Value chain analysis of pulses and oilseeds from Ethiopia

This document is the value chain report carried out on behalf of the Centre for the Promotion of Imports from developing countries (CBI) under the title “Value Chain Analysis for Pulses and Oilseeds Ethiopia”. It was carried out between July and September 2018.

Figure 1: Process of elaboration of the value chain report

The main results of the report are listed as follows.

Products

- The most promising products are sesame, mung beans, soya beans, sesame oil and tahini. After our in-depth review based on market data and interviews, we consider the most promising product-market combinations to be the ones listed below. We believe there is a significant opportunity to increase exports to Europe.

- Organic and conventional sesame seeds

- (Organic) mung beans

- Soya beans

- Sesame oil marketed as socially aware product

- Tahini, potentially as organic tahini

- Export capacity for these products exists, but value-add is more difficult. All aforementioned products are currently being produced in Ethiopia, although to very different extent. Production and export capacity exists for the agricultural raw materials. Soya and mung bean production is increasing and the government has already identified these as very interesting crops (albeit for the Asian market). Capacity for oil and tahini is much less developed but promising in terms of greater profitability for Ethiopian companies.

Value chain

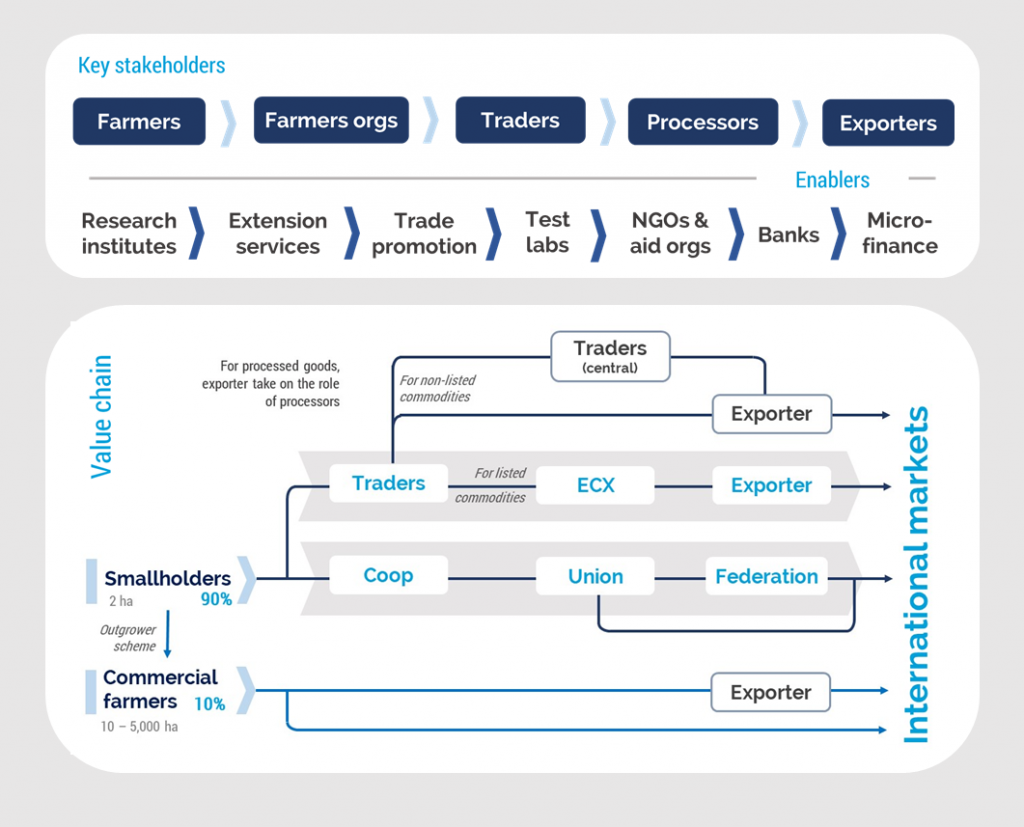

- The value chain can graphically summarised as (see Figure 22 in Section 5.1)

- There is a strong similarity between the oilseed and pulses value chains. In general terms, the structure of the marketing chain can be divided into three segments: primary, secondary and tertiary markets. In Ethiopia, farmer organisations are conformed by three layers: cooperatives, unions and Federations. In this context, the smallholder value chain has four layers (farmers, collectors, aggregators and exporters). There are five main cross cutting organizations identified through the oilseed and pulses value chains.

- The Oilseed and pulses sector is male dominated. The oilseed and pulses sector is a predominantly male sector so far. Outgrower schemes could provide an opportunity for more female participation.

- Unforced child labour is relatively common, as in most agricultural societies. As with most agricultural societies, children form part of the work force, especially if – as in Ethiopia – workers are difficult to find in peak times. More investigation and clear protocols are required for outgrowers in order to address this point.

- Use of agro-chemicals is not extended. In general, the use of pesticides is not very extended; often raw materials are grown in a way that is compatible with organic certification. However, there is also little engagement in organic production and therefore cross contamination due to rotational crops common.

- Very little evidence of a quality infrastructure; a single accredited laboratory. There is very little quality infrastructure or indeed quality culture in Ethiopia. A single ISO17025 accredited labs is available and most testing for EU exports is done in Europe at high cost (1% of export value). Exporters and indeed the value chain partners don’t necessarily have proper understanding of European business ethics and might be seen as unreliable.

Issues

- Productivity, especially in sesame, is low. Due to a lack of Good Agricultural Practices, mechanisation, irrigation and agricultural inputs, yields are in most cases below world average and far below international best results.

- Ethiopian market prices are distorted and specialist exporters have gone out of business as a consequence. The Ethiopian oilseed and pulses sector in general, but the sesame sector in particular, is currently distorted by two factors: the overwhelming presence of smallholders and the significant shortage of FOREX. Both factors together lead to a non-competitive pricing structure of the sector that needs to be addressed in the framework of any successful intervention. As a result, many of the professional exporters in agricultural goods have been replaced by FOREX-seeking import organisation. Agricultural exports have not been profitable for the last years. Possible solutions are discussed; we recommend a double strategy of on the one hand shortening the value chain by working with exporting farmers and outgrower schemes and on the other hand increasing the amount of production of value-add products (of which some will be produced by farmer organisations).

- Sesame sector possible heading towards a bust in next months. The sesame sector might be heading towards a bust in the coming months (Nov 2018-Jan 2019); this might give an opportunity for a “reset” of the market with certain changes. The immediately obvious need for action when a bust occurs provides an opportunity for change the status quo. Intervention programmes, especially with market linkage, are likely to be quite welcome.

- Exporters very focussed on Asia. The export sector is currently very focused on the Asian market and characterised by a certain short-term thinking (stakeholders used the term “hit and run”) that is not easily compatible with the long-term, quality oriented and somewhat picky European market.

- Exporters will need preparation before going to Europe. We consider that most exporters interviewed still need a fair bit of preparation before they can sustainably (and profitably) export to Europe. Certification (HACCP, ISO22000), training in business culture, marketing and business planning are needed.

- Trade promotion is very necessary to increase awareness of Ethiopia as a source of mung, soya and value-add products. Ethiopia is not known currently as producer of mung bean, soya bean, sesame oil and tahini. This requires trade promotion and awareness raising in Europe.

Opportunities

- Exporting to Europe is an aspiration. Exporters have a positive attitude towards the EU and consider it an aspiration.

- There is good demand for the chosen products in Europe. For all five products, a clear demand could be seen from available data. In addition and where possible, this was confirmed directly with importers from Europe. Some of the products can clearly differentiate themselves on the market.

- High profit margins for value-add products. Especially in the context of joint ventures with European partners, high profit margins can be achieved both for sesame oil and for tahini, especially if organic.

- Organic sesame if traded through exporting farmers is profitable. Ethiopia, unlike other African contenders, can deliver organic sesame, because it has the corresponding certification. Currently, demand in organic sesame far outweighs supply.

- Market requirements are largely known. Although the remaining exporters are knowledgeable in market requirements and some have had experiences with the EU with raw materials, this is much less true for value-add products.

- Joint ventures in processing or trading can solve a number of issues. There is an opportunity for joint ventures especially in sesame trade and value-add products; success cases with Myanmar exist

- Mung and soy beans make for excellent rotational crops for sesame. Rotational crops can counteract nutritional depletion of fields and contribute to an improvement of yields.

- For the selected commodities, our analysis of demand indicates a clear opportunity for Ethiopia for replacing current suppliers to the European Union. The main reasons are

- Quality of Humara-type sesame from Ethiopia is a reference for the sesame sector; Ethiopia is already a large producer and exporter and imports into Europe are very healthy

- Ethiopia is able to provide organic sesame which is a growth sector in Europe

- Ethiopia is demonstrably GMO-free in soya beans for which a market exists in Europe that is currently serviced from countries with greater GMO risk

- Mung beans from Ethiopia have been reported to be good for sprouting, a growth market in Europe; organic mung beans are difficult to obtain in Europe and for sprouting of particular interest

- Sesame oil and tahini consumption are growing in Europe; Ethiopia is ideal for social marketing as a traditional source of sesame, smallholder presence and fascinating local culture that can be exploited in branding. In addition, the Humara type of sesame has an exceptional taste profile for tahini

Interventions

- For any successful intervention, some fundamental areas need to be addressed, such as access to FOREX and the linked problem of disconnect from market prices, certification, linkage to European partners, trade promotion and a review of ECX

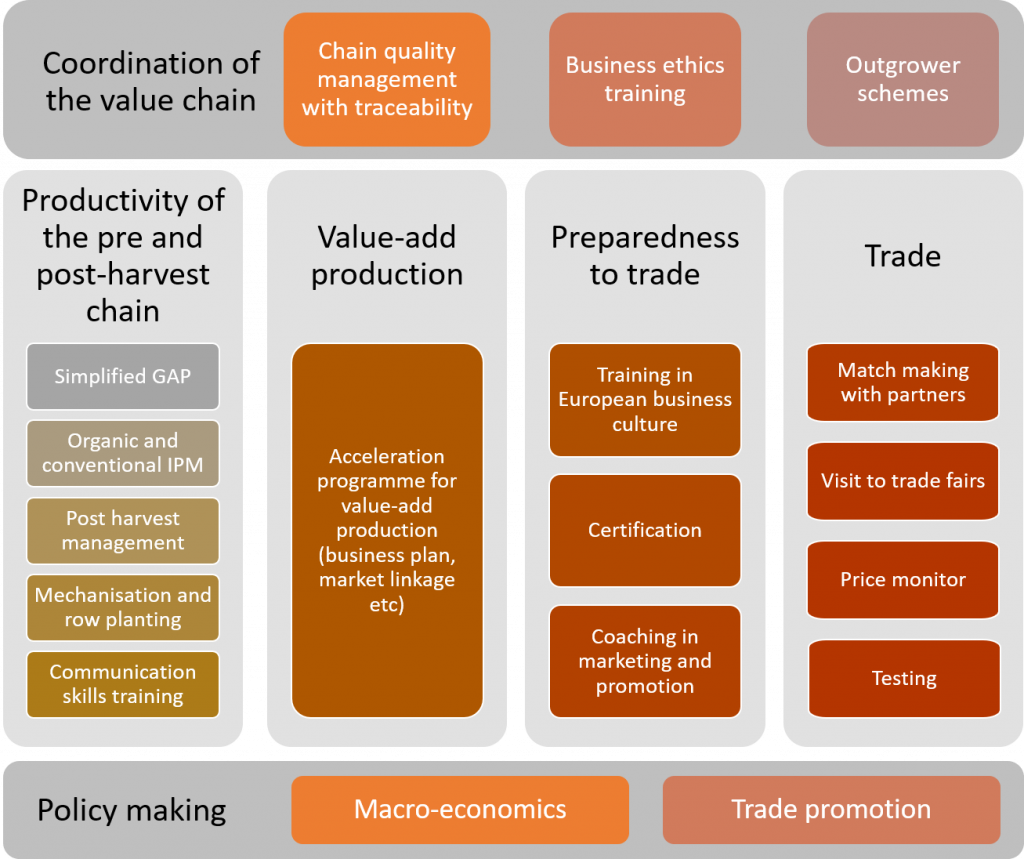

- Possible areas of intervention can be summarised as shown below:

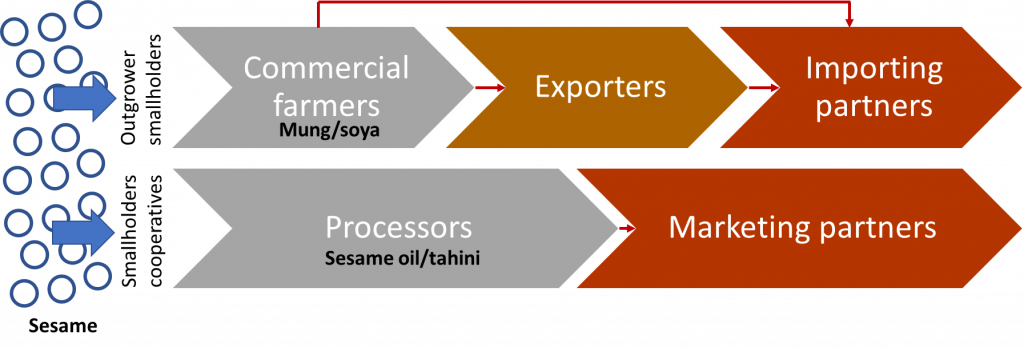

- The main recommended partners for an intervention are shown below. At the current stage we believe that a mixed strategy of intervention is best, where support is provided to exporting farmers and processors of value-add products

The report is based on existing literature, knowledge gathered through experience and project work by both the national and European experts and interviews with stakeholders. It also draws material from three larger stakeholder events held in two cities in Ethiopia (Addis Ababa and Gondar). These events contributed in particular to the identification of issues, opportunities, possible solutions and partners in the value chains under consideration. This report was elaborated under the guidance of Ms D.A. Braak and Mr M. Hulst from CBI. It is the result of a collaboration between Syntesa Partners and Associates with lead consultant being Dr Heiner Lehr and Shayashone Trading PLC as the Ethiopian partner, led by Mr Yared Sertse.

Search

Enter search terms to find market research