Entering the European market for stevia

To enter the European stevia market, you must comply with legal requirements laid down by the European Union as well as market requirements. Stevia’s varied applications in the food and beverage industry make this segment especially interesting for suppliers from developing countries. A growing trend to source as locally as possible has made European and North African suppliers the main competitors in the European market.

Contents of this page

1. What requirements must stevia comply with to be allowed on the European market?

To enter the European stevia market, you must comply with EU legislation, but also with the specific requirements of your buyers. If you wish to enter niche markets, additional requirements will apply.

What are mandatory requirements?

Steviol glycosides from stevia, also known as stevia extract, were authorised for use in the European Union in November 2011 and are included in the EU list of food additives, under ‘sweeteners’. Stevia leaves were authorised six years later, in 2017, under the novel foods law’s authorisation procedure. Stevia leaves are therefore no longer classed as a novel food, and infusions made from stevia leaves can be marketed in the EU.

Food safety is a top priority in the European Union. The General Food Law, which applies to all food products and food ingredients, including stevia in all its forms, ensures that all food is safe to consume. Under the General Food Law’s legislative framework, you must have a traceability system in place throughout your entire supply chain.

Implementing Hazard Analysis and Critical Control Points (HACCP) is key to managing food safety. Under Regulation (EC) 852/2004, if you are a food processor of stevia, you have to implement an HACCP system.

Regulation (EC) 1333/2008 sets out rules for food additives, including definitions, conditions of use, labelling requirements and procedures. Every food additive approved in the European Union is assigned an E-number. Having an E-number means the additive has passed safety tests and is authorised for use. Stevia extract has been assigned two E-numbers: E 960a for steviol glycosides from stevia, and E 960c for enzymatically produced steviol glycosides. The latter were recently included under Regulation (EU) 1156/2021, which amended the food additives regulation and included a new method for the production of Rebaudioside M. This new process involves bioconversion of purified stevia leaf extract (≥95% steviol glycosides) through a multistep enzymatic process.

European Union Regulation (EU) 2016/1814 recognises 11 steviol glycosides: stevioside; rebaudiosides A, B, C, D, E, F and M; steviolbioside; rubusoside; and dulcoside. According to this regulation, any commercial ingredient can be at least 95 percent of any combination of the recognised glycosides. A maximum of 5 percent non-steviol glycoside material is also permitted.

Tips:

- For further information about buyer requirements, read the CBI study What requirements must natural food additives comply with to be allowed on the European market.

- Read the EU’s guidance on how to be compliant with and implement the EU’s General Food Law.

- Consider connecting with and/or joining stevia associations such as the International Stevia Council and the World Stevia Organisation. These organisations are a good source of information on the stevia industry, regulations and standards.

Impurities, contamination and pesticides residues

Regulation (EU) No 231/2012 defines purity and contamination criteria for steviol glycosides. The regulation contains separate purity requirements for enzymatically produced steviol glycosides, because the enzymatic process used in the production of rebaudioside M can result in impurities different from those that may occur in steviol glycosides (E 960a) obtained by water extraction and further recrystallisation. Table 1 shows the purity criteria for E 960a steviol glycosides from stevia and Table 2 shows the purity criteria for E 960c enzymatically produced steviol glycosides.

Table 1: Purity requirements for steviol glycosides from stevia, E 960a

| Total ash | Under 1% |

| Loss on drying | Under 6% (105°C, for two hours) |

| Residual solvents | Under 200 mg/kg methanol Under 5,000 mg/kg ethanol |

| Arsenic | Under 1 mg/kg |

| Lead | Under 1 mg/kg |

Source: Regulation (EU) No 231/2012

Table 2: Purity requirements for enzymatically produced steviol glycosides, E 960c

| Total ash | Under 1% |

| Loss on drying | Under 6% (105°C, for two hours) |

| Residual solvents | Under 5,000 mg/kg ethanol |

| Arsenic | Under 0.015 mg/kg |

| Lead | Under 0.2 mg/kg |

| Cadmium | Not more than 0.015 mg/kg |

| Mercury | Not more than 0.07 mg/kg |

| Residual protein | Not more than 5 mg/kg |

| Particle size | Not less than 74 μm (using a mesh #200 sieve with a particle size limit of 74 μm) |

Source: Regulation (EU) No 231/2012

In addition to these purity criteria, stevia extract and leaves must comply with EU Regulation (EC) No 1881/2006 on contaminants. This legislation defines specific contaminant levels for groups of foodstuffs, but any contaminated product can be rejected by buyers or banned by EU authorities. Contaminants analysed in stevia include microbiological agents, nicotine, mycotoxins and heavy metals such as lead, cadmium and mercury. Suppliers should pay special attention to the presence of pyrrolizidine alkaloids (PAs), which are often found on stevia plants.

Maximum residue levels (MRLs) for pesticides on food are regulated by Regulation (EC) No 396/2005. The limits on raw materials, in this case stevia leaves, also apply proportionally to derivative products such as stevia leaf extract. Residues of glyphosate and polycyclic aromatic hydrocarbons (PAHs) should be very closely monitored by stevia suppliers.

The Rapid Alert System for Food and Feed (RASFF) is a portal created by the European Union to ensure food safety. If public health risks are detected in the food chain, RASFF members report it via a notification in the portal. Information exchanged there can result in products being recalled from the market.

Tips:

- Use the EU’s MRL database to identify the MRLs for stevia and comply with them. Maximum levels for stevia are defined under tarragon, so look up tarragon in the database to find applicable MRLs for stevia.

- Visit the interactive RASSF portal and search for food safety hazard notifications for steviol glycosides and stevia leaves. You can search by keyword, date, product, country of origin, notification type and risk degree.

Labelling requirements

For stevia extract, the labelling requirements you must comply with depend on whether or not your stevia extract is intended for sale to the final consumer. This is outlined in Chapter IV – LABELLING of Regulation (EC) No 1333/2008.

Regulation (EU) No 1169/2011 defines requirements for the provision of food information to consumers, including sweeteners such as stevia extract. This regulation states that the labels of foods containing food additives must include:

- the name of its category – in this case ‘sweetener’;

- its specific name; or

- its E number – in this case E960a or E960c.

Regulation (EU) 1169/2011 (EU 2011) also states that any food containing a sweetener authorised by the EU is required to carry 'with sweetener(s)' as a statement accompanying the name of the food. Foods containing both added sugar(s) and sweetener(s) have to carry 'with sugar(s) and sweetener(s)' as a statement accompanying the name of the food. If the food is a table-top sweetener, the description of the sweetener must include the term ‘…-based table-top sweetener', stating the name(s) of the sweetener(s) used in its composition. Table-top sweeteners are exempted from mandatory nutrition declaration.

The last amendment to the food additives regulation was good news for food and beverage manufacturers that use stevia extract, as ‘steviol glycosides (E 960)’ have now been renamed ‘steviol glycosides from Stevia (E 960a)’. The new regulation comes with a transitional period so manufacturers can implement the new labelling, and is expected to take effect from January 2023. However, companies such as Cargill are encouraging their customers around Europe to update their ingredients labels as soon as possible as this will give consumers more transparency and clarity about the product’s plant origin and should have a positive effect on stevia demand.

Consumer concerns about E-numbers are leading to continual innovation in the food and beverage industry. Some companies, such as Betterfoods in Germany, have developed clean-label, E-number-free natural sweetener alternatives from stevia leaves.

Tip:

- Review the European Commission webpage about sugars and sweeteners, which provides useful information about labelling.

Convention on Biological Diversity and the Access and Benefit-Sharing scheme

The Nagoya Protocol of the Convention on Biological Diversity (CBD) aims to ensure that benefits of genetic resources and long-established knowledge are shared equitably. It does so through its Access and Benefit-Sharing (ABS) scheme, which is particularly important for ingredients collected from the wild. The Nagoya Protocol is important for the stevia market. There have been petitions to negotiate benefit-sharing agreements with the Guarani, the indigenous people that discovered stevia’s sweetening properties.

The Nagoya Protocol has been translated into European law in Regulation EU 511/2014. It is also likely that it has been incorporated into your national laws.

Tips:

- Determine if your country is a signatory to the Nagoya Protocol by visiting the Nagoya protocol website.

- Visit the CBD website as it provides a range of useful information on CBD and ABS. For example, use the country website tool for information specific to your country.

What additional requirements do buyers often have?

Documentation

European buyers of stevia expect exporters to provide clear and organised product and company documentation. This helps them verify that you meet their requirements and quality specifications.

The main documentation buyers will expect you to provide are:

- Safety Data Sheet (SDS)

- Technical Data Sheet (TDS)

- Certificate of Analysis (COA)

Tips:

- Review these sample versions of a Safety Data Sheet, Technical Data Sheet and Certificate of Analysis for stevia extract. The Swedish ingredient developer BAYN Solutions also has product data sheets that are useful to review.

- Make sure your documentation is up to date and readily available. For further information, see the CBI study on how to prepare technical and safety data sheets and send samples for natural food additives.

Quality requirements for stevia

In addition to the purity criteria defined in the EU regulation, buyers may have their own quality requirements. Their specific requirements will depend on the final application of the stevia extract, so you should speak to your buyers to find out what they are.

Nevertheless, most buyers want some of the same general product and quality characteristics. The majority of European food and especially beverage manufacturers require stevia extracts with high solubility. European buyers also prefer stevia extracts that are white in colour, rather than light yellow.

Consistency is one of the most important aspects for European buyers. Small differences in the production process of your stevia extract will have a big effect on its flavour, particularly its sweetness as a finished product. Therefore, the use of standardised production processes is key.

For stevia leaves, taste, smell and appearance characteristics play a major role in product categorisation, applications and sales potential. Dried stevia leaves are sometimes sold as such to consumers. However, when used to manufacture infusions for food and beverage applications, stability in taste and quality is a must for manufacturers and brands.

Tip:

- Only agree to European buyers’ specific requirements if you can actually meet them, as a failure to do so may end your business relationship.

Certification

Besides HACCP certification, many European buyers require a certification recognised by the Global Food Safety Initiative (GFSI) to guarantee the safety and quality of the stevia.

The Food Safety System Certification (FSSC 22000) and ISO 22000 are the most common certifications required by European stevia buyers. ISO 9001 or another quality management system is also a must to guarantee quality management.

Tips:

- Consider becoming certified as this will help you enter the European market.

- Make sure to display your certifications on your website and marketing materials.

Packaging requirement

To preserve the quality of your stevia extract or stevia leaves, use appropriate packaging materials, like food grade bags, kraft paper bags and carton boxes. You should also follow general requirements which include:

- Using packaging materials that do not react with your stevia.

- Using clean packaging materials to prevent contamination.

Figure 1: Examples of packaging

Source: Various

Packaging requirements often differ from buyer to buyer, with common packaging sizes for stevia extract ranging from 1 kg to 25 kg. You should speak to European buyers and find out what their specific requirements are.

The EU is committed to environmental sustainability and sustainable growth, something it made clear in its Circular Economy Action Plan and in the European Green Deal. In this sense, there is increasing pressure on European businesses to reduce their waste and increase recyclability through targets and policies.

Tip:

- Consider using recycled and/or recyclable packaging materials. Read this guide on packaging to reduce environmental impacts for information and guidance on ways to do this. You can also visit the Hispack trade fair website to learn about sustainable packaging trends and providers in the European market.

Payment terms

There are different payment methods used in the stevia trade. The type of payment terms used depends on various factors, such as the order volume and the length of your business relationship. Before trading with European buyers, carry out risk assessments of the available payment terms.

There are several methods of payment. However, for both importers and exporters, Letters of Credit (LC) are considered the safest payment term. Based upon their needs, importers and exporters can choose from several LC payment terms.

Once a business relationship is established, other payment methods such as cash in advance, documentary collections and open account can be used as well. It is also common to use combinations of various payment methods.

Tips:

- Consider following ITC’s free online course on export financing: ITC SME Trade Academy - Summary of Export Finance and Payments.

- Download ITC’s free SME trade finance guide.

- See the CBI study Tips for organising your export of natural food additives to Europe, as it provides information and guidance on payment terms used in this sector.

Delivery terms

When agreeing delivery terms with European buyers, normally as defined by the Incoterms (International Commercial Terms) framework, you must carefully consider three important factors: delivery time, volume and cost.

The global COVID-19 pandemic has created logistical challenges for exporters in developing countries. Delays and higher transport costs are two key challenges that exporters and importers have faced. These challenges are expected to remain for the foreseeable future, as different states and governments around the world continue tackling COVID-19 with measures affecting international trade.

Suggested practices to help manufacturers that depend on sweeteners such as stevia overcome challenges resulting from COVID-19 include looking for low-risk suppliers, geographical diversification of sourcing locations, more stringent quality control protocols and partnering with suppliers that offer robust, detailed traceability systems.

Tips:

- Visit the Freightos website to use the Freightos freight calculator to get international freight rate price information for transporting freight by ship and air. Doing so will allow you to make a more informed decision before agreeing delivery terms with buyers.

- See the CBI study Tips for organising your export of natural food additives to Europe, as it provides information and guidance on delivery terms used in this sector.

What are the requirements for niche markets?

Certification of organic production

In recent years, there has been growing consumer demand for certified organic products in the European market. As a result, European buyers are increasingly looking for certified organic food ingredients. However, steviol glycosides extracted from organically grown stevia cannot be called organic in the European Union, because of the ion exchange resin used in the extraction process. Therefore, EU organic certification only applies to Stevia rebaudiana Bertoni leaves.

Nevertheless, producing steviol glycosides from organically grown stevia leaves can be beneficial for your company, as organic farming practices are environmentally friendly. Moreover, if the regulation on the designation of organic steviol glycosides changes at any time in the future, your company will have an advantage over competitors.

Some European companies offer organic stevia leaves and innovative organic stevia extracts derived from infusing stevia leaves. Since these extracts involve minimal processing, they can be certified as organic and have applications in the same segments as stevia extract from steviol glycosides. However, stevia is still little used the organic food and beverage market. For manufacturers of organic stevia tea infusions, the challenge is to deal with the bitter aftertaste that makes it impossible to use in organic foods.

Tips:

- If you grow your own stevia leaves, consider converting to organic production methods and get organic certification to be able to export organic stevia leaves.

- Look at the products of European companies that use organic certified stevia leaves, such as the Real Stevia Company (Sweden), Oviatis (France) and Betterfoods (Germany).

Environmental and social sustainability

There is growing consumer demand in the European market for products which have been produced under environmentally and socially sustainable conditions. Stevia processors are emphasising stevia supply chain sustainability from farm to final product. Figure 2 shows how Cargill, a leading market player, has set up its own sustainability standard and audit programme.

Figure 2: Sustainable stevia value chain

You can show that you meet sustainability standards by getting certification for all stages of your stevia production. At the farm level, the Farm Sustainability Assessment (FSA) and Global G.A.P. are the most common certifications to show compliance with good agricultural practices in stevia leaf production. SMETA, which is based on the Ethical Trading Initiative (ETI) Base Code, is the certification demanded by most European buyers to verify that your business is socially responsible. Fair for Life certification can also be good to have, but is not normally required by European stevia buyers. However, the main way buyers verify if suppliers are working sustainably and upholding the code of conduct in their business contract is through on-site visits.

Tips:

- Inform prospective buyers about the certifications and standards you work with to prove that you meet environmental and social standards. Display them on your company website and marketing materials.

- Read examples of codes of conduct for suppliers such as that developed by Tate&Lyle.

2. Through what channels can you get stevia on the European market?

The European stevia market was worth US$150.8 million in 2021 and is expected to grow to US$233.63 million by 2026, at a compound annual growth rate (CAGR) of 9.15%. Channels for entering this expanding market depend on which segment you want to target, as well as on the characteristics of your product and capacity of your company.

How is the end market segmented?

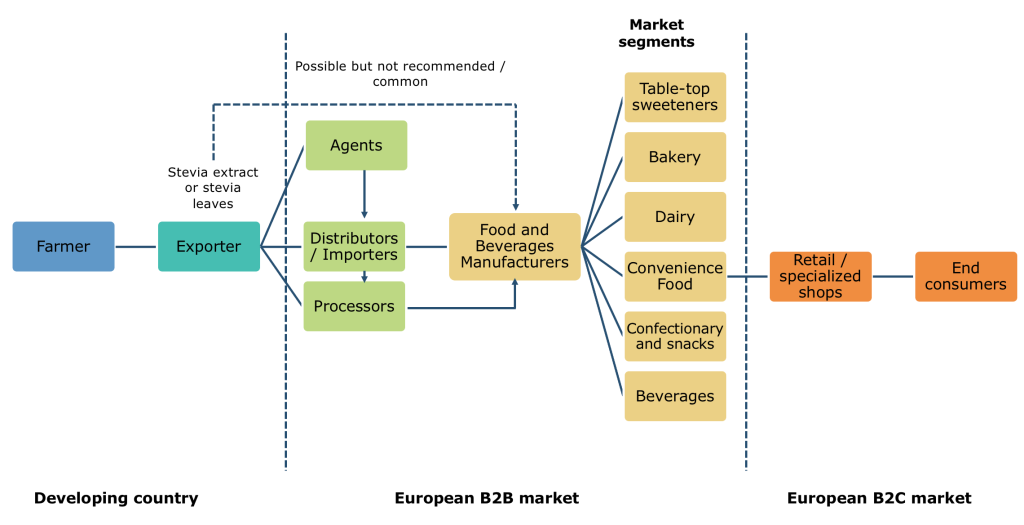

The European market for stevia can be segmented by industry: food and beverage, health products and personal care products. Although stevia has a wide range of uses, its main application and the focus of this study is the food and beverage industry. Within this industry, the market for stevia can be further segmented by application. Figure 3 shows the end-market segments for stevia in the food and beverage industry.

Figure 3: End-market segments for stevia in the food and beverage industry

Food and beverages industry

Stevia extract is widely used as a sweetener by food and beverage manufacturers. New product launches with stevia in the European market increased from 40 in 2010 to almost 2,000 in 2020. Its main applications are in the sports nutrition, soft drinks and confectionary segments. However, stevia extract is also used as a sweetener in bakery goods, dairy food products and dietary supplements, and in table-top sweeteners. The use of organic stevia tea infusions and stevia leaves as a sweetener in food and beverages has grown exponentially, mainly in premium organic beverages, tea, botanical protein powders, healthy bars and snacks, sports nutrition foods and beverages, savoury snacks and sauces.

Food processors are continually innovating to offer natural sweetening alternatives to food and beverage manufacturers. Key drivers for stevia’s growing use are its low calorific value and sweetness, along with the increasing number of health-conscious and vegan consumers.

Tips:

- Read the CBI market potential study about stevia to learn more about growing demand for stevia in the food and beverage industry.

- Monitor food and beverage trends to identify potential applications of stevia in the market. Trend portals such as Food Navigator and Food Ingredients First can be useful.

- For some examples of stevia-based sweeteners currently on the market, visit the web shops of brands such as Mattisson and Pura Vita, and supermarkets websites such as Rewe (Germany), Waitrose and Partners (United Kingdom) and El Corte Ingles (Spain).

Through what channels does stevia reach the end market?

Figure 4 shows the export value chain for stevia. The main channels through which stevia extract reaches the end market are importers and distributors, processors and agents. Stevia leaves can also be exported in bulk as a raw material from developing countries to European processors.

Figure 4: Stevia export value chain

Importers and distributors

European importers and distributors source stevia directly from exporters or through agents to sell to food and beverage processors and manufacturers. They often deal in a wide range of natural ingredients and their import volumes can range from a few kilos to thousands of tonnes. Their expertise lies in the global sourcing of natural ingredients, ensuring quality, documentary and regulatory compliance.

France, Spain, Germany, the United Kingdom, the Netherlands and Italy are interesting markets with relevant players. Some important distributors include Firmalis and Denk Ingredients. There are also importers specialised in stevia and sugar substitutes. Alongside sourcing expertise, they offer food and beverage manufacturers of all sizes consulting services and custom support. Bayn Solutions (Sweden) is one such importer.

Processors

There are a number of processors in the European market with integrated stevia supply chains. These are usually medium to large-size processing companies that supply food and beverage manufacturers that use stevia as a sweetener in their products. Most processors source their raw materials directly from growers. Cargill, a US-based ingredient manufacturer with its European headquarters in the Netherlands, is an example of a stevia processor with an integrated supply chain. Tate & Lyle, a leading ingredient supplier based in the United Kingdom, is another important player with a fully integrated supply chain. These processors invest resources into innovation of steviol glycosides to meet their customers’ demand. A big area of innovation is in eliminating stevia’s bitter aftertaste, which many consumers do not like.

There are also processors that buy dried stevia leaves, usually organic, to make stevia tea infusions for food and beverage manufacturers. Most prefer to produce these infusions in Europe, due to better quality control and assurance, than to buy them directly from developing countries.

Import volumes vary depending on the processor size, type and market segment.

Agents

The job of an agent is simply to help exporters in developing countries and importers in Europe make a deal. They do not have any stock or storage facilities of their own. Agents are usually well connected with European distributors and wholesalers and can be found in developing countries as well as in Europe. However, it is not that common for companies to use agents in the European market.

Tip:

- Read this article about the stevia value chain for a step-by-step description of stevia’s path from farm to final product in the European market.

What is the most interesting channel for you?

If you are an exporter of stevia leaves, processors are the most interesting channel for you. On the other hand, European importers and distributors are the most interesting channel for stevia extract exporters in developing countries. Using importers can help you avoid issues related to logistics and other trade-related risks. As a small or medium-sized stevia exporter, you can enter into long-term partnerships with them.

Importers also use resources to market your stevia to their customers on the European market. They usually provide storage and logistics facilities, which can make distribution of your products easier.

Examples of interesting importers and distributors are Van Wankum Ingredients, The Real Stevia Company and Disproquima. Examples of interesting processors are Stevial (France) and Betterfoods (Germany).

Tips:

- To find ingredient importers and distributors, visit Fi Europe, Europe’s leading ingredient trade fair. You can see the exhibitor list at any time to look for potential buyers.

- See FoodIngredientsFirst’s list of sweetener (non-sugar) suppliers. It provides names of leading importers, distributors and ingredient manufacturers in Europe.

- See the websites and exhibitor catalogues of leading food and beverage trade fairs such as Anuga, SIAL and BioFach to look for innovations and potential buyers in the food and beverage sector.

- Read the CBI study on Tips for finding buyers on the European natural food additives market.

3. What competition do you face on the European stevia market?

Figure 5 shows a worldwide map of stevia extract suppliers to the European Union and United Kingdom. Intra-EU suppliers are important for the stevia market and a challenge for stevia extract and stevia leaf suppliers from developing countries. There is a growing trend of sourcing from local suppliers due to lower logistics costs and a smaller environmental footprint. However, non-EU suppliers will still be relevant for European buyers. By differentiating yourself and offering a good-quality product, you can remain competitive.

Which countries are you competing with?

The main EU competitors in the European market for both stevia extract and stevia leaves are France and Spain. However, non-EU developing countries are also important for the European stevia extract market and represent more than 50% of total imports.

Figure 6 shows the volume of European stevia extract imports between 2017 and 2021 from the six main non-EU suppliers. China, Morocco, India and Malaysia are the leading non-EU suppliers. Malaysia is not in this top six, but is recognised by buyers as a supply country and is the main supplier to the UK market. Although South Korea, Israel and Thailand are in the top six of non-EU suppliers, they are not considered key suppliers by European stevia extract buyers.

China

China was the largest exporter of stevia extract, traded under HS code 29389090, to the European market in 2021. China accounts for 80% of the world’s stevia production.

European buyers see China as a country with a well-established stevia industry and very good machinery and knowledge. The Chinese government actively supports the stevia industry by providing financial support to stevia manufacturers. Chinese stevia suppliers can provide European buyers with large quantities of stevia.

However, China’s stevia industry faces challenges. There are questions about its quality, given that there have been cases of Chinese exporters inappropriately labelling the purity content of their stevia due to the lack of quality control practices. Moreover, Chinese agricultural growers face various challenges, including the loss of agricultural land, declining soil quality and pollution. In addition, there are sustainability concerns in the supply chain. For example, PureCircle, a leading American stevia producer, attracted negative media attention because of issues of forced labour in their production of stevia in China.

European buyers of stevia from China have revealed that reliability, transparency and poor communication are often issues when dealing with Chinese exporters of stevia. Therefore, new alternatives to China are interesting for European buyers of both stevia extract and stevia leaves. European processors see African countries as a high-potential source of stevia leaves.

Morocco

Morocco was the second-largest non-EU exporter to the European Union in 2021. Its exports of stevia extract to the European market grew rapidly between 2017 and 2021. This is wholly due to a growth rate of 48% in the volume of imports to France during that period.

Morocco will most likely maintain this growth in the coming years, as its short distance from Europe makes it attractive to some European buyers. This trend towards sourcing from countries that are closer is driven by the lower environmental impact and shorter delivery times. Although this trend benefits Moroccan exports, suppliers cannot fully compete with larger stevia suppliers, such as China, as Moroccan volumes are still lower.

India

India was the third-largest non-EU exporter of stevia extract under HS code 29389090 to the European Union in 2021.

India has a developing stevia industry supported by government initiatives. For example, the National Bank for Agriculture and Rural Development (NABARD) offers loans and subsidies for stevia cultivation. Despite these efforts, Indian farmers lack financial capital to start cultivating stevia, which involves high start-up costs.

Indian stevia exporters supply both leaves as well as extracts to the European market. There is a lack of extraction plants in India and raw material is also exported to countries such as China and Malaysia. India’s inability to supply large volume orders compared to China and Malaysia is likely to affect the perception of European buyers requiring larger volumes.

Malaysia

Malaysia was the second-largest exporter of stevia extract to the European market in 2019, with 387,133 tonnes exported. In 2021, it ranked eighth, with 50,868 tonnes. This decrease is largely explained by a drop in both the volume and value of exports to France, where imports from Morocco grew in proportion. This may be due to logistics challenges Malaysia faced during COVID-19 and/or by a growing preference to source from closer suppliers. However, Malaysian exports to the United Kingdom, where it is the main non-EU supplier and accounts for almost half of total imports, remained stable.

According to European buyers, Malaysian stevia suppliers are well established and capable of supplying larger volumes to the European market. Malaysian suppliers are seen as reliable business partners. However, some buyers have experienced quality issues in the past.

Large stevia processors, such as PureCircle, have implemented technical assistance projects in cooperation with the Malaysian government to increase profitability of stevia crop cultivation and improve the stevia value chain.

Tips:

- Position yourself against competing countries by highlighting your country’s strengths to European buyers. These strengths may include your country’s close geographical proximity to Europe or trade agreements in place, among others.

- Highlight your sustainability strategy, especially if you are an exporter from a country that is not geographically close to the European Union.

Which companies are you competing with?

Sunrise Nutrachem Group (China)

Sunrise Nutrachem Group is an established Chinese company in the European market. Besides supplying stevia and other sweeteners, they also supply a wide range of organic superfoods and extracts, food supplements and food additives. They hold several certifications for quality compliance, including ISO (9001), HACCP, BRC, EU Organic Certification, Halal and Kosher.

The company also has advanced technical facilities, such as an in-house laboratory to test its products and ensure they meet quality requirements. They also cooperate closely with established international laboratories such as SGS and Eurofins.

Sunrise Nutrachem Group is an international player in the food ingredient and food additive market. It exports to more than 100 countries, including France and Germany, where it is known as a reliable supplier of high-quality stevia extract.

Nutra Choice (Malaysia)

Nutra Choice is an established Malaysian company exporting stevia extract. Their products are HACCP, GMP, ISO and Halal-certified. In addition to stevia, Nutra Choice offers a wide range of nutraceutical and functional ingredients.

The company’s website clearly states their unique selling points and value proposition to differentiate themselves from other natural ingredient suppliers.

Oviatis (France)

Oviatis is an example of a European competitor that suppliers stevia leaves to the European market. Oviatis offers dried stevia leaves, leaf powder, infusettes and seeds in organic quality. They showcase the fact that their stevia is locally grown in France and that the manufacturing of all derivative products is conducted wholly in France. Moreover, they highlight their 100% supply chain traceability.

Oviatis offers a sweetener solution with applications in the food, cosmetics and animal feed sectors.

Tips:

- Ensure you have a professional and informative website showcasing your key strengths and competitive advantages. Display your certifications, but also highlight your commitment to the environment and your community.

- Sign up for professional newsletters such as New Food Magazine to stay informed about the latest trends and competitors entering the European market.

Which products are you competing with?

Stevia is a natural alternative to sugar and can be used to reduce sugar use. Besides competing with sugar itself, it also competes with other natural sweeteners and sugar alternatives.

Coconut sugar

Indonesia, Thailand and the Philippines are the major producers of coconut sugar. Coconut sugar contains fewer calories than traditional sugars and is a rich source of antioxidants. It has several beneficial active properties, including vitamins and minerals such as potassium, magnesium, sodium and iron. The growing vegan population in Europe is expected to increase demand for coconut sugar. However, as a plant-based sweetener, stevia can also benefit from this trend. Organic coconut sugar is currently one of the most popular table-top sweeteners in the organic market. Figure 7 shows an example of coconut sugar in the European market.

Coconut sugar has a high fructose content compared to stevia, which has no fructose in it. Fructose is often associated with health problems. This gives stevia an advantage over coconut sugar, especially considering opportunities in the fructose-free products market. For an example, see Frusano's fructose-free products, which include beverages sweetened with stevia.

Figure 7: Coconut sugar in the European market

Source: Photo by kiliweb for Open Food Facts

Agave nectar

Agave nectar, also referred to as agave syrup, is made from the juice of the agave plant, native to southern parts of North America, Latin America and South America. Agave nectar has minimal effects on blood sugar and insulin levels, making it a suitable sugar alternative for diabetics.

Food and drink formulators and manufactures are familiar with agave nectar, since it is used in a variety of food products, such as granola, energy bars, chocolate and beverages. Agave nectar is also suitable for vegans and is a popular organic sweetener. Figure 8 shows an example of agave syrup in the European market.

Like coconut sugar, agave syrup contains fructose. Moreover, it can take up to six years for agave plants to reach maturity and be suitable for extraction.

Figure 8: Agave nectar in the European market

Source: Photo by kiliweb for Open Food Facts

Monk fruit

The monk fruit plant is native to regions of Southeast Asia, such as Thailand and China. It is a source of mogrosides, which are sweeteners that can be up to 600 times sweeter than regular sugar. The Chinese company Guilin Layn applied for market approval for monk fruit in 2018, but it has not yet been approved in the European Union.

If approved, monk fruit could become a competitor for stevia in the European market. However, it also represents an opportunity, as the two products can be used together. Mixes of monk fruit with stevia or erythritol are popular in regions where monk fruit is approved and will most likely be introduced in Europe as well. Figure 9 shows an example of monk fruit sweetener with stevia.

Figure 9: Monk fruit and stevia sweetener

Source: Photo by kiliweb for Open Food Facts

Tips:

- Position yourself against competing products. Do this by highlighting your unique selling points to European buyers.

- Familiarise yourself with competing products that are available on the European market. For example, read the CBI study on coconut sugar.

4. What are the prices for stevia on the European market?

Stevia prices are affected by factors such as supply fluctuations, weather conditions and crop yields. The price of stevia has been declining since 2015, when China started to become a major supplier.

As shown in Figure 10, European import prices for stevia extract ranged between €14 and €165 per kilo in 2021. Prices were higher for imports from the United States, most likely due to the quality and degree of processing. Prices were lowest for Morocco, with an average import price of €14 per kilo. Chinese prices remained relatively stable during the past five years, with an average price of €24 per kilo. As China is the main supplier to the European market, this is a good reference price. However, prices can vary widely due to differences in quality and volumes traded.

Similar to other product value chains, price margins in the stevia market differ widely depending on the volumes traded, the product quality and type (stevia leaves, liquid or powdered extracts, organic infusions, etc.), its final application and where the food and beverage manufacturer is based.

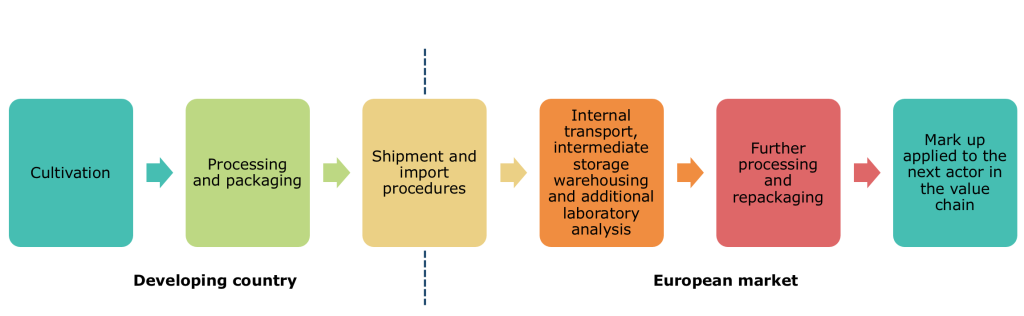

Suppliers from developing countries should be aware of factors that may influence the final price of stevia sold to food and beverage manufacturers. Figure 11 shows a breakdown of these factors. Each step in the value chain adds another cost to the final product. Not all costs are paid by you as a supplier. Some are shared, even if they take place in the European market, and others are for your buyer. However, you need to understand all of the costs involved in order to set your price.

The last process step in Figure 11, ‘Mark-up applied to the next actor in the value chain’, depends on the position of your European buyer. For example, if your customer is an agent who sells to an importer, who then sells to a processor, who then sells to food and beverage manufacturers, the mark-up will be different than if your customer is a processor that sells directly to the food and beverage industry.

Figure 11: Price breakdown of stevia sold to food and beverage manufacturers

This study was carried out on behalf of CBI by Dana Chahin in collaboration with Global Trade Promotion partners.

Please review our market information disclaimer.

Search

Enter search terms to find market research