9 tips to go digital in the natural food additives sector

Digitalisation is increasingly present in the supply chain of food and food additives. The COVID-19 pandemic sped up this digital change, as players, from farmers to exporters, began to use digital solutions in their work in response to pandemic-related challenges. Digitalisation offers many benefits for suppliers, such as expanding markets, improving process efficiency and crop productivity, and creating better relationships with buyers. Keeping up with digital trends and tools is becoming more important for suppliers of natural food additives to be competitive and successful.

Contents of this page

- Understand what digitalisation can do for your business.

- Use e-commerce platforms to find buyers and optimise sales.

- Use IoT technologies to improve agricultural productivity and decision-making.

- Improve the resilience of your crops and business using big data.

- Help your suppliers gain access to financial services through digital tools.

- Improve the transparency of your business through digitalisation.

- Learn and gain new knowledge using internet resources.

- Use business management software to improve your processes and customer relationships.

- Look for national or regional organisations and projects that can help you go digital.

1. Understand what digitalisation can do for your business.

In the food and food additives sectors, players are increasingly managing information and processes digitally. There is a growing number of digital solutions and tools that can benefit actors in the supply chain, all with different uses and goals.

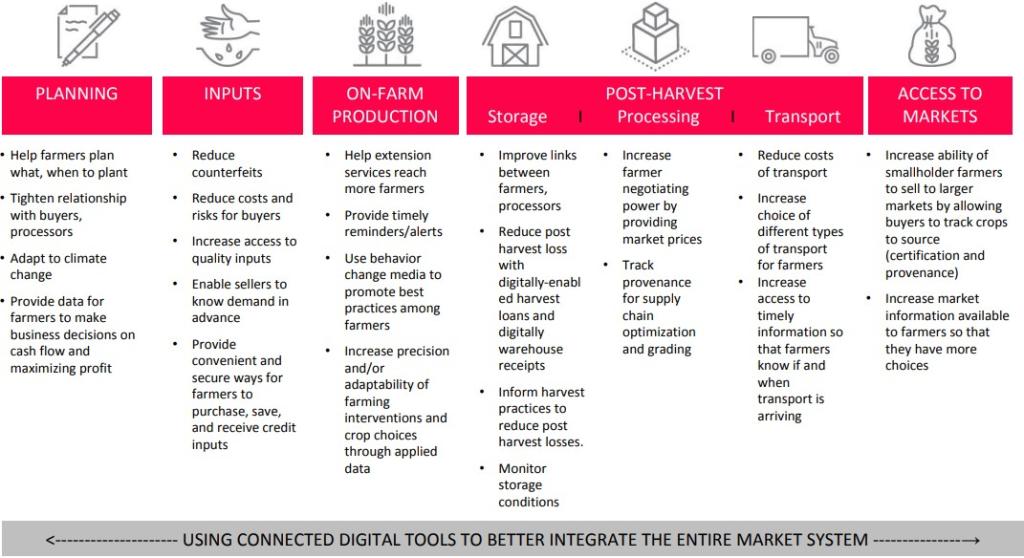

Figure 1: Overview of digitalisation in agriculture

Source: BMZ digital global network, 2023

Some of the main digital solutions used in the food additives supply chain include:

- Digital agricultural and market data;

- Drone and sensor data to support precision farming;

- Post-harvest monitoring equipment;

- Digital platforms and marketplaces;

- Software solutions;

- ICT-enabled extension; and,

- digital financial services.

More and more producers and exporters are starting to see the benefits of using digital tools. Below are some of the advantages of digitalisation at different levels, and activities of the agricultural value chain:

Figure 2: Benefits of digitalisation in the agricultural value chain

Source: USAID, 2023

Other benefits of digitalisation in agriculture include:

- Facilitating access to finance and payments for inputs and outputs;

- Contributing to environmental protection through improved traceability of processes; and

- Improving business productivity and competitiveness.

Going digital can benefit your work, provided you know what you want to achieve. The success of digital transformation lies in having a clear goal. You need to determine your priorities and define the challenges you want to tackle. Then, you need to assess whether a digital tool can help you reach your intended goal. Going digital without a clear objective and a clear strategy can result in problems and difficulties moving forward.

Tips:

- Make sure you have mobile technology first. Smartphones or tablets are essential for most digital solutions.

- Identify your needs before deciding on using or investing in any tool. Use this USAID tool to find out whether digital technology may be useful for you.

2. Use e-commerce platforms to find buyers and optimise sales.

E-commerce in the natural food additives sector provides opportunities for exporters to reach new clients, access markets and promote their products. Marketplaces can be very useful digital tools for suppliers seeking to enter the European market.

In recent years, online retailing and e-commerce increased in the food sector. Restrictions related to the COVID-19 pandemic forced agriculture market players to find substitutes for in-person interactions and transactions. E-commerce marketplaces allowed these necessary transactions to continue safely and quickly, connecting buyers and sellers. This development will become more relevant for the food additives sector too.

Online marketplaces and e-commerce platforms facilitate market access for suppliers. E-commerce allows exporters to:

- Easily connect with farmers;

- Sell agricultural products with faster service;

- Reach new customers or access existing customers more efficiently;

- promote and advertise their business and products;

- potentially increase their sales;

- earn more through premiums for high-quality produce and good customer reviews;

- Ease transactions between buyers and sellers by introducing intermediary services;

- provide access to foreign markets; and,

- increase customer service and loyalty.

Online selling comprises two different channels or two different types of platforms:

- Business-to-business (B2B); and,

- Business-to-consumers (B2C) e-commerce.

Popular examples of B2C platforms are Amazon and eBay. While these platforms can reach a wider customer base, most buyers are final consumers. Also, these platforms are often not specialised in trading food additives. Given that food additives suppliers often sell to other businesses, such as food manufacturers, B2C is of little interest to the sector.

B2B platforms are more relevant for the natural food additives sector. They can provide access to new potential buyers who may be difficult to reach through traditional sales channels. For example, smaller buyers demanding lower quantities of natural food additives. In B2B online trading, suppliers must upload the product information to the platform and keep it up to date. Suppliers should inform buyers about the product’s origin, quantity, price, cooperative’s name (if applicable), process, quality, and affiliation to a certification scheme.

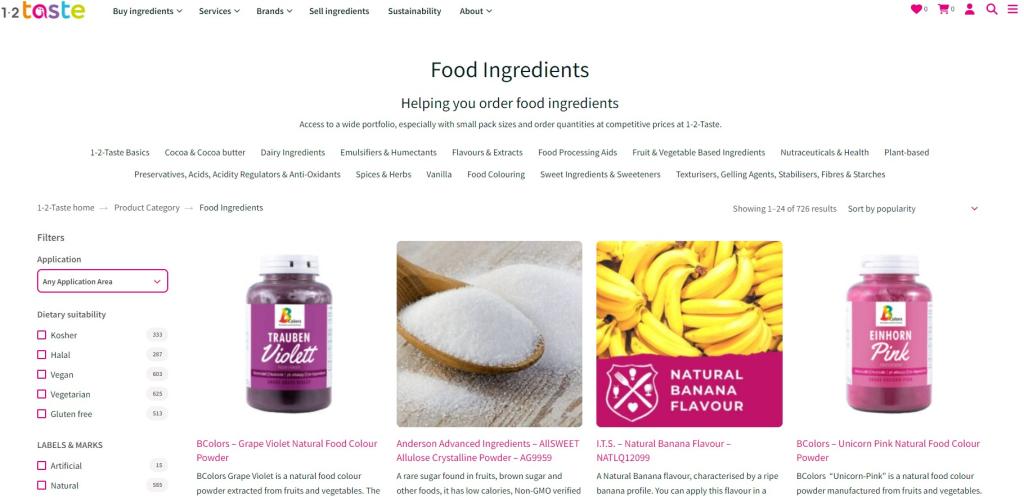

Some examples of B2B platforms for the food additives sector are 1-2-taste, Leroma, Tridge, and Tradekey. There are also some e-commerce platforms that connect exporters with farmers. They work as B2B marketplaces, where farmers offer their raw materials, and exporters buy them and process them into food additives. Producers Market, Agri Marketplace, TruTrade in Africa, and ComX in Nigeria are examples of such trading platforms.

Figure 3: Example of a B2B e-commerce platform

Source: 1-2-Taste, 2023

While e-commerce offers many benefits, online marketplaces may not be the right solution for all suppliers and in all cases. Connectivity is a key barrier. Without access to reliable internet and digital devices, suppliers are less able to sell their products online. Also, poor infrastructure and poor logistics networks can reduce farmers’ ability to effectively sell online. Also, it may not be necessary to change sales channels if suppliers already have good relationships with customers. In some cases, the risks of investing in a new sales channel may outweigh the benefits.

Some farmer groups and exporters may try to create their own e-commerce marketplaces. This is a risky effort, requiring strong entrepreneurial business and technical skills. Less complicated solutions, such as social media or existing marketplaces, may work just as well with equal or higher gains.

Tips:

- Check that the platform you are considering sells products that match your offer. This way you are sure to connect with buyers of your type and reach your target segment.

- Compare the costs and type of charging between marketplaces. Some charge a commission for each transaction. Others charge through a subscription or fee. Platforms that offer more help in finding buyers may charge more for their services.

- Be aware that you may face a lot of competition as e-commerce buyers have a wide range of products to choose from. While e-commerce allows you to promote yourself, displaying your product alone will not ensure that you reach clients. You still need to show that your product is worth the money.

- Check if there are online marketplaces in your country, and use them to expand your market.

3. Use IoT technologies to improve agricultural productivity and decision-making.

The Internet of Things (IoT) is becoming one of the most promising technologies in the agriculture sector. It allows farmers to make decisions based on crop data, helping them to improve yields and increase profits.

IoT refers to physical devices connected to the Internet, which record, track, and share data with little or no human intervention. IoT in agriculture mainly involves the use of sensors, aerial drones, cameras, and geographic position systems (GPS). IoT collects real-time data on temperature, soil moisture, weather conditions, among other data. Data is then transmitted via a network, stored, and processed in data management applications. The collected information can be delivered to suppliers through an app, via SMS, IVR (interactive voice response), or even WhatsApp.

IoT is very useful for data-driven agriculture, also known as smart farming. Farmers can access valuable, real-time insights that can support their decision-making. Also, IoT devices are useful to send alerts or automate things. These features can help farmers adopt best practices, optimise production, and make farmers more sustainable. This should mean higher yields, reduced risk of crop failure, lower operating costs, higher profits, and improved livelihoods.

The use of drones in the agricultural industry is increasing. Among IoT technologies, aerial drones are becoming a popular solution for precision farming. There are examples of producers in developing countries already using drones successfully, especially in Africa. Producers can either buy the devices or pay drone service providers who rent them on a time basis. Paying for the service of using drones is often more affordable for exporters and producers of food additives. Drone service providers can charge an average rate of 160 US dollars per hour for agricultural use. Meanwhile, a single drone can cost thousands of euros.

Table 1: Examples of usage of drones in agriculture in developing countries

|

Country |

Uses |

Link for further reading |

|

Togo |

Suggesting crop line orientations, spraying plots with insecticide treatments, and applying fertiliser. |

|

|

Benin |

Monitoring crop health, assessing crop nutrient requirements, and deriving fertiliser recommendations. |

|

|

Ghana |

Applying pesticides efficiently with limited or no wastage and ensuring optimum distribution of chemicals. |

Source: ProFound, 2023

The use of sensors is also becoming more common in precision agriculture. PANI is a solution offering irrigation advice to small and marginal farmers in India. It uses a network of low-cost ground sensors to measure data on air temperature, wind speed, soil moisture, and other data. Data is collected in a central database, where it is combined with available satellite data and weather prediction data. Small and marginal farmers receive irrigation advice via mobile phones. The PANI system is low-cost and requires little maintenance. Farmers can subscribe to receive irrigation advice and warnings for an estimated US$5 for the basic version of the service.

Farm21 is another solution for farmers that collects crop data using a network of low-cost soil sensors. The platform combines information from the sensors with data from satellites and meteorology. Farm21 provides information on water management, disease pressure, weed warnings, and growing cycles. This helps farmers make better decisions about irrigation, fertilisation, protection, planting, and harvesting. It also helps them reduce inefficiencies, maintain optimal growing conditions, and improve yields.

One of the main concerns around IoT is security. IoT devices are always connected to the Internet and can handle sensitive data. Vulnerabilities can lead to breaches, unauthorised control, and other potential threats.

Tips:

- Consider the type of connectivity that devices need to connect to each other and the Internet. The topography and location of your farm might determine your available options.

- Check required technical knowledge, maintenance, and set up costs before investing in IoT.

- Ensure that platforms respect data privacy and do not misuse your farmers' data. As with all digital tools, ensure that your systems are secure.

4. Improve the resilience of your crops and business using big data.

Climate change and rising global temperatures are making weather more unpredictable. Farmers are more vulnerable, posing major challenges to food production and food security. SMEs in developing countries must be involved in mitigation, adaptation, and resilience efforts. Big data predicts weather forecasts and shocks. Thus, it can help farmers to reduce their vulnerability to climate change.

Big data refers to the analysis of large amounts of data. In big data for agriculture, the data is often on weather parameters such as temperature, precipitation, and wind. Data is often collected through satellites, weather stations, and crowdsourcing. Big data solutions build future climate scenarios based on historical data and past climate behaviour. Users of these solutions get accurate forecasts of climate behaviour and extreme weather events. This way, big data helps farmers improve their ability to respond to weather conditions. It is also useful for adopting climate-resilient farming practices.

Big data can also be very useful in addressing the spread of pests and diseases. The use of big data analytics can help farmers detect, track, and prevent disease outbreaks. Farmers get alerts of potential outbreaks and can take preventive and mitigating measures in advance. In the long term, this translates to more resilient crops and businesses.

Examples of applications that leverage big data:

- Cropin uses machine learning and satellite monitoring to perform predictive analysis. It delivers customised reports and insights to farmers via PCs or smartphones. Its digital farming solution includes geotagging for accountability, advice based on satellite and weather data, alert log and management on pest and diseases.

- FarmBetter provides recommendations to farmers based on their location, practices, and goals. This app gives access to knowledge on how best to adapt to climate challenges.

- FarmStack by Digital Green provides farmers with context-specific information on sustainable agronomic practices. Farmers have access to data on soil health, availability of inputs, weather forecasts, and potential pest attacks. Also, farmers can get near real-time inputs from service providers through Interactive Voice Response and Telegram. Such digital advice is very important in remote areas where extension agents and field officers rarely go.

Tip:

- Read the FAO publication “E-agriculture in Action: Big Data for Agriculture” to learn more about big data, its benefits for agriculture, and several case studies.

5. Help your suppliers gain access to financial services through digital tools.

Access to finance is a major challenge for many food and food additive producers. Lack of finance prevents producers from investing in inputs and services. This makes it difficult to improve yields and product quality, which exporters require to meet European buyer requirements. However, there is a growing number of digital tools that give smallholders access to financial services.

Digital Financial Services (DFS) provide financing to previously unbanked customers. DFS are especially useful in regions where traditional banking infrastructure is weak. DFS focus on saving money, accessing credit or insurance, and performing transactions via digital channels.

Some of the main DFS in agriculture are savings and credit products. These can be used to finance agricultural transactions, such as improved seeds or agricultural tools. These services can be adapted to the specific needs of farmers, depending on planting, harvesting, and marketing cycles. Basic transaction accounts are also common. These mobile wallets allow farmers to store funds and receive payments. DFS can help to address specific challenges across the agricultural value chain and contribute to combating poverty.

Examples of existing digital tools useful to farmers and food additive suppliers:

- KoltiPay is a fintech feature issued by Koltiva. Koltipay offers solutions such as e-payments, e-wallets, e-bills, e-loans, e-insurance, and financial statements. KoltiPay enhances the financial inclusion of producers in rural areas. This tool also facilitates cashless payments, empowers producers to save, offers micro-insurance for crops, and grants loans to small producers, with low interest rates. KoltiPay is in the following apps: FarmCloud (for farmers), FarmGate (for traders), and FarmRetail (for agri-input shop owners).

- Kisan Diary by Digital Green is an app that captures, analyses and controls farmers’ financial data. The app provides profit and loss analysis based on crop and time. Kisan Diary helps suppliers to better manage their farming and expenses. Kisan Diary has more than forty thousand users.

- Mosabi is a financial education app for entrepreneurs in emerging markets. It helps them to improve decisions and behaviours related to money and business. Mosabi educates producers and exporters on financial literacy. It also connects them to financial service providers using an alternative credit scoring profile based on users’ activity within the platform. Entrepreneurs who use Mosabi may be able to increase their income/savings and access DFS. This tool currently has 2,800 users.

- Credit wallet is a financial platform that provides tokenised credits to actors in agricultural value chains. This tool enables real-time monitoring of transactions and creates financial transparency.

- CashCard provides basic financial services to farmers in Nigeria. This tool creates a financial identity for smallholder farmers to qualify for micro-credit. CashCard also allows farmers to access farm inputs on credit, receive market price updates via SMS, and get paid using only their phone number.[AS1]

- Farmerline gives West African farmers a digital identity to support their access to finance for agricultural inputs. Farmerline delivers quality inputs to growers and allows payment over the season.

Tips:

- Make sure your devices and apps are always updated to the latest versions. This helps to fix vulnerabilities and ensure the security of your products.

- If possible, collaborate with agri-fintech experts or consultants. They may offer tailored solutions and strategies.

- Help supplier farmers access financial services by digitalising their transactions and giving them access to the transaction history. Banks can then use this digital transaction history for credit scoring and offer financial services to farmers with good credit scores.

6. Improve the transparency of your business through digitalisation.

The need for transparency in the food chain is growing. Digital technologies, such as blockchain, can increase transparency and traceability in supply chains.

European buyers continue to highlight traceability as one of their major requirements. Consumers are demanding more information about product’s origin and valuing sustainable production practices. Additionally, regulations are being adopted. One example is the European Commission’s proposal for a Corporate Sustainability Due Diligence Directive, aimed at improving due diligence in the market.

Digitalisation of agricultural processes is a key enabler for traceability. It allows real-time tracking, supply chain monitoring, better coordination, and increased visibility. Companies can manage supply chain transactions and processes, trace the origin of ingredients, ensure product authenticity and quality, and add their story to the final product. There are several types of technologies and software that allow companies to digitise data on products and practices and upload it to databases. Data can then be easily extracted and shared with partners for transparency purposes.

One such technology is blockchain. It is a decentralised, networked database (a way of storing and exchanging data). Blockchain is a secure and transparent way to digitally record and store data. Blockchain records transactions chronologically and shares it among multiple parties. Thus, blockchain helps improve transparency in incomplete trust environments. It makes data visible to more parties and detects attempts to alter or falsify data.

Starting with blockchain on your own is a huge step. It requires the cooperation of other participants in the supply chain. Farmers rarely use blockchain on their own. Instead, they use solution providers.

Examples of traceability in agriculture:

- Koltitrace by Koltiva is a leading platform working to make supply chains traceable and sustainable. Koltitrace tracks supplier data to digitise and verify supply chains. This tool allows you to automate data exchange with IoT-enabled smart farming technology solutions. Customers can see in detail the annual GHG emissions and carbon removals of the value chain. Also, it provides tracking of land use change (for example, deforestation).

- Smallholdr is a mobile application and web platform to collect data and track produce in smallholder supply chains. This tool generates unique QR codes used as identification for farmers and it is attached to boxes or buckets. Thanks to QR codes, Smallholdr tracks products and items along the supply chain "from farm to fork". The Smallholdr system generates a stream of detailed geo-tagged data on what field agents and farmers are doing. This provides vital operational information, as well as accurate data on compliance.

- FarmerLink is a digital platform for smallholder farmers in developing countries. It captures offline data and keeps real-time records of farmers, plots, production, and sales. It also provides specific services for CO2 sequestration. FarmerLink helps users make informed decisions and connect with supply chain actors. It also allows users to share information with relevant stakeholders, ensuring traceability and comprehensive supply chain management. This platform has more than 20 thousand farmers from different supply chains.

- Producers Trust is a platform that captures and manages sustainability data from farmers. It seeks to de-risk supply chains, enable ESG reporting and regulatory compliance. Producers Trust offers advisory services to scale sustainable supply chain transition. Also, it has its own software solution called StoryBird. Companies can use it to visualise data and build customer experiences using sustainable supply chains.

- Bext 360 is a platform that provides blockchain traceability and sustainability measures. By documenting ingredient purchases and movements in real time, users can see exactly how much of the ingredient came from mapped harvesting sites. Purchases are documented in the blockchain app to confirm that payments are made directly to harvesters, not to middlemen. Actual payments are made digitally, through a mobile banking platform, which allows buyers to confirm with receipts that payments are made in full and on time; these receipts are uploaded to the blockchain and attached to each transaction.

Tips:

- Read the CBI study “Blockchain in Europe” to get a better understanding of what blockchain is.

- Read the publications “Beyond the blockchain from Agriterra” and “E-Agriculture in Action: Blockchain For Agriculture” from FAO to get inspiration from practical applications of blockchain technology, and their opportunities and risks.

7. Learn and gain new knowledge using internet resources.

Suppliers can increase their knowledge and improve their practices by using the wide range of digital resources available today.

Specifically for producers, digital agricultural extension resources stand out. They provide information and advice to producers. Most of the time, information is delivered via mobile phones and digital channels (SMS, IVR, low-cost video and interactive radio). Digital agricultural extension helps technical assistance reach more farmers and be timelier. An example of such a resource is Koltiskills. This is an e-learning platform for farmers’ education on good agricultural practices. Koltiskills offers extension services to train suppliers in sustainability practices. It also supports producers in preparing for sustainability certifications such as Rainforest Alliance, RSPO, 4C and FSC.

Producers can also access information on agricultural topics in mobile applications or digital platforms. These resources allow farmers to learn new skills and innovative farming techniques. It also helps them connect with experts and peers in the sector. Some examples of these resources include:

- Agrolearning by Solidaridad, offering free training tools to promote sustainability practices; and,

- ICTforAg which brings together agri-food system actors, to promote knowledge sharing on the use of digital tools.

There are many educational resources and tools that give exporters market information. For example, the International Trade Centre has two very useful tools for exporters:

- Market Access Map provides information on tariffs and other requirements to enter a market with a specific product or from a specific origin. The platform provides quick, easy, and free access to information.

- Export Potential Map analyses the export potential for selected products, markets, and suppliers. By comparing the potential across countries and products, you can better select your target market.

Online magazines and their articles are a valuable source of easily accessible information. You can read online food industry magazines such as Food Navigator, New Food Magazine, and Food&Drink Business Europe. You can also read online tech magazines such as AgriTech Tomorrow and PrecisionAg.

The websites of major trade fairs such as Biofach and Anuga provide relevant information on the food additives sector. You can access press releases, exhibitor’s information, and webinars, to get an idea of the market dynamics and opportunities. Please note, however, that this digital information cannot replace the experience of attending a physical trade fair. On-site trade shows are essential for exporters to connect with potential buyers. They still prefer to meet suppliers in person and be able to taste, feel, and see products first-hand.

Tips:

- Visit the ICTforAg website and watch videos from previous conferences/sessions, to learn more about digitalisation in agriculture.

- Subscribe to the CBI newsletter to receive information about the natural food additives sector, digital events, and webinars.

8. Use business management software to improve your processes and customer relationships.

As an exporter you must maintain a high level of efficiency and be prepared to meet the digital requirements of clients. Business management software will help you work more efficiently and avoid human error. For smaller exporters, the implementation costs can be a barrier. But once functional, it will likely save you time and prevent potential expensive mistakes.

Building a long-term relationship with European buyers requires careful Customer Relationship Management (CRM). CRM platforms can help to manage relationships with customers, organising data in a centralised database. Companies can access all their contacts and keep a detailed record of all communications (emails, calls, and meetings). They can also monitor their sales and keep track of their orders and deliveries. These features help companies create standardised processes, automate sales tasks, follow-up, and improve service.

CRM is essential for small and medium-sized businesses. The ability to build trust and provide transparency is key for SMEs to stand out from the crowd and key to success. CRM allows SMEs to have effective relationship management with buyers, intermediaries, and other stakeholders.

Here are some of the ways that SME exporters can benefit from using a CRM solution:

- Improve customer service through quick response times and tailored solutions;

- Drive sales growth by following up on leads;

- Improve data-driven decision making and analysis;

- Improve process efficiency by automating tasks;

- Respond more effectively to queries, concerns, and issues;

- Build customer loyalty;

- Eliminate redundant or contradictory communications;

- Improve supply chain planning; and

- Process orders more efficiently and ensure timely delivery.

CRM is often part of a broader management system known as Enterprise Resource Planning (ERP). ERP is a system that integrates the management of business processes, often in real-time, using software. Companies can use ERP software to collect, manage, and interpret data from business activities. ERP systems can help exporters to increase productivity and lower costs. Also, they are useful to manage international trade processes, shipment tracking, and gain supply chain visibility. Exporters cooperatives and farmer groups can use ERP to manage inventory and shared resources, streamline operations, track product origin, and maintain transparency among members.

For example, an exporter in Nepal uses ERP software from Odoo to map their supply chain. This allows the exporter to quickly share field data with their marketing team, who can use it to develop stories about their suppliers. Besides this, the sales team can use the ERP software to map their buyers and track the communication with them. During trade fairs, the exporter uses the mobile application of Odoo to update buyer information based on in-person conversations, which remain important besides the digital CRM.

Some of the most popular software for SMEs include HubSpot, Zoho CRM, Agile CRM, Freshsales, Streak, eProd, and Farmforce. These solutions are ideal as they are easy to use, customisable, and flexible. Also, they offer free basic plans, and some work in mobile applications.

Tips:

- Check and compare the prices of the solutions you are interested in. Note that many software providers offer free plans for basic functions and charge extra for additional or more advanced features.

- Use a CRM with robust security features to protect customer data.

- Make sure you document your processes in a practical database and a decent backup system (in the cloud) if you think your company is too small to implement CRM or ERP software.

9. Look for national or regional organisations and projects that can help you go digital.

Implementing digital tools in your operations takes time, money, and dedication. As valuable as it is, going digital still requires considerable effort. Many digital technologies have a high cost of adoption, can be very expensive, and need a learning curve. Most suppliers may need external or extra training to use tools effectively. Suppliers should turn to organisations or partners who offer support and guidance in the digital transformation process.

NGOs, private sector organisations, and government entities with an active role in agricultural development will likely have a role in the digitalisation of farmers and SME exporters. They often develop, monitor, or fund digitalisation projects for agriculture. It is important to find out which digitalisation projects near you suit your needs, offer help or financial support. This will make the digital transition more effective and useful.

Examples of digitalisation projects in developing countries:

- The Agrifin project supports the introduction of digital technologies and innovation services to smallholders in Indonesia. In 2021, the project conducted in-depth research into the Landscaping of the Digital Agricultural System in Indonesia. It proposed several interventions that could be carried out in the spice and herb sector.

- TAMAP is a project funded by the European Union (EU) in Sri Lanka. TAMAP aims to support the creation of an enabling environment for sustainable and efficient agricultural production. The project supports the implementation of digital agricultural applications, including producers of spices and herbs.

- Village Link is an example of a digital support project in Myanmar. The company developed the application “Htwet Toe” which allows farmers to upload photos of their crop issues and ask questions in recorded voice messages. Within 12 hours, farmers receive advice from agricultural professionals on suggested treatments.

- The Agricultural Innovation Project supports Egyptian smallholder farmers (including spice and herb producers) in using digital solutions. The project was funded by GIZ and aims to improve access to information on input supply, marketing, and extension, as well as financial services.

- The EU-funded programme Markup supports spice and herb producers and processors in Kenya, Uganda, and Tanzania. In collaboration with partners, the project supported the establishment of the East African Trade Information Portal and the Kenyan Trade Portal. It also supported a joint venture between a Dutch investor and the Tanzanian spice company Trianon.

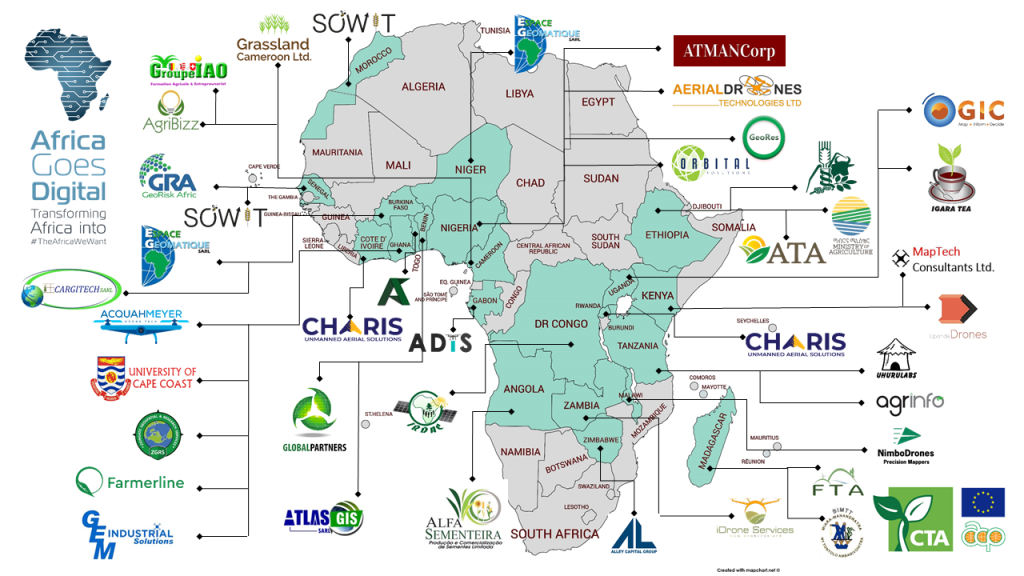

- The Technical Centre for Agricultural and Rural Cooperation (CTA) develops numerous digitalisation projects in Africa. In 2017, the project "Transforming African Agriculture: Eyes in the Sky, Smart Techs on the Ground" supported ICT start-ups in developing countries to acquire the capacity to deliver UAS services. From this group of supported start-ups, Africa Goes Digital was born. This is an association of digital operators seeking to enable and promote the use of digital technologies for development in Africa. The members of this association offer multiple services such as UAS-based consultancy and training. The association now has 41 members in 21 African countries, most of which offer drone services.

Figure 4: Africa Goes Digital Members

Source: Africa Goes Digital, 2023

Tips:

- Search and connect to the sector association of your country or region, to see if they can offer support.

- Have a look at the Africa Goes Digital map and member list if you are an African supplier, to find potential digital service providers in your country.

- Check the websites of non-profit organisations such as GIZ and Solidaridad. They support and implement cross-sectoral projects around the world that promote innovative digital solutions and use data-powered technologies.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research