Exporting linseeds to Europe

The dynamics of the European linseed market have changed in recent years. Linseed is increasingly used for direct human consumption because of its nutritional value and health benefits (omega-3, fibre content). And the product finds more and more applications within (niche) segments such as organic, vegan and raw.

Contents of this page

1. Product definition

Linseed or flaxseed is the seed from the flax plant (Linum usitatissimum), a member of the Linaceae family. The thin yellow or brown seed is one of the oldest cultivated crops, originating from the Mediterranean and Western Asia. The seeds are mainly grown in regions with relatively low winter temperatures and are processed for their nutritional value and high content of fibre and oil. Russia, China, Kazakhstan, Argentina and Canada are among the largest global producers of linseed.

The main market for human consumption of linseed can be found within the bakery and health food segments. Whole or broken seeds are used as food ingredients in baking and confectionery industries, while crushing the linseed produces both linseed oil and fibre-rich linseed meal as by-product. The latter is mostly used as animal feed. Linseed is also making major strides in recent years, being used in seed mixes for snacks and breakfast products, as part of the healthy foods trend.

The use of linseed (and linseed oil) in the food sector is relatively small when compared to its various industrial uses. Linseed oil is used extensively as an ingredient in paints, varnishes and many other industrial products.

Codes for linseed:

Harmonised System (HS) linseed, whether or not broken, is included in:

| HS code | Description |

|---|---|

| 1204 00 90 | Linseed, whether or not broken, excluding for sowing. |

Source: Flax Farm

Product specification

Quality

General

- Two similar types of linseed are commonly traded: brown and yellow (golden) seeds. The different types are closely related in terms of oil content, but the brown seeds contain more alpha-linolenic fatty acids (59%) when compared to the yellow seeds (51%). The nutritional value of brown linseed can therefore be considered to be slightly higher.

- Both types of linseed are used for human consumption. Yellow linseed is preferred for cooking purposes, as it blends better with various dishes.

- The best time to transport linseed is directly after harvest. However, the storage life of linseed is estimated to be around 12 months, at a moisture content of 9-11%. The shelf life of linseed meal is considerably shorter and the product should be kept cool and in vacuum.

- Whole linseeds are often not digested by the human body, preventing the intake of nutrients. To benefit from their nutritional value, the whole seeds can be broken, ground or milled. The milled seeds can turn rancid easily when exposed to air and light, but are suitable for further food processing.

- Among other elements, linseed grading is determined by the seed’s odour. Seeds that are classified as off-odour include seeds containing a ‘musty’, ‘sour’, or ‘commercially objectionable foreign’ odour and will be graded lower in quality. Heat-related damage (during transportation) is an important cause of off-odour.

- Seed uniformity also influences the quality grading for linseeds. A high presence of dark/discoloured, broken/damaged and immature seeds is detrimental to seed quality.

- For further information on the quality and grading of linseed, refer to the Grain Inspection Handbook – Flaxseed (US Department of Agriculture).

- It is important to prevent adulteration and contamination of seeds by foreign materials (e.g. dust) by keeping facilities and equipment clean.

- Ensure proper storage and transportation (see ‘Packaging’).

Organic (if relevant)

- Comply with organic standards for the production of linseed. Refer to the section on ‘Niche requirements’ for further details on organic production and labelling.

Source: Honeyville

Labelling

Ensure traceability of individual batches and use English for labelling purposes, unless your buyer has indicated otherwise. Labels must include the following:

- Product name and grade

- Whether or not the product is destined for human consumption

- Manufacturer’s lot or batch code

- Name and address of exporter

- Product’s country of origin

- Shelf life: Best-before date / use-by date

- Net weight / volume in metric units

- Recommended storage conditions

- Organic (if relevant): Name / code of the certifying body and certification number.

Source: Wheat Montana

Packaging

Linseed is primarily packed as break-bulk cargo, for example in flat jute fabric bags, polypropylene (PP) bags or multiwall paper bags. Using transportation in bulk for linseeds is uncommon, due to its easy germination characteristic. In the lower volume segments, such as snacks, bakery products and direct consumption, bagged linseed is transported in containers.

Ensure preservation of quality by:

- Thorough cleaning of the holds or containers before loading the seeds.

- Protecting the cargo from moisture during loading so as to avoid mould, spoilage and self-heating.

- Contact with metal components should be avoided to prevent the linseed turning rancid.

- Ensuring appropriate temperature, humidity / moisture and ventilation conditions during transportation. The linseed causes toxic CO2 levels during unventilated transport. Linseed is easily oxidised and should therefore be kept from exposure to sun and heat.

- Protecting the cargo from pests such as beetles, moths, etc.

Source: Nuts in Bulk

2. Trade statistics

Imports

- European imports of linseeds have been increasing since 2013, at an annual average rate of +5.4%. In 2017, linseed imports to Europe amounted to 927 thousand tonnes (€412 million). The last five years show an annual value increase of only +0.1%, due to a strong price decrease in recent years.

- There are no data available to distinguish between linseeds that are imported for oil-crushing or for other end uses, or between different qualities or varieties.

- Belgium is the largest importer of linseed in Europe (50% share in volume in 2017), mainly due to its position as a trade hub for this product, via the port of Antwerp, and its crushing activities. Belgium has recorded an annual average increase of +1.4% in volume since 2013.

- Germany is another large importer of linseeds in Europe, with an 18% share in total imports. Since 2013, Germany has registered an annual increase of +6.5% in volume and +2.4% in value.

- Poland and the Netherlands are also significant importers of linseeds in Europe, accounting for shares of 11% and 7.6% respectively in 2017. Dutch imports of linseeds have increased at an average annual rate of +15% in volume (+13% in value) since 2013. Poland’s imports have increased sharply at an average annual rate of +43% in volume and +32% in value over the same period.

Tip:

- Follow developments in the European trade for linseeds and identify developments such as the emergence of new suppliers and decline of established ones. An interesting source to get acquainted with the European market and its trade dynamics is the website of the European Commission’s Trade Helpdesk. The website of FEDIOL also provides annual industry statistics for linseeds and centralises publications which are relevant to the oilseed sector.

- The largest suppliers to Europe in 2017 were Russia (31%), Kazakhstan (21%), Belgium (18%) and Canada (7%).

- In 2009, genetically-modified linseeds (not allowed in the European Union) sourced in Canada were discovered entering Europe, resulting in a dramatic drop in the share of Canadian supplies to Europe, from 41% in 2009 to 7% in 2017 (in volume). The damaged image of Canadian linseed and the country’s lowered competitiveness resulted in a decline of linseed production in Canada.

- The decrease in global production of linseed pushed farmers in the Black Sea area to increase cultivation, resulting in a significant increase in output from countries such as Kazakhstan, Russia and Poland (replacing Canada as Europe’s largest supplier).

- However, Canada is re-emerging as a supplier to the European Union. European Union’s restrictions on the herbicide haloxyfop have re-shifted demand to Canada, where farmers do not use it.

- The share of European imports that originated from developing countries was 25% in 2017, amounting to 234 thousand tonnes (€97 million). In the 2013-2017 period, these imports increased at an annual rate of +21% (in volume).

Tip:

- Identify your potential competitors and learn from them in terms of: 1) Marketing: website, social media, trade fair participation, etc. Examples of well- structured websites include DM Global Marketing (Canada) and Rapid Overseas (India). 2) Product characteristics: origin, quality, oil content, etc. 3) Value addition: certifications, processing techniques.

Exports

- Total European exports of linseed amounted to 350 thousand tonnes (€193 million) in 2017. In the 2013-2017 period, the exported volume increased around +10% annually in volume and +6% in value. A small share of these exports is covered by linseed produced in Europe, but the largest part relates to re-exports from other sources.

- Belgium is the largest exporter in Europe, accounting for 50% of total exports in 2017. Since 2013, the average annual volume of Belgium’s exports has increased by +5.6%.

- Other important exporters are Poland (18% share in volume), the Netherlands (9.0%) and the United Kingdom (6.2%).

- Germany is Europe’s largest export destination for linseed, taking a share of 41% in volume, followed by Belgium (12%) and the Netherlands (11%).

- Linseed is commonly processed as a food ingredient in the industrial bakery and confectionery industry. Its taste and nutritional value make linseed a popular food ingredient for products such as bread, biscuits and cereal bars. It is also crushed for its oil.

Tips:

- The website of FoodDrinkEurope provides insight into consumption patterns of food products, including the use of linseed, across different European countries.

- The websites of Food Navigator and Innova Market Insights can also give you a good overview of market developments for food ingredients in Europe, including linseed.

Consumption

*Apparent consumption: defined as a calculation of (imports – exports) + production.

The latest FAOSTAT production statistics (2018) are included into the calculation for apparent consumption for 2016.

- The total apparent consumption of linseed in Europe amounted to 826 thousand tonnes in 2016, showing an average annual increase of +9.3% since 2013.

- Apparent consumption of linseed in Europe is by far the largest in Belgium, reaching 414 thousand tonnes in 2016. Note that apparent consumption includes industrial demand, such as crushing activities. Belgium exports a share of its processed linseed products under a different trade code (example: linseed oil).

- Other European countries with significant linseed consumption are Germany (143 thousand tonnes) and France (59 thousand tonnes).

- Total linseed crushing in Europe amounted to 667 thousand tonnes in 2017. The majority of crushing is done in Belgium (56% share in volume) and in Germany (23%).

Production

- The total linseed production in the European Union amounted to 148 thousand tonnes in 2016, having increased at an annual average rate of 6% between 2012 and 2016. When compared to the level of apparent consumption (826 thousand tonnes in 2016), it becomes clear that the European Union’s production only supplies a small share of its total market demand.

- The two largest producers of linseed in the European Union are the United Kingdom and France. The United Kingdom produced 48 thousand tonnes in 2016, accounting for around 32% of total European production. France produced 45 thousand tonnes in 2016, accounting for around 30% of total European production. Production in the United Kingdom increased between 2012 and 2016 at an average annual rate of 3%; France’s production increased at an annual average rate of 17%.

- Sweden is another important producer of linseed in Europe, with a total production of nearly 17 thousand tonnes in 2016 (11% of Europe’s production). Sweden’s production decreased at an annual average rate of -8% between 2012 and 2016.

- For 2016, other smaller producers were Belgium (9 thousand tonnes), Poland (8.3 thousand tonnes) and Germany (6 thousand tonnes).

3. Market trends

Exploring the health food market

- The use of linseed as a nutritional and functional ingredient opens up opportunities in the niche market for health food products. The Omega-3 fatty acid content of linseed as well as its dietary fibres are regarded as beneficial to human health and gain increasing popularity.

- The demand for linseed follows the global development of the Omega-3 market. Consumer awareness of Omega-3 in the European Union is estimated at around 90%, but actual consumption is still expected to grow significantly and benefit suppliers. The global market for Omega-3 ingredients is estimated to reach USD 7.49 billion in 2021, from a current value of around USD 3.70 billion.

- The European market for Omega-3 ingredients exceeded 23,500 tonnes in 2014 and is expected to grow in the coming years as a result of favourable regulations on the use of omega 3 as a food ingredient.

- The growing use of linseed as a healthy food ingredient has stimulated the direct consumption of whole and broken seeds. The linseed is sold directly in consumer packaging and can be added to yoghurts, oatmeal, salads etc.

Tips:

- Promote the various applications and health properties (Omega-3, fibres, lignans) of linseed. Make sure to provide your buyer with accurate product specifications and composition details, with a focus on: 1) Product description and code, 2) Origin, 3) Certification(s) [if applicable] and food safety, 4) GMO-free certificate, 5) Production: ingredients, additives, process, 6) Sensorial properties: smell, colour, taste, appearance, 7) Packing: net content, kind of packaging, size, layers, 8) Shelf life, 9) Nutritional values, 10) Analytical properties, 11) Microbiological properties, and 12) Allergy list.

- Make sure your product characteristics and quality match your target market and end-user in terms of: 1) Taste and odour, 2) Purity level & uniformity.

- Stay informed on the news for Supplements and Nutrition trends in the European Union by visiting the Nutraingredients website. Take advantage of the vast amount of information on the growing Omega-3 market and promote your product’s properties accordingly.

Food safety: avoid rejection at the border

- In 2009 and 2010, different shipments of genetically-modified (GM) linseeds were intercepted within imports to Germany and Belgium. The discovery in cereals and bakery products of the so-called Triffid (FP 967), a GM variation that is able to resist herbicides, did not comply with the zero-tolerance policy for GM linseed in the European Union.

- Canada is considered the main country of origin for Triffid and continues to produce this seed type, as it is approved for domestic use as well as for exports to the United States. However, the discovery in Europe directly paralysed Canadian exports to the European market, affecting its position as the main supplier to the region, as described under ‘Trade statistics’.

- More recent warnings in European food safety for linseed were related to different contamination sources such as cyanide poisoning, salmonella, mites and rodents, often originating from Black Sea countries.

Tips:

- On the website of the Rapid Alert System for Food and Feed (RASFF), you can browse through various border rejections and alerts for linseed under different categories: ‘nuts, nut products and seeds’, ‘cereals and bakery products’, and ‘dietetic foods, food supplements, fortified foods’. In this manner, you can learn about common problems faced by suppliers during border controls and adopt appropriate measures to avoid them.

- Take the appropriate pre and post-harvest measures needed to avoid the occurrence of Salmonella, Aflatoxin and other sources of contamination in your seeds. The Empres Food Safety Guide (on the FAO’s website) regarding prevention and control of salmonella and E. coli is a good point of departure.

- Be familiar with FEDIOL’s Hygiene Guides, including set procedures dealing with salmonella and other sources of contamination.

- See our study on Buyer Requirements for the oilseeds market for more information on food safety regulations.

Opportunities for organic certification

- The European market is increasingly demanding more organic-certified linseed for the edible seed industry, especially within the health food segment.

- The market for organic linseed is currently short in supply, resulting in products being sold with premiums reaching up to 40% relative to conventional linseed.

- The competitive position of European producers of organic linseed has remained limited due to low production levels. Germany, for instance, imports around 95% of its organic linseed from non-European Union countries, such as Argentina, China and Russia (FIBL & IFOAM, 2012).

Tips:

- Investigate the possibilities for organic certification, including the opportunities and costs involved in the process. Bear in mind that prices for conventional linseed are fairly low compared to other oilseeds; in this respect, organic certification may represent an opportunity for value addition and to avoid price volatilities. In addition, organic linseed belongs to a niche segment which commands lower volumes than the conventional market, which can be interesting if your supply capacity is limited.

- For information on organic certification in Europe, visit the website of Organic Farming in the European Union, which also contains guidelines concerning imports of organic products. Also consult the International Federation of Organic Agriculture Movements website for information on certification standards.

- See our study on Trends for Oilseeds for more information.

4. What legal requirements must my product comply with?

Contaminants in food: The European Union has laid down maximum levels of contaminants in food, including ingredients such as linseeds. Specifically for linseed, contamination of salmonella can be an issue. See the Market trends section, for more information on food safety and salmonella.

Tip:

- Check out the maximum levels for contaminants in food set by European Union legislation.

Maximum Residue Levels (MRLs) of pesticides in food: European Union legislation has been laid down to regulate the presence of pesticide residues (MRLs) in food products. One important example for linseed is the European Union’s recent restrictions on the herbicide haloxyfop, as described above in this study.

Tip:

- If the linseed has been treated with pesticides, verify that residues remain within limits. For more information, consult the specific European Union legislation: Maximum Residue Levels (MRLs) of pesticides in food.

Genetically modified organisms: It is impossible for most exporters of genetically modified oilseeds to access the European market, due to a zero-tolerance for imports of genetically-modified organisms (GMOs). This can even be the case for GMOs, which are considered safe by the European Food Safety Authority (EFSA).

At this moment, the only genetically modified oilseeds available on the European market are soybeans and rapeseed.

Tip:

- Do not export genetically modified linseed. Read more about the regulatory framework for GMOs in Europe on the website of the European Food Safety Authority (EFSA).

Additives, enzymes and flavourings in food: The European Union has set a list of permitted flavourings and requirements for their use in foodstuffs intended for human consumption, which includes linseed. This is particularly relevant to food manufacturers. However, insight into this legislation can help you to understand their requirements.

Tip:

- Familiarise yourself with the concerns of the end-users of your products by checking European Union legislation on additives, enzymes and flavourings in food.

Hygiene of foodstuffs: Food business operators are required to put in place, implement and maintain a permanent procedure, or procedures, based on the HACCP (Hazard Analysis and Critical Control Points) principles. This also applies to the import of food to the European Union and export from the European Union.

Tip:

- Ensure compliance with European Union legislation on Hygiene of foodstuffs (HACCP).

5. What additional requirements do buyers typically have?

Food safety management: Buyers commonly require their suppliers to have a quality/food safety management system in place. These systems require companies to demonstrate their ability to control food safety hazards in order to ensure that food is safe at the time of human consumption.

Tip:

- Suppliers can apply a basic HACCP system. However, if they aim to supply food manufacturers more directly, it is necessary to have a certified food safety management system recognised by the Global Food Safety Initiative, such as ISO 22000, British Retail Consortium (BRC) or International Featured Standards (IFS) Food. Visit the website of the Global Food Safety Initiative for more information.

6. What are the requirements for niche markets?

Regulation (EC) 834/2007 on organic agriculture: The European Union has established requirements on the production and labelling requirements with which an organic product of agricultural origin must comply in order to be marketed in the European Union as “organic”.

Tips:

- In general, the market for organic linseed is still a niche segment. If you do choose to obtain a certificate for organic production, find out more about Organic production and labelling.

- Make sure that your organic certification is harmonised with European legislation.

- See our study on Buyer Requirements for the oilseeds market for more information.

7. Market channels and segments

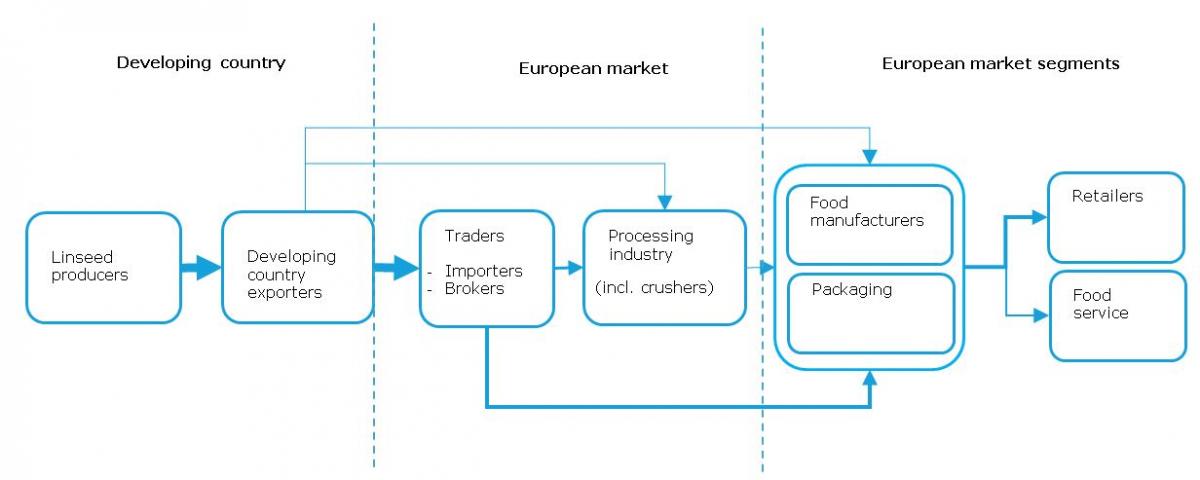

Figure 6: Trade channels for linseeds in Europe

Figure 6 depicts the different steps in the trade channels for linseed as a food ingredient. Even though linseed goes through a similar route, the actual processes are different for the specific segments. As such, the European market for linseed can be segmented based on its end-use within the food sector.

- The edible seed industry can be divided into two different segments. 1) food processing: A large share of linseed is used whole, broken or milled in bakery and confectionery products. These include different applications, for example on the surface of breads or processed in biscuits, cereal bars etc. 2) consumer market (packaging): Direct consumption of linseed, mainly for health purposes. Linseed is sold whole or broken / ground to consumers, to be sprinkled over foods such as yoghurts, oatmeal and salads.

- The crushing industry relates to the production of linseed oil (and linseed cake as a by-product). The oil is used as an edible oil and as an ingredient in paints, varnishes and many other industrial products, whereas the linseed cake is mostly used in animal feed. According to FEDIOL, the total European Union’s crushing of linseed amounted to 667 thousand tonnes in 2017. Most crushing is done in Belgium (56% of total European Union crushing) and Germany (23%).

Next to the conventional application of quality seeds in the food sector, health food niche markets are more frequently requesting organic-certified linseed. This trend is especially true in Western Europe, where buyers are willing to pay a higher price for a higher quality product. As stated previously, the margin for organic-certified linseed can reach up to 40%.

Figure 7: Segmentation of linseeds in Europe

Tips:

- If you are able to supply directly to food processors (or crushers) in terms of volume, as well as consistent delivery and quality, make sure you have adequate quality control systems. The different systems available are described under ‘additional requirements’ above. Make sure to consult your (potential) buyer on the certifications which are required by them.

- If you are dealing with smaller volumes or specialised linseed (e.g. organic-certified), importers are quite certainly the most suitable entry points.

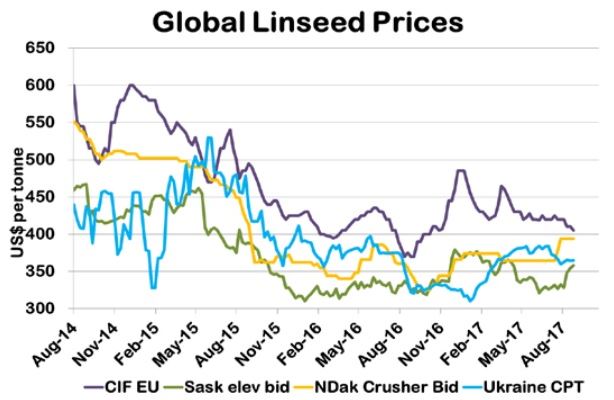

Price

Linseed prices have fallen significantly in recent years due to excess supply. This increase in production was mainly driven by larger harvests in Canada, Kazakhstan and Russia. Rapeseed is gaining popularity at the expense of linseed, which drove linseed prices further down. However, declining North American production in 2017 and rejection of East European and Central Asian supplies due to exceeding herbicide limits may change this scenario and bring prices up.

The following snapshot of the Flax Council of Canada’s “Flax Market Snapshot (September 2017)” shows the global price developments for linseed between August 2014 and August 2017.

Figure 8: Global price developments for linseed (in US$ per tonne) from August 2014 to August 2017

Source: Flax Council of Canada, 2017.

Tips:

- Develop sustainable relationships with buyers in order to profit from the current international scenario for sesame seeds in the long run.

- Develop good market information systems so as to be aware of market movements in linseed worldwide.

Interesting Sources

- The EU Vegetable Oil and Protein meal Industry - www.fediol.eu

- Flax Council of Canada – www.flaxcouncil.ca

- The Food and Agriculture Organisation of the United Nations has a variety of agricultural databases – http://www.fao.org/faostat/en/#home

- For information on the latest market developments in the Oils and seeds sector, visit Agribusiness intelligence.

- B2B marketplace – go4WorldBusiness

Please review our market information disclaimer.

Search

Enter search terms to find market research