Entering the European market for specialty rice

The market for speciality rice in Europe is small compared to the total rice market. Europe is a demanding market that has strict requirements for pesticide residue levels and mycotoxins. Most speciality rice is sold in the specialised retail segment, but it is also increasingly available in mainstream supermarkets. Make sure your rice is unique in terms of fragrance, colour and/or impact on the environment and society.

Contents of this page

- What requirements and certifications must speciality rice comply with to be allowed on the European market?

- What additional requirements and certifications do buyers often have?

- Through what channels can you get specialty rice on the European market?

- What competition do you face on the European speciality rice market?

- What are the prices for speciality rice?

1. What requirements and certifications must speciality rice comply with to be allowed on the European market?

Speciality rice has to comply with mandatory food safety and quality requirements. Maximum pesticide residue levels are the most important aspect to check, followed by mycotoxins. Customs documents are also important to benefit from trade preferences.

What are mandatory requirements?

Mandatory requirements concern food safety and quality. They include legal rules, quality requirements, and packaging and labelling requirements.

Official food controls: non-compliance leads to stricter requirements

Food imported into the European Union (EU) is inspected regularly. These inspections can be carried out at the border or later on in the value chain (e.g. on the importer’s premises). The checks are intended to ensure that the products meet legal requirements, described in more detail below.

Non-compliance with European food legislation is reported through the Rapid Alert System for Food and Feed (RASFF). In 2023, 123 issues with rice were reported through the RASFF; 9% more than in 2022. The most common issues were the presence of pesticide traces that exceeded the Maximum Residue Limits (MRLs), mycotoxins and heavy metals.

Source: GloballyCool, based on the RASFF database, May 2024

If imports of a certain product from a specific country repeatedly fail to meet requirements set by European food legislation, the frequency of official controls at the border is increased. For rice, these origins are listed in Annex 1 of the regulation on the temporary increase of official controls and emergency measures. Table 1 lists export locations that temporarily need have more official checks upon entry into the EU.

Table 1: Recent history of temporary increase in identity and physical checks of rice from India and Pakistan in the EU (% frequency of official controls)

| Country of Origin | India | Pakistan | ||

| Hazard | Pesticide residues | Mycotoxins | Pesticide residues | Mycotoxins |

| January 2022 | 0% | 10% | 0% | 10% |

| July 2022 | 5% | 5% | 5% | 5% |

| February 2023 | 5% | 10% | 5% | 5% |

| June 2023 | 0% | 0% | 5% | 5% |

| February 2024 | 0% | 10% | 5% | 10% |

| July 2024 | 10% | 10% | 5% | 10% |

Source: EUR-Lex, July 2024

Tip:

- Use My Trade Assistant of Access2Markets for an overview of market access requirements for rice per country. Use HS code 1006 then search for your specific rice product.

Control of pesticide residues

The EU Regulation on maximum residue Levels of pesticides specifies the maximum residue levels (MRLs) for pesticides in food products. A general default MRL of 0.01 mg/kg applies if no specific level is mentioned in relation to a product. Products that contain higher pesticide residues than permitted are withdrawn from the European market.

In 2022, 45% of all issues reported in RASFF related to excessive pesticide levels or traces of illegal pesticides. In 2023, pesticides made up two-thirds of all reported issues. For rice, more than 50% of these cases involved excessive residues of multiple pesticides.

The most common excessive levels of single pesticides in rice are tricyclazole – the MRL for which has been 0.01 mg/kg since 2017 (previously 1mg/kg) – and Chlorpyrifos (MRL of 0.01 mg/kg). Another MRL changed in the period under review is Buprofezin, for which the MRL was reduced from 0.5 mg/kg to 0.01 mg/kg in 2019.

The EU maintains a list of approved pesticides.

Tips:

- Select your product (rice or code 0500060) or the pesticide that you use in the EU pesticide database to see the list of relevant MRLs.

- Read about pests and diseases management in the Rice Knowledge Bank and reduce your use of pesticides by applying integrated pest management (IPM) during production. IPM is an agricultural pest control strategy that uses natural control practices as well as chemical spraying.

Control of contaminants

Food contaminants are substances that have not been added to food intentionally. They may infect the rice during production, packaging, transport or storage. Contaminants can pose a health risk to consumers. To minimise these risks, the EU has set maximum levels for certain contaminants in rice.

Mycotoxins

More than 30% of all issues reported in the RASFF database in 2022 and 2023 were due to mycotoxins, although the number of issues in 2023 was substantially lower than in 2022. Mycotoxins are toxic compounds produced by types of mould. The most common mycotoxins in rice are aflatoxins and ochratoxin A.

The EU has set aflatoxin and ochratoxin A limits for rice to protect consumers.

Table 2: Mycotoxin limits for rice

| Mycotoxin | Product | Limit (μg/kg) |

| Aflatoxins | Rice, untreated | 5 for B1 10 for sum of B2, G1 and G2 |

| Ochratoxin A | Rice (under unprocessed cereals) | 5 |

Source: EUR-Lex, May 2024

Ochratoxin A was researched in the EU between 2018 and 2022. Studies suggested that it may cause genetic mutations and cancer. So far, these studies have not resulted in any significant reductions in the EU’s limits.

Tip:

- Use the Manual on the application of the HACCP System in Mycotoxin prevention and control on the Food and Agriculture Organisation (FAO) website.

Metal contaminants

Metals like lead occur naturally in soil and water. Pollution from human activity adds to the background level of metals in the environment. As a result, metal residues can occur in food. Contamination can also result from food processing and storage.

While no reported issues were reported on rice in 2022, there were six reports of heavy metal contaminations in 2023. These were related to cadmium in Italian rice. So far, there have not been any issues for rice from outside of Europe.

The EU has set the following limits for cadmium and lead residues in rice:

- 0.2 mg/kg of cadmium in rice

- 0.2 mg/kg for lead in rice

- 0.15 mg/kg for arsenic in milled rice

- 0.25 mg/kg for arsenic in parboiled and husked rice

- 0.1 mg/kg for arsenic in rice for infant and young children food production

Tip:

- Check the national legislation in your target countries through the My Trade Assistant tool on EU Access2Markets. National legislation can be stricter than European legislation.

Customs documents relevant for trade preferences

Customs clearance requires several export documents. These are explained in the CBI’s study on tips for organising your grains, pulses, and oilseeds exports to Europe. One important document is the Certificate of Origin, which declares the country a good originates from. It is required if you want to claim preferential tariff treatment under a free trade agreement. The document can vary between free trade agreements. For countries that have a preferential trade agreement with the European Union, the EUR.1 certificate is used.

It is important to check if your country or competing companies from other countries benefit from trade preferences. You should check whether your country is a GSP (Generalised Scheme of Preferences) beneficiary or do other trade agreements apply? Visit the Access to Market portal to find out the schemes that apply to your country.

In terms of GSP, there are three types of arrangements relevant to the international rice trade to Europe:

- Standard GSP: an arrangement for low and lower-middle income countries. It removes customs duties on two-third of tariff lines. The list of countries that benefit from this scheme changes every year. Currently, it includes India, Bangladesh, Cambodia, Laos, Sri Lanka, Myanmar, Pakistan and Thailand.

- GSP+: an incentive arrangement for sustainable development and good governance. It lowers the tariff to 0% for seven vulnerable low and lower-middle income countries that implement 27 international conventions related to topics like labour and human rights, and environmental and climate protection. Countries whose rice exports benefit from GSP+ include Pakistan, Sri Lanka and the Philippines.

- GSP-EBA: an arrangement for the least developed countries. It gives them duty and quota-free access to the EU market. Relevant countries that benefit from this scheme are Myanmar, Cambodia, Bangladesh and Laos.

If you are an exporter in a GSP beneficiary country, you may benefit from better tariffs compared to exporters from ‘most favoured nations’. To qualify for preferential treatment, you need to comply with the rules of origin and prepare the necessary documents.

Certificate of authenticity for basmati rice

For basmati rice from India or Pakistan, there are certain varieties exempted from import duties. The special rules for these imports of basmati rice and a transitional control system for determining origins are set out in Commission Regulation (EC) No 972/2006. This document also includes a list of approved basmati varieties.

If Indian or Pakistani exporters would like to take advantage of the preferential import tariff, they need a certificate of authenticity, issued by the Export Inspection Council (India) or the Trading Corporation of Pakistan.

According to the UK Basmati Code of Practice 2022, basmati rice can only be marked with its country of origin if at least 97% of the grains originate from the country named on the package (India or Pakistan). If the product is referred to as ‘basmati rice’, the non-basmati rice content must not be more than 7%. Buyers from other European countries will likely follow the same or similar guidelines.

Tip:

- Read the Quick guide to working with rules of origin on Access2Markets to understand why and what it takes to be allowed to pay lower customs duties when importing rice into Europe.

Size specifications

Rice and speciality rice is divided into short, medium and long grain rice, depending on the grain size and length/width ratio. This is also set out in the Regulation (EU) No 1308/2013.

- Short grain rice has a length of less than 5.2 mm and a length/wide ratio of less than 2.0.

- Medium grain rice has a length of between 5.2 and 6 mm and a length/wide ratio of between 2 and 3 mm.

- Long grain rice has a length of more than 6 mm, and a length/wide ratio of between 2 and 3 (type A) or more than 3 (type B).

Quality requirements

If you want to export speciality rice to Europe, you must meet the common quality standards. It is best to follow the FAO International standard for rice (2019) (PDF) in the Codex Alimentarius, which describes the quality dimensions for rice, including husked, milled, husked parboiled and milled parboiled rice. In practice, grain moisture content (maximum 15%) is the most important factor in maintaining grain quality.

The FAO standard for rice applies to internationally traded rice and can be used as guidance for the European market. It states that rice must be safe and suitable for human consumption. The standard sets minimum requirements but leaves room for buyer preferences and legal market requirements, such as the EU’s MRLs for pesticides on rice.

Packaging requirements

Rice can be packed in different sizes of up to 50 kg. The most common quantities for speciality rice are 25 kg bags for trading and up to 10 kg for wholesale packaging for the food service segment. Most pre-packaged rice for consumers does not exceed 2 kg in weight, but this depends on segments and regions. For example, in southern Europe and the ethnic market segment, rice consumption is relatively high, leading to larger packaging units.

The packaging materials are most often the following two types:

- Woven polypropylene bags for smaller quantities (e.g. 25 and 50 kg) can be used to pack speciality rice.

- Kraft paper bags with optionally a PE in-liner: these bags are traditionally used for organic rice but are being used conventional rice more too. In 2024, an estimated 25–30% of international grains, pulses and oilseeds were packed in sacks is with Kraft paper bags.

- LDPE bags can be used for speciality rice. LDPE packaging helps to preserve flavour and aroma. This packaging is often used for retail packaging as well.

The packaging must protect the product and comply with Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food.

Zero tolerance for GMO rice

The European Union (EU) has a zero-tolerance policy for genetically modified organisms (GMOs) that it has not approved. The EU has not authorised any genetically modified rice crops.

If genetically modified rice varieties were adopted in countries exporting rice to the EU, the Federation of European Rice Millers (FERM) warns that the EU s zero tolerance policy would create considerable problems for the rice supply and disrupt the European rice industry.

Tips:

- Read the Grain Quality page of the Rice Knowledge Bank to learn how to manage rice quality.

- Consult the buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform for additional requirements, such as labelling.

2. What additional requirements and certifications do buyers often have?

European buyers often have requirements in addition to legal obligations. These often relate to food safety and sustainable and ethical business practices.

Buyer-specific quality specifications

Rice quality is mainly related to shape, colour, milling cooking quality and integrity (e.g. fissures and cracks in the grain). For speciality rice, European buyers have their own specifications, which focus on the following parameters:

- Grain length

- Stickiness

- Aroma

- Texture

- Flavour

Certification as a guarantee for food safety and beyond

Food safety is key in the European market. Although legislation already addresses many potential risks, it is not enough alone. The large number of reported issues in 2022 in the RASFF database shows that things still go wrong. For this reason, importers prefer to work with producers and exporters who have Global Food Safety Initiative (GFSI) recognised food safety system certificates.

For rice millers and processors (who perform hulling, sorting and packaging) who want to supply the European market, the most popular certification programme is Food Safety System Certification (FSSC 22000). It is based on the ISO methodology and offers the most structured and logical approach to food safety management systems.

Sector initiative for rice: the Sustainable Rice Platform

Major commodities are sometimes part of specific initiatives to work on more sustainable production and trade. Rice has a sector initiative called the Sustainable Rice Platform (SRP).

Leading rice companies support the platform and its standard for sustainable rice cultivation. Members include all kinds of stakeholders, from certifiers, and international donors to European importers and supermarkets. European importers include Ebro Foods (Spain), Euricom (Italy), Westmill Foods (UK), Riso Gallo (Italy) and Mars Food (Belgium). European supermarkets that support SRP include Jumbo, Kaufland, Lidl and Ahold Delhaize.

These companies are committed to improving climate-smart, sustainable best practices amongst smallholders. Examples of exporters that have joined the initiative include Amiha Agro (India), Amru Rice (Cambodia), Atlas Foods (Pakistan), Loc Troi Group (Vietnam) and Saman (Uruguay).

Sustainability compliance

European buyers increasingly demand social and environmental compliance. This means you often need to undersign your buyers’ code of conduct or third-party codes of conduct. You can also opt for third-party certification schemes, such as Fairtrade, B Corp and SMETA.

While Fairtrade certification ensures that individual products meet high social and environmental standards, B Corp certifies entire companies. B Corp certification requires companies to meet high standards of performance, accountability and transparency on a wide range of factors.

Tips:

- Check with your buyer to determine which certification scheme is the most relevant to your target market.

- Check SRP’s step-by-step guide to getting SRP-verified to see your roadmap towards certification.

- Read the CBI buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform for more detailed insights on advantages and their certifications.

Fairtrade certification

Fairtrade-certified rice packages can display the Fairtrade logo, which helps products stand out and attracts more aware consumers. Fairtrade certification is most suitable for products from smallholder farms.

Figure 2: Purple Rice Mix – colourful Fairtrade-certified rice from Laos

Source: GloballyCool, July 2024

Tips:

- Watch Fairtrade International’s introduction video to learn how the Fairtrade system works. Read their standard for Cereals to find out what the exact requirements are.

- Find a Fairtrade-certified trader of your product and contact them to find out more about the potential of Fairtrade certification.

- Check the Fairtrade Minimum Price and Premium Table to see fair trade pricing for different rice varieties and origins.

Organic certification

Organic-certified rice has become quite normal in Germany, the Netherlands, the United Kingdom (UK) and Scandinavia. While organic rice was initially dominated by large rice brands, nowadays, private label rice is also available as organic.

basmati, pandan and jasmine rice are the most common certified varieties in Europe. Organic certification is less common for minor speciality rice varieties and ethnic brands.

If you want to export organic rice to Europe, you need to comply with Regulation (EU) 2018/848. It establishes the rules on organic production and labelling. The rice should not contain any chemical traces.

Tips:

- Consider organic certification if you can. Getting certified can be expensive, and you should be prepared to comply with the process of marketing organic products. Read more about organic rice farming in the Tropics and Subtropics by Naturland.

- Explore Standards Map to learn about the different voluntary sustainability and social standards and see which ones are available in your country.

3. Through what channels can you get specialty rice on the European market?

There are multiple segments and channels through which speciality rice reaches the European market.

How is the end market segmented?

Speciality rice is now sold in mainstream supermarkets. However, the more special the rice variety, the smaller the market segment. Ethnic food retail outlets and the high-end restaurant segment (gastronomy) are likely to carry niche varieties.

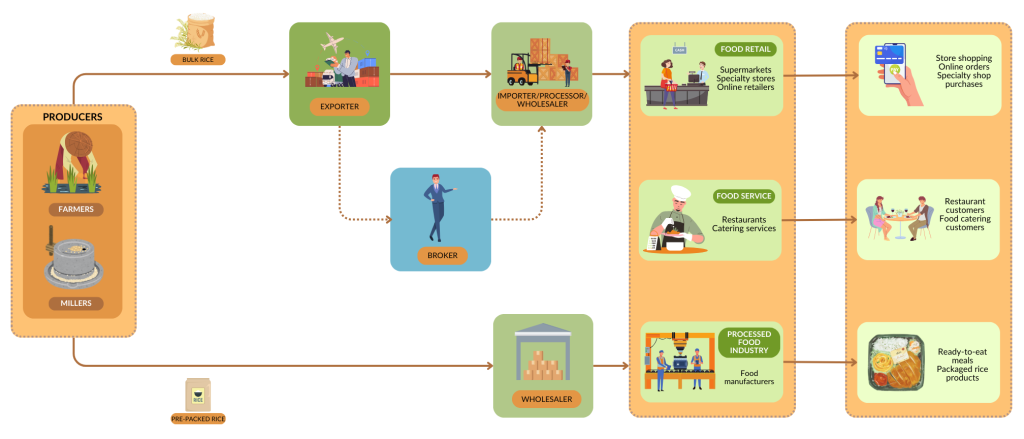

Through which channels does a product end up on the end-market?

Large players dominate the mainstream rice market in Europe. They can be classified into rice millers, brands and brokers. Major names include Ebro Foods, Mars and Euricom. Speciality rice is traded in smaller volumes, so players in the market are also usually smaller. Importers, wholesalers and brokers trade speciality rice. Some specialise in niche markets like ethnic, organic and fairtrade. The end market consists of food retail, food service and food processors.

Figure 3: European market channels for speciality rice

Source: GloballyCool, July 2024

Importers and wholesalers

Importers of speciality rice typically have good contacts in the origin countries and take care of product quality and specifications. They can be rice mills that import rice (e.g. Reis Mühle Brunnen (RMB) from Switzerland), mill and pack it. Others are more trading companies. For example, CIACAM from France is a pulses specialist but trades several rice varieties too. Importers trade in bulk, while importers and rice mills process and pack the rice, which they then supply to wholesalers.

Some of the traders and packers in Europe come from origin countries. One example is Nature Bio Foods from India, with Daawat. This company is the largest organic rice trader/wholesaler from India and is part of LT Foods. Although most of its rice comes from India, LT Foods also imports organic speciality rice from Thailand, Pakistan and Cambodia. Diversifying sources helps LT Foods offer a wider range of rice varieties that appeal to different types of customers.

There are other traders who specialise in organic rice, such as DO IT (Netherlands) and Ziegler (Germany). Several organic-certified traders also have Fairtrade certification. One good example is Autour de Riz (France), which sources organic rice from Fairtrade projects in India, Thailand, Cambodia, Sri Lanka and the Philippines.

Brokers

A considerable amount of rice (between 10–20% of speciality rice) is sold through brokers. Brokers know a lot about the global rice supply, markets and logistics. They handle the transportation, documentation, compliance and partnerships that simplify international trade.

Rice brokers connect rice from the origin countries to importers in the destination countries. They work on a commission basis. Examples include JS Commodities and Jackson Son & Company (UK), Schepens & Co and S. Stabel (Belgium) and HBI (France).

The DCX Group has also hosted an international digital rice exchange based on blockchain for several years.

Online retailers

While several traditional food retailers have set up online sales channels, there are also purely online food retailers. They sell rice that is often packed in origin countries and sourced from importers, processors and millers under private labels.

Examples of online retailers include Buy Whole Foods andAbel & Cole (UK), BienManger and Greenweez (France), Planeta Huerto (Spain), Jamoona (Germany) and Global Food Hub (the Netherlands).

Tips:

- Use a broker to enter the market if you have difficulty finding reliable clients.

- Make sure you have good quality control systems if you plan on supplying bulk rice directly to food processors or packed rice to wholesalers. Consistent quality and volumes as agreed in the contract are important.

What is the most interesting channel for you?

Speciality rice suppliers should build strong partnerships with importers and rice mills and avoid bulk trade. Rice that is pre-packed at origin can be sold through wholesalers.

If your speciality rice is unique, market introduction may take a long time. The more unique your rice is, the more important it is to find the right partners to represent and market your product.

Tips:

- Visit international trade fairs to find potential buyers. BIOFACH is best for sustainably certified rice. SIAL and Anuga are best for regular rice. While rice brands often exhibit at these events, rice importers and brokers often attend these fairs as visitors.

- Consider attending the European Rice Convention to learn more about the European market.

- Find rice millers through the list of members of the North European Rice Millers Association.

4. What competition do you face on the European speciality rice market?

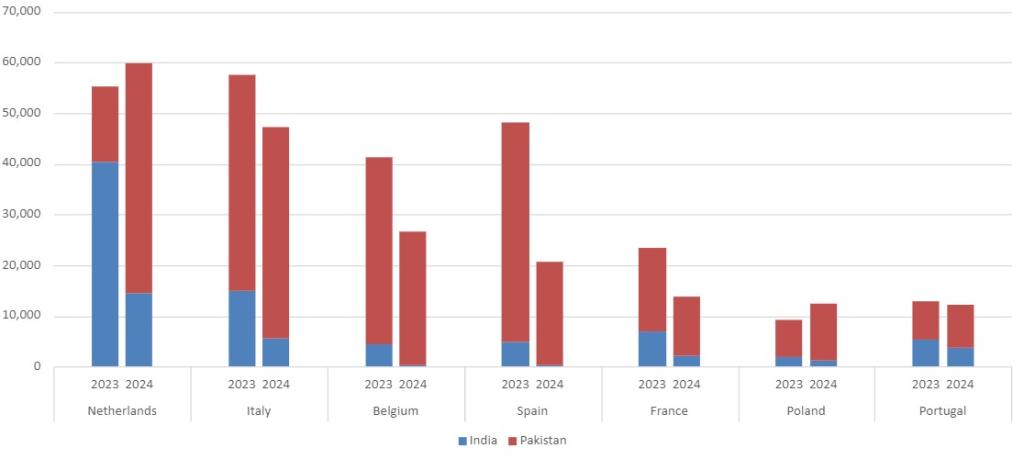

Pakistan and India are the main players on the speciality rice market due to the large volumes of basmati rice they export to Europe. Thailand is also an important supply country. Cambodia benefits from favourable import tariffs to Europe.

Which countries are you competing with?

Pakistan and India have long histories and are dominant in the European rice market. Over the last five years, imports from Cambodia have grown quickly.

Source: GloballyCool, based on UN Comtrade, June 2024

Pakistan: pesticide-free and organic super-basmati rice with duty-free access

Pakistan is an important rice exporter, known for its high quality. The country exported 450,000 tonnes of rice to Europe in 2023. Most of these exports are basmati varieties, but they also include some non-basmati varieties, such as IRRI-9. Exports peaked in 2021, a year marked by a record harvest. European markets that imported large amounts include Italy (40% in 2023), the UK (18%), Belgium (16%), the Netherlands (15%) and Spain (13%).

Pakistani rice benefits from a zero-duty import policy to the EU and the UK. An EU Commission decision in 2018 to decrease the maximum residue level (MRL) for the fungicide tricyclazole from 1 to 0.01 mg/kg was very beneficial to Pakistani exports. This explains their leading position in the 2019–2023 period, ahead of India. For exports of organic rice, Pakistan also became the biggest exporter to Europe in 2021, with 37,000 tonnes. It also had a market share of more than 40%, far ahead of India, Thailand, Argentina and Cambodia.

The quality of Pakistan’s basmati rice, compared to Indian rice, has also benefited its rice exports to Europe. Since July 2022, 5% of rice shipments from Pakistan have needed to undergo pesticide testing. Before July 2022, this testing frequency for mycotoxins was 10%. This then changed to 5%, at which it remained until February 2024. Since 2024, the mycotoxin testing frequency has returned to 10%. India’s rice testing frequencies in the European market also changed but differently. In the January 2022 to July 2024 period, this had a substantial impact on the competitiveness of both countries in the European market.

- Between June 2023 and July 2024, India did not have increased pesticide testing, while Pakistan’s rate was 5%. This explains India’s growth in rice exports to Europe in 2023.

- From July 2024 onward, India’s rice export testing frequency for pesticides went up to 10%, while Pakistan’s rate stayed at 5%.

- Between June 2023 and February 2024, India’s testing rate for mycotoxins was 0% compared to 5% for Pakistan. This temporarily contributed to increasing rice imports from India.

These modifications in testing frequencies affected export quality control procedures in both countries. For example, aflatoxin alerts went up considerably in Pakistan between January 2022 and July 2022. Stricter pre-shipment inspections and more aflatoxin rapid testing decreased the number of alerts again.

Excessive pesticide residues are rarely detected in basmati rice varieties cultivated in Pakistan – the ‘Super Basmati Family’ – as these varieties are closer to the original traditional cultivars.

The UK is Pakistan’s largest European market for rice, importing 109,000 tonnes in 2023. Other important destinations for Pakistani rice include Italy (88,000 tonnes), the Netherlands, Belgium, France (44,000, 42,000 and 36,000 tonnes respectively) and Germany. The main segments for Pakistan’s basmati rice are ethnic and gourmet-purpose applications in these markets.

The Rice Exporters Association of Pakistan (REAP) organises trade fair participation, delegations and other services for their members.

India: duty-free access, but struggling to meet legal requirements

India is Europe’s second-largest supplier of basmati rice and benefits from duty-free access to the European market.

India’s basmati rice exports to Europe have been under pressure since the EU Commission’s decision in 2018 to decrease the maximum residue level (MRL) for the fungicide tricyclazole from 1 to 0.01 mg/kg. However, India temporarily enjoyed beneficial access to the European rice market over Pakistan. Between June 2023 and July 2024, India did not have an increased frequency of pesticide testing, while Pakistan’s rate was 5%. This made India’s rice exports to Europe grow considerably in 2023.

In July 2024, India’s rice export testing frequency for pesticides went up from 0 to 10%, while Pakistan’s rate stayed at 5%. This is likely negatively affected India’s rice exports to Europe as these testing frequencies have remained the same. Enhanced diplomatic and trade relations could lead to more favourable terms for India’s rice exports to Europe.

Rice imports from India take relatively large market shares in the UK (32% in 2023), the Netherlands (30%), Italy (15%) and Germany (9.2%). Rice is produced in several parts of India. The largest are West Bengal, Punjab and Uttar Pradesh. Each region different rice varieties. Records by the All India Rice Exporters’ Association (AIREA) noted that 32 basmati varieties and 6,000 other varieties are produced in India.

High production capacities and many varieties have given India a strong position in the European rice market. These advantages have been improving thanks to the long-term cooperation between India and the International Rice Research Institute (IRRI). Indian rice exporters can be found on the ExportersIndia platform. The Indian government also works to secure Geographical Indication (GI) status for basmati rice in Europe. However, this is unlikely to be recognised by India alone, as Pakistan is also a large producer of basmati rice.

Figure 5: Main European markets for basmati rice imports from India and Pakistan, brown/husked rice types (in tonnes) between September 2023 and June 2024

Source: Rice News Today statistics (25 June 2024)

*Note: Data for 2023–2024 is incomplete; United Kingdom, Switzerland and Norway not included

Thailand: famous for ‘Thai rice’ or jasmine rice

Thailand’s rice exports to Europe show a declining trend (averaging -5.3% between 2019 and 2023). Export volumes were the lowest in 2021 but have recovered since. European markets in which Thai rice held relatively large shares include France (13% share in 2023), Italy (11%), the Netherlands and Belgium (both 10%). Exports to Europe went down in 2021 due to the Covid-19 pandemic and high transportation costs. The increasing value of the Thai currency did not help exports either.

Thai rice is quite special in Europe, and it labels its fragrant rice on packages as ‘Thai rice’. Thailand’s total fragrant rice exports reach about 2 million tonnes per year, 12–15% of which is exported to Europe. Although the country has reduced its export volume to Europe since 2019, it has kept its strong position in the European market due to its specialisation in jasmine rice (Thai Hom Mali).

The EU and Thailand started negotiating a free trade agreement in 2023. It is unclear when this process will be finalised. Thailand also exports considerable volumes of organic rice to Europe, between 8,000 10,000 tonnes per year. There are also several initiatives to produce Fairtrade-certified rice, with a total of ten Fairtrade-certified rice producers (July 2024). This has given Thailand’s rice crops another way to stand out.

Northeastern Thailand is the home of the Thai Hom Mali (Thai jasmine rice). Northern Thailand, in particular Chiang Mai and Chiang Rai, is known for its commitment to the organic cultivation of Khao Deng (red rice) and Khao Khai Noi (black rice) varieties.

Figure 6: ‘Thai rice’ next to basmati rice in a Spanish supermarket

Source: GloballyCool, June 2024

The outlook for Thai rice exports to Europe in 2024 is moderate to negative. While Europe is still dependent on Thai jasmine rice, its exports have suffered from the strong Thai Baht since the end of 2023. The strong Baht makes Thai rice relatively expensive compared to rice from other countries.

Cambodia: specialised in fragrant rice

Cambodia increased its rice exports from 2019 to 2023, reaching 243,000 tonnes in 2023, with a 14% average growth rate. European export destinations include France (17% in 2023) and the Netherlands (11%). Drought temporarily negatively affected Cambodia’s rice exports, but exports to Europe have since recovered.

Milled rice accounts for 30% of total Cambodian exports, and organic rice makes up less than 1% of Cambodia’s milled rice export volume. Of Cambodia’s total rice exports, 82% is fragrant rice; equalling 540,000 tonnes. Between 30 and 40% of the fragrant and mostly milled rice is exported to Europe. European buyers know Cambodia for its premium jasmine rice grown during the rainy season, such as ‘Phka Rumduol’. Cambodia benefits from duty-free and quota-free access to the EU market under the GSP-EBA scheme.

Cambodia's rice industry can meet the international demand for its premium grade and aromatic rice. Besides its competitive supply of common white rice, valuable varieties of Cambodian rice include its premium jasmine rice (‘Phka Romduol’, mainly targeted at the ethnic Asian population in Europe), Phka Malis, and Phka Rumdeng that present distinct unique profiles, comparable to Thai jasmine and Indian basmati rice.

Supported by the Cambodian Rice Federation (CRF) and the Cambodian government, the Cambodian rice industry has developed significantly in recent years, with improved irrigation, research and development for rice production and investments in modern rice mills. This will drive further growth in rice exports to Europe over the next few years.

Which companies are you competing with?

Two companies from Pakistan and Cambodia that export speciality rice to the European market are given below.

Atlas Foods: sustainably produced basmati rice from Pakistan

Atlas Foods is one of Pakistan’s leading exporters of sustainably produced rice. Like almost all of Pakistan’s exporters, super basmati rice is the largest export variety. What makes this company special is the higher quality non-basmati Silky Sortex Long Grain variety, which it developed in-house.

The company is also dedicated to sustainable rice production. It shows its commitment to sustainability through its participation in the Sustainable Rice Platform (SRP) and collaborating with Syngenta Pakistan to prevent farmers overusing pesticides.

Amru Rice: ambassador of organic rice production in Cambodia

As the largest producer and exporter of Cambodian organic rice, Amru Rice has been working to reshape Cambodia’s rice sector. Amru cooperates with local farmers, trains them and ensures their livelihoods in education and financial security. Amru Rice has been a strong ambassador for organic practices, working with farmers through ‘contract farming’, with conditions for environmental protection and climate resilience, to promote sustainability and social inclusion.

Since 2023, the company has worked on building rice mills and drying silos in Mondulkiri to ensure better prices for farmers. The company had 30,000 smallholders under contract for organic rice production as of 2023.

Tip:

- Visit BIOFACH to get a better idea of the market opportunities and competition. Work on creating a unique range of products, combining a unique rice variety and sustainable impact.

Which products are you competing with?

Speciality rice, such as basmati rice from India and Pakistan and jasmine (Hom Mali) from Thailand, competes with various other rice types and added-value grains. Less-known yet popular speciality rice varieties include ST25 (Vietnam, organic) and Sen Kro-Ob (Cambodia).

Other competing products include:

- Non-aromatic long-grain rice, for dishes in which aroma is not important.

- Short-grain and medium-grain rice, such as Arborio (for risotto) and sushi rice. These rice types are used for their texture.

- Alternative grains: quinoa and fonio provide different textures and nutritional profiles, appealing to health-conscious consumers looking for variety.

- Innovations like ‘high protein rice’: rice enriched with pea protein.

Figure 7: High-protein rice in a German supermarket

Source: GloballyCool, June 2024

Tip:

- Ensure that your product has a Unique Value Proposition (UVP). This could be your product’s unique or superior aroma, taste, colour or convenience. Test thoroughly and compare your speciality rice with other rice available in the market.

5. What are the prices for speciality rice?

Different rice varieties have different prices. The prices for speciality rice are normally higher than white rice because as speciality rice is a premium product. Other factors that affect prices include origin, quality, degree of processing and whether the rice carries a certification or a brand name.

World rice prices change over time. They are influenced by current and expected availability and demand. Average global indica rice (‘traditional’ Asian rice) prices were 23% higher in March 2024 than in March 2023. Prices for aromatic and glutinous rice have fluctuated, with either stable or falling trends.

In the European market, average prices may differ depending on the country’s market characteristics and preferences. Overall, rice in western and northern Europe is more expensive than in eastern and southern Europe. In turn, there is considerable local japonica rice production in southern European countries (e.g. Italy). This may affect competing rice varieties.

Tips:

- Compare your own insights and price information with that of your buyers or other exporters to gain a balanced insight.

- Use commercial rice indexes to stay informed on rice prices, such as Rice Online and Oryza.

Globally Cool carried out this study on behalf of the CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research