Entering the European market for avocado oil

To enter the European market for avocado oil, you must meet mandatory requirements set by the European Union. You should also consider meeting common additional requirements that European buyers and niche markets have, as this will help you with market access. The European market for avocado oil is divided into three segments, which provide different channels through which you can access the market. You will face competition from other countries, companies and products on the European market.

Contents of this page

1. What requirements must avocado oil for cosmetics comply with to be allowed on the European market?

What are mandatory requirements?

As an exporter of avocado oil from a developing country, you can only export to the European market if your products comply with the European Union’s mandatory legal requirements for natural ingredients for cosmetics. If you do not comply with these requirements, your avocado oil will not be admitted to the European market.

EU Mandatory Requirements

Your products must comply with the European Union’s (EU) mandatory legal requirements for natural ingredients for cosmetics. These include:

- Cosmetic Regulation (EC 1223/2009) is the central regulatory framework for cosmetic products for the European market, covering the safety and effectiveness of cosmetic products. It is especially advisable to focus on Chapter 3: Safety Assessment, Product Information File, Notification.

- Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), as natural ingredients such as avocado oil used in cosmetics are classified as chemicals.

- EU Commission Regulation (EU) No 655/2013 requires that (explicit or implicit) claims for cosmetic products are supported by adequate and verifiable evidence.

- The EU has packaging and labelling requirements for chemicals based on the Globally Harmonised System of Classification and Labelling of Chemicals (GHS) as set out in its Classification, Labelling and Packaging (CLP) Regulation Regulation (EC) 1272/2008.

Under the CLP Regulation, labelling should include the following:

- The name, address and telephone number of supplier

- The nominal quantity of a substance or mixture in packages made available to the general public (unless this quantity is specified elsewhere on the package)

- Product identifiers

- Where applicable, hazard pictograms, signal words, hazard statements, precautionary statements and supplemental information required by other legislation

Figure 1: Hazard label for avocado oil

Tips:

- See the CBI study ‘What requirements must natural ingredients for cosmetics comply with to be allowed on the European market?’, as it provides further information about EU mandatory requirements.

- Visit the European Commission Access2Markets trade helpdesk, as it provides a complete list of requirements. Enter your avocado oil’s HS code and review the assistance provided there.

- Familiarise yourself with the comprehensive guidance on CLP provided by the European Chemicals Agency (ECHA).

- Contact Open Trade Gate Sweden if you have specific questions regarding rules and requirements in Sweden and the European Union.

Technical Documentation

To comply with the EU’s legal requirements, European buyers of avocado oil will demand that you provide a well-prepared technical dossier. This is very important. When a European buyer of avocado oil was asked about the importance of documentation, they stated: “Yes of course, if you do not have them (technical documentation) there is not going to be a sale at all.”

Having documentation is also essential to be able to meet mandatory regulations when exporting to the EU, as a well-prepared technical dossier demonstrates the traceability, sustainability and quality of avocado oil used by buyers in their products.

European buyers of avocado oil for cosmetics usually expect exporters to provide them with a Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (COA). Table 1 shows what is contained in the SDS, TDS and CoA to help you prepare these three pieces of documentation.

Table 1: Contents of Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA)

| Safety Data Sheet (SDS) | Technical Data Sheet (TDS) | Certificate of Analysis (CoA) which matches: |

| Product description | Product description | Data mentioned in the TDS |

| Product classification | Product classification | Pre-shipment samples approved by buyer |

| Hazard identification | Quality analysis | Contractual agreements with buyer |

| Information on safety measures | Information on applications | |

| Certificates |

Ensure you have a well-prepared SDS, TDS and CoA for your avocado oil and have them ready for European buyers. If you already have documentation, you should inform buyers about this when you approach them.

Tips:

- Review the CBI study on preparing a technical dossier for cosmetic ingredients, which provides comprehensive information and guidance on preparing a technical dossier. Doing so will give you an advantage in your journey to enter the European market.

- Review the example Technical Data Sheet, Safety Data Sheet and Certificate of Analysis for avocado oil provided here.

- Use pre-existing information available about your avocado oil when preparing a dossier to substantiate any claims you make. This will likely save you time in your journey to enter the European market.

- If you have limited experience with Safety Data Sheets, engage a consultancy firm to help you prepare them. Consultancy firms offering such services can be found by doing basic online searches.

Convention on Biological Diversity (CBD) / Access and Benefit-Sharing (ABS)

To export avocado oil to Europe, you must comply with requirements on using plant resources agreed under international treaties and protocols, including the Convention on Biological Diversity (CBD). This is because the CBD is a part of EU law. Furthermore, it is likely that your own country is also a signatory to the CBD. In that case, you have legal obligation to comply with the CBD under the national law of your country.

The Nagoya Protocol on Access and Benefit-Sharing (ABS) provides guidelines on accessing and utilising genetic resources and traditional knowledge as well as the fair and equitable sharing of benefits. As with the CBD, European companies must comply with the ABS legislation, which is also likely to be a part of the national law of your country. As an exporter of avocado oil to the cosmetics sector, you should make sure you comply with the ABS legislation.

Tip:

- Visit the CBD website, as it provides a range of useful information on CBD and ABS. For example, the country profile function provides information about your country’s position on CBD and ABS, and about exporting from your country.

What additional requirements do buyers often have?

Quality and consistency requirements

European buyers of avocado oil in the cosmetics industry are increasingly demanding that the avocado oil they buy is of the finest quality. You should therefore ensure your avocado oil meets good and verifiable standards in raw material production and manufacturing, something you can do in several ways.

There are no internationally defined parameters for avocado oil in the cosmetics industry. However, European buyers often have specific requirements for avocado oil concerning its chemical profile and the consistency of its composition, as well as its smell, texture and colour. The fatty acid, oleic acid and palmitic acid content of avocado oil is particularly important in the cosmetics industry. A European buyer of avocado oil stated in an interview: “The palmitic and oleic content is important to us and the colour is also quite important.”

To ensure that products meet their quality requirements, European buyers routinely test the products they purchase. They also test samples provided by prospective exporters before deciding whether to do business with them. For example, when asked whether they test their avocado oil, a European buyer stated: “yes, at the moment when it arrives here”. Another Europe buyer of avocado stated they test their avocado oil

“all the time, every batch”.

Avocado oil for cosmetic products has to be pure and not contaminated with chemicals or other substances. So, ensure your avocado oil is not adulterated with foreign substances.

High-quality, consistent avocado oil is important to European buyers because it is vital to making cosmetics. One European buyer of avocado oil stated: “A problem is the consistency in the goods, from batch to batch.” Buyers therefore prefer high-quality avocado oil across all orders, in packaging that is suitable to the order volume; for example, avocado oil in a steel drum that can hold 25 kilograms for an order of that size.

Tips:

- Meet the preferences and specifications that European buyers of avocado oil have, as it shows your commitment to exporting high-quality avocado oil. This will make it easier for you to enter the European market.

- Only make commitments and reach agreements with buyers if you can guarantee that you will meet them. Failing to meet commitments may damage or end your business relationship with buyers.

Quality management standards

European buyers of natural ingredients for cosmetics are increasingly using quality management standards when assessing the credibility of prospective exporters. Adopting quality management standards gives you credibility because it shows your commitment to delivering high-quality ingredients, along with giving your company a favourable image. It can also help to demonstrate your compliance with mandatory requirements.

You should therefore consider adopting quality management standards, as the system you need to have in place for this will help to increase the quality of your avocado oil and make it more appealing to buyers. Examples of standards which help to demonstrate the good quality of your avocado oil include:

- Good Agricultural and Collection Practices (GACP); and

- Good Manufacturing Practices (GMP) developed by the European Federation for Cosmetic Ingredients.

You should also consider adopting quality standards for production methods, as these will help you to enter the European market. Examples include:

- ISO 22000 and ISO 9001:2015 from the International Organization for Standardization (ISO);

- Food Safety System Certification FSSC) 22000; and

- Consider following the Hazard Analysis and Critical Control Points system.

Tips:

- Inform European buyers about the standards you meet, as it increases your appeal.

- Display any certification you have that is sought by buyers on your website and marketing materials. It may give you an edge over other competitors, as buyers look for these standards when assessing exporters. The Mexican company Sesajal is an example of an avocado oil exporter doing just that.

Labelling and packaging

Along with complying with the EU’s mandatory Classification, Labelling and Packaging (CLP) requirements as set out in Regulation (EC) 1272/2008, consider meeting other common additional labelling and packaging requirements that European buyers have. This includes listing the following on your product documentation and labels in English unless asked otherwise:

- International Nomenclature Cosmetic Ingredient (INCI) name and product name

- Name and address of exporter

- Batch code

- Place of origin

- Date of manufacture

- Best before date

- Net weight

- Recommended storage conditions

- Organic certification number along with the name/code of the certifying inspection body if you export organic avocado oil

European buyers require good quality avocado oil, so consider preserving the quality of your avocado oil by doing the following when it comes to packaging:

- Using aluminium lined or lacquered steel containers, as they do not react with the components in avocado oil.

- Ensuring packaging materials such as drums are clean and dry before avocado oil is put into them. For example, a European importer of avocado oil stated: “A problem that I experience is that they (exporters) do not package it (avocado oil) in clean drums.”

- Filling the headspace in packaging, such as in shipping containers, with gasses that do not react with components in avocado oil. Examples of such gases include carbon dioxide and nitrogen.

You can also preserve the quality of your avocado oil in other ways. These include ensuring your avocado oil is kept at an appropriate temperature throughout its supply chain, along with storing the oil in a dry place.

Packaging requirements often differ from buyer to buyer. One European buyer of avocado oil stated: “We prefer to buy in drums, steel drums.” Another buyer stated: “Most of the time we get it into a steel drum.” So speak to European buyers to find out their specific requirements and consider meeting those requirements.

The EU is committed to environmental sustainability and sustainable growth, something it has made clear in its Circular Economy Action Plan and the European Green Deal. It has set key priorities, such as reducing waste and increasing recyclability.

The EU is therefore putting increasing pressure on European businesses to reduce their waste and increase recyclability through targets and policies. So environmental sustainability is becoming more important to European buyers, a trend that is expected to continue. You should therefore consider using recycled and/or recyclable packaging materials.

Figure 2: Examples of packaging

Source: Various

Tips:

- Speak to European buyers to find out if they have preferences as well as specific requirements concerning labelling and packaging. Consider meeting them as it can help to increase your chances of entering the European market.

- Only agree to meet specific packaging requirements of European buyers if you can meet them. Failing to do so could end your business relationship with buyers.

- Inform your logistics provider that your avocado oil needs to be kept in a cool and dry place on its journey to the European market to preserve its quality.

- Consider using recycled and/or recyclable packaging materials, as environmental sustainability is becoming increasingly important to European buyers. Read the guide on packaging to reduce environmental impacts for information and guidance on ways to do this.

- Ensure certified organic avocado oil and conventional avocado oil are physically separated to prevent contamination.

Payment terms

Payment is central to all trade and presents risks to all parties involved. Before doing business with European buyers, you should do risk assessments of the available payment terms. As an exporter of avocado oil, you should ensure that you minimise your risks whilst working to meet the needs of European buyers.

There are several methods of payment. However, for both importers and exporters, Letters of Credit (LC) are considered to be the safest payment term. An LC allows both parties to contact a neutral arbitrator, usually a bank, to resolve any issues. For the exporter, the chosen bank is a guarantor of full payment as long as goods have been dispatched.

Based upon their needs, importers and exporters can choose from the several LC payment terms. They include standby, revocable, irrevocable, revolving, transferable, un-transferable, back to back, red clause, green clause and export/import. For exporters, a standby LC is considered to be the safest, and it is frequently used in international trade. This is because it provides security to both importers and exporters who have little trading experience with each another. Other payment terms include cash in advance, documentary collections and open account.

Tips:

- Minimise your risks whilst working to meet the needs of European buyers. You can do this firstly by assessing your needs, secondly by speaking to European buyers and finding out their needs and thirdly by working out a compromise which satisfies both sides. Do not agree on terms you cannot meet.

- See the CBI study on tips for organising your exports of natural ingredients for cosmetics to Europe, which provides guidance on available payment terms used in this sector.

Delivery terms

Before agreeing delivery terms with European buyers, you must carefully consider three important factors: delivery time, volume and cost. This is because failing to meet agreed delivery terms could end your trading relationship with European buyers.

- Delivery time: European buyers prefer short delivery times. Air freight is usually faster than sea freight. Air freight is also more reliable in regard to on-time delivery. It is important to note delivery times are usually longer because of the global COVID-19 pandemic; reasons for this include mandatory quarantine measures and restrictions on the movements of goods.

- Delivery volume/quantity of order: The volume of your order is an important factor to take into consideration when choosing a mode of transport. Larger quantities are often cheaper to ship by sea. With smaller volumes air freight can be less expensive, as margins get smaller.

- Cost of delivery method: It is estimated that sea freight is usually 4-6 times cheaper than air freight. This applies to larger volumes. It is not likely that price of your cargo will increase substantially if you increase the volume. Please note, however, that the COVID-19 pandemic has increased the cost of air freight. This is likely to change once passenger flights are fully operational again.

Due to the global COVID-19 pandemic, exporters in developing countries are facing logistical challenges. These challenges are likely to remain in the foreseeable future, as governments use different measures to try to tackle the pandemic.

Lockdowns, quarantine measures and import and export restrictions imposed by governments are disrupting supply chains and creating major challenges for exporters. They lead to delays in the delivery of orders and higher delivery costs. As one European buyer of avocado oil interviewed for this report stated, “there are a lot of delays”.

Tips:

- Be open-minded and flexible and remember that there will be tensions and trade-offs with European buyers, especially if you are doing business with them for the first time.

- Learn about Incoterms. This knowledge will help you when negotiating payment and delivery terms with your potential buyers.

- Speak to your logistics provider about what the global COVID-19 pandemic means for you before agreeing terms with European buyers. This is because delivery times could be longer due to the COVID-19 pandemic.

What are the requirements for niche markets?

Organic and fair trade

There is a growing demand for certified raw materials in the European cosmetics market. Cosmetic products and raw materials are increasingly being certified according to natural and organic standards. For example, when asked about the need for organic certification, a European buyer of avocado oil stated that in the cosmetics industry “organic is becoming more and more important”.

The leading organic standards are:

There are over ten other natural and organic cosmetic standards in Europe; they include Demeter and Organic Farmers and Growers.

As an exporter of avocado oil from a developing country, you can obtain various certifications that represent environmental and social standards. These include:

- UNCTAD BioTrade Initiative BioTrade Principles and Criteria

- FLO Fairtrade, FLO Fairtrade and FairForLife standards

- FairWild, which attests the use of sustainable collection, social responsibility, and fair trade practices.

Figure 3: Logos of organic and fair trade certifications

Source: Various

Tips:

- Consider obtaining natural and/or organic certification for your avocado oil, as this will likely give you an advantage in entering the European market.

- Visit the NaTrue website and the COSMOS website and review the information they provide on obtaining natural and/or organic certification for your avocado oil.

- Inform European buyers of avocado oil that you have certification after you have obtained natural and/or organic certification. The Mexican company Sesajal is one such example of an avocado oil exporter. Doing so is likely to make you more appealing to buyers, which will probably make it easier for you to enter the European market.

- Visit and review the information available on the ITC Sustainability Map about certification schemes in the sector. This will make you more knowledgeable about popular certification schemes in the European consumer market for cosmetic products and their natural ingredients. It will also help you make a more informed choice when assessing if there is a business case for you to obtain certification.

2. Through what channels can you get avocado oil on the European market?

In the European market, avocado oil is mainly used in the food, cosmetics and health product industries. Avocado oil mainly enters the European market through importers/distributors. European processors may also directly source avocado oil from developing countries; this is another important channel. As an exporter, it is important to know how the European avocado oil end-market is segmented, through which channels avocado oil is brought into the European market, and which of those channels is the most interesting for you. This knowledge will help you to enter the European market.

How is the end-market segmented?

The European market for avocado oil can be segmented by end-user industries: the cosmetic, food and health product industries. Figure 4 gives examples of avocado oil products in each segment of the European market. This study focuses on avocado oil used by the cosmetics industry.

Figure 4: Examples of avocado oil products on the European market

Source: Various

Cosmetics industry

The cosmetics industry uses avocado oil in personal care products as an active ingredient because of its properties. It is a rich source of vitamins A, D, E, C, as well as omega 3 fatty acids and oleic acid. Avocado oil has several applications in the cosmetic sector because of its moisturising and antioxidant properties. These include the ability of avocado oil to replenish dry skin, calm itchy skin, moisturise skin, protect skin from ultraviolet radiation, protect against skin damage and help to heal sore skin.

Avocado oil is also used in hair care products because it gives shine, smoothness and softness, as well as being ideal for dry hair. Avocado oil is also used in massage oil because of its active ingredients. According to Blue Wave Consulting, the global avocado oil market was worth USD 587 million in 2018. It is forecast that the market will grow at a compound annual growth rate of 5.3% until 2025. The growing demand for natural personal care products is expected to boost the demand for avocado oil in the coming years.

In addition, natural ingredients are gaining popularity in the cosmetics industry. You should consider obtaining certification, such as Nature and/or COSMOS certification, to prove your avocado oil is natural. Doing so will increase your chances of entering the European market.

Food industry

The food and beverage industry uses avocado oil because of its active ingredients, particularly its high oleic acid content. It is also used because it is high in fibre and potassium, is rich in texture and has a pleasant flavour. The food and beverage industry also uses avocado oil because it is considered to be a healthier alternative to other vegetable oils, such as olive oil.

Health products industry

Avocado oil is used in health products such as supplements as an active ingredient because of its properties. These include its antioxidant and anti-inflammatory properties, oleic content and ability to help control cholesterol levels, lower blood pressure, improve heart health and enhance wound healing.

This study focuses on the use of avocado oil by the cosmetics industry.

Tips:

- Familiarise yourself with the beneficial properties avocado oil provides to the cosmetic industry, as these are its main selling points for the European market. For example, avocado oil is a rich source of vitamins A, D, E, C, omega 3 fatty acids and oleic acid, which it makes it ideal for a range of cosmetic applications.

- Visit trade fairs to determine if the industry is open to your product, get market information and find potential buyers. Trade fairs also give you an opportunity to speak to end-users and distributors, and to gauge your competition, especially the way they are marketing their products. Doing so is likely to help you access the European market. There are various trade fairs that focus on the cosmetics sector. Examples include InCosmetics and Vivaness.

- See the CBI study on tips for finding buyers in the European cosmetics market for an overview of trade fairs in the sector.

Through what channels does avocado oil reach the end-market?

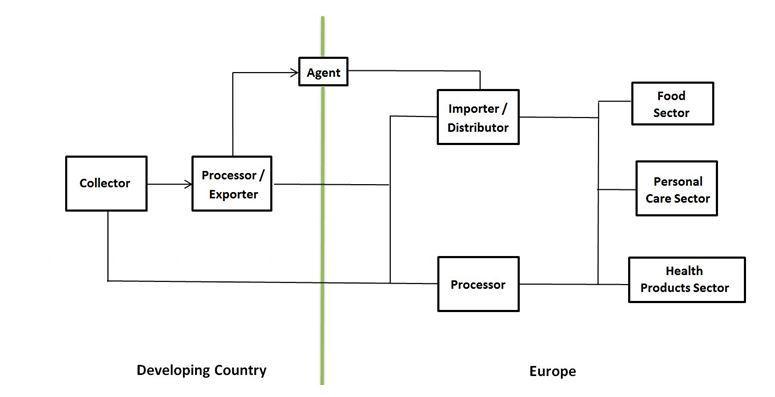

Figure 5 shows the export value chain for avocado oil on its journey to the European market. Avocado oil is extracted from avocado fruits by several methods, including cold-press and solvent extraction. Avocado oil usually reaches the European market in a liquid form.

Importer/distributor

As a processor/exporter in a developing country, the main entry points to the European avocado oil market are importer/distributors. European importers/distributors often trade in a wide range of natural ingredients. Their expertise is in the global sourcing and storing of natural ingredients, ensuring product quality and documentary and regulatory compliance, as well as selling to processors and cosmetic companies.

The importers/distributors De Lange, Gustav Hees and O&3 supply avocado oil to European companies. Some importers/distributors, such as SanaBio, specialise in trading and supplying organic avocado oil to European cosmetic companies.

Agents

An export agent is a firm or an individual that undertakes most of the exporting activities on behalf of an exporter, usually for a commission. Agents can be found in developing countries as well as in Europe; however, it is uncommon for companies to use agents in the European market. As an exporter from a developing country, you can work with agents who represent you and act on your behalf on the European market.

Processors

European buyers often travel to developing countries to personally meet their suppliers of avocado oil when assessing their credibility as potential trading partners. Indeed, one European buyer of avocado oil stated they “visit the crops and meet the persons directly who are pressing the oils” because it is a “matter of trust for us and that is how we can be sure of the quality of the product because we also saw where it came from”. Import volumes for this channel are larger, usually in the range of tonnes.

European processors also source avocados directly from developing countries via sourcing projects; they then process the fruit into oil in Europe. The French company Olevea is one company doing this.

The processing of avocado oil takes place in various countries other than Europe; these include Mexico, the United States and New Zealand.

Figure 5: Export value chain of avocado oil

Source: Ecovia Intelligence

Tips:

- Consider expanding your avocado oil portfolio by including organic avocado oil, as this is likely to help you find a wider range of customers. A wider product range gives you more attention on the market, thus making you stand out from your competition.

- Be prepared to provide high-quality samples to prospective buyers, who will test your samples to assess whether you are a credible exporter of avocado oil and someone they can do business with. Make sure that you are able to deliver products that have the same consistent quality when they place orders, because that is what buyers expect.

What is the most interesting channel for you?

As an exporter of avocado oil, importers/distributors are the most interesting channel for you. This is because importers/distributors have expertise in importing and distributing natural ingredients and they usually have integrated supply chains. An integrated supply chain means having different parts of the supply chain working closer together to improve response time, production time, and reduce costs and waste. Because of their broad customer base, importers/distributors often require a range of avocado oils and are thus keen to find new suppliers.

Tips:

- Invest in the quality of your products before entering the European market. You have to ensure your avocado oil is of high quality and accompanied by a technical dossier. This is because European buyers lose interest when a new supplier delivers a low-quality product or cannot provide a technical dossier.

- See the CBI study on tips for finding buyers in the European cosmetics market, which provides information and guidance on finding buyers in channels through which you can reach the European market, particularly importers/distributors, who are your main entry point into the European market.

3. What competition do you face on the European avocado oil market?

What countries are you competing with?

In your journey to enter the European market, you will be competing with other developing countries. Developing countries successfully exporting avocado oil to the European market often share several key strengths that are fundamental to their success. These include having an established avocado production industry, favourable climatic conditions, government support and an improving infrastructure.

Mexico

Avocado is native to and widely cultivated in Mexico, as it has ideal climatic conditions as well as fertile volcanic soils for avocado cultivation. Mexico has an established avocado oil industry. These are Mexico’s key strengths. Mexico is seen as a large-scale producer of avocados. Suppliers are capable of exporting larger volumes, which is important to European buyers requiring larger volumes and continuity of supply.

However, overharvesting and climate change are other two key challenges facing the Mexican avocado industry. For example, in recent years Mexico’s largest avocado region has seen increases in temperature and erratic rainstorms, which has affected avocado production. The involvement of drug cartels in the Mexican avocado industry has resulted in violence in recent years. This is another challenge facing Mexico.

Peru

Peru is a large producer of avocados with it a long history of avocado cultivation. Peru is a leading supplier of avocados to Europe. There are several reasons for this, including the climatic conditions and soils in Peru, which are ideal for avocado cultivation. Peruvian suppliers are well organised and competitive, which is important to European buyers.

Peru’s avocado industry has developed in recent years and avocado exports are expected to increase in the coming years. There is increasing investment in the Peruvian avocado industry, for example, there has been heavy investment in early production areas of avocado in northern regions of Peru. These are some of Peru’s key strengths. Climate change and a lack of water security are two challenges affecting the Peruvian agricultural industry.

South Africa

With an established avocado production industry, South Africa is an important producer of avocados. In 2018, 10% of South African avocados were processed into oil and puree. The South African avocado industry has steadily expanded since the early 1970s, something expected to continue. South Africa is in a favourable economic and political global position with good infrastructure and business capabilities. These are some of South Africa’s key strengths.

Climate change and disease of avocado crops are two issues facing the South African avocado industry. European buyers generally have a favourable perception of South Africa. When asked about their experience of importing avocado oil from South Africa, one buyer of avocado oil commented: “In general, I would say that everything is positive… I think in general everything is very good.”

Kenya

Kenya is a major producer of avocado with an established avocado production industry. The industry is export-oriented, with avocado exports increasing by 22% between 2020 and 2021. Kenya’s avocado industry is supported by international non-governmental-organisations and governments. For example, the NTF III Kenya avocado project seeks to improve the export performance of the Kenyan avocado sector by increasing exporter competitiveness. These are some of Kenya’s key strengths.

European buyers of avocado oil generally have a favourable perception of Kenya. They give several reasons for this, including that Kenyan exporters are able to “deliver what they are promising… at the quality that we are expecting”. Restrictions on avocado exports by the Kenyan government between November and January every year to maintain avocado quality and prevent premature harvesting is a challenge facing the Kenyan avocado industry. This is because it puts Kenyan exporters at a competitive disadvantage compared to exporters in other countries who are able to supply avocado throughout the year.

Colombia

Colombia is a major producer of avocados, with an established avocado production industry. Colombia’s ability to offer avocados throughout the year and its vast areas of land that are well suited to avocado cultivation are some of Colombia’s key strengths. Product quality and a lack of infrastructure are two challenges facing Colombian avocado producers. However, Colombian producers and exporters are addressing these issues. This is likely to result in European buyers viewing them more favourably.

Chile

With an established avocado production industry, Chile is an important producer. Chile’s geographical position and favourable climatic conditions for avocado production result in Chile producing high quality avocados. These are some of Chile’s key strengths.

However, climate change, particularly drought is a challenge facing Chilean avocado producers. For example, production yields at Chilean avocado plantations fell by 30% between the 2016-2017 harvest and the 2019-2020 harvest. European buyers requiring larger volumes and continuity of supply may perceive Chile less favourably than countries that can offer larger volumes and continuity of supply.

There are also other countries with large well-established avocado production and avocado oil industries, including the United States, New Zealand and Australia.

Tips:

- Find out if your country has programmes to support exporters like you in the cultivation of avocados, production of avocado oil and exporting. Contact the government ministry of trade in your country, as they are likely to have information about this and may be able to offer assistance in exporting your avocado oil.

- Find out if there are avocado trade associations in your country who could help you export avocado oil, and if there are, considering joining one. For example, the South African Avocado Growers Association is a business development association that provides services, programmes and activities designed to support the business development objectives of its members.

- Highlight your competitiveness against producers from competing countries. For example, producers in countries where avocados are widely harvested and or cultivated throughout the year should inform European buyers about this. They should emphasise that they are in a position to supply avocado oil in larger volumes and with more consistency than in countries where this is not the case.

What companies are you competing with?

Several established companies in developing countries are successfully exporting avocado oil to the European market. These companies market themselves as being able to deliver high-quality avocados which meet common European buyer requirements, as well as requirements for niche markets. Thus, these companies have good reputation and credibility in the European market.

Mexican companies

Sesajal is a well-established Mexican exporter of avocado oil to the European market. One of Sesajal’s key strengths is its ability to export high-quality EU certified organic avocado oil. Another of Sesajal’s key strengths is its commitment to ensuring environmental and social responsibility through its Corporate Social Responsibility policy. For example, Sesajal works directly with farmers to promote fair trade practices.

Another of Sesajal’s key strength is its website, which contains professional and well-prepared content supported by good photography. The website includes well-prepared sections that clearly show prospective buyers who the company is, the products offered, its certifications and its commitment to ensuring environmental and social responsibility.

Kenyan companies

Origen is an established Kenyan exporter of avocado oil to the European market. One of Origen’s key strengths is its ability to export large volumes of avocado oil; this is important to European buyers requiring large volumes of avocado oil. Another of Origen’s key strengths is its commitment to upholding environmental and social responsibility. For example, Origen uses environmentally friendly production processes in the production of avocado oil and provides training to its smallholder farmers.

Tips:

- Ensure you meet and uphold social and environmental standards. This is because sustainability and traceability of raw materials is becoming increasingly important to European buyers.

- Consider obtaining certification that proves you meet and uphold social and environmental standards, such as EU organic, Ecocert fair trade and Fair for Life certification.

- Ensure you have a professional website with well-prepared content which clearly informs prospective buyers of your key strengths. For example, the emphasis you place on exporting avocado oil of the highest quality as well as your commitment to upholding environmental and social standards. Doing so is likely to make you more appealing to buyers, increasing your chances of entering the European market.

What products are you competing with?

Avocado oil in cosmetics is mainly used in skin care and hair care products. This is because of its moisturising and antioxidant properties. Its main application is to sooth dry skin. It is widely applied in hair care products, as it replenishes dry hair. There are various oils that compete with avocado oil in its personal care applications. Examples include baobab oil, jojoba oil and argan oil.

Baobab oil

According to industry sources, baobab oil is a competing alternative to avocado oil. However, awareness of baobab and baobab oil is not very high yet among European consumers. Formulators and European consumers are also more familiar with avocado oil because it has a well-established supply chain and is more widely used. At the same time, baobab oil has similar applications to avocado oil, especially in skin care and hair care products.

Figure 6: Baobab oil

Source: Marcus Z-pics/ Adobe Stock

Jojoba oil

A trader of avocado oil stated that jojoba oil is a competing alternative to avocado oil. This is because of its essential fatty acids content, which gives it beneficial moisturising properties. It is used in hair care products, such as shampoos and conditioners. It can also be used to treat dry scalp and fight dandruff. Jojoba oil poses a threat to avocado oil, as cosmetics formulators are much more familiar with it and its use in personal care formulations. In addition, jojoba oil has well-established supply chains.

Argan oil

Argan oil is a product that competes with avocado oil because of its similar applications. Its main applications are skin moisturising, treating several skin conditions and imparting shine to hair. The anti-aging properties of argan oil are another of its key benefits. Formulators are also more familiar with argan oil, as it has a well-established supply chain and it is widely used, which are two of its key strengths. A major disadvantage of argan oil is its high price, with it often being referred to as ‘liquid gold’.

Figure 7: Argan oil

Source: vandycandy/ Adobe Stock

Tip:

- Familiarise yourself with products competing with avocado oil that are available in the European market. Learn about their strengths and weaknesses. You can do this, for example, by reading the CBI Studies on baobab oil which is one of the products competing with avocado oil.

What are the prices for avocado oil on the European market?

Prices for avocado oil vary, depending on the grade and level of quality. Currently, prices for avocado oil range between USD 20 and 50 per litre. By comparison, the FOB price for extra virgin avocado oil, for example, is USD 30 per litre. Refined avocado oil is priced at USD 28 per litre (FOB). In the future, the price of avocado oil will be affected by the impact of climate change on weather conditions and the level of production.

The outbreak of the COVID-19 pandemic in the spring of 2020 interrupted the distribution and supply networks of avocado oil. Further waves of pandemics could increase raw material and delivery costs and therefore lead to a surge in prices for avocado oil.

Tips:

- Be flexible with prices when buyers order lager volumes. You can offer them a discount once you have established a relationship with them.

- Certification schemes allow you to charge a premium for your avocado oil. Ensure you can justify your price with relevant certifications.

This study was carried out on behalf of CBI by Ecovia Intelligence.

Please review our market information disclaimer.

Search

Enter search terms to find market research