Exporting liquorice to Europe

There are significant opportunities for new suppliers of liquorice in Europe, because of growing scarcity in supplies. The market for liquorice roots is relatively easy to enter and if you are a successful roots supplier you can add more value by extraction. Make sure that you comply with legal requirements on Ochratoxin A levels, which is one of the main challenges in this market.

Contents of this page

- Product definition

- What legal requirements must my product comply with?

- What additional requirements do buyers often have?

- What are the requirements for niche markets?

- Which European markets offer opportunities for exporters of liquorice?

- What trends offer opportunities on the European market for liquorice?

- Through what channels can you sell liquorice on the European market?

- What are the end market prices for liquorice?

- What competition do I face on the European liquorice market?

1. Product definition

Liquorice (American English: Licorice) is the root of Glycyrrhiza glabra and Glycyrrhiza inflata. The roots are brown, long and cylindrical and have to be 3 to 4 years old before they can be harvested and dried for extraction. Liquorice extract is produced by boiling liquorice root and subsequently evaporating most of the water. Its active principle is glycyrrhizin, a sweetener between 30 to 50 times as sweet as sucrose. Liquorice extract is traded as a paste, block or spray-dried powder.

The tobacco industry is the main user of liquorice extract. The confectionery industry is estimated to be the second largest user, followed by the pharmaceutical industry. The pharmaceutical industry also uses liquorice from Glycyrrhiza uralensis, but in this document we focus on the confectionery market.

Codes for liquorice extract:

- CAS numbers: 68916-91-6

- Code of liquorice in the Harmonised System (HS): 130212 - ‘extracts of liquorice (excl. that with a sucrose content by weight of >10% or in the form of confectionery)’.

Product specifications

Quality

- Keep Ochratoxin A levels below legal limits minimum by storing the roots in a clean, dry, ventilated space and possibly turning the roots

- Minimise moisture content in the roots by drying

- Glycyrrhizic Acid (GA) is the most important constituent of liquorice. GA content usually amounts to 7.5-8% in Glycyrrhiza inflata and 5.5-6% in Glycyrrhiza glabra. Glycyrrhizin, starch, gums, sugars, moisture and ash are other constituents.

- Use the extraction method (temperature, pressure, time) which results in a composition according to buyer preferences.

- Producing different batches of liquorice extract with a consistent flavour profile is a major challenge. It requires quality control for raw materials and strictly controlled processing.

- Producing different batches of liquorice extract with a consistent flavour profile is a major challenge. It requires quality control for raw materials and strictly controlled processing

- Do not add additives to the extract unless specifically agreed upon with your buyer. Any use of additives should be specified in the Technical Data Sheet (TDS).

- Clean roots before processing to remove other plant material and prevent contamination by foreign materials (e.g. soil) by keeping facilities and equipment clean. Buyers will measure ash content, which will be high if it contains a lot of soil.

Labelling

- Enable traceability of individual batches, whether they are produced by blending or not

- Use the English language for labelling unless your buyer has indicated otherwise

- Labels must include the following:

- Product name

- Batch code

- If the product is destined for use in food products

- Name and address of exporter

- Best before date

- Net weight

- Recommended storage conditions

- If you have Kosher, Halal, organic or other certificates, include the corresponding marks on your labels

Packaging

- Apply fumigation to combat the growth of micro-organisms during storage of the roots. Only apply fumigants authorised by the European Union and keep within limits

- Liquorice extract is sold in steel drums

- The packaging should be waterproof, as liquorice may dry out when liquids diffuse the package.

- Enable re-use or recycling of packaging materials by, for example, using containers of recyclable material (e.g. jute)

2. What legal requirements must my product comply with?

Food processors must have a food safety management system in place based on Hazard Analysis Critical Control Points (HACCP) principles. These systems require companies to demonstrate their ability to control food safety hazards in order to ensure that food is safe at the time of human consumption. Furthermore, products must be traceable throughout the supply chain. If European companies or authorities find out that the safety of your product cannot be guaranteed, they will take the product off the market and will register it in the European Union’s Rapid Alert System for Food and Feed

Tip:

- Search in the European Union’s Rapid Alert System for Food and Feed (RASFF) database to see examples of withdrawals from the market and the reasons behind these withdrawals.

Contamination

Producers of liquorice (extracts) must minimise contamination of their product during growing, processing, packaging, transport and storage. They must not make excessive use of chemicals and safeguard hygiene in their facilities. In the liquorice trade, contamination by Ochratoxin A is a major concern and European importers test for residue levels vigorously.

Tips:

- Use the European Union’s Maximum Residues Level (MRL) database to find out which MRLs are relevant for your product. You can search on your product or pesticide used and the database shows the list of the MRLs associated to your product or pesticide.

- Inform collectors on good practices to minimise contamination and keep liquorice roots dry to comply with maximum levels for certain contaminants, such as Ochratoxin A.

- You can consult the EU Export Helpdesk for a full list of requirements.

- See our research on Buyer requirements for natural food additives for more information on legal requirements.

3. What additional requirements do buyers often have?

Food safety certification

As food safety is a top priority in all European food sectors, you can expect many players to request extra guarantees from you in the form of certification. Many European buyers require certification of a HACCP-based food safety management system.

The most commonly used food safety management systems in the Europe are:

- Food Safety System Certification (FSSC22000);

- British Retail Consortium (BRC);

- International Food Safety (IFS) and

- Safe Quality Food (SQF).

ISO 22000/FSSC 22000 is most relevant for suppliers of ingredients which will be further processed. BRC, IFS and to a lesser extent SQF require more advanced management systems. They are particularly relevant for suppliers of end-products to retailers.

Tips:

- In ITC’s Standards Map you can identify food safety management standards relevant to your product, review the main features of the selected standards and codes and compare standards' requirements side-by-side.

- Refer to the Global Food Safety Initiative (GFSI) for more information on internationally recognised food safety management systems.

Kosher and Halal certification

Although actual European demand for Halal and Kosher products is small, demand for certification of compliance against these religious standards is increasing. Certification allows food manufacturers to use the ingredients in Halal and Kosher products and prevents exclusion of these target groups.

Certification is particularly relevant for extracts such as liquorice, because their status as halal or haram (i.e. not allowed) is often considered questionable.

Halal certification for liquorice requires processing procedures according to Islamic law. Extraction must be done without the use of alcohol. Certified Halal products must also be kept separated from “impure” products, such as products from pigs. A unified standard for Halal does not yet exist. Select a certifier accredited by the World Halal Council for recognition of your certificate in Europe.

Tip:

- Obtain Kosher and Halal certificates to prevent being excluded from access to a growing number of buyers. Often this does not require changes in your processes. Refer to the Halal Authority Board or your certifier of choice for more information.

Documentation

Buyers need well-structured product and company documentation. Buyers generally require a Certificate of Analysis (CoA), a detailed Technical Data Sheet (TDS) and a Safety Data Sheet (SDS).

Tips:

- Make sure that you have documentation available upon request. See our workbook for more information on preparing a TDS and a SDS for natural ingredients.

- Your sampling method should result in lot samples that represent what you can deliver in the quantities, quality and lead time as specified by the buyer.

- Pay attention to strict compliance with international delivery terms as agreed upon with your buyer.

4. What are the requirements for niche markets?

Certification of sustainability

A small, but growing group of European buyers require third-party certification of sustainability. Particularly organic certification is gaining relevance.

To market liquorice in the Europe as ‘organic’, you need to prove that you are not using any forbidden chemicals in your production system and that you are only applying organic processing methods. An accredited certifier must audit your facilities and issue the certificate. These requirements are specified in the European Union Regulation 834/2007.

Tips:

- Obtain an organic certificate to gain access to this small, but growing niche market.

- Visit the ITC’s Standards Map for more information on certification schemes for sustainable production.

5. Which European markets offer opportunities for exporters of liquorice?

Imports and production

Scarcity in the market for liquorice extract provides opportunities for new suppliers

- Demand for liquorice roots is constantly increasing in Europe. Transparency Market Research forecasted a global market growth of 4% annually between 2017 and 2025. Europe accounts for around a quarter of the global market. Production of MAG sweeteners (Mono Ammonium Glycyrrhizinate) from liquorice is the major driver behind market growth.

- In the coming years, some scarcity can be expected in the European liquorice market. China, which was traditionally an exporter of roots and extracts, is becoming a net importer. This is not only caused by an increase in demand, but also by diminished supplies in China. Most liquorice roots are wild-harvested and the country has been draining its resources. As a comparison, in the 1990’s China exported 8,000-10,000 tons of liquorice (both roots and extract), whereas exports dropped to around 3,500 tons in 2006 with imports rising to over 4,000 tons. This development influences the availability of liquorice extracts for use in Europe.

- The French company EVD and German companies Hepner & Eschenbrenner, Norevo and CE Roeper supply most of the European market for liquorice extract. However, a large part of their supplies comes from extraction facilities in countries outside Europe. Spain and Italy produce a significant amount of roots, but total output of liquorice extract is no more than a few hundred tonnes.

- Although liquorice roots are grown in a large area stretching from Iran to China, large-scale extraction is limited to China and Iran.

- Northwest European countries are estimated to account for most European imports of liquorice for use in food applications.

Exports

Between 2012 and 2016, France and Germany fortified their position in the European liquorice trade. Many European food and drink manufacturers prefer to source from French and German importers, such as EVD, Hepner & Eschenbrenner, Norevo and CE Roeper. The German importers have an excellent supply network and sophisticated extraction facilities in the countries of origin.

Tips:

- Monitor new product development to learn about the applications for liquorice extract and use that knowledge in your promotion.

- If you supply roots, but there is no extraction capacity in your country, seek cooperation with (co-)investors to establish an extraction facility.

- Keep your eyes open for new opportunities as a result of decreasing supplies and ever increasing demand from China.

6. What trends offer opportunities on the European market for liquorice?

New Product Development

Liquorice is increasingly being used to produce Mono Ammonium Glycyrrhizinate (MAG). Although current MAG production is small, the use of MAG as a masking agent in products sweetened by stevia has much growth potential. Mafco, (US) one of the largest MAG suppliers, markets its MAG under the name Magnasweet.

Clean labels

European consumers avoid products with ingredients that they perceive as unnatural or products with health warnings. Products with a high dosage of glycyrrhizic acid sometimes carry a health warning on the label for patients with high blood pressure. Certain studies have shown that the consumption of glycyrrhizic acid can increase blood pressure.

Exporters of liquorice extract can offer a solution to food manufacturers by offering them liquorice extract with a low glycyrrhizic acid content of less than 6%.

Tip:

If your liquorice extract is not suitable for MAG extraction, consider promoting its use in products that require clean labels. Advise food manufacturers on the correct dosage to apply to avoid the need to put health warnings on their product labels.

7. Through what channels can you sell liquorice on the European market?

Market channels

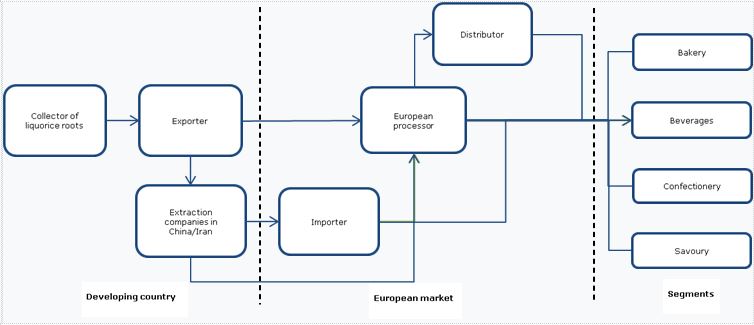

Figure 3: Major market channels for liquorice extracts

Source: ProFound, 2017

Only few companies extract liquorice

European extraction companies still play a role in the processing of liquorice. They can either produce the extract or process the extract (e.g. spray drying). However, most liquorice is imported as extract, because processing near its source lowers costs.

Importers play a vital role

Manufacturers in Europe focus on their production and Research & Development activities. They are not very interested in sourcing directly from developing countries. They prefer to source from European importers and processors who can supply small quantities at frequent intervals.

Tips:

Benefit from the experience and knowledge of European importers and agents instead of approaching end-users directly.

- Agents are particularly interesting if you do not have a strong sales network. However, once you have established a trade relationship through an agent, you cannot establish a direct relationship with the buyer anymore. The sales network of the agent is protected by law.

Market segments

Table 1: Major food segments and applications for liquorice

| Segment | Application | Benefits |

| Confectionery | Liquorice, chewing gum | Typical liquorice taste |

| Dairy | Ice cream | Liquorice taste |

| Beverages | Herbal tea, liquor, cocktails, lemonade | Enhances herbal taste of tea, rounds up taste of beverages, improves colour, acts as foaming agent in lemonades |

| Bakery | Ginger bread, spicy cookies, fruit loaves | Liquorices enhances aromatic sweetness and brown colour |

| Savoury | Aromatic sauces | Sweetens and flavours |

Northern and Southern Europe present two different markets

- Demand for organic certified liquorice is estimated to be small. Moreover, Italian companies present strong competition in this niche.

- North European countries and especially Scandinavian countries (Norway, Sweden, Finland and Denmark) often use liquorice in (salty) confectionery in a dosage of around 4%. South European countries frequently use more pungent and strong liquorice in pastilles in a dosage up to 50%.

Tips:

- Discuss the opportunities for organic certified liquorice with your buyers.

- Focus on the Southern European market if your extract is pungent.

8. What are the end market prices for liquorice?

Prices remain on a high level

- In May 2016, liquorice prices averaged € 6.2 /kg. Prices for liquorice have been relatively stable in the past year with good availability of liquorice roots.

- The prices of liquorice depend on the economic and political situation in the Middle East, which is the main source for liquorice root for food applications. Changes in the political situation may cause large fluctuations in prices.

- Decreasing availability of liquorice from China may push prices upwards in the long-term.

- Chinese liquorice from generally fetches higher prices than Iranian liquorice, as domestic demand for Chinese liquorice is strong and because it contains a higher concentration of glycyrrhizic acid.

- Organic certified liquorice extract can fetch up to twice the price of conventional liquorice extract.

- The following price breakdown shows which costs and margins are applied to liquorice extract before it reaches the end-user.

Tips:

- Monitor harvests in the major production countries to anticipate price developments.

- Find out how much compliance with the new European Union regulation regarding mycotoxins levels will cost you, as it implies stricter quality management and testing.

- Check http://www.roeper.de for market reports on liquorice. You can also use trade data on http://epp.eurostat.ec.europa.eu/ to calculate import prices in Europe.

Figure 4: Price breakdown for liquorice extract, mark-ups in %

Based on Full Container Loads from Central Asia to European importer

Source: ProFound, 2015

Price breakdown

- If agents are involved, they typically receive a commission of a few (2-5) percent. However, their actual profit margin strongly depends on volumes sold and gross margin. They will normally lower their gross margin for big volumes.

- Importers add up to 50-60% to the value of the product if they need to break a container load into smaller lots.

- Processors, such as the ones producing MAG, and blenders can add up to a few hundred percent depending on their activities, such as R&D, fractionation and blending.

Tip:

- You can add value to your product by offering it in a form in which it is easy to use by food manufacturers (e.g. spray-dried).

9. What competition do I face on the European liquorice market?

Less competition from China opens the market for new players

- European producers of liquorice root do not offer much competition, as labour costs for collection are high. Root collection takes place mainly in Central Asia (Iran, Turkmenistan, Afghanistan and China).

- Most extraction facilities are located in Iran and China. However, Chinese liquorice manufactures are increasingly directing their sales towards the domestic market.

- Turkmenistan is an emerging supplier of liquorice extracts.

- Chinese liquorice extract is most appreciated by the pharmaceutical industry, as it contains the highest percentage of Glycyrrhizic Acid. China mainly grows Glycyrrhiza inflata and Glycyrrhiza uralensis.

- European buyers prefer to build long-lasting relationships with their suppliers, as switching costs are high.

- Liquorice extract has a unique flavour profile and is difficult to replace. Therefore, food manufacturers continue to buy liquorice extract even when prices are high.

- Liquorice roots can become scarce and expensive if they are over-harvested. As roots are wild-collected, harvesting is difficult to control, which puts supplies at risk.

- Although collection of liquorice roots is very accessible, extraction of liquorice requires significant investments.

Tips:

- If the Glycyrrhizic Acid (GA) content in your roots is high, focus on the pharmaceutical market, which pays higher prices. GA is highest in roots from Glycyrrhiza inflata and Glycyrrhiza uralensis.

- If you have found a good buyer, keep a long-term perspective instead of acting opportunistic. For example, prevent over-harvesting of roots to ensure long-term supply stability and try to level off price increases in times when world market prices are high.

- Gain control over harvesting by, for example, applying sustainable resource management to the collection. Look into the possibilities of the FairWild certification scheme for wild-collected ingredients.

- Suppliers of liquorice roots can cooperate with other roots suppliers or investors to establish an extraction facility if they are unable to do the extraction themselves.

Main sources

The following trade fairs are good to visit if you want to learn more about the European market and meet potential buyers:

- Food Ingredients Europe (http://www.figlobal.com/fieurope/)

- SIAL (http://www.sialparis.com/)

- Anuga (http://www.anuga.com)

- Biofach (http://www.biofach.de)

Please review our market information disclaimer.

Search

Enter search terms to find market research