Entering the European market for quinoa

The market for quinoa is reaching its maturity stage, which means there is less room to deviate in quality requirements. Ingredient importers and food manufacturers can count on professional and well-organised suppliers. Strong quinoa exporters have raised the level of competition, while most of the European demand is still being fulfilled by Peru and Bolivia.

Contents of this page

1. What requirements must quinoa comply with to be allowed on the European market?

Quinoa must comply with the general market requirements, which you can find in the buyer requirements for grains, pulses and oilseeds on the CBI market information platform. You can also use the Trade Helpdesk, which offers an overview of market access requirements per country using HS code 100850 for quinoa. The most important requirements when exporting quinoa to Europe are food safety, quality and a residue-free product.

What are mandatory requirements?

Food safety: Traceability, hygiene and control

The most important requirement for quinoa is to make sure it is safe for consumption. Food safety and traceability should be your top priority. Non-compliance can lead to temporary import stops or to stricter control from your origin country. As a supplier, you must make sure to work according to the guidelines of Hazard Analysis and Critical Control Points (HACCP).

One of the main concerns for quinoa are pesticide residues, as it is the most common problem identified by European buyers. Buyers in Germany are among the most alert companies for (excessive) pesticide residues. Conventional quinoa must stay within the limits of the Maximum Residue Levels (MRLs) allowed by European regulation and organic quinoa must not have any chemical traces.

Contaminants such as Aflatoxins and micro-organisms such as Salmonella, E.Coli and Listeria monocytogenes must be absent or within the limits according to the European legislation. Be aware that the requirements for quinoa in baby food are more stringent.

Tips:

- Read more about pesticides, contaminants and micro-organisms on the website of the European Commission. Find out the MRLs for pesticides and active substances that are relevant for quinoa by consulting the EU MRL database; Search for quinoa or for ‘buckwheat and other pseudocereals’ (code number 0500020).

- Reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

- Pre-test your quinoa through a recognised laboratory, preferably the same laboratory as your client to avoid differences in testing methods. Use only representative samples.

- Read about your key obligations in Europe as a food and feed business operator.

Nutritional claims must be officially recognised

Quinoa has become a popular ingredient due to their assumed health benefits, but you cannot claim or promote health benefits that are not approved by the European Union. Any nutrition and health claim should only be made in accordance with the requirements of the Health and Nutrition Claims Regulation (EC) No 1924/2006.

Tip:

- Check with the EU Register on nutrition and health claims to see which claims are allowed to be made in the European market.

Quality requirements according to the new standard 2019

In 2019, the Standard for Quinoa was adopted in the FAO Codex Alimentarius. The standard provides a guideline for the minimum quality of quinoa and applies to quinoa suitable for human consumption, packaged or in bulk. When exporting your product, you can refer to this standard or provide your own product data sheet.

The general quality requirements prescribe that quinoa must be:

- safe and suitable for human consumption;

- free from abnormal flavours and odours;

- free from living insects and mites.

- Within the limits of grain purity and content (see table 1 below)

Table 1: Requirements for quinoa grain purity and content

| Moisture content |

Max. 13.0% Lower moisture limits should be required for certain destinations in relation to the climate, duration of transport and storage. |

| Protein content | Min 10.0% on a dry matter basis |

| Saponin content | Max. 0.12% |

| Extraneous matter |

Organic extraneous (husks, stem parts, impurities of animal origin, other seed species, and leaves): max. 0.1% Inorganic extraneous (stones): max. 0.1% |

| Broken grains | Max. 3.0% |

| Damaged grains | Max. 2.5% |

| Germinated grains | Max. 0.5% |

| Coated grains | Max. 0.3% |

| Immature grains | Max. 0.9% |

Size preferences vary

There is not yet an agreement on size grading. Generally, you can follow the indication below (table 2). Buyers can have different grain size preferences, depending on their use and end clients. For example, for making puffed quinoa or quinoa flakes, a larger size may be required. Sorting machines and delivering a uniform product is strongly recommended, if not required by your buyer.

Table 2: Indicative size grading for quinoa (not compulsory)

| Grain size | Range (mm) |

| Extra large | >2.0 |

| Large | 2.0-1.7 |

| Medium | 1.7-1.4 |

| Small | <1.4 |

Packaging and shipment

Common packaging methods for quinoa grains are 25kg polypropylene or multi-layer paper bags. For organic grains, paper is often preferred. The packaging must be suitable to protect the product and must conform to the Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food. For shipments you can use pallets, or stack the bags directly in the container with protective liners between the quinoa bags and the container walls.

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

What additional requirements do buyers often have?

Certifications as a guarantee

As food safety is a top priority in all European food sectors, you can expect most buyers to request extra guarantees from you in the form of certification. Food management systems and certifications that are recognised by the Global Food Safety Initiative (GFSI) are widely accepted throughout Europe.

For quinoa processors (cleaning and packing), a recognised food safety management system is a necessity to become a supplier to European buyers. As a supplier, you may find one of the following certification schemes useful, depending on the role you play in the supply chain (production, distribution or processing):

- GLOBALG.A.P. (agricultural production);

- Food Safety System Certification 22000 (FSSC 22000 /ISO 22000);

- BRCGS for Food Safety (British Retail Consortium);

- IFS Food Standard (International Featured Standard).

Tips:

- Check with your buyer to determine which certification scheme is most relevant for your target market.

- Read the CBI tips for Organising your export and CBI Buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform to get more detailed insights on the advantages of certifications.

Organic certification

An organic label is a common requirement for ‘health’ ingredients such as quinoa, which is why a large part of the current demand consists of organic certified quinoa.

In order to market organic products in Europe, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Note that, starting January 2021, the new legislation Regulation (EU) 2018/848 will come into force.

Traditionally, most organic quinoa is cultivated in the highlands where there is less risk of pests. It is much more difficult to cultivate organic quinoa in lower regions.

Tip:

- Consider organic as a serious option if your situation and location permit it. Remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process to market organic products. Read more about organic certification in the CBI study on buyer requirements for grains, pulses and oilseeds in Europe.

Sustainability and social compliance

European buyers are increasingly paying attention to corporate social responsibility (CSR) concerning the social and environmental impact of their business. As an exporter, you are part of the supply chain and share this responsibility.

Buyers will often have you fill in a set of documents and declarations before doing business or ask you to comply with a code of conduct. Applying standards and certifications will help you fulfil the expectations of buyers. Initiatives or certification schemes that can help improve your CSR performance, are:

- The Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct;

- The Ethical Trading Initiative (ETI);

- Sedex Members Ethical Trade Audit (SMETA)

- GlobalG.A.P.. and GlobalG.A.P. Grasp

Tips:

- Use the ITC Standards Map to learn about the different sustainable and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct. You can also find many practical tools in the amfori BSCI resources.

What are the requirements for niche markets?

Organic, sustainability and social compliance have become part of the main buyer requirements. Only consumer labels for fair trade practices, such as Fairtrade International and Rainforest Alliance, remain niche requirements in the quinoa business for which you need very specific buyers.

Tip:

- Read about the different social programmes and initiatives in the CBI study on buyer requirements for grains, pulses and oilseeds in Europe.

2. Through what channels can you get quinoa on the European market?

Quinoa has a strong presence in the health food market, but it has also reached most common food channels. Quinoa grains are available in different variations in quality (organic), type (Royal Quinoa) and colour and has found many uses as an ingredient. Specialised importers remain the main entry route to the European market, but the role of food manufacturers and food brands is increasing.

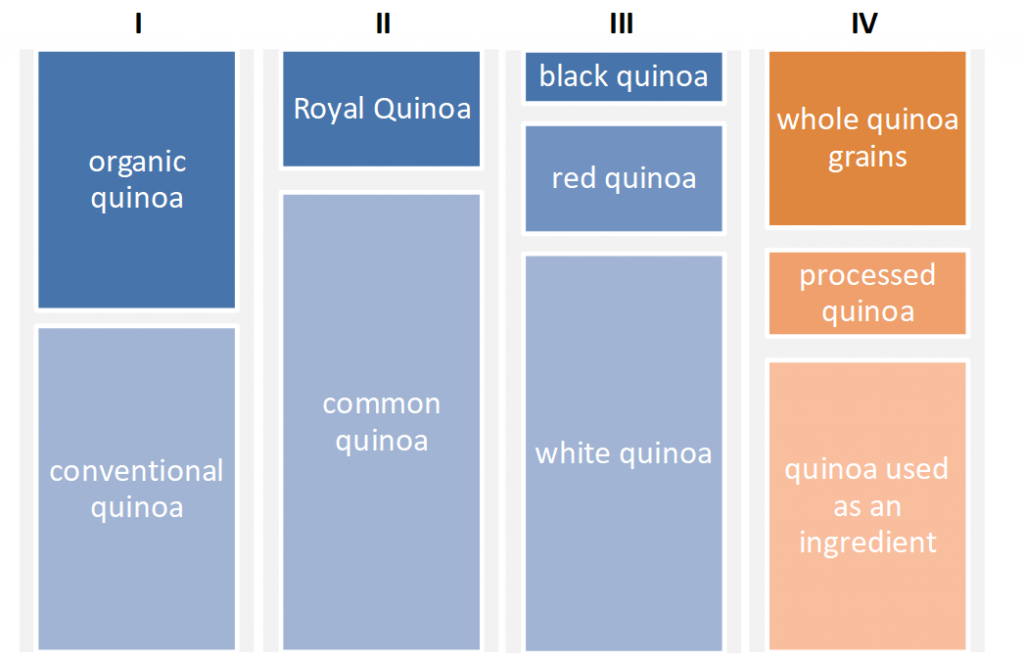

How is the end-market segmented?

Quinoa is no longer a niche product and nowadays is sold by all major retail channels and food service providers. White quinoa is the most common commercial grain, but there are interesting smaller segments for coloured quinoa (red, black or mixed). In Europe, these coloured varieties are often sold for higher prices. Royal quinoa is also a niche segment, although it lacks promotion and is therefore not yet widely recognised by consumers.

One of the most relevant segments is the organic segment. The organic segment for quinoa is estimated to be much larger than the overall market share of organic food (which is generally between 4 and 11% depending on the European country).

Besides packaged (whole) quinoa grains, there is also an additional segment for processed quinoa such as flakes, flour, puffed or pre-cooked quinoa, as well as quinoa used as an ingredient in other added-value products. However, the processing and product development most often take place in Europe to maintain high flexibility and keep marketing and food-safety in own hands.

Figure 1: General impression of the European market segments for quinoa

Note: This figure shows a general depiction of the European market based on general market research and does not represent true values

According to Innova Market Insights, the number of global product launches with quinoa and quinoa derivatives has grown by an average of 20% annually since 2014, to 209 new product launches in 2018. With 42%, Europe has the highest share in these product launches.

Ready-made meals and side dishes, cereals and bakery products lead the list, followed by snacks and baby food. In many products, quinoa is often used together with rice, oats, flaxseed and chia.

Gluten-free (47%) and organic (34%) are the most important claims made for quinoa products, but the vegan claim is strongly upcoming (from 20% in 2014 to 28% in 2018).

Tip:

- Perform store checks or search online for quinoa products that are offered in Europe. This gives you a good idea about the relevant segments for quinoa, but it can also provide leads. Behind every brand is a supply chain with potential buyers.

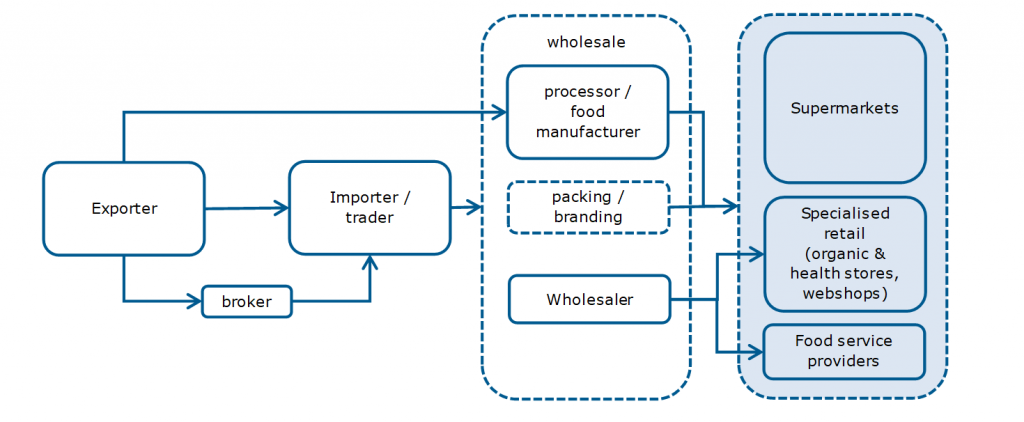

Through what channels does a product end up on the end-market?

Importers of ingredients are the most relevant in the supply chain of quinoa, especially importers of health and organic ingredients. Part of the quinoa is packed and sold to the retail or wholesale channel, but the number of food manufacturers that use quinoa in added-value products is increasing.

Importers or traders

Most of the quinoa is imported into Europe by traders of special ingredients. They have an important role in checking the quality and food safety specifications of the product, as well as in the distribution to smaller users and resellers. Distribution and wholesale activities are sometimes combined with services to pack or process quinoa under private label.

Importers of quinoa are generally health ingredient companies, grain traders or importers of organic food. Some of these companies have processing and packing facilities to fulfil the needs of food manufacturers and food brands.

Among these importers are, for example:

- Tradin Organic, specialised in organic food ingredients;

- Rhumveld, specialised in superfoods;

- Ziegler organic, organic grain trader with processing facilities;

- Ecoterra, importer and processor of organic and ancient Andean seeds;

- Sabarot, importer and supplier of packaged or bulk cereals and pulses.

These importers supply a variety of different wholesalers, food service suppliers, and food brands or manufacturers. Private label packaging (and sometimes even own brands) provide importers with access to brand distributors such as UDEA or retail formulas such as Biocoop and Alnatura.

Brokers

Some of the quinoa grains are traded through brokers. These are often individuals or small companies that link your product to buyers in Europe and take a commission on the sales. Their function is purely commercial, and as a supplier, you will remain responsible for most of the logistical process. Examples of brokers that deal with quinoa are Cogeser and Pedro Grains Sagl (examples are not validated contacts).

Brand owners and food manufacturers

Brand owners and food manufacturers turn quinoa into a commercial food ingredient or end product. These actors need a reliable supply chain and stability, so they often work with medium- or long-term contracts. If quinoa is a major ingredient in their business, direct contracts with producers can be made as well.

Quinoa is typically used by health food developers and grain packing and processing companies. These include companies such as:

- NatureCrops, which develops food with quinoa as a base ingredient;

- Wessanen, a multiple brand company that includes brands such as Alter Eco, (a brand with packaged quinoa) and Bjorg (a food developer that uses quinoa as ingredient);

- Ekibio Groupe, a multi-brand food company that markets organic brands with a story;

- Ebro Foods, which owns brands that pack and mix quinoa such as Tilda and Lassie (traditionally rice packers);

- Pedon, a packing company and food developer of grain and pulse products;

- Damhert, a producer and distributor of functional nutrition and health food products.

Most of the mentioned companies are large users or have a strong interest in quinoa as an ingredient. Several of them have got involved in the sourcing process and buy their quinoa on the international market.

Figure 3: Market channels for quinoa

Tip:

- Try to find buyers that can provide continuity for your business. Many importers and food brands need a continuous supply of quinoa, and long-term contracts provide you both with stability and supply security.

What is the most interesting channel for you?

For quinoa exporters that are new on the European market, it can be a challenge to squeeze into the established trade relations. The best way is to find a specialised importer or broker of (healthy) grains and food ingredients that is willing to expand their supplier network. Experienced importers regularly travel to their supplying countries and understand the challenges of buying quinoa.

However, the growth of quinoa as a commodity is largely driven by food developers that are interested in using quinoa as an ingredient. Food manufacturers and food brands can be your next target group once you have proven yourself as a reliable and stable supplier.

3. What competition do you face on the European quinoa market?

The quinoa trade is dominated by a few producing countries. Exporters in these countries are becoming large, professional operations. When exporting to Europe, you have to take into account the well-established buyer relations, but also the increasing competition from local producers.

Which countries are you competing with?

Peru, Bolivia and Ecuador are responsible for 99% of the European import of quinoa. There are only very minor volumes from India, Canada, Colombia, Turkey and the United States (10 to 180 tonnes in 2019). Most of the additional competition comes from the increasing production within Europe.

Peru: Leading the supply

Peru has been the leading quinoa supplier to Europe since 2014. The country has successfully exploited the commercial opportunities for quinoa. Production in Peru has been growing steadily since 2015, but in the last three years, their overall quinoa export declined slightly and the market share in Europe stabilised. At 17 thousand tonnes, the European Union imported a similar volume from Peru in 2019 as it did in the year before. In Europe, the main buyers of Peruvian quinoa are France, the Netherlands, United Kingdom and Italy.

Peru has several advantages over Bolivia, the second largest quinoa producer; the yields are generally higher in Peru, and the country has its own seaports for exporting quinoa.

Peru has managed to set up a competitive supply chain of bulk exports to Europe, United States and Canada and uses its position to open new markets, such as China. Despite the slower growth in major buying markets, Peru is expected to remain the dominant quinoa supplier.

Bolivia: An origin country with an upward trend

Bolivia took presidency of the FAO 2013 International Year of Quinoa, putting their ancient quinoa grain on the international map. Quinoa is a native crop in Bolivia with a large number of small producers in the highlands. The yields are generally low, which makes it more difficult for them to compete against Peru.

In the last four years, production volumes climbed slowly by one or two thousand tonnes annually. But, more importantly, the yields have improved from an all-time low of 551 kilos per hectare in 2016 to 658 kilos per hectare in 2019.

While having so many smallholders and a unique highland climate, the country has good potential to produce organic quinoa. Another niche that the Bolivian sector created is the Denomination of Origin for Royal Quinoa, a large quinoa grain variety that is exclusively grown in a certain area of the Bolivian highlands (‘altiplano’).

The European import from Bolivia still shows an upward trend and reached nearly 10 thousand tonnes in 2019. Its principle market is mainland Europe with countries such as France, the Netherlands and Germany.

Ecuador: A minor role in the European supply

Ecuador plays a very minor role in the European demand for quinoa. The quinoa production in Ecuador is only a few thousand tonnes, and most of it is exported to northern America. European buyers easily overlook Ecuador and focus on the competitive and high-volume producers in Peru and Bolivia.

Ecuador has not been able to be price competitive with Peru and Bolivia, so it needs to differentiate in other ways. Some Ecuadorian exporters promote a local ‘sweet’ quinoa variety called Tunkahuan, while other companies such as Kinuwa have resorted to added-value products.

European producers increase the level of competition

Besides the main producing countries in South America, most of the additional competition comes from Europe itself. Countries such as the Netherlands, France and Spain have successfully started to cultivate quinoa locally.

Local products are often favoured and considered to be more sustainable, even though the cost price is higher. The competition from within Europe is increasing, but the production does not yet match the large volumes of South America, nor can it fulfil all of the growing demand. It will, however, make European countries a little less dependent on its foreign producers.

In the long term, quinoa cultivation is expected to increase, although it will be gradual according to the demand. In 2018, the German Kiel University already mentioned that new genotypes will make larger scale production possible within five years.

Tips:

- Do your research and experiment with different quinoa varieties. Match the variety with your climate to obtain the best yields and to increase your competitiveness.

- Differentiate in quality (organic, social labels, variety) or in added value if you cannot compete on price.

Which companies are you competing with?

Quinoa has become a commodity on a global level, and so will the competition! Companies with large-scale operations and economic power make it harder for new suppliers to enter the market. Quinoa has entered a maturity stage in which only the most professional companies can be successful.

Alisur: Peru’s largest quinoa exporter

Alisur is specialised in Andean grains and is Peru’s largest quinoa exporter with an (FOB) export value of around 20 million US Dollars in 2019 according to Agrodataperu. Besides quinoa, the company also offers chía, kiwicha, maize and cañihua.

In the past 20 years, Alisur has expanded its business, and now maintains five processing plants throughout the country with advanced sorting equipment and certified food safety standards. Their superior post-harvest processes and their online presentation make an impeccable impression. The company is also present at the main food trade fairs in Europe.

Alisur proves that investment in processing and commerce are essential to becoming a successful supplier of quinoa.

Olam Andina Peru: Economic power

Olam launched its ‘superfoods business’ in 2017, and in 2019, Olam Andina Peru became the second-largest exporter of quinoa in Peru from out of the blue. These types of multinational agri-business industrialists have the economic power to build strong global supply chains and invest in production and processing.

Their participation in the quinoa trade is a threat for many of the smaller and traditional quinoa exporters in the Andean region, especially for those who are dealing with large bulk users or global food developers.

Olam has chosen to work with quinoa farmers in Peru, but origin is not always a key element for the general food industry. The fact that non-traditional competitors will play a larger role in the future is also confirmed by the new cooperation between the Canadian company NorQuin and Ingredion to globally distribute American-grown quinoa ingredients such as high-value quinoa flours.

Andean Valley: Leading in processing capacity

Andean Valley in Bolivia claims to have the largest quinoa processing capacity in the world using state-of-the-art technology. It reaches out to foreign markets through distributors and their own sales companies. In Europe, they export to France, Germany, Spain, United Kingdom and Denmark.

The company works with multiple communities, with around 4000 hectares for cultivation. They support and assist in techniques to grow and manage organic Royal Quinoa from seeding to post-harvest.

The Bolivian background provides the company with the genuine story of the ancestral quinoa grain. However, this inevitably goes together with good entrepreneurship and striving for a fully certified and superior quality grain.

Tips:

- Work efficiently and use the best available processing plants or equipment to clean quinoa. Compare and match your quality standards with your competitors.

- Focus on the right clients. Target potential clients that fit your profile and that see advantages in doing business with you instead of the multinational or large-scale businesses. As a small exporter, you can make a bigger difference by supplying small food brands or independent importers, while with major buyers you will likely lose all negotiation power.

Which products are you competing with?

Quinoa is a multifunctional ingredient that can be cooked as a side dish or used as an ingredient for a wide range of products. There has been little competition from other healthy grains replacing quinoa, but this does not mean it cannot happen in the future. Other nutritious and ancient grains such as fonio and teff have the potential to take away some of the success of quinoa.

Grains and seeds that pose most threat to the quinoa market share similar properties: gluten-free, nutritious, rich in protein, multifunctional, ancestral background or ancient grain, etcetera.

Tip:

- Always diversify your business and avoid becoming dependent on one single product. You will make your company more attractive to buyers when offering a wider assortment of products, but you will also reduce the impact of market fluctuations.

4. What are the prices for quinoa?

After the strong growth in demand in 2014-2015, the production increased significantly and pushed the European import price for quinoa down to around 2 euros per kilo. Suppliers without strong buyer connections cleaned out their stocks for prices below 2 euros per kilo. Prices remained low until 2018. Meanwhile, Peru has become the main benchmark for quinoa prices. Bolivian prices have been higher, partly because of the lack of efficiency and competitive power compared to Peru, but also due to a higher share of organic quinoa.

In 2019, there was a small recovery. The production seems to have become more in line with the demand and the Chinese buying activity from both Peru and Bolivia have had an upward impact on the prices. The 2020 crop is expected to be good. However, both Bolivia and Peru have been facing lockdowns due to COVID-19, making quinoa processing and export more challenging. It is still unsure what the influence of the Chinese demand and the restrictions of COVID-19 will have on the trade value of quinoa. Product availability and expected production volumes will be an important factor to monitor.

In general, a realistic import value for conventional quinoa in the long term will be between 2 and 2.5 euros per kilo, while organic quinoa can be sold with a 10 to 20% premium.

The breakdown margins for quinoa depend on the fluctuations in producer price, grain quality and the level of processing. You can expect importing companies to have a gross margin of around 15%. It can be higher when cleaning processes or re-packing take place in Europe. Most of the value of the end-product is consumed by food brands and retailers due to their high costs of processing, marketing and human resources.

Tip:

- See the price development of quinoa for two major exporters in the graph of Prices of Quinoa: Alisur vs Vinculos Agricolas by Garay Company.

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research