Which trends offer opportunities or pose threats on the European home decoration and home textiles market?

Millennials and Gen Z are quickly becoming Europe’s main consumers and professional buyers. As a result, these generations strongly influence the home decoration and home textile (HDHT) sector and strategies. For them, an important key buying motive concerns how products for the home can improve their mental and physical wellness. Sustainability is an important aspect of this. These consumers want brands to contribute to a better world through social and environmental responsibility.

Contents of this page

1. Sector transformation: millennials and Gen Z become the dominant consumer group

- In the coming decade, the European HDHT market will increasingly focus on sustainability;

- Shorter distribution chains;

- Digitisation in marketing and services.

However, the most disruptive transformation will be in consumers’ reasons for buying. In the 2030s, a new generation of consumers and professional buyers will be in charge: a mix of millennials (who will be in their forties or fifties by then) and Gen Z (who will be in their thirties). Their values will shape what products are produced and sold, and how.

The market will need to offer products that help these consumers achieve their personal goals. For the millennial and Gen Z generations a key reason for buying is how products can improve their wellness. Simply stated: they want to feel good about what they are buying. They prefer offers that improve their wellbeing and provide meaningful social/environmental benefits. These topics are closely related. For example, 6 out of 10 millennials and Gen Z feel guilty about their negative environmental impact. This makes sustainability another core buying motive.

HDHT companies must adjust

HDHT importers, retailers and brands need to move closer to these new consumers to fulfil their wellness needs.

This has various aspects:

- In-depth market intelligence – marketers need to know what drives these consumers, how they live and work, what buying behaviour determines the market segments, and the disposable income of each group.

- Sustainability – businesses must actively embrace sustainable values and practices, and be transparent to increase trust among and loyalty from customers.

- Storytelling – effective storytelling creates engagement, inspires, and builds loyalty among these consumers, who are more open to new cultures and origins and like to learn about new techniques, materials and cultures.

- Communication channels – sales and marketing must be more online (social media), using consumer reviews and influencers to build trust among peers.

- Content – communication must be brief, to-the-point, visual and transparent, since these consumers demand proof of any claims made.

- Co-creation – these consumers want to be involved in the design process, whether via feedback loops or brand champions/influencers, or simply by being able to modify products at home.

- Convenience – businesses must offer convenience in buying (online, 24/7, delivered and easily returned) and in clever solutions for shared living and tiny spaces.

- Selling and production cycles – cycles must be shorter and less dependent on traditional ideas of seasonality, with less volume but at competitive prices.

Business models are evolving

The business models that can deliver the desired wellness benefits are:

- Sustainable – value-driven concepts with social and environmental values and practices at their core;

- Connected – market intelligence, customer relationship management and active sales;

- Creative – design-led in terms of product, production, service, staff policy and marketing.

Tips:

- Become familiar with new consumer groups, for example via GWI’s reports on millennial and Gen Z consumer behaviour.

- See our study on the European demand for HDHT for relevant trade figures.

- Check CBI’s News & Stories for the latest news in the sector. To stay updated, subscribe to our newsletter.

- For inspiration, consult the exhibitor lists of the main European HDHT trade fairs like Ambiente,Maison&Objet, Heimtextil, spoga+gafa and imm cologne.

2. Sustainability: social and environmental responsibility

Sustainability is quickly becoming part of the core consumer needs in HDHT. A total of 86% of European consumers consider sustainability important or very important. Similarly, 29% of European consumers are already deliberately and consciously buying sustainable products. Rather than consuming less, people want to consume responsibly. Millennials and Gen Z are committed to creating a better world, and older generations increasingly want to contribute as well. This will reshape the industry.

Solutions are expected to first and foremost come from the industry, in improving both their environmental footprint and their social responsibility. Companies are expected to take a stand, and practise what they preach in terms of the fairness of their own human resource and supplier policies.

True sustainability is a combination of:

- People: social aspects;

- Planet: environmental aspects;

- Profit: economic aspects such as affordability, marketability and productivity.

Figure 1: CBI webinar on sustainability in the European HDHT market

Source: YouTube

The importance of both environmental and social responsibility in HDHT is reflected in the results of a recent survey of British consumers. Only 11% of the respondents said that they did not value any environmentally sustainable or ethical practices in particular for furniture and homeware.

Source: Deloitte

In 2022, 89% of the surveyed British consumers valued environmentally sustainable or ethical practices for furniture and homeware.

The European Green Deal and a circular economy

European legislation is also moving towards increased sustainability, making it a requirement rather than an option. With the adoption of the European Green Deal, the European Union (EU) strives to become climate-neutral by 2050. This will provide a legal framework for sustainability and will help make sustainable corporate behaviour a must.

Upcoming EU sustainability legislation

The European Green Deal provides a legal framework for social and environmental sustainability. The European Commission has started working on various proposals for new and updated green and social legislation. Relevant proposals for the HDHT industry include the:

- Corporate Sustainability Due Diligence Directive;

- Forced Labour Regulation;

- Green Claims Directive;

- Textile Regulation revision;

- Deforestation Regulation;

- Ecodesign for Sustainable Products Regulation;

- Packaging and Packaging Waste Regulation.

Well-known sustainable initiatives (likeBSCI, ETI, Sedex or WFTO) and certifications (such as FSC, GOTS or OEKO-TEX Made in Green) can help you prove your sustainable conduct.

A main building block of the Green Deal is the circular economy action plan. In a circular economy, waste is eliminated through repair, reuse and recycling.

Figure 3: Repair, reuse and recycle!

Source: European Parliament @ YouTube

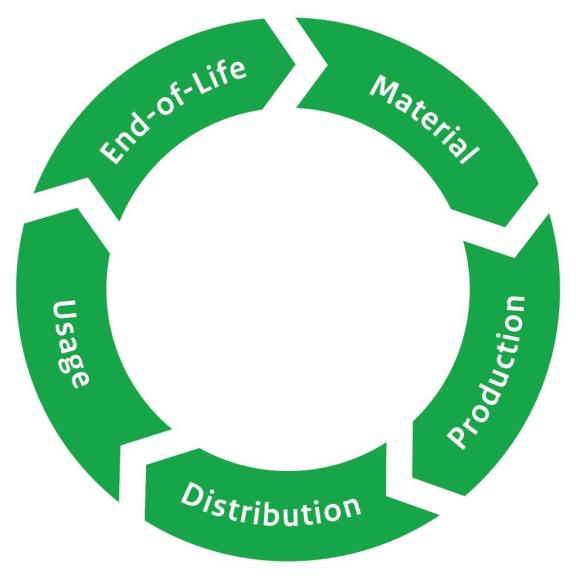

A typical product lifecycle consists of 5 stages. To move towards a circular economy, a product’s end of life starts up a new cycle. Waste no longer ends up in landfills, but is used to create a new material, starting up a new lifecycle.

Figure 4: A circular product lifecycle

Source: CBI Sustainable Design training

You can introduce new or more environmentally friendly and socially responsible practices in each stage. As a producer, you have the most control over the first 3 stages: material, production and distribution.

Table 1: Examples of sustainable practices per stage of the product lifecycle

| Environmentally friendly practices | Socially responsible practices | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

An example of a manufacturer that employs socially and environmentally responsible practices is Ashoka Exports. This Indian company offers a wide variety of jute and cotton bags, including shoppers, laptop bags, and pouches for bathroom accessories. To achieve their mission of ‘Greening Growth Globally’, they use verifiable and transparent social and environmental compliance measures – including Sedex’ social audit SMETA, GOTS (organic cotton) and GRS (recycled cotton). Ashoka also provides medical insurance to its employees and consistently invests in development projects for the community.

A related trend is material innovation, which can be divided into 3 categories:

- Recycling post-industrial or pre-/post-consumer waste;

- Engineering ‘from the lab’;

- Applying agricultural side products or excess harvests.

Figure 5: CBI webinar on sustainable innovations

Source: YouTube

Another Indian frontrunner is Malai. Malai has developed a durable and compostable vegan bio-composite material, made from organic and sustainable bacterial cellulose grown on agricultural waste from the coconut industry. The company works alongside Southern India’s coconut farmers and processing units, whose ‘waste’ coconut water would normally be released into the drainage system and cause pollution. Malai rescues this coconut water and uses it to create a flexible material that works as faux leather for bags, and home and fashion textiles.

Figure 6: Circular coconut waste-based material

Source: Malai @ YouTube

Another interesting development is that colour trends in HDHT are slowing down. The designer and trend forecasting communities are questioning the endless and fast-moving cycles of colour innovation. Many colours have the potential to last much longer than one season. This leads to longer product lifecycles, as products become less quickly unfashionable. This in turn makes products more timeless and creates less waste.

Forecast

Millennials and Gen Z try to influence things through their buying behaviour. They want to buy from companies that contribute to a better world. Although potentially higher prices for sustainable products are a barrier, the demand is there. 55% of British adults say it is important that their HDHT products are made sustainably (and up to 60% of those aged 25-34). They are willing to pay 15% more for this (up to 21% for those aged 25-34). Nevertheless, affordability is important – an international survey showed that 50% of consumers are not sure whether they would pay a premium price for sustainable products in times of inflation. Similarly, 49% of people in a wide range of markets say a lack of affordability prevents them from living healthy and sustainable lifestyles.

Figure 7: Kave Circular

Source: Kave Home @ YouTube

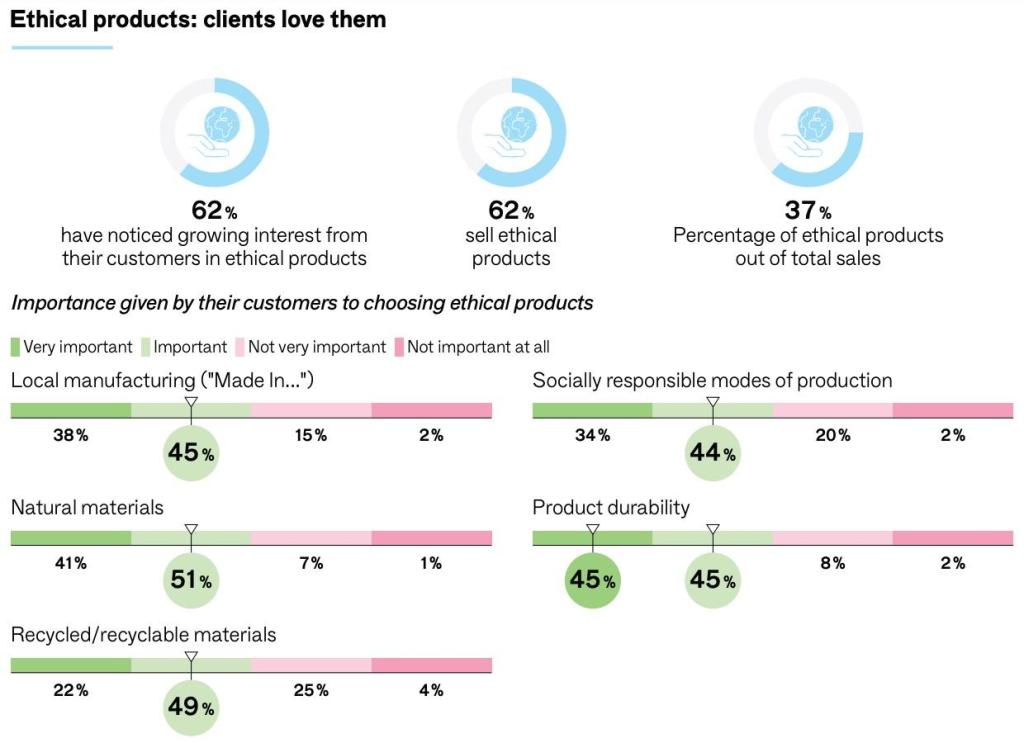

Sustainability is a central and integrated part of millennials’ and Gen Z’s wellness needs. As these generations become the dominant consumers and professional buyers, this trend is likely to continue to grow. This growing importance of sustainability in HDHT is reflected in a Maison&Objet survey from 2021.

Figure 8: Popularity of ethical products among clients of HDHT retailers

Opportunities

- Recycling/upcycling materials from local consumption/production can be an opportunity. Waste or offcut materials from the industry are often readily available and relatively cheap.

- Consumers are interested in the story of your value chain. Not just to make sure that materials are really recycled, but because consumers appreciate knowing that an item used to be part of something else.

- Use your cultural heritage to introduce new patterns and colours to buyers and consumers to make your products unique. You can mix these designs with elements of Western or global culture.

- Being well-prepared for the new (EU) legislation can give you a competitive advantage.

- Social/environmental certification can add value and credibility to your concept.

- Positive gender values can make you stand out.

Threats

- Sustainable products do not automatically lead to a higher price. The price is mainly influenced by design value, quality and finish.

- Western designers are also creating concepts based on recycling/upcycling. This means that design expectations are quite high, and that you will also be competing with European designers.

- You must be able to support any sustainable claims you make, preferably with certifications. Many buyers already require this, and the EU’s proposed Green Claims Directive sets out to make it mandatory.

- Taking a stand on political or social issues creates a following, but you can also risk losing some of your customers. Non-confrontational communication is important.

- In the long term, the trend of buying local (‘Made in Europe’) to reduce environmental impact could become a threat to you.

Tips:

- Actively promote your products’ environmental and social sustainability. Use your website, social media and trade fair participation to tell your story.

- Take advantage of low-cost waste materials for recycling/upcycling. Negotiate well with suppliers and explain the benefits of you taking their waste (preferably, for free). Set up an effective supply chain to collect and process the materials.

- Study good practices of innovators like La Termoplastic F.B.M. cookware and Kinta’s fair-trade home accessories, as well as IKEA’s handwoven rugs, which promote positive gender values.

- For more information on sustainability, see our study on sustainability in HDHT, our tips to go green and tips to become socially responsible, and our webinars on sustainability in the European HDHT market and sustainable innovations for your HDHT business. Our study on buyer requirements provides more information about legislation, sustainability initiatives and relevant certifications.

3. Wellness

The search for health and happiness has become an important focus. Many people, especially younger generations, live under stress due to peer pressure on social media and they struggle to find a home (in the city). The climate crisis is a major concern. To improve their mental and physical wellness, a key question for them is: ‘How can I buy better to feel better about myself?’.

This includes:

- Feeling more connected to others;

- Improving one’s knowledge and skills;

- Living a more active, healthier lifestyle – closer to nature;

- Becoming more creative.

Products that help achieve these personal goals will appeal to millennials and Gen Z. For them, climate change is more personal than for their parents’ generations. As such, sustainability has become a core personal wellness issue. This makes it a stronger reason for buying something for these generations than for any previous consumer group. Millennials and Gen Z want products with social/environmental benefits, so that they can feel good about their purchase.

For 73% of consumers in an international survey, wellness is an essential element of any brand's strategy. Two-thirds are more conscious of looking after their physical/mental health than they were before the COVID-19 pandemic. In fact, more than 67% of people say they make wellbeing a top priority.

The home is closely connected to mental wellness. In an IKEA survey, 40% of respondents who felt more positive about their homes also saw a positive impact on their mental health. Many associate clean, decluttered spaces with a greater sense of calmness. Sleeping and relaxing (for example by reading under a warm blanket) are the most important activities for achieving a sense of wellbeing at home. In a 2024 Maison&Objet Barometer, fragrances and wellness products were HDHT retailers’ best-performing category in terms of sales.

Figure 9: Ethically produced bed textiles of tencel and linen

Source: URBANARA @ YouTube

This focus on wellness translates into several important HDHT market trends:

- Wellness categories (such as yoga, spa, leisure and the garden) will be in demand;

- Social and environmental values are part of the primary wellness values;

- Marketing communication will highlight specific wellness benefits and take a stand in important social/environmental issues, but in a gentle tone of voice;

- Storytelling will focus on stories that allow consumers to learn about new (sustainable) materials, techniques, processes and cultures;

- Design trends will attempt to be ‘bio-centric’ (with full consideration for the planet), for example through natural dyes and finishes, and timeless designs;

- Convenience through digitisation of the shopping journey.

A good example of a company that has embraced sustainable and ethical practices is CRC. This WFTO guaranteed company from India offers a broad range of home accessories and gifts in various materials, including textiles, ceramics and paperware. They strive to ‘impact the lives of artisans in as many ways as possible’ and create self-sufficiency among artisan groups. CRC’s storytelling focuses on its impact, including saving the environment, breaking social barriers, empowering women and promoting urban employment.

Forecast

Wellness will be the main trend in the HDHT sector for the coming decade. All the developments described above will start, continue, grow stronger, and demand a more central place in the business practices of both European companies and exporters from developing countries.

Opportunities

This trend offers opportunities for products/product groups that:

- Are related to the various aspects of wellness, such as spa and yoga items (soap, hammam towels), candles, garden furniture, easy chairs, luxury bed textiles and travel accessories;

- Include natural raw materials or natural colours;

- Are related to leisure, hobbies, sports, toys and games;

- Appeal to the new ‘young old’ consumer;

- Offer attractive stories;

- Are socially and environmentally sustainable and transparent.

Threats

- Sustainability is personal and directly linked to consumers’ wellbeing, especially for younger generations. Products without clear social/environmental benefits do not help these consumers to improve their wellbeing and will be ignored.

Figure 10: CBI webinar on wellness in HDHT

Source: YouTube

Tips:

- Follow the discussions around this key trend by reading publications by the Global Wellness Institute, or research institutes like McKinsey.

- Communicate specific wellness benefits of your products.

- Collaborate to offer one-stop shopping. For example, if you offer soap you can cooperate with fellow producers to offer a coherent bathroom collection including textiles and accessories.

- Study good practices, like Madat’s fair-trade items for spa and yoga practices or Comme Avant’s handmade organic zero-waste soaps and sustainable clothing/linen.

4. New circular business models

With their commitment to sustainability, millennials and Gen Z also introduce new values like ‘sharing over possessing’. These topics are key drivers of new circular business models that extend the lifecycle of HDHT products. Although full circularity is generally not yet feasible for small and medium-sized enterprises (SMEs) in developing countries, there is much innovation in the industry. Recycling, upcycling and experimenting with alternative materials are popular options that you can participate in.

Another way to extend the lifecycle of HDHT products is through retail concepts like sharing, leasing, buy-backs and reselling. These business models minimise environmental impact by keeping products in use for as long as possible. They also provide flexibility and make products available to consumers with smaller budgets. According to a 2023 survey, second-hand furniture is a well-established market in many European countries. Strong growth is expected.

Source: YouGov

The combination of sustainability and affordability make these concepts especially popular among millennials and Gen Z. These environmentally conscious generations value sharing over owning, and generally have less disposable income than older consumers. The flexibility of these concepts also makes it easier for them to adapt to life events such as moving house (often rental) and starting a family.

An example of a company that is rolling out such new business models is IKEA. The company is aiming to make its product range 100% circular by 2030. It focuses on products that can be repaired and reused again and again, before being recycled or remanufactured. Besides offering spare parts and publishing disassembly instructions, IKEA has launched buy-back (and reselling) programmes. It has also been piloting leasing/rental concepts.

Figure 12: IKEA — Why the future of furniture is circular

Source: IKEA @ YouTube

In addition to large retail chains like IKEA experimenting with circular business models, companies are emerging that have circularity as their core business model. For example, Selency and Whoppah are popular online marketplaces where European consumers can buy used home furnishings. Yourse makes designer furniture available to a wider public through leasing, with the option to buy.

Forecast

With the growing influence of millennials and Gen Z, the popularity of circular business models is expected to rise. In a 2019 study among customers of German interior design shop Connox, the most common reason given for never having rented furniture before was simply that they had never thought of it. This supports a 2018 study commissioned by the European Commission, suggesting that increasing consumer awareness of second-hand, renting/leasing and repair markets enhances engagement in the circular economy.

As circular concepts become more and more common, consumer awareness increases. In 2023, HDHT professionals reported a growing demand for circular products:

- 80% noted a growing demand for recycled products;

- 72% for upcycled products;

- 63% for pre-owned items.

Most HDHT retailers now offer products made using recycled materials and upcycled products, and nearly half of them sell second-hand products. 64% of HDHT retailers think it will be essential to offer second-hand/pre-owned products in the future, compared to 41% in 2021.

Opportunities

- Using pre-/post-consumer and post-industrial waste can reduce material costs.

- Circular business models can open up new markets.

- Adding sustainable values to your identity allows you to stand out and broaden your appeal.

- Teaming up with distributors to create buy-back/reselling and refurbishment programmes facilitates longer-term buyer loyalty.

- Recycled and vintage materials allow you to create a luxury positioning based on a ‘limited edition’ concept.

Threats

- Recycled materials may run out. This could force you to phase out product lines even if they are popular.

- Using recycled materials may create concerns about the precise material content and the relevant legal requirements.

- ‘Big Business’ usually has more control over the product lifecycle. For SMEs or newcomers, it can be difficult to compete with them.

- Concepts like refurbishment and reselling may decrease the need for new production.

Tips:

- To facilitate a long product lifecycle, take circularity into account when designing your products. For example, designs should allow for easy replacement of parts that are prone to wear and tear, and materials should be durable (preferably recyclable). An interesting example is Occony’s circular Peak Chair, made of recyclable waste materials. All parts and materials can be separated, allowing for reuse, refurbishment and recycling.

- For inspiration and more information on how to design products suitable for new business models, see for example IKEA’s circular product design guide.

5. Changing global supply chains

In marketing, distribution channels are becoming shorter. For example through wholesalers creating business-to-consumer (B2C) e-commerce marketplaces, or manufacturers skipping wholesale and selling straight to retail. Physical distribution is concerned with the actual, logistical supply chains of materials and semi-/end-products. Here, different forces make supply chains more complex, and sometimes longer.

Global supply chains have been under pressure for quite a while. European importers have realised that political shocks can severely disrupt distribution and markets. Governments have imposed bans and tariffs, and consumers want to know where products come from and whether buying products from certain origins aligns with their values.

Importers have been trying to make their supply chains less vulnerable, through:

- Second sourcing – contracting multiple suppliers for the same (or a similar) product to spread the risk;

- Vertical integration – taking more control over their supply chain by building the capacity of their existing suppliers, or actually taking over suppliers;

- Pre-stocking – building inventory which can be sold in case of new disruptions, often asking manufacturers to keep such (unpaid for) stocks until needed;

- Reshoring – contracting European manufacturers to produce (part of) an existing collection that was previously imported from outside the EU;

- Longer lifecycles – extending product lifecycles when supply chains are fragile.

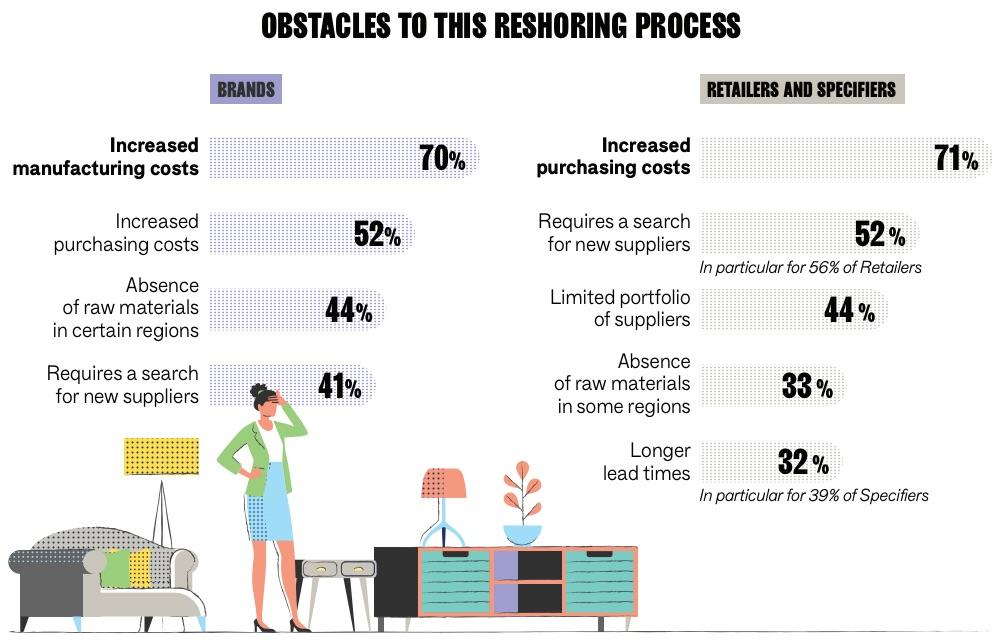

According to McKinsey, value chains shifting away from their current top producers (like in second sourcing) could present a real opportunity for some developing economies in the HDHT sector. Reshoring may be a hot topic, but it is not that easy to realise in practice. Redesigning supply chains takes time, and effects may not be visible in the short term. Also, the value for money of reshored HDHT products often disappoints. In 2022, 26% of HDHT stakeholders planned to localise part of their production or sourcing, but 22% did not – for example because their production relies on skills or materials in specific countries.

Figure 13: Obstacles to reshoring for HDHT stakeholders

Source: Maison&Objet Barometer #4

The changes in supply chains create a more secure distribution system to Western Europe. But they also make the supply chain more fragmented, less efficient and more costly. These costs will be passed on to companies and consumers. For example: if Western importers second-source end products from South-East Asia, but manufacturers there still source components from China, the supply chain will become more tangled, less transparent and, possibly, more costly.

Forecast

Governments will increase their direct involvement in trade through tariffs and other instruments, as well as by encouraging and facilitating sourcing closer to home. This is to increase security in the delivery of goods, as well as to improve sustainability in distribution chains.

Consumers will become used to longer lead times, higher prices and items not always being available. They may favour quality over quantity when buying products (timeless rather than trendy), learn to like a product longer and/or share and exchange items with others. Younger generations in particular will also ask more questions about a product’s origin and whether it aligns with their values. In 2022, 88% of HDHT professionals confirmed their clients are increasingly aware of product or raw-material origin.

Opportunities

- Importers will look for second sources – especially in East Asia – to become less dependent on single sources.

- This may also lead to a more favourable financial context for East Asian exporters, including government subsidies and improved terms for working and investment capital from banks.

- Businesses with verifiable sustainable practices have a competitive advantage.

Threats

- East Asia’s dependence on China for inputs may limit its bargaining position.

- Some production may be re-shored to European suppliers.

Chinese direct investment may replace the original ownership of East-Asian manufacturers and exporters.

Tips:

- Be a preferred partner for importers who are looking for second-sourcing opportunities. Key factors are production capacity, value for money, excellence in communication and (certified) social and environmental compliance.

- Improve your linkages to important stakeholder groups such as financial institutions, material suppliers, government bodies, and labour pools.

- Be unique: unique materials and techniques can prevent you from being replaced.

- Tell the stories of your production and artisans to add value. yers are looking for offers that will make them feel good about their purchases.

6. Home sweet home

In times of disruption, consumers highly appreciate the comfort and safety of their home, family and friends – a revival of ‘cocooning’. The ‘home sweet home’ trend involves people (across generations) enjoying each other’s company, entertaining, cooking and dining, or simply relaxing. This relates to items that create a cosy atmosphere, as well as cookware and dinnerware for ‘slow dining’. In the March 2024 Maison&Objet Barometer, kitchen and gourmet products were the 2nd best-performing category in HDHT.

This trend also contains an element of disconnecting from the troublesome outside world. For older consumers with a relatively high disposable income, the home forms a retreat – a place of luxury, with high-quality furniture and decoration, often in nostalgic styles. Popular materials include comfortable, heavy textiles, dark wood, and metal. Patterns are bold but colours are cosy and warm, including darker, rich reds and purples, sophisticated blues and browns.

Figure 14: Retro revival

Source: John Lewis @ YouTube

The way consumers decorate their home reflects their personality. In this context, both consumers and buyers appreciate good storytelling that evokes an emotional connection. The story behind your product and company can highlight key aspects like your environmentally sustainable and socially responsible values and activities. As European consumers travel to more distant places, they are discovering new stories.

When products are made by hand, from sustainable materials, this further contributes to the concept of sustainability. HDHT products can reflect their origins in their materials, techniques and meanings. They can have cultural stories to tell, especially in the fair-trade segment. These products can also tell the story of the importance of meaningful work and income in developing countries – especially for women. This has kept many interesting artisan skills alive.

Forecast

As millennials and Gen Z start new families, cocooning will become a mainstream lifestyle trend. For example, of those who started cooking and baking more at the beginning of the pandemic, 65% were still doing so a year on. Now, due to the cost-of-living crisis, 44% plan on cooking more at home. The luxury retro styles that older consumer groups prefer will fade unless they attract younger affluent consumers.

Opportunities

- If you can tap into the luxury aspect of this trend, this may offer good margins.

- The luxurious ‘home sweet home’ style is not trendy but based on supreme craftsmanship and a stable colour palette.

- Interior decorators carrying this style are found at all major European HDHT trade fairs.

- The cocooning aspect has growth potential and will move along with the preferences of younger generations.

- Cocooning is particularly promising for specialists in home textiles, home accessories, Christmas items and/or cooking and dining.

Threats

- The luxury trend is fading. Margins may be good, but volumes will be relatively small and the turnaround low.

- The cocooning trend will become mainstream and mid-market, attracting suppliers who produce high volumes at accessible prices.

Tips:

- Study the history of interior design, using luxury home magazines such as Architectural Digest and Coveted.

- Follow terms like hygge (Danish) and lagom (Swedish). These translations of the cocooning style indicate that this is an international trend, with a strong presence in Scandinavian design.

- Study good practices. For example, Versmissen’s products create ambiance for the wealthy consumer. RV Astley’s lighting is inspired by art deco.

- Check Maison&Objet and Ambiente for distributors working with this trend.

7. Shared living and tiny spaces

About 55% of the world’s population lives in urban areas and the UN expects that this will increase to 68% by 2050. In the coming years, more than a million people are projected to arrive in urban areas every week. Europe will mainly be home to small- to medium-sized cities, which are currently growing at twice the rate of megacities. This will create pressure on urban space and raise housing prices.

As a result, consumers are adjusting to tiny urban properties. They are also increasingly adopting new forms of shared living, often with multiple generations living together. Homes are adapted to or designed with shared and private spaces in mind. This creates new directions in the development and consumption of HDHT products.

In their private spaces, consumers like to display their personal style. Values related to differentiation, eclecticism, personal taste and style are important. These are mainly associated with mid-high to premium markets. Items for tiny/shared living spaces must be more flexible, convenient and multipurpose. Such values are found primarily in the mid-/lower-end market.

To improve their wellbeing, consumers in small urban spaces are creating a closeness to nature through flowers and plants. In October 2023, 74% of specifiers reported an increasing demand for green outdoor spaces and/or terraces in residential projects. Tiny balcony gardens are particularly trendy, offering clever seating and gardening solutions. Urban consumers are also increasingly working from home, and many wish to continue working remotely. This further adds to the required multifunctionality and flexibility of their living space.

Figure 15: Adjustable desk

Source: OAKO Denmark @ YouTube

Forecast

The world will be an urban place in terms of population and economic power. As urbanisation grows and hybrid working becomes the norm, urban consumers will be looking for suitable solutions.

Obra Cebuana is a Filipino manufacturer of furniture and home accessories. Their collection of expressive stools combines the styles and amazing craftsmanship of Visayan culture with the abundant natural resources of the country. The Porcupine Stool uses a rattan folding technique resembling origami. The Aloha Stool combines fibreglass with laminated rattan slats. The Pouf Stool consists of rattan strips with a colourful wash. These designs prove that tiny living does not mean furniture has to be boring.

Opportunities

This trend offers opportunities for products/product groups that:

- Can be used around the house, like occasional furniture;

- Are lightweight, collapsible, flat-pack and easily stored;

- Are multipurpose;

- Consist of items with flexible components or several style options.

Because shared living creates demand for both volume (shared spaces) and value (private spaces), there are opportunities across the market. With the forecasted megacities, domestic city marketing may offer an alternative to export.

Threats

- Products with values related to convenience and functionality are often price-sensitive. This means you can expect price pressure and high-volume requirements.

Tips:

- Create clever solutions for tiny living quarters and gardens. Offer (multifunctional/modular) products that allow folding, nesting, flat-packing, stacking, et cetera.

- For shared living, either control your costs and improve productivity for the shared decoration segment or develop high-level design for private quarters.

- For more information on market segmentation, see our study on market channels and segments in HDHT.

- Study the good practices from market players such as IKEA and Habitat. They offer collections based on functional design for large segments of the (lower-)middle markets. For the higher-end, look at distributors with identity-driven product ranges like Iittala and Le Jacquard Français.

- Use sources like home magazines, industry portals, trade fairs and our HDHT market intelligence to stay informed about urban consumers. Megatrend analyses such as 2030: the mega-trends and Megatrends for 2020-2030 describe how they influence work and living.

8. Playfulness

- Playing is essential. People play to have fun and fulfil their need for optimism, escape and invention. It stimulates social connection, reduces loneliness and isolation and provides a distraction from worries. Consumers are therefore embracing new opportunities and concepts to imagine, escape, explore, create and connect.

- Playfulness at HDHT product level has various expressions, including:

- Items that are bold in colour, shape or pattern – such as Jonathan Adler’s style;

- Functional items that are made figurative as if intended to play with – like Alessi kitchenware;

- Modular items that let consumers ‘construct their own product’ – such as HAY’s kaleido trays;

- Items that use cultural styles in a surprising way – likeKitsch Kitchen’s style;

- Items that look badly made or damaged – such as MAARTEN BAAS’s Clay chair;

- Items that use ‘dark’ or surreal humour – like those by Ibride.

Figure 16: Rearrangeable fabric vases made with traditional hat-making techniques

Source: MOBJE @ YouTube

The popularity of the garden and outdoor spaces comes with an increased interest in outdoor toys and games, with a strong focus on construction toys (such as Kapla).

Forecast

The younger generations are playful and creative, and will push this trend further. The combination of play as an essential human need and the current crises makes this an enduring trend.

Opportunities

- This trend represents an expressive style in all segments and has a deep and permanent link to European consumers’ taste palettes.

- It also encourages consumers to practise playful interaction and co-creation through flexible and customisable concepts. Creativity is deeply connected to wellness.

Threats

- Humour and light-heartedness can come across as inauthentic when they are adopted just to be trendy.

- What is considered funny is personal and/or cultural. Your humour may appeal only to specific market niches.

Tips:

- If you offer games and toys, consider expanding into playthings for outdoor areas.

- Give your own cultural patterns a (respectful) twist to create a playful effect.

- Use modularity to let consumers ‘create’ from the components.

- Imagine you are a child when designing for this trend.

- Develop collections that are both playful and sustainable. Sustainability tends to be quite serious in style (natural, spiritual), but it does not have to be.

- Study good practices of brands with a playful style.

Digital technology is becoming more important in every aspect of our lives. The pandemic has accelerated this. After the initial outbreak, digital adoption among both consumers and businesses resulted in 5 years’ worth of progress in just weeks. In 2023, 15% of EU consumers ordered furniture, home accessories and garden products online (in the months preceding the survey). This varied from up to 10% in mainly Eastern European countries to about 30% in countries such as Denmark and the Netherlands.

Consumers generally prefer to buy from brands with both an online and a physical presence, so that they can gather information and inspiration online as well as in person. Online is considered ‘better’ than offline across many criteria, including variety, reviews, price, comparison of brands and products and – perhaps surprisingly – fun. Online is inferior in only 2 aspects: the ability to try the right product and get advice from staff. This is why shoppers still visit physical shops: to try that chair or feel that cushion.

E-commerce

Selling directly to European consumers through your own website can be complicated and costly. You are responsible for factors like aftersales and consumer payment systems. For most exporters from developing countries, this is not feasible. In addition, the General Product Safety Regulation requires you to have an ‘economic operator’ in the EU who is responsible for product safety. Supplying to a European wholesaler or retailer with a strong online presence is more feasible.

Online channels can also help consumers (and professional buyers) find out where products come from and how they are made. The HDHT sector has digital solutions specifically for those looking for sustainable options. For example, consumer platform Avocadostore brings together sustainable fashion and home items. Sourcing platform Linking Maker & Market showcases SMEs from CBI programmes. Ambiente’sEthical Style Guide lists sustainable trade-fair participants.

Important European HDHT trade fairs have now become hybrid, hosting permanent online business-to-business (B2B) marketplaces. Examples are Maison&Objet’s MOM and Messe Frankfurt’s affiliated nmedia.hub. These allow for convenient B2B sourcing and one-stop-shopping. Other relevant marketplaces include Faire and Fairling.

Digital innovations

Digital innovation is moving fast. Important areas in HDHT include:

- Product visualisation – Augmented Reality (AR) and 3D technology;

- Generative Artificial Intelligence (AI) – for activities such as communication and marketing;

- Design – digital options like digital printing, 3D printing and digital sample development;

- Blockchain technology – tracking orders and transactions, monitoring supply chains, facilitating traceability, preventing counterfeiting, and creating digital product passports;

- Smart products – ranging from remote-controlled curtains and lighting, to plant-watering apps and built-in phone chargers.

Forecast

Millennials and Gen Z are already online-focused, and consumers in general are increasingly comfortable with digital technology. 68% were more comfortable with technology in 2023 than the year before, ranging from 36% of over-65s to 77% of 25-to-34-year-olds. 58% of all shopping worldwide is now online, and this is predicted to reach 64% in the coming decade. Growth is driven by working from home, as 65% of consumers report shopping online more as a result.

Digitalisation and digital technology will become more relevant for exporters from developing countries, in areas such as marketing, communication, sustainability and production. The new Ecodesign for Sustainable Products Regulation introduces digital product passports, and the Regulation on Deforestation-free Products requires geolocation data of the area of production. The home is also becoming ‘smart’, playing into the consumer’s need for convenience. IKEA is a frontrunner in this.

Opportunities

- Online marketplaces can be a cost-effective way to achieve global distribution.

- The online shopping trend is global. Exporters gaining experience with e-commerce in export markets can exploit this in their domestic markets and create effective online concepts, and vice versa.

- AI can be useful in creating marketing campaigns, especially across language barriers.

Threats

- Digitalisation generally speeds up communication and service delivery, as well as expectations concerning response time. Consumers and distributors will have less patience.

- In online shopping, price is a leading reason for buying. Price competition is expected to grow.

- There is much discussion around digitalisation and mental health, which may create a countertrend.

- AI may be able to help with basic communication, but cannot replace your authentic tone of voice and story.

Tips:

- Embrace digitalisation where you can, starting with marketing through online marketplaces.

- Increase your online visibility with an attractive website and use social media. For more information on this and digital B2B platforms, see our tips for finding buyers.

- Ensure that relevant staff is computer-literate and well-versed in social media and websites. Invest in training in these areas and in copywriting and photography skills.

- See our special study about alternative distribution channels for more information on international B2C e-commerce.

- For more information on digitalisation in HDHT in general, see our tips digital.

9. Increasing prices

HDHT product prices heavily depend on the cost and availability of raw materials, energy and transport. Recent trade disruptions have negatively affected all of these. Occasional cost increases are not usually passed on to the consumer. Instead, they put pressure on margins.

However, current disruptions have resulted in longer-term cost increases. In January-February 2022, HDHT professionals estimated their costs to be 19% higher. Since then, costs have increased even more. By October 2022, 42% were strongly impacted in their business by the energy crisis. This continuing pressure on their margins forced many HDHT businesses to raise prices, also leading to higher consumer prices. For example, Dutch consumer prices for furniture and home decoration increased by 13% between June 2021 and 2022.

At the same time, the cost-of-living crisis has made consumers hesitant to spend. European consumer confidence dropped in March 2022, including the intent to make major purchases. In an Autumn 2022 survey, about half of European consumers said they planned to spend less on the home and furniture. Although consumer confidence has improved since then, it still scores below its long-term average. In line with this, in February 2024, about half of European consumers still intended to spend less than usual on home decoration and furniture.

The combination of high prices and low consumer confidence may lead consumers to trade down towards the lower segments or save up for more timeless items, as offered by the mid-high/premium segments. Either way, the traditional mid-market will be under pressure; a process that has been ongoing for a while.

Forecast

During the pandemic, consumers re-decorated their homes. Since then, they have been focusing more on experiences like travel. In response, HDHT retailers are cautious about investing in stock. They order conservatively: similar items from familiar wholesalers to avoid risk. Also, many retailers have (had) to repay their government support. In the next couple of years, the retail landscape is expected to consolidate in favour of retail chains and towards lower price segments.

Consumer confidence has gradually recovered since the pandemic. Spending forecasts are modestly positive. The October 2023 Maison&Objet Barometer seems to reflect this, as for most HDHT professionals, sales were the same (40%) or up (28%) in the previous 4 months compared to the same period in 2022. Their sales forecasts for the next 4 months have strongly improved since October 2022: 46% were neutral (-2 pts) and 37% positive (+19 pts). Just 17% were negative (-17 pts).

Opportunities

- Lean and cost-effective exporters who can supply large volumes for the mid-/lower-end markets should focus on larger importers, catering to large networks of retailers. They have the continued buying power and trust among retailers to help them sustain their business.

- Smaller exporters can sell directly to small and individual retailers. This may require keeping stock in Europe and using fulfilment services.

- Consumers will always celebrate and give gifts. This area in HDHT is stable and relatively unaffected by economic hardship.

- Connecting or reconnecting with the domestic market may make sense, as tourism recovers and expats are usually relatively affluent.

Threats

- There is a trend among European importers to buy closer to home. This makes Eastern European countries particularly strong competitors – especially in the mid-/lower-end markets.

- European consumers are focusing on experiences such as travel, which may affect HDHT sales.

Tips:

- If you target the mid-end segment, be aware that these consumers expect added value for money. You must meet standards on characteristics like design, trendiness and sustainability.

- Connect with colleagues for joint export-marketing approaches, to offer both volume and broader collections. Joint investments in marketplaces, design innovation, and promotion could help you create one-stop-shopping concepts for larger importers, bring stock into Europe and reduce the cost of doing so.

- Consider combining shipments with other exporters to lower transport costs.

- Be authentic through special materials, high-level craftsmanship and sustainability. This makes you stand out in a market that may be price-sensitive but still values quality, beauty, storytelling and social and environmental responsibility.

- For more information about market segments and how to appeal to these consumers, see our study on market channels and segments in HDHT.

Globally Cool B.V. carried out this study in partnership with GO! GoodOpportunity and Remco Kemper on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research