Exporting paprika oleoresin to Europe

Paprika oleoresin fits very well within the clean labelling trend in Europe. However, European buyers have difficulty securing paprika oleoresin of good quality. If you are able to guarantee consistent quality and quantity of paprika oleoresin, you can explore the many opportunities that the European market offers.

Contents of this page

- Product description

- What makes Europe an interesting market for paprika oleoresin?

- Which requirements must paprika oleoresin comply with to be allowed on the European market?

- Which additional requirements do buyers often have?

- What are the requirements for niche markets?

- What competition do you face on the European market for paprika oleoresin?

- Through which channels can you get paprika oleoresin on the European market?

- What are the end-market prices for paprika oleoresin?

1. Product description

Paprika oleoresin is an oil-soluble extract from the fruits of Capsicum annuum Linn or Capsicum frutescens (Indian red chillies), which is primarily used as a colouring and/or flavouring in food products. Paprika oleoresin is famous for its colouring properties, due to the content of carotenoid pigments. Major colouring pigments of paprika oleoresin are Trans Capsanthin, Capsanthin 5, 6 – Epoxide, Beta Cryptoxanthin, Beta Carotene, Zeaxanthin, Antheraxanthin, Violaxanthin, Capsorubin or other Carotenoids (Lutein, Neoxanthin, and so on).

Foods that are coloured with paprika oleoresin include cheese, orange juice, spice mixtures, sauces, sweets and emulsified processed meats. Paprika oleoresin also contains capsaicin, which is the main flavouring compound that gives a pungent taste in higher concentrations.

Codes for paprika oleoresin

- CAS numbers: 84625-29-6 (extracts from Capsicum annuum) and 84603-55-4 (extracts from Capsicum frutescens). In practice, the latter CAS number is commonly used for paprika oleoresin containing capsaicin. Capsaicin provides a pungent, hot taste;

- Harmonised System (HS): No separate code for paprika oleoresin. Paprika oleoresin is included in 32030010 (i.e. colouring matter of vegetable origin);

- E number for paprika oleoresin classified as a food additive instead of a food extract with colouring properties: 160c.

2. What makes Europe an interesting market for paprika oleoresin?

Demand for colouring paprika increases

According to Grand View Research, the European oleoresin market value amounted to € 126 million in 2015. The European market for paprika oleoresin is a relatively large market compared to markets for other oleoresins. Paprika oleoresin accounts for an estimated 25% of the total oleoresin market value. The volume of European consumption is estimated at around 2,000 tonnes.

An increased demand for natural food extracts with colouring properties is one of the drivers behind the increase in the demand for paprika oleoresin. Food extracts with colouring properties, as opposed to ingredients classified as food additives, benefit from a consumer demand for natural products and clean labels. Clean labels do not contain E numbers for food additives or names of ingredients which consumers perceive as unnatural.

Salt reduction is another significant driver of the increase in the demand for paprika oleoresin. Many Europeans consume more salt than is healthy for them. Therefore, the demand for products containing less salt is strong. In response, many food manufacturers aim to reduce salt in their products. As they do not want to compromise on taste, they use other ingredients to mask the salt reduction. Paprika oleoresin can offer this function.

The European Food Safety Authority’s approval of a preparation containing paprika oleoresin for use as a feed additive for chickens may stimulate the demand for paprika oleoresin in the next years.

Tips:

- Read our study of buyer requirements to find out whether your extract can be classified as a food extract with colouring properties according to European legislation. If your extract classifies as a food extracts with colouring properties, promote clean labelling opportunities for food manufacturers.

- Raise awareness about the potential of paprika oleoresin for salt reduction and enable easy substitution.

- Obtain Organic certification to strengthen the image of your paprika oleoresin as a natural product and benefit from the promotional value. You will have to use organic extraction solvents for your certification.

- Maximise the stability of paprika oleoresin in order to enable food manufacturers to use this product instead of synthetics.

Europe needs imports to meet demand

Globally, paprika oleoresin production is strongly related to paprika powder production. High prices for paprika powder (e.g. before harvest of next crop) decrease the economic attractiveness of paprika oleoresin extraction.

As paprika can grow in Europe and harvesting can be done mechanically, domestic production is considerable. However, oleoresin extraction is limited, as most paprika is destined for the fresh market or dried and marketed as paprika powder.

Spain, a major paprika producer, also imports dried paprika for oleoresin extraction. Spain has more extraction capacity than its production of paprika for oleoresin extraction. Evesa and Ingredientes Naturales Seleccionados are the leading oleoresin producers in Spain. Evesa has a processing capacity of 300 tonnes annually.

Most European demand for paprika oleoresin is estimated to be met by imports. Globally, an estimated 7,000–8,000 tonnes of paprika oleoresin are produced annually. India, Spain, China and Peru are among the major suppliers of oleoresin to Europe.

In 2015, Indian production amounted to 3,100 tonnes. Due to low prices since 2013, farmers in the aforementioned countries are switching to other crops, so supplies of paprika and paprika oleoresin are decreasing. This trend offers a good moment for new suppliers to enter the market.

North-western European countries such as Germany are estimated to account for most European imports of paprika oleoresin.

Tips:

- Find out how your product compares to Spanish paprika oleoresin and what your unique selling points (USP) are.

- If you are based outside the traditional supplying countries, stress that you offer an alternative source of paprika oleoresin in your promotion.

- Focus your promotion efforts on north-western European countries or establish a strategic alliance with Spanish producers.

3. Which requirements must paprika oleoresin comply with to be allowed on the European market?

Food safety

Food processors must have a food safety management system in place based on HACCP principles. These systems require that companies demonstrate their ability to control food safety hazards in order to ensure that food is safe at the time of human consumption. Furthermore, products must be traceable throughout the supply chain. If European companies or authorities find out that the safety of your product cannot be guaranteed, they will take the product off the market and will register it in the EU’s Rapid Alert System for Food and Feed.

Tip:

- Search the EU’s Rapid Alert System for Food and Feed (RASFF) database to see examples of withdrawals from the market and the reasons behind these withdrawals.

Contamination

The EU has laid down maximum levels of contaminants, pesticides and criteria for the microbiological contamination of food.

Tips:

- Minimise contamination of your product during growing, processing, packaging, transport and storage.

- Do not make excessive use of chemicals. If the paprika for your oleoresin has been treated with pesticides, verify that the residues are within legal limits. Use the EU Maximum Residue Level (MRL) database to find out which MRLs are relevant for your product.

- Safeguard hygiene in your facilities.

- Pay attention to drying and storage in order to minimise microbiological contamination.

- Take note of stricter legislative requirements regarding microbiological contamination, which may cause countries which traditionally focused on the spice market to switch to the oleoresin market. Solvent extraction can reduce microbiological activity but requires greater investments.

Extraction solvents

There are EU rules for the marketing and application of extraction solvents used in the production of foodstuffs and food ingredients.

Tip:

- Minimise residues of extraction solvents in the paprika extract and ensure that they do not present a danger to human health. Learn more about this topic on the EU website about extraction solvents.

4. Which additional requirements do buyers often have?

Food safety certification

As food safety is a top priority in all EU food sectors, you can expect many players to request extra guarantees from you in the form of certification. In particular, many European food manufacturers require their suppliers to implement one of the following HACCP-based food safety management systems: BRC, IFS, ISO 22000 or SQF.

Tip:

- Visit the website of the Global Food Safety Initiative and the Standards Map for more information on food safety management systems. Also find out whether the buyers that you target require certification and which food safety management system they prefer.

Religion

European buyers commonly require certificates for compliance with kosher and halal requirements. This enables the food and beverage industry to use the ingredient in products targeted at a wide consumer group, including Jews and Muslims.

Tip:

- Obtain kosher and halal certificates. Often, this does not require changes in your processes. Refer to the Halal Authority Board or your certifier of choice for more information.

Documentation

Buyers need well-structured product and company documentation. Buyers generally require detailed Technical Data Sheets (TDS) and Material Safety Data Sheets (MSDS).

Tip:

- Make sure that you have documentation (e.g. certificates of analysis, SDS, food safety management certificates) available upon request. See our workbook for more information on preparing a TDS and SDS for natural ingredients.

Representative samples

Your sampling method should result in lot samples that represent what you can deliver in the quantity, quality and lead time as specified by the buyer.

Tip:

- Your sampling method should result in lot samples that represent what you can deliver in the quantity, quality and lead time as specified by the buyer.

Delivery terms

Pay attention to strict compliance with delivery terms as agreed upon with your buyer.

Tip:

- Familiarise yourself with international delivery terms.

Website

European buyers look for credible suppliers. You can improve the perceived credibility of your company by developing your website accordingly.

Tip:

- Somerex (Peru) is a paprika oleoresin supplier with a website that serves as a good example.

5. What are the requirements for niche markets?

Certified sustainable

Although many European buyers require their suppliers to address sustainability, only few of them require corresponding certificates. The demand for Organic certified paprika oleoresin is still very small. On the supply side, the limited availability of organic extraction solvents is a bottleneck for certification.

Logos of EU organic and Fairtrade International:

Tips:

- Only consider certification of organic or otherwise sustainable production if you specifically target the niche market for these products. In that case, you will have to comply with requirements in EU Directive 834/2007.

- Visit the ITC Standards Map for more information on certification schemes for sustainable production.

Quality requirements

European buyers determine the quality of paprika oleoresin mainly by physical and colour aspects. Physical analysis focuses on:

- microbiological activity;

- oil contents;

- solvent residue (in ppm).

Compliance with the limits for microbiological activity requires the application of high-quality standards during harvesting and processing. The prevention of contamination by mycotoxins is particularly challenging.

Methanol, hexane and isopropyl alcohol are solvents commonly used for paprika oleoresin extraction. Buyers require a minimum solvent residue.

The colour value (CV) defines the colour intensity of paprika oleoresin. Some buyers use ASTA units to measure colour intensity. The colour intensity can range from 10,000 to 140,000 CV or 250 to 3,500 ASTA units. Consistent colour intensity is crucial. Deviation from the buyer’s specification should be no more than 1,000 CV.

The properties of paprika oleoresin are primarily related to the origin of the raw material. However, the time between harvesting and extraction as well as the extraction method (pressure, time, temperature) also affect the properties.

Tips:

- Depending on the application of the oleoresin by the buyer as a food colouring and/or flavouring, you can add value to the product by separating the capsaicin from the carotenoid pigments.

- If you standardise the colour intensity with vegetable oil (e.g. sunflower oil), do not use oil from a genetically modified (GM) crop. Also inform your buyer about the vegetable oil.

- Provide a certificate of an accredited laboratory to prove the absence of forbidden dyes. Check whether the laboratory is acceptable for your buyer.

- Prevent adulteration and contamination by foreign materials (e.g. artificial colours or anti-oxidants) to preserve your reputation. Importers regularly analyse products for adulteration.

- Consider widening your product range by offering a water-soluble paprika oleoresin. You can add an emulsifier to achieve this. Inform your buyer about the emulsifier.

- Please refer to CBI Market Intelligence on chillies for information on chillies (i.e. paprika powder), including harvesting and grading.

Labelling requirements

Enable the traceability of individual batches, whether they are produced by blending or not.

Use the English language for labelling, unless your buyer has indicated otherwise.

Labels must include the following:

- product name;

- batch code;

- whether the product is destined for use in food products;

- name and address of exporter;

- best-before date;

- net weight;

- recommended storage conditions.

Paprika oleoresin is not defined as a hazardous material and does not require any hazard labelling.

Packaging requirements

Ensure the preservation of quality by:

- using clean food-grade containers of a material that does not react with constituents of the extract (e.g. lacquered or lined steel), aluminium or glass;

- filling the headspace in the container with a gas that does not react with constituents of the extract (e.g. nitrogen or carbon dioxide).

Enable the reuse or recycling of packaging materials by, for example, using containers of recyclable material (e.g. metal).

6. What competition do you face on the European market for paprika oleoresin?

Technological barrier to entry

Oleoresin extraction requires expensive equipment and considerable expertise. These present high barriers to entry, especially for small-scale paprika producers. For this reason, oleoresin production is concentrated in countries with an established paprika extraction industry.

Competition comes from many regions

The paprika oleoresin market is becoming a commodity market with fierce competition between six major regions producing paprika oleoresin in the world: India, China, Peru, the USA, Spain and South Africa. India is one of the largest suppliers to Europe. The following companies in India hold a major share on the European paprika oleoresin market: Synthite, Universal Oleoresins, Plant Lipids, Kalsec Natural Ingredients and Naturex.

The flavour and colour profiles of paprika differ between origins. Depending on a buyer’s requirements, specific origins can be preferred. For example, Indian producers often use red chilli peppers with a high capsaicin content, which gives a pungent taste to the oleoresin. Indian processors separate the capsaicin from the colouring paprika oleoresin, as food manufacturers usually want a colour without pungency.

In terms of stability under different heat and light conditions, Peruvian and Chinese paprika oleoresin do not perform very well. India’s paprika oleoresin is better in that respect and Spain produces the most stable paprika oleoresin.

Availability is a competitive advantage of Peru. Peru can produce paprika oleoresin almost year-round (January–October). In India, the harvests take place in January and April.

Paprika oleoresin from African origins has a bad reputation with respect to microbiological activity.

Competition from other products

Paprika oleoresin, when used as a colouring, is difficult to replace. Nonetheless, annatto and cochineal can sometimes replace paprika oleoresin, as they are also natural reds.

In many applications, paprika oleoresin is easier to use than paprika powder. Oleoresin dissolves notably better in oily liquids.

Switching costs for European buyers are relatively high, because of high costs for product analysis as part of the supplier audit.

Tips:

- Select a paprika variety with an optimal balance between yields and preferred properties. If you want to avoid competition with India, select a variety with less residual pungency, better colour intensity and/or high stability.

- Promote the ease of use for oleoresin and the possibility to replace paprika powder.

- Suppliers of paprika or paprika powder can cooperate with specialised extraction companies (in other countries) if they are unable to do the extraction themselves.

- Producers using red chilli peppers must reduce capsaicin content if they aim to supply food manufacturers which need oleoresin with low residual pungency.

- The off-seasons in traditional countries of origin, including Spain, offer windows of opportunity.

7. Through which channels can you get paprika oleoresin on the European market?

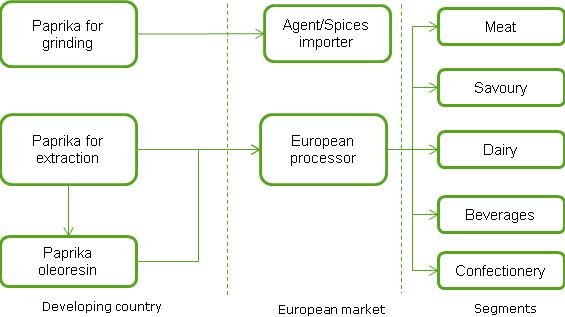

Market channels

European intermediaries add more value

- Instead of focusing solely on the dried paprika market, paprika suppliers have good opportunities on markets for value-added products as well.

- European extraction companies still play a major role in the processing of paprika oleoresin. They sometimes extract the oleoresin from dried paprika, purify an imported oleoresin or standardise products by blending oleoresins from different origins.

Tip:

- Producers of paprika oleoresin with low residual pungency can promote the use of their product in blends with Indian oleoresin to reduce the pungent taste of the latter.

Visit trade fairs in Europe if you want to meet potential buyers; for example, SIAL, Food Ingredients Europe, Anuga, Alimentaria or Biofach.

Market segments

Table 1: Major segments and applications for paprika oleoresin

| Segment | Application | Particularities |

|---|---|---|

| Dairy | Cheese | This application requires the absence of residual pungency. |

| Savoury | Sauces | A spicy or pungent taste of paprika oleoresin can be appreciated for these applications. |

| Meat | Seasonings and spice blends | A spicy or pungent taste of paprika oleoresin can be appreciated for these applications. |

| Beverages | Juices | This application requires the absence of residual pungency. |

| Confectionery | Sweets | This application requires the absence of residual pungency. |

Few opportunities for organic paprika oleoresin

Paprika oleoresin is applied to food in low concentrations of 0.01–0.05%. Due to these very low concentrations, manufacturers of organic food often make use of an exception rule in the organic regulations. They may use a small amount of non-organic ingredients but still label the product as Organic. Therefore, the demand for Organic certified paprika oleoresin remains small.

Tip:

- Only opt for Organic certification if you need to strengthen the natural image of your product.

8. What are the end-market prices for paprika oleoresin?

India accounts for around half of the estimated global production of paprika oleoresin. As India prices aggressively, the country dictates the global prices for paprika oleoresin.

In the past decade, fierce competition from India occasionally drove prices down to around € 18/kg.

Between 2009 and 2012, the prices of paprika and paprika oleoresin increased to around € 27/kg. Bad crops and higher legislative requirements for levels of toxins have driven up prices.

Since the end of 2012, prices for paprika oleoresin (100,000 colour units) have come down to € 22/kg (CFR India) and have remained relatively stable. In general, paprika oleoresin with a higher colour unit value is more expensive.

Tips:

- Monitor harvests in the major production countries (e.g. India) to anticipate price developments.

- Consider the cyclical nature of the paprika oleoresin market when trying to export to Europe. After a year with low supply and high demand, you can expect many new entrants, which will cause oversupply and lower prices. Check price developments of the past five years to identify price cycles and determine the best time to enter the market.

- Reduce raw material costs by improving yields or increasing production scales. For example, irrigation can extend cropping periods and thereby improve yields.

- Further improve your price competitiveness by improving extraction yields.

Price breakdown

Prices of paprika oleoresin for end-users (i.e. food and beverage manufacturers) are considerably higher than the export price (FOB). The following price breakdown shows which mark-ups are applied by the importer. This breakdown does not specify mark-ups applied by other intermediaries such as blenders.

Figure 2: Price breakdown for paprika oleoresin, in % of markup

Source: ProFound, 2017

The margins added by importers and agents are lower for big lots than for small lots. For example, importers usually add a margin of 5–15% for lots of more than a tonne. Their margin goes up to 30% or more on small lots with less than 50 kg of paprika oleoresin.

Blenders add up to a few hundred per cent depending on their activities, such as R&D and blending.

Tips:

- Agents are particularly interesting if you do not have a strong sales network. However, once you have established a trade relationship through an agent, you cannot establish a direct relationship with the buyer any more. The sales network of the agent is protected by law.

- Add value to your product by blending the oleoresin from different sources in order to standardise the quality of your product.

Please review our market information disclaimer.

Search

Enter search terms to find market research