Entering the European market for sesame seeds

Sesame is a common ingredient in Europe and food manufacturing. Trading sesame seeds can be a volatile business because there are many producing countries worldwide. To compete in this market, you need to prove yourself to be an adequate supplier, which means you have to control the risks of microbiological and chemical residues.

Contents of this page

1. What requirements and certifications must sesame meet to be allowed on the European market?

As with all food products entering the European Union (EU), sesame has to meet general food safety and quality requirements. The CBI study on the requirements for grains, pulses and oilseeds on the European market provides a complete summary of requirements that you need to meet to put your product on the EU market. You can also use My Trade Assistant to look up information on product rules and requirements, using the HS commodity code for sesame (12074090), the origin and the destination country.

What are mandatory requirements?

The most important aspects of exporting sesame seeds to Europe are food safety, quality and having a residue-free product. Sesame must be safe for human consumption. Food safety and traceability should be your top priorities.

Controlling food safety in sesame seeds

To guarantee that your sesame meets EU food safety standards, you should test your product and ensure traceability throughout your supply chain. There are maximum residue limits (MRLs) for pesticides, active substances and contaminants. Microbiological contamination, such as from Salmonella or E.coli, must be avoided at all times.

The main challenge of supplying sesame to Europe lies in complying with the MRLs and microbiological parameters. Over the past few years, there have been a lot of incidents involving Salmonella in sesame and with ethylene oxide being used as a sterilising agent. Ethylene oxide is not allowed in Europe, and the maximum residue limit for ethylene oxide in sesame is 0.05 milligrams per kilogram. Due to the potential risks, the European Union has increased border controls for sesame being imported from several origin countries (Table 1). You can find a record of food safety incidents in the Rapid Alert System for Food and Feed (RASFF) Window.

For imports from Latin America and China, growing attention is being paid to Fosetyl-Al and phosphonic acid residues, especially in the organic sector. Phosphonic acid can be present as a degradation product of the fungicide fosetyl. However, it can also originate from other sources, such as authorised fertiliser. Producers claim that the contamination can also have natural origins. For sesame, the MRL for Fosetyl-Al (sum of fosetyl, phosphonic acid and salts, expressed as fosetyl) is 2 mg/kg. In organic products, there can be no detectable traces of these residues. Be aware that phosphonic acid is not included in standard laboratory multi-residue analyses.

Table 1: Increased border controls (July 2024)

| Origin Country | Hazard | Frequency of identity and physical checks |

| India | Salmonella and pesticide residues | 30% |

| Nigeria | Salmonella | 50% |

| Ethiopia | Salmonella | 50% |

| Sudan | Salmonella | 50% |

| Uganda | Salmonella | 30% |

| Turkey | Salmonella | 20% |

| Syria (tahini and halva) | Salmonella | 20% |

Source: Regulation (EU) 2019/1793 (July 2024)

When cleaning and exporting sesame seeds, you must work according to the guidelines of Hazard Analysis and Critical Control Points (HACCP). Having a monitoring and management system can help eliminate the risk of food safety incidents. A growing number of companies are using sterilisation technologies like ozone treatment, UV-C and infrared. Regulation on these technologies is not always clear, and you will find different professional opinions in the trade. It is best to discuss preferred cleaning methods with your buyer.

Green Deal

In 2020, the European Union implemented a set of policies and actions called the European Green Deal. The Green Deal aims to make the European economy more sustainable and climate-neutral by 2050. The plan also includes a 50% reduction in the use of pesticides and making 25% of farming land organic by 2030. This will likely gradually decrease pesticide residue levels in the coming years.

Tips:

- Find out the Maximum Residue Levels (MRLs) for pesticides that are relevant for sesame seeds. Search for ‘Sesame seeds’ (code number 0401040).

- Read the information sheet on phosphonic acid by Skall, the Dutch control body on organic food.

- Reduce the amount of pesticides you use by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management to grow healthy crops and minimise pesticide use.

- Read key regulations like Regulation (EU) 2023/915 (April 2024) on the maximum levels for certain contaminants in food and Regulation (EU) 2019/1793 (July 2024) on the temporary increase of official controls and emergency measures that govern the entry of certain goods from certain third countries into the Union. EU regulations are constantly updated.

- Analyse your sesame seeds for export to Europe to check if you meet the food safety requirements. Make sure to use a recognised laboratory.

Nutrition and health claims

Think about the European guidelines when promoting the health benefits of sesame seeds. You cannot promote health benefits that are not approved by the European Union. Any nutrition and health claims should only be made in accordance with the requirements of Health and Nutrition Claims Regulation (EC) No 1924/2006 (consolidated version of 13/12/2014). General claims, such as ‘healthy’ or ‘superfood’ are allowed if they are presented with a specific permitted health claim.

Tip:

- Read with the EU Register of Health Claims and the Permitted nutrition claims to see which claims can be made on the European market.

Harvest and post-harvest management

Quality starts at farm-level. Most quality issues occur during production, harvest and post-harvest practices. Most sesame farmers are smallholders with basic tools. To avoid losses, farmers should harvest sesame at the right time and dry the pods carefully. Moisture is the enemy for quality sesame and can lead to mould. For threshing, having clean tarpaulin is critical to keep the seeds separate from dirt and stones.

Before exporting sesame to Europe, sesame should pass through a cleaning facility that complies with quality and food safety standards.

Packaging

For export, sesame is mostly packed in 25 kg bags or big bags of up to a tonne. The bags can be either be made from polypropylene or multi-layered kraft paper, depending on client specifications. The organic market usually prefers paper because it is considered more sustainable.

Packaging must be suitable to protect the product and conform to Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food (version 27-03-2021).

Labelling

Sesame for export requires standard labelling. Read about it in the CBI’s buyer requirement report on grains, pulses and oilseeds. It is only mandatory to include additional information as described in Regulation (EU) No 1169/2011 on the provision of food information to consumers (consolidated version: 01/01/2018) when marketing sesame or sesame products to consumers.

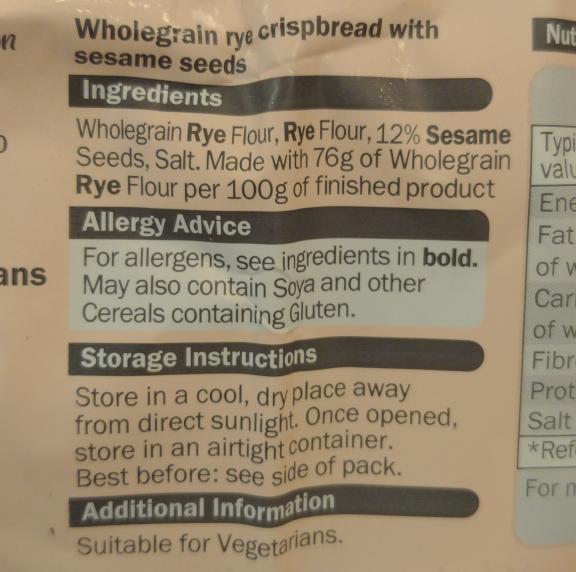

All consumer products require nutritional information. In the case of sesame, you have to clearly indicate that sesame is a potential allergen. This means that you must highlight the presence of sesame in the list of ingredients, for example, by using a different font, font size or background colour (Figure 1). Labels must also indicate the potential presence of other allergens, such as peanuts or nuts.

Figure 1: Example of an information label on a consumer product with sesame

Source: Photo by klaxon8791 per Open Food Facts (retrieved 2024)

Storage

After drying and cleaning the seeds, sesame is best kept in a suitable storage area. Stored sesame needs a low moisture level of <6%. The recommended temperature is 15–25° Celsius, and the best relative humidity (RH) is around 50%.

Your warehouse should be well ventilated. Ideally, you should place the bags with sesame on pallets at a distance from the wall.

Hermetic storage can prolong the shelf life and quality properties of sesame. For example, look at vQm Packaging and VacQPack vacuum packaging solutions. In addition to improving the keeping conditions, pests like mites, Indian mealy moth, weevils and flour beetles will be unable to reach the sesame seeds.

Figure 2: Harvesting and storing sesame

Source: Access Agriculture (2016)

*Note: Use clean tarpaulin and avoid contact with cow dung

Tips:

- Always discuss specific packaging requirements and preferences with your customers. Prepare for different using packaging preferences and make sure it is of good, food-grade quality.

- Read the CBI buyer requirements for grains, pulses and oilseeds for additional information on packaging and labelling.

What additional requirements and certifications do buyers often have?

There are no official quality standards for sesame seeds. Besides following the European food safety legislation, consult your buyer on their specifications and preferences.

Quality management and grading

The required quality will depend on your buyer’s specifications. Different buyers and market channels may need different quality grades. The main grading criteria for sesame include colour, purity, oil content and seed quality. For oil millers, oil content is more important than physical appearance. Table 2 shows an indicative grading for minimum and high-quality sesame. Sesame seeds must not have a high moisture level or an off-odour.

Seed cleaning facilities need to remove foreign matter such as dirt, stones, seeds from other plants and foreign materials. Metal detection and in-line magnets are highly recommended by buyers, if not required. More advanced suppliers add colour sortex technology for a uniform and premium product. Buyers will expect consistency in product quality.

There are also different types of processes you can add, such as hulling and toasting. Hulling should preferably be a natural process that does not use chemicals.

Table 2: Indicative quality grading for minimum and high-grade sesame seeds

| Minimum grade | Highest grade | |

| Purity | >97.00% | >99.99% |

| Foreign material | <3.00% | <0.02% |

| Moisture | <7.5% | <5% |

| Colour differentiation | <10.00%/mixed | <0.02% |

| Damaged or broken grains, cortical damage | <10.0% | <0.4% |

| Oil content | >45% | >52% |

| Immature kernel | <0.50% | <0.30% |

| Free fatty acid (FFA) | <2% | <1% |

| Colour | Brown/mixed colour seeds | Uniform white/creamy white/black |

Source: Industry sources (2024)

Tips:

- Maintain strict compliance with quality and deliver the quality agreed on with your buyer. Include a product data sheet and certificate of analysis when offering your sesame. Being careless with your standards will give buyers a reason to claim on quality issues.

- Comply with your local quality standards. Check for example Tanzania standard for sesame seeds, the final draft East African standard for sesame or the Rwanda standard for sesame seeds. You can search for international standards in the European Commission’s Technical Barriers to Trade (TBT) database. For an example overview of premium, standard and lower grade sesame, look at the offer of the Indian company Sheetal Industries.

Certifications as a guarantee

Certifications are a good indication of your compliance with food safety requirements. They assure buyers, but buyers do not rely only on certifications. Your understanding of quality and food safety is crucial to gain their trust. Working in accordance with high quality standards and a HACCP-based food safety standard is just as important as the certification itself.

To get certified, it is best to implement a standard that is recognised by the Global Food Safety Initiative (GFSI). These standards are widely accepted throughout Europe. Common certifications include:

- FSSC 22000/ISO 22000 (Food Safety System Certification)

- BRCGS for Food Safety (British Retail Consortium)

- IFS Food Standard (International Featured Standard)

Tip:

- Read the CBI’s tips for organising your export and the CBI’s buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform for more detailed insights into the advantages of certifications.

Organic certification

Organic is a specialisation. Organic farming works in harmony with nature. It includes a set of natural practices that increase biodiversity and soil fertility, such as cover crops, crop rotation, intercropping and composting.

There are many European buyers that deal with organic sesame. To market organic sesame in Europe, you have to use organic production methods that comply with Regulation (EU) 2018/848 (consolidated version of 21/02/2023). You can apply for an organic certificate from an accredited certifier. Once you are certified, you can use the EU organic logo, shown in Figure 3. The whole supply chain must be certified, from farmers to exporters.

Figure 3: The EU organic logo

Source: European Commission (retrieved 2024)

Tips:

- Consider organic cultivation if your situation and location permit it. Organic sesame can get you into a very interesting niche market. However, remember that implementing organic production and becoming certified also needs investment. The conversion time from conventional to organic sesame is three years, and there are certification costs for all actors in the supply chain.

- Use the 20 steps to improve organic sesame production published by the Research Institute of Organic Agriculture FiBL. Find other technical guides in the FiBL shop.

- Look into the possibilities of group certification if you are part of a small farmers’ group. IFOAM – Organics International provides training manuals for smallholder group certification with Internal Control Systems (ICS). They also try to make organic certification accessible for small farmers with Participatory Guarantee Systems (PGS). However, PGS needs to be recognised by the European Union. Read more about how to certify a group of smallholders in the IFOAM position paper Smallholder Group Certification for Organic Production & Processing (PDF).

- Find the list of approved control bodies and authorities for applying equivalent standards and control schemes in non-EU countries.

What are the requirements for niche markets?

European buyers are paying increasing attention to sustainability and corporate social responsibility (CSR). As a processor and exporter, you share the responsibility for ensuring a sustainable supply chain.

Sustainability and social compliance

Buyers will often need you to fill out a set of documents and declarations before doing business. Alternatively, they may ask you to comply with a specific code of conduct. Applying for standards and certifications will help you meet buyers’ expectations. Initiatives and certification schemes that can help improve your CSR performance include:

- Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct (PDF)

- Sedex Members Ethical Trade Audit (SMETA)

- GLOBALG.A.P. and its Risk Assessment on Social Practice (GRASP)

- Ethical Trading Initiative (ETI), which uses the ETI Base Code

- Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct (PDF)

- Sedex Members Ethical Trade Audit (SMETA)

- GLOBALG.A.P. and its Risk Assessment on Social Practice (GRASP)

- Ethical Trading Initiative (ETI), which uses the ETI Base Code

Another option is a consumer label for social or sustainable conduct. You can make it visible to consumers. Possible social labels include:

- Fair for Life

- Fairtrade International

- Rainforest Alliance (not a key commodity)

Kosher and Halal certification can be relevant for specific consumer groups.

Tips:

- Use the ITC Standards Map to learn about the different sustainability and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI Code of Conduct (PDF). You can also find practical tools through the amfori BSCI platform.

2. Through which channels can you get sesame on the European market?

There are many market segments and potential buyers to explore. You can make yourself an attractive supplier by listening to the different market needs. You can reach more demanding clients, such as food manufacturers, with experience and consistency in quality and volume.

How is the end-market segmented?

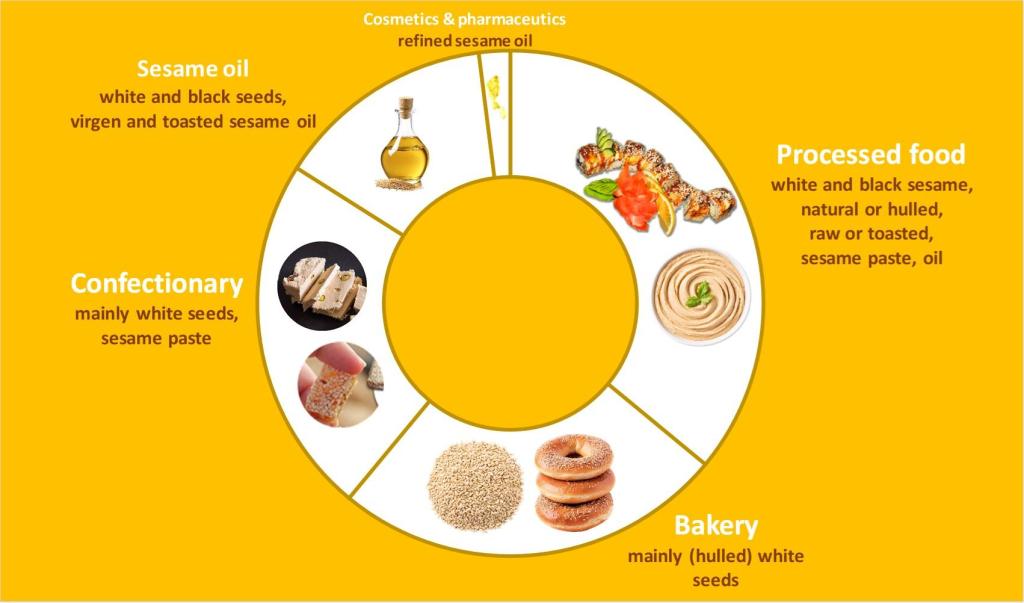

You can find sesame in many product applications. Food processors, bakers and confectionary producers are responsible for the majority of sesame uses. Another way to segment the sesame market is by product and consumer type.

Figure 4: Indicative visualisation of the market segments for sesame seeds

Source: ICI Business (2024), based on Fortune Business Insights and industry sources with images from pixabay (2024)

Segmentation in applications: Processed food, bakery and confectionary

Sesame has a large number of applications. Most applications for sesame are food related. Figure 4 gives a suggestion of market segments based on industry sources.

Processed food is likely to be the biggest category. It includes sesame paste (tahini), hummus, spice mixes (gomashio) and prepared foods, such as salads, sauces and sushi. For home cooking, retail packaged sesame is available for consumers in supermarkets, Asian stores and online shops.

The bakery industry and the confectionary industry complete the top three segments that use sesame. Sesame is mainly used as a topping for bakery products like bread and buns. Premium seeds may be used to give baking products a luxury appearance. In confectionary, there are many sweets and snacks like sesame-honey bars, halva and sweet biscuits.

Sesame oil can be pressed in Europe, but some buyers also import sesame oil from origin. Toasted sesame oil is a popular tastemaker in Asian cuisine. Virgin sesame can be used for stir-frying or as a seasoning. A small percentage of sesame is ends up in the cosmetic and pharmaceutical industry.

Segmentation in product and consumer types

Product and consumer types are another way to consider market segments. People who buy sesame or sesame products include traditional and health oriented consumers. There are different consumer groups and various forms of sesame: white or black variety, raw or toasted, hulled or natural, oil, paste and flour.

Most consumers already eat white sesame seeds in bakery products. Products introduced by traditional consumers use natural (unhulled) sesame, sesame paste, both black and white sesame, and toasted sesame oil for stronger flavour. This segment will grow together with Arab and Asian communities and consumers that adopt new cuisines. The consumer group that is looking for healthy or vegan food is also growing. They will lean towards natural sesame or cold-pressed virgin oil.

Tips:

- Focus on whole sesame seeds, natural or hulled, as this will be your main bulk market. By adding value, such as oil pressing or seed toasting, you can tap into additional markets. Learn more about the sesame oil market in the report about Exporting sesame oil to Europe for food.

- Meet specific quality requirements when targeting a premium segment. Make sure your sesame is uniform in colour and shape and has a high purity level.

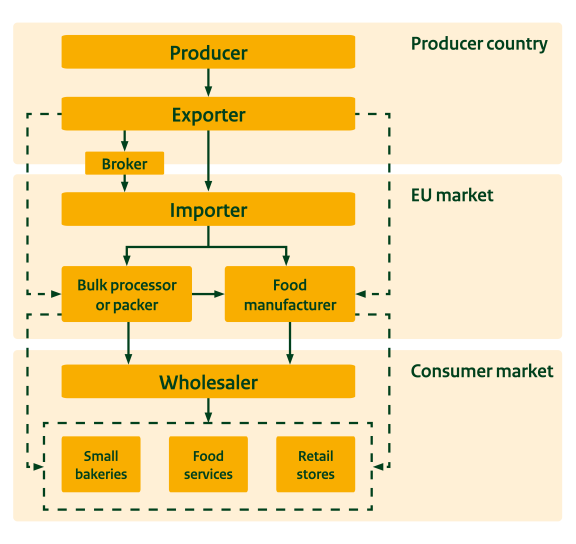

Through which channels does a product end up on the end-market?

Sesame often enters the market through importers and brokers that handle bakery ingredients, seeds, grains and organic food ingredients. Before sesame reaches the end-consumer, most seeds are transformed into food products. This gives food manufacturers and bakeries a relevant position in the supply chain.

Figure 5: Sesame seed supply chain

Source: ICI Business (2024)

Importers

Bulk traders and importers are the most common entry into Europe. They play a crucial role in matching supply and demand. This includes making sure that imported products meet quality and food safety criteria.

Importers can have a specific industry focus, such as Arasco, which focuses on bakery ingredients. Some offer sesame seeds as part of a large assortment of grains and seeds. Others, like Talianis, include them in their herbs and spices category. There is a relatively large number of importers of organic sesame, including Nungesser, DO IT ORGANIC and Delphi Organic.

Some companies offer their clients and suppliers additional services: processing and packing. Companies like Bakker Seeds, agaSAAT and Yme Kuiper use advanced cleaning and sorting equipment to meet food manufacturers’ specific needs.

Most importers have good contacts in producing countries. Several have even integrated their European business into primary production and processing at the country of origin such, as Olam in Burkina Faso, Dipasa in Mexico and Nature Bio Foods Europe, which has a head office in India.

As a supplier, there are many potential buyers to choose from. However, before connecting to buyers, it is best to do your homework and understand their business first.

- agaSAAT (Germany)

- Arasco (Netherlands)

- Bakker Seeds (Netherlands)

- Blife Srl (Italy)

- CARE Naturkost (Germany)

- Delphi Organic (Germany )

- Dipasa Europe (Netherlands)

- DO IT ORGANIC (Netherlands)

- JKT Foods (Netherlands, United Kingdom)

- LenersanPoortman | Groupe Depre (Netherlands)

- Nature Bio Foods Europe (Netherlands, India)

- Nungesser (Switzerland)

- Olam Europe (Netherlands)

- SIGCO | Acomo Group (Germany)

- Talianis (Greece)

- Tampico Trading (Germany)

- Tradin Organic (Netherlands)

- Voicevale (United Kingdom)

- Yme Kuiper (Netherlands)

Brokers

Some buyers prefer using brokers. Brokers are often individuals or small companies that link your product to buyers in Europe and take a commission on the sales. They either represent suppliers or buyers of commodities. Their experience and network can be useful to reach different buyers and companies that are otherwise hard to reach.

Examples of brokers are:

- Anabela Foods (Germany)

- AVS Spice (Netherlands)

- Belfrudis (Belgium)

- Cardassilaris (Greece)

- Van der Does Spice Brokers (Netherlands)

Bulk processors, packers and food manufacturers

Companies that use sesame as an ingredient need reliable supply chains and stability. They often work with medium and long term contracts. For some, sourcing is not their core-business so they use importing partners. Large volume processors have more direct relations with suppliers in the countries of origin. Companies in the processing channel transform sesame into a wide variety of added-value ingredients and consumer products. This includes packing sesame for food brands.

Bulk processors, such as Henry Lamotte and Haitoglou Bros S.A., turn sesame seeds into new ingredients, such as sesame oil, paste and flour. Haitoglou Family Foods includes other sesame products and calls itself Europe's largest sesame processor. The Italian company Pedon mixes and packs sesame with grains and pulses for consumers. Others like Jannis S.A., Unitop and BioVeri produce confectionary products, such as sesame snaps and bars.

- BioVeri (Poland)

- Ekibio Groupe (France)

- Haitoglou Bros S.A. | Haitoglou Family Foods (Greece)

- Henry Lamotte (Germany)

- Horizon Natuurvoeding (Netherlands)

- Intersnack (Netherlands)

- Jannis (Greece)

- Pedon (Italy)

- Seeberger (Germany)

- Sesame & Tahina (Hungary)

- Unitop (Poland)

- Wasa, Barilla Group (Sweden, Italy)

Tips:

- Invest sufficient time in your market entry. Check your buyer’s potential in terms of volume, level of integration and their processing activities. Get to know these companies and their priorities. Companies that may seem to be competitors can also be clients or partners.

- Use a broker to facilitate your market entry if you have any difficulties finding reliable client relations. They can help you find and connect with suitable buyers.

- Make sure you have adequate quality control systems if you are able to supply food processors directly in terms of services, volume and consistent quality.

What is the most interesting channel for you?

To secure a position in the sesame market, you need to make sure that you can meet demand for consistent quality and volume. Importers and brokers are your best chance as a new exporter. They can help you understand the market. Bulk processors and packers with direct sourcing activities are also an option. Remember that buyers have different strengths and networks. Find out what is important for them and which segments they supply. See where your sesame seeds fit in best.

Food manufacturers and food brands can be your next target group once you have proven yourself as a reliable and stable supplier. Your business must be service-oriented to deal with food manufacturers. Companies further down the chain make their suppliers responsible for quality and DDP delivery. For them, it can be useful to purchase smaller lots from existing stock in Europe.

Tips:

- Meet importers and food manufacturers at large food trade fairs, such as SIAL, Anuga, BIOFACH, Food Ingredients Europe and the iba trade fair. Use the exhibitor lists and databases to search for interesting companies.

- Use the Organic-bio database to find specialised traders of organic oilseeds.

- Read our tips for finding buyers on the European grain, pulses and oilseeds market on the CBI market Information platform.

3. What competition do you face in the European sesame market?

Competition in the European sesame market can be very strong due to the many producing countries. Companies in the main competing countries are well established, and they offer high-quality seed cleaning and close cooperation with farmers. However, in practice, even the best companies can have difficulties in securing sufficient volumes of sesame for the European market.

Which countries are you competing with?

India, Nigeria and Pakistan the strongest suppliers to the European market. Turkey is a net importer and re-exports some of its sesame to Europe after reprocessing. Most organic sesame is from Uganda.

Source: ITC Trade Map, July 2024

India remains the largest supplier despite reputation damage

India has been the most dominant supplier of sesame to Europe for many years, accounting for approximately 50% of its supply. For Europe, India is still a key supplier of sesame, but its import value dropped by 65% to less than €40 million in 2021.

With two annual harvests and a volume of between 700,000 and 800,000 tonnes, India is one of the largest producers of sesame in the world. Volume and competitive pricing are key strengths of Indian producers. The actual export volumes depend on crop quality and availability. Farmers often have to deal with extreme climate conditions, such as floods and droughts, which result in lower harvests. Both India and Nigeria face serious reputational problems and stricter controls due to contaminated sesame seeds.

In an attempt to eliminate microbes like Salmonella, exporters in India used ethylene oxide as a sterilising agent. Ethylene oxide is not permitted in Europe. Discussions by food safety coordinators in October 2020 led to additional controls for sesame from India. Border rejections and product re-calls affected the reputation of Indian sesame, reducing trade between India and Europe. Since the drop in 2021, Europe has gradually increased its imports again, but it will take time before India reclaims its dominant position. This situation has created opportunities for other producing countries.

Nigeria evolves into a sesame superpower

For Nigeria, sesame is an important agricultural commodity for export and profitable for farmers. It is one of the top producers on the African continent, together with Sudan and Tanzania. Nigeria’s potential has not gone unnoticed by European importers. The European import value doubled from 2020 to 2023, reaching €49 million.

Its agricultural potential has attracted large commodity firms, such as Olam Agri. Over the last decade, Olam has invested in out-grower programmes and farm training. The company runs a modern processing facility for sesame.

The National Sesame Seed Association of Nigerian (NSSAN) claims that Nigeria’s sesame is world class. It is a good reason for them to empower farmers and promote the development of export-quality sesame. According to the Nigerian Export Promotion Council (NEPC), around 80% of production is exported. Meanwhile, the International Fund for Agricultural Development (IFAD) has allocated $1.7 billion (USD) for agricultural development projects.

Despite these efforts, concerns about contamination Salmonella and pesticides, and logistical issues may further affect the growth. The European Union has increased border controls on Nigerian sesame and currently inspects 50% of the shipments. This increases the costs for importers and reduces Nigeria’s competitiveness. Production volumes may also fall because farmers are fleeing their lands in the northern region due to increasing terrorist attacks.

Pakistan wins market share through product promotion and quality

In just a few years’ time, Pakistan has become Europe’s third largest sesame supplier. Pakistan is still a small producer of sesame compared to its neighbour India. But the production volumes have increased fast.

The cultivation area expanded by 187% between 2019 and 2024 under the National Oilseeds Enhancement Program (NOEP). They dedicate the growth to Pakistan’s efforts to enhance the quality, competitiveness and visibility of sesame seed exports. The surplus production has replaced some of India’s export to Europe. If the incentives make sesame seeds permanently profitable for farmers, Pakistan can create a stable position in the European market.

Source: TRACES (retrieved July 2024)

Uganda leads the supply of organic sesame

Uganda is one of the five largest suppliers of sesame seeds to Europe and the main supplier of organic sesame. If the official data is correct, 90–95% of Europe’s sesame imports from Uganda is of organic seeds. The total import value reached €14 million in 2023.

Several European companies have offices in Uganda to source organic sesame, such as DO-IT Organic, Tradin Organic and Nungesser. Enterprises with foreign capital or relations, such as AgriExim, Shares and GADC, helped to develop Uganda’s organic sector.

The specialisation in organic sesame cultivation offers Uganda a unique advantage and an interesting niche market. However, the new EU regulation for organic certification has made it more difficult and expensive for farmers to continue as organic certified. The new regulation requires farmer groups to have the certification in their own name and allows fewer farmers per group. Without a financial incentive or clear benefit to organic agriculture, farmers may return to conventional farming. This could weaken Uganda’s competitive advantage in the European market.

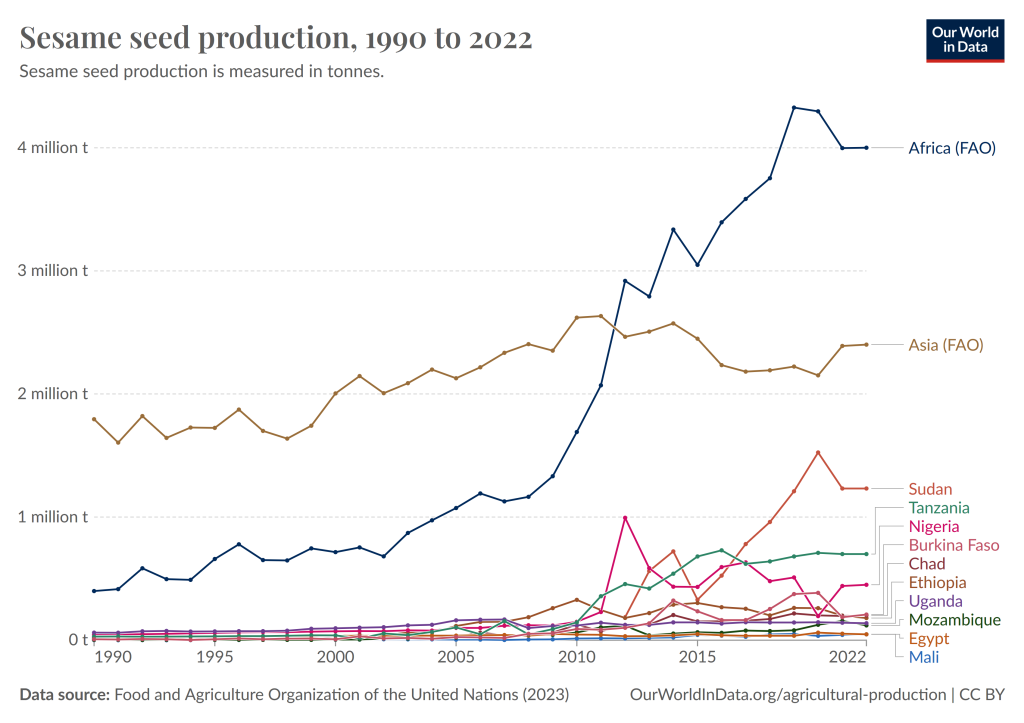

Figure 8: Production growth in African countries and other regions, in million tonnes

Source: Our World in Data (retrieved July 2024)

Alternative origins can help stabilise the supply

Sesame is cultivated in many countries. Countries in Africa in particular have shown enormous growth in the last decade. However, quality issues, adverse climate conditions and political conflicts are not uncommon in many major sesame-producing countries. This often leads to shortages of high-quality and EU-compliant sesame seeds. With this in mind, European buyers look to diversify risks and look for alternative sources that can contribute to stability.

In Africa, Sudan is the largest producer of sesame with fluctuating trade with Europe. Chad and Mozambique have also increased their exports to Europe. Turkish importers have replaced most Nigerian sesame with supplies from Chad, Sudan and Brazil. Turkey also plays a role in seed cleaning and treatment before re-exporting to Europe. Production in Latin America offers buyers a different climate zone and an interesting alternative to African suppliers. Guatemala has been the main supplier, although Brazil has shown the most growth. Paraguay and Bolivia are the important origins for organic sesame.

Confidence in quality and cost-efficiency are the most important criteria for buyers to start sourcing from a new country. However, specific nuances in seed quality and taste properties can play a role as well. A positive experience can quickly lead to increased exports.

Tips:

- Monitor developments in other producing countries to find trade opportunities. Check the news on the Commodity Board. Follow developments in demand in large consumer markets, such as China, Turkey, South Korea and Japan. They have more influence on global development than Europe, which is relatively small.

- Show stability and build a reputation by offering a reliable supply. Be honest about your capabilities and focus on the long term. Failing to complete a contract can result in losing a client to a competitor.

Which companies are you competing with?

The most successful sesame exporters have invested in extensive farmer training and high-quality seed cleaning. If you want to compete with these companies, you will have to maintain the same high standards. The better you manage your quality and sesame supply, the better your chances in the European market. Specialisations, such as offering organic sesame, can differentiate you from the competition.

Olam Nigeria Ltd. claims most Nigerian sesame export

Olam Nigeria Ltd. is one of the largest sesame exporters in Nigeria. The size and resources of a multinational like the Olam Group puts their operation at an advantage in a country where capital is scarce for many entrepreneurs. Economic resources are a great asset when building a quality processing plant and investing in farm training programmes.

Big companies like Olam receive more media attention. If they do not meet their high expectations of sustainable and responsible conduct, negative news can greatly affect their reputation. This happened to Olam when the company was accused of an extensive foreign exchange fraud in Nigeria. However, an investigation team did not find evidence for these allegations.

Another multinational company that is very active in Africa is ETG Holdings. ETG claims to be responsible for 50% of Africa’s sesame trade and to have a global market share in sesame of 15–20%.

ARMCOM focuses on quality to reach premium markets

Pakistan has a long history of rice exports. It is no surprise that companies like Arm Commodities (ARMCOM) combine sesame with a range of rice and traditional products like dates and Himalayan pink salt.

ARMCOM offers natural, hulled and roasted sesame with a purity of up to 99.98%. With a dedicated group of food scientists, they are committed to food safety and quality. The company can reach premium markets through advanced technology such as CO2 treatment and colour sorting, together with certifications, such as FSSC22000, SMETA and organic.

Other Pakistani companies also build on their rice milling experience to process sesame, such as Latif Rice Mills and HAS Trading. HAS Trading emerged with its first export of premium quality hulled sesame seeds in 2018. They are proof that there is potential for new suppliers that comply with high food standards.

Some of these new suppliers began to compete with established suppliers from India, such as Dhaval Agri, Raj Foods, Sun Agro and HL Agro.

GADC specialised in organic sourcing

Gulu Agricultural Development Company (GADC) is one of the largest suppliers of organic sesame in Uganda. They provide agricultural extension services and source sesame from 18,000 organic smallholder farmers through community-based networks of buying agents. They train farmers on a variety of topics including agronomy, organic principles, post-harvest handling, numeracy and basic financial literacy.

By taking a leading role in the sesame sector, GADC connected with several major clients in Europe that are specialised in organic ingredients. Their cleaning facility, which employs infrared and UV-C disinfection, ensures their clients of products that meet European food safety requirements.

Other companies that export organic sesame from Uganda include Agri Exim, Shares Uganda, Godson Group and Nature Bio Foods (a subsidiary of the Indian LT Foods Ltd.).

Tips:

- Define your strategy and key strengths. Compare your product with those of other suppliers and look for niches where you have a competitive advantage. It is easier to target a specific market if you know how you can differentiate from your competition.

- Keep up with the certification levels of your competitors. However, do not depend on these certifications alone. Show your clients that you understand what they need. Always prioritise quality and compliance starting at farmer level.

- Strengthen your presence in the European market, both online and at trade fairs. You need to be in the picture like your competitors.

Which products are you competing with?

Sesame is irreplaceable in some products. Some foods like tahini, halva and authentic Asian foods need sesame as an ingredient. This creates a consistent demand from the food industry. Food manufacturers avoid changing ingredients because it requires adapting costs and changing labelling.

Where sesame can be replaced more easily, notably in bakery products and home food preparation, there is competition from other trendy seeds that have a healthy image. This includes hemp seed, linseed, poppy seeds and chia seeds.

Tip:

- Diversify your product portfolio and try not to depend on sesame oil alone. Include other crops in your offer that fit your clients’ interests. This will make you better prepared for competing products and give you the advantage of being able to combine shipments of different products.

4. What are the prices of sesame on the European market?

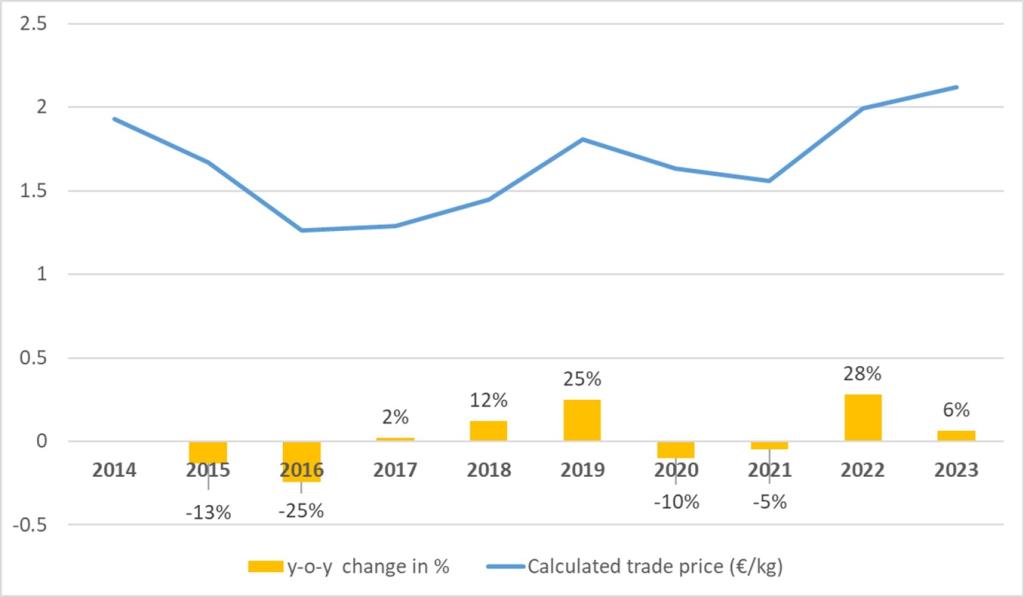

The market price for sesame in Europe can fluctuate up to 30% from year to year. Price developments mainly depend on supply and demand. Prices have also been rising over the past three years. This shows that European demand was not easily met.

Additional reasons for the recent upward trend include the growing costs of production, logistics, inspection and border control. Recent issues with Salmonella and ethylene oxide contamination have led to stricter checks and made it more challenging for importers to source EU-compliant sesame.

Figure 9 shows an indicative development of average annual prices, based on trade statistics. It does not show short term price peaks, dips or differentiation in quality. For example, the trade price for certified organic sesame in 2023 was much higher than the average price due to a shortage. The long term perspective is unpredictable but, in the short term, price levels will likely remain stable.

As an individual supplier, your selling price and profit margin depend on seed quality and the level of processing. Cleaning, hulling and sorting sesame will result in higher quality and, thus, a more valuable product. Offering clients additional security through sterilisation processes, pre-export inspections, laboratory checks and protective vacuum packaging will give you a competitive advantage. However, it will also increase the cost price of your product. Security and peace of mind have their value for importers but, as an exporter, you must also be able to maintain a price level similar to that of other suppliers with the same quality grade.

Figure 9: Calculated trade prices in EU import

Source: Eurostat, calculations by ICI Business (2024)

The importer’s gross margin should be somewhere between 15 and 25% to cover import costs, testing and sales margins. They can also add value by re-processing, packing and small distribution. Sales prices by wholesalers and retailers vary depending on the quality, added value and package size. Retailers can sell small consumer packages of 100 g sesame for around €3.

Table 3: Indicative sales prices for hulled sesame seeds, in euros per tonne (estimation 2024)

| Type of sales | Low | High |

| Bulk exporter | 1,600 | 2,500 |

| Bulk importer and distribution | 2,100 | 3,100 |

| Wholesale (25 kg packaging) | 4,000 | 8,000 |

| Retail (1 kg packaging) | 7,000 | 15,000 |

| Retail (100 g packaging) | 13,000 | 30,000 |

Source: Industry sources and expert calculations (2024)

Tips:

- Make realistic and detailed cost calculations. Quality, supply and demand determine the price of your sesame. However, as a supplier, you have to make your own cost calculation and check whether the trade price is realistic for your company.

- Check the updates on platforms like Mundus Agri, Commodity Board and Tridge. Create an account to see price details. You can get the most reliable and up-to-date information by talking to different European buyers.

ICI Business carried out this study on behalf of the CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research