Entering the European market for acacia gum

Compliance with European regulations is essential in order to access the European market. Consistency of quality is vital for buyers. Sustainability and traceability are essential, so transparency about your supply chain is crucial. Sudan, Chad, Mali, and Senegal are the most significant European Acacia gum market suppliers. However, your biggest competition might come from European companies with vertically-integrated processing in Africa.

Contents of this page

1. What requirements and certifications must Acacia gum meet to be allowed on the European market?

You can only export Acacia gum to European Union (EU) members if you comply with the applicable EU requirements. For a complete overview of these standards, refer to our study on buyer requirements for natural food additives or consult the specific requirements for your product in Access2Markets by the European Commission.

Buyer requirements can be divided into:

- Mandatory requirements: legal requirements you must meet to enter the market;

- Additional requirements: those you need to comply with to stay relevant in the market;

- Niche requirements: apply to specific niche markets.

What are the mandatory requirements?

When exporting to Europe, you must comply with the legally-binding requirements of the EU. The most crucial requirements are related to food safety. To enter the European market, you must comply with several regulations that guarantee safety, including:

- General Food Law: This law mainly sets traceability, hygiene, and control requirements. Compliance with this legislation ensures that food additives are safe for consumption and that legal limits for food contaminants are not exceeded.

- Regulation (EC) 1333/2008 sets the rules on food additives, including definitions, conditions of use, labelling and procedures.

- Regulation (EU) 231/2012 provides E-numbers and has specifications for the use of extraction solvents in the production of approved food additives, including Acacia gum (E414). In 2017, EFSA re-evaluated the safety of Acacia gum, and the outcome in 2019 showed that it is generally safe to use as a food additive.

Official border control for Acacia gum imported into the European Union

Official food controls include regular inspections that can be carried out at point of import or at all further stages of marketing. In case of non-compliance with European food legislation, individual cases are reported through the Rapid Alert System for Food and Feeds (RASFF), which is also freely accessible to the general public.

Be aware that repeated non-compliance with European food legislation by a particular country might lead to special import conditions or even the suspension of imports from that country. Those stricter conditions include laboratory tests for a certain percentage of shipments from specified countries. The New Official Controls Regulation will extend its scope to organic products.

Contaminants control in Acacia gum. The European Commission’s Regulation sets maximum levels for specific contaminants in food products. Buyers will expect you to comply with increasingly stringent food safety requirements. Food safety issues include microbiological (bacteria, moulds), physical (plastic residues, metal, dirt), and chemical contamination. The specification sets for Acacia gum are given in the table below.

Table 1: Purity requirements for Acacia gum

| Requirements | Acacia gum / Acacia fibre/ Acacia gum E414 |

| Identification | 1g dissolves in 2ml of cold water, forming a solution which flows readily and is acid to litmus, insoluble in ethanol |

| Loss on drying | Not more than 17% (105 °C, 5 hours) for granular and not more than 10 % (105 °C, 4 hours) for spray-dried material |

| Moisture | 13-15% |

| Ash | <4% |

| Acid-insoluble ash | Not more than 0.5% |

| Acid-insoluble matter | Not more than 1% |

| Starch or dextrin | Boil a 1 in 50 solution of the gum and cool. To 5ml, add one drop of iodine solution. No bluish or reddish colours are produced. |

| Tannin | To 10ml of a 1 in-50 solution, add about 0.1ml of ferric chloride solution (9 g FeCl 3 .6H 2 O made up to 100 ml with water). No blackish colourisation or blackish precipitate is formed. |

| Arsenic | Not more than 3mg/kg |

| Lead | Not more than 2mg/kg |

| Mercury | Not more than 1mg/kg |

| Cadmium | Not more than 1 mg/kg |

| Hydrolysis products | Mannose, xylose and galacturonic acid are absent (determined by chromatography) |

| Escherichia coli | Absent in 5g |

| Salmonella spp. | Absent in 10g |

Source: Eur-lex.europa.eu, 2024

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products in Regulation 396/2005. Products containing more pesticide residues than allowed will be withdrawn from the European market. The European Union regularly publishes a list of approved pesticides authorised for use. This list is frequently updated.

Contamination with heavy metals can be an issue for Acacia gum, particularly if it comes from regions with high levels of environmental pollution. Heavy metals such as lead, cadmium, and mercury can be present in the soil and water, potentially contaminating the Acacia gum during production. Table 1 gives the requirements for the maximum level of heavy metals in Acacia gum.

Microbial contamination can be an issue for Acacia gum, especially if it is not processed or stored properly. High moisture content and inadequate storage conditions can lead to microbial growth. To reduce this risk, Acacia gum is often processed through spray drying, which helps reduce microbial contamination and improves its solubility. Proper storage conditions, such as keeping it in a dry and cool environment, are essential to maintaining its quality and safety.

Labelling

In Europe, Acacia gum is commonly labelled ‘Acacia Gum’ or ‘Gum Arabic’. These names are recognised under EU regulations for food additives and dietary fibres. Because acacia gum is also recognised as a dietary fibre in Europe, the product can be labelled ‘Acacia fibre’. Food and drink products labelled as ‘Acacia fibre’ are mainly found in France, accounting for 15% of all products that include Acacia gum; the remaining is labelled as gum Arabic.

Figure 1: Examples of products in France and the UK labelled as Acacia gum

Source: Mintel GNPD, 2024

To export your Acacia gum to the European market, you must comply with the EU’s labelling requirements outlined in the EU’s food additives and flavourings legislation. Whether or not your Acacia gum is intended for sale to the final consumer determines the labelling requirements with which you must comply. This is outlined in Chapter IV – labelling, under Articles 21, 22 and 23 of Regulation (EC) No 1333/2008. You must comply with the labelling requirements that apply to your situation, depending on whether your Acacia gum is intended for sale to the final consumer.

In addition to the EU’s mandatory labelling requirements, European buyers of Acacia gum may have additional labelling requirements, such as a specific language and measurement units. English is generally the preferred language for labelling, and European measurement units are kilogrammes.

When exporting Acacia gum to Europe, the label must include specific information to comply with European Union regulations. Acacia gum is generally considered safe for use in various applications. However, it is important to handle it properly to avoid issues like dust formation. Here are the key elements that should be on the label:

- Product Name: Clearly state “Gum Arabic” or “Acacia Gum” or “Acacia fibre”.

- Type of Gum Arabic: Specify whether it is from Acacia Senegal or Acacia Seyal.

- Net Weight: Indicate the weight of the product.

- Batch Number: Include a batch number for traceability.

- Manufacturing Date: Provide the date of manufacture.

- Country of Origin: State the country where the Acacia gum was purchased.

- Supplier Information: Include the name and address of the manufacturer or supplier.

- Handling Instructions: Any special handling or storage instructions.

- Compliance Marks: Include marks for organic or other relevant certifications if applicable.

Because Acacia gum is recognised as a fibre, consumer products may also carry nutrition claims such as “source of fibre” or "high in fibre". In Europe, these claims are “source of fibre” (3%) or “high in fibre”(6%), depending on the dosage of the Acacia gum.

Packaging requirements

For exporting crude or processed gum Acacia (gum Arabic) to Europe, the most common package sizes and materials are designed to protect the product from moisture and contamination.

Common package sizes:

- 25kg bags: This is the most common size for crude and processed gum Arabic.

- 50kg bags: Used for larger quantities, though less common than 25kg bags.

- Fibre drums: Typically used for bulk quantities, ranging from 50kg to 200kg.

Common packaging materials:

- Polyethylene-lined multi-wall paper bags are ideal for packaging Acacia gum powder and granules. They provide moisture resistance and durability during transportation.

- Laminated woven polypropylene bag: This bag is suitable for packaging kibbled Acacia gum. It provides excellent moisture protection and is resistant to tearing and punctures.

- Fibre drums with polyethylene liners: Used for larger quantities. Stable and robust, with the added advantage of being stackable.

Additional considerations:

- Sealing techniques: Heat sealing is commonly used for polyethylene-lined and laminated woven bags to provide an airtight and moisture-proof seal. Fibre drums often use lids with polyethylene gaskets for an airtight seal.

- Vacuum or nitrogen packing: Acacia gum can be vacuum-packed or nitrogen-flushed before sealing to protect against moisture and oxygen.

- Sustainability: Consider using recycled and/or recyclable packaging materials, as environmental sustainability is becoming increasingly important for European buyers. For information and guidance on how to reduce environmental impacts, read this guide on packaging.

Tips:

- Check the CBI study on which requirements must natural food additives comply with to be allowed on the European market? This provides further information about the mandatory requirements you must comply with to enter the European market.

- Comply with food safety requirements during drying, storage, processing (such as sieving, mixing, grinding or crushing), packaging and transport. This will help prevent contamination with mycotoxins and other contaminants. Consider obtaining a food safety management certification.

- Always ask your buyer for their specific size and preferred packaging material requirements. Your supplied products should be easy to handle and use in the customer's production process.

- Use the EU’s MRL database to identify the Maximum Residue Levels (MRLs) for Acacia gum and comply with them.

- Control pesticide amounts in your Acacia gum production. You can apply the Integrated Pest Management System (IPM) for this. This agricultural pest control strategy uses control practices in addition to chemical spraying. For more information about Integrated Pest Management, see the FAO website.

What additional requirements and certifications do buyers often have?

Buyers demand proof of your product’s safety and that it meets quality and sustainability requirements before they buy from you. If European companies or authorities find out that the safety of your product cannot be guaranteed, they will take the product off the market.

Documentation

European buyers of Acacia gum expect exporters to provide them with well-structured and organised product and company documentation, which helps prove that you meet their requirements, such as specific quality specifications. You must, therefore, provide buyers with documentation. Always ensure your documentation is up to date and easy to provide.

European buyers of Acacia gum usually expect exporters to provide them with Safety Data Sheets (SDS), Technical Data Sheets (TDS) and Certificates of Analysis (CoA). An SDS includes information such as the properties of the Acacia gum, the physical, health, and environmental health hazards, protective measures, and safety precautions for handling, storage, and transportation of the product. A TDS is a specification sheet for a product and summarises the technical characteristics of the product. A CoA outlines all the tests performed on a product before it is shipped to a customer.

Review these examples of a Safety Data Sheet and a Certificate of Analysis for Acacia gum. Doing so will give you a greater understanding of what documentation buyers expect.

Food safety and quality requirements for Acacia gum

European buyers can have different quality requirements depending on the type of ingredient and its use. European buyers test their products, usually per batch, to ensure they meet their quality standards and are not polluted or contaminated. European buyers will generally also analyse the composition of your gum to determine whether it is Acacia gum from Acacia Senegal or Acacia Seyal.

European buyers require Acacia gum of a consistent quality and consistency. They generally prefer Acacia gum with a light colour and a minimum odour. If the Acacia gum is light and has a minimum odour, it does not affect the appearance of the food or drinks they produce with it. European buyers often prefer to use other ingredients to change colour or smell if necessary.

For European buyers, gums must be 100% natural (i.e. not adulterated through the addition of any chemicals) and 100% pure (i.e. not mixed with any other gums that have similar characteristics). Importers regularly analyse products for adulteration.

European buyers often demand certification to demonstrate the safety and quality of the Acacia gum they buy. The world’s major food retailers are increasingly requiring certification to GFSI-recognised standards. The Global Food Safety Initiative (GFSI) recognised standards for audits and certification include FSSC 22000 and ISO 22000.

Figure 2: Examples of food safety system certification standards

Source: Standards websites, 2024

Sustainability requirements

EU legislation increasingly pressures European buyers to ensure their supply chains are transparent and traceable. Therefore, when selecting product suppliers, they demand a transparent supply chain. Buyers want guarantees that the product they buy matches the product’s specifications and can be traced back to the source.

Buyers expect their suppliers to provide them with all the necessary information. It is common practice that buyers require their suppliers to follow and sign their supplier codes of conduct. Such codes are based on, for instance, the Ethical Trading Initiative Base Code. It focuses on issues such as human rights and fair working conditions. See this supplier declaration of the Norevo code of conduct for an example.

Exporters need to have information on production and labour practices and environmental issues. Implementing an environmental management system, such as ISO 14001, will help you improve environmental performance through more efficient resource use and waste reduction.

Supplier Ethical Data Exchange (SEDEX) is another standard commonly used by European buyers. SEDEX principles assess and audit suppliers. Becoming a SEDEX-certified member can be advantageous, especially if you wish to supply larger companies.

Tips:

- See the CBI study tips on how to organise your export of natural food additives to Europe, which provides information and guidance on delivery and payment terms used in this sector.

- See the CBI study on how to prepare technical data sheets, safety data sheets and sending samples for natural food additives. This study provides information and guidance on preparing documentation and sending samples.

- Before getting certified, research your targeted market segment and talk to your buyers to determine the certifications they demand, as this can vary from buyer to buyer.

- Conduct due diligence on potential buyers to ensure they have the resources to pay for your Acacia gum.

What are the requirements for niche markets?

Consumer demand for products produced under environmentally and socially-sustainable conditions is growing in Europe. For example, regarding social sustainability, in recent years, there has been growing consumer demand for ethically-produced products. Figure 3 shows this trend in Europe based on the number of food and drink product launches with a claim related to sustainability. This trend is expected to continue.

European environmental sustainability and sustainable growth are made clear in the Circular Economy Action Plan and the European Green Deal. This ethical and sustainable demand is also applicable to Acacia gum. Acacia gum companies like Nexira and Alland & Robert collaborate with other companies to run sustainability programmes like reforestation projects.

Organic certification

According to Mintel GNPD data, which tracks all food and drink product launches in retail, the share of organic products has reached an average of 17%. There is growing consumer demand for organic products in Europe. Like the total consumer food and drink products market, organic Acacia gum is also growing. Rising awareness about organic products' health benefits and sustainability is driving this trend.

Organic certification for Acacia gum is an additional benefit for accessing the European market. It demonstrates that the product meets a certain quality standard and allows you to use this certification as a selling point when approaching prospective European buyers. Acacia gum must comply with organic EU regulations to be traded as organic. After obtaining organic certification, European buyers often request a certificate of inspection (COI); a mandatory EU requirement for any organic ingredient traded on the European market.

Source: Mintel GNPD, 2024

Figure 4: EU Organic logo

Source: European Commission, 2024

Tips:

- Consider acquiring certifications that prove your Acacia gum meets social and environmental standards. Inform prospective buyers about your certification and display it on your company’s website and in your marketing materials.

- Before you certify your product as organic, find out if there is a market for your product. Can you earn back your investment? Talk to potential buyers to see if they would be interested in organic-certified natural ingredients.

- Consult the ITC Sustainability Map for a full overview of certification schemes used in this sector.

2. Through which channels can you get Acacia gum on the European market?

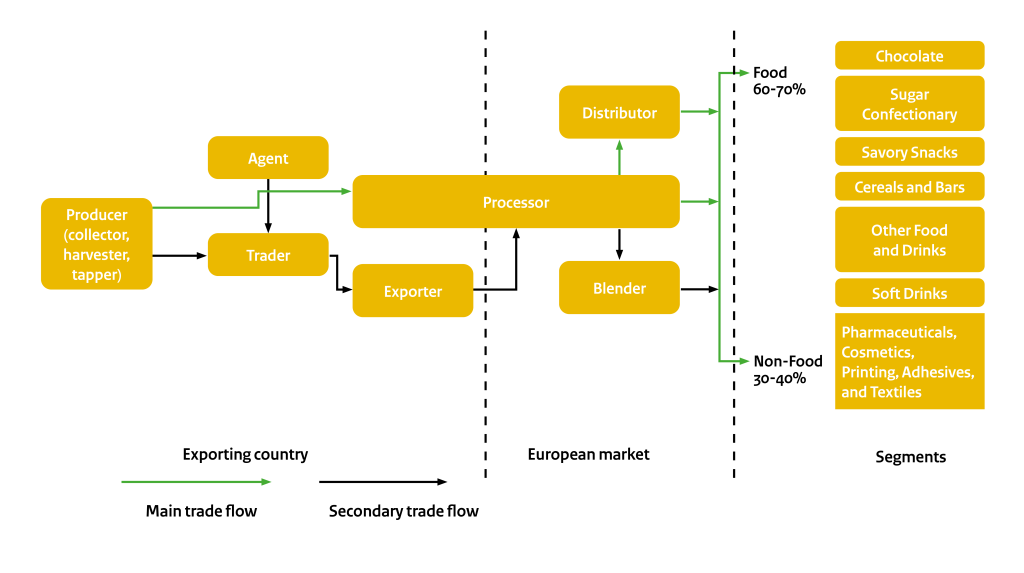

Acacia gum is mainly imported into the European market through importers and processors, who supply most of the food and beverage industry. Acacia gum is widely used in products like confectionery, snacks, and bakery items, representing 60-70% of its uses. Some food manufacturers buy directly from European processors, while others rely on distributors for specific countries.

How is the end-market segmented?

Acacia gum has a wide range of uses, with approximately 60-70% used in the food industry. In the food and drinks industry, most consumer products that include Acacia gum are found in confectionery (chocolate, sugar, and chewing gum), snacks (savoury snacks and cereal bars), and bakery products. Non-food applications include pharmaceuticals, cosmetics, printing, adhesives, and textiles.

Source: Mintel GNPD, 2024

Tip:

- Follow food and beverage sector trends to see how the market evolves. You can visit the websites of European sector associations to learn about specific industry sub-sectors.

Through which channels does a product end up on the end-market?

Food manufacturers mostly purchase their Acacia gum through importers, which often include processors and blenders. However, some companies buy directly from European-based processors with local African operations. These processors also rely on distributors to supply specific countries. Due to their significant market share, it is assumed that most food and drinks companies source Acacia gum from vertically-integrated European processors.

Figure 6: Market channels for Acacia gum

Source: Profound, 2024

Producer

Producers are the first agents in the Acacia-gum value chain. Their main functions are to collect, dry, package and deliver the product to the next processor or trader in the value chain. Their activities included cultivation, tree tapping, harvesting and drying. Some producers are members of farmer-based organisations. In general, producers are small, low-income farmers who lack resources. Production skills may vary across and within countries in Africa. Insufficient production and marketing skills are some of the causes of low productivity and output in several producing countries, including Burkina Faso, Kenya, Niger, South Sudan and Uganda. Transaction costs and the availability of market information are key for the producers to determine where and how much product they can sell.

Trader

The role of traders is to connect producers to markets and create economies of scale in developing countries. While Acacia gum producers are generally small and lacking in resources, traders collect volumes from individual producers and sell them in bulk to processors or exporters. They may also add value to the product by cleaning, sorting, grading, transporting, and storing it, which is usually done at regional or terminal market level. Local traders generally sell their products to regional traders, who sell them to processors or exporters.

Exporter

Most exporters interact directly with foreign buyers and are typically located in large cities, far from forests and plantations. However, they may have agents in villages closer to the production sites. In Sudan, exporters are typically based in Port Sudan and Khartoum; in Chad and Senegal, they are based in the capital cities. Some exporters, like Asiyla Gum in Senegal, are vertically integrated. They have their plantations and cleaning and sorting facilities.

After buying the Acacia gum from traders, exporters must refine the cleaning and grading of the product to ensure that shipments meet international standards. After this final cleaning and grading, the product is further crushed, bagged and put into containers to be sent through customs. Exporters must ensure that shipments pass the required inspections and that the required certificates are obtained from the competent government authorities.

Processor

Most high-grade processing occurs outside Africa, especially in Western Europe and North America.

The level of processing in most countries in the African gum belt is minimal, except for Sudan and Senegal, where the domestic-processing sector has become increasingly important. The increase in the number of processing facilities in Sudan has boosted competition for crude gum, translating into higher prices paid to local traders and producers.

Some industrial users may also purchase unprocessed or semi-processed Acacia gum. This is often the case among larger manufacturers with the grinding, filtration, and spray-drying equipment necessary to process their own.

Tips:

- Visit trade fairs to connect with European buyers to identify and meet potential buyers. Examples include Anuga, Fi Europe and BioFach.

- Be prepared to send high-quality samples to prospective buyers, who will test them to assess whether you are a credible supplier of Acacia gum. Requesting samples is standard procedure in the food industry. Being prepared gives you an advantage when looking to access the European market.

What is the most interesting channel for you?

As an exporter of crude Acacia gum, your most important channels are the European processors and the international food and ingredient industries with processing capacity and know-how. As an exporter of processed Acacia gum, your most important channels are importers and blenders. Contacting the food and drinks companies directly would require application and product expertise.

Most European food manufacturers purchase their Acacia gum from distributors. The distributors sell products to processors and food ingredient companies. They are often companies with a strong customer network and highly-developed application know-how.

In addition to the distributors, there are international food ingredients processors such as Kerry and Ingredion, with integrated supply chains or their local representatives. These food ingredient companies also have strong application know-how and are in direct contact with key accounts. They have major research departments that develop tailored solutions for food manufacturers, such as low-cost thickeners that retain their functional properties under specific conditions (e.g., heat and acidity). This type of R&D requires close collaboration between food manufacturers and Acacia gum processors.

Food manufacturers also purchase Acacia gum directly from manufacturers in the countries from where the product originates. Food manufacturers will have different requirements than importers and traders. For example, food manufacturers may require dietary fibre to meet a specific viscosity level or a blend with other hydrocolloids.

Tips:

- Consider working with a representative with a good reputation. You can look for commercial agents on the website of Internationally United Commercial Agents and Brokers (IUCAB), which lists all their national member organisations.

- If you aim to supply a ready-to-use Acacia gum directly to European food manufacturers, promote the functional properties and provide knowledge on its usage.

3. What competition do you face in the European Acacia gum market?

The crude Acacia gum industry is very concentrated, with the highest production and exports coming from Sudan, Chad, Nigeria, Mali, and Senegal, amongst other smaller African countries. The Acacia gum processing industry is also very concentrated and is mainly situated in Sudan and through vertically-integrated European and US companies. These companies, like Nexira, Alland & Robert, Gumco, and Kerry, have processing operations in France, Germany, the UK, and Italy.

Which countries are you competing with?

In 2023, the total global imports of Acacia gum amounted to 186,683 tonnes. Globally, France and India account for some 50% of Acacia gum imports. The US is another big destination market. 52% of the global volume, 98,768 tonnes, was imported by European countries. The import and export statistics include crude and processed Acacia gum, which makes estimating total European consumption more challenging. Figure 7 shows the leading countries that supply Acacia gum to Europe. The main producers and exporters of crude Acacia gum are Sudan, Chad, Nigeria, Mali, Cameroon, Senegal and Kenya.

Source: ITC Trademap, 2024

Since 2022, Cameroon has emerged as a new European exporter, exclusively supplying Germany. Similarly, Nigeria’s Acacia gum exports are limited to the German market. In Germany, there are some processing companies like Willy Renecke, Novero, and Roeper who source the crude product directly from what is called the ‘gum belt’. While Nigeria and Cameroon export exclusively to Germany, this analysis focuses on Sudan, Chad, Mali and Senegal, as these countries export to multiple European markets.

There are important differences between producing countries. Sudan has historically played a leading role in the Acacia gum industry. Chad has made significant progress in recent decades in terms of both the quantities produced and the quality. Due to various political challenges, Nigeria has been hindered by inconsistent quality, poor market organisation and production disruptions. Exports have made a comeback in Cameroon, Mali and Senegal after decades of decline and stagnation. In many other countries in the African gum belt, domestic gum resources remain underexploited, such as in parts of Ethiopia, Kenya and South Sudan.

Sudan

Sudan has historically played a leading role in the Acacia gum industry. Until 2009, a monopoly existed in Sudan. The Sudan Gum Arabic Company, partly state-owned, was the only entity allowed to export Acacia gum.

Sudan is the world’s largest Acacia gum-producing country, believed to account for some 70% of global production. Sudan's global exports were 77,300 tonnes in 2023, of which 42%, or 32,700 tonnes, were destined for Europe. French operators Nexira and Alland & Robert buy over half of Sudan's Acacia gum production, which is further processed and exported to other European and intercontinental countries.

Chad

Chad is the world’s second-largest producer of Acacia gum. The country produced over 42,000 tonnes of Acacia gum in 2022, a significant increase from 2021. Chad now produces around 16,000 to 20,000 tonnes a year of Talha (Acacia Seyal) and around 5,000 to 7,000 tonnes of Kitir (Acacia Senegal), exploiting only 50% of the national Acacia gum resources. Unlike the other producing countries, the market in Chad is solely driven by the private sector, free from any government intervention. Harvesting Acacia gum is essential in Chad, accounting for 40% of family farm incomes in the dry season.

In 2023, Chad exported almost 25,500 tonnes of Acacia gum, of which 10,600 to Europe. France (9,164 tonnes) was the main destination market, while smaller volumes exported to the UK and Germany. In the case of Chad, Acacia gum is exported through the airport of N’Djamena, or the port of Douala in Cameroon. While Chad benefits from rising prices due to disruptions in Sudan, it faces challenges in increasing its production capacity. Improving infrastructure and quality standards is essential to meet global demand and capitalise on market opportunities. After oil and cotton, Acacia gum is Chad’s third most important export product. For more than 500,000 Chadian households, harvesting Acacia sap is a crucial source of income.

Companies like Nexira are involved in sustainable programmes in Chad, aiming to reduce desertification and empower local communities through Acacia gum production. The SOS SAHEL and Nexira Partnership have launched the Acacia Project in Chad, focusing on sustainable harvesting and empowering local communities, particularly women (most Acacia gum harvesters are women).

Mali

With over 10,000 plantation hectares, Acacia gum is produced in six of the country's eight regions. The Kayes region is the most significant gum-producing area, dominated by Acacia Senegal. In other zones, the Acacia Seyal and Combretum species are more prevalent.

In 2023, Mali exported about 21,000 tonnes of Acacia gum, of which Europe imported 3,700. Major players in the global gum Arabic market, companies like Nexira and Agrigum International, often source their products from Mali and other African countries. These companies play a crucial role in the supply chain, ensuring that high-quality gum Arabic from Mali reaches European markets.

The Interprofession of the Actors of the Gum Sector (IF-Gomme Mali) is a private organisation established in 2017 under the OHADA Act. It aims to promote and organise the Acacia gum sector in Mali. The organisation brings various stakeholders together in cooperative societies, including nurserymen, producers, collectors, processors, traders, and exporters. IF-Gomme Mali focuses on improving Acacia gum's production, collection, processing, and export. The sector is significant in Mali, with over 370,500 people involved, 80% of whom are women. The organisation also works on quality control and organic certification to meet international standards.

Senegal

Senegal is the fourth-biggest exporter of Acacia gum to Europe. In 2023, Senegal exported 3,200 tonnes of Acacia gum in total, 400 tonnes of which to Europe. France, where the two biggest processors, Nexira and Alland & Robert are located, was the biggest destination.

Tips:

- Position yourself against competing countries by highlighting your country’s strengths to European buyers.

- Find out if your country has programmes that help exporters improve their harvest, cultivation, processing and export. You can do this by contacting local chambers of commerce or government ministries of trade.

Which companies are you competing with?

Competition in the Acacia gum sector primarily comes from European processing companies. This section also gives examples of potential competitors in Sudan, Chad, Mali, and Senegal.

Europe

Approximately 70% of the global trade in raw gum is controlled by four major processors, primarily based in Europe and the USA. These companies buy raw gum for further processing and resale as an additive for various industries. This means these companies are your main competitors, and they are based in Europe. These companies are: Nexira (France), Alland & Robert (France), as well as Gumco (UK) and Kerry (with its processing and blending facilities in the UK and Ireland respectively).

In addition to these companies, you are competing with all food ingredient companies that offer food ingredients with the function of adding ‘texture’ or ‘fibre’ to a product. Examples of these companies are Ingredion, Tate & Lyle, and Cargill.

Sudan

Several companies are involved in the production and processing of Acacia gum in Sudan, such as:

- Foga: This company is directly involved in cultivating and processing Acacia gum in Sudan. They also engage in reforestation projects, partnering up with organisations like Ecosia to plant Acacia trees. In 2021, the company opened two factories in Sudan, one cleaning factory close to the production areas and a processing factory to add value to Acacia gum within Sudan. The Acacia gum is processed into industrial Spray Dry Powder and the consumer Instant Powder.

- Sudan Gum Arabic Company: A major player in the industry, this company handles a significant share of Sudan’s gum Arabic production and exports. The company was established in 2010 as Sayed Elobied Sons Trading Co.

- Acacia Gum Ltd. is the exclusive marketing and sales agent for the cooperative of local producers for The Gum Arabic Company (GAC) in the United Kingdom, Europe, and the Americas.

Chad

Seyal Tchad has been active since 1986 and is dedicated to cleaning, sifting, sorting, and packaging Acacia gum. To ensure quality and traceability, Seyal Tchad has strategically positioned local agents in the seven gum-producing regions of Chad. They have a traceability system where every bag of gum is traced to the collector and the area it was collected from.

Mali

Sahel Agrisol is an example of a local producer and exporter of gum Arabic and various other agricultural commodities. Apart from Acacia gum, they deal in sesame, soybeans, maize, and shea butter, alongside value-added products including mangoes, maize, cocoa, and coffee. The company facilitates access to these goods, working closely with cooperatives and producers across the Sahel and West Africa.

Senegal

An example of a company in Senegal is Asiyla Gum Company SARL. This company was established in 1999 by Eastern Plantation Holdings Limited (99%) and a local partner, Mr. Serigne Seck (1%). The company’s production started in 2006 when the trees reached maturity. They have invested 19,966 hectares of Acacia plantations in different parts of Senegal. According to the company, these can produce up to 5 kilos of gum per tree.

Tips:

- Build long-term and sustainable trade relationships with your buyers. Trust is necessary from both sides: the supplier and the buyer. Respond promptly and always follow up. A good website with information on your company, products and certifications can support this.

- Consider getting food safety certification for your company. This will demonstrate the high quality and safety of your processing facilities. However, consult with your buyers and potential buyers to determine if this is necessary to prevent unnecessary costs.

Which products are you competing with?

In general, you are competing with all other ingredients used by the food industry that provide the same texture functionality in a food or drink product. Although Acacia gum's foaming and emulsifying functionality is unique, producers face competition from other natural and synthetic gums like guar gum, Locust Bean Gum, starches, carrageenan, and pectins. Besides its texture functionality, Acacia gum faces competition from other soluble fibres, like fruit fibres. However, the texture properties of an ingredient will be crucial in determining which ingredients are chosen for specific applications in food products.

Tips:

- Position yourself against competing products by highlighting your company's and product's strengths. Get to know your customers' products, their functional needs, and (indirect) competing ingredients.

- Learn more about the competing ingredients. Note that every hydrocolloid, gum or fibre might have its specific functionality, often in combination with other ingredients. Some reading material is the European market potential for seaweed hydrocolloids.

4. What are the prices of Acacia gum in the European market?

The price of crude Acacia gum is generally lower than that of processed Acacia gum. In the European market, crude Acacia gum typically ranges from €1.23 to €1.93 per kilogramme. On the other hand, processed Acacia gum, which has undergone additional refining and quality control, can range from €3.59 to €6.28 per kilogramme, depending on the type and origin.

Acacia gum is a minor component in food and drink product formulation. However, Acacia gum’s functionality is key to the taste and texture of the end products. Food manufacturers often work with cost-in-use for their ingredients instead of the actual pricing of the ingredient. Cost-in-use does not only include the ingredient price but all costs from procurement to application. It gives the balance of the costs and the functional and nutritional benefits. The justified cost-in-use depends on the dosage needed in the end product, the functionality's importance and the substitutes' availability. In addition, there is the benefit of the product. If the consumer product can carry a fibre claim on the package, a premium price is justified, and the price of the ingredient used might be higher compared to an ingredient only used for functional reasons. Acacia gum's natural status, multifunctionality, and superior performance, make it difficult to substitute with other ingredients, indicating that price is not the primary consideration for manufacturers. Political and ethical issues, however, may cause a company to seek alternative suppliers or explore potential substitute ingredients.

Generally, exporters and importers use freight forwarders to arrange transport to the importer. Transport costs are typically around 1% but heavily depend on the locations of the exporter and importer. The importer adds costs of clearing the goods, inspection and storage. Finally, the importer's sales margin depends largely on the order size. If agents are involved, they typically receive a commission of a few percent (3-4%). However, their actual profit margin strongly depends on volumes sold and the gross margin. Blenders add up to a few hundred percent depending on their activities, such as R&D and blending. Distributors, including importers, usually add 10 to 60% to the product's value, depending on the order size. Their mark-up is around 10% for big orders (Full Container Loads) and up to 60% when the orders are very small (<50kg). Please note that these are general numbers for commodity products.

Tips:

- Carefully calculate the price breakdown of your product before setting and agreeing prices with European buyers.

- If approaching a food manufacturer directly, show your customer the cost-in-use instead of the list price per kg. Show transport costs and other handling costs. If you are talking to a food company as a potential customer, be prepared to show the ingredient's value in their products.

ProFound – Advisers In Development carried out this study in partnership with Monique van der Wouw of Wouw Food Market Analysis on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research