Entering the European market for teff

Although the European market for teff is relatively new, the competition is increasing from suppliers in South Africa and the United States, as well as within Europe. To become part of the teff supply chain to European markets, you must work closely with teff growers and pioneering food companies. Your most promising market channels are specialised importers of bakery and healthy food ingredients, or manufacturers of gluten-free brands.

Contents of this page

1. What requirements must teff comply with to be allowed on the European market?

Teff must comply with the general market requirements, which you can find in the buyer requirements for grains, pulses and oilseeds on the CBI market information platform. You can also use the Trade Helpdesk, which offers an overview of legal market access requirements per country using HS code 100890 for “other cereals”. The most important requirements when exporting teff to Europe are food safety, quality and a residue-free product.

What are mandatory requirements?

Food safety: Traceability, hygiene and control

The most important requirement for teff is to make sure it is safe for consumption. Food safety and traceability should be your top priority. Non-compliance can lead to temporary import stops or to stricter control from your country. As a supplier you must make sure to work according to the guidelines of Hazard Analysis and Critical Control Points (HACCP).

Reducing the risk of contamination and chemical residues is among the most important things to assure teff grains are safe for consumption. Although teff is not known to be a pesticide intensive crop, pesticide residues must be a main point of attention when exporting the grain to Europe. Northern Europe, in particular Germany, are among the most alert buyers for (excessive) pesticide residues.

Contaminants such as Aflatoxins and micro-organisms such as Salmonella, E.Coli and Listeria monocytogenes must be absent or within the limits according to the European legislation. Be aware that the requirements for teff in baby food are more stringent.

Tips:

- Read more about pesticides, contaminants and micro-organisms on the website of the European Commission. Find out the MRLs for pesticides and active substances that are relevant for teff by consulting the EU MRL database; Search for teff or for ‘common millet / proso millet’ (code number 0500040).

- Reduce the amount of pesticides by applying integrated pest management (IPM) in production. IPM is an agricultural pest control strategy that includes growing practices and chemical management.

- Read about your key obligations in Europe as a food and feed business operator.

Nutritional claims must be officially recognised

Teff has much potential as an ingredient due to its nutritional value, but you cannot claim or promote health benefits that are not approved by the European Union. Any nutrition and health claim should only be made in accordance with the requirements of the Health and Nutrition Claims Regulation (EC) No 1924/2006.

Tip:

- Check with the EU Register on nutrition and health claims to see which claims are allowed to be made in the European market.

Making sure your teff product is gluten-free

If you want to sell your teff as a gluten-free product, you need to make sure these substances are not present in your product. You must avoid cross-contamination. The most drastic method of ensuring this is when such substances are not even present in your production facility.

In the European Union, allergens such as gluten need to be declared on the label. According to the legislation on gluten-free food and specific food labelling, gluten-free products cannot contain more than 20 mg/kg of gluten. Up to 100 mg/kg may be marketed as ‘very low gluten’. European companies that specialise in gluten-free food may be stricter than the European regulation.

Maintaining high quality

There is no specific marketing standard for teff grains or flour, but you can use the standards for millet in the FAO Codex Alimentarius as a reference:

The main quality requirements and characteristics for millet (and teff) are indicated below in table 1.

Table 1: General requirements for millet and teff

|

Minimum quality requirements:

|

|

|

Important quality characteristics:

|

|

|

Additional limits and requirements:

|

|

Tip:

- To measure falling number see factsheet falling number of Grain Growers or the procedures for the falling number test by the Canadian Grain Commission.

Packaging and shipment

Common packaging methods for teff grains are 25kg polypropylene or multi-layer paper bags. For organic grains, paper is often preferred. The packaging must be suitable to protect the product and must be conform to the Regulation (EC) No 1935/2004 on materials and articles intended to come into contact with food. For shipments you can use pallets, or stack the bags directly in the container with protective liners between the bags and the container walls.

Tips:

- Always discuss specific packaging requirements and preferences with your customers.

- Check the additional requirements if your product is pre-packed for retail in the Codex General Standard for the Labelling of Prepackaged Foods or Regulation (EU) No. 1169/2011 on the provision of food information to consumers in Europe.

What additional requirements do buyers often have?

Certifications as a guarantee

As food safety is a top priority in all European food sectors, you can expect most buyers to request extra guarantees from you in the form of certification. Food management systems and certifications that are recognised by the Global Food Safety Initiative (GFSI) are widely accepted throughout Europe.

For teff processors (cleaning, milling and packing), a recognised food safety management system is a necessity to become a supplier to European buyers. As a supplier, you may find one of the following certification schemes useful, depending on the role you play in the supply chain (production, distribution or processing):

- GLOBALG.A.P. (agricultural production);

- Food Safety System Certification 22000 (FSSC 22000 /ISO 22000);

- BRCGS for Food Safety (British Retail Consortium);

- IFS Food Standard (International Featured Standard).

Tips:

- Check with your buyer to determine which certification scheme is most relevant for your target market.

- Read the CBI tips for Organising your export and CBI Buyer requirements for grains, pulses and oilseeds on the CBI Market Information platform to get more detailed insights into the advantages of certifications.

Sustainability and social compliance

European buyers are increasingly paying attention to corporate social responsibility (CSR) concerning the social and environmental impact of their business. As an exporter, you are part of the supply chain and share this responsibility.

Buyers will often have you fill in a set of documents and declarations before doing business or ask you to comply with a code of conduct. Applying standards and certifications will help you fulfil the expectations of buyers. Initiatives or certification schemes that can help improve your CSR performance, are:

- The Business Social Compliance Initiative (amfori BSCI), implementing the amfori BSCI code of conduct;

- The Ethical Trading Initiative (ETI);

- Sedex Members Ethical Trade Audit (SMETA)

- GlobalG.A.P. and GlobalG.A.P. Grasp

Tips:

- Use the ITC Standards Map to learn about the different sustainable and social standards and see which ones are available for your country.

- Check your company’s current performance and implement the amfori BSCI code of conduct. You can also find many practical tools in the amfori BSCI resources.

- Read about the different social programmes and initiatives in the CBI study on buyer requirements for grains and pulses in Europe.

What are the requirements for niche markets?

Organic certification

An organic label is a common requirement for ‘health’ ingredients. Offering organically cultivated teff will be popular in the health food sector. The potential demand for organic teff will be difficult to fulfil with the current supply.

In order to market organic products in Europe, you have to use organic production methods according to European legislation and apply for an organic certificate with an accredited certifier. Organic teff must be clean from any chemical traces. Note that, starting January 2021, the new legislation Regulation (EU) 2018/848 will come into force.

Tip:

- Consider organic as a serious option if your situation and location permit it. Remember that implementing organic production and becoming certified can be expensive. You must be prepared to comply with the whole organic process to market organic products. Read more about organic certification in the CBI study on buyer requirements for grains, pulses and oilseeds in Europe.

Fair trade label

A consumer label for fair trade practices for teff grains, such as Fairtrade International and Rainforest Alliance, is still nearly non-existent at the moment. The market for teff with such a label is very small, because teff is still a niche product. It may become an interesting way to differentiate your product in the future, but you will need to find very specific buyers.

2. Through what channels can you get teff on the European market?

Teff is still a niche product that is often marketed by companies that specialise in allergen-free food or health ingredients. There are several brands and bakery channels that are relevant for the promotion of teff.

How is the end-market segmented?

Most teff is processed into flour for the bakery industry, food manufacturing or retail. Teff finds its way to the consumer market through specialised bakeries, restaurants, health shops or retailers with ethnic or gluten-free products.

Bakery sector

The bakery sector is by far the largest segment for cereal flours. The sector includes small, industrial and supermarket bakeries and takes in 72% of the flour. Only a very small percentage works with niche cereals such as teff. The best potential for teff lays within the specific segments that include bakeries with gluten-free products or with a focus on ancient grains or innovative products.

For small bakers, it is easier to make a new product with teff, while for industrial bakers, product development is usually a long process but with a bigger impact for the niche ingredient. The market shares of industrial and craft bakers are approximately the same size, but there are great differences between European countries. In the United Kingdom and the Netherlands, the industrial bakeries represent 80% of the production, while in Germany, France and Spain, the percentages are much lower, between 30 and 40%.

Food manufacturing

- Besides bakeries, other type of food manufacturers are also potential users of teff. The biscuit and rusk manufacturers use about 14% of the available cereal flour, but there are several other, mostly health-oriented food producers that have seen the health benefits and usability of teff grains. This has resulted in a variety of teff-based products and brands, such as:

- Joannusmolen teff breakfast

- Teff Inside for diet and sport nutrition

- 3 Pauly pasta with teff

- Amadin teff drink

- Schär Crispbread

- Consenza crackers with teff

- Tobia organic teff flakes

Many of these products are available in specialised shops (or web shops) of healthy and natural food products such as Holland&Barrett (International) and Reformhaus (Germany). A few brands also entered the main supermarket channels.

Figure 1: SchÄr Crisbread, a teff-based product

Source: SchÄr

Household use & other uses

Household flour accounts for 12% of the flour market. Teff can be an alternative ingredient for home baking, in addition to other specialty flours such as almond flour, chickpea flour and rice flour. For household users, it is important to understand the application and the baking characteristics of teff or teff flour. The current knowledge is especially present with ethnic users, including restaurants.

Household teff can be most commonly found in specialised shops:

- Health shops with allergen-free food and health ingredients;

- Ethnic shops with Ethiopian food products;

- Organic grocery stores and some supermarkets with ‘free-from’ sections.

Once teff becomes a more widely known product, general grocery stores will likely start to adopt consumer packed teff.

Tip:

- Learn more about the European bakery and flour milling industry through the British Federation of Bakers, Facts & Figures of European Flour Millers, and news sites such as BakingBusiness (limited access without registration).

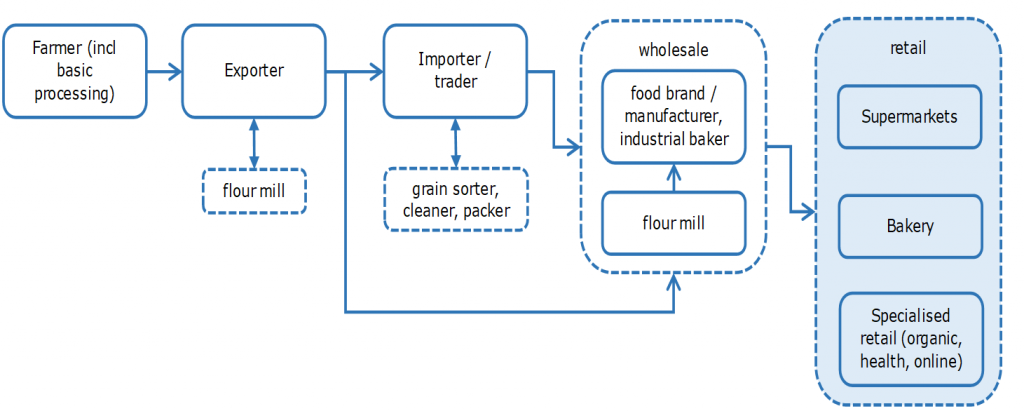

Through what channels does a product end up on the end-market?

The main channels for teff grains or flour are importers of ingredients and milling companies. Food manufacturers can also source internationally when teff plays an important role in their business, such as brands that are specialised in gluten-free products.

Figure 2: Market channels for teff grains (and flour)

Importers of food ingredients and milling companies

Teff mainly enters the European market through food ingredient imports and milling companies. They have an important role in checking the quality and food safety specifications of the product, as well as in the further processing and distribution to smaller users and resellers.

Companies that are most likely to enter the teff business are companies with bakery ingredients, health ingredients or a gluten-free specialisation. Importers that import, trade or mill teff:

- Tradin Organic, specialised in organic food ingredients;

- Ziegler organic, organic grain trader with processing facilities;

- Bakels, supplier of bakery ingredients;

- Danatura, an importer of healthy, natural grains and seeds;

- Millets Place, a company specialised in the cultivation and marketing of teff.

Industrial bakers and food manufacturers

According to the UK Federation of Bakers, there are strong links between the industrial baking sector and the agriculture and milling industries in the European bread market, with many of the large bakers being owned by key agricultural or milling concerns. Large plant bakeries may therefore have their own sourcing of ingredients. Some of the traditional milling companies have become brands and food manufacturers, such as Schnitzer and Baukhof in Germany.

For food manufacturers to adopt new ingredients, the supply chain needs to be reliable and stable. Food manufacturers with a specific focus on gluten-free and health food will be most interested in using teff grains in their products. Typical brands that have such a focus, are:

- Schär, one of the major gluten-free brands

- Zonnatura, a Dutch brand that promotes natural food

- 3Pauly, with a focus on alternative nutrition and bakery specialties

- Orgran, an Australian ‘free-from’ brand selling in Europe

- Semper, specialised in gluten-free food products

Tip:

- Make sure to learn all product characteristics and processing methods of teff grains, as well as the requirements for gluten-free processing. Knowledge is important to enter the specialised bakery and gluten-free market channels.

What is the most interesting channel for you?

Teff is still a relatively small product in the European food industry. When exporting teff to Europe, the ingredient companies will be the most logical route to supply your grains, but not every ingredient or milling company will be interested in such a niche grain, so it is important to look for specialisations such as in bakery ingredients, health and organic ingredients and gluten-free ingredients.

There are also several companies that have made teff their primary business, such as Millets Place, Tobia Teff, Teff Inside and Teff Land. This means that they know the product well and they can be a good starting point to explore potential supply chains or even cooperation. When you can guarantee a reliable supply volume, large plant bakeries and food manufacturers could become your next target group.

Tip:

- Visit international trade fairs to find potential buyers, for example at one of the main food fairs in Europe such as SIAL, Anuga, Biofach or Food Ingredients Europe, or at a specific bakery fair such as Südback and iba, or a specialised event for allergen-free food such as the Free From Expo, or one of the locally organised Allergy Show.

3. What competition do you face on the European teff market?

The competition among teff suppliers in Europe will likely increase, although the market is not yet sufficiently developed for both local farmers and foreign suppliers to enter the teff business en masse. Foreign suppliers stand a chance on the European market if they are able to efficiently produce and process teff grains and turn it into a food-grade export product.

Which countries are you competing with?

Ethiopia dominates the teff production worldwide, while most of the European import seems to be covered by the United States and South Africa. However, exact data on production and supply is lacking. Spain and the Netherlands are the most prominent producers in Europe.

Ethiopia: Produces more than 95% of the world’s teff grains

Ethiopia is the world’s largest producer of teff grains, growing more than 95% of the teff in the world. Teff is a staple crop in Ethiopia and part of a daily diet with food products such as ‘injera’ (a local flatbread). Around 6 million Ethiopian farmers are involved in the annual cultivation of 4 to 4.5 million tonnes of teff. Despite this very large production volume and growing demand in Europe and the United States, the country is not capitalising teff in the international market.

To maintain the stability of domestic prices and assure food security, Ethiopia banned the export of unprocessed teff grain and flour for several years. Only since 2015 has Ethiopia made concrete plans for the export of teff, allowing the export of milled and processed teff, originating from 48 selected farms that manage 6,000 hectares. Upscaling this international trade will be a challenge for many Ethiopian smallholders in terms of traceability, logistics and compliance with European requirements.

Ethiopian teff exports were valued at less than 1,000 tonnes in 2019, and the export to Europe remained small with 97 tonnes of teff grains and 11 tonnes of flour. So far, injera has probably been the most successful export product, with Mama Fresh being one of the most successful companies. However, the unofficial account of trade specialists is that there are large volumes of teff leaving Ethiopia illegally.

United States: Teff buyer and grower

The European import of niche cereals from the United States was around 1,700 tonnes in 2019, but a large proportion of this is likely wild rice. Still, the volumes are higher than most other countries.

The growing interest in global cuisines and initiatives by companies such as The Teff Company have resulted in a steady cultivation of teff grains. In the United States today, teff is primarily grown in Idaho, Oregon, and Washington State, and mainly destined for the domestic market.

To supply Europe, the United States may not be price competitive, but food safety legislation would be more in line with Europe than traditional producers in Africa. However, the country is not likely to export a lot of teff, as it still needs foreign supply itself. The United States is principally a teff buyer.

South Africa: One of the main suppliers to Europe

In South Africa, teff was originally grown as animal feed, but nowadays there is also commercial teff cultivation for human consumption. The European Union imported around 750 tonnes of niche cereals, most of which probably concerned teff grains. There are several buyers in Europe that are known to import teff from South Africa.

The increasing international demand can be a reason for animal feed growers in South Africa to start growing teff for human consumption and export.

Europe: Roughly 30 to 50% of supply from European production

The European teff market is still small and there is not yet a market for large-scale producers. Part of the limited demand for teff grains is fulfilled by local producers. A rough estimation of the market share of European-produced teff is 30 to 50%. If available, a local supply is often preferred because it is considered more sustainable, much easier in logistics, and with better traceability and food safety control.

Spain is probably most advanced in the cultivation of teff, with volumes of up to 1,000 tonnes. Most of Spain’s teff is exported, which makes Spain one of the larger, if not the largest, exporters of teff in the world. The Netherlands, and possibly a few other European countries, produce smaller quantities of teff as well, but there is little information about the exact volumes.

France, Italy, Poland as well as Germany may have larger potential to grow teff in the future, as these are the countries that currently produce the most niche cereals in Europe.

Other countries: Future competition can come from many sources

There are several countries that could play a role in future competition in teff grains. Several online sources suggest there is teff production in Uganda, Kenya, Cameroon, Argentina, India, Ukraine, Canada and Australia, among other countries.

In most African countries, teff is used for animal feed or as a cover crop. Teff (or injera) is only a part of the human diet in Eastern Africa, such as Ethiopia, Eritrea and Djibouti. After Ethiopia, Eritrea is believed to be the second-largest teff producer, but this is mostly for domestic consumption and little is exported, so the country has little significance as an international competitor.

Trade statistics indicate Argentina, Ukraine and Israel as potential competitors, with news sources confirming the production or active trade in teff grains. Possible cultivation in India, Canada and Australia has had a minor impact on the European import.

Tip:

- Consider teff as a bulk product and focus on price efficiency. A niche grain such as teff will ultimately become just another commodity and requires you to be efficient and price competitive. You must learn how to cultivate and process teff, using the right equipment and teff varieties.

Which companies are you competing with?

The number of suppliers is relatively limited, but you must not underestimate the competition of new companies. Most successful companies will have a strong link with the cultivation of teff or already have an international network of cereal grain buyers. Examples of companies that are active in the production and trade of teff are Icon Foods International, AGT Foods and Millets Place.

Icon Foods International

In South Africa, teff is commonly used as fodder or animal feed. Icon Foods International is a South African company that has turned its founder’s experience in teff cultivation for polo ponies into an export business of gluten-free grains and flours. With Ethiopian’s influence and expertise, it started off as a small factory and developed into a full milling plant.

AGT Foods Africa

AGT Food and Ingredients is one of the largest suppliers and exporters of staple foods and food ingredients in the world. This multinational company has offices and processing facilities in important agricultural regions such as Canada, the United States, Turkey, India, Australia and South Africa. There are sales offices in the United Kingdom, the Netherlands and Spain, and shipments to more than 120 countries.

At their facility in South Africa, the company includes teff in the food range, but with a global reach they can easily expand their teff business globally. This makes the Africa division of AGT Foods one of the biggest potential competitors in the teff trade. Their current offer in South Africa includes four teff varieties: brown (red), dark brown, ivory and white (manja).

Millets Place

Millets Place is a specialised company in teff grain operating from the Netherlands. The company founders have developed a range of protected strains of teff (MP-Teff) and work with dedicated growers in different countries. They control the supply chain from cultivation to processing and commercialisation.

After the teff grains are harvested, Millets Place outsources the cleaning to expert contracting partners in Europe to obtain >99.5% purity. Since February 2019, the company works with their own engineered mill to grind teff into flour. They not only offer conventional and organic teff, but also teff derivatives such as teff flour, teff puffs and teff flakes in white and brown variations.

As a competitor, Millets Place leads in cultivation techniques and has all the advantages of an integrated company, but teff growers may benefit from this company’s experience by cooperating with them. However, they explicitly do not work with Ethiopian growers due to ethical reasons, considering the continuous food shortage and famine in the country.

Tip:

- Start with your local or regional market when you are new in the teff business. Having gained experience in producing steady volumes and[properly organised your business, international buyers will take you more seriously. Moreover, markets in Europe tend to be much more difficult in terms of requirements and competition.

Which products are you competing with?

There are several ancient and healthy grains the European consumer can choose from. Teff has to compete with grains that are currently better known as food, such as spelt, einkorn, quinoa and amaranth. Millet type grains are more often used as birdseed. However, the nutritional properties of teff as a gluten-free grain, high in iron and low on the glycaemic index, could be considered superior to many other grains on the market. Even though these are not yet sufficiently promoted, they give teff a potential competitive advantage.

As an agricultural crop, teff must compete with common high-yielding grains such as maize, wheat, barley and sorghum, which are often more familiar to growers and have much larger markets globally. Teff is relatively easy to cultivate, but it is also a labour-intensive crop, which makes it less attractive for farmers when (international) prices for other grains are high.

Tips:

- Emphasise the nutritional benefits of teff in your marketing efforts and commercial communication. You can also include specific nutritional information in the product specifications you send to potential clients.

- Make sure to have a reliable source of teff when you want to supply the European market. This means you must work closely together with farmers and keep producing the volumes you need for your clients, regardless of the prices.

- Compare the development of different ancient grains: See the graph with the growth of products with ancient grain ingredients provided by the Whole Grains Council in the article about ancient grains in Miller magazine.

4. What are the prices for teff?

Teff lacks clear international pricing and organised data. Prices fluctuate and simultaneously depend on the origin and the advancement in cultivation. As the main teff producer, Ethiopia provides an important indication for teff prices, although these are not necessarily representative for other producing countries.

According to the FAO Analysis of price incentives for teff in Ethiopia for the time period 2005–2012, the historic FOB export prices in Ethiopia varied between 512 and 1002 USD per tonne (2005-2012). According to European buyers, recent FOB teff prices were approximately 1.35 USD per kilo for teff grains and 1.60 USD per kilo for teff flour. The most recent trade data (2017) from Ethiopia confirms these prices (see figure 4).

The FAO country brief points out that the general grain prices in Ethiopia in 2019 increased about 40% due to production shortfalls and high fuel prices. The Ethiopian Grain Trade Enterprise (EGTE) keeps track of wholesale prices in Ethiopia, which were on average slightly above 1000 USD per tonne in the first quarter of 2020. The prices for white teff grains are slightly higher than those for brown/red or mixed teff.

Realistically, international prices must take into account the effort of additional administration and food safety management. Commercially, you can expect a FOB price of between 1,000 and 1,500 euros per tonne. The recent COVID-19 crisis may push up prices temporarily while consumers are stocking more healthy foods.

In the European retail, packaged teff grains up to 1 kilo are generally sold for 5 to 6.50 euros per kilo, and teff flour for 6 to 8.50 euro per kilo. Most of the margin goes to wholesalers and retailers. The teff market is relatively new and small, which involves more risks and higher marketing and sales costs. This is reflected in the division of margins and price breakdown (see figure 5).

Table 2: European retail prices (for packages up to 1kg)

| Teff grain: | 5 - 6.50 euro per kilo |

| Teff flour: | 6 - 8.50 euro per kilo |

| Organic teff grains / flour (often from Spanish cultivation): |

7 - 8.50 euro per kilo (up to 18 euros per kilo for brands) |

ICI Business carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research