What is the demand for home decoration and home textiles in the European market?

The European market for home decoration and home textiles (HDHT) peaked in 2022, after bouncing back from an import dip due to international trade disruptions. However, increased prices and low consumer confidence pose a challenge. Many imports come directly from developing countries. Because European importers often re-export products, you should focus on segments rather than countries. The mid- to high-end markets are particularly promising. If you can meet the need for sustainability and add unique value, there is potential across the sector.

Contents of this page

1. What makes Europe an interesting market for home decoration and home textiles?

European HDHT imports peaked in 2022, following strong recovery from previous trade disruptions. Consumers’ renewed focus on the home and garden is expected to keep driving demand, with sustainability becoming more and more important. At the same time, relatively high prices and low consumer confidence make consumers less eager to spend. Developing countries play a key role in the market. The mid- to high-end segments offer opportunities and allow you to avoid competing with mass production from countries like China in the low-end segment.

European imports peaked in 2022

Marketing and services for the European HDHT market generally take place within Europe. However, a lot of production takes place in lower-cost (developing) countries outside of Europe.

Source: UN Comtrade

Europe’s HDHT imports grew from €156 billion in 2019 to €162 billion in 2023, at an average annual growth rate (CAGR) of 0.9%. This modest overall growth included considerable fluctuations. The COVID-19 pandemic led to a -6.2% drop in 2020, after which imports bounced back with 20% growth in 2021. This large increase was most likely due to delayed shipments from 2020. Modest growth followed in 2022, before imports returned to values comparable to pre-pandemic levels in 2023.

The worldwide HDHT import market showed the same pattern. With a stable global market share of about 39%, Europe is a key market for HDHT products.

Similarly, Europe’s direct HDHT imports from developing countries grew from €66 billion in 2019 to €67 billion in 2023, at a CAGR of 0.4%. This translated to a market share of 41% in 2023. However, the actual market share is probably much higher because a lot of intra-European trade consists of re-exported products from developing countries. This makes Europe a particularly interesting market for you.

These overall data mainly reflect home decoration imports, which generally account for 88% of total European HDHT imports. However, a closer look at home textile imports reveals a different pattern.

Source: UN Comtrade

Unlike in home decoration, most of Europe’s home textile imports come directly from developing countries – about 60% on average. This translated to €11 billion worth of home textiles out of a total value of €18 billion in 2023.

Rising prices and low consumer confidence challenge the market

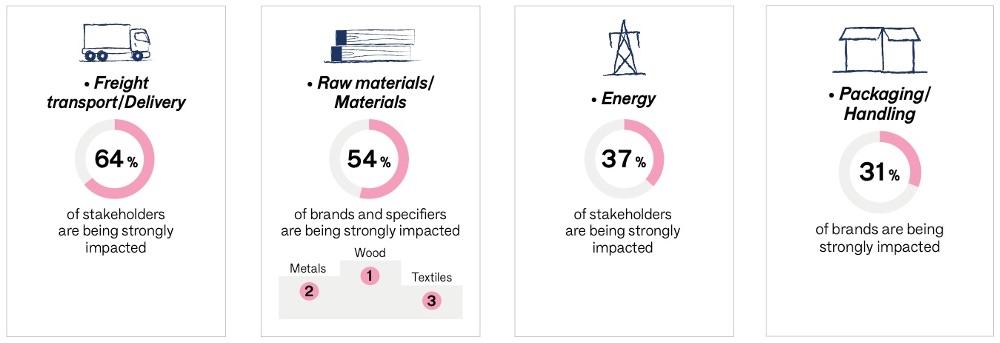

The recent fluctuations in HDHT imports had various causes. The effects of the COVID-19 pandemic and the war in Ukraine have disrupted international trade. First, the pandemic caused costs of raw materials, energy and transport to rise. In January/February 2022, key HDHT stakeholders estimated their costs to be 19% higher compared to the year prior.

Figure 3: Impact of cost increases on HDHT companies, Jan-Feb 2022

Source: Maison et Objet Barometer – Issue 3

After that, costs rose further due to the war in Ukraine. By October 2022, 42% of the HDHT companies were strongly impacted in their business by the energy crisis. These longer-term cost increases forced HDHT companies to raise their prices, also leading to higher prices that may deter consumers from purchasing. As some costs have come back down again, such as freight rates, some companies have responded by lowering their prices again too. However, consumer prices generally continue to be higher than before the pandemic.

Consumer spending and confidence are under pressure

The HDHT sector is sensitive to economic cycles. When economic circumstances and prospects are down, consumers postpone buying items that they do not urgently ’need’. When economic conditions are good, purchases of such non-essential products tend to rise.

European consumer confidence fell sharply in March 2022 due to the situation in Ukraine and the subsequent energy crisis. This reflected a large drop in households’ expectations about the general economic situation in their country, and their own future financial situation. Consumers’ intent to make major purchases also declined. An Autumn 2022 survey revealed that about half of European consumers planned to spend less on home and furniture. Although consumer confidence has improved since then, it remains below the long-term average. In line with this, in February 2024 about half of European consumers still intended to spend less on home decoration and furniture.

Source: OECD

Before the pandemic, consumer spending (‘private consumption expenditure’) in the leading European HDHT markets (Germany, France, UK, Netherlands, Italy and Spain) grew by about 1-3% per year. 2020 broke this trend, with decreases across Europe. In 2021, growth bounced back. Forecasts for 2024-2025 are modest, in line with consumer confidence. This seems to be reflected in the April 2024 Maison&Objet Barometer. For most HDHT professionals, sales were either the same (36%) or went up (25%) in the previous six months compared to the same period in the previous year. For April-September 2024, 45% of HDHT professionals expect their sales outlook to be neutral. Prospects are positive for 34% of the HDHT professionals.

The combination of high prices and low consumer confidence may lead consumers to trade down towards lower-end products, or save up for more timeless items as offered by the mid-high to premium segments. At the same time, pandemic-related lockdowns have led to an increased focus on the home and garden, and rise of trends like wellness and ‘home sweet home’. The importance of the home and garden is generally expected to stay high and drive demand for HDHT products. This may partially compensate for the pressure that the cost-of-living crisis puts on consumer spending.

Tips:

- For more insights into the effect of rising prices, check out 8 strategic options for small businesses to overcome inflation and 7 business tips for dealing with high inflation.

- See our study about the trends in the European HDHT market for an overview and an analysis of their effect on demand.

Demand for sustainable HDHT is growing

Sustainability is becoming a must in the European HDHT market. The new European Green Deal includes both environmental and social requirements. In this context, many European laws are under revision and new legislation is being developed. Some of this legislation will apply to you directly, some indirectly via your buyers. If you prepare well and can meet the requirements, this new legislation can create opportunities.

Upcoming EU sustainability legislation

Particularly relevant proposals for the HDHT industry include the:

- Corporate Sustainability Due Diligence Directive

- Forced Labour Regulation

- Green Claims Directive

- Textile Regulation revision

- Deforestation Regulation

- Ecodesign for Sustainable Products Regulation

- Packaging and Packaging Waste Regulation

Well-known sustainable initiatives (e.g. BSCI, ETI, Sedex, WFTO) and certifications (e.g. FSC, GOTS, OEKO-TEX Made in Green) can help you prove your sustainability.

In addition to these legal developments, European consumers are also increasingly adopting more sustainable lifestyles. The COVID-19 pandemic has boosted this trend. An impressive 86% of consumers in various European markets consider sustainability (very) important, and 29% deliberately and consciously buy sustainable products. At the same time, the current cost-of-living crisis drives the need for sustainable products to be affordable.

Although there are no official trade data on sustainable HDHT products, HDHT retailers have previously noticed growing interest from their customers in ethical products – including items made with natural or recycled/recyclable materials, using socially responsible modes of production. Despite the cost-of-living crisis, 55% of British adults in a 2024 survey say it is important that their HDHT products are made sustainably. Retailers have also noted increased demand for recycled products, upcycled products and second-hand/pre-owned items. Interest in these products is likewise reflected in British consumer behaviour, for example.

* in the previous 12 months

Source: Deloitte

Tips:

- Use sustainable solutions for raw materials, production, transport and distribution, consumer use, and waste disposal.

- Clearly communicate your sustainable values through your marketing materials. If your products have a unique origin and/or story, communicate the special techniques, materials, producers, processes or meanings. This may add value to your concept and that of your importer.

- For more information, check our study on sustainability in HDHT, our tips to go green and tips to become socially responsible,and our webinars on sustainability in the European HDHT market and sustainable innovations for your HDHT business.

- For more information on relevant legislation, sustainability initiatives and relevant certifications, see our study on buyer requirements.

- Prepare for the new and upcoming EU legislation. Discuss with your buyers what they need from you, for example when it comes to their due diligence obligations, and how you can help each other in the process.

China is becoming less dominant in the European HDHT market

China is Europe’s main HDHT supplier, but its dominance is declining. The country’s large-scale and highly mechanised production systems, combined with the availability of (especially man-made) raw materials make it a competitive supplier. However, rising labour costs have affected its price competitiveness, and trade disruptions impact exports. European importers are increasingly looking for suppliers in other (developing) countries. They want to diversify their collection, become less dependent on China as a single supplier, and/or order shorter runs to reduce stock risk.

* Excluding China

Source: UN Comtrade

In this context, China’s HDHT exports to Europe declined from €47 billion in 2019 to €46 billion in 2023. As a result, the country’s direct market share dropped from 30% to 28%. The other leading suppliers are all European countries, trading (and often re-exporting) within Europe. Germany is the largest, with €16 billion in 2023. Poland follows with €11 billion, Italy with €10 billion, France with €7.2 billion, and the Netherlands with €6.9 billion.

Countries’ roles in the European market

European countries have different roles in the market. Some are mainly importers and others are mainly manufacturers. Western European countries are mainly importers, and most Western European importers are re-exporters. They do not just sell their products in their own country, they distribute them across the continent.

European production mainly takes place in Eastern Europe, mostly because of relatively low transport and labour costs. This can make these countries a good alternative for European buyers to source low- to mid-end products. Western and Southern Europe also produce some high-end products from well-known premium brands with a long history.

In general, your focus should be on the mid- to high-end market. These segments offer you good opportunities if you can add value to your products, for example via design, craftsmanship, and sustainable aspects. This allows you to avoid competition from mass-producing low-cost countries at the lower ends of the market, like China.

Developing countries outside of China are performing relatively well

The interest in finding alternatives to Chinese suppliers could benefit companies from other developing countries, like you. Their combined supplies of HDHT products to Europe grew from €19 billion in 2019 to €21 billion in 2023, at a CAGR of 2.6%. This added up to a market share of 13% in 2023.

Out of these countries, the 6 leading suppliers are:

- Türkiye - €3.9 billion

- India - €3.7 billion

- Vietnam - €3.4 billion

- Pakistan - €2.6 billion

- Indonesia - €1.3 billion

- Bangladesh - €1.1 billion

Categorising these imports reveals that China almost completely focuses on home decoration (93%). The supply from other developing countries is more balanced, with 64% home decoration products and 36% home textiles. Individual countries clearly differ in their focus category.

Home decoration supplies from developing countries other than China

Source: UN Comtrade

When it comes to home decoration exports from developing countries other than China to Europe, Vietnam is leading. The country directly supplied 2.4% of Europe’s home decoration imports in 2023. India and Türkiye followed with direct market shares of 1.5% each, and Indonesia supplied a further 1%. Thailand and Serbia accounted for about 0.4% each.

Vietnam mainly specialises in home decoration (85%), rather than home textiles (15%). Like producers from China, Vietnamese suppliers are very productive and can deliver at low cost. They generally have a good idea of what is commercial and trendy, and effectively combine handmade and mechanised production. As a result, they can be an effective (second- or dual-sourcing) alternative to China. Although there are exceptions, Vietnam mainly produces for the lower-end segments with limited design value. This should generally not be your focus.

Manufacturers from India, Indonesia and Thailand tend to be more of a direct competition for you. These producers often have access to a wide range of natural materials and skilled craftsmanship. This allows them to compete in the mid- to high-end segments of the European market. These countries each have their own offering and established place in the market. For example, Indonesia is Europe’s leading supplier of rattan furniture, as the country is estimated to produce up to 80% of the world’s rattan.

Turkish suppliers provide a mix of industrial and handmade production at relatively low costs. They benefit from their location close to Europe, which allows them to offer short delivery times. Eastern European countries also offer a convenient location and relatively low labour costs. In 2022 Serbia joined the top-6 suppliers from developing countries other than China – overtaking Ukraine, which now comes 7th. Bosnia-Herzegovina is in 9th position.

Home textile supplies from developing countries other than China

Source: UN Comtrade

Pakistan, Türkiye and India are key players in the European home textiles market. Together, these countries directly accounted for nearly one third of imports in 2023. Bangladesh supplied another 4.7%, followed by Egypt and Vietnam with about 1% each.

Leading suppliers Pakistan and India are high-volume, low-pricing sourcing hubs for home textiles, with access to cheap labour. These countries are worldwide leading cotton producers, with a large spinning capacity to make textile products from this cotton. Their producers also have the wider power looms that are required to efficiently manufacture bigger-width items. Vietnam additionally specialises in high-volume, low-cost production. Like in home decoration, you should avoid competing on price: focus on the mid- to high-end segments of the home textiles market instead.

Bangladesh is a more direct competitor to you. With its reasonable prices, large skilled workforce and abundance of renewable natural materials, Bangladesh can produce home textiles for the mid- to high-end market. Egypt, on the other hand, is famous for its high-quality Egyptian cotton, making the country a strong player in high-end cotton products. As in home decoration, Turkish home textile manufacturers benefit from their convenient location and relatively low-cost labour.

South and Southeast Asia dominate the supplies of home textiles to Europe – not just from developing countries but worldwide. Cambodia, Tunisia and Sri Lanka are also fairly large home textile suppliers that are performing relatively well in the European market.

Tips:

- Compare your products and your company to your competitors. You can use the ITC Trade Map to find exporters per country to compare aspects like market segment, price, quality and target countries.

- Check our studies per HDHT product group to determine the competition for your specific products.

- Avoid competing on cost with mass-producing countries in the low-end market, unless one of your core competencies is to continuously improve the efficiency in your production chain. Instead, add value to make your products stand out.

- For more information about segments in HDHT, read our study on market channels and segments.

2. Which European markets offer the most opportunities for home decoration and home textiles?

The larger Western European economies are the main importers of HDHT products. However, importers in these countries generally re-export their products to various countries across Europe. Your best strategy is therefore to focus on a segment rather than a specific country.

Source: UN Comtrade

Europe’s leading importer of HDHT products is Germany with a 17% market share in 2023, followed by France (14%) and the United Kingdom (12%). Together, these countries account for almost half of the total European HDHT imports. Smaller markets with a share of less than 10% – but still in the top 6 importers – are the Netherlands (8.1%), Italy (7.0%) and Spain (5.7%). All these markets showed a strong recovery from 2020’s trade disruptions in 2021-2022, followed by a return to pre-pandemic import levels in 2023.

Most Western European importers, however, resell their imported products across Europe, or a specific European subregion like Scandinavia or the Benelux. This explains why in HDHT, small countries like the Netherlands often import much more than they consume.

Focus on segments

In terms of marketing, you should know that countries are not markets. The HDHT market consists of different segments, ranging from low- to high-end (check our study on market channels and segments). Every European country has these segments, although their size may vary. Therefore, it makes much more sense for you to focus on a segment in your product group and connect to importers in that segment instead of in a specific country. These importers will then sell your products in that segment across Europe.

Source: UN Comtrade

Germany: Europe’s largest importer

Europe’s leading HDHT importer is Germany. The country is the largest economy in Europe, home to nearly one fifth of the European Union’s population. Germany’s large domestic market, role as a trade hub, and relatively high HDHT imports from developing countries make it an interesting market for you.

Germany’s HDHT imports slightly decreased from €28 billion in 2019 to €27 billion in 2023, at a CAGR of ‑0.6%. Due to trade disruptions in 2020, imports decreased by ‑0.5% – which is much lower than the European average of ‑6.2%. Germany’s role as a key trade hub in Europe may have helped the country maintain a strong performance. Imports peaked at a strong €32 billion in 2022.

About half of Germany’s HDHT imports in 2023 came directly from developing countries, which is above the European average. These imports performed well, growing from €12 billion in 2019 to €13 billion in 2023 at a CAGR of 1.8%. They peaked at €17 billion in 2022. Germany’s main suppliers from developing countries are China, Türkiye, India and Vietnam, followed by Pakistan, Bangladesh and Indonesia.

In 2023, the total German HDHT import value consisted of €24 billion worth of home decoration products (88%) and €3.6 billion worth of home textiles (12%). While 47% of home decoration imports came straight from developing countries, for home textiles this share was much larger, at 70%. This matches the European pattern.

France: reliance on intra-European trade

The second-largest European importer of HDHT products is France. Its HDHT imports grew from €21 billion in 2019 to €22 billion in 2023. Imports fell by ‑8.6% in 2020 but bounced back strongly to a peak of €24 billion in 2022. This resulted in an overall CAGR of 1.5% between 2019 and 2023. However, the country relies relatively heavily on intra-European trade. This may limit opportunities for you to enter the French market.

Developing countries' direct share of France’s HDHT import market dropped from 38% in 2019 to 27% in 2023, which is far below the European average. It seems France has substituted some of its direct imports from developing countries with supplies from European trade hubs like Germany, the Netherlands and Belgium.

China, India, Vietnam, Türkiye and Pakistan are France’s leading suppliers from developing countries. Opportunities for (nearby) countries that are highly proficient in French, like Tunisia and Morocco, are relatively good, as this makes it easier for French importers to do business with them. Their HDHT exports to France grew at CAGRs of 6% and 8%, respectively, when those of other leading developing countries decreased.

French imports generally consist of around 90% home decoration products and 10% home textiles. Again, the direct market share of developing countries is much higher for home textiles (50% in 2023) than for home decoration (27%) – but both are relatively low compared to the European average. Nevertheless, because the French market is so large, these relatively small shares represent considerable import values.

Brexit: stimulates direct trade with the United Kingdom

The UK could well offer you opportunities, considering the country’s high imports from developing countries and potentially increased interest in direct sourcing. The UK’s withdrawal from the European Union (Brexit) has led to relatively low consumer confidence levels since 2016. At the same time, Brexit has resulted in British buyers importing more directly from developing countries rather than via European importers. This allows them to avoid additional fees now that they are no longer part of the EU single market.

The country’s HDHT imports dropped from €21 billion in 2019 to €19 billion in 2023, despite a peak of €23 billion in 2022. This translates to a CAGR of ‑1.9%. This was mainly due to a decline in imports from EU countries such as the Netherlands, Germany and France.

After peaking at €15 billion in 2022, imports from developing countries returned to their 2019 level of €12 billion in 2023. Developing countries’ 61% direct share of the British HDHT import market is larger than in any other leading European market. However, relatively a lot comes from China – the United Kingdom’s leading supplier with a direct market share of 44% in 2023. Other leading suppliers from developing countries are India, Vietnam, Pakistan and Türkiye, followed by Indonesia and Bangladesh.

In 2023, British imports consisted of 86% home decoration products (€17 billion) and 14% home textiles (€3.6 billion). Developing countries were the main source for both, but at 72% their direct market share of home textile imports was particularly large.

The Netherlands: important European trade hub

Despite being a relatively small country, the Netherlands is Europe’s fourth-largest HDHT importer. This is because the country is also a key trade hub, re-exporting imports across Europe and relying on the ‘Rotterdam effect’. Dutch imports grew from €12 billion in 2019 to €13 billion in 2023, at a CAGR of 1.1%. This included a peak of €15 billion in 2021-2022. Like its fellow trade hub Germany, the Netherlands kept its imports fairly stable in 2020.

Dutch imports from developing countries declined slightly from €5.3 billion in 2019 to €5.1 billion in 2023, following a peak of €6.9 billion in 2022. This translates to a direct import market share of 39%. China, India and Vietnam are the Netherlands’ main suppliers from developing countries, followed by Türkiye, Pakistan, Indonesia and Cambodia.

In 2023, Dutch HDHT imports consisted of 91% home decoration products (€12 billion) and 9.2% home textiles (€1.2 billion). Developing countries’ direct share was 38% for home decoration and 49% for home textiles. This matches the general European pattern.

Italy: imports recovered from a dip

Italy could offer you opportunities considering the strong recovery of its HDHT imports. Being particularly affected by the pandemic, Italy experienced a GDP drop of ‑8.8% in 2020. The country’s HDHT imports were hovering around €10 billion, before falling by ‑15% in 2020. However, strong performances in 2021 and 2022 led to an overall increase from €10 billion in 2019 to €11 billion in 2023. This translates to a relatively strong CAGR of 3.0%.

Italian HDHT imports from developing countries grew from €4.3 billion in 2019 to €4.5 billion in 2023, at a CAGR of 0.9%. This included a peak of €5.6 billion in 2022. For 2023, this resulted in a direct import marketshare of 39%. Italy’s leading suppliers from developing countries are China, Türkiye, Pakistan, India and Vietnam, followed by Myanmar, Bangladesh and Indonesia.

In 2023, Italian HDHT imports were made up of €10 billion worth of home decoration (89%) and €1.4 billion (11%) worth of home textiles. Developing countries’ direct share for home decoration was 36%. At 68%, the share for home textiles from developing countries was rather high.

Spain: imports have also bounced back

Spain is the sixth-largest European HDHT import market. In 2020 the Spanish economy experienced the largest drop in Europe, with a decrease in GDP of ‑11%. Spain’s HDHT imports dropped by ‑17% in 2020, but they came back strong in 2021. This led to an overall increase from €8.7 billion in 2019 to €9.2 billion in 2023, at a CAGR of 1.3%.

Imports from developing countries grew from €4.4 billion in 2019 to €4.7 billion in 2023, at a CAGR of 1.1%. This represents a direct import market share of about 51%, which is well above the European average of 41%. China, India, Pakistan and Vietnam are Spain’s main suppliers from developing countries, followed by Türkiye, Bangladesh and Indonesia.

In 2023, home decoration made up 88% (€8.1 billion) of Spanish HDHT imports, and home textiles 12% (€1.1 billion). The direct developing country share was especially large for home textiles at 71%.

Tips:

- Do not just focus on specific European countries. Particular market segments (high, middle or low) generally behave similarly across countries, whether they are mature or emerging markets. Your best approach is to identify the appropriate segment for your products and let your buyers distribute your products across Europe within this segment.

- Use European HDHT trade associations to find buyers. Key associations include EURATEX (textiles) and EFIC (furniture). National associations like HWB (Germany), the Giftware Association (UK) and VIIA (Netherlands) can also be useful.

- Visit online or attend European trade fairs to find buyers. The main European HDHT trade fairs are Ambiente, Heimtextil (home textiles) and imm cologne in Germany, and Maison&Objet in France. Other interesting events in the key markets are spoga+gafa (garden) in Germany, the Autumn Fair and Spring Fair in the UK, showUP and Design District in the Netherlands, Salone del Mobile in Italy and Intergift in Spain.

- See our tips for finding buyers for more information on how to search for and/or attract new buyers.

- See our studies per HDHT product group for more specific trade statistics for your products.

3. Which products from developing countries have the most potential on the European market?

The European HDHT market offers opportunities. Particularly promising product groups are basketry, carrying products (bags), candles, soap, bed textiles and homewear. These groups show good potential based on trade statistics and sector trends.

The HDHT sector is large and very diverse, even within the individual home decoration and home textile sub-sectors. These sub-sectors are further subdivided into categories, consisting of various product groups. Analysing these product groups can give you a broad idea of promising products for the European market. However, you should keep in mind that the true potential of a product also depends on factors like its quality, price, style and design, thus also the segment you target with it.

The European HDHT market generally offers you good opportunities, especially in the mid- to high-end segments. To appeal to consumers in these segments, your product needs to stand out. Use design, decoration, craftsmanship and the story behind your products to stand out from your competition. Using special (sustainable) materials, techniques and patterns are good ways to add value. By supporting this with an active sales strategy, you can be successful.

This chapter highlights six promising HDHT product groups to give you an idea of the potential in the European market: basketry, carrying products (bags), candles, soap, bed textiles and homewear. Of course, opportunities are not limited to these products – there is potential across the whole sector.

Basketry

A traditionally strong product group in HDHT is basketry. Like the HDHT sector in general, European basketry imports peaked in 2022. They nearly doubled between 2019 and 2022, from €571 million to €931 million, before returning to €660 million in 2023. This translates to an overall CAGR of 3.7%, which is well above the sector average of 0.9%.

Europe’s basketry imports mainly come from developing countries. In 2023, developing countries directly supplied about 76% of them. China is the leading supplier with a 36% import market share (€239 million), but this share is declining (from 46% in 2019). At the same time, the combined direct import market share for other developing countries such as Vietnam, Indonesia, Bangladesh and Madagascar grew from 36% in 2019 (€205 million) to 39% in 2023 (€260 million). This translates to a CAGR of about 6.1%.

Baskets are both decorative and functional storage items. They help consumers create both physical and, as a result, mental space. This type of ‘decluttering’ fits in well with the long-term sector trends of wellness and shared living. The pandemic boosted these trends, as restrictions forced people to spend more time together at home.

Source: UN Comtrade

Basketry also fits in well with the growing importance of sustainability[CM1] . About 80% of the basketry that Europe imports is made from natural materials – 10% bamboo, 12% rattan and 58% ‘other’ natural materials like sea grass, jute, water hyacinth and abaca. However, using natural materials does not automatically make a product sustainable. The raw materials must come from responsibly managed, renewable sources. Paints and dyes should also preferably be natural. This partly explains the declining market share of China, which uses a lot of manmade materials.

In addition, when baskets are made by hand this further contributes to the concept of sustainability. Basketry can reflect its origins in its materials, techniques and meanings, and is traditionally a key part of the fair-trade segment. Especially handmade items that feature traditional patterns, weaving techniques or unique materials. These baskets are often made by women in rural areas. Africa has a strong tradition in basketry – from Ghanaian bolga baskets to raffia baskets from Madagascar. Asia also has a tradition in basketry, as do some Latin American cultures.

Figure 12: xN Studio – fair trade basket weaving in Uganda

Source: xN Home @ YouTube

Bags

Carrying products, or bags, are a large product group with good potential. This is the largest home textiles group among Europe’s HDHT imports, both overall and for exporters in developing countries. Bags within the HDHT sector are mainly functional. They range from shopping and travel bags to office and school bags. More fashion-oriented personal accessories belong to personal accessories or fashion/apparel, rather than HDHT.

When the COVID-19 pandemic restricted travel and forced people to stay home, they did not need bags to carry their items around. This contributed to a sharp drop in imports. When restrictions were lifted, people needed bags again for activities like travelling, commuting, playing sports and shopping. Even during the current cost-of-living crisis, European consumers continue to travel. In line with this, European imports of bags bounced back. Imports grew from €22 billion in 2019 to €23 billion in 2023, at a CAGR of 0.4%.

Developing countries' direct import market share grew from 47% in 2019 to 48% in 2023. Leading supplier China accounts for about a third of Europe’s imports. Its supplies declined from €7.4 billion in 2019 to €7.2 billion in 2023, at a CAGR of ‑0.6%. At the same time, the combined direct imports from other developing countries (like Vietnam, India, Indonesia, Cambodia and Myanmar) increased from €3.2 billion in 2019 to €3.7 billion in 2023, at a CAGR of 3.3%. With that, their market share grew from 14% in 2019 to 16% in 2023.

The largest category in this product group includes textile travelling bags, rucksacks and shopping bags. Such textile items are a good alternative to disposable plastic bags, which are being used less and less, following restrictions set by the EU’s Plastic Bags Directive. Internationally, most consumers use their own shopping bags – this grew from 63% in 2019 to 67% in 2023. The rising demand for sustainability is also expected to boost long-term interest in bags from materials like jute, sea grass, mela leaf, catkin, or recycled materials. This offers opportunities for countries that are rich in these types of resources, like Bangladesh.

Sustainable alternatives to disposable plastic bags

A 2022 Euroconsumers study shows reusable plastic shopping bags (LDPE) sold at supermarket checkouts are the most environmentally friendly option – but context is key. A ‘life cycle analysis’ of different types of shopping bags considered all the resources used to make, ship, use and dispose of them.

For an LDPE bag, 1-2 uses are enough to pay for its environmental impact – depending on whether or not it contains recycled materials. Jute bags need 36-68 uses to have less impact than LDPE. Cotton bags must be used just over 100 times due to the water and energy consumed in their production. Organic cotton bags would have to be used 154 times because organic cultivation requires more land. However, the study suggests that up to 90% of the energy footprint of bags comes from shipping them from Asia to Europe.

Of course, the longer consumers keep using a bag, the more sustainable it becomes. You can facilitate this in your design: by making your bags durable and attractive, you invite consumers to keep reusing them.

Candles

Another well-performing product group is candles. The European Candle Manufacturers Association estimates that 700 million kg candles are consumed each year in the EU. Home wellness products like scented candles are popular in Europe, with 57-73% of French, German, British and Italian survey respondents in 2023 regularly buying/using them. The popularity of scented candles is reflected in a recent international survey, in which 75% of HDHT retailers also sell fragrances, scents and perfumes – including scented candles. 53% of these retailers have noticed increased demand for such products.

European imports of candles grew at a particularly strong CAGR of 6.6% – the highest rate of any HDHT product group. They increased from €1.7 billion in 2019 to €2.2 billion in 2023, including a peak of €2.5 billion in 2022. Developing countries’ direct market share grew from 22% in 2019 to 25% in 2023. Although most of these candles came from China, other developing countries also performed well – including Vietnam and India, as well as Indonesia, Tunisia, Morocco and Cambodia. Their combined market share grew from 4% (€71 million) in 2019 to 5% (€108 million) in 2023, as their supplies increased at an impressive 11% CAGR.

Candles play a key role in wellness , especially when they are scented. Scents are known to have an effect on people’s wellbeing. According to the National Candle Association, selecting candles based on their scent or fragrance can be a great way to improve mood, reduce anxiety, and even combat fatigue or loneliness. Candles also make good gifts that fit in well with the home sweet home trend, especially to create a cosy atmosphere during the darker months and the holiday season. In a 2024 survey, fragrances, wellness products and gifts were among HDHT retailers’ best-performing categories in terms of sales.

Figure 13: IKEA – Scented plant-based wax candles in glass and ceramic jars

Source: IKEA @ YouTube

Plant-based ingredients and organic wax are used more and more to offer a more sustainable alternative. For example, soy wax has become a popular option. Beeswax candles are a niche category, often offering a mix of natural ingredients and handmade production.

Soap

Soap is another popular product group in HDHT that can be both functional and decorative. Based on a recent international survey, nearly half of HDHT retailers also sell body and face care products and about a third of them have noted an ever-growing need for such products. Although European soap imports peaked in 2020, benefiting from the emphasis on hygiene due to the COVID-19 pandemic, they continue to perform well in the years after. Overall Europe’s soap imports grew from €1.9 billion in 2018 to €2.1 billion in 2023, at a CAGR of 2.5% per year.

China plays a relatively modest role in this market, with a 3.9% share in 2023. With strong competition from European manufacturers, developing countries other than China had a combined direct market share of 12% (€255 million). Of these countries, Türkiye is a particularly strong player (7.0% in 2023). Indonesia also performs well, with an impressive CAGR of 13% resulting in a direct market share of 1.1%.

A greater focus on hygiene mainly drives the demand for soap dispensers. The more luxurious ‘raw’ and chunky soap bars that belong to HDHT are linked to longer-term, deep-seated consumer needs. These bars play an important role in the wellness trend in which consumers create a spa atmosphere at home – with longer and more elaborate bathing to boost their mental and physical wellbeing.

Sustainable values are also important in body care. Consumers often associate ‘sustainable’ and ‘natural’ with ‘healthy’. Natural and ‘exotic’ ingredients, decoration, and sustainable packaging are popular. They make soap an ideal gift to pamper yourself or friends and family. Again, these products were among HDHT retailers’ best-performing categories in terms of sales in a 2024 survey.

Bed textiles

Another large product group is bed textiles – the second-largest of Europe’s home textile imports from developing countries, after bags. It consists of products like duvet covers, bedspreads and pillowcases. European overall bed textile imports peaked at €4.8 billion in 2021-2022, before returning to pre-pandemic levels of €4.1 billion in 2023.

As is common in the home textiles sub-sector, China plays a relatively modest role in this market, with an 11% import market share (€443 million in 2023). Together, developing countries other than China directly supply nearly three-quarters of Europe’s bed textile imports (€2.9 billion in 2023). Pakistan is a particularly important player, directly supplying more than one third of Europe’s bed textile imports (€1.7 billion in 2023).

Trendy sustainable materials for bed textiles are organic cotton, hemp and bamboo. Ramie and soy silk are popular for duvet covers too. Bed textiles also play a role in the wellness trend. Because a good night’s sleep is essential, comfortable bed textiles that create a relaxed atmosphere are a must. In fact, sleeping is among the most important activities for achieving a sense of wellbeing at home. Plus, 33% of people consider sleep to be important for building better mental health. As a continuing consumer trend, wellness is set to keep driving long-term demand.

Figure 14: URBANARA – ethically produced bed textiles of natural materials

Source: URBANARA GmbH @ YouTube

Homewear

Homewear has a special place in home textiles. This large product group consists of sleepwear and bathrobes, which are products you wear rather than use (decoratively) around the house. Europe’s homewear imports grew from €3.0 billion in 2019 to €3.2 billion in 2023, at a CAGR of 1.7%. They peaked at €3.9 billion in 2022.

With 22% of imports in 2023, China is Europe’s leading individual homewear supplier. However, other developing countries play a much larger role in this product group. Particularly those that specialise in textiles and clothing, like Bangladesh (17%). Their combined direct import market share represents about half of European homewear imports. These supplies grew from €1.4 billion in 2019 to €1.6 billion in 2023, at a CAGR of 2.9% – compared to a decline at a CAGR of ‑2.3% for China.

Although there is a lot of mass production in the home textiles sector from countries like India, there are opportunities for smaller-scale producers with more attention to detail. Cotton is the most common material, with about 57% of European imports. Other natural materials account for 9-10%. This includes more luxurious fabrics like silk and cashmere, or blends of these fibres. Popular sustainable[CM2] options are organic cotton and bamboo fibres.

Figure 15: CARE BY ME – bathrobe of 100% GOTS certified organic cotton

Source: CARE BY ME @ YouTube

Homewear also fits in with the wellness trend. Like cosy bed textiles, comfortable sleepwear is key to a good night’s sleep. And a luxurious, soft bathrobe adds to the relaxing spa experience that many consumers are recreating in their own home. Simple and affordable products that help consumers unwind and improve their wellbeing at home can make a big difference.

Tips:

- See our studies per HDHT product group for an analysis of the potential of your specific products. These include studies on products such as basketry, textile travel accessories, office and school bags, candles, soap, bed textiles, and homewear.

- See our study about the trends in the European HDHT market for an overview and an in-depth analysis of their effect on demand.

- For more information about the European ban on single-use plastics and other legislation, see our study about the requirements your products must comply with on the European HDHT market.

- Keep in mind that for most product groups, the potential is highest in the mid- to high-end market segments. Avoid having to compete on price at the lower ends of the market unless you specialise in low-cost/high-volume production. For more information, see our study about market channels and segments in HDHT.

Globally Cool carried out this study in partnership with GO! GoodOpportunity and Remco Kemper on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research