Exporting healthy snacks with grains, pulses and oilseeds to Europe

Grains, pulses and oilseeds are often used in healthy snacks. Their nutritional value is positively received by health-conscious consumers. As an exporter, you can target the market for specific ingredients or specialise in processing ingredients or even consumer products. The further you develop your supply chain, the higher your investment and your responsibility in food safety and information to consumers will be.

Contents of this page

- What requirements must healthy snacks comply with to be allowed on the European market?

- Through what channels can you get healthy snacks with grains, pulses and oilseeds on the European market?

- What competition do you face on the European healthy snack market?

- What are the prices for healthy snacks on the European market?

Entering the European market for healthy snacks with grains, pulses and oilseeds

Europe counts several strong brands that sell healthy snack products with grains, pulses and oilseeds. For a non-European supplier, entering the European market with an added-value product will be challenging. To find your niche, you must be original and try to use authenticity as your unique selling point. Depending on the market channel you choose, you must find a distributing partner or be able to support the sales locally.

1. What requirements must healthy snacks comply with to be allowed on the European market?

Healthy snacks with grains, pulses and oilseeds must comply with the general requirements for these ingredients, which you can find in the buyer requirements for grains, pulses and oilseeds on the CBI market information platform. You can also use the Trade Helpdesk, which provides an overview of market access requirements by filling in the specific HS code of your product

What are mandatory requirements?

Food safety: Traceability, hygiene and control

To get healthy snack products on the European market, you have to deal with strict rules and obligations on food safety. The General Food Law, which regulates food safety in the European Union, applies to all food products.

Food safety and traceability should be your top priority. Non-compliance can lead to temporary import stops or to stricter control from your origin country. As a supplier, you must make sure to work according to the guidelines of Hazard Analysis and Critical Control Points (HACCP).

You must devote attention to the levels of pesticides, contaminants and microbiological criteria. There are maximum residue limits (MRLs) for pesticides that are used for grain and pulse ingredients. Contaminants, such as mycotoxins and heavy metals, and micro-organisms, such as Salmonella, E. coli and Listeria monocytogenes, must be absent or within the limits according to the European legislation. Be aware that the requirements for organic and baby food are much more stringent (see table 1 and 2).

Table 1: Simplified table for EU limits for micro-organisms and contaminants

| Food category | Micro-organisms / contaminant | Sampling plan* | Limits | Stage where the criterion applies | |

| n | c | ||||

| Legume vegetables, cereals and pulses | Lead | - | - | 0,20 mg/kg wet weight | - |

| Cereal grains excluding wheat and rice | Cadmium | - | - | 0,10 mg/kg wet weight | - |

| Wheat/rice grains, wheat bran/ germ for direct consumption; soy beans | Cadmium | - | - | 0,20 mg/kg wet weight | - |

| Ready-to-eat foods intended for infants and ready-to-eat foods for special medical purposes | Listeria monocytogenes | 10 | 0 | Absence in 25 g | Products placed on the market during their shelf life |

| Ready-to-eat foods able to support the growth of L. monocytogenes | Listeria monocytogenes | 5 | 0 | 100 cfu/g | Products placed on the market during their shelf life |

| Listeria monocytogenes | 5 | 0 | Absence in 25 g | Before the food has left the immediate control of the producer | |

| Ready-to-eat foods unable to support the growth of L. monocytogenes | Listeria monocytogenes | 5 | 0 | 100 cfu/g | Products placed on the market during their shelf life |

| Sprouted seeds (ready-to-eat) | Salmonella | 5 | 0 | Absence in 25 g | Products placed on the market during their shelf life |

*n = number of units comprising the sample; c = number of sample units giving values over the limit.

Sources: COMMISSION REGULATION (EC) No 1881/2006 setting maximum levels for certain contaminants in foodstuffs and COMMISSION REGULATION (EC) No 2073/2005 on microbiological criteria for foodstuffs

Table 2: Simplified table for EU maximum levels for mycotoxins (μg/kg)

|

Aflatoxins B1 / Sum of B1, B2, G1 and G2 |

Ochratoxin A | Deoxynivalenol | Zearalenone |

Fumonisins (Sum of B1 and B2) |

|

| Peanuts and oilseeds and processed products thereof (not oil), for direct human consumption or use as an ingredient in foodstuffs | 2,0 / 4,0 | ||||

| All cereals and all products derived from cereals, including processed cereal products | 2,0 / 4,0 | 3,0 | |||

| Processed cereal-based foods and baby foods for infants and young children | 0,10 / - | 0,50 | 200 | 20 | |

| Wheat gluten not sold directly to the consumer | 8,0 | ||||

| Cereals intended for direct human consumption, cereal flour, bran and germ as end product marketed for direct human consumption | 750 | 75 | |||

| Bread (incl. small bakery wares), pastries, biscuits, cereal snacks and breakfast cereals | 500 | 50 | |||

| Maize intended for direct human consumption, maize-based snacks and maize-based breakfast cereals | 100 | 800 | |||

| Processed maize-based foods for infants and young children | 20 | 200 |

Tip:

- Read more about pesticides, contaminants and micro-organisms on the website of the European Commission. For MRLs of pesticides and active substances that are relevant for your ingredients, consult the EU MRL database.

Follow the rules for ingredients

If you use different ingredients for your healthy snack product, make sure they are all allowed within the European legislation for novel food, genetically modified food ingredients and food additives.

Novel Foods

New food ingredients such as cañihua (not yet allowed), fonio and chia seeds are ‘novel foods’. For the use of authorised novel food ingredients, there may be restrictions and additional labelling requirements, which is the case for chia seeds. For products that are not yet authorised, such as cañihua, you must first get the ingredient approved by submitting an application with the European Commission and provide evidence of safe consumption.

Genetically Modified Organisms (GMOs)

The European Union has authorised only a few varieties of maize, soybean and oilseed rape. You can find these in the EU Register of authorised GMOs. GMO ingredients must be fully traceable and properly labelled when used in food products. European member states also have the freedom to prohibit authorised GMO on a national level. When marketing healthy snacks, GMOs are best avoided completely.

Food improvement agents

Food additives, food enzymes and food flavourings are known as "food improvement agents". You can use food improvement agents according to the specific EU regulation. For example, you can find approved additives, numbered and preceded by the letter E, in the database on Food Additives. For healthy snacks, consumers often expect a product with few additives and preferably only natural ingredients.

Tips:

- Use natural ingredients for your healthy snack products and avoid modified and chemical ingredients. Novel food ingredients can be an interesting addition to your product, especially when they possess health benefits.

- Read how to submit a novel food application from a third country using the e-submission system on the website of the European Commission. In the summary of applications and notifications, you can find several ingredients and new uses that are being assessed by the European Food Safety Authority (EFSA).

Make sure nutritional and health claims are approved

To promote a healthy snack, you can emphasize the health properties of the grains, pulses or oilseeds that it contains. However, you are not allowed to promote health benefits that are not approved by the European Union. Any nutrition and health claim should only be made in accordance with the requirements of the Health and Nutrition Claims Regulation (EC) No 1924/2006.

Table 3: Examples of claims that you are allowed to use for food ingredients

| Ingredient | Allowed claim |

| Barley and oat grain fibre | contributes to an increase in faecal bulk (digestion) |

| Alpha-linolenic acid (ALA) (for example in linseeds, chia, sacha inchi) | contributes to the maintenance of normal blood cholesterol levels |

| Plant sterols and stanols commonly found in vegetable oils | contribute to the maintenance of normal blood cholesterol levels |

| Protein in pulses | contributes to a growth in muscle mass and to the maintenance of muscle mass and normal bones |

A nutrition label that you can expect to see more in the future on food products in Europe is the Nutri-Score. This is a coding system for consumers to see which products are recommended and which should be avoided. It is a voluntary system, but health authorities in several countries such as France, Germany, Belgium and Spain have recommended its use.

Tips:

- Check with the EU Register on nutrition and health claims to see which claims are allowed to be made in the European market.

- Read the news item “Nutri-Score – a promising initiative in nutritional quality labelling” on the CBI website.

Labelling regulations

The labelling of food products is subject to the Regulation (EU) No 1169/2011 on the provision of food information to consumers. Food labels must be clear and legible (minimum font size 0.9mm or 1.2mm for >80cm2) and provide sufficient information to the consumer, including nutritional value and allergens (see table 4).

Table 4: Mandatory and voluntary labelling practices for healthy snack products

| Mandatory: | Voluntary: |

|

|

|

Need-to-knows:

|

|

Tip:

- Use a specialist company that can help you with labelling and registering your product. Search for food compliance consultants or food lawyers in Europe. Labelling rules can differ slightly per country.

Packaging

The packaging of food stuffs must be suitable to protect the product and must comply with the Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food.

EU Member States are also required to take measures to reduce packaging waste and must introduce systems for reusing, recovering and recycling packaging materials. As a food manufacturer, you have a responsibility to offer a sustainably packaged product, which is based on the principle of "extended producer responsibility" (the polluter pays).

An example is the Green Dot initiative, a protected symbol that is used on packaging to indicate that the producer has made a financial contribution towards the recovery and recycling of the packaging. The use of the Green Dot on packaging is only mandatory in Spain and Cyprus. To use the ‘Green Dot’, you have to contact the ‘Green Dot’ member organisations in the countries in which your packaging is distributed for a valid trademark usage agreement.

Figure 1: The ‘Green Dot’ symbol

Tip:

- Always discuss specific packaging requirements and preferences with your customers.

What additional requirements do buyers often have?

Being a manufacturer and exporter of healthy snacks sometimes means you may have to deal with the preferences of retailers. Their requirements in quality, social responsibility and service level vary, but for large buyers, these can be very stringent.

Certifications as a guarantee

As food safety is a top priority in all European food sectors, you can expect most buyers to request extra guarantees from you in the form of certification. Food management systems and certifications that are recognised by the Global Food Safety Initiative (GFSI) are widely accepted throughout Europe. For food manufacturers, a recognised food safety management system is a necessity to become a supplier to European buyers. Certified food safety management schemes include:

- Food Safety System Certification 22000 (FSSC 22000 /ISO 22000);

- BRCGS for Food Safety (British Retail Consortium);

- IFS Food Standard (International Featured Standard).

Product standards

Professional buyers of healthy snacks may have additional requirements for your product in terms of quality, originality and presentation.

Your product has to fit in with the assortment or portfolio of your client. This requires originality and flexibility from you as a supplier. You have to make your product attractive and, if necessary, you must be able to adapt to the requirements of a client. Product requirements such as size and packaging become especially important when manufacturing for a private label.

It is important to understand the demand of consumers and the trends that drive them, for example convenience, indulgence, variation, flavour, functionality or special ingredients. See the CBI studies about trends in grains, pulses and oilseeds and the market potential for healthy snacks with grains, pulses and oilseeds.

Corporate image

The branding of your product and company is important to build confidence with your clients, but also to share your story with potential buyers and consumers. The investment in marketing will be higher when you market a finished healthy snack brand, compared with supplying different grains, pulses or oilseeds as ingredients.

The impression of your company must be spotless. Your website must be distinctive and be in line with the identity of your company. Your corporate image must be truthful and professional. This also indicates a high level of organisation.

Larger retail clients (especially supermarkets) sometimes require you to have a local marketing budget or participate in product promotions. This can become a relatively large investment for small producers.

Logistical services and delivery

For a retail chain, the administrative process to include you as a supplier is long. Once you are on their supplier list, they will expect you to adapt to their purchasing and delivery conditions. You have to become familiar with their systems and processes.

Retail clients avoid burdens. Supplying retail clients means you will have to have some type of presence in Europe, either by yourself or through a logistical partner. As a supplier, you must be able to solve logistical problems of your client and be able to offer a complete service of warehousing and (just-in-time) distribution. Non-compliance is not taken lightly, and your contract may even include penalties for late deliveries.

When working with a representative that imports and distributes your product, make sure to have workable volumes. Full container loads are important to keep costs low, so try to combine shipments and products.

Health labels

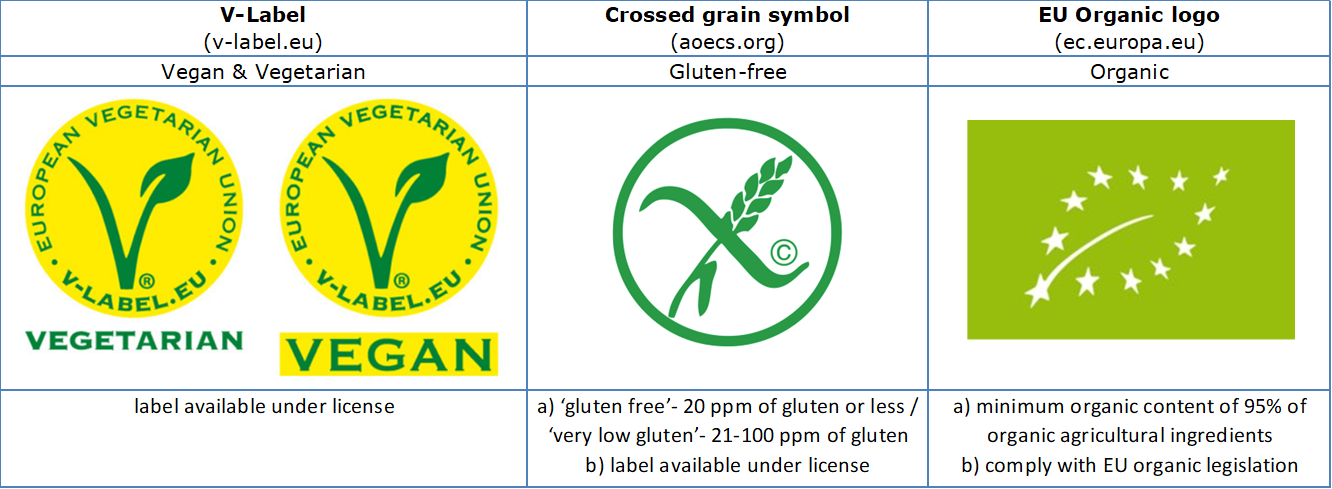

Labels are important to highlight the health aspects of your snack product. Among these health-related labels are the V-Label for vegan and vegetarian, the crossed grain symbol for gluten-free and the EU organic label. You can request a license offer for the V-label and read the Frequently Asked Questions about licensing the crossed grain symbol. For organic and gluten-free labelling, there are additional requirements (see table 5).

Table 5: Labels for healthy snack products with grains, pulses and oilseed

Tips:

- Check with your buyer to determine which certification schemes and product labels are most relevant for your target market.

- Make your product appealing and marketable for buyers. Devote attention to the presentation of your product as well as your company website and the story behind your business (storytelling).

- Consider organic if you are able to source 100% organic ingredients. You must be prepared to comply with the whole organic process and EU organic legislation to market organic products. Read more about organic certification in the CBI study on buyer requirements for grains and pulses in Europe.

What are the requirements for niche markets?

Sustainability and social compliance

European buyers are paying more and more attention to corporate social responsibility (CSR), meaning the social and environmental impact of their business. As an exporter and food manufacturer, you are part of the supply chain and share this responsibility. Applying standards and certifications will help you fulfil the expectations of buyers.

Business initiatives or certification schemes that can help improve your CSR performance, are:

- The Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct;

- The Ethical Trading Initiative (ETI);

- Sedex Members Ethical Trade Audit (SMETA)

- GlobalG.A.P. and GlobalG.A.P. Grasp

Consumer labels for fair trade practices, such as Fairtrade International and Rainforest Alliance, is a niche requirement, but it can help win the sympathy of consumers. For the environmental quality of your product, there is a relatively new label of On the way to Planet Proof. The search engine for Planet Proof certified products shows it is still predominantly a European label, but it will gradually become more global.

Tips:

- Use the ITC Standards Map to learn about the different sustainable and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct. You can also find many practical tools in the amfori BSCI resources.

- Read about the different social programmes and initiatives in the CBI study on buyer requirements for grains and pulses in Europe.

2. Through what channels can you get healthy snacks with grains, pulses and oilseeds on the European market?

Healthy snacks have different health benefits and promotional strengths. Naturally healthy products are most important and find their way into specialised and conventional retail. For small producers, a distributing partner will be unmissable.

How is the end-market segmented?

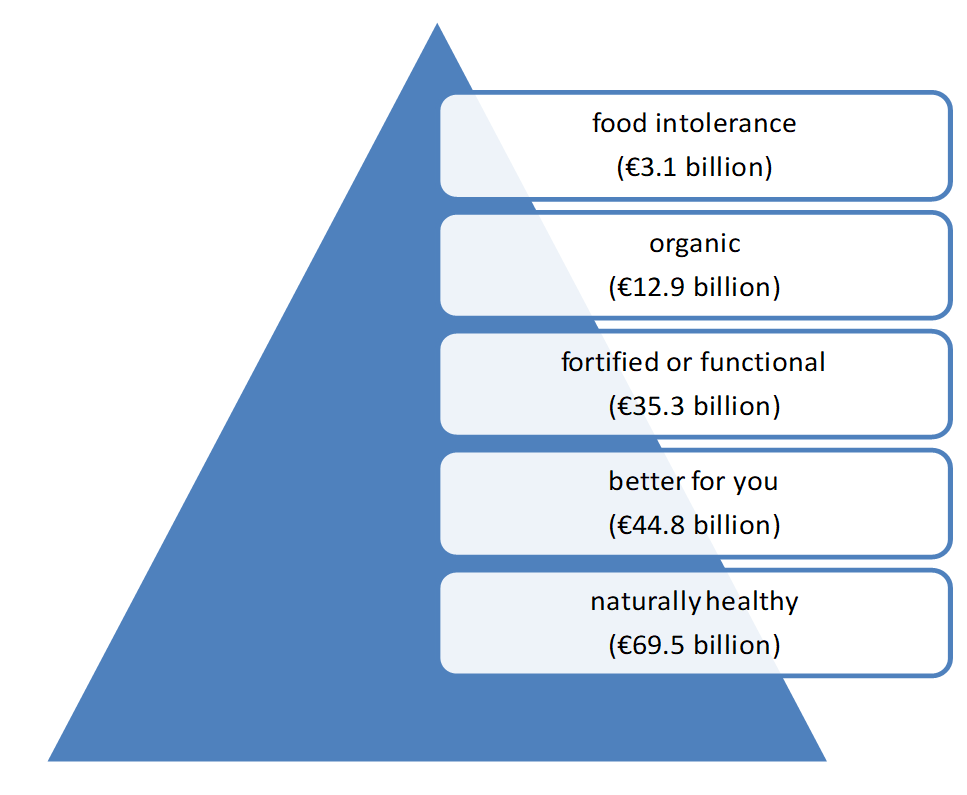

Health food such as healthy snacks can be segmented into different types of health and wellness claims. According to this 2016 Euromonitor presentation, the total retail sales of health food is 167 billion euros, of which 140 billion is concentrated in Western Europe. The growth of health food is higher in Eastern Europe.

Figure 2: Retail value sales of health and wellness types in food

Source: Euromonitor at Vitafoods Europe May 2016, graph and calculations by ICI Business

Naturally healthy is the biggest segment, with almost 70 billion euros in retail sales, which includes the use of specific ingredients such as oats, quinoa, chia and pulse flours that are considered beneficial to human health.

The segments “better for you”, which includes, for example, snacks with reduced sugar or salt, and fortified or functional food such as energy bars, are also large segments with 44.8 and 35.3 billion euros respectively.

Organic represents about 8% in the retail sales of health food, but is most dominantly present in Western Europe. The smallest segment is food intolerance, but may be very relevant for grains and pulses, specifically gluten-free grains and vegan pulse protein.

With an eye on the health food segments, it is best to use natural or unprocessed ingredients when developing healthy snacks for the European market. You can make your product attractive to specific audiences by using extra nutritious, allergen-free or organic grains, pulses and oilseeds.

Tip:

- Visit European health shops and supermarkets to see what type of healthy snacks with grains, pulses and oilseeds they offer. Many shops have their products online, such as Rewe (Germany), Tesco, Holland&Barrett (United Kingdom), Albert Heijn and Ekoplaza (Netherlands). You can find a list of European supermarkets on Wikipedia.

Through what channels does a product end up on the end-market?

Healthy snacks with grains, pulses and oilseeds find their way onto the end-market through distributors of food brands, (competing) manufacturers or by direct marketing. Importers of foreign brands often concentrate on European products and sometimes on ethnic snack products. These products are then sold by health shops, ethnic stores and online shops. Private label and well-branded products are also sold by major conventional retailers.

Figure 3: Market channels for healthy snacks with grains, pulses and oilseeds

Importing distributors

Distributors play an important role in getting healthy snacks on the market. They can combine brands and product groups from different suppliers and reach smaller segments and specialised shops. There are many types of food distributors: import and wholesale can both be among their activities.

In most cases, imported products are regional or European brands. Distributors of healthy snacks are often specialised in organic food or food for specific diets, and likely have a strong regional focus. For example:

- Udea, an organic wholesaler in the Netherlands that brings different healthy organic brands and private labels onto the market. They supply their own organic supermarket franchise, Ekoplaza, as well as independent organic shops, day care centres and food service providers, mainly in the Netherlands and Belgium.

- Lavida food, a British-Irish distributor of gluten-free food, including snacks, represents brands such as Semper and Le Pain des Fleurs in the United Kingdom and Ireland. They sell through wholesalers such as Tree of Life and large retailers such as Waitrose and Holland & Barrett.

- Food From Nature imports and distributes natural and organic food such as healthy snacks and sports products. Their key market is Spain and Portugal, where they focus on consumers who have adopted a healthy lifestyle and people with food intolerances.

Ethnic importers focus more on the import of foreign brands. The snacks that they bring into the European market often contain nutritious ingredients and are healthier than conventional snacks, but they are not promoted as healthy snacks. Importers use their authenticity as a key selling point:

- Unidex, a specialised importer and distributor of authentic and exotic food, works with brands such as Peyman from Turkey and resells their roasted chickpeas.

- Asia Express Food is part of the Brouwer wholesale group and mainly focuses on importing brands from Africa, India and Asia. Snack products include Haldiram’s spicy fried split mung beans from India and Royal Orient hot rice crackers made in Thailand.

Retail (direct marketing)

From food manufacturers and distributors, healthy snacks are sent to different retail outlets, from where they are sold to consumers. Retailers aim for an interesting assortment for their clientele, but also require their suppliers to offer full local service. Strong brands such as Gerblé–Céréal (France) and Rapunzel (Germany) are directly marketed to larger retail chains.

Healthy snacks are sold by specialised or non-specialised retailers. Throughout Europe, you can find many shops that are specialised in organic food or health products, which are popular places to stock healthy snacks, such as:

- Natural and health products at Holland & Barrett (UK) and G&W (Netherlands)

- Organic products at the dennree group (with organic retail chains denn’s and Biomarkt in Germany) and NaturéO (France).

- Non-specialised retailers, such as supermarkets and convenience stores, often have a separate section for health food and dietary food.

A fast-growing channel is online retail. Online food retailers make use of the consumer habit of online shopping and sell a variety of healthy snacks online. In the future, you can expect more and bigger players such as Amazon to enter the online sales of health food, but the current market includes online sellers such as:

- Ocado (UK), one of the leading online supermarkets.

- Food Oase (Germany), specialised in food intolerance, with snacks such as breadsticks made from buckwheat and amaranth and waffles made from maize and quinoa.

- Orientalmart (UK), an online supermarket and specialist in oriental food products, including a variety of snacks with rice and soybean.

Brand owners and food manufacturers

Many healthy snacks and snacks made with grains, pulses and oilseeds are brought onto the European market by local brand owners and manufacturers.

Local snack producers often use imported ingredients, but because of their local production in Europe, they are well positioned to deal with local wholesalers and retailers. Some companies, such as De Smaakspecialist in the Netherlands and Ekibio in France, are mainly brand marketers. Others, such as Europe Snacks in France, have dedicated their business to private label manufacturing.

Tip:

- Read about the supply conditions of Ocado and their Grocery Supplier Manual to understand the terms and conditions of doing business with this type of retailer. If you are registered as a food supplier in the United Kingdom, you can fill in a supplier application form and try to become a supplier.

What is the most interesting channel for you?

As an exporter of healthy snacks with grains, pulses or oilseeds, you have the option to find a distributor or set up your own direct marketing. Remember that European brands are dominant. The central question is: What makes you unique and why should a European retailer choose your product?

For most exporters of healthy snacks, it will be most feasible to find a dedicated distributor. This is easier said than done. Most distributors only represent European food brands and not every distributor has extensive experience with import. For non-European brands, it will take time and effort to find and select the right distributing partner.

If you want to export ethnic or authentic products from your country, your channel may be more specific. For example:

- the typical Peruvian corn for toasting of the Plebeyo brand has access to the EU market through online channels such as Amazon (in Germany) and digital and physical shops specialised in ethnic food such as Ponto Brasil & Latino (Germany), Tienda Peru Online (Spain) and EL INTI (France).

- The pea snack of the Oishi brand (Philippines) is sold through ethnic stores Orientalmart and Union Oriental Foods in the United Kingdom.

If you choose to focus on direct marketing and want to supply retailers yourself, your responsibility will go far beyond facilitating the import. For a retailer, it is important that you are locally active with marketing, warehousing and distribution. Many of the logistical activities can be outsourced to logistical and fulfilment companies, but retailers often require a local contact point for supply contracts (see also buyer requirements above).

To get your product ready for direct marketing to retailers, it is recommended to work with food marketing consultants. They can help you adapt your snack product to the European markets, but also with local requirements, presentation, strategy and marketing campaigns. Some distributors can be helpful in this as well, such as Afco Traders, a full-service importer, distributor, and business partner that offers marketing and sales services for small and medium-sized producers of quality, organic and natural brands.

Tips:

- Present your healthy snacks and meet with potential buyers at large food trade fairs such as SIAL in France, Anuga or Biofach (organic) in Germany and Natural & Organic Products Europe in the United Kingdom.

- Make yourself attractive as a supplier by facilitating the logistics and offering different snack varieties instead of one single product. Starting off in Europe can be difficult when your volumes or product range are small.

- Be realistic and patient: Do not expect to end up in major channels immediately and use smaller channels at first, which may be much easier.

- Find logistical service providers if you lack a distribution structure in Europe. Use branch organisations such as the Holland International Distribution Council, which helps international companies into the European market through the Netherlands, a leading gateway for imported food in Europe.

3. What competition do you face on the European healthy snack market?

Import and production data of products that typically include snacks with grains, pulses and oilseeds, indicate that the main competition comes from within Europe (See figure 4). The biggest exporters to Europe are producing countries nearby, such as Turkey and Ukraine, ethnic (mainly Asian) food suppliers like China and Thailand, and the United States and Canada.

Which countries are you competing with?

Turkey and Ukraine – Large nearby producers

Nearby producers such as Turkey and Ukraine are relatively large suppliers of bakers’ wares, which is a relevant category for snacks based on grains and seeds. The EU imported 114 million euros worth of bakers’ wares from Turkey in 2018 and 43 million euros worth from Ukraine. The large Turkish population in the European Union partly explains the popularity of Turkish snacks and bakers’ wares.

The proximity of these countries plays a role in cheaper logistics, but also in their relation to the European Union. Both countries benefit from trade agreements with the European Union, reducing import taxes to 0% for most products. Their size also makes them very suitable for large volume production of cereal grains, which gives them access to significant raw material resources.

China and Thailand – Leading in ethnic food

Oriental food and snacks are widespread on the European market. Specialised importers and retailers of ethnic and Asian products, such as Amazing Oriental (Netherlands), OrientalMart (UK) and Paris Store (France), are mainly responsible for the sales of Oriental snacks. Asian snacks often include ingredients such as rice, sesame, soybean and other pulses, such as rice crackers, coated nuts, dried bean curd or pea snacks.

China and Thailand are the main suppliers of bakers’ wares to Europe. China is the second-largest supplier, with a value of 70 million euros in 2018. Thailand follows with 55 million euros. The main strengths of suppliers from these countries is their low-cost production, but also the unique products and flavours that define these snacks as ethnic food.

United States and Canada – Large-scale production

Industrialised countries such as United States and Canada share a similar interest in healthy snacks. These countries have access to a local supply of cereals and pulses and manufacturers know how to relate to the European standards and interests.

In bakers’ wares, the United States is still Europe’s largest supplier, with 63 million euros in 2018. Canada exports less, approximately 39 million euros in 2018, but unlike the United States is growing in value. Over the past years, Canada has been able to benefit from preferential trade tariffs, while products from the United States have become less competitive due to higher tariffs.

European competition – Strong in baked goods

Your main competition in healthy snacks with grains, pulses and oilseeds comes from Europe itself. The food industry is well developed, and local brands have the advantage of being close to their end market. They have a good understanding of the supply requirements and consumer interests.

Some of the countries with the highest demand for snacks based on grains, pulses and oilseeds, are also the strongest competitors in manufacturing. Italy has the highest production value in rusks, biscuits and preserved pastry (over 4 billion euros in 2017), and together with the United Kingdom, Germany, Spain, France and the Netherlands, they represent 75% of the total production value in Europe.

There is a big difference in the number of manufacturers. Italy, France and Spain have a much higher number of manufacturers. For example, according to Eurostat, there are over 1400 enterprises in Italy, and only 189 in Germany. This means your competitors in southern Europe are smaller in size, and Northern Europe is more dominated by larger producers. The total production value in Europe has been relatively stable over the years and will likely remain so.

Tips:

- Start in your home country with marketing your healthy snacks and use that experience to expand regionally and then globally. Experience as a regional exporter of healthy snacks will help you prepare to compete with competitors from different countries. Showing European buyers your international experience will also help convince them of your capacities.

- Register your product and trade name in Europe when you want to enter the market with your own brand. Check for details with the European Union Intellectual Property office (EUIPO) or the Benelux office for Intellectual Property (BOIP).

Which companies are you competing with?

Foreign competitors have invested in size, food quality and safety and use typical local ingredients. This is how they are trying to compete with European health snack companies. Healthy snack companies in Europe are innovative and have brilliant marketing strategies. It will be difficult to compete on skills, but you can differentiate by staying authentic and close to yourself.

Peyman Kuruyemis (Turkey): Leading by size

Peyman is one of the largest producers of dried fruits, nuts and seeds in Turkey and they use local raw ingredients to supply consumer packed snacks such as roasted chickpeas, snack seeds and popcorn. They managed to finance a new factory with a 10 million-euro loan from FMO in 2017 for the expansion in new markets.

Their size and proximity to the European market gives them an advantage in developing business with European clients such as Heuschen & Schrouff and Unidex (ethnic food importers).

Peyman is a producing company that mainly markets simple snacks. This may explain why their marketing is less elaborate than European brands that market healthy snack brands with multiple ingredients. For example, the website is only available in Turkish.

Koh-Kae (Thailand): diversity in ethnic snacks

The snack brand Koh-Kae of the Mae-Ruay Factory Co in Thailand offers a large variety of snack products, including broad bean, green pea and mung bean snacks. The brand is well known in its home country and has expanded to the European market through the ethnic food channels such as Asia Express Food. With HACCP and ISO9001, the company complies with EU standards for food quality and safety. Commercially, they combine their authenticity with health.

Nutrition & Santé (France): innovation is key to the healthy snack market

Nutrition & Santé, headquartered in France, develops active and natural food products and nutritional solutions. They have 50 people dedicated to product innovation. Among their brands are Gerblé–Céréal and Gerlinéa, which include gluten-free crackers and fibre and protein-rich cereal bars. The company responds well to consumer interests for more natural food, improving recipes by eliminating palm oil and avoiding artificial flavours or colours. They produce two-thirds of their marketed products in their own factories.

9Nine brand (UK): small original brands can be big

There are also many small brands and food companies that offer healthy snacks. They are the evidence that small brands can still be successful in this competitive market. Smaller brands are usually original or specialised.

The UK brand 9Nine is an example in the United Kingdom that is completely dedicated to seeds as the main ingredient for their seed bars. They also share the nutritional information of each of the seeds and tell the consumer where they are sourced, including sesame from India, chia seeds from Bolivia and pumpkin seeds from China. Although ingredients often come from abroad, the manufacturing is often done by local manufacturers.

9Nine offers their products through their online shop as well as through major retailers such as Tesco, Holland&Barrett and Amazon.

Tips:

- Use authentic and natural ingredients for your healthy snack products. You need to have a product that compares to existing brands, but you can also increase your competitiveness by being original and authentic. Think about typical local flavours and ingredients.

- Start with a simple snack product with limited processing. A local grain, pulse or seed that is semi-processed into a snack requires less marketing and is the easiest to enter the European market with. Once you are on the market, you can try to expand with other healthy snack products.

- Add a story to your product: how did it evolve, what was the purpose and how has it contributed to your surroundings. Providing a personal story will make you unique.

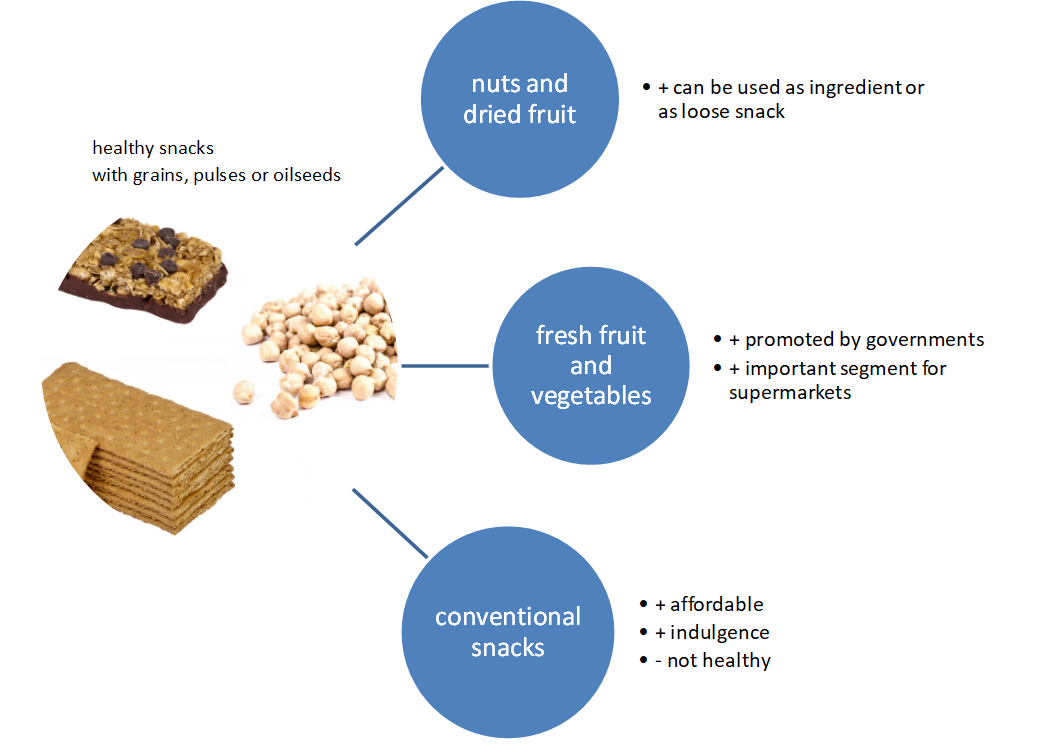

Which products are you competing with?

European consumers have a wide range of snack products to choose from. Nutritious cereals, pulse proteins and oilseeds are commonly used ingredients in healthy snacks, such as cereal bars, crackers, crisps and bakery products. These snacks compete with:

- snacks made from other healthy ingredients;

- fresh fruit and vegetables;

- conventional snacks.

Grains, pulses and oilseeds have an advantage as an ingredient, because its flour, oil and protein often form the basis of a new snack product. Other ingredients that are popular in healthy snacks include dried fruit and nuts – which can be used both in snack products (fruit and nut bars) but can also easily be bagged as a loose snack.

Fresh fruit and vegetables have the advantage of being promoted by many governments and often has a central focus for supermarkets. Fruit and vegetables are increasingly being turned into healthy snacks by freshly cutting and packing them in small containers.

Less healthy conventional snacks often score better on price or indulgence. They are cheap and sweet. Healthy snacks have high-quality and expensive ingredients, so there is a smaller target group that can afford to buy them regularly. Healthy snacks are growing in popularity because consumer conscience is increasing, but the mass market is still characterised by conventional snacks such as salty crisps, sweet cookies and chocolate. Consumers are also tempted by conventional snacks that have added an ingredient or claim that makes it seem healthier.

Figure 6: Competition and alternatives for snacks with grains, pulses and oilseeds and their advantages and disadvantages

Tips:

- Develop healthy snacks that combine grains and oilseeds with fruit and nuts, such as fruit bars with chia seeds or ancient grain crackers with dried fruit.

- Adapt to your main target group: find specialised food channels for lifestyle buyers, athletes and consumers with dietary needs or make healthier snacks affordable for the masses.

4. What are the prices for healthy snacks on the European market?

Prices for healthy snacks with grains, pulses and oilseeds vary according to the type of snack, the brand and its marketing, product quality and also the outlet where it is sold to the consumer.

Food prices

Food prices in Europe have increased around 2% annually in the past three years (2017-2019) according to the European Food Prices Monitoring Tool. Central and Eastern Europe (Poland, Romania, Hungary) have contributed the most to the price growth. In markets where healthy snacks are most popular (UK, Germany, Nordic countries, France), food prices are stable or are even decreasing. Prices for healthy snacks with grains, pulses and oilseeds are also subject to the agricultural prices of the ingredients.

General consumer prices for healthy snacks, such as crackers and cereal bars, vary between one and four euros per package (see table 6). This is a rough end-price range you must aim for as an exporting brand. Food packages are often small in Europe and sometimes include individual sizes.

Table 6: Examples of health retail snack prices including local VAT (February 2020)

| Brand – product | shop | weight | price |

| Le Pain des fleurs – green lentil crispbread | Ekoplaza (Netherlands) | 150g | €2,99 |

| Dr. Karg’s – crackers with spelt and quinoa | Ekoplaza (Netherlands) | 110g | €2,29 |

| Landgarten – roasted soybeans | Ekoplaza (Netherlands) | 50g | €1,29 |

| Organix Goodies – Strawberry-Apple Oat Bar | Healthy Supplies (UK) | 6x30g | €3,59 (2,99 GBP) |

| Eat Real - Quinoa Sour Cream & Chive Chips | Healthy Supplies (UK) | 80g | €2,10 (1,75 GBP) |

| Amisa - Buckwheat Wholegrain Crispbread | Healthy Supplies (UK) | 120g | €2,87 (2,39 GBP) |

| Byodo – Rice crackers with linseed | e-Biomarkt (Germany) | 100g | €1,39 |

| FrankenKorn – four cereal bread slices | e-Biomarkt (Germany) | 500g | €1,29 |

| De Rit Organics – Bean stick crisps | e-Biomarkt (Germany) | 75g | €2,99 |

Price calculation

Define your price according to your cost price and margins. The more exclusive your ingredients and the more original or complex your product, the higher the price you can ask for your product. For example, crisps made from pulse flours generally have a higher value-weight ratio than wheat or rice crackers. However, you must always compare your prices with similar products on the market and get feedback from your buyers.

When marketing your own healthy snack brand, you must take into account marketing costs. This can include promotions, discounts, trade fairs and advertising. Brands are higher priced than private labels, but for retailers, private label snacks (usually produced by European contracted manufacturers) have become a profitable business, focusing on costs, quality and efficiency.

External costs that will influence your product’s price are distribution costs and retailer margin. Gross retailer margins can be up to 30-40%, while distribution takes around 10 to 15% depending on the services and logistical volumes. Throughout time, the average margins of retailers have become higher because of their increasing dominance in the supply chain, while producers and suppliers had to settle for a decreased value share of the final price. For retailers, margin and rotation speed are more important in deciding whether to work with your brand than the price of the product.

Tips:

- Compare your product with healthy snacks and their prices in different web shops and online offers of grocery stores and supermarkets in Europe. See if your price calculation can be justified.

- Check the Food supply chain monitor to see differences in price levels per country.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research