Entering the European market for oleoresins

To enter the European oleoresins market, you must comply with European Union legislation as well as market requirements. Under stricter food safety regulations, organic certification of oleoresins may become a minimum requirement. Stay informed about your competitors and alternative products, as the competition is rapidly evolving. Securing a reliable source of raw materials will protect your business and partners from increasing price fluctuations.

Contents of this page

1. What requirements must oleoresins comply with to be allowed on the European market?

What are mandatory requirements?

Ensuring food safety is a top priority in Europe. The General Food Law, which applies to all food products and food ingredients, including oleoresins, ensures that all food is safe to consume. As an exporter of oleoresins from a developing country, you must comply with this law, which is the general framework for food regulation in the European Union.

Tips:

- For further information about requirements that apply to your business, read the CBI buyer requirements study for the natural food additives sector.

- If your oleoresin is used for colouring purposes, such as paprika oleoresin, read the market entry chapter of the CBI product factsheet for natural food colours, which has more information about applicable legislation.

Flavouring legislation

EU Regulation (EC) No 1334/2008, also known as The Flavouring Regulation, contains general rules for flavourings and food ingredients with flavouring properties used in and on foods. Under this law, oleoresins are classified as natural spice extracts, as they are 100% extracted from the original plants.

Regulation (EC) No 1331/2008 defines a common authorisation procedure (CAP) for food additives, food enzymes and food flavourings. This describes the procedure for updating the relevant EU lists. For the full list of flavourings and source materials, see Annex I of Regulation (EC) 1334/2008.

Due to the strict authorisation procedure, it is becoming increasingly difficult to export small volumes of new oleoresin flavourings to the European market. Keep in mind that obtaining approval is a long and expensive process and will likely require the involvement of your European buyer.

Tips:

- For more information about European flavouring legislation, visit the European Flavour Association website and read the Guidance Document.

- Visit the EU food flavourings database to see which oleoresins are authorised in the EU.

Impurities, contamination and pesticides residues

The EU legally requires proof that your oleoresins are not contaminated with or contain a maximum level established for elements in three categories:

- Physical –plastic, metal and dirt residues

- Chemical – pesticides

- Biological – bacteria

Thus, you must prove your oleoresins are free from contaminants in these three categories or are within the levels set by the EU. Products that do not fall within food safety limits are reported through the European Union Rapid Alert System for Food and Feed (RASFF) and can be recalled from the market. This results in costs and reputation damage for both the supplier and the European buyer.

Regulation (EC) No 1881/2006 defines specific contaminant levels for groups of foodstuffs. However, any contaminated product can be rejected by buyers or banned by EU authorities. Some of the regulated contaminants are nitrate, mycotoxins and metals such as lead, cadmium and mercury.

Maximum residue levels (MRLs) for pesticides on food are regulated by Regulation (EC) No 396/2005. The limits on raw materials also apply proportionally to oleoresins. Pesticide residues can be a problem for European buyers of oleoresins. Because extracts have higher residue concentrations than the raw material, pesticide residues pose a big challenge in spice oleoresins. This makes it very important to secure good-quality raw materials and keep monitoring and testing your products. The sector is increasingly using organically grown plants to avoid pesticide residue contamination.

Tips:

- Use the EU’s MRL database to identify the maximum residue levels (MRLs) applicable to your oleoresin and its source materials.

- Visit the European Union’s Access2Markets Portal for further information about MRLs.

- Review the FAO’s Integrated Pest Management approach to reduce pesticide use in your raw material production.

Extraction solvents

To ensure consumer safety, the EU regulates the use of extraction solvents in food production. Authorised solvents and their conditions of use, along with their maximum residue limits are outlined in EC Directive 32/2009. You must therefore only use solvents in accordance with the conditions of use per foodstuff or food ingredient. The EU’s authorised solvents for oleoresin extraction in compliance with Good Manufacturing Practices are the following:

- propane

- butane

- ethyl acetate

- ethanol

- carbon dioxide

- acetone

- nitrous oxide

In addition, Parts II and III of Directive 32/2009 list extraction solvents whose conditions of use are specified to ensure they are not a danger to human health. For example, the EU permits the use of methanol and propan-2-ol for all uses when residues of these two solvents do not exceed the maximum residue level (MRL) of 10mg/kg.

There has been growing consumer demand for natural foods and ingredients in Europe in recent years. Industry feedback is that this trend is set to continue. Thus, European buyers prefer to source products extracted by means of naturally occurring solvents, such as carbon dioxide and ethanol.

Tip:

- Take extra precaution and care when handling solvents, such as hexane, because they are dangerous and can be difficult to handle.

Labelling and packaging

To enter the European market, your oleoresins must comply with EU labelling law for food flavourings. These rules are described in Chapter IV – LABELLING of Regulation (EC) No 1334/2008.

Flavouring legislation defines requirements for manufacturers of flavourings and finished food products. This includes specific requirements for the use of the term ‘natural’ on labels. The designation ‘natural flavouring substance(s)’ may only be used if the flavouring component contains exclusively natural flavouring substances. Flavourings may be labelled ‘natural’ only if the flavouring component consists of all-natural flavouring preparations and/or flavouring substances.

If you export EU organic certified oleoresins, you must comply with organic labelling requirements as well. You must display where the agricultural raw materials composing the product have been farmed and the code number of the certification body next to the EU organic logo.

The EU’s classification, labelling and packaging (CLP) regulation (Regulation (EC) 1272/2008) introduced the Globally Harmonised System (GHS) of international recommendations. The aim is to maintain a high level of protection for human health and the environment. Under this regulation, manufacturers have to identify hazardous chemicals and inform users about their hazards through standard symbols and phrases. Some oleoresins are classified as hazardous and chemical substances. If your oleoresins are classified as hazardous, the EU legally requires you to comply with the CLP Regulation to enter the European market. Figures 1 and 2 show examples of standard CLP pictograms used for some oleoresins.

Figure 1: Hazard symbols for pepper (Piper), P. methysticum, extraction oleoresin

Source: C&L Inventory, 2022

Figure 2: Hazard symbols for ginger oleoresin

Source: C&L Inventory, 2022

CLP regulation requires you to package your oleoresins in a way that contents cannot escape. Your packaging must therefore be strong, solid and resistant to damage from its contents.

To maintain the high quality of your oleoresins, use appropriate packaging materials in accordance with CLP. You should therefore consider:

- Using food-grade containers made out of materials that do not react with oleoresins, for example glass, aluminium, lined or lacquered steel.

- Filling the headspace of your container with a gas that does not react with oleoresin, for example, carbon dioxide and nitrogen. Headspaces left with oxygen for a long time can have a detrimental effect on product quality.

- Using clean packaging material at all times to avoid contamination of your oleoresin.

Further to the EU’s mandatory labelling and packaging requirements, European buyers of oleoresins may have additional preferences in line with the regulation. You should therefore speak to your buyers to confirm their preferences. Some European buyers for example recommend the use of galvanised drums for oleoresins and advise against polypropylene and other plastic materials.

Tips:

- Check the Classification and Labelling database (C&L Inventory) on the European Chemicals Agency (ECHA) website to see if your oleoresins are classified as hazardous.

- Familiarise yourself with the comprehensive guidance on CLP provided by ECHA.

- Ensure certified organic oleoresins and conventional oleoresins are separated physically to prevent contamination.

Documentation

European buyers of oleoresins often require exporters to provide organised and well-structured product and company documentation. Complete and up-to-date documentation strengthens business credibility and makes you look organised and well prepared.

Oleoresin exporters are usually expected to provide European buyers with:

- Safety data sheets (SDS) – This contains a product description, classification, hazard identification, and information on safety measures.

- Technical data sheets (TDS) – This contains a product description, product classification, quality analysis, information on applications, and certificates.

- Certificate of analysis (COA) - This contains analytical data from the product delivered. The COA should match data mentioned in the TDS, the pre-shipment sample approved by the buyer, and contractual agreements with the buyer.

Tips:

- Consider having SDS, TDS and COA ready for European buyers of oleoresins.

- Review these examples of a safety data sheet (SDS) for turmeric oleoresin, certificate of analysis (COA) for black pepper oleoresin and a technical data sheet (TDS) for paprika oleoresin.

Certifications

Besides implementing HACCP principles in line with EU legislation, European buyers of oleoresins often demand additional certifications showing food safety compliance and quality management. The most common certification bodies and standards are: the International Organization for Standardization (ISO 22000, ISO 9001), Food Safety Systems Certification (FSSC 22000), British Retail Consortium Global Standard (BRCGS), International Featured Standards (IFS) and certifications recognised by the Global Food Safety Initiative (GFSI). Halal and Kosher certifications are also relevant for the food and beverage industry.

More buyers are also demanding certification of good and sustainable farming practices for the raw materials of your oleoresins. Most common are Global G.A.P. and the Farmer Sustainability Assessment (FSA).

In addition to certifications, some buyers visit suppliers on-site to conduct audits and start a business relationship. For an example, see how Henry Lamotte Oils GmbH, a German company that sources oleoresins from developing countries, works with their suppliers.

Tip:

- Before getting certified, research your target market and talk to potential buyers about their specific certification requirements.

Quality and consistency requirements

The physical aspects of oleoresins are what European buyers mostly use to determine their quality. Physical analysis focuses on three aspects — colour, flavour and purity — whose importance depends on the final application of the oleoresin.

Curcumin content is the main quality factor for turmeric oleoresins, which are used for their colouring properties. For paprika oleoresins, colouring properties as measured using ASTA colour values, and capsaicin contents, which determine spiciness, are the most important aspects. To ensure that oleoresins with colouring effects, such as turmeric and paprika, contain no added synthetic dyes, European buyers may require certificates from licensed laboratories or do their own additional testing.

Most of the differences in quality requirements concern oleoresins’ oil content, which determine flavour profile. For example, some black pepper oleoresin buyers require an oil content of 20%, whereas other buyers require an oil content of 25%, which provides a stronger flavour profile.

In general, oleoresins used in food must be 100% pure from the named plant they are extracted from. For example, 100% paprika oleoresins must come from fruits of Capsicum annuum Linn or Capsicum frutescens. However, sometimes it may be suitable to add other ingredients, such as edible oils, to make oleoresins smoother and more user-friendly. This is the case for black pepper oleoresin. Keep in mind that if you mix your oleoresin with other ingredients, you must label it as a ‘blend of oleoresins’.

Consistency is one of the most important aspects for European buyers, so the use of standardised production processes is key.

Tips:

- Ask your buyers about specific quality requirements they expect you to meet.

- Be prepared to provide buyers with certificates and documentation showing you comply with their quality specifications.

Payment and delivery terms

There are several methods of payment available to choose from. Letters of Credit (LC) are considered to be the safest payment term for both exporters and importers. Dependent on their needs, exporters and importers can choose from a number of LC payment terms.

European buyers have different payment terms depending on how well they know the supplier. Talk to your buyers to learn about different options now and in the future. Once buyers feel they can trust the quality of your products and reliability of your supply, they usually offer better payment terms, including advance payments.

When negotiating delivery terms with European buyers, carefully consider time, volume and cost. It is important to note that the COVID-19 pandemic is still affecting the international movement of goods, due to lockdowns and port congestions. Keep this in mind when discussing delivery terms with your European buyers.

Tips:

- See the CBI study on organising your natural food additives exports to Europe, which provides useful guidance on available payment and delivery terms used in this sector.

- Speak to your logistics provider about current logistics disruptions before agreeing delivery terms with European buyers.

What are requirements for niche markets?

Organic certification and sustainability

Organic certification is gradually becoming a basic requirement in the natural flavours market. Besides, environmental and ethical benefits are not the only reason for the trend towards organically grown products. Another key factor driving the increasing popularity of organic certification among buyers is the effort to reduce product contamination with pesticide residues and impurities. Since extraction processes often increase the potency of even small levels of pesticides in the botanical sources of oleoresins, exporters in developing countries should consider switching to organic farming.

Besides organic certification, compliance with sustainability standards is increasingly important for European buyers and consumers. Corporate social responsibility (CSR) strategies and voluntary sustainability standards are now common practice in the sector. This is partly due to consumer desire for sustainable food, but also to new European regulations. The European Green Deal and its Farm to Fork Strategy are being implemented EU-wide to create a fair, healthy and environmentally-friendly food system. This new set of laws will also impact your business as a supplier. To learn more, read the CBI study on how the EU Green Deal will impact your business.

Most buyers ask suppliers to uphold a supplier code of conduct based on the UN Global Compact principles or the Ethical Trading Initiative Base Code. Key elements include human rights and fair working conditions and wages. The Business Social Compliance Initiative (BSCI) and the Supplier Ethical Data Exchange’s (Sedex) social auditing methodology (SMETA) are also commonly used by natural ingredient companies with global supply chains. If you wish to supply companies that use this methodology, becoming a Sedex certified member could give you a competitive advantage.

Depending on the plant used for your oleoresin, the FairWild standard for wild-harvested plant ingredients is another option to show compliance with responsible sourcing of raw materials.

Tips:

- Display your certifications, CSR initiatives and voluntary sustainability standards on your website and marketing materials.

- Consider recycling or re-using packaging materials, as environmental sustainability is becoming increasingly important for European buyers.

- Look at the supplier codes of conduct and responsible sourcing policies of potential European buyers of your oleoresins. For example, Döhler’s code of conduct for suppliers and Firmenich's Responsible Sourcing Policy.

2. Through what channels can you get oleoresins on the European market?

How is the end market segmented?

The European end market for oleoresins can be segmented by industry: the food and beverage industry, the health products industry and the cosmetics industry.

Figure 3: End-market segments for oleoresins

Template design from Slidesgo

Food and beverage industry

The global market for oleoresins was valued at US$1.43 billion in 2021, and is expected to grow at a compound annual growth rate of 6.9% between 2022 and 2030. Food and beverage applications dominated the market and accounted for half of its revenue share in 2021. Europe accounted for approximately one third of the global oleoresin market and offers growing opportunities for suppliers in developing countries. Increasing demand for natural flavouring and colouring agents is boosting demand for oleoresins in the European market.

The main applications of oleoresins in the food and beverage sector are in snacks, seasonings and condiments, ready meals, bakery goods, beverages and meat and seafood products. Pepper oleoresin, for example, is used by the food industry to add taste, but also as a colourant and preservative because of its anti-microbial properties. Paprika oleoresin and turmeric oleoresin are both mainly used as a flavouring agent and as a colourant. Meanwhile, capsicum oleoresin is mainly used to add flavour because of its stronger taste.

Health products industry

The pharmaceutical and nutraceutical industry uses oleoresins in its products because of its health-related properties. Consumer demand for medicinal formulations with health benefits is one reason pharmaceutical manufacturers are using oleoresins in new developments. Turmeric oleoresin, for example, is thought to have antioxidant benefits.

Applications in this segment are expected to grow globally at a compound annual growth rate of 7.2% between 2022 and 2030. Keep in mind, however, that to claim health benefits for oleoresins, you have to comply with specific EU requirements and legislation.

Cosmetics industry

The cosmetics industry uses oleoresins because of the subtle flavours and scents they impart, along with the consistency they provide. Oleoresins are found in cosmetic products such as lotions because of their water insolubility. They are also used as a fixative in perfumes and colognes. Oleoresins can also be used as a colourant. Paprika, for example, is used in products for its bright red or orange colour.

Keep in mind that oleoresins used for the cosmetics industry have to comply with specific requirements and legislation.

Tips:

- Assess the specific benefits and uses of your oleoresin to choose the right market segment and application for you.

- If you want to enter the cosmetics and health products segments, read the CBI studies about natural ingredients for health products and for cosmetics.

Through what channels do oleoresins reach the end market?

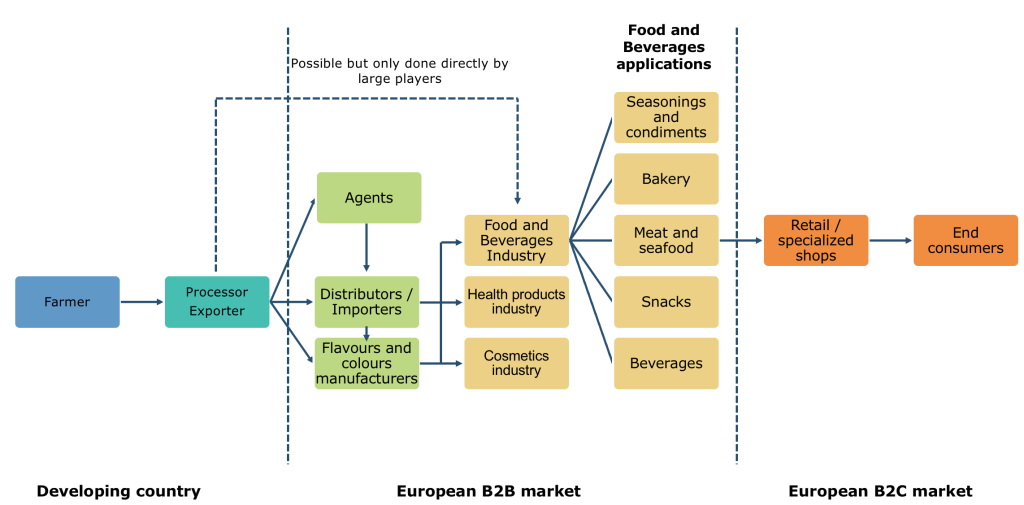

The food and beverage industry offers wider opportunities for oleoresin suppliers from developing countries and is the focus of this study. The main channels for entering this end-market segment are importers and distributors, flavouring and natural colours manufacturers, and agents.

Figure 4 shows the export value chain for oleoresins to enter the European market.

Figure 4: Export value chain for oleoresins

Importer or Distributor

As a processor or exporter of oleoresins, European importers and distributors are an interesting entry point to the European market. European importers and distributors typically deal with a wide range of natural ingredients. Their expertise lies in the global sourcing of natural ingredients, ensuring quality, documentary and regulatory compliance. Importers and distributors sell to flavouring, natural colours, and food and beverage manufacturers. They usually have storage warehouses for ingredients as well as their own laboratories to do quality checks. Some also process sourced products further to offer custom solutions for food and beverage manufacturers.

Leading importers and distributors of oleoresins on the European market are located in Germany, Spain, the Netherlands, France, Belgium, Austria and Poland. Leading companies include British Pepper and Spices (United Kingdom), Diego Pérez Riquelme e Hijos and Disproquima (Spain) and Roeper, Rüther Gewürze GmbH and Henry Lamotte Oils GmbH (Germany).

Flavouring and natural colours manufacturer

As a processor or exporter of oleoresins, flavouring and natural colours manufacturers are another interesting entry point to the European market.

Natural colours manufacturers mainly buy paprika and turmeric oleoresins, which are further processed to create blends or custom solutions for food and beverage manufacturers.

Flavouring manufacturers buy different oleoresins based on their flavour characteristics. They blend them together to make distinct flavour profiles for different segments of the food and beverage industry. Givaudan and Symrise are two leading flavouring and natural colours manufacturers in the European market.

Agent

An export agent is a firm or an individual that undertakes the majority of exporting activities on behalf of an exporter for a commission. Agents can be found in developing countries as well as in Europe; however, it is not that common for companies to use agents in the European market. As an exporter in a developing country, you can work with agents who represent and act on your behalf on the European market.

Tip:

- If you are struggling to find reliable buyers, use an agent to put you in touch with those most suitable for you.

What is the most interesting channel for you?

Importers and distributors, as well as natural colours and flavouring manufacturers, are an interesting channel for your European market entry.

Importers and distributors are the most interesting channel because they specialise in importing and distributing oleoresins in the European market, have a good understanding of the European natural food ingredients market and a wide range of customers. In addition, importers and distributors have storage facilities and an established logistics network. When combined all together, this can be very helpful to small and medium-sized exporters of oleoresins in a developing country, like you.

Another potential channel is natural colours and flavouring manufacturers. These include medium-sized natural colours manufacturers that buy oleoresins directly from the source and supply custom solutions to the food and beverage industry. Some examples are Bart (Poland) and Holland Ingredients (the Netherlands). The flavour industry, which is more relevant for oleoresins, includes both vertically-integrated global companies as well as small and medium enterprises and family-owned businesses. In fact, the latter make up the majority of members of the European Flavour Association. These companies may be interested in sourcing directly from developing countries, rather than through distributors, in order to shorten their supply chains and develop their own solutions for the food and beverage industry.

Interesting flavour manufacturers include Doehler (Germany), Nactis (France) and Treatt (United Kingdom).

Tips:

- Read the CBI study on tips for finding buyers in the European natural food additives market.

- Visit the websites of different national flavour associations in Europe. For example, the Dutch Association of Flavours and Fragrances (NEA), the UK Flavour Association and the Association for Food Aromas in France. The European Flavours Association also has a list of its members that is used by buyers.

- See the exhibitor lists and visit relevant trade fairs for natural ingredients, such as Fi Europe. Other trade fairs such as Anuga, SIAL and Biofach (for organic products) can also offer excellent insights on food and beverage players and trends.

3. What competition do you face on the European oleoresins market?

More than 60% of European imports of oleoresins come from developing countries. Oleoresins imports stayed stable over the past five years. In 2020, COVID-19 negatively impacted import volumes of oleoresins and other natural ingredients. However, the market started to recover in 2021 and volumes have been increasing again. Figure 5 shows a worldwide map of oleoresin suppliers to Europe.

Which companies are you competing with?

As shown in Figure 6, India, China, Sri Lanka, the United States, Lebanon and Indonesia were the main non-EU suppliers of oleoresins to the European market in 2021. Government support and improving infrastructure are some of the key strengths shared by developing countries that successfully export oleoresins to the European market.

India

Eurostat data shows India was the largest exporter of oleoresins to Europe in terms of volume in 2021. India is an established player in the oleoresins market, with a few companies, such as Akay Group and Synthite Industries, accounting for a major share of the global spice oleoresin market. India has favourable climatic and soil conditions for growing spices and semi-tropical herbs, making it a leader in spice production. However, seasonal and agro-climatic conditions have led to spice shortages, forcing Indian oleoresin processors to import spices from elsewhere. They must then re-export their value-added product within 120 days or pay a duty of 70% of the import value. This situation is affecting several oleoresin processors. Increased prices for raw materials, thin margins, rising production costs and increasing competition from China are other key challenges to India’s oleoresin industry.

European buyers of oleoresins from India have on the whole reported positive experiences. They see the country as mainly a supplier of pepper oleoresin, with few big players dominating the market, some of which sell directly to the food and beverage industry.

China

In terms of volume, Eurostat data shows China was the second-largest exporter of oleoresins to Europe in 2021. China has an established commercial oleoresin industry. In recent years, foreign companies have been setting up oleoresin production facilities in China, thanks to greater raw material availability and lower production prices. China grows spices, but also buys raw material from all over the world, including Africa.

European buyers of oleoresins from China have reported positive experiences, including the ability to provide large volumes and good-quality products. China is perceived by many oleoresins buyers as the new leading supplier, taking the place of India. However, European buyers have expressed concerns about human rights violations in China, especially in the region of Xinjiang. In addition to conducting regular social audits in Chinese fields and factories, European buyers are therefore continuing to diversify supply countries. African countries such as South Africa, Zambia, Malawi and Zimbabwe are being explored as possible sources for paprika oleoresin, which is the main product sourced from China.

Sri Lanka

Sri Lanka was the third-largest exporter of oleoresins to Europe in terms of volume in 2021 and it is the ninth most important spice exporting nation worldwide. Oleoresin exports are actively promoted by the Sri Lankan Export Development Board. Trade fair participation, market information and an online exporter directory are among the services offered to facilitate entry to the European market.

Sri Lanka has favourable climatic conditions, fertile and diverse soil types for growing a variety of spices. Cinnamon, pepper and cardamom are the main spices grown in commercial quantities. However, one of the main challenges faced by the Sri Lankan spice industry is the lack of technology and mechanisation to produce essential oils and oleoresins, particularly in the small-scale processing sector. Other challenges at the sector level include shortage of labour, lack of formal training to enhance the skills of the existing workforce and inadequate standards and codes of conduct to maintain best quality and traceability. At country level, the ongoing political and economic crisis is also a threat to Sri Lankan exporters.

United States

The United States was the fourth largest exporter of oleoresins to Europe by volume in 2021. The majority of these exports went to the Netherlands. However, most of these US exports are likely intra-company exports. DSM, for example, is based in the Netherlands and also operates in the United States. Moreover, there have been several mergers and acquisitions among global players in the natural colours and flavour industries that could also explain these intra-company exports. For example, in 2020, Givaudan acquired Ungerer & Company, as US company specialised in flavour, fragrance and specialty ingredients.

The prices of oleoresins imported from the United States are also higher than those from other non-EU countries supplying the European market. This may indicate a higher-quality product.

Lebanon

Eurostat data shows Lebanon was the fifth-largest exporter of oleoresins to Europe in terms of volume in 2021. Lebanon supplies buyers in the Netherlands, the United Kingdom, Germany and France. Initiatives such as QOOT, the country’s first agri-food innovation cluster set up in collaboration with Berytech and the Embassy of the Netherlands, are actively promoting small and medium Lebanese agri-food enterprise exports to Europe.

Although Lebanese suppliers may not be able to compete with countries such as India and China in terms of volumes, the country has the potential to enter niche and specialised markets. A big challenge, however, is the impact climate change is having on Lebanon’s agricultural sector. The country is also experiencing a major financial crisis, while still recovering from the Beirut port explosion of 2020 and effects of COVID-19.

Indonesia

Eurostat data shows Indonesia was the sixth-largest exporter of oleoresins to Europe in terms of volume in 2021. Indonesia has an established oleoresin industry. In recent years, experts have seen a trend of oleoresin manufacturers being attracted to major spice producing countries, such as Indonesia, because of greater raw material availability and lower prices.

Indonesia’s favourable climatic and geographical conditions make it a leading global producer of spices, particularly pepper, nutmeg and cinnamon. The Indonesian government also supports the country’s spice industry. However, challenges facing Indonesia’s spice industry, which affects its oleoresin industry, include ageing plants, shrinking plantations and a lack of knowledge of proper cultivation and post-harvest management procedures among local farmers.

Tips:

- Find out if your country has programmes that support the production and export of natural ingredients and oleoresins. Government export promotion agencies, the ministry of trade or equivalent in your country usually provide assistance to exporters.

- Position yourself against competing countries by highlighting your competitive advantages. Showing your sustainability compliance or producing organic oleoresins may be a key differentiator in the industry.

- Sign up for specialised sector newsletters, such as Food Ingredients First, to stay informed about new supply countries, competitors and trends.

Which companies are you competing with?

There are several well-established companies from China, India and Sri Lanka in the European market. To compete with them, you should offer a differentiated product and work on defining your unique selling points.

Indian companies

Synthite Industries Pvt. India is estimated to control more than 30% of the global market for oleoresins. It is a well-established Indian company exporting oleoresins to the European market. They export a range of high-quality oleoresins with different food safety and quality management certifications, such as FSSC 22000, ISO 9001 and ISO 14001:2015. The last of these demonstrates that they have an environmental management system in place.

To meet market requirements to decrease solvent use and extract higher-quality oleoresins, Synthite Industries also uses specialised technologies such as Supercritical CO2 Extraction and Centritherm®.

Chinese companies

Hebei Tianxu Biotech Co., Ltd is an experienced Chinese company exporting oleoresins to Europe. Their products include capsicum oleoresin and black pepper oleoresin. The company is ISO 9001-certified and has its own laboratory to test the quality of its products.

Hebei Tianxu Biotech Co., Ltd is listed in the Ingredients Network, a supplier database set up by Informa that receives over 500,000 online visitors. They also recently participated in Hi & Fi Asia-China, an international trade fair for the food and health industry and a good place to connect with European buyers interested in sourcing specifically from Asia.

Sri Lankan companies

H.D.DE SILVA & SONS (PVT) LTD is a well-established Sri Lankan company exporting oleoresins to the European market. One of the company’s key strengths is its ability to export a wide range of organic and conventional oleoresins. The company and its products are certified under international standards relevant for the European market, such as ISO 22000, FSSC 2200, SMETA, Kosher and Halal.

To ensure product consistency and quality, they also have their own laboratories. Moreover, the company exhibits at leading international trade fairs such as Fi Europe, which is a good place to find buyers and assess the competitive landscape.

Tips:

- To differentiate yourself from competitors, consider entering niche markets, such as organic oleoresins, where competition and supply are still low and demand is expected to grow.

- To attract international buyers, make sure you have a professional and up-to-date website. For an example, see EOAS Organics in Sri Lanka.

- Consider taking ITC’s free online course on setting up an Export Marketing Strategy to help you stand out from the competition.

Which products are you competing with?

Spices

Spices such as turmeric, ginger, cinnamon and chilli, also available in fresh or dried form, are competing products for oleoresins.

However, oleoresins provide several advantages over conventional forms of herbs and spices, especially for their use in the food and beverage industry. Oleoresins’ flavour is about 5 to 20 times stronger than that of the corresponding herbs and spices on a per kilo basis. As an example, 5–10 kg yield of oleoresin can replace the equivalent of 100 kg of black pepper spice. Oleoresins can also be standardised for flavour, have longer shelf life than spices in fresh or dried form, and are free from microorganisms and enzymes.

The impact of climate change on spice cultivation and production, which can lead to a lack of availability and increase in prices is a key disadvantage that both spices and oleoresins face. For example, Indian turmeric prices went up in 2021 due to rains and increased demand.

Essential oils

Essential oils such as black pepper, citrus, lavender, peppermint, oregano and thyme, which are commonly used in the food industry are competing products to oleoresins. Strengths of essential oils include their strong aromatic effects, as well as their stronger flavour when compared to oleoresins.

However, oleoresins have advantages over essential oils. First, fewer low flavour notes are destroyed during its extraction than during the steam distillation of essential oils. In addition, heavy oils of oleoresins contain some important flavour notes that are not present in oils. For example, compared to black pepper oil, black pepper oleoresin contains the pungent crystalline material piperine along with other low flavour and top flavour notes.

Synthetic ingredients

Synthetic ingredients used to add flavour in the food industry are competing products to oleoresins. The advantages that synthetic ingredients have over oleoresins include consistency of quality and greater reliability of supply, as they are not dependent on weather conditions and harvests. In addition, depending on their application in the food industry, synthetic ingredients can be modified by formulators.

European food manufacturers are replacing synthetic and harmful ingredients due to the rising health consciousness of European consumers and their willingness to spend more on high-quality products. European buyers foresee that the trend towards natural products in the flavours sector is expected to continue in the near future. This presents an opportunity and an advantage for oleoresins.

Tips:

- Familiarise yourself with products competing with oleoresins that are available in the European market. For example, read the CBI study on Exporting essential oils for food to Europe.

- Position yourself against competing products by highlighting the strengths of your company and your oleoresins to European buyers. High-quality products, backed by technical information and certifications, are key to showing your compliance.

4. What are the prices for oleoresins on the European market?

Price fluctuations are one of the largest threats facing the European oleoresin market. Unreliable supplies of plant material are the main factor behind oleoresin price variations. Climate change, transportation restrictions and shortages of packaging materials are some elements affecting the availability of raw material. The harvest of many spices, including black pepper, cardamom, coriander, cumin, turmeric and others, has been heavily affected by weather changes.

The COVID-19 pandemic worsened pre-existing procurement and logistics challenges in the oleoresins supply chain. Lockdowns and prevention measures that are still in place in some countries are disrupting the global supply chains of several food ingredients. Prices are reflecting this situation, and may continue to do so in the coming years.

Figure 7 shows European import prices for oleoresins from the six leading non-EU suppliers between 2017 and 2021. In 2021, the average import price was €20 per kilo. Leaving out the United States, the average was €16, with Indonesia and Lebanon pulling down this price. It is important to note that this is an aggregate price for oleoresins from all plants and spices, as the HS code used to calculate import prices includes all oleoresins. This data is therefore an approximation; specific prices will vary per oleoresin.

Tips:

- Carefully calculate the price breakdown of your oleoresins before setting and agreeing prices with European buyers to avoid incurring financial losses.

- Monitor the price dynamics of your raw materials. As an example, read these price insights about cumin and turmeric.

- To find current price information on oleoresins, visit international B2B portals such as Alibaba.

This study was carried out on behalf of CBI by Dana Chahin in collaboration with Global Trade Promotion partners.

Please review our market information disclaimer.

Search

Enter search terms to find market research