Entering the European market for certified honey

European buyers are more and more interested in certified honey. Demand for certified honey is expected to grow as a result of proposed EU regulations requiring companies to back up claims about the environmental footprint of their products and services. The two most common certification schemes for honey are organic and Fairtrade, with very high potential for dual certification. As an exporter, you should certify according to market demand and buyer requirements, making sure that certification is economically viable for you and that it results in secure long-term commitments.

Contents of this page

- What requirements must certified honey comply with and which certifications does it need to obtain to be allowed on the European market?

- Through which channels can you get certified honey on the European market?

- What competition do you face on the European certified honey market?

- What are the prices of certified honey in the European market?

1. What requirements must certified honey comply with and which certifications does it need to obtain to be allowed on the European market?

If you want to export certified honey, you must comply with strict production and processing requirements, as well as pass inspections. The EU Organic Regulation and the scheme-specific standards detail the requirements you must comply with to be able to label and sell your honey as such in the market. This section highlights the main requirements specific to certified organic and fair-trade honey. For a complete overview of other requirements for both conventional and certified honey, please see to our study on buyer requirements.

EU organic certification

In Europe, the use of the terms ‘organic’, ‘bio’ and ‘eco’ is only allowed if honey is certified. This means that, in order to market honey as organic in the European Union (EU), it must comply with the EU organic regulation (Regulation (EU) 2018/848). This regulation sets the principles and requirements for organic production, the necessary related certification, and the use of indications referring to organic production. EU organic regulation applies to several products originating from agriculture, including beekeeping, and is aimed at any operator involved at any stage of production, preparation and distribution of the concerned products.

Organic beekeeping differs from conventional beekeeping in their methods and the stages in the production and processing of honey that are required to guarantee that honey has been produced organically. According to EU organic regulation, key procedures include:

- Conversion period: the transition from conventional to organic beekeeping takes 12 months, during which the wax must be changed to organic. Non-organic beeswax may be used only under the specific conditions laid down in Annex II, Part II.

- Origin of bees: per year, up to 20% of the colonies can be replaced with non-organic queens or swarms if they are placed in hives with organic combs.

- Nutrition: hives shall be left with sufficient reserves of honey and pollen at the end of the production season. Bee colonies should only be fed when the survival of the colony is endangered due to climatic conditions, with organic honey, organic pollen and organic sugar (syrups).

- Health care: bee health should be managed without the use of conventional veterinary products such as antibiotics. the use of homeopathic, herbal treatments (e.g. menthol and thymol) and natural acids (e.g. lactic and acetic acids) is permitted, as well as physical treatments for the disinfection of hives, such as steam or direct flame. If treatment with unauthorised products such as antibiotics is used, the treated colonies must be placed in isolation apiaries for the duration of the treatment, the wax must be replaced with organic wax and a conversion period must be applied.

- Animal welfare: clipping of queens’ wings is prohibited.

- Siting of apiaries: the hives must be placed in areas consisting essentially of organically produced crops or spontaneous/wild vegetation. They should also be away from potential sources of pollution such as roads and urban centres. As bees typically forage within a 2km radius of their hive, the Regulation strongly advises an organic foraging radius of at least 3km (EU Regulation) or 4 miles (UK Regulation).

- Hive construction: beehives must be made of natural materials, and only natural products such as propolis, wax and vegetable oils may be used. The beeswax for new foundations must come from organic production units.

- Honey extraction: the destruction of bees in the combs and the use of synthetic chemical repellents are prohibited during the collection of bee products.

- Internal control systems: beekeeper cooperatives should implement internal control systems comprising of a set of documented control activities and procedures to check compliance including beekeeper’s inspections.

EU organic regulation has transitioned from an ‘equivalence’ system to a ‘compliance’ system for importing organic products. This means that companies from developing countries must now adhere to and fulfil all detailed requirements of the EU organic regulation. While this regulation is already in force in the EU, controls in developing countries are just starting to be put in place. Starting from 1 January 2025, certificates confirming compliance with regulation 2018/848 will be necessary for organic imports from most developing countries into the EU and Switzerland.

This change will have a significant impact on beekeepers in developing countries wishing to export organic products to the EU from 2025 onwards. The expectation is that this will particularly affect small producer groups. All exporters need to take relevant practical measures to ensure compliance with the Regulation. You need to understand the requirements and be able to show that production and control are in compliance with equivalent strict standards. To export your honey, you also need to be inspected and certified by control authorities or bodies. Regulation (EU) 2021/2325 lists in its annexes the recognised control authorities and control bodies of developing countries and ‘equivalent’ countries, i.e. countries with which agreements exist for the import of organic products.

Once you comply with the EU organic regulation and get certified as organic by an authorised control body, you can use the EU organic production logo on the labels of your honey. Note that honey produced during the conversion period cannot be labelled or advertised as organic. The use of the logo is optional for products imported from developing countries, but it may help you market your organic honey across the EU. Don’t forget to label your batches with the name of the control body and the certification number when exporting organic honey.

Figure 1: European Union Organic Logo

Source: European Commission, 2024

Fairtrade International certification

Fairtrade International is the most widely recognised fair trade certification in Europe. There are some general standards that apply to all products under the Fairtrade umbrella and define Fairtrade requirements in terms of trade, production, business development and human rights. This means all Fairtrade honey producers must comply with the Fairtrade Standard for Small-scale Producer Organizations. Fairtrade honey traders must meet the Fairtrade Trader Standard.

In addition to these two general standards, there is a Fairtrade Standard for Honey, which sets out specific requirements for honey for both producers and traders. This standard also applies to honey by-products such as propolis and beeswax. The specific requirements for honey include:

- Fairtrade purchasers must pay the Fairtrade price and premium for the honey to the producer no later than 30 days after receipt of the transfer of ownership documents.

- First buyers must pay at least 60% of the contract value to the producer in advance at any time after signing the contract and at least six weeks before shipment.

- Fairtrade buyers’ procurement plans are for a minimum of 12 months and must be renewed at least three months before they expire.

- Buyers must take steps to help producers reduce climate-related risks.

Fairtrade also provides guidance on honey quality and price levels. Honey traded under Fairtrade terms is divided into two categories, A and B, according to its water and hydroxymethylfullfural (HMF) content. Quality defines prices. The current minimum prices and premiums for honey, whether organic-certified or conventional, can be found in the Fairtrade Minimum Price and Premium Information.

Fairtrade certificates are only issued after a physical inspection has confirmed that all relevant standards have been met. The accredited Fairtrade certifier is FLOCERT. Only after accreditation can the Fairtrade logo be placed on the product. As with organic honey, it is important that batches of Fairtrade certified honey are labelled with the name of the inspection body and the certification number.

Figure 2: Fairtrade International Logo

Source: Fairtrade International, 2024

Tips:

- Become familiar with the organic standard. It describes good beekeeping practices that can be adopted by beekeepers everywhere. Note that most European buyers do not accept the claim ‘organic by default’ and only recognise certified honey as organic.

- See this list of recognised control bodies and control authorities issued by the EU, to ensure that you always work with an accredited certifier.

- Keep records to show your compliance with EU organic regulation and make all declarations and other communications that are necessary for official controls available. You should be able to provide importers and authorities with information to allow for the identification of suppliers at any time.

- Become familiar with Fairtrade’s hazardous materials list. This list mentions agrochemicals, especially pesticides, that can be potentially hazardous in some form or other to human and animal health as well as to the environment. Fairtrade recommends avoiding the use these materials.

2. Through which channels can you get certified honey on the European market?

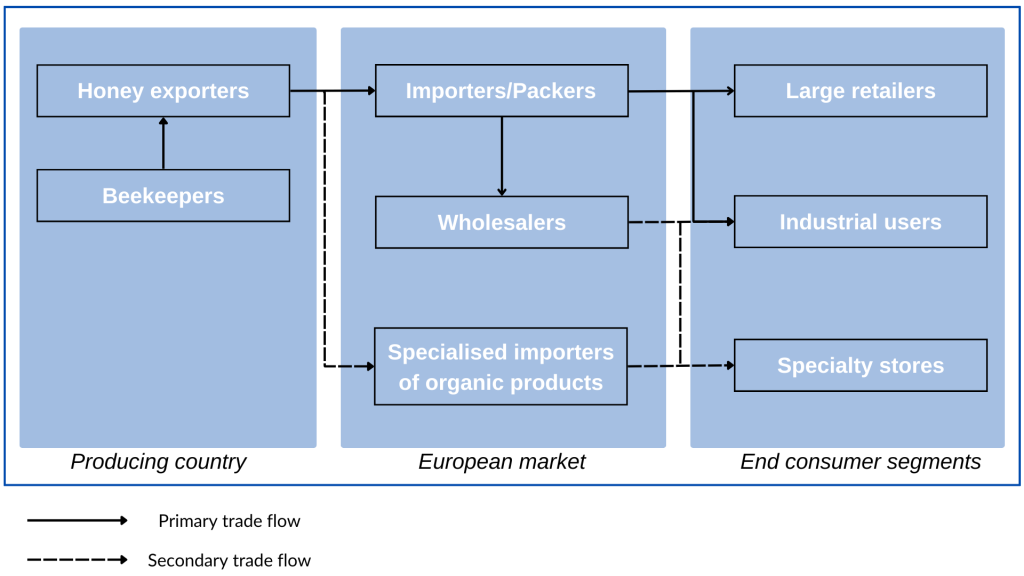

Certified honey reaches the European end market through various trade channels, mainly through importers. Within the European end market, there are different segments, depending on the quality, origin and use of the honey. This section explains how this market is segmented and gives an overview of the main trade channels, providing valuable information for exporters.

How is the end-market segmented?

The European end-market for certified honey is segmented based on quality and industry use. Understanding these segments is vital for producers and exporters aiming to enter or expand in the European market.

By quality

The low-end segment usually consists of certified polyfloral honeys of mixed origin and not of high quality. This honey is usually intended for industrial use, as an ingredient for the confectionery and bakery sectors. The generalisation of organic honey in recent years has promoted the industrial use of certified honey.

In the middle segment, certified honey is intended for the consumer market through large retail chains. It usually consists of honeys from the main common bee crops and forages (e.g. acacia). In the mid-range, there is a niche market for Fairtrade certified organic honey, which is becoming more and more important in the European market.

Finally, the high end of the market includes exclusive certified honeys, such as honey from a specific region, and high quality monofloral honeys. These are aimed at specialty shops and shops that only sell organic/certified products.

By usage

Honey is used in various ways across industries, proving its versality. The European end-market for certified honey is diverse, responding to consumer preferences and industry needs. The food and beverage industry is the largest consumer of honey in Europe, utilising it as a natural sweetener, flavour enhancer and ingredient in various products. This segment accounts for over 60% of the total honey consumption in Europe. Certification is not yet widespread in the food and beverage industry. However, given the large size of the segment, certified honey is finding increased opportunities in this segment. Honey used in this industry must comply with EU regulations on food safety and should meet the quality standards outlined in the EU Honey Directive.

The cosmetics and personal care industry is an emerging segment for certified honey, using its moisturising properties mainly in skincare and haircare products such as Lush’s fairly traded honey shampoo, Burt’s Bees honey and grapeseed hand cream, lip balms and soaps. This segment constitutes approximately 10% of the honey market. Honey used in cosmetics must adhere to the EU Cosmetics Regulation, ensuring it is free from contaminants and that it meets specific quality standards.

The pharmaceutical and nutraceutical industry is a significant consumer of high-quality, certified honey, particularly for its therapeutic and health-promoting properties. This segment represents an estimated 15% of the market. Honey used in pharmaceutical and nutraceutical products must comply with stringent quality standards, including microbiological safety, purity and bioactive component verification. Examples of honey-based products in this segment include Firsthoney’s Manuka Honey Immunity Boost Pouches, Medex’s Syrup Iron and Matys’ Organic Mucus Cough Syrup.

Through which channels does certified honey end up on the end-market?

As an exporter, you can use different channels to bring your certified honey to the European market. Market entrance varies based on honey quality and supply capacity. It is important to note that nearly all honey supplies to Europe come in the form of bulk shipments. Only a few small retailers are interested in retail-packaged honey, but they represent a very minor share of the market.

Importers

Importers/packers are central to the honey trade, sourcing honey in the countries of origin and acting as intermediaries between international producers and the European market. They import large quantities of honey in bulk and process it. Importers are also responsible for packaging and labelling the honey for distribution and sale to the retail channel or to industrial users under their own or private brands. Importers generally supply their honey directly to industrial users and retailers.

For certified honey, there are two types of importers: regular and specialised importers. Regular importers work with both bulk and certified honey and cater to different market needs. Examples of certified honey importers in Europe include Apimiel (Germany), Naturalim France Miel (France) and Ético: The Ethical Trading Company (United Kingdom). On the other hand, specialised importers focus exclusively on organic or fair-trade honey. These actors source honey from certified producers and handle all aspects of quality assurance, including traceability and certification compliance. They often sell their honey to specialty shops such as fully organic shops, although these represent a smaller part of the total retail market and are indicated as a secondary trade flow. As several premium retail chains have also launched their own premium private labels, competition in the higher segments for niche honeys has increased considerably. Examples of specialised importers in Europe include GEPA (Germany) and Altromercato (Italy).

Wholesalers

Wholesalers purchase honey in bulk from importers/packers and distribute it to various retail outlets, food service providers and industrial users. They act as intermediaries; managing large inventories and distributing honey to a wide range of customers, including supermarkets, specialty stores and the hospitality industry. They often provide logistical support, storage and transportation services. Many wholesalers also import honey directly from origin. Examples of European wholesalers include: Vehgro (The Netherlands) and Schütte Honey GmbH of the JGS Group (Germany).

Retailers

Retailers are the final link in the trade chain, selling honey directly to consumers through various outlets, including supermarkets, hypermarkets, specialty stores and online platforms. They buy honey from importers and wholesalers for resale or use in their products. They manage the sale of honey to end consumers, ensuring a diverse range of products to meet different consumer preferences, including conventional, certified, and speciality honey varieties. Retailers are also responsible for marketing, pricing and customer service.

Most honey in the European market is distributed to consumers through the retail channel, i.e. large retailers. Supermarkets and hypermarkets are the main outlets for honey. The largest retail groups in the EU are Schwarz Gruppe (Germany), ALDI (Germany), REWE (Germany), EDEKA (Germany), Tesco (UK), Sainsbury’s (UK), Carrefour (France) and Auchan (France). These supermarkets have their own private label products, which are typically sold at more competitive prices than commercial honey brands. Due to their size, these retail groups have substantial purchasing power, although they still buy through importers.

Figure 3: Main trade channels for export of certified honey to Europe

Source: ProFound, 2024

What is the most interesting channel for you?

Importers are the main trade channel for certified honey. Importers specialise in international trade and have extensive knowledge of import regulations, documentation and logistics. In addition, importers can expand distribution efforts more effectively, which can help honey exporters enter and expand into new markets. Their infrastructure and resources allow them to manage larger volumes and expand market reach more efficiently. By establishing long-lasting relationships with importers, honey exporters can navigate the complexities of international trade, optimise distribution and maximise market potential. Fairtrade-certified importers usually build long-term relationships with their suppliers. They do not easily switch between suppliers, which is positive for existing suppliers, but might reduce opportunities for new suppliers.

Tips:

- Invest in long-term relationships. Whether you are working with an importer or other actor, it is important that you establish a strategic and sustainable relationship with them. This will help you manage market risks, improve the quality of your product and reach a fair quality/price balance.

- Find buyers who match your business philosophy and export capacities (in terms of quality, volume and certifications). See our study on finding buyers on the European honey market for more tips.

3. What competition do you face on the European certified honey market?

Competition in the European certified honey market exists at both country and company levels. Countries such as Mexico, Brazil, Argentina and China stand out as major competitors due to their established track record as suppliers and their ability to produce organic and fair trade honey. This competition is reflected not only in the quantity and quality of the exported honey, but also in the strategies adopted by exporting companies to meet European standards and obtain a larger market share.

Which countries are you competing with?

The main competing countries include Mexico, Brazil, Argentina and China. These countries have historically established themselves as major suppliers of honey to Europe and have significant numbers of organic hives and organic production, as well as significant sales of fair trade honey. There is no aggregate data on trade in certified honey.

Source: ITC Trade Map, 2024

Mexico is one of the main exporters of organic and Fairtrade honey in the world

Mexico is the world’s seventh largest producer of honey. In 2022, Mexico produced 64,320 metric tonnes of honey, an increase of more than 2,000 tonnes compared to the previous year. Beekeeping has taken on an increasingly important role as a supplementary income in Mexico and Central America. This is because coffee rust disease has reduced coffee production. Today, 75% of Mexican beekeepers are low-income farmers who see beekeeping as a means of increasing their income. Mexico also stands out for its production and marketing of Fairtrade honey. In 2022, Mexico sold 335 tonnes of Fairtrade honey, making it the third largest volume in Latin America and the Caribbean. This is an increase of 15% from 290 tonnes in 2021 and represents an 11.6% share of global sales volumes of Fairtrade certified honey.

Mexico is estimated to be the fourth largest supplier of honey to the European market, with an import volume of 9,714 tonnes in 2023. Imports from Mexico represent 2.7% of total honey imports to Europe and are mainly sent to Germany (71%), the United Kingdom, Switzerland and the Netherlands. Despite remaining amongst the main suppliers of honey to Europe, European demand for honey from Mexico was weak the last two years and packers claimed to be overstocked. Between 2019 and 2023, Mexican honey supplies declined -8.4%. This situation is explained by the overall decline in honey imports to Germany, as this is the main destination for Mexican honey entering Europe.

Mexico is also one of the world’s leading exporters of organic honey. Mexico has approximately 2,322 bee producers certified under the Organic Products Law (5% of the total number of beekeepers in the country). In addition, Mexico has 448,185 organic hives, making it the country with the third largest number of organic hives in the world in 2022. This is a significant increase of 70% compared to the number of organic beehives in 2021. The annual production of organic honey is estimated at four thousand tonnes and is mainly marketed to the European Union, Japan and the United States.

Brazil is responsible for supplying most organic honey worldwide

Brazil is the world’s tenth largest honey producer. In 2022, Brazil produced 60,966 tonnes of honey, representing an increase of around 9% compared to the previous year. In total, 101,797 beekeeping establishments and 2,158,914 hives are registered in the country. Brazilian beekeepers are mainly small producers, beekeeping is still the second or possibly the third source of income, and the sector is still not very organised compared to the soybean, corn and cotton crops sectors. In addition, hive productivity has been falling year after year due to adverse weather and some producers have reported drops in productivity of their hives of up to 60%.

In Brazil, domestic consumption is one of the lowest in the world. Small and medium Brazilian rural entrepreneurs are increasingly empowered to export their products. Consequently, more than 60% of the national production is usually exported. Brazil is the 8th largest supplier of honey to the European market, with imports amounting to 3,717 tonnes in 2023. Imports from Brazil represent 1.0% of total honey imports to Europe and are directed almost entirely at Germany, and to a lesser extent Belgium and the UK.

Brazilian honey is highly appreciated abroad due to its superior quality and low presence of toxic substances. Brazilian honey has large floral sources due to botanical and geographical differences and the large size of the country. The absence of antibiotic and pesticide contamination positively sets Brazilian honey apart in the international market. Brazil is the largest supplier of organic honeys to different international markets. In fact, it is considered responsible for supplying about 90% of the world’s organic honey. With 629,939 organic hives, it ranks as the country with the second largest number of organic hives in the world in 2022. In 2022, Brazilian exports of organic honey to the EU declined significantly from 28,698 tonnes to 21,960 tonnes. This is in line with the drop in organic food sales in Europe, because of inflation and the cost of living crisis.

China remains the world’s largest producer and exporter of honey despite quality issues

China is the largest exporter of honey in the world and in Europe. In 2023, China exported 103,305 tonnes to Europe. Despite some quality problems with Chinese honey (mainly related to residues), imports from China account for 42% of total honey imports to Europe and are mainly directed at the UK, Belgium, Poland and Spain, among other markets. Chinese honey supplies to Europe increased by 8.7% in the last 5 years, mainly to compensate for the shortages caused by the war in Ukraine.

China is also the world’s largest producer of honey with 461,900 tonnes produced in 2022. This is a large country with many beekeepers and a great diversity of botanical sources capable of producing high-quality honey such as clover, linden, milkweed, alfalfa and acacia. Although its natural properties are being questioned by various national and international control bodies, the amount of honey produced still easily exceeds that of any other country.

China is also a large honey-consuming country. China’s vast territory, its large population, together with the improvement of the population’s standard of living, make the potential for domestic honey consumption enormous. The proportion of domestic consumption has historically been over 60-70% and per capita honey consumption is estimated at approximately 250 grams.

China appears to produce a significant amount of organic honey. In fact, with 229,084, it had the fifth largest number of organic hives in the world in 2022. However, China is well known as an epicentre for the development of modes of food fraud and the concept of China and fake honey is linked in the minds of people around the world. Chinese honey often does not meet the strict quality standards of markets such as the United States and Europe. It may contain harmful contaminants, such as antibiotics and heavy metals, which can pose health risks to consumers. It often includes rice syrup, corn syrup and other cheaper sweeteners. Although China is on the ‘list of developing countries’ authorised to sell honey in Europe, the EU is more cautious about buying honey from China and a growing number of European importers avoid Chinese honey because of its bad reputation.

Argentina stands out for its global sales of Fairtrade and organic honey

Argentina is the world’s third largest exporter of honey. Until a decade ago, Argentina was the main supplier of honey to Europe. However, a severe loss of bee colonies and bee fodder has seriously affected Argentina’s honey supply. Today, Argentina is the third largest supplier of honey to the European market, with imports of 20,277 tonnes in 2023. Imports from Argentina represent 5.6% of total honey imports to Europe and are mostly directed at Germany, and to a lesser extent Spain and Belgium. In the last 5 years, there has been a slight decrease – of 0.4%, but overall the supply of Argentinean honey remains stable and sufficient. Argentina was the first country in South America to achieve developing country parity to export to the EU, which has allowed Argentine honey producers to sell to the EU with direct recognition from the destination country; a major competitive advantage for Argentine producers.

Argentina is also the world’s fifth largest honey producer. In 2022, the country produced 70,437 tonnes of honey thanks to more than 15,306 beekeepers and more than 3,500,000 hives there. Climatic conditions and technological advances make it possible to obtain a quality honey with multiple identities that make it stand out on an international level. The country has a great advantage in that there is a high level of technology in beekeeping. However, the sector is facing some challenges such as the abuse of pesticides, lack of financial support and the spread of diseases. Also, the increase in the area cultivated with soybeans in Argentina is associated with a 60% drop in yield of honey per hive.

Argentina is in the early stages of organic honey production. Out of more than 3.5 million hives in the country, 31,909 hives were organic in 2022. Organic honey production is mostly located in Chaco, La Pampa, San Luis and Santiago del Estero and is largely destined for the US and EU markets. In 2020/21, total organic honey production was estimated at 328 tonnes, of which 327 tonnes were exported.

Argentina stands out most for its production and marketing of fair trade honey. In 2022, Argentina ranked as the second largest supplier of Fairtrade honey in Latin America and the Caribbean with 363 tonnes of honey sold, -5.2% less than in 2021. This also places it amongst the top Fairtrade honey supplying countries in the world, commanding a 12.6% share of global Fairtrade certified honey sales volume in 2022.

Guatemala bets on organic, fair-trade and differentiated bee products

Guatemala is considered a smaller honey exporter. However, it has gradually become an exporter of honey to the European Union, the United States and Central America. Around 75% of the honey it exports is consumed in the EU. In 2023, Guatemala exported 670 tonnes of honey to Europe, with a value of 2,016 thousand euros. Guatemala’s main export destinations were Germany, Switzerland, Austria and Italy.

Guatemala is a particularly small player in global honey production. In 2022, the country produced 6,002 tonnes of honey, an average annual growth of 3.8% since 2019. The country has 4,154 registered beekeepers and 234,906 hives. Beekeeping is generally practised as a sideline activity by small farmers and it is estimated that around 65% of production comes from the south-west of the country.

National consumption is relatively low, ranging from 30 to 56 grams per capita per year, so the sector’s main activity is the export of honey. The country has experienced a ‘boom’ in beekeeping in recent years and honey is seen as an export product. Many Guatemalan honey producers have started to offer a variety of products, such as organic honey and fair-trade honey to meet the growing demand for natural and sustainable products in the international market. In line with this, they are implementing improvements in their production processes, including the application of systems equivalent to HACCP. Also, the government is reinforcing all measures to ensure the safety of honey through a rigorous national sampling plan that allows for the detection of chemical and microbiological contaminants. This is to guarantee the production and export of Guatemalan honey to existing markets.

In 2022, Guatemala had 28,454 organic beehives dedicated to honey production, up by 3.8% compared to the previous year. The country also emerged as a significant player in the Fairtrade honey market, selling the highest volumes under Fairtrade terms in Latin America and the Caribbean. With 549 tons of Fairtrade honey sold, Guatemala accounted for 19% of the global Fairtrade honey sales volume in 2022. This important contribution underlines the country’s commitment to sustainable and ethical honey production, reinforcing its reputation in international markets.

Which companies are you competing with?

Casa Apis – Central de Cooperativas Apicolas do Semi-Arido Brasileiro

Casa Apis is a Brazilian cooperative dedicated to the production and export of honey and other bee products. Founded in 2005, Casa Apis has established itself as one of the leading beekeepers’ cooperatives in Brazil, with a strong focus on sustainability and quality. The cooperative brings together over 900 families of beekeepers, providing training and resources to improve production practices and ensure the high quality of their products. Its products are exported to various international markets, including Europe, where they are valued for their purity and quality.

The company stands out for its commitment to organic and fair-trade production, promoting care for the environment and the native forests of the Piauí region, as well as ensuring sustainability in its supply chain. To this end, it complies with strict international certifications such as USDA Organic, EU Organic, Fairtrade, True Source Honey and Non-GMO. It also complies with quality control standards such as Good Manufacturing Practices (GMP) and Hazard Analysis and Critical Control Points (HACCP). Casa Apis has recently launched an ecological reforestation project, financed partly by Fairtrade premiums.

Argenmieles

Argenmieles is an Argentinian company dedicated to honey production, processing and export. Founded in 2010, the company has a long history in the beekeeping industry and has established itself as a key player in the global honey market. It is the leader in the country’s packaging honey and exports to more than 20 destinations worldwide (most of them in bulk), including the USA, Europe and Japan.

The company has its own production and works closely with local beekeepers, implementing rigorous quality controls from harvesting to the packaging of the honey. Between its own and purchased production, it manages some 3,000 tons per year, of which 95% goes abroad. Argenmieles also stands out for its commitment to sustainability, adopting organic production practices and obtaining certifications such as USDA Organic, Orgánico Argentina and True Source Certified. At its plant in Chaco, there are 5,000 organic certified beehives surrounded by several native forests.

Bioflora

Bioflora is a Mexican company dedicated to the production and export of honey and other organic beekeeping products. The company is a cooperative society made up of over 150 small beekeepers, producers of certified organic honey. Founded with a strong commitment to sustainability and respect for the environment, Bioflora has become a benchmark in the Mexican beekeeping industry.

Bioflora stands out for its certified honey, which meets various international quality and sustainability standards. The company is certified in Fairtrade International, USDA Organic, EU Organic and FDA, as well as GMP. The company places special emphasis on the traceability and purity of its products, which has enabled it to achieve a very high level of international competitiveness. Bioflora exports directly to Europe, the United States and Japan.

Copiasuro – Cooperativa de Producción Integral Apicultores del Sur Occidente

Copiasuro is a Guatemalan cooperative dedicated to the production and export of honey and other bee products such as propolis and beeswax. Founded in 1987, Copiasuro brings together over 175 beekeepers from the southwestern region of Guatemala. They produce bee products on a small scale and in cooperation, following sustainable beekeeping practices and high standards of quality, safety and traceability.

Copiasuro produces certified EU Organic and Fairtrade honey, meeting high standards that ensure their products are environmentally friendly and socially responsible. The cooperative already has a strong environmental track record, helping members to transition to organic production and launching reforestation projects across southwest Guatemala.

The company exports an average of 300 tonnes of Fairtrade certified honey annually, of which 45 tonnes are also certified organic. Some of the importing markets for Copiasuro’s honey include Italy, Switzerland, Spain, France, the Netherlands, Germany and Costa Rica. For the cooperative’s members, Fairtrade certification has been a crucial factor in gaining access to the European market.

Tips:

- Work together with other beekeepers and exporters in your region if you lack company size or product volume. Together, you can promote good-quality certified honey from your region and be a more attractive and more competitive supplier for the European market.

- Use digital marketing strategies to reach a broader audience. This includes creating a strong online presence through social media or a professional website. Engaging content and attractive visuals can help build brand awareness.

- Analyse your main competitors in the European market. This includes studying their product range, pricing strategies, branding, marketing tactics, and more. Pay attention to what makes them successful and where they might have weaknesses.

4. What are the prices of certified honey in the European market?

Prices for certified honey in the European market can vary significantly depending on several factors, such as the type of certification, whether the honey is polifloral or monofloral, the country of origin, and the specific market conditions at the time of sale. In general, European average prices for honey are higher than the world average prices. Organic and fair-trade certified honey receives a premium over conventional honey due to the additional costs associated with certification, sustainable practices and compliance with strict quality standards.

Organic honey tends to have higher prices because consumers are willing to pay more for products that are seen as healthier and produced without synthetic chemicals. In 2022, the average retail price of organic honey in Europe ranged from 7 to 12 euros per kg, depending on the country and point of sale. Imported organic honey is priced 10-20% higher than conventional honey. Considering that in 2023 the average price of conventional honey was 2.19 EUR/kg, an import price of 2.4 to 2.6 EUR/kg is estimated for organic honey.

Fairtrade certified honey also enjoys a price premium, reflecting the ethical and social standards for which it advocates, such as fair wages and better working conditions for producers. In Europe, Fairtrade honey is usually sold to the public for 4 to 7 euros per kg. However, prices can vary depending on the floral origin of the honey, the packaging and the reputation of the brand or the cooperative that produces the honey. Regarding the import price of Fairtrade honey, Fairtrade defines minimum prices that must be paid directly to the producers.

Table 1: Fairtrade Minimum Price and Premium Price for Honey

| Type | Quality | Price level (INCOTERMS) | Unit | Currency | Minimum price | Premium |

| Conventional | A | FOB | 1 kg | EUR | 2.38 | 0.2 |

| Conventional | B | FOB | 1 kg | EUR | 2.15 | 0.2 |

| Organic | A | FOB | 1 kg | EUR | 2.76 | 0.2 |

| Organic | B | FOB | 1 kg | EUR | 2.48 | 0.2 |

Source: ProFound using data from Fairtrade International, 2024

Certified honey must pass through several stages and intermediaries from the time of export until the final consumer purchases the product, as shown in the section on distribution channels. All intermediaries add value to the product, so the prices paid for the product vary at each stage. In general, retail prices are at least three times higher than production prices. The figure below shows the estimated margins at each stage:

Figure 5: Price breakdown of certified honey

Source: ProFound, 2024

Tip:

- Provide information on the benefits of certified honey, such as its environmental impact, quality and support for fair-trade practices. This can help build consumer awareness and appreciation for the added value of your certified honey, who then support higher price points.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research