8 tips for finding buyers on the European natural food additives market

These eight essential tips on how to find European buyers in the natural food additives sector will guide you through the complex process of increasing your sales. Remember that your success in identifying and winning the interest of suitable buyers for your products depends on various factors, such as product quality, pricing, level of competition, sound marketing and specific buyer preferences.

Contents of this page

- Clearly define your offering

- Conduct market research

- Target your potential buyers systematically

- Invest in your online presence

- Attend trade fairs and other industry events

- Visit the website of sector associations

- Be selective when using company/industry databases

- Look for organisations that can support you

1. Clearly define your offering

Before you start identifying and searching for buyers, you need to clearly define the offering of your company in terms of products and services. With a clear value proposition at hand, your potential clients will better understand the benefits they can expect of buying from your company and why they should choose you.

When defining your value proposition you should include a detailed description of your product range, a list of the product properties, the quality and quantity you can provide, prices, delivery terms, and all relevant international certificates needed on the market. Also describe your expertise providing professional services that facilitate a smooth export process, such as handling quality management, food safety and logistics.

Your unique selling point (USP) should also be covered in your value proposition: What makes your product different from its competitors? Do your ingredients have outstanding properties? Is your product process innovative? Or do you simply provide excellent quality or attractive prices?

Try to follow a structured process when defining your value proposition and USP. A good value proposition already reflects on specific buyer segment preferences and tests whether your offer is matching with buyer’s needs. This helps you succeed in the challenge to target the right buyer (Tip 2) and distinguish between buyer segments.

Tips:

- Be thorough when describing your company’s products, value proposition and USP. The more you reflect international buyers’ needs in the process and the more precise you are about what you offer, the better you can target the right buyers.

- See our study on “Doing business with European Buyers” and “Buyer requirements for Natural Food Additives” to test your value proposition and your USPs.

2. Conduct market research

Thorough market research helps you identify potential buyers efficiently and find the right buyer for your product. When researching the market, you get a better understanding of the export value chain and you get to know the relevant stakeholders in the sector. With your insights of market research at hand, you save time and resources when identifying and targeting potential buyers.

In Tip 1, your market research starts already when describing your offer and value proposition. In the best case scenario you already have preferences for your buyer segment, since in the above-mentioned structured elaboration of your value proposition you have reflected and tested the relevance of your product offer to your main buyer segments.

When conducting market research, first get an overview of all customer segments and understand the dynamics of the export value chain and the needs of its stakeholders.

Generally speaking, the main channels through which natural food additives will wind up on the end-market are importers and distributors, processors, food and drink manufacturers, and agents. Since value chain actors and relevant buyers vary greatly between sub-categories of products within the natural food additive sectors, review CBI’s detailed product studies within this category. As an example, buyers can be categorised as follows for stevia (see Figure 1):

- Agents: They merely mediate the deals between exporters and final clients in Europe and have no stock or storage facilities. It is not common for exporters to work via agents towards the European market.

- Distributors/Importers: European importers and distributors are an interesting entry point to the European market. European importers and distributors typically deal with a wide range of natural ingredients. Consider contacting companies like Roeper (Germany), A2 Trading, Brenntag Food and Nutrition and TER Ingredients

- Processors and manufacturers: Besides several specialised processors, there are global players like Givaudan and Symrise in this field. These global players have a wide portfolio of products and have also acquired smaller and important firms over the last years (e.g. Naturex, today part of the Givaudaun group).

- Food and Beverage manufacturers: If you offer ready-to-use natural food ingredients with enough quantity, quality and an excellent after-sales service, direct sales to big processors (Unilever, Nestlé, Oetker Group, Associated British Foods) can be an option for you. As Figure 1 shows, direct stevia sourcing by food and beverage manufacturers is not common, as raw materials or further processed products are normally purchased through distributors/importers or processors.

Figure 1: Export value chain for natural food additives, stevia as example

Source: CBI / Dana Chahin

Tips:

- Conduct in-depth market research and get an overview of your product’s value chain before targeting buyers.

- Start by researching the buyer segment you already had in mind when you defined your company’s and product’s value proposition. Expand your search to other value chain actors.

- Consult CBI product factsheets for specific products and learn about trends and relevant value chain stakeholders, the most important European markets, and specific key buyers (e.g. coconut sugar, gums, oleoresins, seaweed extracts, stevia and vanilla extracts).

3. Target your potential buyers systematically

Once you have determined your target markets geographically and the corresponding buyer segments, create a long list of potential buyers and target them systematically. Your long list could include customers identified in your market research (Tip 2), mentioned in the CBI product studies, from food additives associations lists (see Tip 6), from trade events exhibitors or visitors lists, or from your own specific internet search process.

You can only narrow down your search if you can identify and contact the right contact person from your long-listed companies. Research the company’s website and LinkedIn profiles, and use internet search engines to identify the names of contact persons relevant for you. Purchasing and category managers or personnel working in business or product development are generally the right people to approach. It can always be worth a try to target the management, mainly of smaller to medium-sized buyers, since they are normally very interested in staying ahead of trends and are looking for attractive sourcing options.

Tips:

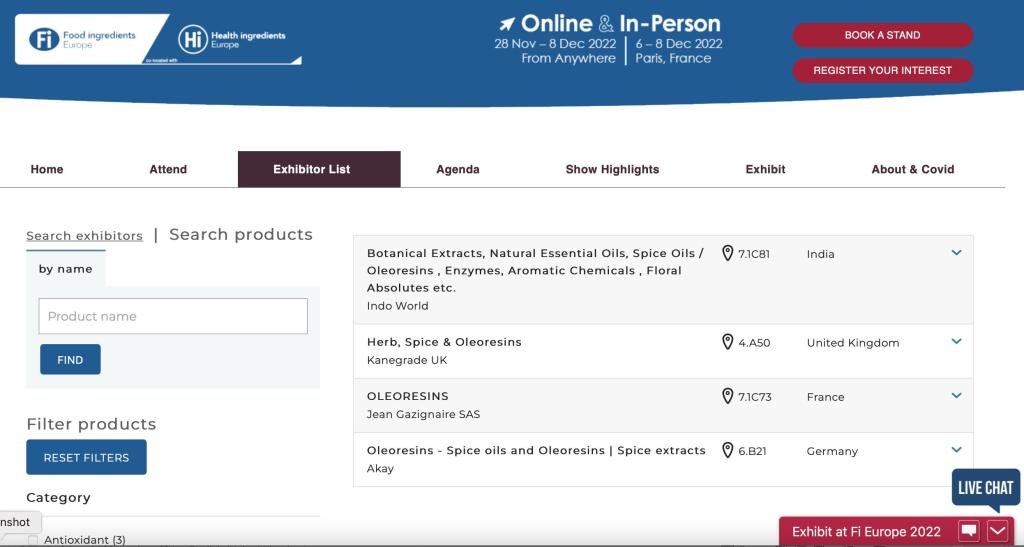

- Start building your longlist of potential buyers by using a trade fair exhibitor directory, like the one from Food Ingredients Europe. On their website you can access the complete exhibitor list. Search and filter this directory according to your interest and compile potential buyer company names and the respective contact person. To build your longlist systematically, use a Customer Relationship Management (CRM) software or service or simply an Excel file.

- Complete your list of existing customers and contacts, as well as promising leads from LinkedIn research or industry databases (see also Tips 5 and 7), then narrow down your search systematically.

- Register for the online event at Fruit Ingredients, communicate and fix appointments with the trade fair exhibitors and visitors. The online service lets you interact with industry stakeholders remotely.

- When contacting potential buyers always use customised messages, never generic, and from the first contact on show the potential buyer that you understand their product needs.

- Be honest about your capabilities and target prospective European buyers. For example, only target medium-to large-sized buyers if you can supply large volumes consistently.

Figure 2: Exhibitor list/specific search on Food Ingredients trade fair website

Source: https://exhibitors.figlobal.com/hifi22/

4. Invest in your online presence

Your online presence assures your visibility to your clients and enhances your credibility as a future business partner. Your potential clients should be able to learn how they benefit from doing business with you. So display your value proposition and your overall marketing, and let them discover your company’s strengths and your product’s properties and advantages! It is indispensable that you create and maintain a professionally designed website and that you network and promote your products on social media channels.

Make sure that your website attracts the attention of visitors in your target markets, creates a desire for your offer, and in the end converts the visitor into a customer. Include your value proposition and strong marketing message on the homepage of your website, with catchy images and videos. Also, share technical information and the state of your international certifications. A good design leads the visitor through your website. Last but not least, follow the principles of search engine optimisation (SEO) to appear in the internet searches of your potential clients. When optimising your website via SEO, make sure that relevant keywords describing your product category and USPs like quality aspects, product origin, CSR achievements and certifications are added to your website’s metafile.

Use social media to transport your marketing message and to network with potential clients and business partners. Since most natural food additives exporters aim to operate at the B2B level, it is recommended to focus mainly on LinkedIn to network with buyers and to share news about your company and products via regular posts. Make sure to create and maintain a “company page” that is adequately connected with the individual profiles of your employees. Other social media channels to promote your products and services in the B2B context and which can be easily integrated into your website environment include YouTube, Instagram and Twitter.

Buyers tend to look for new products and suppliers online by visiting trade fair directories, searching for contacts in LinkedIn product/interest groups and associations’ members lists, or via an internet search. It is therefore important for you to be present on as many online channels as possible, clearly identifying your offer.

A good example is the website of the Indonesian producer CV Bonafide Anugerah Sentosa. This company has a professional website and a good online presence in social media.

Figure 3: Example of producer website

Source: https://www.bonafideanugerahsentosa.com/

5. Attend trade fairs and other industry events

International trade fairs and other industry events offer you a great platform to get to know and network with prospective buyers, increasing your company’s visibility and gaining further knowledge about the industry. Due to Covid-19 challenges, many live event organisers have also established virtual platforms and digital tools in order to facilitate networking and promote your products. This offers you an elegant way of entering the stage of international trade.

Virtual platforms and events offer you a relatively easy-to-manage and mostly comfortably priced stage to meet international buyers. But participating or even exhibiting at live events has the advantage of meeting buyers face-to-face and presenting your products and samples to the public.

It is very important that you prepare well for your participation in any trade event. Find out whether the fair suits your product and attracts the buyers you are looking for. Prepare your marketing materials such as personal business cards and company and product catalogues in digital form, and have a link or QR code to share these materials instantly with interested buyers. Also consider having a tablet ready to show your content and pictures to potential clients.

When preparing, also search on the website for a list of exhibitors and make appointments with potential buyers (see also recommendations in Tip 2, ‘Market Research’). If you are considering attending a trade event as an exhibitor, keep in mind the high cost of such a venture and enquire whether you could participate along other companies at a country or sector association stand. Also check your options to participate in trade promotion programmes, as explained in Tip 8 of this study.

Since not only trade event organisers but also the entire industry has made a big leap forward in terms of digitalisation, ensure that your digital marketing channels are updated and in perfect condition. Use your website and LinkedIn profiles to announce your visit to events and connect instantly over LinkedIn with people you will meet at the event. As business will develop after the event, you must take time to ensure effective follow-up.

Besides international trade fairs, there are good opportunities for networking with potential buyers at industry-specific conferences, annual meetings of relevant international and European industry associations, and B2B matchmaking events.

The leading international trade fair for Natural Food Additives is Fi Europe. FIE added an online edition in 2022, allowing participants to join the event remotely. Trade fairs like Anuga, SIAL and Biofach (for organic products) also offer excellent insights on food and beverage players and trends.

Figure 4: Announcement of FIE online and in-person trade fair in 2022/Biofach 2023

Source: FIE Website/Biofach Website

Besides the leading industry events and trade fairs in Europe, there are other interesting international sales events outside Europe that you can consider researching or visiting:

- Food Ingredients China (FIC) organises one of the largest trade shows for food additives and ingredients in China.

- Biofach South East Asia – trade fair for the organic sector in the South East Asian region.

- Biofach India – trade fair for the Indian organic sector.

- Biofach China – trade fair for the Chinese organic sector.

- Food Africa – trade fair to meet international and African agents, distributors and retailers from the food sector.

- ALIMENTEC – international trade fair based in Colombia focusing on food processing, food and beverages.

- Food Ingredients South America – leading trade show for food ingredients in Latin America.

- Biofach Brazil – a leading trade show on organic products in Latin America.

Tips:

- Research relevant live and virtual trade fairs and industry events, and set priorities in terms of finding buyers, general networking and learning about industry trends.

- Search for potential buyers and contacts using the event’s exhibitors list. Reach out to relevant contacts and try to pre-arrange meeting prior to the event.

- Prepare your marketing materials (digital or print), and consider bringing a tablet to showcase your company and products digitally.

- Use directories of trade events like Tradefairdates or 10times to find relevant events.

6. Visit the website of sector associations

The natural food additives market counts on various sub-sectors and products, some of which have formed their own national or international associations. Sector associations play an important role in the representation and promotion of the sector. They provide you with important information about the industry’s requirements and developments in their specific market.

Associations’ websites and members lists are a good source to find potential buyers (see tip 2 ‘Targeting buyers’) and to access research findings and news from withing the industry. Some associations also organise events that allow you to update your technical know-how and network with industry stakeholders.

Important sector associations include:

- European Flavour Association (EFFA) – an umbrella organisation of the European flavours sector. You can find the members list on its website.

- The International Federation of Essential Oils and Aroma Traders (IFEAT) represents the interests of companies involved in the production, processing, trading and manufacturing of ingredients used in flavours, fragrances and aromatherapy.

- EU Specialty Food Ingredients is a membership organisation for the specialty food and ingredients sector. You can find the full members list on their website.

Consider connecting and utilising the support offered by sector associations at the European country level. Important associations include:

- Food&Drink Europe – European food and drink association, represents the interests of food and drink companies, national food and drink federations, and specific sectoral associations based in Europe.

- Food and Drink Federation (FDF) – the association of the UK food and drink industry. You can find the full members list on their website.

- UK Flavour Association – association representing the interests of the UK flavouring industry. You can find the full members list on their website.

- Federation of German Food and Drink Industries (BVE) – the leading economic association of the German food industry. You can find the full members list on their website.

- Deutscher Verband der Aromenindustrie e.V. (DVAI) –a German association of the flavour sector. You can find the full members list on their website.

- Association Nationale des Industries Alimentaires (ANIA) – the French association representing the French food industry. It provides information on how Covid-19 is impacting the food & drink industry in France.

- Syndicat National des Ingrédients Aromatiques Alimentaires – association representing food flavouring companies in France. You can find the full members list on their website.

- Federatie Nederlandse Levensmiddelen Industrie (FNLI) – represents the Dutch food & drink industry. You can find the full members list on their website (Dutch only).

- Dutch Association of Fragrance and Flavoring Manufacturers (NEA) – an umbrella organisation of the fragrance and flavouring sector in the Netherlands. You can find the full members list on their website.

Tips:

- Utilise the support provided by natural food additives associations in European countries and connect with their members to identify business opportunities.

- Regularly check association websites for the latest updates on regulations, trends, developments and innovations in the industry.

7. Be selective when using company/industry databases

Using trade databases can be valuable when identifying your longlist of potential buyers and following the principles mentioned to target buyers systematically (see Tip 3). However, you must choose wisely through which service or directory you access data, since no database is complete, and most databases are not tailored to your needs.

There are many sources to access data for free, such as members lists of natural food additives associations, chambers of commerce and trade fair exhibitors lists. The list of natural ingredients suppliers provided by FoodIngredientsFirst, which contains the names of leading importers, distributors and ingredient manufacturers in Europe, is also helpful.

In addition to free directories, you can find buyer databases for sale by companies or institutions (including trade fairs). Before you engage in such a purchase, ensure that the data offered is relevant for you and that there is no free alternative to gain access to the promised contacts. Do not use such data for mass mailings, since sending unsolicited, collective emails is generally ineffective and could actually turn potential buyers off.

Relevant databases for exporters of natural food additives to Europe include:

- EUROPAGES – directory of European companies. EUROPAGES lets you search by sector (for example natural food additives). To further filter your search results, select companies located in the most prospective European country markets (e.g. Germany, France, the Netherlands) and by company type (e.g. ‘agent/representative’, ‘distributor’, ‘manufacturer/producer’).

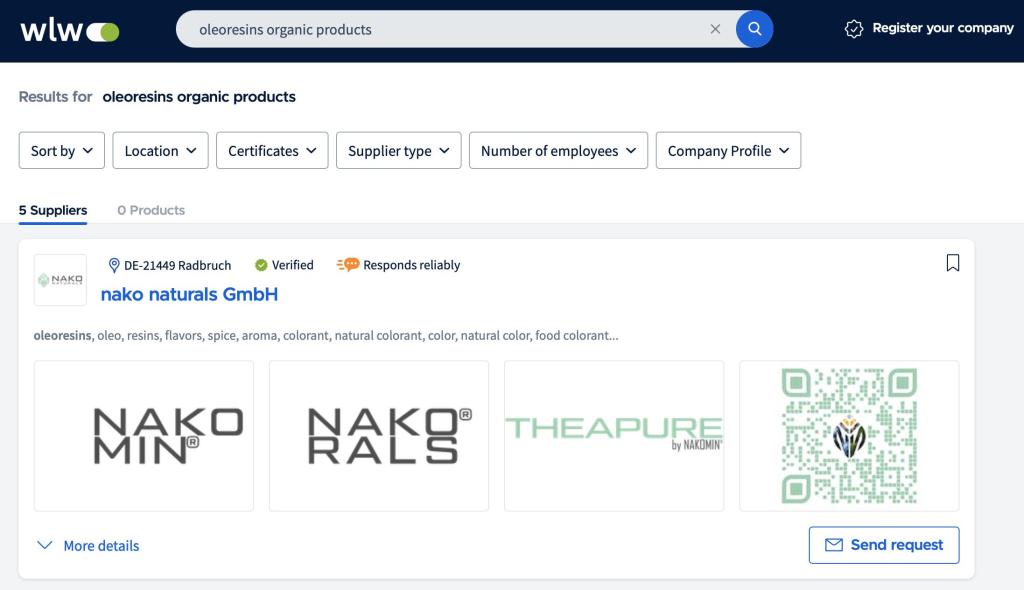

- wlw –a leading B2B online marketplace in Germany, which is the most prospective European country market for natural food additives. To further filter your search (e.g. ‘organic products’, ‘oleoresins natural colours’), select companies by type (e.g. ‘manufacturer’, ‘service provider’, ‘dealer’, ‘distributor’). Companies in other European country markets are also listed.

- Kompass – is a large company database. Basic searches can be performed for free by entering product name (e.g. gum arabic, guar gum, oleoresin), import and/or export, and European country market. If you subscribe, Kompass lets you apply more filters and purchase complete databases.

Tips:

- Carefully assess if you want to purchase datasets from private service providers; check for free alternatives.

- Avoid sending mass emails to potential clients, as buyers are likely to consider them as spam.

- Conduct searches in the right language for each European country market on search engines: this is likely to generate more accurate results.

- Make a follow-up phone call shortly after sending your first email: it is likely to increase the response rate.

Figure 5: Example Industry Database (WLW)

Source: https://www.wlw.de/en

8. Look for organisations that can support you

Several governmental and non-governmental organisations support international business activities and engage actively with SMEs in trade promotion activities. They generally offer valuable help to start your export activities. The most specific support is provided by a few national export promotion agencies in Europe (e.g. CBI and IPD).

In addition, Business Support Organisations (BSOs), like national and regional chambers of commerce and embassies, fund export-related activities such as market research, matchmaking and trade fairs. You can also use the resources of BSOs to provide you with information on the markets you are targeting.

Important European and international organisations that could support you are:

- Centre for the Promotion of Imports from developing countries (CBI) – CBI supports companies from developing countries in exporting to the European market with export coaching projects and market intelligence on various key sectors.

- Import Promotion Desk (IPD) – IPD seeks to promote the import of certain products from specific partner countries, bringing together the interests of German and EU importers with exporters from emerging markets.

- International Trade Centre (ITC) – ITC is an agency of the World Trade Organization and the United Nations, working to enable export success of small and medium-sized enterprises (SMEs) in developing countries. ITC also runs the virtual training platform SME Trade Academy.

- Open Trade Gate Sweden (OTGS) – OTGS supports companies from developing countries to export to Sweden and the European Union, assisting exporters with information on export procedures, regulatory requirements and market intelligence.

- Enterprise Europe Network (EUN) –a European Commission initiative that helps companies innovate and grow internationally through international partnerships, advice and innovation.

- Swiss Import Promotion Programme (SIPPO) – SIPPO does not support SMEs directly, but supports national BSOs in their export-related promotion and services. In doing so, SIPPO indirectly supports exporting companies in the areas of market intelligence, matchmaking and networking. SIPPO offers online training on its Trade Promotion Academy.

Tips:

- Check the service offer of European export promotion agencies and try to benefit from their export capacity-building and matchmaking programmes.

- Connect with chambers of commerce in your country and use the resources and services they provide – for example, the Indonesian Chamber of Commerce and Industry, Philippine Chamber of Commerce and Industry, Malaysia External Trade Development Corporation, Ghana Chamber of Commerce and Industry, Nigeria Export Promotion Council and Kenya National Chamber of Commerce and Industry.

- Subscribe to newsletter services and LinkedIn groups, and follow the LinkedIn company pages of business support organisations and export promotion agencies.

Figure 6: Export promotion agencies

Source: Organisations’ websites

This study was carried out on behalf of CBI by Jonas Spahn in collaboration with Global Trade Promotion partners.

Please review our market information disclaimer.

Search

Enter search terms to find market research