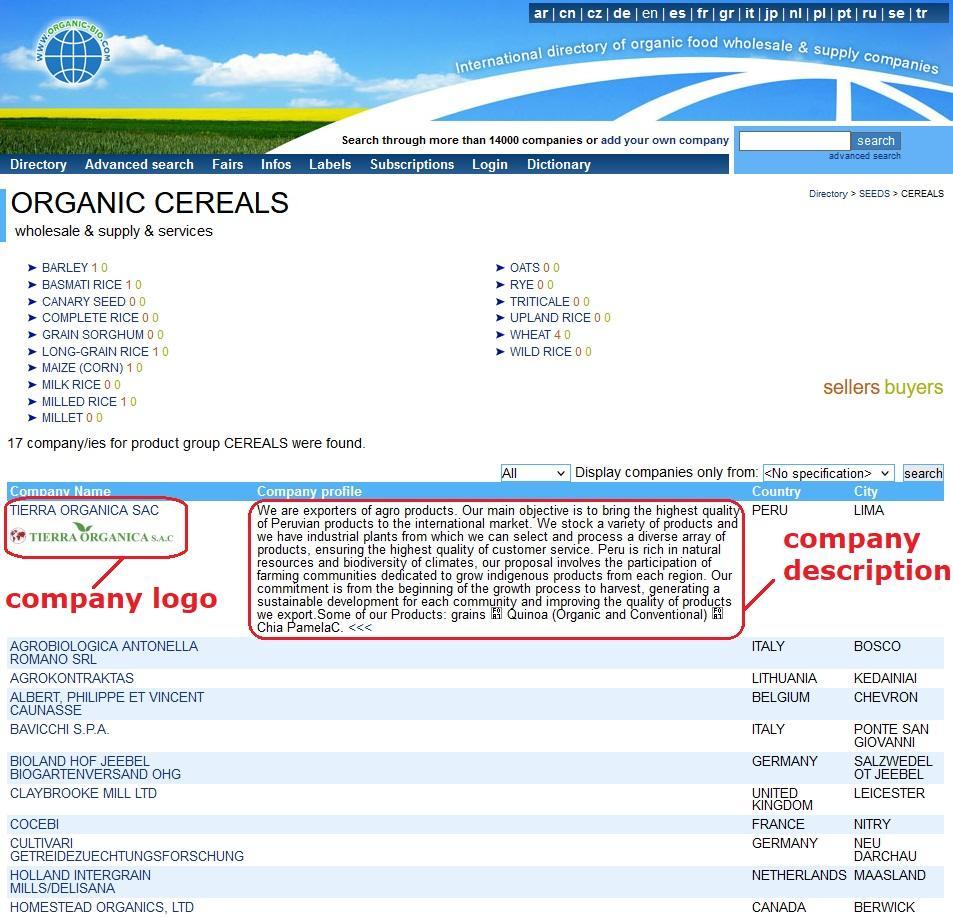

You can use trade directories to search for potential buyers, and you can also register your company so that buyers can find you. Make sure you make a professional impression. Create a strong profile by adding logos and images (see figure 3).

Some trade directories charge a registration fee or a fee to contact potential buyers. You can use a free trial to start with and then decide whether it is worth paying the annual fee. The directories that may be useful for exporters of grains, pulses and oilseeds include:

- Organic Bio: International directory of organic food companies;

- Green trade: A marketplace for suppliers and buyers of organic products;

- Food1: International B2B portal for food suppliers, including the grains industry;

- Kompass: Global B2B multisector database;

- Global buyers online: Search for the latest trade leads from buyers and importers from all over the world;

- Europages: Directory of European companies. This is a professional portal that encourages business-to-business exchange;

- Lieberanten.de: A database in German for finding importers, distributors and wholesalers in Germany;

- Wer Liefert was (wlw): B2B platform for small and medium-sized companies from Germany, Austria and Switzerland.

Do not forget about certifications databases. For example, you can find many companies with food safety standards in the public register of FSSC or the BRCGS directory. You can search these directories by country and by category.

Figure 3: Example of presentation in Organic-bio.com

Source: Organic-bio.com

Tip:

- Use the trade directories to create your own database. Also see our advice on structuring your search for buyers.

6. Use online market places and trade platforms, but be selective

Today, every supplier can have a presence on online market places and B2B trading platforms. These platforms bring together supply and demand with an unlimited assortment of products. They have made international trade more inclusive, and often less specialist.

There are a number of general and specific trade platforms:

- Tradekey or Alibaba are non-specialised trade platforms that have been around for some time;

- Tridge, a relatively new platform, focuses on the global sourcing of food and agricultural products. It also provides market intelligence and data and facilitates trade transactions;

- uFoodin is a worldwide food and beverage B2B market place and social network;

- ECOCEREAL is an even more specialist platform, built for producers and processors of organic cereals;

- RangeMe and Product Guru (focusing mainly on the UK) are product discovery platforms for retail brands. These are digital showrooms that connect consumer brands with retail buyers.

When publishing your offer on a platform, be selective about which ones you use and consider the pros and cons (see figure 4). European buyers are not always willing to do business on these platforms. Many of them follow a procedure when taking on a new supplier, including quality and food safety checks.

On the upside, the extended services of online platforms can help you integrate your supply chain. They help with transactions, logistics and trade securities, making it possible for many new companies to trade internationally. For this reason, we can expect these platforms to continue to grow and to play a bigger role in the future.

Figure 4: Pros and cons of working with online market places and trade platforms

Source: ICI Business

Tip:

- Always be transparent about your product and your terms and conditions. Trade platforms may seem like a quick way to make deals, but European buyers still expect full compliance with regulations and product requirements. Read about doing business with European buyers of grains, pulses and oilseeds and make sure that every deal has a contract.

7. Build a professional website to attract buyers

Web searches are very popular among buyers, so make sure your company can be found online. Increase your online visibility by creating a professional website. This is your digital business card.

Your website will be the first place for buyers to assess whether you are a suitable supplier. If you do not have a website, they may assume you are a small exporter and are unable to fulfil their requirements. Remember that your website is your main online communication channel. It should fully reflect your business and commercial identity.

Things you can do to optimise your website:

- Register your own URL: Create your own website. A Facebook page alone does not look professional when trading in grains, pulses and oilseeds.

- Provide complete information: Make sure your website provides a full picture of your company. Include relevant content such as:

- product information (such as technical data sheets and photos);

- information on your production and processing;

- certifications;

- activities in social responsibility and sustainability;

- your company’s strengths.

An example of a well-structured company website is ONganic, an Indian company supplying specialty rice. Another is Andes Harvest, a Bolivian-Argentinian agricultural company. Both have a unique identity and provide a very clear idea of their products and experience.

- Use clear, correct language: Websites should be written in good English, and if possible, in the language of your target market(s).

- Update your website regularly: Regular updates and news items show that you are pro-active. A website with up-to-date information also gives you a higher listing in search engines.

- Link to your website on other channels: Link to your website on external websites used by buyers. For example, contribute articles for news websites such as The Organic Magazine or World-grain.com. You can also try to use online advertising on news sites such as FoodNavigator.

- Use Search Engine Optimisation (SEO): SEO will help you attract more visitors on your website. To do this, you can register for Google Search Central or use the Microsoft SEO Toolkit.

8. Use social media for networking

You can find many European purchasers or category managers on professional networks. LinkedIn is the most important social networking platform for professionals. On LinkedIn, you can search for companies or people that are active in the grains, pulses and oilseed sector. Specific groups to find useful contacts, are:

- The Grain Trader (20,000 professionals)

- World Grain-Oilseeds (5,000 professionals)

- Global Pulses Trade (11,000 professionals)

- Global Pulse Confederation (GPC) (2,000 professionals)

If you know the name of a company, you can search for people that work there and connect with them. You can also choose to post articles and news about your company, or share videos. These will help potential buyers to find you.

Other professional social networks include Xing in German-speaking countries and JDN Viadeo in France. Another social network that specialises in food and beverages is uFoodin. On uFoodin you can find members from 6,000 linked food companies.

Tips:

- Learn how to create a B2B social media strategy and about the 3 steps to B2B social media marketing success for your business.

- Join specific groups related to grains, pulses and oilseeds on LinkedIn to find and communicate with potential trade partners.

- Make sure that your contributions on social media are professional and enhance your company’s image. Share content that your buyer will be interested in.

9. Ask for help from support organisations

There are European organisations that help exporters from developing countries. Some of them can help you with promotion or to connect you to European importers. Others focus on technical development, which can improve your profile with buyers. Check with the following organisations to see whether there are specific programmes for your country or opportunities for finding buyers for your products.

Centre for the Promotion of Imports from developing countries (CBI)

On the CBI website, you can find product studies that describe market channels for various grains, pulses and oilseeds. They also mention some potential buyers. In addition to extensive market information, CBI offers export coaching. Their coaching programmes can help you access the European market. They are only open for applications during the application period and for the selected countries in the relevant programme.

CBI has launched a project in Kenya for women entrepreneurs (2021-2026) in multiple sectors, including grains, pulses and oilseed. Another project will start in Guinea for fonio. Browse the current projects for the latest details.

Import Promotion Desk (IPD)

IPD brings together German importers with exporters in emerging growth markets. 1 of the sectors they operate in is natural ingredients. This includes grains, seeds (quinoa, amaranth, chia, and specialty rice) and pulses (kidney beans, pinto beans, white beans, and peas). They organise participation in trade fairs, training and matchmaking events.

Browse their services to see if any are of interest to your business. If you are a participant in 1 of their programmes, you will have free access to e-learning courses on market access, marketing and trade fair participation.

SwissContact

SwissContact is a foundation for technical cooperation. They have 30 projects in over 20 countries to support sustainable development. They do this by providing access to skills, knowledge, markets, technologies and financial services, so that you can find buyers more easily.

Open Trade Gate Sweden (OTGS)

OTGS is part of the National Board of Trade Sweden. They support companies from developing countries wishing to export to Sweden and the European Union. Through them, you can find information about the market and about rules and procedures. They also offer valuable tips on how to find a business partner.

Finnpartnership

Finnpartnership promotes business partnerships between companies in developing countries and Finland. They offer a free matchmaking service for companies in developing countries. This service can help you find business partners in Finland.

Enterprise Europe Network (EEN)

EEN is the world’s largest support network for small and medium-sized businesses. The network focuses on innovation and international growth and is active in all business sectors. There is a database of partnering opportunities to enable the exchange of business and technology leads. This includes finding partners to distribute your products. Most network partners are based in Europe, but there is also a growing number of local Network contact points outside of Europe.

International Trade Centre (ITC)

ITC provides support through advisory services, capacity building, training and mentoring, free tools and business data, and trade-specific publications. With their tools Export Potential Map and Trade Map, you can find the markets with most potential for finding buyers. You can also enrol in various courses to improve your knowledge and skills. You can prepare yourself better for finding buyers with courses in export development, entrepreneurship, and trade support.

Tips:

- Regularly check the activities of export promotion agencies such as the IPD and CBI. Apply for export support programmes that are relevant to your company.

- Find courses on ITC SME Trade Academy to improve your commercial skills.

10. Structure your search for buyers

When you are searching for and contacting potential buyers, it helps to document your work. This way you will not forget contacts, and the additional information you can obtain is also valuable for your follow-up.

Create a database of contacts and turn customer acquisition into a regular activity. It is important to be proactive if you want to become a successful exporter. In your database you can include relevant information such as:

- Company information (name and type of company)

- Contact details (purchasers, category managers, business owners)

- Interest (level of interest, product needs and requirements, feedback on your product)

- Level of importance (their potential for your company)

- Next step (follow-up in the future)

You can automate a lot of your acquisition processes using a Customer Relationship Management (CRM) programme. This allows you to manage customer interaction, lead tracking and automated marketing such as newsletters. There CRM tools can be used for every business type and size.

Tip:

- Take your time when selecting a CRM. Read about selection criteria on Infotivity or XRM Vision. Find out which CRM best suits your company in the Forbes Best CRM Software For Small Business. Or receive a professional selection of software solutions through SoftwareMatching.io.

Read our Tips for Doing Business and Tips for Organising your export to Europe. These can help you understand more about how to enter the European market and what it takes to become a successful exporter to Europe.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research