9 tips for organising your natural food additives exports to Europe

Once you find a buyer who accepts your offer, you will have to start organising the export of your natural food additives to the European market. A good understanding of practical export processes is crucial to becoming and remaining a successful exporter. This can be challenging because of European import policies and buyer requirements. The tips listed below provide practical information on how to approach the organisation of your export.

Contents of this page

- Draft a contract and understand what you sign

- Secure your payment: agree to a suitable payment method

- Look into trade financing options

- Manage export shipping costs and risks by choosing the right delivery term

- Cover trade risks with insurance

- Select the most efficient way to organise international transport

- Provide the required documentation for customs

- Use safe packaging with the required labelling

- Use the support of organisations to organise your exports

1. Draft a contract and understand what you sign

Once you have agreed with your buyer on price, product specifications, payment, shipment and destination, you need to draft a contract. Always insist on having a formal contract that defines the conditions of the trade. With a contract, you have a tangible record and a legal foundation that can be enforced in case the buyer breaches the agreement. Well-defined contracts protect your business.

Before signing a contract, you must fully understand what is agreed upon because non-compliance can lead to disputes between you and the buyer. If there is any doubt about a detail in the contract, make sure to clarify the draft text with your buyer before signing the contract. Carefully review details on price, delivery and payment terms, quality requirements, applicable charges, and the procedure for resolving disputes. Once both parties have formally signed the contract, the trade agreement is confirmed.Top of Form

What should be in the contract?

Some of the main topics that should be covered in an international trade contract are:

- Contact information of buyer and seller: Names and addresses of both parties

- Product specifications and quantity: Product quality, characteristics, and certificates

- Delivery terms: Incoterms and delivery schedule

- Price and payment terms: Price paid by the buyer, payment method and conditions

- Documents provision: Documents to be provided by you to the seller or bank

- Breach of contract and resolution: What happens in case of breach of contract

Refer to the Model Contracts for Small Firms (pages 35-58) at the International Trade Centre (ITC). This gives a detailed description of what should be in a contract and provides a model contract.

Tips:

- Do not export without a contract.

- Before signing a contract, ensure you understand its requirements. If you are unsure, ask the help of someone with experience in international trade contracts.

- Be precise in describing the specification of your product in contracts.

- Negotiate contract terms with the buyer to align them with your preferences.

- Improve your negotiating skills, look for tips online, such as Negotiations and Contracts by the Swedish Chamber of Commerce, or follow an online course such as Export Sales and Negotiation by ITC.

2. Secure your payment: agree to a suitable payment method

International trade offers a range of payment terms, each with pros and cons. Understanding that different terms pose different risks for all parties involved is crucial. As such, it is essential to evaluate the risks and benefits of each payment term before reaching an agreement.

Several factors affect your choice of an international payment method as an exporter. Remember the goal of mitigating potential risks while finding common ground with your European buyers. Selecting the right payment method is crucial for establishing enduring relationships with buyers.

European buyers mostly use the following methods of payment: Letter of Credit, Payment in Advance, Documentary Collection and Open Account.

Letter of Credit (L/C)

The Letter of Credit (L/C) method is the most used payment method, especially in new trade relations. L/C provides security to both buyers and sellers. This is because L/Cs allow both parties to engage a neutral party, typically a bank, to resolve disputes.

The chosen bank guarantees the exporter full payment upon the dispatch of goods as long as the conditions outlined in the payment contract are met. Common conditions that need to be met before you get paid include the following:

- Documentation requirements: you have to present the required documentation, such as invoices and transportation documents, to the buyer or the bank.

- Shipping and delivery terms: you have to comply with specific requirements related to shipping and delivery. For example, you need to ship your product using the mode of transport that has been agreed upon, and the product should arrive on time.

- Product quality: you must ensure that the shipped product meets the agreed level of quality.

The buyer can reject the goods if you cannot comply with one of the set conditions, and you will be exposed to the risk of not receiving payment. Accordingly, you should therefore be careful when agreeing to the L/C payment method. Only agree if you understand and can the specific conditions outlined in the contract.

One downside to this payment method is that it can be expensive because banks charge a fee for the service. You can make this less of a disadvantage by splitting the costs with the buyer.

Payment in Advance

Payment in Advance is a payment method whereby the buyer pays you before receiving the product. This payment method requires a high level of trust on the buyer's part. After all, a buyer is making the payment without a guarantee that you will deliver the products and comply with all the buyer’s requirements. All of the risk lies with the buyer. This method is therefore often only used when the buyer and the seller have a well-established relationship.

Documentary Collection

This payment method gives you security because you keep control of the goods until you receive payment. Trade documents, such as invoices, shipping papers and insurance papers, are transferred through banks. You instruct the bank when the buyer can get these documents. Either you first require the buyer to make the payment (Document Against Payment – D/P) or you require the buyer to accept a contract for payment at a specified future date (Document Against Acceptance – D/A). This payment method means you stay in control of your goods until they are paid for. However, you are exposed to some risks as you have no guarantee that the buyer will make or accept the payment once your product has been shipped. The product could be at its destination and the buyer may fail to pay. If this happens, you can try to ship the product back or store it at the destination while you try to find another buyer.

Open Account

Open Account can be seen as the opposite of Payment in Advance; you have to deliver your product to the buyer before you receive payment. This method is different from L/C, for example, as you do not receive a guarantee of payment before you ship your product. This means that all of the risk lies with you: the seller. Similar to Payment in Advance, the Open Account method requires a well-established relationship between buyer and seller. As a seller, you should only agree to this payment method if you have a longstanding relationship with the buyer and are sure they will make the payment.

Gaining a competitive advantage

As an exporter, you can gain a competitive advantage depending on the payment method you pick and your payment terms. Being flexible about the payment method can help you to make agreements with potential buyers. For example, you can gain an advantage by accepting a Letter of Credit as a payment method if your competitor only accepts Payment in Advance.

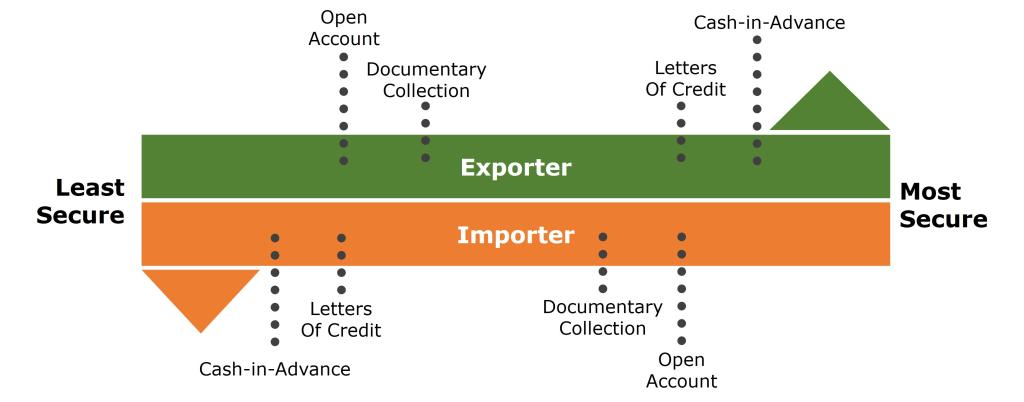

Again, when deciding on your payment method, remember that the most secure payment method for you is Payment in Advance, followed by Letters of Credit, Documentary Collection and Open Account (see Figure 1). For buyers and importers, it is the other way around. Ideally, when beginning a trade relationship with a new buyer, you want to ask for Payment in Advance to minimise your risks. However, buyers may not be willing to agree to this method as it is very risky for them. If they are unwilling to take the risk, you should insist on the Letters of Credit method so you can share the risks with the buyer.

Figure 1: Payment Methods Risk Diagram

Source: ProFound, adapted from International Trade Administration, 2023

Tips:

- learn more about the different payment methods. You can take this Export Finance course by ITC or read this detailed description of payment methods by Trade Finance Global.

- Be flexible, but carefully consider what risks you are willing to take when negotiating the payment method. Consider the costs associated with the different payment methods, for example, the fees a bank will charge for their services for the Letter of Credit or Documentary Collection methods.

3. Look into trade financing options

Many financial institutions can help finance your business. These include large commercial trading banks such as BNP Paribas, HSBC, and Deutsche Bank. Development banks sometimes provide the same services at a discount because of their public function. Examples of development banks include the European Investment Bank (EIB), the Asian Development Bank (ADB), the African Development Bank (AfDB), the European Bank for Reconstruction and Development, and the Inter-American Development Bank (IDB).

Impact investors could be another interesting party. For instance, look into the services offered and products covered by Shared Interest (United Kingdom), Alterfin (Belgium), Sidi (France), Rabo Rural Fund, Triodos Investment Management and Oikocredit (the Netherlands), Impact Finance (Switzerland), and Root Capital (United States of America).

Note that financial institutions will only lend money if you have a few years of successful export track record. This means you should have no claims or financial losses. This can be a challenge when starting up, as you might not have working capital or a track record yet.

Tips:

- Choose a bank active in Europe and experienced in providing the payment services you need. A bank that is active both in your country and in Europe is ideal.

- If possible, use trade facilitation programmes offering advice and discounted payment services fees. Examples are the EBRD Trade Facilitation Programme and the Asian Development Bank’s Trade Finance Programme.

4. Manage export shipping costs and risks by choosing the right delivery term

To better understand the rules and responsibilities of the exporting and importing parties involved in export, you need to know about International Commercial Terms (Incoterms). Incoterms are an internationally recognised standardised set of global trade rules by the International Chamber of Commerce. They define the responsibilities and risks of buyers and sellers in international trade.

Incoterms are helpful because they indicate who is responsible for which part of organising export. This includes the allocation of costs, risks, and obligations. Using Incoterms will result in a smoother international trade process for you and the buyer.

Incoterms are divided into two groups: those for any mode of transport (EXW, FCA, CPT, CIP, DAP and DDP) and those that only apply to transport over sea (FAS, FOB, CFR and CIF).

For sea transport, the two most common Incoterms for the export of natural food additives are Free on Board (FOB) and Cost, Insurance, and Freight (CIF):

- FOB: You are responsible for transport and risks until the product is shipped at the agreed port of shipment. From that point, the buyer is responsible for transportation, insurance, customs, tariffs and taxes.

- CIF: You are responsible for the costs, insurance, and transport until your product arrives at the agreed destination port. From that point, the buyer is responsible for unloading, customs, tariffs, taxes and insurance.

For air transport, the most used Incoterms for the export of natural food additives is Carriage and Insurance Paid To (CIP):

- CIP: You are responsible for delivery, delivery costs, and insurance costs until your product is handed over to the air carrier. When delivered, the buyer takes on all responsibilities.

Figure 2: Incoterms division of responsibility

Source: Freightos, 2023

Ensure you understand the obligations related to the Incoterms you agreed upon with the buyer. It is important to know what your responsibilities are as the exporting party. Understanding your responsibilities also helps in pricing your goods for export. For example, some Incoterms demand less organisation on your part than others; consider this when pricing your goods.

Tips:

- Use Incoterms to identify your and the buyer’s responsibilities.

- Familiarise yourself with all different Incoterms by reading Using Incoterms.

- Make your preferences clear to your buyers. Include these terms in your offer once you agree on which Incoterms to use. For instance, you may want to aim for FOB Incoterms for shipment by sea in negotiating with your buyer to simplify organising transportation.

5. Cover trade risks with insurance

Exporting your product comes with risks: buyers may not pay, your product may get damaged or stolen during transport, delivery can get delayed and changing legislation can cause your product to no longer meet regulations. To diminish risks, consider insuring your goods and payments, especially if you deal with high-value shipments.

Export Credit Insurance

It is common to obtain insurance coverage against payment default risks. The insurance that covers this risk is called Export Credit Insurance (ECI). ECI covers situations where buyers cannot pay because they are insolvent or do not pay within the agreed time frame. ECI also covers non-payment risk due to events beyond the buyer's or seller's control, such as problems in transferring money between countries.

Unless you and the buyer have agreed on Payment in Advance, which eliminates the risk of non-payment, you should consider ECI.

ECI can make you more competitive because it guarantees payment. Many European buyers prefer delayed payment methods like Letter of Credit or Documentary Collection. If you do not want to take the risk of non-payment associated with these delayed payment methods, you may lose out on business. To avoid this scenario, ECI can cover the risks, allowing you to offer delayed payment and increasing your chances of signing trade deals with buyers.

The process of getting ECI usually involves the following steps:

- Inquire about getting ECI at an agency; ask about your options based on the transaction you want to make and ask what documents and information they require.

- After collecting the required documents and information, apply for ECI.

- The agency will give you their offer with terms and an indication of the costs.

- If you accept the offer, the agency will look into the buyer’s financial position.

- The agency will give you a definitive offer.

- If you accept the terms and costs, you can sign the contract.

It is essential that you fully understand the terms and conditions before you sign and that you know what you are insured against and not. If you are unsure, ask the insurance company for an explanation or help.

ECI providers include export credit agencies, commercial banks and other financial institutions. Many countries have government-owned export credit agencies to increase the competitiveness of their exports. These government-owned agencies should be your first choice for getting ECI, so try to find your local agency by contacting your local government trade department.

Other types of insurance

If you have agreed to CIF or CIP Incoterms, you might be responsible for the insurance of your product during the main transport. In this case, you must get freight insurance if you agree on this with the buyer. Freight insurance covers the risk of damage or loss during transport.

If you agree on FOB Incoterms, the buyer is responsible for insuring the product during transport. However, if you cannot rely on the buyer to do this, consider applying for Seller's Interest Insurance. Seller's Interest Insurance covers the risk of the buyer not insuring the goods during transport and not being able or willing to pay for damage or losses. The cost of product insurance depends on the total value of the goods you want to export, the origin and the distance it must travel.

You should get freight insurance well before the shipment is loaded. While the possibility of damage or loss of goods during shipment is low, insurance is relatively low-cost and will save you a lot of problems and expenses if something goes wrong.

Some international companies that offer freight insurance are Gallagher, Maersk and AIG. You can find many other companies online. The buyer may require you to work with a specific insurance company.

Tips:

- Refer to Berne Union - Member organisations of the Berne Union for a list of reliable insurance companies. Alternatively, ask your local government trade department where you can purchase reliable insurance.

- Find suppliers of ECI via Trade Credit Insurance | ICISA.

- Have your documents ready when applying for insurance. Insurance companies will ask for information on the contract, buyer, and your business plan.

- Comply with all the requirements and conditions in the insurance policy. If you do not comply, you risk not being compensated if you have to make a claim.

- Pay attention to what is covered by the insurance. Insurance does not always cover 100% of the potential losses you insure against. The policy contract will state the terms and amount of insurance payment in the case of damage.

6. Select the most efficient way to organise international transport

When selecting the most appropriate mode of transport, you must account for quantity, conditions during transport, costs, delivery times, and customer demands. Organising your transport properly will positively impact your business, as it enhances buyer satisfaction.

Quantity and mode of transport

Make sure your goods arrive on time. European buyers often prefer shorter delivery times to meet their market demands. However, while air freight is faster, it is often unsuitable for large quantities due to costs. If the buyer needs small volumes, you could consider air freight.

The most common mode of transport for large quantities of natural food additives is by cargo ship, which allows large volumes and is cost-effective. Transport by ship also emits less greenhouse gasses, making it a more sustainable option than air freight. This is increasingly important to European buyers.

Figure 3: Comparison of sea and air freight

Source: ProFound, 2023

Costs of shipping

The shipping costs depend on:

- Volume: larger volumes come with a lower cost of transport per unit shipped.

- Distance: the longer the journey, the more expensive the shipping.

- Special requirements: if you need faster delivery, additional cooling, or more sustainable shipping, this will cost more.

- Market conditions: high demand for shipping and low supply increase costs. Low demand and high supply might lower the cost.

- Fuel prices: rising fuel prices increase the cost of shipping.

- Transport disruptions: disruptions to transport channels, such as the blockage of the Suez Canal in 2021, can temporarily increase transport costs.

Conditions during transport

Ensure the right conditions are met for the shipment of your product. Natural food additives often need to be transported and stored under specific conditions to prevent loss of quality. These conditions may include temperature, humidity, absence of contaminants and handling. For example, many ingredients must stay cool and be kept out of humid spaces. If your product requires certain conditions during transport, choose a trustworthy logistics provider and inform them about the necessary conditions.

Tips:

- Work with reliable transport companies to ensure proper handling of your goods.

- Get an idea of shipping costs by looking at Freightos, Searates.com or shipping companies' websites, such as Maersk, Hapag-Lloyd and MSC.

- Compare your shipping options to find the best transporter in terms of price and reliability.

- Invest in good-quality packaging to protect your products during storage and transportation (see tip 8).

7. Provide the required documentation for customs

European customs control the flow of goods into the European Union and collect tariffs. While you, as the exporter, may not be directly responsible for customs clearance, providing all required documents and support to your buyer/transporter is crucial. Failure to do so will result in your product being refused entry to the European market, which has significant negative consequences for your trade relationships. Therefore, make sure to send the export documents by email to your buyer and in hard copy (on paper) together with the shipment.

Required Documents and registration

To get your natural food additives shipment through customs, you must provide at least the following documents with your shipment:

- Packing list: provides information on the content of each container. It includes item description, quantity, weight, dimensions, marks, and numbers.

- Commercial invoice: provides a detailed description of the goods transported, including value, the transaction terms, and the quantity traded. This document is used by customs to value the goods and calculate the tariff.

- Safety Data Sheet: provides information about the properties, hazards, and safe use of the specific natural food additive.

If you are exporting more than 1 tonne (1000 kg) of a product that contains substances registered in REACH, you must also provide the REACH registration number. The buyer of the product will have to provide you with this number.

Tariffs

Find out what EU tariff applies to your product. Tariffs on natural food additives are specific to the product and each trade relation between the country of export and the country of import.

If your country has a trade agreement, your product may be exempt from paying tariffs when exported to the European Union. To use the tariff exemption, you must provide a certificate of origin indicating that your product originates from a country exempt from the tariff. You can get a certificate of origin from a local competent authority; you can find this authority through government trade agencies in your country.

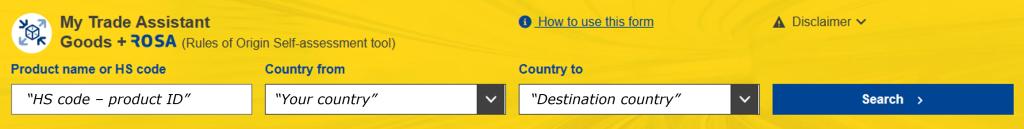

Use the My Trade Assistant tool to find the up-to-date tariff charged for natural food additives exported from your country. Information on how to use this tool can be found here.

Figure 4: Access2Markets Trade Assistant Tool

Source: European Commission, 2023

Rapid Alert System for Food and Feed (RASFF)

The Rapid Alert System for Food and Feed (RASFF) is used in European countries to share information about unsafe food and feed. It helps them respond fast to potential risks and ensure food safety.

When multiple issues with a product from a particular country are reported, European customs will take measures and sometimes perform additional tests on that product with that origin coming into Europe. This can cause significant delays.

To decrease the chances of delayed customs clearance, you can stimulate or advocate quality control measures in your home country on the products you export.

Tips:

- Discuss with your buyer what documents you must provide for your shipment.

- Refer to the customs clearance documents and procedures page on Access2Markets to find detailed information on EU import procedures.

- Consider hiring a customs agent or freight forwarder to take care of your customs procedure. However, this comes at a cost. You can find agents through CLECAT or the International Federation of Freight Forwarders Associations.

8. Use safe packaging with the required labelling

You have a lot to gain by carefully selecting the packaging of your natural food additives. Consider several packaging aspects, including protective features, contamination risks and unit size. In any case, always consult your buyer about packaging requirements to ensure your packaging is compliant. Failure to correctly package your product can result in loss of product quality and unsatisfied customers or result in issues with passing through customs.

Protective features

Protection of your product during transport and storage is the primary function of packaging. Proper packaging protects against external factors such as light, oxygen, moisture and physical damage that can affect the quality of a product. You should, therefore choose packaging that adequately protects against the damage factors applicable to your product. For example, you can opt for moisture-resistant packaging, such as plastic liners, to protect against moisture, airtight containers to keep out oxygen, or opaque packaging to shield against light.

The requirements against contamination of food products are very strict. To prevent contamination, you should always use food-grade packaging and never reuse packaging used for a different product.

During the transport, storage and processing of your product, the packaged product is handled by several operators. Discuss with your buyer and logistics provider how to package your goods to prevent physical damage to the packaging and product. For example, use double packaging for gums.

Information and labelling

Information about your product and how to handle it has to be visible on the outside of the packaging. Following the European regulations for labelling foodstuffs, you have to comply with the labelling guidelines and list the following:

- The name under which the product is sold

- Statement ‘for food’ or a more specific reference to its intended food use

- Net quantity

- Information on minimum durability or ‘use by’ date

- Storage conditions (e.g., do not expose to high temperatures, keep out of direct sunlight, moisture level, etc.)

- A list of all ingredients in descending order if your product is a mix of different ingredients

- Your company name and address

- Lot marking (identification code of batch; L XXX)

- Information about intake limits

- Warning ‘may harm activity and attention in children’ – if your product contains food colours

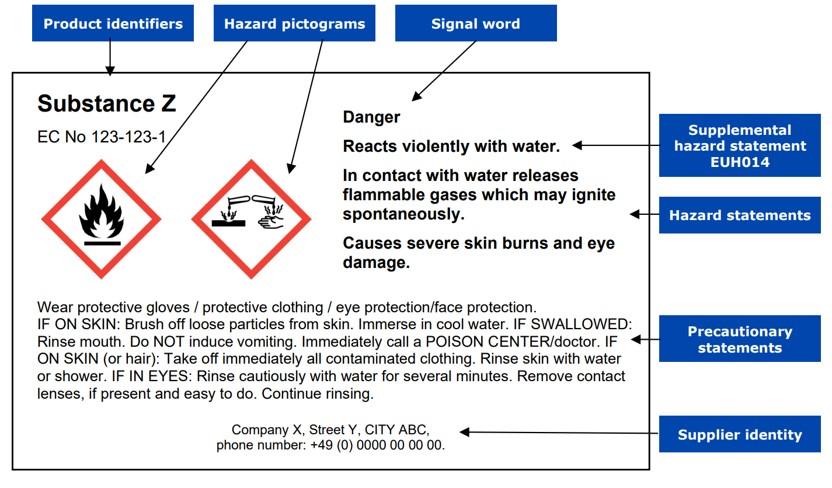

Additionally, if your product is registered by the European Chemicals Agency (ECHA), you must conform to the EU’s classification, labelling and packaging (CLP) regulations. For example, peppermint essential oil and guar gum require additional labelling to indicate potential hazardous properties of the product.

Use ECHA’s online tool, Information on Chemicals, to check if you need to include a hazard statement label when packing your product. Note that ECHA launched a new database early in 2024: the ECHA CHEM (Chemicals database). Over the coming years, it will be transferring information from the previous database to this new one. During the transition, users may need to consult both ECHA CHEM and the former platform.

Figure 5: Example of a hazard statement label according to CLP regulations

Source: European Chemicals Agency, 2023

Sustainability

Consider using recycled or recyclable packaging and minimising the use of plastic and resource-intensive materials. The EU’s Circular Economy Action Plan aims to reduce plastic and waste. European businesses are pressured to align with sustainability goals through targets and policies influenced by buyer preferences. In the coming years, it is expected that new restrictions on the use of plastic will follow. Spain, for example, introduced a plastic tax on non-reusable plastic packaging.

Figure 6: Plastic and craft paper industrial bags

Source: Alliance Packaging Ltd., 2023; Palmetto Industries, 2023

Explore possibilities for using non-plastic packaging by looking for sustainable packaging suppliers. For example, you could consider switching to biodegradable plastics. However, remember that the packaging needs to protect your product throughout transport. For example, you might want to replace plastic bags with craft paper ones – which reduces plastic use but might increase the chance of tears and damage to the product.

Tips:

- Do not reuse packaging. Buyers will not accept this as residual substances can seriously damage the quality of your product.

- Discuss your packaging options with your buyer. Ask about the type of container, unit size, and information.

- Read this report on Packaging Guidelines for Ocean Freight to learn about possible solutions for your product and company.

- Limit the use of non-reusable plastic in packaging. Learn more about the new EU rules on importing and exporting plastic waste.

9. Use the support of organisations to organise your exports

Seek support from relevant agencies and organisations to increase your success in exporting to the European Market. Engaging in export promotion programmes and working with industry groups will improve your exporting activities. It is highly recommended that you join these programmes if you can. By joining these programmes, you can improve your knowledge of trading with European partners. Some programmes also help you to set up a network and connect with buyers.

European government agencies

- CBI – the Centre for the Promotion of Imports from Developing Countries is a Dutch government agency that assists exporters in developing countries who want to enter European markets for export. They offer coaching, trade fair visits, training and market studies to help exporters access European markets.

- IPD – the Import Promotion Desk supports importers and tour operators in their search for overseas business partners, opening up new supply sources for them in selected developing countries and emerging markets. And for small and medium-sized enterprises (SMEs) in the partner countries, IPD facilitates access to the EU market.

- OTGS – Open Trade Gate Sweden supports companies from developing countries with exporting to Sweden and the European Union. They assist exporters in understanding rules and procedures, as well as in providing them with market information.

- SIPPO – the Swiss Import Promotion Programme's overall objective is to integrate developing and transition countries into world trade by advising and supporting Business Support Organisations.

Non-government agencies

- ITC – the International Trade Centre is a development trade agency that offers informative articles and studies such as How to Access Trade Finance and Model Contracts for Small Firms, practical pieces of training at ITC SME Trade Academy, and advisory services.

- COLEAD – the Committee Linking Entrepreneurship-Agriculture-Development is a European-based organisation promoting sustainable and inclusive agricultural trade and development. The organisation provides various services, including technical assistance, market access and development, standards compliance, institutional strengthening, networking, and advocacy.

You can find more support organisations by looking for government trade agencies in both the destination country and your own. For example, the Nigerian Investment Promotion Commission supports Nigerian entrepreneurs looking to export their products.

Figure 7: Logos of different support organisations

Source: Various, 2023

Tips:

- Read CBI’s Tips for Doing Business and Tips for Finding Buyers to learn more about doing business in the European natural food additives market and how to connect with European buyers.

- Use the European Commission’s Access2Markets platform to find detailed information on tariffs, import and export regulations and procedures that apply to entering the European market.

ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research