Entering the European market for seaweed hydrocolloids

Complying with European regulations is a minimum requirement to access the European market. Special attention should be paid to controls on contamination and heavy metals, and audits on safety issues are common. Sustainability and traceability are important, and it is crucial for you to be transparent about your supply chain. China, the Philippines, India, and Indonesia are the biggest suppliers to the European seaweed hydrocolloid market and represent your biggest competition.

Contents of this page

- What requirements and certifications must seaweed hydrocolloids comply with to be allowed on the European market?

- Through what channels can you get seaweed hydrocolloids on the European market?

- What competition do you face on the European seaweed hydrocolloids market?

- What are the prices for seaweed hydrocolloids?

1. What requirements and certifications must seaweed hydrocolloids comply with to be allowed on the European market?

As an exporter of seaweed hydrocolloids from a developing country, you must ensure the safety of your products for use in the European market. You must therefore meet the EU’s mandatory requirements for food safety and natural food additives. Buyers often have additional requirements of their own and can request certifications.

What are mandatory requirements?

When exporting to Europe, you must meet the legally binding requirements of the EU. The most crucial requirements are related to food safety. To enter the European market, you must comply with several regulations that guarantee safety, including:

- The General Food Law: This law mainly sets requirements for traceability, hygiene, and control. Compliance with this legislation ensures that the seaweed hydrocolloids are safe to eat and that legal limits for food contaminants are not exceeded.

- Regulation (EC) 1333/2008, which sets the rules on food additives, including definitions, conditions of use, labeling, and procedures.

EU regulation 2012/231/EU provides E-numbers and specifications for approved food additives, including refined carrageenan (E407), processed Eucheuma seaweed (E407a), agar (E406), alginic acid and its salts (E 400–E 404).

In 2022, FAO and WHO released a report that reviews the food safety information, currently available about seaweed harvested from both wild stocks and aquaculture, and recommends further discussion as well as international guidance on the potential hazards of this, like metals, pollutants, microbiological and physical hazards (like microplastics).

Tips:

- Read the CBI study “What requirements must natural food additives meet to be allowed on the European market?”, which provides further information about mandatory requirements you must meet to enter the European market.

- Read the EU’s guidance on how to be compliant with and implement the EU’s General Food Law. Doing so will give you a greater understanding of a mandatory requirement you must comply with to enter the European market.

Official border control for seaweed hydrocolloids imported to the European Union

Official food controls include regular inspections that can be carried out at import or at all further stages of marketing. In case of non-compliance with the European food legislation, individual cases are reported through the Rapid Alert System for Food and Feeds (RASFF), which is freely accessible to the general public.

Be aware that repeated non-compliance with European food legislation by a particular country might lead to special import conditions or even suspension of imports from that country. Those stricter conditions include laboratory tests for a certain percentage of shipments from specified countries. The New Official Controls Regulation will extend its scope to organic products.

Tips:

- Read the EU’s factsheet on food traceability, which provides useful information and guidance about food traceability in the EU.

- Read and comply with the EU’s Key Obligations of Business Operators, as they derive from EU food safety legislation.

Contaminants control in seaweed hydrocolloids

The European Commission Regulation 1881/2006 sets maximum levels for certain contaminants in food products. Buyers will want you to meet the increasingly stringent food safety requirements. Food safety issues include microbiological (bacteria, moulds), physical (plastic residues, metal, dirt), and chemical contamination. In the table below, the specification sets are given for carrageenan (E407 and E407a (or PES)), agar, and sodium alginate.

Table 1: Purity requirements for seaweed hydrocolloids

|

Requirements |

Carrageenan (E407 and E407a) |

Agar (E406) |

Sodium alginate (E401) |

|

Identification |

Test for galactose, anhydrogalactose, test for sulphate and soluble in hot water; insoluble in alcohol for a 1,5 % dilution |

Solubility insoluble in cold water; soluble in boiling water |

Test for sodium and test for alginic acid. |

|

Loss on drying |

≤ 12 % (105 °C, 4 hours) |

≤ 22 % (105 °C, 5 hours) |

≤15 % (105 °C, 4 hours) |

|

Solvent residues |

≤ 0.1% (methanol, ethanol, 2-propanol (singly or in combination)) |

|

|

|

Viscosity |

≥ 5 mPa∙s (1.5% solution) at 75°C |

|

|

|

Sulphates |

Sulfate (dried hydrocolloid basis, as SO4) ≥ 15% and ≤ 40%; |

|

|

|

Water insoluble matter |

|

|

≤2 % on the anhydrous basis |

|

Ash |

≥ 15% and ≤ 40%; |

≤ 6,5 % (on the anhydrous basis determined at 550 °C) |

|

|

Acid-insoluble ash |

≤ 1% (in 10% hydrochloric acid) |

≤ 0,5 % (determined at 550 °C on the anhydrous basis) |

|

|

Acid-insoluble matter |

E407: ≤ 2% (in 1% v/v sulfuric acid) E407a: ≥ 8% and ≤ 15% acid-insoluble matter (in 1% v/v sulfuric acid) |

≤ 1,0 % |

|

|

Starch |

|

Not detectable by the following method: To a 1 in 10 solution of the sample, add a few drops of iodine solution. No blue colour is produced. |

|

|

Gelatine and other proteins |

|

Dissolve about 1 g of agar in 100 ml of boiling water and allow to cool to about 50 °C. To 5 ml of solution, add 5ml of trinitro-phenol solution (1 g of anhydrous trinitrophenol/100 ml of hot water). No turbidity appears within 10 minutes. |

|

|

Water absorption |

|

Place 5 g to agar in a 100 ml graduated cylinder, fill to the mark with water, mix and allow to stand at about 25 °C for 24 hours. Pour the contents of the cylinder through moistened glass wool, allowing the water to drain into a second 100 ml graduated cylinder. Not more than 75 ml of water is obtained. |

|

|

Low molecular weight carrageenan (fraction below 50kDa) |

≤5 % |

|

|

|

Formaldehyde |

|

|

≤50 mg/kg |

|

Arsenic |

≤3 mg/kg |

||

|

Lead |

≤5 mg/kg |

||

|

Mercury |

≤1 mg/kg |

||

|

Cadmium |

≤2 mg/k |

≤1 mg/kg |

≤1 mg/kg |

|

Total plate count |

≤5 000 colonies per gram |

||

|

Yeast and molds |

≤300 colonies per gram |

≤500 colonies per gram |

|

|

Escherichia coli |

Absent in 5 g |

||

|

Salmonella spp. |

Absent in 10 g |

Absent in 5 g |

Absent in 10 g |

Source: Eur-lex.europa.eu

The European Union (EU) has set maximum residue levels (MRLs) for pesticides in and on food products in Regulation 396/2005. Products containing more pesticide residues than allowed will be withdrawn from the European market. The European Union regularly publishes a list of approved pesticides that are authorised for use in the European Union. This list is frequently updated.

Seaweeds can bioaccumulate high levels of heavy metals like arsenic, lead, cadmium, and mercury from the aquatic environment. These heavy metals can come from both anthropogenic activities (mining, petrochemical processing, electronics waste, municipal waste) and natural causes (volcanic activities). The requirements related to the maximum level of heavy metals in seaweed hydrocolloids is given in Table 1.

Microbial contamination can occur during growth, cultivation, harvest, processing and handling, and storage of seaweed. While studies have highlighted that coastal seaweeds can act as reservoirs for Vibrio parahaemolyticus and Vibrio vulnificus populations, the bacterial species are relatively sensitive to heating and drying processes and, therefore, may not survive the food processing.

Tips:

- Use the EU’s MRL database to identify the Maximum Residue Levels (MRLs) for seaweed hydrocolloids and comply with them.

- Control pesticide amounts in your seaweed hydrocolloid production. You can apply the Integrated Pest Management System (IPM) for this. This is an agricultural pest control strategy that uses control practices in addition to chemical spraying. For more information about Integrated Pest Management, see the FAO website.

Documentation

European buyers of seaweed hydrocolloids expect exporters to provide them with well-structured and organised product and company documentation, as this helps to prove you meet their requirements such as specific quality specifications. You must therefore provide buyers with documentation.

European buyers of seaweed hydrocolloids usually expect exporters to provide them with Safety Data Sheets (SDS), Technical Data Sheets (TDS) and Certificates of Analysis (CoA). A Safety Data Sheet includes information such as the properties of the seaweed hydrocolloid; the physical, health, and environmental health hazards; protective measures; and safety precautions for handling, storing, and transporting the product. A Technical data sheet is a specification sheet for a product and summarises the technical characteristics of the product. A Certificate of Analysis outlines all the tests performed on a product before it is shipped to a customer.

Tips:

- See the CBI study “How to prepare technical data sheets, safety data sheets and sending samples for natural food additives?” This study provides information and guidance on preparing documentation as well as sending samples.

- Review these examples of a Safety Data Sheet and a Certificate of Analysis for carrageenan, and this example of a Technical Data Sheet for agar. Doing so will give you a greater understanding of what documentation buyers expect.

Labelling

The EU’s Classification, Labelling and Packaging (CLP) Regulation (EC Regulation 1272/2008) identifies hazardous chemicals and informs users about their hazards, using standard symbols and phrases.

Carrageenan is classified as hazardous by the European Chemicals Agency (ECHA), and you must display the two hazard labels as shown in Figure 1. This means ”Warning!”. According to the classification provided by companies to ECHA in CLP notifications, this substance causes serious eye irritation and is suspected of causing cancer. Agar and alginate are not classified as hazardous and do not require such labelling.

Figure 1: Carrageenan health warning labels

Source: ECHA

To export your seaweed hydrocolloids to the European market, you must meet the EU’s labelling requirements outlined in the EU’s food additives and flavourings legislation. Whether or not your seaweed hydrocolloid is intended for sale to the final consumer determines what labelling requirements you must meet. This is outlined in chapter IV – labelling under Articles 21, 22 and 23 of Regulation (EC) No 1333/2008.

In addition to the EU’s mandatory labelling requirements, European buyers of seaweed hydrocolloid may have additional labelling requirements, such as the language spoken in the country of export and measurement units. In general, English is the preferred language for your labelling and European measurement units are in kilogrammes.

Tips:

- Check the European Chemicals Agency (ECHA) database, and continue to do so regularly, to determine if your seaweed hydrocolloid is hazardous. If your seaweed hydrocolloid is hazardous, use the appropriate special packaging and corresponding warning labels.

- Read ”Understanding CLP”. This will give you a better understanding of a mandatory requirement you must meet to enter the European market.

Packaging requirements

Packaging requirements can differ from buyer to buyer, with common packaging sizes ranging from 1 to 25 kg and these must be agreed upon with the buyer. European buyers demand high-quality seaweed hydrocolloids. To meet these high standards, you can preserve the quality of your seaweed hydrocolloids by always:

- Using packaging materials that do not react with your seaweed hydrocolloid.

- Storing your seaweed hydrocolloid in a dry and odour-free environment.

Since seaweed hydrocolloids attract moisture, waterproof packaging is used. Use plastic (polypropylene) or paper bags with a polyethylene lining. This kind of packaging protects seaweed hydrocolloids from moisture and prevents a decline in product quality. In addition, depending on order quantity, boxes and drums with an inner polythene liner can be used.

Tips:

- Choose a food safety management system that is approved by the Global Food Safety Initiative.

- Always ask your buyer for their specific packaging requirements.

- Consider using recycled and/or recyclable packaging materials, as environmental sustainability is becoming increasingly important for European buyers. Read this guide on packaging to reduce environmental impacts for information and guidance on ways to do this.

What additional requirements and certifications do buyers often have?

Quality requirements for seaweed hydrocolloids

European buyers can have different quality requirements depending on the type of extract and its application. Carrageenan’s and agar’s viscosity levels, depending on their application in the food industry, are an example of this. Speak to European buyers to find out about their specification of needs. European buyers test products they buy, usually on a per batch basis, to ensure it meets their quality standards and to ensure products are not polluted or contaminated. European buyers require seaweed hydrocolloids with a consistent quality.

Certification

European buyers often demand certification to demonstrate the safety and quality of seaweed hydrocolloids they buy. The world’s major food retailers are increasingly requiring certification to GFSI-recognised standards. The Global Food Safety Initiative (GFSI) is a non-profit association of industry experts committed to improving food safety along the value chain. The GFSI approves a number of food safety standards covering farming, packaging, storage, and distribution. GFSI-recognised standards for audits and certification include FSSC 22000 and ISO 22000.

Figure 2: Examples of certification

Tip:

- Before getting certified, research your targeted market segment and talk to your buyers, to determine the certifications they demand, as this can vary from buyer to buyer.

Payment terms

Payment is central to all trade and presents risks to everyone involved. The type of payment terms used depends on several factors, such as the order volume and the length of your business relationship. Carry out risk assessments of the available payment terms before trading with European buyers.

Although there are several methods of payment for both importers and exporters, Letters of Credit (LC) are considered the safest payment terms. This is because an LC lets both parties contact a neutral arbitrator, usually a bank, to resolve any issues. For the exporter, the chosen bank is a guarantor of full payment if goods have been shipped.

Based on their needs, importers and exporters can choose from several LC payment terms. These include standby, revocable, irrevocable, revolving, transferable, un-transferable, back-to-back, red clause, green clause and export/import. For exporters, standby LC is considered the safest, and it is frequently used in international trade. This is because it provides security to both exporters and importers that have little trading experience with each other. Once a business relationship is established, other payment methods such as cash in advance, documentary collections and open account can be used as well. It is also common to use combinations of various payment methods.

Tips:

- Carry out due diligence on your potential buyers, to ensure they have the resources to pay for your seaweed hydrocolloid.

- See the CBI study “10 tips for organising your export of natural food additives to Europe”, which provides information and guidance on payment terms used in this sector.

Delivery terms

When agreeing on delivery terms with European buyers, you must carefully consider the 3 important factors of delivery time, volume, and cost. Failure to meet agreed delivery terms can result in the end of your trading relationship with European buyers. Seaweed hydrocolloids are transported into Europe by plane or boat. In the case of sea freight, the most commonly used Incoterms are EXW (Ex-Works), FOB (Free On Board), CFR (Cost and Freight), and DDP (Delivered Duty Paid). In case of air freight they are EXW, CIP (Carriage and Insurance), CPT (Carriage Paid To), DDP, and DAP (Delivered At Place).

Delivery time: European buyers prefer shorter delivery times. Air cargo is usually faster than sea freight. Air freight is also more reliable for on-time delivery.

Delivery volume and/or quantity of order: Larger quantities are often cheaper to ship by sea. With lower volumes, air freight can be less expensive as margins are smaller.

Cost of delivery method: Sea freight is estimated to usually be 4-6 times cheaper than air freight. This applies to larger volumes.

Tips:

- Visit the Freightos website and use the Freightos freight calculator to get international freight rate price information, for transporting freight by ship and air. Doing so will allow you to make a more informed decision before agreeing on delivery terms with buyers.

- See the CBI study tips for organising your export of natural food additives to Europe, which provides information and guidance on delivery terms used in this sector.

What are the requirements for niche markets?

In Europe, there is growing consumer demand for products that have been produced under environmentally and socially sustainable conditions. European buyers are seeking to buy sustainable seaweed hydrocolloids. European environmental sustainability and sustainable growth is made clear in the EU’s Circular Economy Action Plan and the European Green Deal. Companies like Cargill are showing initiative for sustainable programmes. This programme, Red Seaweed Promise™ is to help ensure a long-term sustainable red seaweed supply chain, to address key sustainability challenges for the harvesting and cultivation of red seaweed, while enhancing producer livelihoods, supporting local communities, and conserving the marine environment.

Source: Mintel GNPD

As an exporter, one way to meet this demand is to obtain certification that proves you meet social and environmental standards. In 2017, the Aquaculture Stewardship Council and the Marine Stewardship Council (ASC-MSC) launched a new standard and certification scheme for environmentally sustainable and socially responsible seaweed production. Seaweed operations have been associated with a number of environmental impacts, such as effects on water movement and the physical structure of terrestrial and aquatic habitats, as well as changes in water quality, primary and secondary productivity, and native fisheries. With global seaweed production increasing along with demand for certification, the MSC and ASC recognise the importance of having a standard that rewards sustainable seaweed production and provides a benchmark for improvement. Consider whether there is a business case for you to acquire ASC-MSC certification, as it can help you enter the European market.

Other certification schemes such as EU organic certification or the Fairtrade or FairForLife standards are used only incidentally. Currently, both carrageenan and agar are allowed as non-organic ingredients in an organic labelled product. This is because there is no organic alternative available and the dosage in the end product is lower than 5%. However, in the future this will probably change. Organic certification for seaweeds requires a system to monitor the quality of the water (the concentrations of toxins) in which the seaweeds are grown. One example of a company that has successfully established organic production of seaweeds is Setexam. Whereas Setexam can extract organic certified agar from the organic certified seaweeds, extraction of alginates cannot be certified. The use of acids and alkalis for alginate extraction does not meet the requirements in EU Regulation 2018/848. In theory, organic production of carrageenan is possible. However, in practice, organic certified carrageenan is not yet available.

Tips:

- Consider acquiring certifications that prove your seaweed hydrocolloids meet social and environmental standards. Inform prospective buyers about the certification you have that proves you meet social and environmental standards, and display this on your company website and marketing materials.

- Consult the ITC Sustainability Map for a full overview of certification schemes used in this sector.

- Ask your association to prepare a Code of Conduct for the association members. A Code of Conduct sets rules for the association members on sustainable production conditions (for example, no overharvesting of seaweeds). You can then make documentation about the Code of Conduct available for interested buyers.

2. Through what channels can you get seaweed hydrocolloids on the European market?

The commercial production of seaweed hydrocolloids, such as carrageenan and agar, is spread across all continents. The seaweed hydrocolloids have a wide range of food applications due to their specific functionality as texture food ingredients. As a supplier, exporter, and distributor, the product and application know-how for different end markets is a key capability. Importers/Distributors are your most likely channel to sell seaweeds in the European market.

How is the end-market segmented?

Seaweed hydrocolloids have a wide range of applications, of which the main share is used in the food industry. Non-food applications are in health products, personal care and home care products. In the food and drink industry, ice cream, desserts, bakery (fillings) and meat products are the leading applications for carrageenan, alginates, and agar.

Source: Mintel GNPD

Through what channels does a product end up on the end-market?

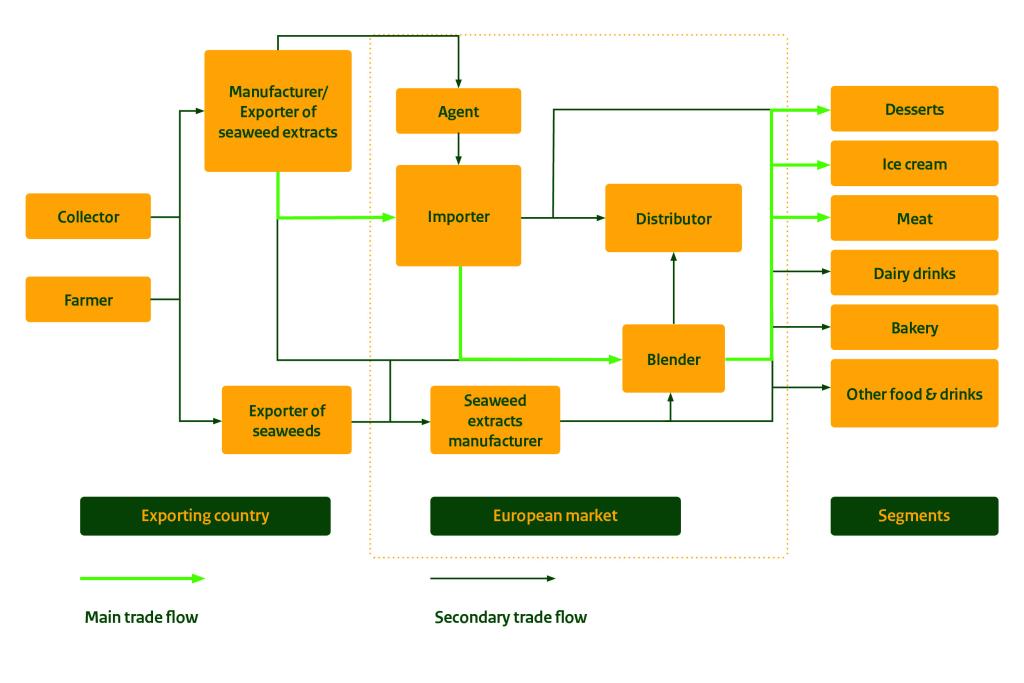

Food manufacturers mostly source their seaweed hydrocolloids through importers and blenders, although also some companies source directly from the processors that have the processing operations in Europe. These European processors also use distributors for specific countries.

To export to the European market, farmers and collectors in developing countries typically go through seaweed hydrocolloid processors and/or seaweed exporters/traders. In the Philippines, for example, there are 400 industry players in the trading of seaweed, of which 18% are large traders. According to an industry source, most of the carrageenan is blended with other hydrocolloids, tailored by application before it is sold to food manufacturers.

Figure 5: Market channels for seaweed hydrocolloids

Source: ProFound

Importers/Distributors

Importers of seaweed hydrocolloids normally handle large quantities and have direct contacts with exporters in producing countries, providing them access to all the different segments in Europe. Importers either sell the seaweed hydrocolloids to other local food processors or export the product elsewhere in Europe. In most cases, importers have long-standing relationships with their suppliers. They are responsible for a wide range of services in the value chain. These include logistics, customs clearance and documentation, risk management (sourcing from origin, price, exchange rate), quality control, and so on.

At the same time, they have a large network of suppliers from all over the world, and can switch relatively easily to other suppliers, which gives them a lot of negotiation power. They are up to date on current price levels in the global market and provide little room for margins, unless you can prove that your product is unique and is worth a price premium. They may also use agents, but this is less common. Many importers and distributors have long-term partnerships with seaweed hydrocolloids processors in developing countries, but also with the European processors. Examples include Will & Co, (Marcel Carrageenan), Biesterfeld (CP Kelco), Ingredience, and Norevo.

Seaweed extracts manufacturers

The seaweed extracts manufacturers, producers of seaweed hydrocolloids, are the main clients of local traders for dried seaweed. They source RDS (Raw Dried Seaweed) locally but also consider buying raw materials abroad, during periods of occasional shortages and cheaper seaweed prices. They transform the RDS into carrageenan, which is typically in the form of SRC (Semi Refined Carrageenan), RC (Refined Carrageenan), and carrageenan blended products.

Some seaweed hydrocolloid production takes place in Europe, like in Spain, France and Denmark. CEAMSA, ROKO, CP Kelco, and Hispanagar are examples of European companies that produce and import seaweed hydrocolloids. However, there is a general shift towards sourcing from developing countries, since production levels are increasing and prices are lower in non-European countries, like Indonesia. Examples of such companies are, W. Hydrocolloids (which also acquired the operations of Kerry Food Ingredients), Shemberg Corporation, and Marcel Trading Corp.

Blenders

Seaweed hydrocolloids have a very specific texture functionality in food and drink products. They are often combined with other hydrocolloids, like guar gum, pectin, or starch, to obtain blends with a specific functionality. In recent years many of these blending companies were acquired by bigger food ingredient companies like Ingredion, which acquired Katech and Tic Gums. For now, there is only a limited number of independent companies left.

Agents

Agents act as intermediaries between you, importers, and processors or buyers in the food industry. They are actors with vast market knowledge and can help you assess and select interesting buyers. Some agents are independent, while others are hired to make purchases on behalf of a company. Be prepared to pay an extra commission for their work, usually ranging between 3 and 10%. Consider working with a representative with a good reputation. You can look for commercial agents on the website of Internationally United Commercial Agents and Brokers (IUCAB). The IUCAB website lists all their national member organisations.

Tip:

- Visit trade fairs to connect with European buyers, to identify and meet potential buyers. Examples of such fairs include Anuga, Fi Europe and BioFach. See the CBI study “8 tips for finding buyers on the European natural food additives market” for an overview of trade fairs in this sector.

What is the most interesting channel for you?

Most of the European food manufacturers source their seaweed hydrocolloids from importers and distributors. These importers also include big international food ingredient companies like Dupont and CP Kelco, which have integrated supply chains, or their local representatives. These seaweed hydrocolloid processors have major research departments, to develop tailored solutions for food manufacturers, such as low-cost thickeners, which retain their functional properties under specific conditions (for example, heat and acidity). This type of R&D requires close collaboration between food manufacturers and seaweed hydrocolloid processors.

Besides buying from importers, food manufacturers also source seaweed hydrocolloids directly from manufacturers in countries where seaweed hydrocolloids originate from. Food manufacturers will have different requirements than those of importers and traders. For example, food manufacturers may require the seaweed hydrocolloid to meet a specific viscosity level or might require a blend with other hydrocolloids.

Tip:

- When you supply a ready-to-use seaweed hydrocolloid directly to European food manufacturers, you must be able to show your functional ingredient know-how and application expertise.

3. What competition do you face on the European seaweed hydrocolloids market?

Traditionally, the seaweed hydrocolloids processing sector was dominated by multinational corporations from Europe and the US, including through foreign direct investments in developing countries, such as the Philippines. These are companies like FMC (now IFF), Cargill, CP Kelco, Kerry, and CEAMSA. Now, Chinese companies dominate the market, but seaweed hydrocolloids are produced all around the world, including in countries in Asia, the Americas, and Africa.

Which countries are you competing with?

In 2022, the total imports of seaweed hydrocolloids, including carrageenan and agar, were 68,856 tonnes. Approximately half of the volume was traded within the EU (34,302 tonnes), and the remaining 34,554 tonnes were imported mainly from developing countries. Most of the imported volume came from China (11,784 tonnes), followed by the Philippines (8,446 tonnes), India (4,491 tonnes), and Indonesia (3,385 tonnes).

Source: Eurostat (2023)

China: the world’s largest seaweed hydrocolloid producer

China is the biggest seaweed hydrocolloid processor and exporter in the world, and for Europe. It uses some 125,000 tonnes a year of seaweeds, of which 92% is imported from Indonesia, mainly through Chinese processors that invested in Indonesia. The country produces some 38,000 tonnes of carrageenan, which is around one-third of the global production volume. Some 55% of this volume (20,849 tonnes) is exported, and of this total export, 44% is shipped to Europe. China and Europe have a trade agreement that allows for a zero tariff for carrageenan imports. For Europe, this makes China an attractive country to source from.

The Philippines

Since the early 1970s, over 200,000 coastal families have engaged in commercial seaweed farming. The Philippine seaweeds are exported to the United States, China, Spain, Russia, and Belgium, where they are used as carrageenan in food and non-food products. Recognising seaweed production as one of the Philippines’ most important aquaculture commodities, the government also provides both material and technical support. Currently, the Philippines has 1,065 seaweeds species, but production is mainly of Eucheuma and Kappahycus. The country pioneered the cultivation of the carrageenan-bearing seaweeds Eucheuma, that led to its dominance in commercial seaweeds’ production, and recognition as the top seaweed producer in the international market.

India

In 2022, India was ranked third in the total seaweed hydrocolloid exports to Europe, totalling 4,491 tonnes of carrageenan and agar. Besides local production, India also imports from China. Indian companies, like for example, Meron, blend carrageenan into functional systems. India is also a producer of alginates, and this production is supported by the government; for example, the District Rural Development Agency, the Department of Biotechnology, and Tamil Nadu State, all support the cultivation and harvesting of seaweed.

Indonesia

Indonesia is the fourth biggest exporter of seaweed hydrocolloids to Europe. In 2022, this export volume was 3,385 tonnes. Indonesia is the world’s largest producer of seaweed hydrocolloid. Over a million coastal people in Indonesia rely on income from seaweed farming, contributing to the country’s rapidly expanding seaweed industry. Indonesia is the world’s number one producer of Gracilaria, Cottonii, and Spinosum, the raw materials for agar and carrageenan. Indonesia has a total domestic production of 25,057 tonnes of carrageenan, of which 40% is produced by Chinese invested plants. In 2021, approximately 65% of Indonesian carrageenan seaweeds were exported in dried form, leaving only 35% for local processing. Of the carrageenan produced in Indonesia, some 55% was exported. Of this total of exports of 16,055 tonnes, 14% was ATC, 58% SRC, and 28% RC grade. 84% of the Indonesian exports is shipped to China.

Chile

Chile is a competitor in niche markets. Chile supplies Gigartina skottsbergii and Sarcothalia crispata seaweed and carrageenan made from those seaweeds.

Peru

Peru is the second largest seaweed producer in the Americas, however, 98% percent of the seaweed taken from Peru is exported to China.

Tips:

- Position yourself against competing countries by highlighting your country’s strengths to European buyers, as these make you more appealing. The strengths of your country can include its close geographical proximity to the European market, the absence of quotas, and a record of exporting high-quality seaweed hydrocolloids.

- Consider joining industry associations which help exporters of seaweed hydrocolloids in developing countries like yourself. Examples of associations include the International Seaweed Association, the Indonesia Seaweed Industry Association, and the Seaweed Industry Association of the Philippines.

What companies are you competing with?

The processing and supply of seaweed hydrocolloids is concentrated. This is highly dominated by Chinese companies which are also processing seaweed in other developing countries, like Indonesia. All players have an international website and show their sourcing, production, and application know-how.

Chinese companies

By mid-2021, around 150 Chinese companies were processing carrageenan, double the 50-60 reported in 2007. There are also 250 companies that do not produce carrageenan, but which distribute or wholesale it. There are many small companies with less dedication to carrageenan. The top 3 account for 22% of the total production. The 3 biggest seaweed hydrocolloid companies in China invested heavily in the Indonesian processing sector, accounting now for nearly half of all domestic processing throughput in Indonesia. These companies are:

BLG Group (Shanghai Brilliant Gum), which was founded in 1996, employs 500 people, and is a biotechnology group specialised in R&D, production, and sales of hydrocolloids. The company has 4 factories of which 3 are in China and one is in Indonesia. The company’s portfolio includes carrageenan (SRC and RC) and agar, but also other gums like xanthan gum and LBG. Carrageenan capacity is estimated at 8,000 tonnes, with an estimated utilisation of 60%. The company has several certificates including, Food Safety System Certification (FSSC) 22000 and International Organisation for Standardisation (ISO) 22000:2005 certification, ISO 9001:2000 certification. As a member of Marinalg International, they play an active role in boosting safety use of hydrophilic colloids and sustainable farming methods of seaweeds.

Green Fresh Group is a hydrocolloid R&D and production enterprise of Hong Kong Green Future Food Hydrocolloid Marine Science Co., Ltd., specialising in the development of food colloids – carrageenan (SRC, ATC), agar, konjac gum, and blends (solution). The company employs 300 people and has a carrageenan capacity of 3,000 tonnes (7,985 tonnes planned after acquisition), utilisation of 60%, so having an estimated output of 1,800 tonnes a year.

Fangchenggang Longrun Carrageenan Co.,Ltd was founded in 2013 and employs 300 people with a focus on carrageenan and konjac manufacturing, marketing, research, and development. The designed capacity for refined carrageenan is 6,000 tonnes a year and 1,500 tonnes a year for semi-refined carrageenan. Utilisation is estimated at 50%.

Filipino companies

In the Philippines, virtually all carrageenan seaweed is processed domestically by some of 18 carrageenan processors, of which 5 are multinational and the remaining are local companies. Processing plants in the Philippines are mainly located in Cebu. Most of the seaweeds produced in the country are transformed into carrageenan, either as semi-refined carrageenan (SRC), also known as Philippine Natural Grade (PNG) carrageenan, or refined carrageenan (RC).

Due to mainly climate change-related events (typhoons, ice-ice disease, sea surface temperature rise), some farmers are experiencing difficulties dealing with the effects on their seaweed farming and leave their farm to look for other opportunities. Despite this decline in production, Philippine carrageenan, particularly food-grade SRC still dominates the global supply. The declining seaweed production trend made some of the processing plants decide to relocate to areas where seaweed supply is more abundant and cheaper, such as in Indonesia. On average, these companies operate at 65 percent capacity at present.

|

Carrageenan Type |

Company |

Capacity (tonnes) |

|

Refined |

Shemberg Biotech Corporation (Alcohol) Marcel Food Sciences Inc. (CPKelco) (KCL) WHI / BPI (KCL) Shemberg Marketing Corp (KLC) |

1,800 1,800 1,400-1,500 800 |

|

Semi Refined |

Ceamsa Asia Inc. Mioka Biosystems Corp (Marcel) TBK Manufacturing Corp Marcel trading Corp Mega Polygums Corp LM Zamboanga Carrageenan Manufacturing Corp Shemberg Marketing Corp Froilan Trading Corp W. Hydrocolloids Cebu Carrageenan Corp |

1,800 1,500 1,800 1,800 2,500 5,400 3,600 1,800 3,600 1,800 2,400 800 |

Source: Philippine Seaweed Industry Roadmap 2022-2026

Indian companies

Examples of producing and exporting seaweed hydrocolloid companies in India are:

AquAgri Processing Private Limited was the first company in the country, promoting the cultivation of sea algae with established manufacturing facilities, to produce carrageenan for the food processing industry.

Snap Alginate is the largest processor of natural seaweed based products in India, manufacturing alginates (food, pharmaceutical, and industrial grade), carrageenan, stabiliser emulsifier blends for the food industry and seaweed biostimulant for agriculture and aquaculture.

Meron (Marine Hydrocolloids) is among the market leaders of agar (capacity around 1,500 tonnes) in India. The company exports to South America, CIS, Europe, Russia, Africa, Southeast Asia, the Middle East, the Far East, the USA, and Australia.

Indonesian companies

The companies are member of Indonesia Seaweed, taking care of quality and promoting Indonesian products. Good and Productive Farming Practices for Gracilaria (Agarophyte seaweed) and Cottonii (Carrageenophyte seaweed) are adopted by Indonesian seaweed farmers. The Indonesian Good Aquaculture Practice has been acknowledged by international markets like Europe. In addition, Indonesian producers apply the national standard “Standar Nasional Indonesia” (SNI), which was developed to cover all products and processes related to production of seaweed and seaweed products. The SNI is harmonised with international standards that are applied to export products including CCRF, CITES, ISO, HACCP and SPS agreements.

Astruli (Indonesia Seaweed Industry Association) currently has 20 members, including 10 Carrageenan and 10 Agar processors. The members have a wide experience in servicing international markets and certifications ranging from Kosher and Halal to BRC, HACCP, FSSC, GMP, Organic and ISO 9001.

Indonesia exports carrageenan to 42 countries and agar to 40 countries. Indonesia processes more than 30,000 tonnes of carrageenan and some 10,000 tonnes of agar a year. Note that Chinese owned companies (BLG and Fresh Green) have 85% of the market and they are by long stretch market leaders in Indonesia producing 10 up to 100 times more than Indonesian companies; 150 tonnes a day vs 100 tonnes a year. Indonesia is the number 8 exporter in carrageenan and nr 7 in agar. Carrageenan processing in Indonesia is being done by 16 local companies. The government of Indonesia has established several processing plants, and thus owned some carrageenan processing plants in the country.

Examples of Indonesian companies are:

Hydrocolloid Indonesia, which is the leading manufacturer of carrageenan in Southeast Asia.

Algalindo Perdana, which has the brand name Sea-Tech Carrageenan, has 3 factories, and is engaged in compounding carrageenan and konjac.

PT Amarta Carrageenan Indonesia, which was established in 1990 and has its own production since 1998. This company is believed to have an annual production output of 1,800 tonnes.

PT. Agar Swallow, which is one of Indonesia’s biggest agar manufacturers. The company was established in 1991 and employs 250 people. The capacity per month is 100 tonnes.

Agar Sari Jaya, which is an agar company, which was established in 1998, which has 3 production plants producing 20 tonnes per month. The company employs 120 people.

Chilean companies

Chile is a niche market. A limited number of companies exporting into Europe was identified. The main player is Gelymar, offering both carrageenan and alginate and being one of the leading global carrageenan processors. Gelymar has 4 manufacturing sites located in Chile and Indonesia, has 2 product technology centers located in Chile and a worldwide distribution network in more than 50 countries.

Peru companies

Peru is a niche player and exports mainly to China. Only very small carrageenan processors for the European market can be found like jesus de nazareth peruvian

What products are you competing with?

In general, you are competing with all other ingredients used by the food industry that provide the same functionality in a food or drink product. This includes mainly gums like gum arabic, guar gum and tara gum. But also for example in non-vegan applications, agar is competing with gelatine. These ingredients might have a slightly different functionality in the consumer end products, are being used in different dosages and are used in combinations with other ingredients. Therefore, it is important to show your customer your product’s benefit in their product related to the cost, being the cost-in-use. That might be more appealing than just listing the price of your product. In the food industry it is very common to use hydrocolloid blends specifically designed for an application.

For seaweed hydrocolloids processors it is hard to find additional opportunities because of the link to the seaweed raw materials. One option could be to develop seaweed-based consumer products as a health product. Another directive opportunity is developing seaweed hydrocolloids processed in a different way like the company GPI did with its SF103 product. This product is a natural fibre derived from red seaweed waste streams. This product is not treated with alkali or heat treatment, this product has no E-number and is therefore perceived as a clean label ingredient. The ingredient can be labelled as seaweed hydrocolloid or seaweed powder or consumer product.

Tips:

- Position yourself against competing products. Do this by highlighting the strengths of your company and your product. Get to know the products of your customer, the functional needs and the (indirect) competing ingredients.

- Learn more about the competing ingredients. Some reading material is the European market potential for gums study and exporting gums to Europe.

4. What are the prices for seaweed hydrocolloids?

The prices of seaweed hydrocolloids depend on various factors, such as origin, climatic conditions, processing, and quality set by the grade and type. For example, the price of refined carrageenan can be in the range of 10-25 EUR/kg (FOB prices). The prices for agar also vary depending on the quality. On average FOB prices of agar-agar are about 20-30 EUR/kg.

The price of seaweed hydrocolloids is not set by the cost price plus margin but is set by the availability-demand ratio. Availability is depending on the seaweed harvest yields which is depending on weather conditions, and diseases. There is a delay in price adaptions due to different harvest periods, this could be 6-12 months.

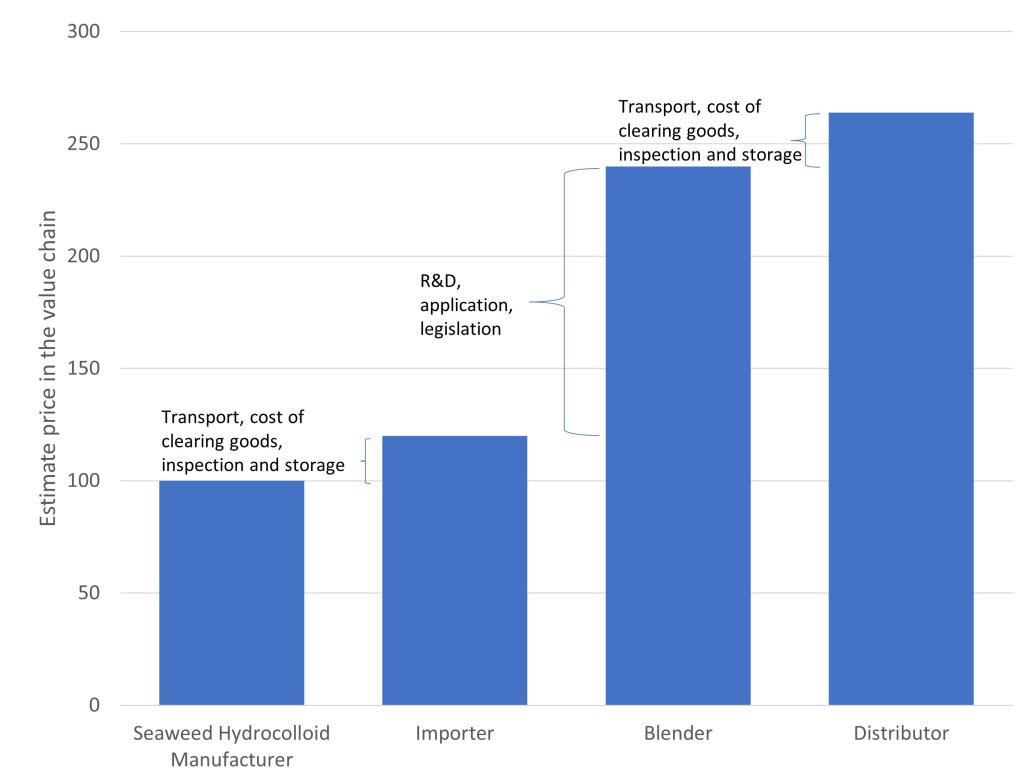

Exporters and importers typically use freight forwarders to arrange transport to the importer. Costs of transport are typically around 1%, but heavily depend on the locations of the exporter and importer. The importer adds costs of clearing the goods, inspection and storage. Finally, the sales margin of the importer depends largely on the size of the order. If agents are involved, they typically receive a commission of a few percent (3-4%). However, their actual profit margin strongly depends on volumes sold and gross margin. Blenders add up to a few hundred percent depending on their activities, such as R&D, blending, and legislation related to the application. Distributors, including importers, usually add 10 to 60% to the value of the product depending on the order size. Their mark-up is around 10% for big orders (Full Container Loads) and up to 60% when the orders are very small (<50 kg). Please note that for seaweed hydrocolloids the seaweed extract manufacturer or the importer is often also the company that performs the blending activities. There are (commercial) databases showing the average world price for products like carrageenan. An example for carrageenan is Procurement Resource.

Figure 7: Value chain for processing seaweed hydrocolloids

Source: ProFound

Tips:

- Carefully calculate the price breakdown of your seaweed hydrocolloid before setting and agreeing prices with European buyers.

- If approaching a food manufacturer directly, show your customer the cost-in-use instead of the list price per kg.

Monique van der Wouw of Wouw Food Market Analysis and Kasper Kerver of ProFound carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research