Entering the European market for homewear

The mid-end to high-end segments of the European market offer good opportunities for homewear. You can add value to your products through the use of special techniques and materials, as well as sustainable values. Entering the European market also means you need to comply with the European Union’s mandatory (legal) requirements, as well as any additional or niche requirements your buyers may have.

Contents of this page

1. What requirements must homewear comply with to be allowed on the European market?

The following requirements apply to homewear on the European market. For a more detailed overview, see our study on buyer requirements for Home Decorations and Home Textile (HDHT).

What are the mandatory requirements?

When exporting to Europe, you must comply with the following legal requirements:

- General Product Safety Directive

- REACH

- Textile Regulation

- Packaging and packaging waste legislation

General product safety

The EU’s General Product Safety Directive is framework legislation that requires that all products marketed in the European Union must be safe to use. If no specific legal requirements have been laid down for your product and its use, the General Product Safety Directive still applies. If specific requirements do apply, the Directive applies in addition to those, and covers other safety aspects that may not have been specifically described elsewhere.

Unsafe products are rejected at the European border or withdrawn from the market. The European Union has introduced a rapid alert system (RAPEX) to list such products.

Tips:

- Use your common sense to ensure that normal use of your product does not cause any danger.

- Search the RAPEX database for homewear for an idea of what issues may arise.

Restricted chemicals: REACH

The REACH regulation (EC 1907/2006) lists restricted chemicals in products that are marketed in Europe. For example, REACH restricts the use of azo dyes in textile products. If you dye (the materials for) your products, make sure you do not use certain azo dyes that release any of the 22 aromatic amines that are prohibited. You should be aware that the legislation lists the aromatic amines, not the azo dyes that release them.

In addition, REACH restricts the use of certain flame retardants in textiles. These include Tris (2,3-dibromopropyl) phosphate (TRIS), Tris (aziridinyl) phosphine oxide (TEPA) and Polybromobiphenyles (PBB). These are prohibited in products intended to come into contact with the skin.

Since November 2020, new limits apply for 33 CMR substances (substances that are carcinogenic, mutagenic or toxic for reproduction). These limits affect textiles such as homewear. They are listed in entry 72 of Annex XVII and include substances such as formaldehyde, heavy metals and benzenes. In general, the maximum concentration is 1 mg/kg, but there are exceptions.

Tips:

- Make sure you comply with the restrictions for the use of chemicals as laid down in the REACH regulation.

- If your production process includes dyeing, make sure your products do not contain any of the azo dyes that release the prohibited aromatic amines. You should also check that your suppliers adhere to this; ask for certified azo-free dyes.

- Follow developments in the field of flame retardants, as new alternatives are being developed. You can do so, for instance, through pinfa.

- Familiarise yourself with the full list of restricted substances in products marketed in Europe via the Access2Markets platform.

- For useful information and tips from the European Chemical Agency, see REACH Annex XVII (a list of all restricted chemicals), Information on REACH for companies established outside Europe and Questions & Answers on REACH.

Textile Regulation

The EU’s Textile Regulation states that textile products need to be labelled or marked. The purpose of the Textile Regulation is to ensure that consumers in the European Union know what they are buying. The Regulation applies to all products that contain at least 80% (by weight) textile fibres. It requires textile products to have a label that states the full fibre composition of the product and, if applicable, the presence of non-textile parts of animal origin. The label should be durable, easily legible, visible and accessible. It should also be printed in all the official national languages of the European countries where the product is sold.

There is no Europe-wide legislation on the use of symbols for washing instructions and other care aspects of textile items. Because consumers do consider care information to be important information on a product label, you are advised to follow the ISO 3758:2012 standards on the care labelling code using symbols for textiles.

Tips:

- For more information on the Textile Regulation, see Frequently Asked Questions.

- Know your own products and study the European labelling rules to find out how they should be labelled in Europe. For example, if you use a cotton name, trademark or other term that implies the presence of a type of cotton, you must also use the generic fibre name ‘cotton’. You can find more information about this on the EU’s Access2Markets website: textile labelling rules.

Flammability

Several countries have national legislation regarding the flammability of clothing in general or sleepwear in particular. These countries include the Netherlands and the United Kingdom.

Tip:

- The UK Fashion and Textile Association provides information about the Dutch legislation in English.

Children’s clothing

There are specific standards regarding the flammability of children’s nightwear and the safety of children's clothing intended for children up to the age of 14. These standards specifically regulate the use of cords and drawstrings. Customs authorities often reject clothes due to a risk of suffocation, strangulation or injuries. This applies especially to clothes for children up to the age of 7.

Figure 1: Children’s winter pyjamas

Source: Pxhere

Tip:

- For children’s homewear, do not use cords in the neck areas or with long free ends that can become traps, nor parts (such as buttons) that children can easily remove and swallow.

Packaging

Europe has specific packaging and packaging waste legislation. This EU Directive 2015/720 aims to prevent or reduce the impact of packaging and packaging waste on the environment at European level. Buyers may therefore ask you to minimise the use of packaging materials (paper, cartons, plastics) or to use recycled materials, for example.

Europe also has requirements for wood packaging materials (WPM) used for transport, such as:

- packing cases

- boxes

- crates

- drums

- pallets

- box pallets

- dunnage

All wood packaging material and dunnage from non-European Union countries must be:

- either heat treated or fumigated in line with ISPM15 procedures

- officially marked with the ISPM15 stamp consisting of 3 codes (country, producer and measure applied) and the IPPC logo

- debarked

These requirements do not apply to:

- wood 6mm thick or less

- wood packaging material made entirely from processed wood produced using glue, heat and pressure, such as plywood, oriented strand board and veneer

- wood packaging material used in trade within the European Union

The objective of this Directive is to prevent organisms that are harmful to plants or plant products from being introduced into and spreading within the European Union. It also regulates imports from third countries in line with international plant health standards. Keep this in mind when you decide on the packaging of your homewear.

Tip:

- Read more in the overview of EU rules on wood packaging material.

What additional requirements do buyers often have?

Sustainability

Social and environmental sustainability make your products stand out on the European market. Think of sustainable raw materials and production processes, as well as the impact your company has on the environment, the wellbeing of your workers and society as a whole. Buyers appreciate a good story to create an emotional connection with their customers.

Nowadays, an increasing number of European buyers demand adherence to the following schemes:

- Business Social Compliance Initiative (BSCI): European retailers developed this initiative to improve social conditions in sourcing countries. They expect their suppliers to comply with the BSCI Code of conduct. To prove compliance, the importer can request an audit of your production process. Once a company has been audited, it is included in a database for all BSCI participants.

- Ethical Trading Initiative (ETI): this initiative is an alliance of companies, trade unions and voluntary organisations. It aims to improve the working lives of people across the globe that make or grow consumer goods.

- Sedex: this membership organisation strives to improve working conditions in global sourcing chains. It offers a collaborative platform where you can share information on your ethical and labour standards with (potential) buyers, based on a Self-Assessment Questionnaire (SAQ).

You can refer to standards such as ISO 14001 and SA8000 to read up on sustainable options. However, only niche market buyers demand compliance with such standards.

Particularly in home textiles, organic cotton is becoming an increasingly popular sustainable option, although this is not yet a mainstream requirement. You can explore your options for organic certification via The Global Organic Textile Standard (GOTS). The easiest way to use certified organic cotton is by either sourcing certified yarn or, if you do not weave yourself, certified organic cotton fabric.

In 2020, the European Commission adopted the Circular Economy Action Plan as a main building block of the European Green Deal. The action plan includes the intention to launch a new Strategy for Textiles in 2021. The goal of this strategy is to strengthen competitiveness and innovation in the sector, boosting the European market for sustainable and circular textiles.

A recent study by the International Trade Centre concluded that, irrespective of the product, retailers in the major European markets are putting more environmentally and socially sustainable products on their shelves. Simply because consumers ask for it. According to the survey, 98.5% of retailers consider sustainability as a factor in their product sourcing decisions.

Tips:

- Optimise your sustainability performance. Reading up on the issues addressed by initiatives such as BSCI and ETI will give you an idea of what to focus on.

- If you can show your sustainability performance, this may be a competitive advantage. For instance, with a self-assessment like the BSCI Producer Self-Assessment, or a code of conduct such as the ETI base code.

- Check out the Circular Economy Action Plan for details on the planned Strategy for Textiles.

- For more information, see our special study on sustainability and our webinar on the sustainable transition in apparel and home textiles.

Labelling

The information on the outer packaging of homewear should correspond to the packing list sent to the importer. The external packaging labels should include:

- producer name

- consignee name

- quantity

- size

- volume

- caution signs

The most important information on the product labels of homewear is its composition, size, origin and care labelling. Your buyer will further specify what information they need on the product labels or on the item itself, such as logos or ‘made in…’ information. This is part of the order specifications. It is common in Europe to use EAN or barcodes on the product label. For more information, please refer to the labelling-specific rules under the Textile Regulation.

Packaging

Importer specifications

You should pack homewear according to the importer’s instructions. They have their own specific requirements for the use of packaging materials, filling boxes, palletisation and stowing containers. Always ask for the importer’s packaging specifications, which are part of the purchase order.

Damage prevention

Properly packaging homewear minimises the risk of damage through dirt, temperature or humidity. Packaging should make sure the items inside a cardboard box cannot damage each other. It should also prevent damage to the boxes when they are stacked inside the container. Packaging therefore usually consists of an outer cardboard box lined with protective material like plastic wrapping. The actual products are usually packed in polybags, either individually or in relatively small numbers, depending on the size of the product.

Dimensions and weight

Packaging must be easy to handle in terms of dimensions and weight. Standards are often related to labour regulations at the point of destination and must be specified by the buyer.

Cost reduction

Boxes are usually palletised for air or sea transport, and you have to maximise pallet space. Packaging must provide maximum protection. However, you should also avoid using excess materials or shipping ‘air’. Waste removal is a cost for buyers. You can reduce the amount and diversity of packing materials by:

- partitioning inside the boxes, using folded cardboard

- matching inner and outer boxes by using standard sizes

- considering packing and logistical requirements when designing your products

- asking the buyer for alternatives.

Material

Importers are increasingly banning wooden crating and packaging due to their unsustainability and high material and disposal costs. Economical and sustainable packaging materials are more popular. Using biodegradable packing materials can be a market opportunity. For some buyers, it can even be a demand.

Consumer packaging

Sleepwear is usually displayed unpacked. However, especially in the high-end segment it is common to gift wrap sleepwear in a box. The buyer usually provides the design for such special packaging. Bathrobes and dressing gowns are usually displayed and sold hanging. Any consumer packaging must be simple in design but functional: it needs to protect against water and staining.

Tips:

- Always ask for the importer’s order specifications, packaging and labelling requirements.

- See Packaging Europe for more information on the latest packaging developments, with regular news articles about biodegradable packaging.

Payment and delivery terms

Payment terms are usually agreed upon with the buyer in the order contract. They vary from buyer to buyer and are related to the volume and value of the order, the type of distribution partner, whether or not an agent is involved, and what delivery terms apply.

Delivery terms, officially known as Incoterms, depend on the type of distribution partner and their preferences regarding physical distribution. Importers generally prefer Free On Board (FOB) or Free Carrier (FCA) arrangements.

FOB is restricted to goods transported by sea or inland waterway. It means that the seller pays for transportation of the goods to the port of shipment, plus loading costs. The buyer pays the cost of marine freight transport, insurance, unloading and transportation from the arrival port to the final destination. FCA can be used for any transportation mode. In this type of arrangement, the seller fulfils their obligation to deliver when they have handed over the goods, cleared for export, into the charge of the carrier named by the buyer at the specified place or point.

Retail multiples can ask for Cost Insurance Freight (CIF). That means that they will ask you to include the shipping and insurance charges in your quotation. Small retailers may go a step further and ask you to arrange that the goods will be delivered to their doorstep via a Delivered Duty Paid (DDP) arrangement. For importers who consolidate orders in your country, Ex Works (EXW) terms are often best.

Tips:

- For a more detailed overview of the various terms and conditions, and how to work with these, see our study on terms and conditions. This also explains the benefits of having your own terms and conditions.

- Study the different types of Incoterms, including what your and your buyer’s rights and obligations are.

What are the requirements for niche markets?

Fair trade

According to the World Economic Forum, 86% of people want significant change to make the world fairer and more sustainable after COVID-19. The concept of fair trade supports fair pricing and improved social conditions for producers and their communities. Especially if the production of your homewear is labour intensive, fair-trade certification can give you a competitive advantage. Common fair-trade certifications include certifications issued by the World Fair Trade Organisation (WFTO) and Fair for Life.

Tips:

- Ask buyers what they are looking for. Especially in the fair-trade sector, you can use the story behind your product for marketing purposes.

- If certification is not feasible, work according to fair-trade principles without being officially guaranteed or certified. Carefully document your company processes so you can support your claim.

- Check the ITC Sustainability Map database for more information on voluntary standards and their requirements, including fair production.

Sustainable textiles

While sustainability is gaining ground, the use of certification is still not common in this sector, apart from organic certifications, which are becoming widespread. As this is a means of demonstrating sustainability, there is an increasing interest from buyers in this type of certification.

There are several ecolabels for textiles:

- The Global Organic Textile Standard (GOTS) is a textile processing standard for organic fibres. It ensures environmental and social responsibility throughout the production chain of textile products.

- OEKO-TEX Standard 100 certification guarantees that no hazardous chemicals are used in the production of textiles. It provides textile and clothing companies with more transparent supplier relationships and facilitates the flow of information regarding potential problematic substances.

- The European Union’s Ecolabel seeks to minimise products’ environmental impact by looking at the use of environmentally friendly chemical options. The label is awarded only to products with the lowest environmental impact in a product range.

- The voluntary Nordic Swan eco-label is used for textile products in Sweden, Norway, Finland, Denmark and Iceland.

Tips:

- Explore the possibility of sourcing organic cotton for your homewear. Textile products containing a minimum of 70% organic fibres can get GOTS certified. The easiest way to get certified is to use certified organic cotton yarn if you are weaving the fabric yourself, or certified organic cotton fabric if your production solely involves Cutting Making Trimming (CMT).

- Read more about GOTS, OEKO-TEX and the European Union’s Ecolabel in the ITC Standards Map.

- Determine which certification programme would be the best fit for you and apply if possible.

2. Through what channels can you get homewear on the European market?

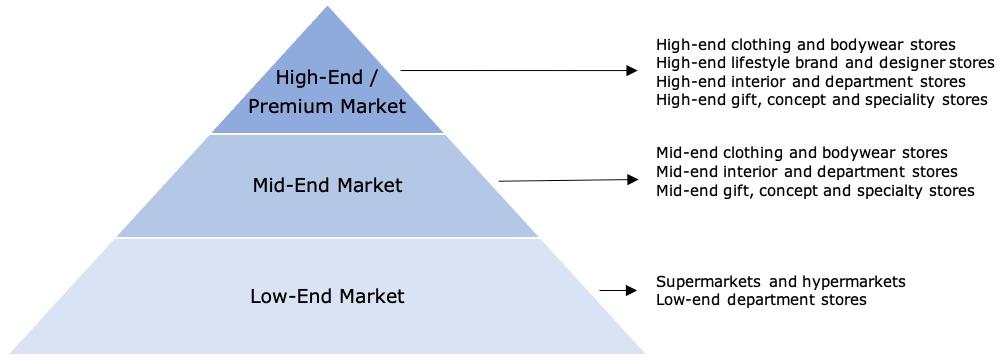

The homewear market is segmented into low-end, mid-end and high-end (premium) market segments. The items are put on the market through the traditional channels: importers/wholesalers that supply to retailers, as well as retailers that buy directly from suppliers.

How is the end-market segmented?

Figure 2: Homewear market segmentation in Europe

Low-end market

In the low-end market segment, simple and inexpensive homewear is common. Retailers in this segment include department stores such as Zeeman, and supermarkets like Tesco. Products from India, Bangladesh and China generally dominate the low-end market. Competing with this type of cheap mass production is almost impossible. Therefore, the mid-end and high-end market segments offer you the best opportunities.

Mid-end market

The mid-end market segment has a stronger focus on design, material and finish, while prices are still reasonable. To supply this market, you need to pay particular attention to design and quality. Stores like Zara and Marks & Spencer are key players in the mid-end market. Especially in the higher mid-end segment, the story behind your company and products becomes more important. A sustainable approach will help to further distinguish your proposition from the competition.

High-end/premium market

In the high-end market segment, designer quality is common and private labels are the standard. This is also the market segment where expensive and refined raw materials such as silk, cashmere or blends of high-end fibres are used. Luxury department stores such as Harrods and Le Bon Marché, and even well-known designer brands offering premium homewear like Dolce & Gabbana play an important role here.

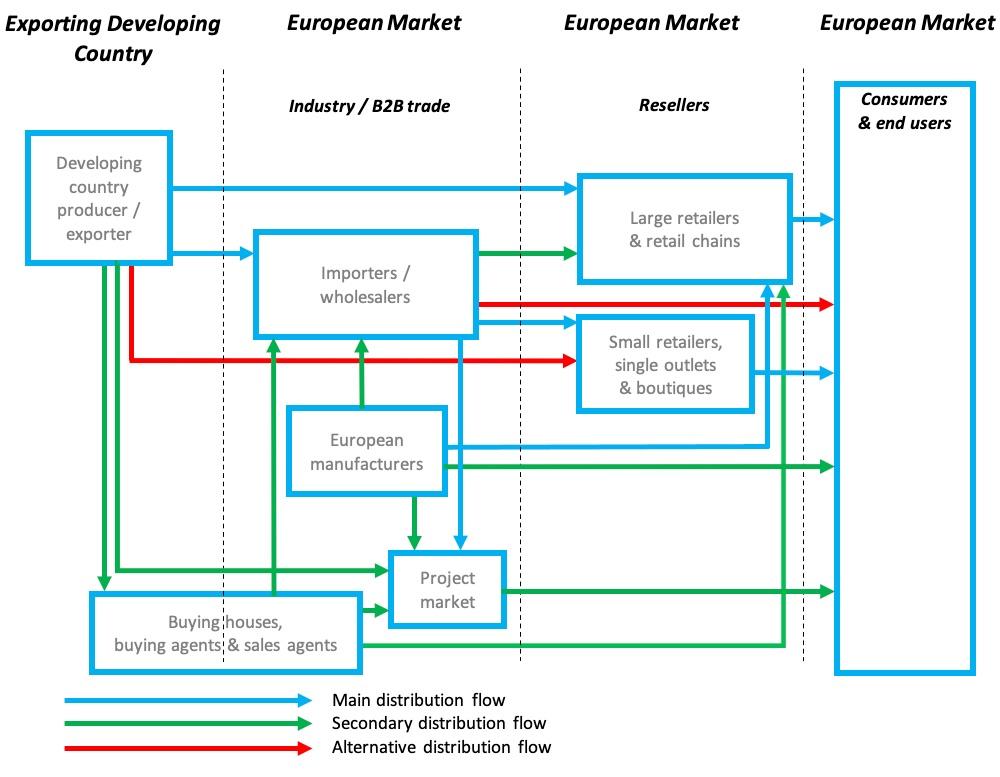

Through what channels does homewear end up on the end-market?

The channels through which homewear is put on the market differ somewhat from those for home textiles in general. Agents, brokers and buying houses play a more important role in the trade in bathrobes and dressing gowns from developing countries. However, direct selling to retailers is also becoming increasingly important in this market.

Figure 3: Trade channels for homewear in Europe

Importers/wholesalers

Importers/wholesalers sell products to retailers in their own country or region, or re-export to the broader European market. Some European markets are therefore supplied by wholesalers/importers from other European countries (internal European trade). Supply to buyers in the project market (such as hotels and spas) can be considered a secondary distribution flow for European importing wholesalers.

These importers/wholesalers take care of the import procedures. They take ownership of the goods when they buy from an exporter (as opposed to agents), taking on the risk of the onward sale of the products. Developing a long-term relationship can lead to a high level of cooperation on appropriate designs for the market, new trends, use of materials, type of finishing and quality requirements.

Importing retailers

Retailers come in many sizes: large and part of a chain, or small and independent. Especially larger retail chains often import directly from their suppliers in developing countries. Many, such as Ikea, even have their own buying offices in developing countries. Others, mainly the smaller independent stores, order in Europe from wholesalers.

There is a tendency for consolidation in European retail. Large retail brands are becoming more widespread in Europe and more ‘lifestyle-centred’, offering home decoration and textiles as well as fashion accessories and furniture.

Buying agents, buying houses and sales agents

You can encounter several types of intermediaries in your dealings with European buyers. In your own country there may be buying houses, and in Europe there are both buying and sales agents.

European buying agents represent European buyers in sourcing countries. They act as intermediaries, meaning that they do not import products themselves. Sometimes agents have a more limited role, such as checking the quality of the products in your warehouse on behalf of a specific importer or checking compliance with the codes of conduct that you have agreed on with your buyer. Buying agents can work individually or as part of purchasing companies.

Buying houses are similar to buying agents, but they are based in your country and usually offer a broader range of services, which can include raw material sourcing, design and sampling services.

European sales agents can represent you in helping to find buyers in the European market. However, you should be careful before entering into (exclusive) agreements with them, as European legislation is quite protective when it comes to the position of commercial agents.

Agents and buying houses mostly operate based on commission. They may approach you directly, or your (potential) buyer could indicate they prefer working through an intermediary. However, if possible, working directly with a buyer is preferable. This saves on commission and allows you to communicate directly with the buyer.

E-commerce

E-commerce in home decoration and home textiles (HDHT) is increasing, particularly since the COVID-19 pandemic, and can help you reach a broader range of customers. However, the rise in e-commerce actually has fairly little effect on the way you should conduct your business as an exporter. While European HDHT retailers often sell their products both in stores and online, the way you supply them stays the same. Even online-only retailers need to stock items before they can sell them to consumers. Therefore, supplying to online retail is not a separate market channel in itself.

Another way to tap into the trend of online sales is by opening your own web shop. However, this is not easy.

Selling directly to European consumers via your own website would mean:

- supplying small batches and/or individually packaged items

- being prepared to pre-stock and offer more just-in-time supply concepts

- arranging effective consumer payment systems

- competing with experienced and well-known European and producer-country wholesalers/retailers

- dealing with aftersales on a business-to-consumer (B2C) level, including returns and replacements

Because all this is rather complicated and can be costly, direct online sales to European consumers are not feasible for most exporters from developing countries.

Tips:

- To find potential buyers, search the list of exhibitors or attend the main (online) trade fairs in Europe: Ambiente - Frankfurt (February), Heimtextil - Frankfurt (January) and Maison et Objet - Paris (January especially, and September.

- Search the member lists of relevant industry associations to find potential buyers, such as EURATEX (European Apparel and Textile Confederation).

- See our tips for finding buyers on the European market.

- To help you enter the market, consider working with an agent or representative with a good reputation. You can look for commercial agents on the website of Internationally United Commercial Agents and Brokers (IUCAB).

- For more information about trading directly with smaller retailers, see our special study on alternative distribution channels.

What is the most interesting channel for you?

Wholesale importers are the main channel between exporters in developing countries and European retailers. They are interesting if you want to develop a long-term relationship and they usually have good knowledge of the European market. They can provide you with valuable information and guidance on European market preferences.

However, as the market is becoming more and more competitive, large retailers are increasingly importing for themselves instead of through European wholesale importers. The obvious advantages are cutting out the margins of the wholesaler and reducing delivery time to the market. In the lower-end market segments, the self-importing retailers might want to drive a much harder bargain with you. However, in the higher mid-end segment, which offers you the most opportunities, price is less of an issue.

Smaller, independent European retailers continue to purchase mainly from domestic wholesalers/importers. As in other European market sectors (such as food or clothing), independent HDHT retailers struggle to compete with retail chains. They need to stand out on value-added service, as well as specialised offers and authenticity. They typically prefer small order quantities per item, small total order volumes and delivery to their doorstep, with a limited likelihood of repeat orders. You need to calculate if this is cost-effective for you.

The trend of direct sourcing is expected to continue in the future and may create more opportunities for you. The pool of buyers may increase if more retailers become importers, possibly resulting in an improvement of your bargaining position. Importing retailers order for their own shops and can therefore place orders much more quickly than some of the importers/wholesalers, who may first need to show samples to their retailers before exporters receive their orders.

Tips:

- Consider targeting retailers directly, to improve your bargaining position and increase your chance to close deals faster.

- Relate your offer and terms to the targeted retailer (large/small). Ask your existing buyers how they operate if you are unsure. The better informed you are about this aspect, the better you will be able to set prices.

- For more information on the pros and cons of dealing directly with smaller retailers, read our study on alternative distribution channels.

- Offer suitable services such as fast delivery and after sales support to build a relationship based on mutual benefits.

- When you are participating in international trade fairs, especially in Europe, make sure that you have a policy for small, independent retailers coming to your booth. If you choose to sell to them, you must have appropriate terms of trading (such as low minimum order quantities, delivery to the doorstep of the retailer or pre-stocking).

3. What competition do you face on the European homewear market?

Around a fifth of European homewear imports comes from China. These Chinese exports mainly consist of mass-produced items for the lower-end segments. Instead of competing with Chinese manufacturers, your best opportunities are in the mid-end to high-end market, where you can add value.

European homewear imports are not clearly dominated by a single source country. China is the biggest supplier of homewear to the European market, accounting for 20% of imports, followed by Bangladesh with 12% and India with 11%. Germany, (7.1%), Turkey (6.5%) and Poland (5.1%) are next on the list.

However, you should be aware that in the European market, countries have different roles. A rough distinction can be made between countries that are mainly importers and countries that are mainly manufacturers. In general, Western European countries are mainly re-exporters. Most Western-European importers do not only sell their imported products in their own country, but also distribute them across Europe.

European production mainly takes place in Eastern European countries. This is mostly because of their closeness to the Western European market and their relatively low labour costs. This sometimes makes them a good alternative for sourcing from the Far East.

Mass-produced homewear is segmented in the lower ends of the market and produced in the most cost-effective country. We advise focusing on the mid-end to high-end market, where you will not face competition from these countries.

Which countries are you competing with?

China supplies the lower-end market

After being relatively stable between 2016 and 2019, Chinese homewear exports to the European market dropped by 17% to €570 million in 2020. This added up to an average annual decline of -4.1% over the period from 2016 to 2020. This means China has let some of its market share slip.

Its low-cost workforce, availability of raw materials and efficient shipping to Europe compared to other Asian countries make China the most competitive supplier. However, the cost of labour in China has also steadily increased in the last 10 years, which has affected China’s price competitiveness. In the coming years, disruptions following China’s trade war with the United States and the outbreak of COVID-19 may also negatively impact the country’s trade performance. This could benefit companies from other developing countries.

Chinese producers mainly supply the lower ends of the market with low-priced products, as product development and creativity are not their core strengths. To avoid having to compete with Chinese suppliers on costs, you should make your product offering stand out and stay away from mass-produced homewear. Focus more on sustainability, materials and the story behind your product. This allows you to enter the mid-end and high-end market, where your best opportunities are.

Bangladesh specialises in clothing production

Bangladesh, a country specialised in the manufacturing of clothes, is the second largest exporter of homewear to Europe. Its exports fluctuated slightly between 2016 and 2020, but thanks to a relatively limited decline of -5.9% in 2020, Bangladesh managed to achieve an overall average growth of 2.8% per year.

The country’s main selling points are its reasonable prices and a large skilled workforce. In addition, importers generally perceive Bangladesh as relatively accessible and customer-oriented.

However, freighting from Bangladesh can be more expensive than from other countries in the region. Because the Bay of Bengal is shallow, ships from Bangladesh to Europe have to make a detour via Colombo. The damage to Bangladesh’s reputation from previous safety issues in the textile sector also poses a challenge.

India struggles to hold on to its market share

Like China, India saw its exports of homewear to Europe fluctuate in recent years and then drop sharply in 2020, by -18%. This added up to an average annual decrease of -4.2% between 2016 and 2020. This is similar to developments in China.

India offers skilled labour and transport at relatively low costs. As one of the biggest cotton producers in the world, manufacturers have direct access to high-quality cotton at relatively low prices. In addition, the Indian government’s recent efforts to reach out to the leading nations in the world have resulted in strong bilateral trade relationships. Nevertheless, the COVID-19 pandemic has greatly affected Indian homewear exports to Europe.

Turkey keeps its performance stable

Between 2016 and 2020, Turkey’s exports of homewear to Europe were remarkably stable at around €185 million. In addition to the local production of long-fibre cotton, Turkey’s strengths are its low-cost workforce and its location close to the European market. This makes manufacturing locations in Turkey attractive, primarily based on cost. Relatively easy and affordable transport may also explain why Turkey’s homewear exports to Europe were apparently unaffected by the COVID-19 pandemic.

Poland strengthens its position as a regional supplier

Even more so than Turkey, Poland benefits from its closeness to the Western European market. This allows suppliers to offer short delivery times. At the same time, labour in Poland is relatively affordable compared to Western Europe. Suppliers have a good understanding of the European consumer and have well-established and efficient production lines. In addition, products ‘Made in Europe’ are increasingly popular.

These advantages have helped Poland to quickly increase its homewear supplies to the rest of Europe in recent years. Even in 2020, Polish exports to the European market continued to grow by an impressive 13% to €143 million. As a result of this strong performance, Poland’s share of the European homewear import market has grown from 3.5% in 2016 to 5.1% in 2020.

Cambodia lets some of its market share slip

Cambodia is a well-known industrial manufacturer for large clothing brands. In Cambodia, as in India, exports of homewear to Europe appear to have been significantly affected the COVID-19 pandemic. In 2020, Cambodia’s homewear exports to Europe decreased by-28%, falling back to their 2016 level. As a result, the country dropped two places on the list of Europe’s leading homewear suppliers, to number 10.

Tips:

- Compare your products and company to the competition. You can use ITC Trademap to find exporters per country. You can compare on market segment, price, quality and target countries.

- To stand out from your main competitors, focus on design, craftsmanship, quality and the story behind your products.

Which companies are you competing with?

The following companies are examples of the type of competition you face on the European market for homewear.

Linen Tales, Lithuania

Lithuanian manufacturer Linen Tales has a broad collection of linen products, of which sleepwear is one category. The company has worked on making the linen as soft as possible, which is especially relevant for sleepwear. They supply both the B2C and the B2B (business-to-business) market. For B2B, they offer customisation as well as off-the-shelf products.

Because Lithuania has its own linen production, there are quite a number of suppliers of linen products from this country. A strong selling point of linen is that it can be produced much more sustainably than cotton. Linen Tales also aims to be as sustainable as possible with respect to their packaging (which is biodegradable) and other aspects of production and logistics.

Oyun, United States

Oyun is a good example of a company that combines simple yet sophisticated designs with high quality materials such as alpaca wool, fine merino wool and special cotton blends. The finish and quality of the products are high, and Oyun’s positioning in the market is in line with that.

The company clearly explains its sustainable values, both environmental and social, on its website. Interestingly, the company prefers to develop high-quality, timeless products with a long life span, both design-wise and with respect to wear and tear. This is an alternative take on making sustainable products, in line with the concept ‘buy good things, own them a long time’: the opposite of fast fashion and disposable products.

Nadia Dafri, Turkey/France

Nadia Dafri is a designer label that focuses on high-quality fabrics, refined handiwork and designs that highlight the characteristics of handiwork. Their range of cotton gauze bathrobes are the latest addition to a broader collection of home textiles. The emphasis in their bathrobes is on simple, sophisticated design, and they are made of lightweight and very soft cotton. The unfinished hems are a typical element of the brand’s design.

Which products are you competing with?

Consumers are increasingly committed to a responsible lifestyle and minimising their environmental impact. Eco-friendly produced homewear is therefore an ongoing trend, competing with mainstream homewear. For example, sustainably produced homewear can be made using 100% organic cotton and natural dyes.

Homewear produced with a blend of bamboo and organic cotton is another example. These items are manufactured by combining 100% organic cotton with bamboo fibres. Bamboo fibres are extremely absorbent and have natural antibacterial qualities. When combined with organic cotton, this results in very soft homewear that is both lightweight and durable.

Products such as ‘loungewear’ and the more traditional jogging suits (daywear) have also increased in popularity during the pandemic and the subsequent lockdowns. As more people are working from home, and this trend is expected to continue after the COVID-19 pandemic is over, demand for this group of products may increase further.

Tips:

- Compare your products and company to the competition. You can use ITC Trademap to find exporters per country. You can compare on, market segment, price, quality and target countries.

- To stand out from your main competitors, focus on design, craftsmanship, quality and the story behind your products.

4. What are the prices for homewear on the European market?

Prices for homewear vary across market segments, ranging from low-end to high-end. After adding logistics costs, wholesaler and retail margins and value-added tax (VAT), European consumer prices amount to about 4 to 6.5 times your selling price.

Table 1 gives an overview of the indicative prices of homewear in the low-end, mid-end and high-end market segments. ‘Indicative’ is key here, since prices for homewear vary depending on technique, size, material, design, brand and other ways of value addition, including a strong sustainable concept.

Table 1: Indicative consumer prices for homewear in Europe

| Low-end | Mid-end | High-end / premium | |

| Bathrobes and dressing gowns | €12-35 | €35-195 | €195 and over |

| Sleepwear: shorts | €4-15 | €15-90 | €90 and over |

| Sleepwear: nightdresses | €8-20 | €20-150 | €150 and over |

Consumer prices depend on the value perception of your product in a particular segment. This is influenced by your marketing mix:

- product benefits

- promotion (brand or not, communication of product benefits)

- points of sale (reseller positioning)

- price

The European consumer price for your homewear products is set at around 4 to 6.5 times your selling (FOB) price. Besides energy, labour and transport costs, FOB prices depend heavily on the availability and cost of raw materials. For example, in recent years the price of wool has increased considerably, largely due to renewed demand from China. Occasional increases in the prices of raw materials are not directly passed on to the consumer, but do put pressure on exporters’, importers’ and retailers’ margins.

The following percentages give an indication of a price breakdown for homewear in the supply chain:

- shipping, import, handling costs: +15-20%

- wholesaler: +50-90%

- retail: +90-150%

- VAT*: +20%

*Rates of VAT in Europe range from 18% in Malta to 27% in Sweden. On average, the rate of VAT is around 20%.

For example, in Table 2 the FOB price is set at €10.00. Depending on the market segment your product is designed for, the consumer price ranges from €41.00 in the low-end market to €65.50 in the high-end market.

Table 2: Example of the price breakdown per market segment

| Low margin | Middle margin | High margin | ||

| FOB price | €10.00 | €10.00 | €10.00 | Your FOB price |

| Transport, handling charges, transport insurance, banking services (20/15/15%) | +2.00 €12.00 | +1.50 €11.50 | +1.50 €11.50 | Landed price for the wholesale importer |

| Wholesalers’ margins (50/75/90%) | +6.00 €18.00 | +8.60 €20.10 | +10.40 €21.90 | Selling price from the wholesale importer to the retailer |

| Retailers’ margins (90/110/150%) | +16.20 €34.20 | +22.20 €42.30 | +32.70 €54.60 | Selling price excluding VAT from the retailer to the end consumer |

| Selling price including VAT (20%) | +6.80 €41.00 | +8.50 €50.80 | +10.90 €65.50 | Selling price including VAT from the retailer to the end consumer |

The FOB price of €10 includes your own margins as a producer. These margins depend on your efficiency and price setting. Generally, margins in the lower segment, which deals with high volumes for low prices, are smaller than those in the mid-end and high-end segments.

Some examples of homewear prices across Europe are:

- OEKO-TEX and GOTS-certified organic cotton children’s pyjamas, noctu (United Kingdom), around €32

- men’s bamboo and cotton pyjama bottoms, Bamigo (the Netherlands), €49.99

- women’s hooded fleece jumpsuit, Jelmoli (Switzerland), around €65

- men’s cashmere knit robe, Maison Cashmere (Italy), €287

Tips:

- Study consumer prices in your target segment to determine your price and adjust your cost accordingly. The quality and price of your homewear must match what is expected in your chosen target segment.

- Calculate your prices regularly and carefully, especially when you know that prices for your raw materials regularly fluctuate. When raw material prices put pressure on your margin for a longer period, consider increasing your price or finding another suitable alternative.

- Understand your segment. Offer a correct marketing mix to meet consumer expectations. Adapt your business model to your position in the market.

This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with Remco Kemper.

Please read our market information disclaimer.

Search

Enter search terms to find market research