8 tips for organising your export of grains, pulses and oilseeds to Europe

When you start exporting grains, pulses and oilseeds to the European market, it is essential to prepare your exports well. You need to understand the contract with your buyer, agree on payment and delivery terms, prepare the required export documents and organise the transport. The tips below can help you to get prepared for organising your (first) shipment to the European market.

Contents of this page

1. Review contractual agreements

It is crucial to thoroughly review the purchase conditions of your potential buyer. Having a contract with clear and precisely outlined agreements will protect your business. This contract will form the basis of legal procedures if you or your buyer breach the agreement. So, you should fully understand the contract terms and their implications. Do not sign or confirm a contract that is either incomplete or unclear to you.

Check if the contract is in line with your previous agreements, at least on the following details:

- Price

- Terms of delivery (Incoterms)

- Delivery date or period

- Product specifications such as required quality or grade

- Quantity or tonnage and tolerances

- Packing details

- Fees and/or charges applicable

- Payment terms

- Default procedures

- Dispute resolution procedure

- Reference to general terms and conditions

Standard contracts

The majority of the trade contracts in agricultural commodities are based on standard contracts developed by trade associations. The Grain and Feed Trade Association (GAFTA) offers a variety of standard contract types. These standard contracts are commonly used in the trade of grains. GAFTA estimates that 80% of the world’s grain trade is shipped using these contracts. The contracts cover aspects like payment terms, delivery terms, quality, insurance and arbitration (formal dispute resolution) in case of disputes.

Examples of standard contracts include:

- Contract for pulses for human consumption in bulk or bags (FOB terms)

- General contract for grain in bulk (FOB terms)

Tip:

- If there is no standard contract specifically for your product, then use one of the GAFTA contracts as a template to create your own contract.

Use your rights as a supplier

The European Commission (EC) has introduced the EU Directive 2019/633 on unfair trading practices in business-to-business relationships in the agricultural and food supply chain. This directive aims to protect small and medium-sized suppliers against stronger buyers. This also applies if you are located outside the EU, as long as your buyer is located in the EU.

The legislation bans 16 unfair trading practices. Ten trading practices are forbidden (‘blacklisted’ practices) and 6 trading practices (‘grey area’ practices) are allowed only if both parties clearly agree on the practices beforehand. The practices that are forbidden include:

- Payments made later than 60 days (for perishable goods, this is 30 days)

- Refusal to sign a written contract

- Contract changes only made by the buyer (‘unilateral’)

- Transferring the risk of loss and deterioration to the supplier

- Transferring the costs of examining customer complaints to the supplier

Tips:

- Visit the website of Australia Grain Growers to learn more about how to manage risk in grain contracts.

- Read more about your rights as a supplier regarding the directive on unfair trading practices in the food chain.

2. Agree on payment terms

Payment terms are part of the sales contract. These terms determine when and how a payment should be made, to ensure clarity between you and your buyer. Payment terms can vary based on the relationship you have with your buyer and the type of products you are selling. Coming to an agreement can be challenging, especially when you deal with a buyer for the first time. Make sure to agree upon beneficial payment terms for you and your buyer to start and maintain business together, while limiting your risk to a minimum.

Commonly used payment terms in the trade of grains, pulses and oilseeds are Cash against Documents (CAD) and Letters of Credit (L/C). Other payment terms are open account, advance payment and post-payment.

Table 1: Payment terms compared

| Payment term | Risk for exporter | Pros | Cons |

| Letters of Credit (L/C) | Low | Safe method for first transactions | Relatively costly |

| Cash against Documents (CAD) | Medium | Lower costs than L/C | Not the most suitable for first transactions |

| Open account (OA) | Medium-high | Low costs | Especially useful for high-volume and low-margin commodities |

| Advance payment | Low | Low costs and positive effect on working capital | - |

| Post-payment | Medium-high | Low costs | Negative effect on working capital |

Source: GloballyCool (2024)

Letters of Credit (L/C)

Letters of credit (L/C) are commonly used in international trade transactions. It is a safe and popular method at the start of a business relationship. In an L/C, the bank of the importer (buyer) issues a document in which it guarantees to pay you once you have met the terms of the credit. There are various types of L/Cs. To make it as safe as possible, the L/C should be final and not be able to be reversed. In that case, the bank cannot make any changes without your approval.

The downside of an L/C is that it can be costly due to the additional fees (you can expect a cost of up to 2.5-3.0% for small transactions). For that reason, it is often not the preferred payment method for buyers. To solve this problem, you can suggest to split the fees between you and the buyer.

If you choose an L/C, you should learn about the meaning and process of an L/C. Generally, an L/C involves the following steps:

- You have signed a contract with your buyer to sell them your goods. You have come to an agreement to use an L/C as the payment method.

- The buyer requests an L/C from their bank and signs the bank’s L/C application form.

- The issuing bank approves the application, issues the actual L/C and sends it to you.

- Once you have received the issuing bank’s L/C, you ship the goods to your buyer.

- You prepare the documents as requested in the L/C and provide them to the issuing bank.

- The issuing bank examines the documents. Once all documents are present and in accordance with the L/C, the bank will pay you.

- The issuing bank receives the payment from your buyer according to the terms defined in the L/C.

- The issuing bank forwards the documents to your buyer.

- The buyer uses the documents to collect the goods from the carrier.

Cash against Documents (CAD)

Following this payment method, you first ship the goods to the buyer and send the key shipping documents (such as a bill of lading, a commercial invoice, etc.) via your bank to the buyer’s bank. The buyer’s bank keeps these shipping documents until it receives the payment from your buyer. After the payment has been made, the buyer’s bank provides the shipping documents to the buyer, after which the buyer can claim the goods from the carrier.

CAD has a higher risk for the exporter/seller compared to an L/C, but it is very common in established and long-term relationships and comes at a low cost. You are guaranteed to receive payment before the buyer claims the goods. After payment, the buyer is guaranteed to receive the documents that permit them to obtain the goods.

Open account (OA)

Following the open account payment method, you first ship the products to the buyer without receiving immediate payment. The payment is then made after the goods have been delivered. The payment is made within a set time, agreed between you and the buyer (for example, 30, 60 or 90 days from the date of the invoice).

It is a risky payment method that requires trust between both parties. In general, you should avoid using this method. However, if you sell a low-value good (for example, soy beans or wheat), an OA will save you and the buyer the costs that come with the L/C and CAD methods. Due to the high risk of the OA method, it is only recommended for use with trusted, long-term trade partners and if your financial situation allows for it.

Advance payment and post-payment

Another option is to make use of the advance payment or post-payment methods. Advance payment means that the payment is made before the goods are delivered or the services are provided. It essentially means that the buyer is paying for the goods or services upfront before receiving them.

Alternatively, post-payment is when the buyer makes the payment after the goods have been delivered. In this case, the buyer will receive the goods first and then make the payment at a later agreed date or period. For example, buyers that purchase high-end ingredients (like organic chia and quinoa) with strict quality requirements may want to check the quality of the product and any residues before making the payment. The buyer might do this to make sure that the goods comply with the high quality requirements.

Tips:

- Learn about the relevant international payment terms. The International Chamber of Commerce (ICC) offers online training and guides on trade finance to help you understand the payment options and procedures.

- Consider the risk of international trade transactions carefully. The relationships and trust between you and your buyers first need to be built and that takes time. For your first transaction with a new buyer, you should insist on a low-risk payment method like Cash against Documents (CAD) or Letters of Credit (L/C). If an L/C is too costly, you can suggest splitting the fees. Once you have created a trustworthy relationship, you can move to the CAD method.

- Get help from financial institutions to figure out how far you can negotiate different payment terms. Doing this will help you to negotiate more effectively and make better-informed decisions.

- Make sure that the payment terms you have agreed with your buyer are included in the contract. Make sure that you understand and agree with these terms before signing the contract.

- If you want to use an L/C, ask your bank about the costs and procedures involved. Make sure the bank you choose is experienced with L/Cs and is also recognised in Europe. The bank of your European buyer should also be recognised. Find out which banks are the best trade finance providers in Europe and in your country or region.

3. Insure your exports

Exporting grains, pulses and oilseeds carries several risks. Export insurance helps you to reduce the risk of possible financial loss or damage that could occur when you trade internationally. The type of insurances you will need depend on the specific risks of your exports.

Export credit insurance (ECA)

For the export of grains, pulses and oilseeds, export credit insurance (ECA) is one of the most common types of insurance. This insurance protects you if your buyer does not pay, for example, due to insolvency. In addition, ECA can help to increase your competitiveness. It makes it easier for you to agree on deferred payment, which might be requested by European buyers, because it ensures that you will get paid.

ECA companies are responsible for this type of insurance. It is important to look for a reliable ECA company that is part of a larger international network. Some well-known ECA companies are Atradius, Allianz Trade and Coface. The insurance rates they offer are determined by your annual turnover and claims history and your buyer’s risk profile.

ECA can be offered on a single-buyer basis or a multi-buyer basis. A single-buyer basis covers one single buyer, also known as a ‘risk’. A multi-buyer policy is better if you make regular shipments to different buyers and use a ‘pay-as-you-go’ service. You can arrange a multi-buyer policy for the short term (repayment period of up to one year) and medium term (repayment period of between one and five years). In the grains, pulses and oilseeds sector, you can make use of a short-term insurance package.

ECA works as follows:

- You give the ECA company certain information about your company and your buyers.

- The ECA company analyses the financial health – creditworthiness and financial stability – of your buyers so that it can draw up credit limits and commercial terms.

- You export goods to your buyers, with the risk covered to the limit set by the ECA policy.

- The ECA will update you if they adjust your credit limits. This might happen if economic conditions change.

- You can include new buyers in the policy and/or extend the coverage for your existing buyers. If you want to add a new buyer to your ECA policy, you are responsible for checking the creditworthiness of the new buyer. The ECA company will assess this and either confirm the agreement or decline your request.

- If a buyer does not pay accordingly, you must inform the ECA company. The ECA company will make sure that the unpaid invoice is settled (up to the insured amount set by the policy).

Cargo insurance

When you transport your goods, you are at risk because your goods could get lost or damaged. Whereas marine insurance only covers the liability of a maritime transportation company, cargo insurance is used to protect your product shipment throughout its entire journey to a buyer. So, cargo insurance is important because it protects you against any loss of or damage caused to the cargo. This is especially important if potential cargo loss would have a large impact on your business.

The Incoterms that you have agreed upon with your buyer determine whether you or the buyer is responsible for insuring the goods. For grains, pulses and oilseeds, Free on Board (FOB) and Cost Insurance Freight (CIF) are the most common Incoterms used. Following FOB, you are responsible for preparing and approving the goods for export and making sure the goods are transported to and loaded onto the cargo vessel. Up to this point, the risk and costs are your responsibility. Once the goods have been loaded onto the cargo vessel, your buyer takes over the risk and costs.

Seller’s interest insurance

If cargo damage or loss happens in a phase of the transport for which your buyer is liable, it is the buyer’s responsibility to pay for the damage. However, if your buyer does not have proper coverage for cargo damage or loss, this may affect you as an exporter/seller. Seller’s interest insurance can cover you to protect your financial interest in goods that you have sold, but which have not yet been paid for by the buyer. This type of insurance is less common than export credit insurance (ECA).

Product liability insurance

You need to make sure that your products are safe and comply with legal standards. If your product does not comply, product liability insurance can cover costs like legal fees and compensation. However, compensation coverage depends on the practices and efforts you have taken to comply with the standards. This insurance does not cover intentional damage or contractual liabilities. You could consider taking out product liability insurance for grains and ingredients with strict requirements.

Currency insurance

Currency insurance can protect you against possible loss due to changes in exchange rates between different currencies. When you do business with European buyers, you will mostly trade in Euros or US dollars. In commodity trade, the risk of currency conversion loss is low due to the speed of trade. However, if you work with long-range buying contracts or expect currency risks, you can choose to insure your business against currency conversion loss or use forward exchange contracts.

Tips:

- Export credit insurance (ECA) offers you good protection against several possible risks. Search for a reliable ECA company that is part of a larger network. Check out the members of Berne Union (International Union of Credit and Investment Insurers) or of ICISA (the International Credit Insurance and Surety Association) to find an ECA company.

- If you are responsible for cargo insurance, find a reliable insurance company through the Member Associations list of the International Union of Marine Insurers.

- Check the risk of trading with a specific country via the Atradius country risk map or the Allianz Trade country risk ratings & reports.

- Read more about export credit insurance (ECA) on the websites of export credit insurance companies like Allianz Trade and Coface.

4. Comply with European customs policy

The European Union (EU) has standardised customs procedures to streamline the import of goods from outside the EU. This includes, for example, customs declarations and rules of origin to determine the origin of goods for tariff purposes. Usually, importers or customs brokers or agents are responsible for taking the goods through customs. However, it is very important to learn about European customs procedures because you will need to provide several necessary documents.

Customs documents

A variety of export documents are needed to pass customs. Make sure that all the required export documents are complete and filled in correctly. A small mistake in the documents can result in serious delays.

Your buyer will depend on you for the following documents:

- Commercial invoice: a record or evidence of the transaction between you and the importer. This should contain details about the exported goods, like the description and quantity of the goods, their cost, the terms of payment, the terms of delivery, etc.

- Certificate of Origin: a document declaring the country where a good originates from. This is required if you want to claim preferential tariff treatment under a free trade agreement. The document can vary between free trade agreements. For countries with a preferential trade agreement with the European Union, a EUR.1 certificate is used.

- Packing list: a commercial document that provides information about the imported goods and the packaging details of the shipment. For example, the number, content, weight and dimensions of the packages.

- Freight documents: the freight documents that you need to present depend on the transport mode you are using. For example, a CMR (for road transport), bill of lading (for goods transport by sea), air waybill (for goods transport by plane) and/or CIM (for rail transport).

- Freight insurance invoice: this invoice is only necessary if the information about your freight insurance costs are not mentioned in your commercial invoice.

- Official certificate (sometimes also called a ‘health certificate’) following the template in Annex 4 and described in Article 11 of the EU Implementing Regulation (EU) 2019/1793. This certificate must be issued by the competent authority in the export country. This certificate is only necessary for high‑risk food products of non-animal origins. These products and origins are listed in Table 1 and 2 of CBI’s buyer requirements for grains, pulses and oilseeds.

- Analytical report showing the results of sampling and analysis (described in Article 10 of the EU Implementing Regulation (EU) 2019/1793) of the identified risks of high-risk products (Table 1 and 2 of CBI’s buyer requirements for grains, pulses, and oilseeds). These risks could include mycotoxins or pesticide residues, for example.

Your buyer needs all of the above documents to be prepared by you. The buyer must prepare the following documents themselves:

- Single Administrative Document (SAD): a form for import declaration. This contains information about the parties involved, the goods and commercial and financial data.

- Customs value declaration: a document stating the value of the goods. This is necessary if the value of the goods is higher than €20,000.

- Common Health Entry Document (CHED-D): a registration form for shipments of high-risk food products of non‑animal origins. These products and origins are listed in Table 1 and 2 of CBI’s buyer requirements for grains, pulses and oilseeds.

Import tariffs

Tariffs are a trade barrier that can have an impact on your competitiveness in the European market. European importers generally tend to buy goods from suppliers in duty-free import countries. So, it is important to find out what tariffs apply to your product and country, as well as other restrictive trade barriers. You can find this information by using the TARIC database and My Trade Assistant by Access2Markets.

Many grains, pulses and oilseeds have a zero percent import tariff. This is especially the case for developing countries. The EU’s Generalised Scheme of Preferences (GSP) has removed or reduced import tariffs for goods that come from certain developing countries. Also, the EU has free-trade agreements with certain countries to remove or reduce tariffs. For certain cereal commodities that are widely produced in the EU, an EU tariff rate may apply. This could be the case for wheat, maize, barley, rice and oats, among other products.

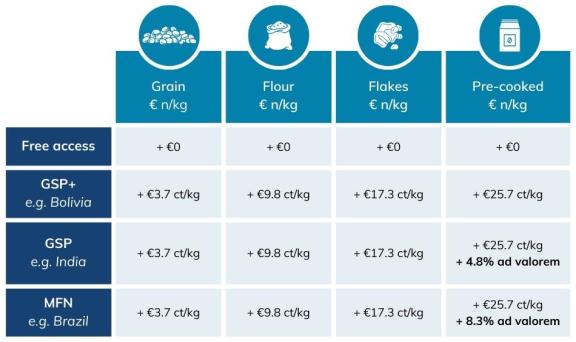

The more processed a product is, the higher the baseline tariff (also called “Most Favoured Nation” or MFN tariff) usually is. Unprocessed quinoa, teff, fonio or amaranth, for example, has an MFN rate of €37/tonne. If the quinoa grains are rolled or flaked at their place of origin, then the MFN rate rises to €173/tonne. Quinoa flour has an MFN rate of €98/tonne and pre-cooked quinoa has a rate €257/tonne and 8.3% ad valorem (value-based).

Figure 1: Import duties for grain, flour, flakes and pre-cooked ancient grains under the EU’s several tariff schemes

Source: GloballyCool (March 2024)

In this example of quinoa, the mentioned MFN rates apply to countries that cannot benefit from a preferential scheme or agreement. Exporters from the supplying countries of Peru, Ethiopia and Guinea can benefit from free access to the EU, whereas Bolivian exporters must only pay the volume-based tariff and Indian exporters must pay the volume-based tariff along with a reduced ad valorem rate. This example shows how tariff rates can have an impact on an export product’s competitiveness in a certain target market.

Trade agreements

It is important to check if your country is a GSP (Generalised Scheme of Preferences) beneficiary country or if other trade agreements apply. Visit the Access to Market portal to find out about the schemes that apply to your country.

With regard to the GSP, there are three types of arrangements:

- Standard GSP: an arrangement for low and lower-middle income countries. It partially removes customs duties on two-thirds of the tariff lines. The list of countries that benefit from this scheme changes every year and includes, for example, India, Nigeria and Kenya.

- GSP+: an incentive arrangement for sustainable development and good governance. It lowers the tariff to 0% for seven vulnerable low and lower-middle income countries that implement 27 international conventions related to topics like labour, human rights and environmental and climate protection. The countries that benefit from the GSP+ for their exports of grains, pulses and oilseeds are Bolivia, Kyrgyzstan, Pakistan and Uzbekistan.

- GSP-EBA: an arrangement for the least developed countries. It gives them duty-free and quota-free access to the EU market. Countries that benefit from this scheme include Myanmar, Ethiopia and Burkina Faso, for example.

If you are an exporter in a GSP beneficiary country, you may benefit from better tariffs compared to exporters from “Most Favoured Nations”. To qualify for preferential treatment, you will need to comply with the rules of origin and prepare the necessary documents.

Tips:

- Learn about customs clearance documents and procedures.

- Learn what freight forwarders do and how to choose the right one by reading Freightos’ guide to choosing a freight forwarder. Search for freight forwarders or customs brokers through the International Forwarding Association. You can also look for the European national associations via the European Association for Forwarding, Transport, Logistics and Customs Services (CLECAT) or for your national association via the International Federation of Freight Forwarders Associations (FIATA).

- Find out about information on tariffs, requirements and customs procedures for your product and country by using the TARIC database and My Trade Assistant by Access2Markets. Use the Market Access Map to learn about your competitive advantage based on trade preferences and tariffs.

- Read Access2Markets’ guide to working with rules of origin and follow the instructions on how to pay lower customs duties.

5. Organise your transport in a proper way

Transport modes and costs

According to the International Grains Council (IGC), over 80% of the global trade in grains and oilseeds is shipped by maritime transport. Grains (such as wheat, rice, maize and barley) and oilseeds are often shipped internationally in bulk carriers. Bulk vessel categories for transporting these goods include Panamax, Supramax and Handysize. Low-volume or high-value goods are shipped in bags inside containers.

A commonly used index to get an idea of maritime transport costs is the Grains and Oilseeds Freight Index (GOCI) by the ICG. It is a trade-weighted composite measure (measurement based on multiple data items, ranked by trade) of the sea freight costs for grains and oilseeds. It is based on nominal voyage rates (the total freight cost for a route per ton of cargo, in USD) on the most important routes. You can use this index to get an overall picture of the trend in transportation costs.

Storage conditions

Grain products should be stored in good conditions to avoid any deterioration or quality loss. Aspects that you should consider include temperature control, humidity levels and proper ventilation. For example, if the temperature is too high or if it is too humid, insects and moulds will develop. Hence, make sure to keep the grain cool and dry. Keep in mind that storage conditions differ per type of grain. In general, the temperature should be below 15 degrees (below 10 would even be better) and the moisture content should be below 14%.

Oilseeds are more difficult to store compared to grains. The most important storage condition is to maintain the temperature and moisture at a good level. Proper storage conditions limit mould development and the formation of free fatty acids, and help to maintain the oil colour. Insect control treatment might be necessary if the oilseeds are stored for more than a few weeks.

Shippers may require the cargo to be fumigated (disinfected or purified with certain chemicals). However, you should discuss and agree upon this with your buyer first. This because fumigants (disinfection or purification chemicals) are generally not allowed for organic goods.

Tips:

- Implement a food safety certification programme such as the Food Safety System Certification (FSSC 22000). The FSSC 22000 is based on the ISO method and requires organisations to conduct a hazard analysis and to implement HACCP (hazard analysis of critical control points) principles to identify and control significant food safety hazards.

- Read more about grain storage via AHDB's Grain Storage Guide and Coceral’s Good Hygiene Practices for the collection, storage, trading and transport of grains, pulses and oilseeds.

Incoterms

Understanding the International Commercial Terms (Incoterms) is a crucial aspect of international trade. Incoterms are a set of standardised international trade terms used in contracts for the sale of goods. They are essential when it comes to the consignment and payment of goods that are shipped internationally. You should specify the chosen Incoterm in the contract to prevent misunderstandings or disputes. Also, make sure to take into account the Incoterm when calculating your price.

Each Incoterm specifies:

- At what point in the transportation process the responsibility and risk for the goods transfer from you to the buyer.

- The division of costs between you and the buyer.

- The tasks and obligations for you and the buyer. This relates to transportation, insurance, import clearance and the delivery of goods.

The most recent version of Incoterms was published in 2020, encompassing 11 Incoterms rules that are grouped into two categories: rules for any modes of transport and rules specifically for sea and inland waterways (see Figure 1).

The most common Incoterms for the international trade of grains, pulses and oilseeds are Cost Insurance Freight (CIF) and Free on Board (FOB). Bulk grain and oilseeds are sometimes sold via Ex-Works (Ex-Farm) to licensed storage elevators or warehouses. In such situations, the transaction takes place within the borders of a single country and the international buyer is present in the origin country.

Figure 2: Incoterms 2020 explained by Inco Docs

Source: Inco Docs on YouTube

Tips:

- Check out the paper of the Organisation for Economic Co-operation and Development (OECD) to get a better view of the Maritime transportation costs in the grains and oilseeds sector.

- Use the free freight rate calculator of Freightos to calculate your freight costs and determine your freight rates. Also use Freightos to stay up to date on the latest news about shipping and freight cost increases, shipping issues and shipping container shortages.

- Visit the website of the Transport Information Service and the Container Handbook to know how to store and transport different types of cereals and oilseeds.

- Visit the website of the International Chamber of Commerce to learn more about the Incoterms.

6. Use proper packaging

The choice of packaging primarily depends on your buyer’s preferences. However, there is flexibility to adjust your packaging to guarantee the quality and efficiency of your product. The proper packaging will depend on the type of good you are shipping and the sales channel that you are using.

You can use the following packaging options to transport your grains, pulses and oilseeds:

- Bulk carrier (no packaging): this is used to ship commodity goods – such as wheats, oats, maize and rice – to large buyers. Sometimes, buyers stipulate the use of a container-sized bag to reduce the risk of contamination.

- Bulk bags (up to a tonne): these are large woven polypropylene bags with handles. They make it possible to handle and transport large quantities in a convenient way.

- Woven polypropylene bags for smaller quantities (for example, 25 or 50 kg): these can be used for goods with a lower volume or specialty goods, such as dried lentils, chickpeas, speciality rice and sesame seeds.

- Kraft paper bags: these bags are traditionally used for organic products, but increasingly also for conventional products. In 2024, an estimated 25-30% of international grains, pulses and oilseeds are packed in sacks using Kraft paper bags.

Figure 3: Chickpea flour packed in a Kraft paper bag

Source: GloballyCool

Grains, pulses and oilseeds should be packed in containers that preserve the product’s hygienic, nutritional, technological and organoleptic (sensory) qualities. Moreover, it is important that the packaging is whole and undamaged, dry, clean and free from insects or fungus. The container and packaging material must be made from safe materials and not transfer any harmful substances or undesirable odours or flavours to the product. If a product is packaged in sacks, these have to be clean, sturdy and strongly sewn or sealed.

Recently, European buyers have become more cautious about the risk of mineral oil hydrocarbon residues on packaging material and on the product itself. They are categorised into two main groups: MOSH (Mineral Oil Saturated Hydrocarbons) and MOAH (Mineral Oil Aromatic Hydrocarbons). As a supplier, your buyers may increasingly ask you how you deal with this risk during the packaging process.

Labelling

Labels on bulk packaging should include the following information:

- Name and variety of the product

- Batch code

- Net weight (metric system)

- Shelf life/best before date

- Recommended storage conditions

- Lot identification number

- Country of origin

- Name and address of the manufacturer, packer, distributor or importer

Other details that might be included are:

- Brand

- Harvest date

- Drying method

If you are transporting organic or novel food, additional labelling is needed.

You may also consider fumigation treatment (disinfection or purification using certain chemicals) during shipping. Carefully consider which fumigant (disinfectant or purifying chemical) to use and whether it is allowed in the European Union, and also check the shipping company’s safety guidelines. If the container’s ventilation outlets will be covered, this may cause moisture issues inside the container.

For non-retail containers, labelling information can either be placed on the container or in the accompanying documents. The container must at least include information about the product name, the lot identification and the name and address of the manufacturer or packer. Instead of the lot identification and name and address of the manufacturer or packer, you are also allowed to place an identification mark on the container. However, it is important that the identification mark is clearly identifiable with the accompanying documents.

Tips:

- Find the specific packaging requirements about a variety of grains, pulses and oilseeds in CBI’s product factsheets.

- Take a look at the list of product standards in the Codex Alimentarius of the Food and Agriculture Organization of the United Nations (FAO). It provides basic information on packaging and labelling, but also contains important information on moisture content, hygiene and contaminants, for example.

- You can save space in the container by storing the bags without pallets. Sufficient ventilation and protection of the bags can be achieved by using liners on the floor and walls (see images of dunnage). However, the handling costs will then increase for your buyer, as they will need to unload the bags manually.

- For grains, pulses and oilseeds that can either lose quality if stored for a long time or have a higher risk of pest infestation, you can choose vacuum packaging, such as the VacQPack system. However, this packaging will be more expensive. Also consider fumigation (disinfection or purification) alternatives by checking what fumigation providers offer, such as Ecotec.

Document your quality process and protect yourself against claims

Product testing and control are always part of the trade in grains, pulses and oilseeds. But when you are selling organic ingredients or grains for health market channels, you should expect your product to be thoroughly tested by your buyer – especially in northern and western European markets. A quality claim can be made easily, and these often concern excessive pesticide residue.

Although you cannot avoid quality issues completely, you can protect yourself as much as possible by keeping a proper and well-documented procedure. One of the things to remember is that organic products have zero tolerance for pesticide residues, but testing methods and precision often vary between different laboratories. This means that advance testing may show that your product is okay, while your buyer’s test outcome may be different.

Follow the recommended steps below to defend your product quality and deal with quality claims:

- Avoid cross-contamination by keeping your storage well organised in separated product lots.

- Use recognised sampling and inspection companies (for example, SGS, Bureau Veritas or Intertek).

- Use European laboratories such as Eurofins, Groen Agro Control, TLR International laboratories or, even better, the same laboratory as your buyer.

- Collect counter samples of each lot you export and preferably keep these for as long as the product’s shelf life.

- Make sure the samples match the same lot that you are shipping.

- Include the technical product data with your quotation and shipment.

- Use traceability codes. Find the criteria and traceability requirements in the FAO Food traceability guidance or in the overview of the ITC Traceability in food and agricultural products.

- Ask your buyer for written confirmation of their acceptance of the product’s quality on arrival.

- If a quality claim arises, take the claim seriously and look for a solution together with your buyer.

- Maintain a network of brokers and traders so that you always have an alternative sales channel for rejected products (as long as food safety is guaranteed).

7. Use support organisations to learn about best export practices

Several international organisations are available to help you in organising your exports. They can either help you with the technical part of arranging your shipment or explain the requirements to enter the European market. The following platforms, organisations and handbooks might be interesting to you:

- Access2Markets helps you to get informed on the import tariffs, taxes, procedures, requirements, customs documents and trade agreements that apply if you want to export to the European Union.

- International Chamber of Commerce (ICC) offers arbitration, export learning tools and information about Incoterms.

- International Trade Centre (ITC) offers trade-related practical training and advisory services for small businesses. Their SME Trade Academy provides online courses on trade-related topics. They also have Model Contracts for Small Firms.

- GAFTA is the international trade organisation for agricultural commodities. It provides information on contracts, arbitration, trade assurance and policy. It also organises events and training in commodity shipping and making contracts.

- The Container Handbook provides cargo loss prevention information from German marine insurers.

- The BMT Cargo Handbook is a database that provides knowledge on cargo transportation in the marine industry. It was set up by marine consultancy and surveying company BMT Netherlands B.V.

- The FAO has published a list of product standards in the Codex Alimentarius. These standards can guide you when exporting specific grains, pulses and oilseeds.

- The Chamber of Commerce in your country can provide you with advice and information on export‑related topics.

Tip:

- Check if there are trade support organisations in your country that can give advice or offer training programmes on exports. Use ITC’s global Business Support Organization directory to look for institutions that can support you.

8. Read other CBI studies on how to export to Europe

CBI has published a variety of other studies that provide information and practical tips on how to export grains, pulses and oilseeds to the European market. These studies can help you increase your chances of success in entering the European market.

- To find new buyers in Europe, see CBI’s study on Tips for Finding Buyers on the European grain, pulses and oilseeds market.

- Read CBI’s study on Tips for Doing Business to learn more about the European business culture, how to conduct a sales pitch and how to build business relations.

- CBI’s Exporting to Europe Guide explains the exporting process in 12 steps, from how to get your company ready for exporting to Europe to growing your exporting business.

GloballyCool carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research