Entering the European market for sunflower seeds

Sunflower seeds are growing in popularity among European consumers, following trends towards healthy, organic and plant-based foods. They are also becoming more popular in the bakery sector and among other food manufacturers in Europe. A few European countries produce and import sunflower seeds themselves, but demand exceeds supply. In addition, the sunflower seeds market is considered flexible and able to source seeds from all corners of the world. The main suppliers to Europe are Romania and Bulgaria. To compete with these suppliers, you will have to prove that you are a committed supplier of high-quality sunflower seeds.

Contents of this page

1. What requirements must sunflower seeds comply with to be allowed on the European market?

Sunflower seeds are growing in popularity among European consumers, following trends towards healthy, organic and plant-based foods. They are also becoming more popular in the bakery sector and among other food manufacturers in Europe. A few European countries produce and import sunflower seeds themselves, but demand exceeds supply. In addition, the sunflower seeds market is considered flexible and able to source seeds from all corners of the world, as long as suppliers are trustworthy, committed and able to provide a sustainable supply of good-quality seeds. The main suppliers to Europe are Romania and Bulgaria. To compete with these suppliers, you will have to prove that you are a committed supplier of high-quality sunflower seeds.

What are mandatory requirements?

Food safety: traceability, hygiene, and control

Consumer safety is the most important consideration for any food product sold on the European market, and sunflower seeds are no exception. To guarantee that the sunflower seeds you sell meets EU food safety standards, you must make sure that they contain very few or no pesticide residues, contaminants such as metals and micro-organisms such as salmonella or E. coli. To meet these standards, you must apply the principles of the Hazard Analysis Critical Control Point (HACCP) system.

Aflatoxins (like mycotoxins), ambrosia and pesticide residues (ethylene oxide) are among the serious concerns in connection with sunflower seeds exports to the European Union. In recent years, there have been recurring notifications through the EU Rapid Alert System for Food and Feed (RASFF) concerning the occurrence of aflatoxins and other contaminations in consignments of sunflower seeds from countries including France, Egypt and Romania. This has led to more frequent import controls.

In 2021, there was one incident reported to the RASFF concerning residues of ethylene oxide in sunflower seeds imported into France (but the country of origin was not clear). This led to a withdrawal from the French market. Several reported incidents concerned contamination with aflatoxins, which led to several measures including treatment and detainment of the produce. Commission Regulation (EC) No 1881/2006 provides the maximum levels for certain contaminants allowed in foodstuffs, including oilseeds (see Table 1).

Table 1: Maximum permitted levels of aflatoxins in oilseeds (including sunflower seeds)

| Maximum levels (μg/kg) | |||

| Aflatoxins |

B1

|

Sum of B1, B2, G1 and G2 | M1 |

|

Groundnuts (peanuts) and other oilseeds and processed products thereof, intended for direct human consumption or use as an ingredient in foodstuffs, with the exception of: — crude vegetable oils destined for refining |

2.0 | 4.0 | - |

|

Groundnuts (peanuts) and other oilseeds, to be subjected to sorting, or other physical treatment, before human consumption or use as an ingredient in foodstuffs, except: — groundnuts (peanuts) and other oilseeds for crushing for refined vegetable oil production |

8.0 | 15.0 | - |

Note: European Regulation No 1881/2006 regulates the presence of aflatoxins. Types B1, B2, G1 and G2 are found in contaminated food, aflatoxin M1 is only found in milk products.

Source: European Regulation (EC) No 1881/2006 setting maximum levels for certain contaminants in foodstuffs

Tips:

- Get acquainted with the EU food safety policy and learn about the maximum residue levels (MRLs) for active substances used in plant protection products, including pesticides and active substances, that apply to sunflower seeds (use code 0401050).

- Visit the website of the Integrated Pest Management (IPM) Coalition, which provides several resources aimed at helping farmers worldwide reduce their use of hazardous pesticides.

- Check the website and overview of alerts related to sunflower seeds of the EU Rapid Alert System for Food and Feed (RASFF).

- Check ePing for an overview of country-specific measures that affect trade as well as contact persons per country defined by the WTO. Search for sunflower seeds.

Packaging

There are several regulations that control food packing in the EU, but 2 regulations are relevant for sunflower seed exports to Europe. Regulation (EC) No 1935/2004 requires that packaging materials do not release harmful levels of their components into foods and that they do not change the taste, smell or composition of food.

Sunflower seeds are most commonly transported as bulk cargo or break-bulk cargo, in jute bags, poly-woven bags or multiwall paper bags. If you are selling directly to retailers in Europe, most likely you will be using plastic bags to package your product. In that case, you must comply with Regulation (EU) No 10/2011 on plastic materials intended to come into contact with food.

Tips:

- Ensure appropriate temperature, humidity/moisture and ventilation conditions during transportation. Also avoid exposing your product to sun and heat, as the high oil percentage and high fibre content can cause sunflower seeds to undergo self-heating during transport.

- Talk with your buyers in Europe about their packaging needs and explain clearly what options you can offer. Poor packaging can result in buyers choosing a different supplier.

- Check out this webinar by Eurofins on product packaging considerations, changing packaging regulations and top reasons for import retentions.

Labelling

Food labelling requirements exist to ensure that food products sold on the European market are safe for consumers. In this context, Regulation (EU) No 1169/2011 establishes a clear and harmonised presentation of information.

Information required following EU Regulation 1169/2011

- the name of the food;

- the list of ingredients;

- allergens (for example, soy, nuts, gluten and lactose)

- the quantity of certain ingredients or categories of ingredients;

- the net quantity of the food;

- the date of minimum durability or the ‘use by’ date;

- any special storage conditions and/or conditions of use;

- the name or business name and address of the food business operator;

- the country of origin or place of provenance;

- instructions for use where it would be difficult to make appropriate use of the food in the absence of such instructions;

- a nutrition declaration.

Tips:

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

- Read the CBI buyer requirements for grains, pulses and oilseeds for additional information on labelling.

- You may consider engaging a labelling audit to see if your product complies with EU labelling standards. Trade-e-bility offers such services for a low fee.

What additional requirements do buyers often have?

Quality standards

Refers to the specifications of your buyer. Different buyers and market channels may require different quality grades. However, as a general rule, food imports into the EU must be:

- safe and suitable for human consumption;

- free of abnormal flavours and smells;

- free of dirt in amounts that may be harmful to human health (for example, there should be no dead insects or plant residues in your product);

- free of sand or living insects.

Tip:

- Learn the quality requirements of your buyers by discussing their expectations with them. Make sure to always deliver products that comply with these requirements. Not meeting buyers’ quality requirements can cause you to lose buyers and can damage your country’s reputation as a supplier of quality products.

Certifications

Certification schemes have become a common means to assure European buyers that products meet quality standards. As such, most European buyers accept food management and certification programmes recognised by the Global Food Safety Initiative (GFSI), including BRCGS Global Food Safety Standard, FSSC 22000, GLOBALG.A.P. and International Featured Standard (IFS), among others.

Your choice of a suitable certification scheme will depend on whether you are involved in the production, distribution or processing of sunflower seeds. Generally, sellers who are involved in the processing of foodstuffs are advised to apply a recognised food safety standard, such as ISO 22000.

Tips:

- Involve your buyer in your selection of a certification scheme for your product.

- Learn about the advantages of quality certification schemes by reading CBI tips for Organising your export and CBI buyer requirements for grains, pulses and oilseeds.

What are the requirements for niche markets?

Organic certification

Because of their high oleic content, oilseeds such as sunflower seeds can easily absorb pesticide residues and other harmful chemicals. Organically produced sunflower seeds are a good alternative, therefore, for health-conscious consumers. But even if you produce sunflower seeds following organic methods, you will not be able to sell them in the European market unless you apply for an organic certificate with an accredited certifier. Accredited organic certifiers will verify that you comply with Regulation (EU) 2018/848.

In general, the market for organic sunflower seeds is still a niche segment. At the same time, experts see the organic market as an opportunity for new players, as the demand for organic seeds is rising and big producers such as France and Romania generally do not produce organic seeds. Ukraine used to produce organic seeds, but its supply is disrupted because of the war. If you choose to obtain a certificate for organic production, find out more about the legislation for Organic production and labelling.

Tip:

- Read the CBI buyer requirements for grains, pulses and oilseeds to learn more about the requirements for the organics market in the EU, and find a full overview about organic farming on the EU ‘Organics at a glance’ webpage.

Gluten-free certification

Despite its continuous growth, gluten-free remains a niche market. Sunflower seeds are naturally gluten-free, when unflavoured and unseasoned. But some brands on the market use additives and flavourings containing gluten. To sell your sunflower seeds in Europe as ‘gluten-free’, you must follow the guidelines in Regulation (EU) No 828/2014. In particular, the statement ‘gluten-free’ may only be made where the food as sold to the final consumer contains no more than 20 milligrams of gluten per kilogram of product.

Moreover, companies selling foodstuffs to consumers are legally obliged to provide correct information on the absence or reduced presence of gluten in food products.

Tip:

- While processing sunflower seeds, make sure you have no cross-contamination from crops that contain gluten such as wheat, rye, barley, spelt or even oats (oats are often mixed with other grains).

Sustainability and social compliance

In response to societal demands to reduce the impacts of business on people and the environment, European buyers are paying more attention to corporate social responsibility (CSR). And because they alone cannot guarantee that products that come from outside Europe also comply with sustainability and social standards, buyers will often demand compliance with a code of conduct or that your product obtains CSR certification. The most important CSR certification schemes include:

- the Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct;

- the Ethical Trading Initiative (ETI);

- Sedex Members Ethical Trade Audit (SMETA) GLOBALG.A.P. and GLOBALG.A.P. Grasp;

- consumer labels for fairtrade practices, such as Fairtrade International and Rainforest Alliance, are increasingly adopted by businesses, but remain a niche segment.

The European Commission launched the EU Green Deal (EGD) in 2019 so as to meet its climate goals for 2050. In the roll-out of the EGD policies, environmental and sustainability standards may well become stricter in the coming years. Stay ahead of the curve and learn about the possible impacts of the EGD on imports from non-EU countries by checking CBI’s publication The EU Green Deal: how will it impact my business?

Also, in the context of the EGD, the EU has adopted a proposal for a Directive on corporate sustainability due diligence, which means that for many EU companies, social compliance will not be an option, but an obligation. This legislation currently applies to large companies and their global supply chains. Small and medium-sized enterprises are not included, but this could change in the years to come.

Tips:

- Use the ITC Standards Map to learn about the different sustainable and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct. You can also find many practical tools on the amfori BSCI platform.

Fairtrade

Obtaining Fairtrade certification can give your product a competitive advantage among consumers in Europe and around the world who want fair wages for producers and agricultural workers. However, this market segment remains a niche. To obtain Fairtrade certification, you may want to apply to Fairtrade Labelling Organisations International (FLO), the leading standard-setting and certification organisation for Fairtrade, or Ecocert Fair For Life (FFL) and the Institute for Market Ecology’s Fair for Life. Depending on whether you are involved in production, processing or export, different standards will apply. As the moment, there are no standards that apply to sunflower seeds, specifically.

Tip:

- Sustainability labels are expensive. Before contracting a verifying agency to obtain Fairtrade certification, make sure to check (in consultation with your potential buyer) that there is sufficient demand for this label in your target market and whether it is worth the investment.

2. Through what channels can you get sunflower seeds into the European market?

How is the end market segmented?

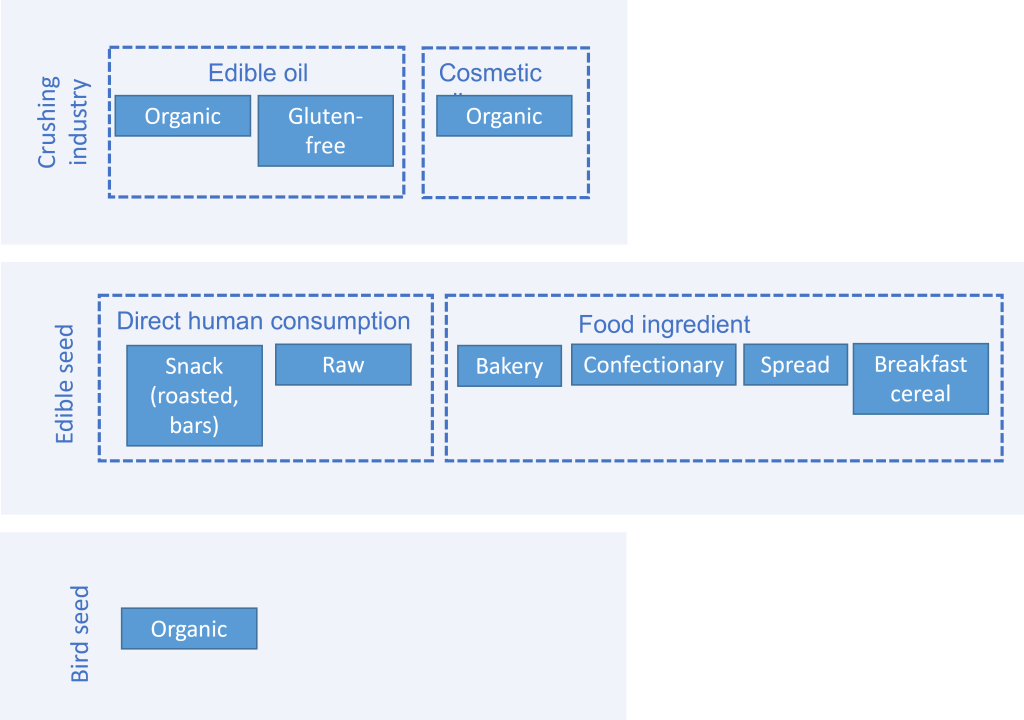

The global market for sunflower seeds is segmented according to colour, application and distribution channel. In Europe, 3 segments are distinguished:

Figure 1: End market segments for sunflower seeds in Europe

Source: Profundo (2022)

- Crushing industry: The majority of sunflower seeds (black grade) are used for oil extraction (80-95% of total production). According to FEDIOL, sunflower seed crushing in the European Union amounted to 8.5 million tonnes in 2020. The largest European crusher of sunflower seeds in 2020 was Hungary (18% market share), followed by Bulgaria (16%), Spain and Romania (both 14%).

- Edible seed industry: Within this industry, sunflower seeds are used either for direct human consumption or as an ingredient in food products, mostly bakery products. Health-conscious consumers are driving the increasing demand for sunflower seeds for human consumption. Sunflower seeds are a healthy and convenient snack, but are also used as toppings for salads, in soups or mixed with vegetables, muesli and other foods. In bakery products, sunflower seeds are often mixed with other oilseeds.

- Birdseed industry: While already growing before COVID-19, sales of birdseed increased sharply during the lockdowns in the context of the pandemic. Any type of sunflower seed is used for birdseed.

Both in the crushing industry and edible seed industry, the market is further segmented into organic and gluten-free. With respect to distribution channels, the sunflower seed market is segmented into offline and online.

Bakery segment

The bakery industry is the main segment for sunflower seeds. Small bakeries and industrial bakeries each cover around 30% of the cereal flour use (mostly wheat flour), with industrial bakers gaining ground over the small ones. New ingredients can help small bakers to differentiate themselves. Germany is at the top in Europe’s bread market, with opportunities in healthy bread substitutes, packaged bakery and other new product launches.

Figure 2: Sunflower seed biscuits

Source: Creative Commons; Vegan Feast Catering, CC BY 2.0

Breakfast cereal

Sunflower seeds can be used as a healthy addition to the existing breakfast cereals. According to Ceereal, the European Breakfast Cereal Association, the breakfast cereal sector includes 75 companies and represents an industrial value of 6 billion euros.

Figure 3: Sunflower seeds used as breakfast cereal

Source: Pixabay (simplified Pixabay license)

Healthy snacks

Nutritious oilseeds are regularly used for healthy snacks. Sunflower seeds are ideal ingredients for energy bars.

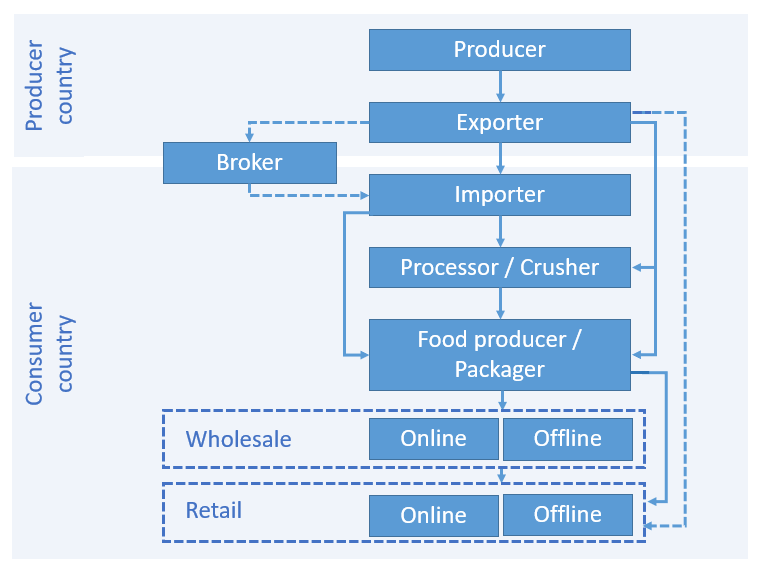

Through what channels does a product end up on the end market?

Trade channels for sunflower seeds will vary from origin to origin but, generally, the supply chain includes 6 distinguishable segments (Figure 4). Some of the segments are described below.

Figure 4: Current channels for sunflower seeds

Source: Profundo (2022)

Traders: importers and brokers

Currently, there are quite a few multinational companies active in the sunflower seed market. These pioneers have more or less integrated their supply chains and sell their brands directly to specialised stores and users. Cleaning and packing can be easily outsourced.

Sometimes agents or brokers are involved, often individuals or small companies that link your product to buyers in Europe and take a commission on the sales. Their function is purely commercial, and as a supplier, you will remain responsible for most of the logistical process. Examples include Cardassilaris (Greece), SOLCO Brokers (Spain) and Sunstone Brokers (Switzerland).

Among the few companies that work with sunflower seeds are:

- Spack: (The Netherlands) importer specialised in specialty oils and trade in organic sunflower seeds and oil

- Tradin Organic: (The Netherlands) importer of organic ingredients, specialised in specialty oils and sunflower seeds and oil

- Tracomex: (The Netherlands) importer of ingredients for the food, animal feed and pet food industries

- Rapunzel: (Germany) organic oilseeds

Processing industry (crushers)

As crushing of oilseeds used to be done between millstones that later became steel rolls, the factories are now known as oil mills and the process as oil milling or oilseed crushing. Sunflower seeds are usually mechanically pressed to squeeze out the oil; the compressed cake is then often further treated in an extractor.

Some of the major commodity traders are also crushing sunflower seeds for oil, including Bunge, Olenex and Cargill.

Tip:

- Check out the webpages of the different FEDIOL members. Each of these member associations lists oilseed crushers in the relevant EU country.

Food manufacturers

Food manufacturers use sunflower seeds as an ingredient to produce different kinds of (food) products. These actors need a reliable supply chain and stability, so they often work with medium or long-term contracts. For many of these companies, sourcing ingredients is not their core business, so they use the services of specialised importers. Manufacturers that use sunflower seeds in large volumes or as a major ingredient in their business sometimes enter into direct contracts with producers.

Some European food producers using sunflower seeds as a food ingredient include Ekibio Groupe (France), Horizon Natuurvoeding (the Netherlands), Intersnack (Germany), Pendon (Italy) and Seeberger (Germany).

Retail

After oil, sunflower seeds sold as kernel dominate the retail segment, closely followed by (roasted) salted, in-kernel sunflower seeds that are sold as snacks. A smaller proportion of sunflower seeds are sold as part of the ingredients of cereals and bakery products.

Tips:

- Plan you market entry strategy well. To that end, study the profiles of potential buyers and decide whether your product can meet their needs.

- Before engaging in international trade, make sure your supply chain is well set up with reliable farmers and good primary processing facilities for drying and cleaning the sunflower seeds. Buyers will expect you to prove that you are capable of providing a steady supply of quality seeds.

What is the most interesting channel for you?

For exporters that are new on the European market, the best way is to find a specialised importer or broker of (healthy) seeds and food ingredients. They can facilitate your market entry and get your product into the distribution and manufacturing channels.

When processing technology in the country of origin is not yet up to European standards, it is best to find an importer with their own cleaning facilities. Well-organised and fully certified exporters that can guarantee a reliable supply and high-quality product can target a wider range of importers of ingredients.

Tip:

- Meet with importers of special ingredients and gluten-free grains at large food trade fairs such as SIAL, Anuga, Biofach and Food Ingredients Europe or smaller, specific events such as the Free From Functional & Health Ingredients Exhibition and iba, a leading trade fair for baking and confectionery.

3. What competition do you face on the European sunflower seed market?

Which countries are you competing with?

Moldova: a steady supplier

Moldova saw its share in total exports to Europe increase over the years until its exports decreased in 2021. Despite this, Moldova’s exports to Europe still far exceed those of other countries. Moldovan growers have rich farmlands and continue to invest in new varieties and techniques. After growing for years, their production area and yields stabilised between 2017 and 2019, followed by a severe decline in 2020. Sunflower seeds are the second-most exported product from Moldova in 2020.

Argentina: increasing share of exports to Europe

Argentina’s share in sunflower seeds exports to Europe increased from 10% in 2017 to over 30% of total volumes exported from non-European countries to Europe in 2021. Whereas production, amounting to 3.4 million tonnes in 2021/2022, is expected to be compromised due to excess rainfall and the presence of a Phomopsis fungus outbreak, the country says demand for it seeds has increased following the Russian invasion of Ukraine.

China: major exporter with expansion potential

Following Argentina, China also saw its share in total extra-European exports to Europe decrease in the past year, falling to 76,140 thousand tonnes in 2021 from 101,798 in 2020. Nonetheless, potential for increased sunflower cultivation remains high in China due to an established industrial supply chain of producing, processing and marketing near sunflower seed producing regions. More than half of all products are domestically consumed, but overseas exports have gradually increased in recent years. The country has been making great strides in the development of its own seeds, due to intensified national policy support, leading private companies and seed companies.

Ukraine: most potential in volume

Ukraine accounts for a quite steady share in exports to Europe, with a volume of 57,682 thousand tonnes in 2021. Ukraine is the world’s top producer of sunflower seeds, but it is not a major supplier of seeds to Europe (rather, Ukraine supplies sunflower seed oil). Because of the Russian invasion of Ukraine and the supply chain disruptions that come with it, Ukraine is seeing the share of its market reduced and it is not certain for how long this situation will continue.

Russia: export quotas make it a less important competitor

Russia, together with Ukraine, is the world’s top producer of sunflower seeds. Although it is among the top 6 exporters to Europe, its market share in Europe was 5% in 2021 (up from 2% in 2019). In the context of its war with Ukraine, Russia imposed export quotas for sunflower seed and sunflower oil at least until August 2022. This qualifies Russia, at least temporarily, as a less important competitor.

Serbia: high-quality and high-yield sunflower seeds

Serbia accounts for a quite steady share in exports to Europe, at 5% of total extra-EU exports to Europe in 2021, at a volume of 19,124 thousand tonnes. Sunflower is the most common oil plant in the country, and the area under sunflower cultivation is about 40% higher than 10 years ago. Serbia has invested a lot in the development and multiplication of standard and new hybrid seeds, in cooperation with the companies Syngenta and Advanta Seed.

Other important and competitive sunflower seed production countries outside the EU are the United Kingdom (5% of total volume in 2021), Turkey (4%) and the United States (3%).

Tips:

- Look for the best logistical route for your supply. Think carefully about the location for collecting and processing the seeds and choose the best port for export. If your company is further away from production sites or logistical hubs, you will have to compensate in another way such as product price to compete with better located exporters.

- Track demand trends in different European countries by checking FoodDrinkEurope; chose countries with the most potential for your product.

Which companies are you competing with?

Moldovan companies

Eco Agromix srl is a Moldovan wholesaler of sunflower kernels (shelled and unshelled), dried plums and walnuts and grapes. According to its website, this company is a family business of Moldovan farmers and traders with over 30 years of experience in agriculture. The company owns about 1,000 ha of land.

Lender Agroprim is a Moldovan crop producer founded in 2007. The company specialises in the production, processing and export of cereals and oil seeds, including sunflower seeds. Lender Agroprim is one of the largest Moldovan companies, in terms of cultivated area (9,300 ha) and production volume. The company exports to the European Union, shipping both railway and freight transport.

Argentinian companies

Argesun is a family-owned company founded in 1990 that produces and exports agricultural products to 70 countries worldwide. Its main export product is inshell and kernel sunflower seed both for human consumption and animal feed. Argesun owns more than 70,000 hectares of land and ships over 2,500 containers abroad every year. Argesun products are certified under the following schemes: FSSC 22000, SMETA and MercoKosher. A catalogue of its export products can be found online.

Snack Crops is an Argentinian oilseed and grain producing company, founded in 2004. Snack Crops produces, processes and exports specialty crops including confectionary sunflower seed (under the trademark SUNNY), popcorn (SNACK), chickpeas (DON GARBANZO) and chia (CHIA PLUS). The company produces 12,000 tonnes of sunflower seed a year. Sunflower seeds are certified under ISO 9001 and Halal. The company sells kernel platinum, kernel grade 1, bird kernel, bakery platinum and bakery standard quality sunflower seeds.

Chinese companies

Chentai Foods is a sunflower seeds factory established in 2010 and located in Inner Mongolia, China. Chentai Foods supplies the international market with black sunflower seeds, sunflower seeds for oil extraction, sunflower seeds for animal feed and sunflower kernels. The company also supplies pumpkin seeds and melon seeds.

Chentai Foods has 5 sunflower seed processing lines, 2 pumpkin seed processing lines and 5 sunflower kernel lines. Its machines include sieving machines, stone picking machines, gravity separators and colour sorting machines. Chentai Foods has a yearly processing capacity of 20,000 metric tonnes of sunflower seeds, 5,000 tonnes of pumpkin seeds and 10,000 tonnes of sunflower kernels. It currently exports to Egypt, Dubai, Iran, Iraq, Kuwait, Turkey, Saudi Arabia and Malaysia.

Ukrainian companies

Agrofirma POLE is a supplier of organic sunflower seeds established in 1999. In 2005, Agrofirma POLE began exporting to Germany and the Czech Republic and since 2010 it has served the entire European market. The company opened logistic warehouses in the Czech Republic and Poland in 2015. All of its processing facilities are FSSC 22000-certified.

Agrofirma Pole has its own organic certified granary silo with a total capacity of 4,400 tonnes for storage of organic raw material and a 2,000 m2 warehouse. In addition to organic sunflower seeds, the company processes and exports cereals, pulses, other oilseeds and feed crops.

M.A.R. Pumpkinseeds is a Ukranian oilseed producer founded in 1992. The company produces, processes and exports pumpkin seeds and sunflower seeds to Europe and Asia. M.A.R. Pumpkinseeds sources from smaller producers as well. The company is ISO 22000-certified.

Russian companies

Altay Pole LTD is a sunflower seed and flax seed processor located in Barnaul and founded in 2005. Altay Pole has a monthly production capacity of over 1000 tonnes. The company produces edible sunflower oil, roasted sunflower seeds and sunflower seed kernel. Altay Pole sells its products on the Russian market and in Europe.

Which products are you competing with?

Sunflower seeds are part of the oilseeds group, which also includes linseed, chia seed and sesame.

Wholeseed sunflower seeds, which are increasingly used as a healthy and vegan food ingredient, could be compared with other seeds such as chia seed, linseed and sesame seed. Those competitors are all growing in popularity because of their nutritional values and are therefore increasingly used for direct human consumption.

As with sunflower seed, the main market for human consumption of linseed can be found within the bakery and health food segments, It is increasingly used in seed mixes for snacks and breakfast products. Whole or broken seeds are used as food ingredients in baking and confectionery industries. Crushed linseed produces both linseed oil and fibre-rich linseed meal as a by-product, which is mostly used as animal feed. Global linseed prices have been decreasing, due to larger harvests.

Chia seeds are rich in omega-3 fatty acids, protein and fibre, just like sunflower seeds. They are equally considered excellent for healthy and plant-based diets. They can be used as seeds or processed into crushed seeds, oil and defatted flour or extracted protein. Due to surplus production, partly as a result of the ‘chia-buzz’, prices dropped and have been relatively stable over the past years.

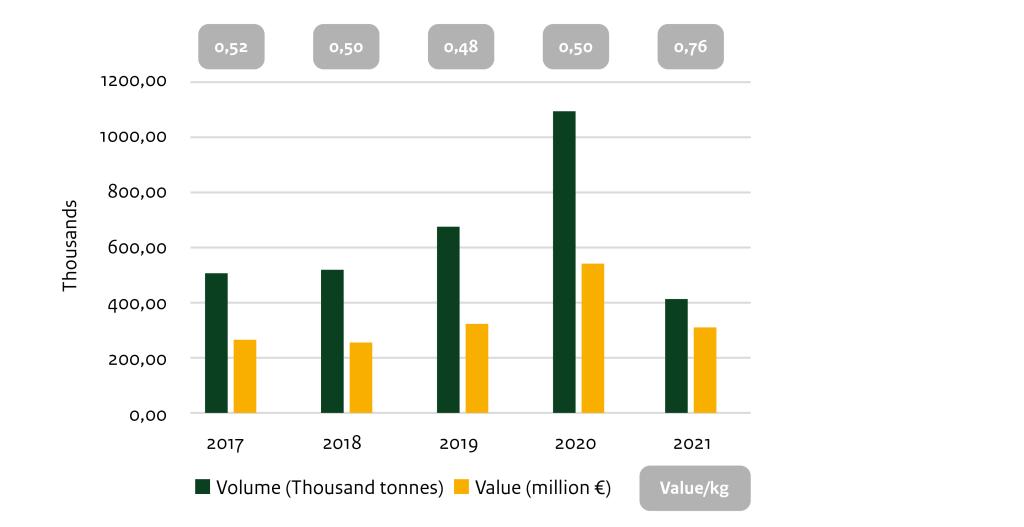

4. What are the prices for sunflower seeds on the European market?

The price you get for sunflower seeds depends on the type of seeds you supply, their quality, the level of processing and whether they have obtained sustainability certification. But international market prices play a role too, and they are driven by global oilseed prices.

After a period of relatively stability, sunflower seed prices began to fluctuate in 2021, when prices in Ukraine (the world’s largest sunflower seed producer) increased, driven by an unmet demand for this product. Market analyses predicted more stable prices for 2022, based on the assumption that global sunflower seed production would break records and increase by 20% compared with 2021 (this would mean a global production of 57.3 million tonnes).

With Russia (the world’s second-largest producer) imposing sunflower seed export bans, in the context of its war with Ukraine, that scenario is unlikely. And supply chain disruptions and subsequent decrease in supply will result in higher prices.

Import prices for sunflower seeds in Europe varied between € 0.7 and € 1.3 per kilogram between 2017 and 2021 (Figure 6). The most price variation is seen in 2022. In February 2022, average prices were € 1.62 per kilogram. In May 2022, 3 months into the Russian invasion of Ukraine, prices had reached € 2.09 per kilo.

Figure 6: Average trade value of sunflower seeds imported into Europe

Source: Eurostat

Tip:

- Create a free account on Tridge.com to obtain sunflower market information. The paid service includes more detailed pricing and market intelligence insights.

Profundo carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research