What is the impact of the war in Ukraine on exports of vegetable oils?

Ukraine and Russia are two of the world’s largest exporters of sunflower oil. Supply chain disruptions are now affecting the global vegetable oils market. They have led to higher prices, which are expected to stay high in 2022‑2023. Although developing countries export other types of vegetable oil, they also benefit from the higher market prices. This will probably more than make up for the higher cost of production inputs and the expected decline of exports to Russia and Ukraine.

Contents of this page

1. How is the war in Ukraine affecting production inputs for vegetable oils?

Up until now, the war in Ukraine has not a caused any shortage of production inputs for vegetable oils, such as fertiliser and energy. But it has caused their prices to increase. This has pushed up production costs. In developing countries where farmers may have limited financial means, the higher prices have led to more projects to find alternatives for artificial fertiliser.

Input prices have gone up

Fertiliser is an important input to grow the oil seeds and fruits that produce vegetable oil. So the world’s largest oil seed producers (such as Indonesia) use large volumes of fertilisers. The main fertilisers for oil palms are potassium and nitrogen (ammonium sulphate). Other inputs for vegetable oil production are electricity, diesel and pesticides.

The war has resulted in higher prices for energy commodities, and for inputs that consume a lot of them. Fertilisers are a good example. Nitrogen-based fertilisers are the largest group. Their production process starts by mixing nitrogen from the air with hydrogen from natural gas (an energy commodity) at high temperature and pressure to create ammonia. About 60% of the natural gas is used as raw material. The other 40% powers the synthesis process.

Russia is one of the world’s main exporters of both fertilisers and energy commodities. The developing countries that export vegetable oils do import some fertiliser from Russia, but also a lot from many other countries. For example, in recent years Indonesia imported US$200-400 million worth of fertilisers a year from Russia – but that was out of total imports worth US$1.7-2.2 billion per year.

Of course, Russia’s temporary ban on fertiliser exports and the quota on fertiliser exports between July and December 2022 may be affecting countries that import fertilisers from Russia. But high fertiliser prices are having a far greater effect. In the case of energy commodities, the developing countries that are important oilseed producers do not rely very much on Russia for their imports.

Farmers are looking for alternatives to synthetic fertiliser

Prices of inputs have increased, but so too have prices of vegetable oils. This may help make up for the higher production costs. Still, individual small farmers may be struggling because of high fertiliser prices. Some governments are trying to support their farmers. In Kenya, for example, the government has received a loan from the African Development Bank. This is meant to “support food security efforts amid rising cost of inputs and prevailing drought”. It is being used to give farmers subsidised access to fertiliser.

To reduce their need for synthetic fertiliser, some farmers are planting alternative crops that need less fertiliser. For example, groundnuts instead of maize. Another alternative that is being looked at in some developing countries is organic fertiliser, such as manure.

Figure 1: Ghanaian farmers look for organic alternatives as Russian fertiliser costs skyrocket

Source: VOAZimbabwe @YouTube

Tips:

- Stay up to date with developments affecting farm inputs. For example, by following RaboResearch Farm Inputs.

- Stay up to date on developments in the global oilseed sector. For example, by following RaboResearch Grain and Oilseeds.

- Use this summary of estimated fertiliser use by crop category in selected countries to see which crops use the most fertilisers.

- Keep track of national projects that offer subsidies or other support to farmers to make up for higher input prices (such as the Kenya African Emergency Food Production Facility).

- Check opportunities to develop a local production/supply of organic fertiliser.

2. How is the war in Ukraine affecting competition for vegetable oils?

Ukraine and Russia are two of the world’s biggest suppliers of sunflower oil. The Russian invasion in 2022 caused an abrupt global shortage of sunflower oil from Ukraine. Food processors had to find other oils to use instead. The most important oil from developing countries is palm oil, but that is often rejected as a substitute because of sustainability issues. The main effect of the crisis in Ukraine on competition for vegetable oils from developing countries is higher prices. These will probably remain high for the rest of 2022-2023.

Ukraine is the world’s biggest exporter of sunflower oil by far, ahead of Russia. Over the last decade, Ukraine has exported 45-55% of the global supply of sunflower oil. Russia has exported 15-25%. Because developing countries produce other types of oil, such as palm and coconut oil, they do not compete directly with Ukraine and Russia. But because vegetable oils can substitute each other (to some extent), their prices usually move together. This makes it interesting to compare the global market for different types of vegetable oil – see figure 2.

*Data based on imports from destination markets and transit trade data is excluded as much as possible.

*2021 is not included because several important markets had not reported their data to UN Comtrade by June 2022.

*Local production and consumption are not shown.

Figure 2 shows that most international trade consists of palm oil, sunflower oil, soybean oil and rapeseed oil. In 2020, these represented 86% of the world’s import volume. A second category is oils traded in smaller volumes, mainly on a regional basis. They are palm kernel oil (3.9%), olive oil (3.4%) and coconut oil (2.7%). A third and final category is oils that each make up less than 1% of the world trade: castor oil (0.8%), maize oil (0.7%), groundnut oil (0.5%), linseed oil (0.3%), cottonseed oil (0.2%) and sesame oil (0.1%).

Indonesia and Malaysia dominate the world trade in vegetable oils. Indonesia accounts for 30-33% of global trade, followed by Malaysia with a 17-19% share. Both countries are key suppliers of palm oil. This is the largest category of vegetable oil because palm oil is not only a food ingredient; it is also used in other sectors such as cosmetics and biodiesel.

Ukraine is the world’s third biggest exporter of vegetable oil. Its share of the global market is about 7%. This is because Ukraine dominates the global supply of sunflower oil.

Next comes Argentina. Its share is 5-8%, not far behind Ukraine. This is because of Argentina’s leading position as a supplier of soybean oil. The Netherlands completes the top 5 with a share of 4-5% per year. It has an important role as the leading re-exporter of palm oil in the European market.

In the short to medium term, Ukraine’s share of global vegetable oil supply is likely to decline. Even if its exports pick up again in 2022, the country will probably see a drop of 40-60% in exports in the 2022-2023 season.

Vegetable oil prices have increased a lot

When the war in Ukraine started in early 2022, it caused immediate disruption to the global supply of sunflower oil. This has led to much higher prices for nearly all vegetable oils (see figure 3). Because of the uncertainty caused by the war, some countries introduced non‑tariff measures as well. For example, Indonesia temporarily banned the export of palm oil to prevent a shortage of domestic cooking oil and price increases. Although measures of this kind were often only temporary, they limited supplies and pushed prices up even more.

Figure 3: Daily vegetable oil prices in 2021-2022 (USD per tonne)

Source: IFPRI (May 2022)

But the war in Ukraine is not the only reason for the big increase in vegetable oil prices. Other factors have also affected prices since 2020, causing them to rise to above‑average levels. The main problems have been failed harvests and COVID-19 restrictions.

- Drought in South America affected soybean production in Brazil, Argentina and Paraguay. These countries’ export volumes are not likely to change, but prices have risen by up to 70% because of weather conditions and the disrupted trade in sunflower oil.

- Malaysia’s production of palm oil is still not back to full capacity. This is because of a labour shortage caused by pandemic-related border closures. The government of Malaysia has approved the hiring of 32,000 foreign workers to solve the problem, but it will take time for the industry to recover.

- Canada’s production of rapeseed fell by 35% in 2021 from the previous year, because of drought. This led to a fall of 5% in rapeseed oil exports and a much bigger fall in rapeseed exports.

Sunflower oil shortage is leading to substitution in recipes

One important trend in 2022 is the substitution of oils in food processing recipes. Although vegetable oils vary in their flavour and uses, it is usually possible to replace one type with another. This is why their prices tend to move together. But substitution can be difficult, because different oils have different processing characteristics and taste profiles. That makes it a big challenge for food processing companies. So it is usually done only when really necessary.

Because of the war in Ukraine, the substitution of sunflower oil in food products became more common in 2022. Examples of such products are mayonnaise and pre-fried frozen vegetables. Rapeseed oil has been the most popular alternative, followed by linseed, groundnut and palm oil (but palm oil is often avoided because of sustainability issues).

During 2022, more sunflower oil became available and so food processors were able to switch back to this ingredient. In the long term, many food processors want to make their recipes more flexible. This is so that they can again change temporarily to other vegetable oils if market conditions make that necessary.

Sustainable alternatives

Palm oil dominates the world market for vegetable oils. This is because it has unique properties. But there is a huge negative side to palm oil production. Rapid expansion of palm oil plantations in Indonesia and Malaysia has caused massive deforestation. This has destroyed the habitats of rare plants and animals, like the orang-utan. Because of this, processors all over the world have been trying to find more sustainable alternatives.

At the same time, WWF states that palm oil is an incredibly efficient crop. Millions of small farmers depend on it for their livelihoods. Palm oil accounts for 40% of global vegetable oil supplies, but takes up only 6% of all the land used for vegetable oil production. With this in mind, the best option is to make existing production areas more sustainable. That should prevent further deforestation and harm to ecosystems.

Here are some examples of sustainable projects.

- Quercus Group in Ghana – a project in 2018-2020 to revive 4,000 hectares of sustainable palm oil plantation and to refurbish an old oil mill.

- SerendiPalm in Ghana – production of organic and fair-trade certified red palm oil.

- The BUL/Bidco Oil Palm project in Uganda – a public-private vegetable oil development project, which aims to create a fully integrated value chain for palm oil and self-sufficiency.

Certification can be a good way to prove your sustainability. Examples are RSPO (Roundtable on Sustainable Oil), organic (various options, depending on your target market) or fair trade certification. For more information, see our studies on palm oil alternatives.

Prices have gone up and are likely to stay high

All in all, the disruptions and price rises of 2022 have been unique. The same goes for the way governments have reacted. Trade restrictions have often made the supply of vegetable oils even more unstable.

The most important question now is this: how long will the market and prices remain unstable? The problem is that nobody knows the answer to this question. One important factor is how long the war in Ukraine lasts.

Another factor is how much more land farmers all over the world can plant with oilseed crops. And how successful their harvests are. Up until now, there have been no clear signs that the global supply will return to previous levels. In the medium term (2022-2023), prices will probably stay high. But after reaching a peak in March-July 2022, they did fall again.

Tips:

- Study how the type of oil you produce could replace sunflower oil, and explain this to your (potential) buyers.

- Stay up to date with global oilseed markets through the Agriculture and Horticulture Development Board.

- Keep track of international price developments through Trading Economics.

3. How is the war in Ukraine affecting vegetable oil exports from developing countries?

Russia and Ukraine are very important markets for palm oil from developing countries – especially from Indonesia. Imports by both countries are likely to be lower in 2022. But this will not affect Indonesian exporters of palm oil very much. Many factors affect supply and demand, and the war in Ukraine is only one of them.

Ukraine and Russia import most of their incoming vegetable oils directly from developing countries. Re-export through other countries is not common. Figure 4 provides more details of Russia’s and Ukraine’s vegetable oil imports. It shows that Russia’s average imports from developing countries reached more than a million tonnes a year before the war. Ukraine’s imports are relatively small – 20% of Russia’s import volume for palm oil, and 5% for other vegetable oils.

Indonesia will see a fall in exports of palm oil to Russia and Ukraine

Indonesia supplies almost all Russian and Ukrainian palm oil imports. Its average export volume to Russia had reached 940,000 tonnes a year. To Ukraine, the figure was 173,000 tonnes. Although Russia is not one of Indonesia’s biggest export destinations, it is still an important market. In fact, it is Indonesia’s 12th-largest destination.

Because Indonesia has not imposed sanctions on Russia, its exports of palm oil to Russia are likely to continue. But volumes may come down. The estimated fall is 5-15%. This is because of potential lower demand from the Russian market. Imports by Ukraine are also likely to go down in 2022. After all, the war has cut demand for palm oil by the Ukrainian food processing industry.

Altogether, Russia and Ukraine are good for about 5% of Indonesia’s palm oil exports by volume. The worst-case scenario, a 20% fall in demand from those countries, would reduce that volume by 1%. This is equal to 0.3% of the world market. That is a share so small that other events could easily make up for it. For example, failed harvests of oilseed crops.

Net exporting countries can benefit from higher vegetable oil prices

Because many developing countries are not self-sufficient in vegetable oils, they are affected by the unstable market and rising prices. The poorest households in these countries may face the threat of food insecurity. But even when a developing country is a net exporter of vegetable oil, global developments can affect the local market. This happened in Indonesia in 2022, when the government temporarily banned the export of palm oil in order to bring down the high price of domestic cooking oil.

Several developing countries are important exporters of vegetable oils. If they are net exporters, they are likely to benefit from higher oil prices. Price of almost all types of oil rose in 2022, although they later dropped back to lower or normal levels.

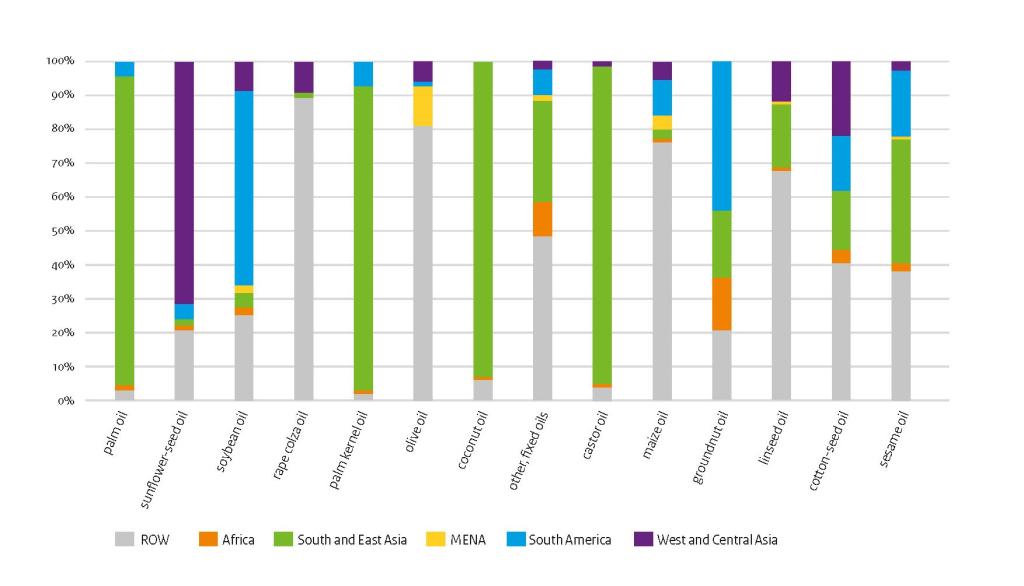

Figure 5: Share of developing countries, by region in global trade volume of vegetable oils, by type (average per year in 2018-2020)*

Source: UN Comtrade (June 2022)

*ROW (rest of the world) is all other producing countries.

Figure 5 shows that South and East Asia have large shares of the global export markets for palm oil, palm kernel oil, coconut oil and the category “other fixed oils”. Africa stands out for its share of groundnut oil exports, as well as other fixed oils and cotton-seed oil. The MENA region is a relatively large exporter of olive oil and maize oil.

Asia dominates palm, palm kernel and coconut oil exports

South and East Asia is an important exporting region for palm and palm kernel oil, and also coconut oil. About 99% of these oils from developing countries are produced in Asia. The other 1% comes from Africa. Here are some details of exports of these oils.

- Indonesia is a leading exporter of palm and palm kernel oil, as well as coconut oil.

- Palm oil also comes from a range of African countries: Ivory Coast (139,000 tonnes a year on average in 2018-2020), Ghana (101,000 tonnes), Kenya (12,000 tonnes), Nigeria (10,000 tonnes), Uganda and Egypt (6,000 tonnes each).

- Palm kernel oil is also exported by Ivory Coast (11,000 tonnes) and Ghana (3,000 tonnes).

- Coconut oil is also supplied in large volumes by the Philippines (989,000 tonnes, the world’s largest exporter), Malaysia (139,000 tonnes), Papua New Guinea (25,000 tonnes), Sri Lanka (20,000 tonnes), India, Vietnam, and Ivory Coast (6,000 tonnes each).

MENA countries are important exporters of olive and maize oil

The MENA region dominates developing country exports of olive and maize oil. Its olive oil exports reached more than 1 million tonnes a year on average in 2018-2020. Soybean oil and maize oil exports were much smaller, at 267,000 and 57,000 tonnes. Tunisia is the biggest exporter of olive oil by far, followed by Syria. Maize oil is exported by three countries in the MENA region: Egypt, Morocco and Tunisia.

Various countries export groundnut, linseed, cottonseed and sesame oil

Developing countries export small but often quite important volumes of groundnut, linseed, cottonseed and sesame oil. Linseed oil only comes from Asia. The same goes for cottonseed and sesame oil. Africa exports groundnut oil, cottonseed oil and sesame oil.

Here are some details of the exports of these oils from developing countries in Asia and Africa.

- Groundnut oil is exported in large volumes by Senegal (32,000 tonnes a year on average in 2018-2020), Sudan (21,000 tonnes), Gambia (3,000 tonnes) and Nigeria and Togo (almost 1,000 tonnes each).

- Linseed oil is exported in large amounts by Indonesia (13,000 tonnes).

- Cottonseed oil exports are dominated by Benin (4,000 tonnes). Indonesia also exports 1,000 tonnes.

- The export of sesame oil is important for Vietnam (1,900 tonnes) and Bangladesh (1,300 tonnes). Nigeria, Sudan and Burkina Faso export 200-700 tonnes each.

Other fixed oils

The category “other fixed oils” includes oils for the food industry, but also a relatively large share of niche products used in the cosmetics industry. Exports of these oils are the domain of two regions: Asia and West Africa. Bangladesh is the leading exporter (61,000 tonnes a year on average in 2018-2020), followed by Ghana (47,000 tonnes, mostly shea butter), Indonesia (24,000 tonnes) and Burkina Faso (14,000 tonnes, partly shea butter).

Tips:

- Keep track of international trade developments with Trademap.

- Read more about the Russian palm oil market.

Globally Cool B.V. carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research