10 tips to go digital in the grains, pulses and oilseed sector

The supply chain for grains, pulses and oilseeds is becoming more digital. This is most evident for the larger commodity crops, such as wheat, soy beans and maize. Digital technology allows you to collect data, improve agricultural production and get better access to funding and markets. You must be selective in the technologies you wish to use, as there may be many tools available in your country. Other key success factors are the support of the service provider and good mobile connectivity.

Contents of this page

- Go mobile and select your digital solution

- Use digital services to get data and advice that help your decision making

- Make your agriculture smart with digital data

- Increase quality and efficiency with post-harvest technologies

- Link to markets through digital platforms

- Use software applications to organise your company's processes

- Create a digital profile to trade online and to get access to finance

- Join blockchain initiatives to become part of a transparent supply chain

- Use digitalisation to measure your environmental footprint

- Know where to look for the right digital solutions

1. Go mobile and select your digital solution

The first step in going digital with your business is to go mobile. You need mobile technology to be able to implement many of the available solutions. In Sub-Saharan Africa, there will be 700 million smartphone connections by 2030 due to the improved availability of affordable smartphones. The internet offers a lot of useful data that can be analysed to improve your agricultural production and environmental footprint, to get access to markets and funding and to increase your efficiency and product quality.

The main mobile digital solutions for the grains, pulses and oilseeds sector are the following:

- Information – agricultural and market data and advice to improve business decisions

- Smart farming – drone and sensor data that support precision agriculture

- Smart farming – post-harvest monitoring equipment that helps you get a better quality product

- Market linkage – platforms and marketplaces where you can sell your products

- Farm management – software solutions that help to make your organisation and business processes more efficient

- Funding – a digital profile to get better access to funding and trade

- Supply chain management – blockchain technologies that make the supply chain more transparent

Digital solutions may offer great added value, but they also come at a cost. You have to balance the costs and benefits carefully in advance. For example, you could spend money on a soil quality monitoring system, but if the right fertiliser is not available, it will not add value.

Tips:

- Start with the easy wins and digital solutions that are most suitable and accessible for your business. Expand from there by choosing more advanced technologies.

- Find solutions that integrate various aspects of your business, from agricultural data and advice to access to funding and markets. There are several solution providers that cover more than one aspect of your business, from agriculture to processing to international sales.

2. Use digital services to get data and advice that help your decision making

More data and digital services are becoming available in agriculture, especially for large commodity crops, such as wheat, maize, rice and soy beans. These data and digital services include market data, agricultural data and accompanying advisory services.

Freely available commodity data

Production forecasts and market prices provide important knowledge to manage your business and optimise your margins. Commodity crops are important for food security and are therefore well monitored. An important platform for commodity crops is the Agricultural Market Information System (AMIS). AMIS offers international production forecasts for wheat, maize, rice and soy beans.

Other online data sources include:

- the European Commission’s Crops market observatory with statistics and reports on cereals and oilseeds crops, made possible through the EU’s MARS system;

- the United Kingdom’s Agriculture and Horticulture Development Board (AHDB), which shares the latest industry data, analysis and insights in the international cereals and oilseeds sector;

- statistics from the Food and Agriculture Organisation of the United Nations (FAOSTAT), which offer data on a lot of aspects, including production data for miscellaneous crops.

Satellite data

The use of satellites can provide climate information, crop monitoring, yield forecasts and biomass estimations. When satellite imaging is combined with geographical information systems (GIS), farmers can manage their crops more precisely and make their production more efficient and sustainable. A lot of data and satellite imaging services have become accessible to the general public, but you need knowledge and services to interpret and use the data.

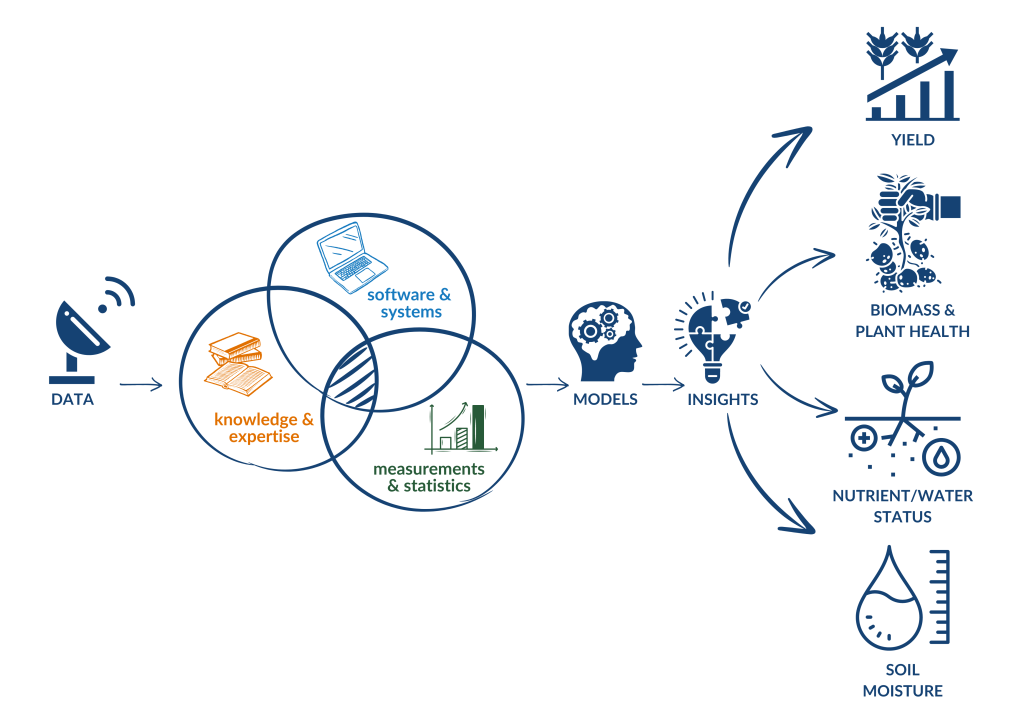

Figure 1: From satellite data to valuable insights

Source: GloballyCool

For example, optical raw data from the EOS (Earth Observing System) and raw data from the SAR (synthetic-aperture radar) can be used to develop a crop growth model. This is only possible with the right technical expertise and a skilled software development company. A successful growth model could monitor regional rice growth stage variations and predict the potential yield across the growing season, for example. Information like this can be used for area outlooks, agriculture mapping, area estimations, monthly bulletins, early warnings, precision farming, yield forecasting, production estimations and international market forecasts.

An increasing number of companies provide satellite data along with advisory services. Examples of these companies include the following:

- SOWIT, which combines satellite data with drone imaging and sensor technology. For farmers, there are six mobile applications available. The applications support inspection and monitoring, fertilisation and irrigation. They also help farmers to act at the best time. The aim of the applications is to improve low and unpredictable yields in a number of African countries, including Senegal, Tunisia, Ethiopia and Morocco.

- Dynacrop, which provides advanced satellite crop monitoring services for agriculture, for which it charges a fee per hectare. Important elements of Dynacrop’s services are crop monitoring and statistics, soil moisture monitoring and application maps for fertilising, seeding and soil sampling. Dynacrop works together with non-governmental organisations (NGOs) and private service providers, such as the Rural Farmers Hub in Western Africa.

Data made available through big companies

It is likely that big agricultural supply companies like Bayer, Syngenta-ChemChina, Dow and BASF will dominate agricultural data in the future. With the data they collect, they can provide recommendations to farmers about their products, including advice on seed planting and chemical applications.

For example, Bayer has built a digital platform like this by partnering with several technology suppliers to get data from agricultural sensors, drones and satellites. Through its subsidiary company ‘The Climate Corporation’, Bayer runs Fieldview, a digital platform that combines all data into one application. More than 220 million acres in over 25 countries are already being monitored through Fieldview.

Microsoft has developed its own data-driven digital agricultural platform, called Azure FarmBeats. The platform makes it possible for farmers to take decisions based on real-time data and analyses of the condition of their soil, water and crop growth, the threat of pests and diseases and weather changes.

In the past few years, Bayer and Microsoft have partnered together to create a cloud-based set of data tools and data science solutions for the food and agriculture industry. This partnership has resulted in an updated Azure Farmbeats platform, called Azure Data Manager for Agriculture. In addition, a license for Bayer’s AgPowered Services tool can be taken out through Azure’s Data Manager for Agriculture.

These platforms offer great value, but there are also significant concerns that the companies behind these platforms have too much control, which may result in a loss of bargaining power for farmers.

Farmer-to-farmer platforms

If you do not want to fully depend on service providers, you can ask for advice from other farmers. Examples of such farmer platforms are:

- the digital network Farmerline in Ghana, which bridges the illiteracy gap by providing agronomic and business tips through voice calls and audio books;

- Agrorite Bookie, which is a digital tool to help smallholder farmers in Nigeria make better decisions, boost their efficiency and yields and make their farms more sustainable through the constant supply of data.

Tips:

- Read AHDB’s Satellites for Agriculture to learn about how satellite technology works and the status of satellite technologies that are available for agricultural applications as of 2018.

- Learn more about Farmerline and how this is empowering Ghanaian farmers.

- Ask for support from a service provider to analyse your data and provide advice on actions to improve your crop.

3. Make your agriculture smart with digital data

There are many aspects of agricultural production that you can measure by yourself. The data that you can collect and analyse will give you more control over your production and yield.

The use of smart data in agriculture can help you to optimise your production and make farming more sustainable. You can collect data (1) from modern farming equipment with sensors and GPS technology, (2) from remote sensors and drones with infrared cameras that show the conditions of your field or (3) from satellites or mobile applications that let you monitor your soil and climate conditions. By using these data, you can apply agrochemicals, fertilisers and irrigation with high precision and give your crops the exact treatment they need. Technologies like these are also available for small and medium-sized farms.

Figure 2: Use of drones in a sorghum field

Source: Sarah Clarry on Pixabay

The advancement of precision agriculture has stimulated the development of new technologies. For example, GrainSense from Finland uses a hand-held scanner with near-infrared (NIR) technology to measure grain quality in the field. This scanner can track the protein, moisture, oil and carbohydrate contents of wheat, barley, oats, rye, rapeseed, maize and soy beans. Similarly, the company AgroCares provides data solutions to measure nutrients and other key parameters in the soil and leaf tissue of crops.

However, precision agriculture is only an option if it is combined with agricultural knowledge or advice and if the proper inputs, such as irrigation, improved seeds and specific fertilisers, are applied.

Tips:

- Try to collect data from sources at different levels. Combine satellite data with drone and sensor data to get a detailed analysis of your field.

- Read about the benefits and applications of digital technologies in the FAO publication Big Data for Agriculture and also read about how small farmers can benefit from large farm technology on the Endeva website.

- Read about how drone technology can be used to enhance soil mapping in African agriculture, a blog by the African Union High Level Panel on Emerging Technologies (APET).

4. Increase quality and efficiency with post-harvest technologies

Post-harvest technology is becoming more important. The application of more post-harvest technology increases yields. Additionally, it contributes to a higher product quality. There are several digital technologies that can support the grading, selection and storage of your grains, pulses or oilseeds.

Sorting grains and pulses

Food safety, purity levels and quality consistency are crucial elements when supplying grains, pulses or oilseeds to the European food market. Using digital technology in the form of an optical sorting machine, you can carefully avoid defects, discolouration and mycotoxins.

Sorting equipment, such as the grain ‘Sortex’ device by the Bühler Group, uses a range of technologies including cameras, lighting and machine-learning software. It removes defective products based on their colour, shape and texture. The Bolivian company Andean Valley has implemented Sortex technology to guarantee high-quality quinoa without losing their production capacity. The device can even separate black, red and white quinoa, which is a strict requirement for certain international markets.

Quality analysis

Digital analysers can check the quality and purity of your product. Grain and seed analysers can measure parameters such as moisture, purity level, weight, protein and oil content. You can gather the analysis data in a quality report and share it with your client. There are many digital analysers available, such as the Vibe QM3i analyser for wheat, rice, seed and grain and the Infratec Nova of Foss Analytics for grains, cereals, oilseeds, beans and pulses.

Storage condition monitoring

You can monitor your storage conditions in a traditional way, but that can be quite time consuming. Nowadays, smart monitoring tools can carefully track your storage conditions and product quality. Temperature, CO2 and moisture are the most important things to track when you are storing grains, pulses or seeds in bulk or in silos.

Modern systems even make it possible for you to monitor your stored crops live from your phone. Examples of these systems are GrainVue, Agrolog, TeleSense and the systems made by Tri-states Grain Conditioning (TSGC). Sensors will alert you if there is a risk of mould or insects and when you need to take action, such as changing the storage conditions (e.g. with ventilation) or selling your crop.

Another example of a tool is the GrainSense flow analyser, which can measure the flow of protein and moisture during harvesting, processing and storage.

Tips:

- Invest in a processing line and grain storage system together with a group of farmers or a cooperative. This way, the investment will only be small and a large group of smaller farmers can benefit from it.

- Read the World-grain.com publication ‘Monitoring CO2 in stored grain’, the Centaur article about managing grain storage with sensors and AI and the TSGC publication ’The Internet of Things Revolutionizes Farming and Grain Storage’ to understand how smart digital monitoring works and why it is important.

5. Link to markets through digital platforms

There are online platforms and organisations that help farmers and exporters to access markets. You can use them for buying input and selling crops, at a local level and sometimes internationally. Digital trade is not currently well integrated into the sector, but digital technologies will provide future opportunities, starting with commodity crops.

Digital trade of non-commodities will stay limited

The digital trade of commodities like wheat, soy beans and maize has increased a lot in recent years. Digital technologies like blockchain have made this possible. However, for very specific products, the potential of digital trade will stay limited in the short term because of the number of services, product variations and quality and food safety checks that are involved.

If you supply non-commodities, there are several options to find buyers online. For example, you can share your product range and receive requests from buyers through platforms including Tridge, Selina Wamucii, Tradekey and Alibaba. Tridge and Selina Wamucii also provide online market information. However, keep in mind that the international non-commodity trade of grains, pulses and oilseeds is quite traditional. This means that digital trading or e-commerce platforms are not common.

Digital trade on a local scale offers opportunities for smallholders

E-commerce is also being developed at the start of the supply chain, in the producing countries, where farmers are being offered digital platforms to sell their crops. Four examples of these platforms are:

- Agri Marketplace, which is a digital trade platform with a Bcorp certification that brings together farmers and industrial buyers. On Agri Marketplace, it is possible to make online payments between the buyer and seller, check the product quality through different options and arrange end-to-end logistics services. It offers a platform for several grains, such as rice, maize, wheat and barley. Other product categories are nuts, green coffee and vegetable oils.

- Lima Links in Zambia, which gives farmers access to live market prices and connects them to buyers.

- GreenConnect, which is a mobile app by the AgriSolve organisation in Ghana. The GreenConnect tool lets farmers sell crops or buy agricultural input and also gives them access to innovation and training.

- NaPanta, which is a free mobile application for farmers in rice-growing regions in the Andhra Pradesh and Telangana states in India. The app is used by around 270,000 farmers and has a lot of features. Not only can farmers see daily market prices, but they can also connect with buyers and with suppliers of agricultural inputs. Farmers can also track their expenses and use the app for information about crop management, pest control, weather forecasts, crop insurance, cold storage and agri-dealer information.

Tips:

- Register with existing international or national platforms to increase your company’s visibility and try to keep up to date with new digital trade initiatives that focus on market connection.

Figure 3: Farmers studying a digital tool

Source: AUXFIN

6. Use software applications to organise your company's processes

Although your buyers may not request digitalisation from you, business management software like Enterprise Resource Planning (ERP) will help you work more efficiently and prevent human error. You first need basic IT infrastructure to implement ERP software.

Enterprise Resource Planning (ERP) is a system that integrates the management of the main business processes to increase productivity and lower your costs. It often combines various software applications to collect, store, manage and interpret data from many business activities.

Digitalisation efforts in the grains, pulses and oilseeds industry are being led by large multinational commodity specialists like Archer Daniels Midland Company (ADM), Bunge, Cargill and Louis Dreyfus Company (LDC). These companies have slowly replaced their paper-based contracts, invoices and payments with digital alternatives and they have made these processes more efficient and reliable. Read more about this initiative later in this study (under “Covantis”).

It can be hard to choose ERP software, as there are typically a lot of alternatives, each with a different structure and coverage. For small exporters, the implementation costs can be a barrier too. Nevertheless, once you have implemented ERP, it will likely save your company time and prevent potential expensive mistakes. It is best to focus on the software that best fits the scale of your business.

Although large agricultural commodity companies might use SAP or Microsoft Dynamics as their management software, there are other applications that are more suitable for exporters that work with multiple smallholder farms in developing countries. Examples of these applications are eProd, Farmforce, Smallholdr, E-HAKIKI and Auxfin.

- eProd is an ERP tool for companies that work with a large number of supply farms. eProd was developed in Kenya and it has been implemented in several countries in Africa, Central America and Central Asia. Exporters can use this tool to create farmer profiles, including information like their credit score, training attendance, field data, supply contracts, GPS location and photos. More than 350,000 farmers were managed through eProd as of 2022.

- Farmforce is a mobile platform for finding companies to engage with smallholder and medium-scale farmers. It extends the traditional ERP to the farm level and provides traceability, management information and transparency. It also records your compliance with sustainability standards like the FairTrade, Rainforest Alliance and Organic certifications.

- Smallholdr is a mobile app and web-based platform for collecting and analysing data, managing field teams and tracking produce in smallholder supply chains.

- The E-HAKIKI digital tool developed by the Quincewood Group helps farmers from the highland regions in Tanzania to verify their input. This makes it possible for the farmers to control their use of fake seeds, get input on time and receive information from extension officers in their areas. The tool also helps farmers to find a reliable market for their produce.

- Auxfin combines ERP software, a main banking platform and digital eCoaches to create eService ecosystems for smallholder farmers. The software helps with the management of outgrower and other farmer groups. It includes basic bank functions, such as bank registration, savings, loans and payments. A number of eCoaches have been developed to help farmers improve their production, but also to help them stay healthy and teach their children. Farmer profiles are stored on the app. Auxfin is currently the most widespread digital platform in Burundi, which benefits 3 million people, and it is present in other African countries too. Auxfin runs 14 different applications, including 4 banking solutions, 2 market connection solutions, 2 social development solutions and 6 eCoach apps for information and training. One of these eCoach apps is the Auxfin AgriCoach app, which gives farmers in rural communities important weather and crop information to help them plan and execute farming activities.

Figure 4: The AgriCoach app; Auxfin's digital solution to help increase agricultural production in Burundi

Source: @Auxfin_in_the_world on YouTube

Tip:

- Make sure you record your processes. If you think your company is too small to implement ERP software, at least make sure you record your processes in a simple way and with a decent backup system (for example, online with a cloud service provider like Dropbox or Google Drive).

7. Create a digital profile to trade online and to get access to finance

Access to funding is one of the main challenges for smallholders in developing countries. However, there is a growing number of mobile applications that give smallholders a digital identity. This digital identity helps them to get a credit score and receive trade funding. In an increasingly digital market, with digital contracts and supply chains, mobile connectivity will become crucial.

Stay informed about developments in digital trade

Since the first pilot projects with digital agricultural commodity trade in the period 2012-2018, a lot of progress has been made. Digital food commodity trade is increasing slowly but surely, also due to several initiatives being launched in the past. This includes general initiatives like the Easy Trading Connect (ETC) platform, as well as agri-trade specialised ones like the DCX Group’s platforms for rice, pulses or grains.

The International Chamber of Commerce (ICC) Banking Commission supported this development by introducing a set of electronic rules (eRules) in 2019 to support the digitalisation of trade finance practices. In 2023, ICC launched an updated version: the eUCP 2.1. The eUCP 2.1 is an addition to the UCP 600, which is the set of private rules for trade and letters of credit. The eUCP 2.1 sets guidelines for the digitalised version of these trade practices.

Now that these kinds of technologies have successfully been implemented for major commodity crops, this technology can be applied to smaller crops too, like quinoa and sesame seeds. The most important condition is that the crop has a certain level of standardisation.

Get access to funding by creating a digital profile

Having a digital profile and a credit score can help a lot in getting access to funding for agricultural input or trade. For example, the One Acre Fund successfully digitised loan repayments for farmers in Kenya in partnership with Citi Inclusive Finance. With greater transparency and efficiency, they successfully decreased repayment collection times from 12-16 days to just 4 days, and lowered costs by 80%.

There are many digital solutions available for the agricultural sector. Some of them focus on a specific product group while others are more general. Most of them focus on their country of origin (the country where the solution was developed). Examples of the solutions available for the grains, pulses and oilseeds sector include the following:

Apollo Agriculture, which is a Kenyan FinTech start-up company that uses satellite data and a machine-learning model to make informed credit decisions. Farmers in remote areas can access the affordable credit for seeds, fertilisers and crop insurance to increase their yields. They can also use their mobile phones to access voice-based training courses and to make payments. Apollo has partnered with over 1,000 agricultural distributors all over Kenya to ensure good availability of the physical inputs.

AgUnity, which is a low-cost and safe transaction record system for smartphones based on blockchain. It helps to include rural communities in funding and gives farmers a digital identity. This way, it creates an efficient digital supply chain, from farmer to consumer. AgUnity was active in 9 countries as of January 2024 and its solutions also comply with traceability standards. The application covers 9 commodities, including maize, sesame seeds, beans and cereals within the grains, pulses and oilseeds sector.

TruTrade, which is an online trading and payment platform in Kenya that makes it possible for small farmers to connect with buyers. It provides digital trading records and gives smallholders credentials to trade. This way, TruTrade makes informal value chains in agriculture digital. In 2023, TruTrade successfully participated in Farm to Market Alliance and Unilever projects to connect 400 millet farmers in Western Kenya with traders.

The UMVA platform, developed by AUXFIN, which is a solution that makes financial transactions possible via an online banking platform. The UMVA platform helps with transactions in the local currency, between different currencies or in ‘product’ amounts, such as a kilo of wheat or pulses. This makes it possible for farmers to sell their produce or to take out credit from a financial institution based on stock that has not yet been sold. Through the platform, farmers bought a total of 1,000 tonnes of fertilisers and 2 tonnes of seeds in the year 2022. In total, more than 500,000 people have a digital transaction account on AUXFIN’s platform.

Digitt+, which is a digital wallet to help and empower people without a bank account in Pakistan, starting with providing financial services and products to marginalised farmers and farming families in rural areas.

Agri-wallet, which is an innovative FinTech solution that contributes to more financially stable agri-food supply chains. Through a system of pre-financing, collectors of grains, pulses and oilseeds can postpone their mobile payment to farmers, while farmers can keep buying agricultural inputs. Agri-wallet uses a virtual currency based on blockchain technology. A part of the farmers’ income is paid out in blockchain tokens via their mobile phones, which they can spend on farm inputs such as seeds and fertilisers from linked suppliers.

Farmerline, which is active in Ghana and offers farmers advice about agricultural practices and better access to funding for agricultural inputs.

Tips:

- Make it possible for your company to have a bank account by improving your company’s credit rating and credentials. Whatever size your company is, financers will grade your credit profile. Learn from Experian’s explanation of what your business credit score means and how to improve it, or build your credentials through new digital applications such as AgUnity.

- Watch the video “How does a blockchain work – Simply Explained” to better understand what blockchain is.

- Watch “Revolutioning Agriculture by Leveraging Blockchain Technology” and “Blockchain Africa Conference 2022 - Using Blockchain Technology to Change Farming in Africa” for recent presentations about how blockchain can further impact Africa’s agricultural sector.

- Learn about ‘smart contracts’ and how they work in IBM’s explanation “What are smart contracts on blockchain?”

- Use the leading international trade finance platform Trade Finance Global (TFG) as a source of information on trade finance and the digital developments taking place.

8. Join blockchain initiatives to become part of a transparent supply chain

Traceability is a big requirement of European buyers. Digital technologies like blockchain can increase transparency and traceability in the supply chain of grains, pulses and oilseeds. Many digital platforms are already using a form of blockchain to digitalise trade in the supply chain. It not only provides smart contracts, efficiency and supply chain monitoring, but can also give you the opportunity to add your story to the final product.

What is blockchain?

Blockchain records data in a distributed ledger. It links data or transactions (blocks) in an encrypted ledger (chain) that is stored on many computers in a peer-to-peer network. The larger the network, the more difficult it is to corrupt.

Read What is blockchain? in CBI’s report “Blockchain in Europe” or watch the video “What is blockchain” by the IBM Food Trust.

Join others: the Covantis case

Grain farmers and exporters who would like to use blockchain can join leading companies and initiatives in the development of blockchain. In the grain and oilseeds sector, a leading initiative is Covantis, which was founded by ADM, Bunge, Cargill, LDC, COFCO and Viterra. Covantis was launched in 2021 with the aim of digitalising the global agricultural commodity trade from Brazil by using blockchain technology. It started with soy beans and maize from Brazil and has since expanded to more grain and oilseed commodities from other countries, including the USA, Canada, Argentina and Uruguay.

Covantis focuses on the large-scale grain trade. It is not meant for small suppliers and special grains, but it provides a glimpse of what the trade of grains, pulses and oilseeds may look like in the future. At the same time, remember that the non-commodity trade in the grains, pulses and oilseeds sector is still mainly taking place in a traditional, non-digital way.

Create your story with QR codes

For suppliers of grains and pulses that are not traded as large commodities and end up as branded consumer products, QR codes can be an attractive option to add information to your product and tell your story. QR codes help with traceability and tell buyers and consumers about the background of your company and your product. The generated data that are linked to QR codes can be easily integrated in blockchain traceability.

Examples of digital tools that support traceability via QR codes and blockchain technology include Farmer Connect and Storybird:

- Farmer Connect uses the SaaS (Software as a Service) platform IBM Blockchain Transparent Supply (BTS). BTS is powered by Hyperledger Fabric. Its mission is to make it transparent where products come from, helping to build trust in the supply chain. Consumers can scan QR codes with the mobile app ‘Thank my farmer’, read the story behind a product and find out where and by whom the product was made. Farmer Connect originally focused on the coffee supply chain, but in recent years the platform has also included other products.

- Producers Trust allows producers in North and South America with a branded product to share their story with consumers via Storybird and Producer Stories. The organisation collects traceability data in the StoryBird app, which is designed to help brands tell real and validated stories. One example of a story on this platform is the story of the quinoa cooperative ‘Cooperativa Agroindustrial Machupicchu’ about their journey to FairTrade certification.

Figure 5: How blockchain can help us transform our agri-food systems

Source: @UNFAO on YouTube

Tips:

- Follow the progress of Covantis via regular status updates on the Covantis website.

- Get inspired from practical applications of blockchain technology and their opportunities and risks in publications and articles like “Beyond the blockchain” by Agriterra, the Wageningen University article “Blockchain improves transparency and sustainability” and the FAO’s E-Agriculture in Action: Blockchain for Agriculture.

9. Use digitalisation to measure your environmental footprint

There is an increasing focus on farm sustainability. Digital solutions and data can contribute to more sustainable agriculture and achieve the sustainability goals of large buyers. As a supplier, you must be open to technological cooperation and sharing relevant data.

An interesting sector-wide initiative is The Round Table on Responsible Soy association (RTRS). This is an initiative of several large soy and maize buyers, processors and retailers. It provides several digital tools to make environmental impact more visible. It has developed a Soy Footprint Calculator to calculate how much soy or maize is needed for soy and maize products and for food and animal feed products. The zoning tool guides the expansion of soy farming and promotes ecosystem conservation in Brazil, Argentina and Paraguay.

The Sustainable Rice Platform (SRP) is another sector initiative that focuses on sustainability. One of SRP’s members is CarbonFarm. CarbonFarm has developed digital tools that help to reduce the carbon footprint in rice smallholder farming, which makes regenerative agriculture profitable for farmers while helping corporations to achieve net-zero (emission) goals.

Figure 6: Sustainable Rice Platform’s three objectives

Source: SRP (January 2024)

There are also interesting company initiatives. For example, Olam International has introduced AtSource to measure the social and environmental impact of agricultural supply chains. One of AtSource’s first monitored projects was to cut the carbon footprint of rice in Thailand. Since then, several other projects have been monitored by AtSource, mostly related to spices, cocoa, coffee and nuts.

Tips:

- Coordinate your efforts to implement digital solutions. When you collect field data and post-harvest data to improve efficiency and product quality, use these data to measure your environmental footprint and for marketing and promotion. Your current and potential buyers will likely be impressed by how much less pesticides or water you are using thanks to precision agriculture.

- Ask for support from specialised service providers. For example, suppliers of affordable crop monitoring technologies like AquaSpy or the low-cost flying sensors by FutureWater can help farmers of commodity crops like maize and soy beans to increase efficiency, save time in the fields and optimise their application of expensive or scarce resources like nutrients and water.

10. Know where to look for the right digital solutions

Digital technologies can help your company become future proof and solve specific issues in the supply chain. It is important to stay informed about developments and decide which technologies best fit your company and situation. When you select digital solutions, it is important to be able to make an informed decision. If needed, ask for help from experts or a business support office or ask your fellow farmers about their experiences.

Use online marketplaces to find technological equipment

Via AgriExpo, you can find technological equipment for precision agriculture, measuring instruments and farm management software. The products on offer are grouped into categories, such as grain analysers and agricultural drones.

Read tech magazines to keep up to date with digital developments

Read online magazines to stay up to date with interesting digital technologies, such as AgriTech Tomorrow, the Miller technology platform (World Milling and Pulses Technologies Refereed Magazine), Feed&Grain, World-Grain.com, GlobalAGTech and CropLife.

Search for digital technology providers online and in frontrunning countries

The Digital Agri Hub has continued the efforts of the Technical Centre for Agricultural and Rural Cooperation (CTA). They have a report called "The Digitalisation of African Agriculture Report, 2018-2019" and they provide a worldwide database of digital tools for the agricultural value chain in lower and middle-income countries.

The solutions are divided into 25 technology categories, in which over 1,100 solutions (as of January 2024) are registered. The database classification has six use cases:

- Farm management and advice – more than 750 solutions

- Market links – more than 420 solutions

- Supply chain management – about 300 solutions

- Finance – about 260 solutions

- Smart farming – about 260 solutions

- Ecosystem support – 130 solutions

The countries with the highest number of available solutions are India, Kenya, Nigeria, Ghana, Tanzania and South Africa. These countries are clearly ahead in technological developments.

The most used technologies are “data analytics and business intelligence”, “artificial intelligence”, “big data”, “location-based services” and “remote sensing”. The organisations behind the solutions are mostly agritech companies (375 in total), followed by the broader categories of “agribusiness” (+280), commercial enterprises (almost 190) and non-governmental organisations/NGOs (+120).

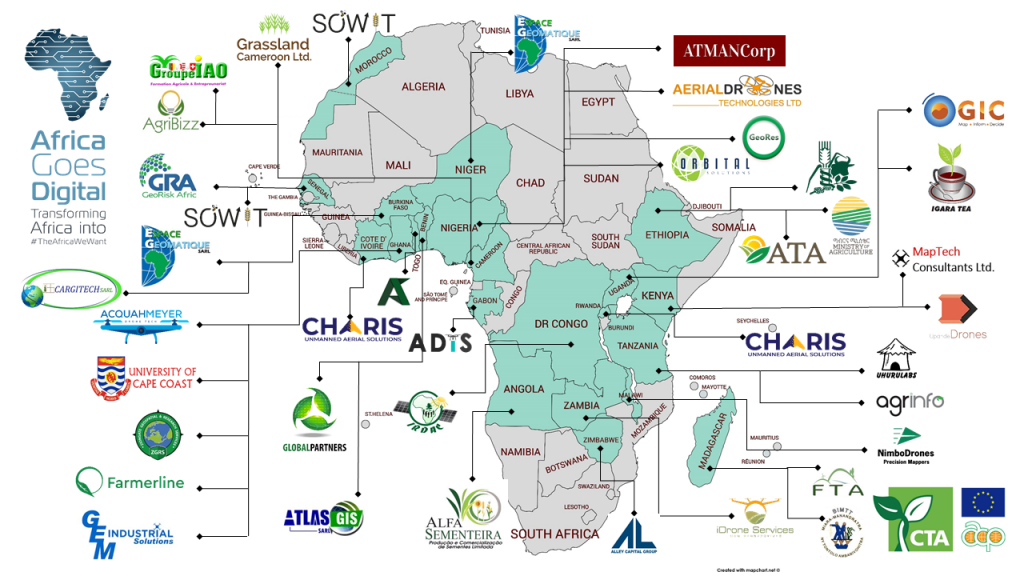

You can also find technology providers at Africa Goes Digital, the pan-African industry association of digital operators (see the figure below).

Figure 7: Digital service providers on the African continent

Source: AfricaGoesDigital

Visit trade fairs or conferences to see the latest digital trends

New digital technologies are often presented at trade fairs and conferences. These are excellent places for networking. Germany will host AgriTechnica in November 2025, the leading global trade fair for agricultural machinery. The World Agri-Tech Innovation Summit in London, every year in September, is also an important event for agritech digital technologies.

Examples of events in other countries are GrainTech India (next edition: August 2024), Expo AgroFuturo in Colombia (next edition: October 2024) and Agritec Africa (next edition: Kenya, June 2024). Or look at the events on the industry calendar of World-Grain.com.

Get local support from organisations

Non-governmental organisations and private sector organisations that are active in agricultural development will likely also play a role in the digitalisation of value chains and companies. For example:

- One Acre Fund is a non-profit social enterprise that supplies funding and training to smallholders. Its Insights and Data Library has several white papers and resources on agricultural innovation.

- The GSMA Foundation is an initiative with resources and support for GSMA Mobile for Development programmes and innovations with socio-economic impact. One of the focus sectors is agriculture.

Tips:

- Find digital solutions for your company via the Digital Agri Hub. Start your search in the countries with the highest number of available solutions: India, Kenya, Nigeria, Ghana, Tanzania and South Africa. These countries are clearly ahead in technological developments and are therefore a logical starting point to look for solutions.

- Read CBI’s Tips for Doing Business and Tips for Organising your Export. These tips can help you to further understand how to do business with European buyers of grains, pulses and oilseeds and what you need to become a successful exporter to Europe.

ICI Business carried out this study in partnership with GloballyCool on behalf of CBI.

Note to the reader: the digital solutions mentioned in this report are meant as examples. CBI and the researcher do not have any special interests in specific technology providers or organisations.

Please review our market information disclaimer.

Search

Enter search terms to find market research