Entering the European market for coconut sugar

As a coconut sugar exporter to Europe, you have to comply with certain legal requirements related to control, traceability, labelling and contamination. European coconut sugar buyers will also have additional requirements that you will have to adhere to. By adhering to these requirements, you will increase your chances of exporting coconut sugar to Europe. Coconut sugar is used by the food and personal care industries, with most going to the food industry.

Contents of this page

- What requirements and certifications must coconut sugar comply with to be allowed on the European market?

- Through what channels can you get your coconut sugar on the European market?

- What competition do you face on the European coconut sugar market?

- What are the prices for coconut sugar on the European market?

1. What requirements and certifications must coconut sugar comply with to be allowed on the European market?

What are mandatory requirements?

Coconut sugar safety – European General Food Law, traceability, hygiene and control

You must ensure your product is safe for the European market. You must therefore comply with the European Union’s mandatory requirements for natural food additives. If you fail to comply, European buyers will not want to work with you. To enter the European market, you must comply with a number of European Union (EU) regulations meant to guarantee food safety, such as:

- The General Food Law, which ensures your coconut sugar’s safety.

- Regulation (EC) 852/2004, which requires a Hazard Analysis and Critical Control Point (HACCP) system in place, if you are a food processor of coconut sugar.

Make sure you test for contamination with physical and chemical elements, since these are two common hazards. In this case, ‘physical elements’ refers to plastic residues, metals and dirt, while ‘chemical elements’ refers to cleaning agents.

Contamination

The EU requires proof that your coconut sugar is not contaminated with or exceeds a maximum level established for elements in three categories:

- Physical – plastic, metal and dirt residues

- Chemical – pesticides

- Biological – bacteria

For food products, the EU has set maximum residue levels (MRLs) for pesticides (EC Regulation 396/2005) and heavy metals (EC Regulation 1881/2006). You must ensure your coconut sugar does not contain pesticides or heavy metals above the levels set by the EU. As a coconut sugar exporter to Europe, you have to comply with the EU microbiological criteria for food-borne micro-organisms, their toxins and metabolites (EC Regulation 2073/2005).

European coconut sugar buyers regularly test imported products to determine whether they are contaminated, or if any contamination remains within set levels. Alongside the EU’s legal requirements, this is another reason why your coconut sugar must not be contaminated, or only within set levels.

Labelling requirements

The EU’s Classification, Labelling and Packaging (CLP) Regulation (EC Regulation 1272/2008) identifies hazardous chemicals and informs users about their hazards, using standard symbols and phrases. For your coconut sugar to enter the European market, the EU legally requires you to meet its CLP Regulation.

According to EU regulations, sweeteners belong to the category of ‘functional class sweetener’. According to Regulation EC No 1129/2011, the labelling of sweeteners, such as coconut sugar must include:

- the name of that category (i.e. 'sweetener');

- a specific name; or

- an E number.

According to Regulation (EU) 1169/2011 (EU 2011) on food information for consumers, any foods containing a sweetener authorised by the EU are required to carry 'with sweetener(s)' as a statement accompanying the name of the food. Foods containing both added sugar(s) and sweetener(s) authorised by the EU have to carry 'with sugar(s) and sweetener(s)' as a statement accompanying the name of the food.

For table-top sweeteners, the description of the sweetener must include the term ‘…-based table-top sweetener', stating the name(s) of the sweetener(s) used in its composition. According to the Regulation (EU) No 1169/2011, table-top sweeteners are exempted from mandatory nutrition declaration.

European Union legislation does not allow claims concerning the low glycaemic content of coconut sugar. Therefore do not make any health claims concerning this.

If you export European Union organic certified coconut sugar, you must comply with its labelling requirements. Therefore, in addition to the EU organic logo, you must display the code number of the control body, as well as stating where the agricultural raw materials have been farmed that the product is made from.

Convention on Biological Diversity/Access and Benefit-Sharing

The Nagoya Protocol of the Convention on Biological Diversity (CBD) aims to ensure that the benefits of genetic resources and long-established knowledge are shared equitably. It does so through its Access and Benefit-Sharing (ABS) scheme which is particularly important for wild-collected ingredients.

The European Union has adopted international treaties and protocols on using plant resources and incorporated these in European legislation. The Nagoya Protocol of the Convention on Biological Diversity (CBD) is an important example of this. It is also likely that it has been incorporated into your national laws.

If your country is a signatory of the Nagoya Protocol, you must abide by the protocol. Non-compliance can result in your coconut sugar not being allowed to enter the European market.

Tips:

- Use the EU’s MRL database to identify the maximum residue levels (MRLs) for your coconut sugar, and then comply with them. For further information about MRLs, visit the EU Trade Helpdesk.

- See the CBI study on buyer requirements for natural food additives. You can find more information there on the mandatory requirements you need to adhere to when exporting natural food additives to Europe.

- Determine if your country is a signatory to the Nagoya Protocol.

- If your country is a signatory to the Nagoya Protocol, ensure you comply with it.

- Do not make any claims concerning the low-glycaemic content of coconut sugar. Familiarise yourself with the EU Regulation on Nutrition and Health Claims.

Documentation

European coconut sugar buyers like it when exporters provide them with well-structured and organised product and company documentation. Consider doing this, since it will give you an advantage when trying to establish yourself in the European market. This will help to develop long-lasting trading relationships with European buyers. In addition, you will appear organised and well prepared to European buyers.

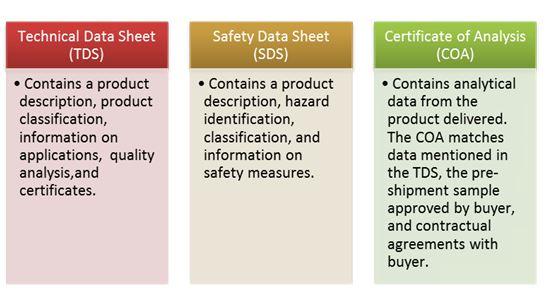

You are generally expected to provide European buyers with:

- Safety data sheets (SDS)

- Technical data sheets (TDS)

- Certificate of analysis (COA)

Figure 1: Technical Documentation Descriptions

Source: Ecovia Intelligence

Consider acquiring SDS, TDS and CoA for your coconut sugar and have them ready for European buyers. If you already have them, you should also inform European buyers of this when you approach them.

Tip:

- Review this example Safety Data Sheet and Certificate of Analysis for organic coconut sugar.

What additional requirements do buyers often have?

Quality requirements for coconut sugar

The Philippines National Standard (PNS) for coconut palm sugar (PNS/BAFPS 76:2010) is a mandatory requirement, set by the Philippines Bureau of Agriculture and Fisheries Standards , which coconut sugar exporters from the Philippines must comply with. This standard outlines the grading and classification of coconut sugar which Filipino producers must adhere to. For example, it sets minimum levels for physical and chemical characteristics, as well as the chemical properties that Filipino coconut sugar must have.

European coconut sugar buyers often require coconut sugar exporters from developing countries to comply with the Philippine standard for coconut sugar because there is no international standard for coconut sugar. The International Coconut Community (ICC), an intergovernmental organisation formed by coconut-producing countries, also has a quality standard for coconut sugar.

Tips:

- If you are coconut sugar producer from the Philippines, you must comply with the Philippines National Standard (PNS) for coconut palm sugar.

- Consider meeting the Philippines National Standard (PNS) for coconut palm sugar if you are a coconut sugar producer in a developing country other than the Philippines. It can help you enter the European market.

- Consider joining the International Coconut Community and meeting its quality standards for coconut sugar. It is likely to give you an advantage in accessing the European market.

- Meet the preferences and specifications of European coconut sugar buyers. Doing so will show your commitment to exporting good quality coconut sugar.

Quality management standards

Food safety is important to European coconut sugar buyers. So European buyers regularly demand extra certification proving the added safety and quality of the coconut sugar they intend to buy. European buyers demand certification set by a food safety management system based on the European Union’s Hazard Analysis Critical Control Point (HACCP) system, as outlined in EU Regulation 852/2004 on the hygiene of foodstuffs.

To trade with European buyers, you should meet their requests for extra certification. Doing so will help you to successfully establish yourself on the European market. This could lead to your developing long-lasting trading relationships with European buyers.

The most common certifications requested by European buyers are Food Safety Certification (FSSC 22000), International Featured Standards (IFS) and Safe Quality Food (SFQ) certification.

Tips:

- Speak to European coconut sugar buyers and find out which certification they want. If you do not have the required certification, then consider getting it.

- If you already have extra certification sought by European buyers, inform them when you approach them.

- Identify relevant food safety management standards for your coconut sugar, using the ITC’s Standards Map.

Labelling and packaging

European coconut sugar buyers often have common labelling requirements for coconut sugar they import. You should therefore consider stating the following information on your labels because these are common labelling requirements European buyers have.

- The name and address of exporter

- Product name

- Batch code

- Whether the product is for use in food products

- Best-before date

- Net weight in metric units

- Recommended storage conditions

Unless instructed otherwise by European buyers, you should use English on your labelling and use European measurement units, for example kilograms. If you export European Union organic certified coconut sugar, you must comply with the EU’s labelling requirements. Therefore, in addition to the EU organic logo, you must display the code number of the control body, along with where the agricultural raw materials composing the product have been farmed.

Coconut sugar attracts moisture, which results in its quality declining. You should package your coconut sugar in appropriate packaging materials before you export it. The quality of incorrectly packaged coconut sugar is likely to deteriorate on its journey to the European market. This could result in major losses for you as an exporter because European buyers could reject your coconut sugar and ask for compensation; they could also end their business relationship with you.

Tip:

- Package your coconut sugar in polypropylene (PP) bags or in kraft paper bags with a polyethylene (PE) inner bag. These materials protect coconut sugar from attracting moisture.

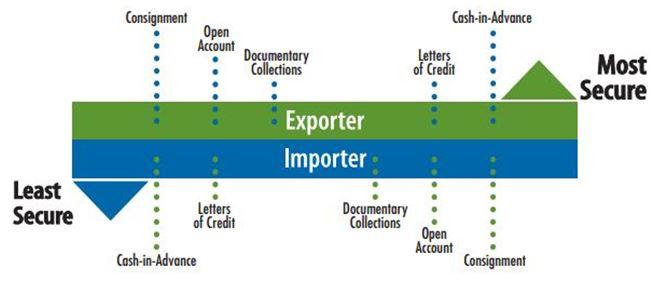

Payment terms

The type of payment terms depend on various factors, such as the order volume and the length of the business relationship. Make sure you choose the payment method that suits your needs. Examples of payment methods include cash in advance, letters of credit, open account and documentary collections. It is also possible to use a combination of payment methods.

Letters of credit (LC) are considered to be the safest payment method for both exporters and importers. This is because they allow both parties to contact an unbiased adjudicator to settle any issues, usually a bank. The chosen bank is a guarantor of full payment for exporters, as long as goods have been dispatched. In these situations, to prevent additional losses, exporters should pay for the return of goods dispatched and find new buyers for them.

Depending on their needs, exporters and importers can choose from a number of LC payment terms. These include standby, revocable, irrevocable, revolving, transferable, un-transferable, back-to-back, red clause, green clause and export/import. Standby is considered to be the safest for exporters, and is routinely used in international trade as it provides security to both exporters and importers who have little trading experience together. Cash in advance, documentary collections and open account are other payment terms available.

Figure 2: Payment risk diagram

Source: trade.gov

Tips:

- Make sure you negotiate payment methods for your coconut sugar that meet your needs and do not put your business at risk.

- Be flexible when negotiating the payment methods with potential European buyers.

- See the CBI study for organising your exports of natural food additives to Europe. It provides more information on available payment terms used in this sector.

- Be open to negotiating discounts with your potential buyers. This may help you establish long-term partnerships with European buyers.

- Carry out due diligence on your potential buyers to ensure that they have the resources to pay for your coconut sugar.

Delivery terms

When agreeing delivery terms with European buyers, you must carefully consider the three important factors of delivery time, volume and cost. Failure to meet agreed delivery terms could end your business relationship with European buyers.

- Delivery time: As an exporter, you need to understand that European buyers prefer shorter delivery times. Air cargo is usually faster than sea freight. Air freight is also more reliable for on-time delivery. Be aware that due to the global COVID-19 pandemic, delivery times are likely to be longer; reasons for this include mandatory quarantine measures and restrictions on the movement of goods.

- Delivery volume and order quantity: The volume of your order is an important factor to consider when choosing a mode of transport. Larger quantities are often cheaper to ship by sea. With lower volumes, air freight can be less expensive, as margins are smaller.

- Cost of delivery method: It is estimated that sea freight is usually 4-6 times cheaper than air freight. This applies to larger volumes. It is not likely that price of your cargo will increase substantially if you increase the volume. Note that the cost of air freight has increased due to COVID-19; this is likely to change when passenger flights are once again fully operational.

Figure 3: Incoterms

Source: velotrade.com

Tips:

- Be open to negotiating discounts with your potential buyers. This may help you establish long-term partnerships with European buyers.

- Visit the Freightos website to find out more information about freight costs. This will help you make a more informed choice when choosing a delivery method as it provides delivery cost estimates.

- Do not allow pressure to force you into agreeing to terms you are not comfortable with. Make sure you agree on delivery terms that are realistic. Once you agree on a certain point, write it down and double-check if you understand it correctly.

- Before agreeing delivery terms with European buyers, speak to your logistics provider about what COVID-19 means for you when exporting to the European market.

What are the requirements for niche markets?

Organic certification

European buyers are increasingly demanding certified organic food ingredients. You should consider getting organic certification for your coconut sugar to increase your chances of accessing the European market.

Certified organic coconut sugar is produced and processed using organic farming techniques. This includes crop rotation, biological crop protection, and the use of green manure and compost. In order to sell your coconut sugar as organic on the European market, you must comply with European Union regulations. You can find information on the EU organic certification on the IFOAM website.

After obtaining organic certification, European buyers often request a certificate of inspection (COI), a mandatory EU requirement for any organic ingredient traded on the European market.

Tips:

- Ensure you have a certificate of inspection (COI) that is up to date to with the latest EU changes that came into force on 3 February 2020.

- Refer to the ITC Standards Map for a comprehensive overview of certification schemes in the sector.

- If you already have the organic certification requested by European buyers, notify them when you approach them.

Environmental and social sustainability

There is growing consumer demand in the European market for products which have been produced under environmentally and socially sustainable circumstances. There is a growing demand from European buyers looking for sustainable coconut sugar.

As an exporter, one way to meet this demand is by obtaining verification and certification proving you meet environmental and social standards. Certification proving your coconut sugar has been produced according to certain sustainability standards can be obtained from the UNCTAD BioTrade Initiative BioTrade Principles and Criteria, as well as FairWild Standards. To prove you meet social (fair trade) standards, consider Fairtrade certification or FairForLife standards.

In November 2020, the Sustainable Coconut Charter was created by some of the leading stakeholders in the vegetable oil sector. Its goal is to increase sustainable sourcing, improve farmer livelihoods, and reduce deforestation and the impact on climate change in the coconut sector.

Tips:

- Consider getting certification to prove your coconut sugar is produced according to certain environmental and/or social standards.

- If you already have certification proving your coconut sugar has been produced according to certain standards, inform European buyers when you approach them.

- Consider signing the Sustainable Coconut and Coconut Oil Round Table charter. This would show European buyers that you are committed to sustainable production of coconut sugar.

2. Through what channels can you get your coconut sugar on the European market?

The commercial production of coconut sugar takes places in several countries around the world; important countries are Indonesia, the Philippines and Thailand. Coconut sugar has a wide range of uses; its main application is in the food industry because it is a healthier alternative to traditional sugars, as well as being suitable for vegans.

How is the end market segmented?

The European market for coconut sugar can be segmented into end-user industries: food and personal care (cosmetics).

Figure 4: Market segmentation of coconut sugar market

Source: Various

Food industry

The global coconut sugar market is set to grow by USD 253 million between 2019 and 2023, according to Technavio. It is estimated that the coconut sugar market in Europe involves around 2,000 tonnes. According to industry interviews, 70-90 percent of coconut sugar is used by the food industry because it is a healthier alternative to traditional sugar. Coconut sugar contains vitamins, has a high mineral content, and is a rich source of iron, magnesium, potassium and zinc. Coconut sugar is also used by the food industry because it is suitable for vegans. Certified organic coconut sugar is required to make organic products.

Coconut sugar is mainly used in food products that are in the premium category. Food manufacturers use coconut sugar in products designed for consumers with high awareness, who are willing to pay a premium for high-quality products. Such food products include organic and fair trade products. The European organic food and drink market was worth EUR 47 billion in 2019 and is expected to grow in the coming years. Coconut sugar has a lower environmental footprint than regular sugar; food manufacturers can use this as a selling point when marketing to consumers of organic and fair trade products.

The vegan food market is also attractive to coconut sugar exporters in developing countries. The number of European consumers adopting vegan diets in increasing in Europe; coconut sugar is considered a vegan alternative to traditional sugar. Coconut sugar is also used as a healthier alternative to sugar to make food products for diabetics and/or anyone looking for an alternative sweetener.

Personal care industry

The cosmetic and personal care industry uses coconut sugar because it is a natural exfoliant which scrubs away dead skin cells. Coconut sugar is used as an ingredient in personal care products such as body scrubs, shaving gels, and face and body creams.

This study focuses on the use of coconut sugar in the food sector.

Tip:

- Make sure to educate yourself on the benefits that coconut sugar offers in the food industry. Make sure you highlight these benefits in your marketing materials and on your website.

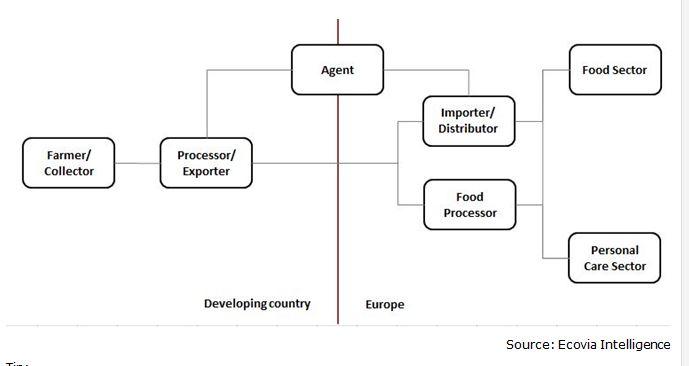

Through what channels does coconut sugar end up on the end market?

Figure 5 shows the export value chain for coconut sugar. The production process of coconut sugar typically is found on a large scale in countries that grow coconuts. Coconut sugar cultivation begins by ‘tapping’ the flower bud stem of a coconut tree, with farmers then making a cut on its spadix. This results in the sap inside flowing into containers placed below to collect it. The collected sap is then transferred into large woks which are placed over moderate heat to evaporate the water in the sap. After the excess water has evaporated, the sap thickens into a thick syrup: coconut sugar.

Importers and distributors

The majority of coconut sugar is imported into the European market through importers and traders. Important ones include Tradin Organic and Delphi Organic. They source coconut sugar from exporters directly or via agents. For example, Tradin Organic has set up direct sourcing projects in Indonesia. Distributors supply food processors in Europe. Import volumes can vary in this channel, ranging between tens of kilos to hundreds of tonnes.

Agent

If you are a small exporter, working with an agent to export to the European market may be beneficial to you. Agents are usually well connected with European distributors and wholesalers. Agents can be found in developing countries as well as in Europe. However, it is not very common for companies to use agents in the European market.

Food processors

Food processors are not very well established as a channel for coconut sugar in the European market. However, this channel is expected to develop further in the future.

Figure 5: Export value chain of coconut sugar

Source: Ecovia Intelligence

Tip:

- Visit trade shows in order to connect with European buyers. You can use this opportunity to get contact details and network with buyers sourcing coconut sugar. Examples include Anuga, Fi Europe & Ni and Biofach.

What is the most interesting channel for you?

As a coconut sugar exporter from a developing country, target European importers and distributors. They are the most promising channels, as most coconut sugar enters the European market through them. European importers are well connected with food processors interested in coconut sugar. These importers are usually located in western European countries, such as the Netherlands, Germany and France. Importers that source coconut sugar usually focus on specific sectors, such as organic and fair trade. Examples of importers include Good Mood Food, Keramis and Z-Company. European companies also directly source coconut sugar from developing countries; Delphi Organic is one such company.

Tips:

- Invest in the quality of your products before entering the European market. You must ensure that your coconut sugar complies with international standards and you need to develop your technical dossier.

- Carefully assess which channels are the most interesting for you, before entering the European market.

3. What competition do you face on the European coconut sugar market?

What countries are you competing with?

Many developing countries are successful in exporting coconut sugar to the European market; they share common strengths which contribute to their success. One key strength shared by countries listed in this section concerns them having favourable climatic conditions for coconut cultivation, yielding the coconuts from which coconut sugar is extracted and processed. Government support for the coconut industry and for the coconut sugar industry is another key strength often shared by these countries. The leading producers of coconut include countries like Indonesia, the Philippines, India, Sri Lanka, Brazil and Vietnam. Larger coconut producers can supply bigger volumes of coconut sugar. In countries such as Indonesia, the Philippines and India, the coconut industry is supported by the government.

Indonesia

Indonesia is the leading producer of coconuts. The country has a well-established coconut sugar industry.

Coconut production in Indonesia is supported by the government. For example, the government of Indonesia is implementing policies such as regenerating areas with high-yielding coconut varieties and expanding the coconut growing regions. Policies will also be supported by partnerships between growers and the processing industry, along with the provision of supporting facilities such as post-harvest equipment and low-interest credit.

The feedback from buyers is that Indonesia coconut sugar exporters are reliable. Indonesian suppliers are capable of suppling large volumes of conventional as well as organic coconut sugar. The coconut sugar from Indonesia is good quality.

However, the Indonesian coconut sugar industry faces many challenges, such as a lack of land, an outdated supply chain and widespread adulteration. Other challenges Indonesia faces include the lack of transparency, and inadequate infrastructure.

The Philippines

The Philippines is one of the major producers of coconut sugar in the world. Coconut cultivation in the Philippines began in 1642, with it becoming an important commercial agricultural crop by the 20th century. The Philippine coconut sugar industry represents a small fraction of the country’s entire coconut industry. However, in recent years the Philippine government has been working to develop and expand the country’s coconut sugar industry; something it is committed to continue doing. For example, the Philippine Coconut Authority is a government agency responsible for developing the industry. This is a key strength of the Philippines.

The coconut sugar from the Philippines is considered to be of a high quality by European buyers. Filipino coconut sugar suppliers are capable of supplying larger qualities of coconut sugar. There are several established suppliers of coconut sugar in the Philippines which are seen as reliable business partners by European buyers.

Some of the main challenges that the Philippines’s coconut sugar industry faces are adulteration of coconut sugar, an ageing and unproductive tree population, as well as frequent typhoons, droughts and cocolisap infestations, which severely threaten coconut trees.

India

India is another leading producer of coconut sugar. One of India’s key strengths is that its government supports the coconut industry. For example, India’s Coconut Development Board has several schemes to develop India’s coconut industry. These schemes include providing farmers with subsidies and helping them acquire internationally recognised certifications.

However, climate change is a key challenge that the Indian coconut sugar industry faces, particularly in certain parts of India where coconut trees are cultivated. Diseases such as lethal yellowing disease and pests are among the challenges the Indian coconut sugar industry faces. Other challenges include the negligence of its agricultural industry, declining natural resources, disruption of land and a lack of adequate infrastructure.

Europeans buyers generally perceive India favourably, with Indian companies doing well in Europe. It is easy to communicate with Indian suppliers. Quality issues can sometimes be a problem for European buyers when it comes to coconut sugar.

Sri Lanka

Sri Lanka is another country that produces coconut sugar. One of Sri Lanka’s key strengths is that its government supports the coconut industry. For example, Sri Lanka’s Ministry of Plantation Industries & Export Agriculture has key expectations and strategic development objectives to develop the coconut industry. It could therefore become easier for Sri Lankan producers to export coconut sugar to the European market.

However, the Sri Lankan coconut sugar industry faces many challenges. These include the low production and productivity of coconut lands, climate change and the high incidence of pests and diseases. In recent years, business ties between Sri Lanka and the EU have improved, with Sri Lankan exports to Europe increasing. Sri Lanka is being viewed more favourably by European companies. Relevant employees at Sri Lankan companies usually speak fluent English, which makes business communications easier.

Brazil

Brazil is the fifth-largest producer of coconuts. The country also produces coconut sugar, but production is still underdeveloped. European buyers regard Brazilian suppliers favourably. However, Brazilian suppliers cannot compete with larger Asian suppliers in terms of volume, as Brazilian coconut production has been decreasing in recent years.

Vietnam

Vietnam is the sixth-largest producer of coconuts in the world. Coconut sugar production is a by-product of coconut production. Coconut production has been encouraged by the Vietnamese government since the 1980s. Coconut sugar production is still underdeveloped in Vietnam. Other challenges that Vietnamese coconut sugar industry faces is a lack of infrastructure, quality issues and corruption.

Tips:

- Find out if your country has programmes helping exporters like you to cultivate coconut trees from which coconut sugar is extracted and processed for export to Europe. Contact the Ministry of Trade in your country; they are most likely able to inform you about this, along with providing assistance with exporting coconut sugar.

- Consider joining the International Coconut Community since they offer a range of assistance to exporters of coconut sugar from developing countries like you.

- If your country is improving its infrastructure, find out if this will benefit the distribution and export of your products. You can do this by contacting local or central government institutions.

- Read this market report on coconut products from Indonesia, as it provides useful information.

What companies are you competing with?

Coconut sugar is successfully exported to the European market by several companies in developing countries. Common features successful companies share include their ability to export high-quality coconut sugar and certified products, which gives them credibility.

Successful companies usually have a professional website with well-prepared content which gives them further credibility. Very often, their website will include sections informing prospective buyers about who they are, and how they source and process their coconut sugar, along with technical details and certifications, accompanied by professionally taken photographs.

Indonesian Companies

CV. Bonafide Anugerah Sentosa is an Indonesian company exporting coconut sugar to Europe. The company offers European Union (EU) organic certified coconut sugar. Organic certification demonstrates the superior quality of their product. The company also provides technical information and documentation about its coconut sugar and about its ability to export large volumes to Europe. Bonafide Anugerah Sentosa also has its own Corporate Social Responsibility & Social Activity policy. Thus, Bonafide Anugerah Sentosa has credibility in the European market.

Filipino companies

ANDY ALBAO CocoWonder is an experienced Filipino company exporting coconut sugar to the European market. The company exports EU organic certified coconut sugar that is compliant with good manufacturing practices (GMP). Another of ANDY ALBAO CocoWonder’s key strengths is its ability to export large volumes. The company is looked at favourably in the European market.

Indian companies

Vashini Exports is an Indian company exporting coconut sugar to the European market. One of Vashini Export’s key strengths is its ability to export British Retail Consortium Food Safety and GMP certified coconut sugar. Having such certification shows the production of its coconut sugar is in accordance with Western standards and has superior quality.

Vashini Export’s has total quality management policies which seek to ensure the highest quality standards for its coconut sugar; this is another of its key strengths. For example, Vashini Export has a specialised in-house quality testing unit which tests the purity, taste, quality and flavour of its products. By meeting common European buyer requirements, Vashini Export is looked at positively in the European market.

Tips:

- Consider getting certification which proves the high quality of your coconut sugar, such as British Retail Consortium Food Safety certification. Also consider meeting the standards for good manufacturing practices (GMP). This can help you in accessing the European market.

- Consider acquiring certification which proves you meet and uphold environmental and social (fair trade) standards, such as Ecocert Fair Trade, Fair for Life and Fair Wild standards.

- Organic foods are becoming increasingly popular in the European market, so consider getting organic certification for your coconut sugar, preferably European Union (EU) Organic certification.

- Ensure you have a professional website with well-prepared content which clearly informs prospective buyers of your key strengths. For example, display the certification you hold, showing the quality of your products along with your commitment to upholding environmental and social standards.

What products are you competing with?

Stevia

Stevia is a product competing with coconut sugar. Stevia is native to South America but nowadays cultivated mostly in Paraguay, Kenya, China and the United States; it is usually processed in China. Stevia contains zero calories and is 200 times sweeter than sugar in the same concentration; this is one of its key strengths. As a result of this, stevia is mainly used as a sweetener in food and drink products.

Another of stevia’s key strengths is that it has no effect on blood sugar levels; it is therefore a suitable sugar alternative for diabetics. Compared to coconut sugar, stevia does not contain any essential nutrients; this is one of stevia’s key weaknesses. Stevia leaves a bitter aftertaste, another of its weaknesses. However, when stevia is used in low volumes, for example by the food and drink industry, this is less of an issue.

In Europe, consumer awareness of stevia is rising, while its applications in food and drink products is expanding. Stevia is a popular natural sweetener; the European market for stevia is expected to increase in the coming years. As a result of this, stevia poses a major threat to coconut sugar.

Agave

Agave nectar, also referred to as agave syrup, is a product competing with coconut sugar. Agave nectar is made from the juice of the agave plant which is native to southern parts of North America, and to Latin America and South America. One of agave nectar’s key strengths is that it has minimal effects on blood sugar and insulin levels; it is therefore a suitable sugar alternative for diabetics.

Food and drink formulators and manufactures are familiar with agave nectar, as it is used in a variety of food products, such as granola, energy bars, chocolate and beverages; this is another of its key strengths. Agave nectar is suitable for vegans, which is all the more important because the European vegan products market is predicted to increase in coming years. This is another of agave nectar’s key strengths.

Compared to coconut sugar, agave syrup contains higher levels of fructose; this is one of its key weaknesses. Another weakness is it is not a rapidly renewable resource; it can take up to six years for agave plants to reach maturity and for agave nectar to be able to be extracted from it.

Monk fruit

Monk fruit sweetener is a product competing with coconut sugar. The monk fruit plant is native to parts of Southeast Asia, such as Thailand and regions in China; the plant is the raw material that monk fruit sweetener is made from. Monk fruit sweetener is a natural zero-calorie sweetener; this is a key strength. This is all the more important due to the growing demand for sweeteners for healthier and natural products in Europe.

Monk fruit sweetener contains high levels of unique antioxidants called mogrosides, which make it 100–250 times sweeter than regular sugar; this is another of its key strengths. Monk fruit sugar also contains beneficial active properties such as anti-microbial, anti-inflammatory and anti-carcinogenic properties; this is another of its key strengths.

However, the weaknesses of monk fruit include that it is difficult to grow and costly to export. In addition, there is a lack of availability, along with it also being expensive. As a result, monk fruit sweetener does not pose a serious threat to coconut sugar; however, if its weaknesses are addressed, it could pose a bigger threat in future.

Tips:

- Familiarise yourself with products competing with your coconut sugar that are available on the European market. Learn about their strengths and weaknesses. Do so by reading the CBI Study on stevia.

- Use your coconut sugar strengths as an opportunity to persuade European buyers to purchase it from you. For example, explain that it contains fewer calories than traditional sugar and that its availability is growing.

4. What are the prices for coconut sugar on the European market?

Coconut sugar prices are usually higher than prices for cane sugar or beet sugar. However, coconut sugar is priced at a similar level to other sweeteners. The market prices for conventional coconut sugar are around 4.5‑6.5 EUR/kg (FOB). Prices of coconut sugar have increased in the last couple of years because of rising demand. Retail prices of coconut sugar range from 15-27 EUR/kg. As an exporter of coconut sugar you can justify the premium by getting certification, such as organic and/or fair trade.

Tips:

- Carefully calculate the cost breakdown of your coconut sugar before setting and agreeing prices with European buyers. Failing to do so is likely to result in your incurring financial losses, since you could sell your coconut sugar for less than what it cost you to produce and export it.

- Obtain certifications to help make your coconut sugar more competitive in the European market. Relevant certifications will also help you justify a higher price.

- Be flexible with your price when buyers order large volumes. One way to do this is to offer buyers a discount after having established a relationship with them. This will make you more appealing to European buyers; but always check and ensure that you do not sell at a lower price than your costs.

- Visit online trading platforms such as Alibaba to see current market prices for coconut sugar and use this price information when setting your own prices. Doing so is likely to increase your chances of being competitive on the market.

This study was carried out on behalf of CBI by Ecovia Intelligence.

Please review our market information disclaimer.

Search

Enter search terms to find market research