Entering the European market for baobab oil

Baobab oil exporters need to comply with European Union (EU) cosmetic regulations, as well as additional buyer requirements relating to quality, packaging and labelling requirements, for example. Fatty acid composition is an important indicator of baobab oil quality. The European market for baobab oil is divided into conventional, and organic & sustainable segments, each providing different channels you can enter through. Zimbabwe, South Africa, Senegal are among the top producers of baobab oil in the world.

Contents of this page

- What requirements and certifications must baobab oil for cosmetics comply with to be allowed on the European market?

- Through what channels can you get baobab oil on the European market?

- What competition do you face on the European baobab oil market?

- What are the prices for baobab oil on the European market?

1. What requirements and certifications must baobab oil for cosmetics comply with to be allowed on the European market?

What are mandatory requirements?

As an exporter of baobab oil from a developing country, your baobab oil can only be exported to the European cosmetics market if you comply with the EU’s mandatory legal requirements for natural ingredients for cosmetics. Failure to comply will stop your baobab oil from entering the European market.

EU Mandatory Requirements

To enter the European cosmetics market you must comply with a number of EU regulations. These include:

- Cosmetic Regulation (EC 1223/2009) is the central regulatory framework for cosmetic products for the European market that covers the safety and effectiveness of cosmetic products. You must be prepared to provide data supporting claims regarding the lack of animal testing as well as informing manufacturers of any animal testing that is carried out during development or safety evaluation. You also need to provide European buyers with information about your baobab oil’s properties and attributes.

- EU Commission Regulation (EU) No 655/2013 requires claims for a cosmetic product on the European market and its ingredients (explicit or implicit) to be supported by sufficient and provable evidence.

- The EU has packaging and labelling requirements for chemicals based on the Globally Harmonised System of Classification and Labelling of Chemicals (GHS) outlined in its Classification, Labelling and Packaging (CLP) Regulation (EC) 1272/2008.

Tips:

- Review Regulation (EC) N° 1223/2009 on cosmetic products for further information about the main rules and regulations for cosmetics, because your baobab oil must comply with this regulation.

- Ensure your compliance with Cosmetic Regulation (EC 1223/2009) is up-to date. This is because Cosmetic Regulation (EC 1223/2009) is subject to constant change and update.

- Be prepared to provide European buyers with detailed information about your baobab oil; this includes information about its physical and chemical, microbiological and toxicological characteristics, as well as any animal testing. This is because European buyers need to include this essential information in their CSPR and PIF.

- Visit the European Commission Trade Help Desk for a complete list of requirements. Doing so will give you greater understanding of the requirements you must meet to enter the European market.

Technical Documentation

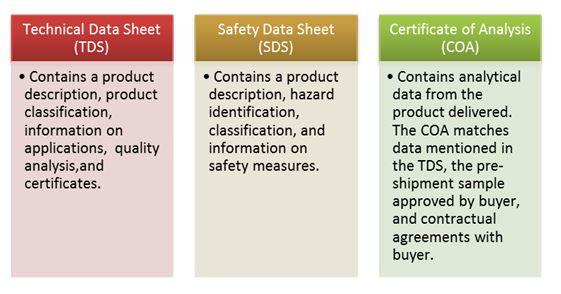

In order to comply with the EU’s legal requirements, you must have a complete technical dossier prepared. The technical dossier should include a Technical Data Sheet (TDS), Safety Data Sheet (SDS) and Certificate of Analysis (COA).

Figure 1: Technical Documentation Description

Source: Ecovia Intelligence

Tips:

- Review the CBI study on how to prepare technical dossier for cosmetic ingredients as it provides comprehensive information and guidance on preparing a technical dossier. This will help you meet the requirements that you need in order to enter the European market.

- Review the example Technical Data Sheet, Certificate of Analysis and Safety Data Sheet for baobab oil.

Convention on Biological Diversity (CBD) / Access and Benefit-Sharing

Since baobab oil is extracted from plants, you must comply with the requirements on using plant resources agreed under international treaties and protocols within the Convention on Biological Diversity (CBD). Because the CBD is a part of EU law and your own country is likely to be a signatory, you will need to comply with it. The majority of baobab oil from Africa is already ratified by the CBD.

The Nagoya Protocol’s Access and Benefit-Sharing (ABS) provides guidelines for accessing and utilising genetic resources and traditional knowledge, as well as the fair and equitable sharing of benefits. Similar to the CBD, European companies need to comply with ABS legislation. African Baobab producer countries are all signatories of the Nagoya Protocol. However, there is a difference in the level of compliance among African countries. The Nagoya protocol affects R&D activities across the entire baobab oil supply chain. As an exporter of baobab oil, you have check if your country is a signatory of the Nagoya Protocol.

Tip:

- Visit the CBD website for a range of useful information on CBD and ABS. For example, the country profile function provides information on your country’s position on CBD and ABS. This gives you more knowledge about exporting from your country.

What additional requirements do buyers often have?

Quality and consistency requirements

European buyers demand baobab oil of the highest quality. Their requirements include:

- Ensuring your baobab is dry during its extraction process into oil. This is because a low moisture content improves the oil extraction process and decreases the likelihood of rancidity and moulds developing once stored.

- Ensuring your baobab oil is uncontaminated by physical elements such as plastic, metal and dirt residues, and biological elements such as bacteria.

- Ensuring your baobab oil has minimal levels of impurities. Examples of impurities include foreign gums, mineral matter and carbohydrate substances such as protein and vegetable fibres.

European buyers often have specific requirements concerning the active properties of baobab oil, as these determine its use in cosmetics. Baobab oil’s composition of fatty acids such as oleic acid, palmitic acid and linoleic acid is an important quality indicator. The peroxide value should be below 10 mmol/l. You should speak to buyers and find out if they have specific requirements. Meeting these requirements is likely to increase your chances of entering the European market.

Consistent quality is important to European buyers of baobab oil. European buyers therefore prefer standardised high-quality baobab oil across all orders in suitable packaging as per order volumes. For example, high-quality baobab oil in a container that can hold 25 kilograms for an order of that size.

Tips:

- Always send European buyers baobab oil of consistently high quality. Failing to do so could end your business relationship and damage your credibility on the European market.

- Make sure that your baobab oil is not adulterated. Especially when you supply unrefined baobab oil, your oil cannot contain any chemicals residues.

- Speak to buyers and find out if they have preferences or specific requirements. Only commit to meeting them if you are actually able to, as failure to do so is likely to end your business relationship with them.

- Only make commitments and reach agreements with buyers if you can guarantee you can meet them. Failing to do so could result in the end of your business relationship with them.

- Make sure you communicate the standards you meet and certification you have in your marketing materials. This allows buyers to distinguish you from other suppliers who do not meet such standards, giving you a competitive advantage. Baobab Fruit Company Senegal is an example of a successful exporter of baobab oil that does this well.

Quality management standards

European buyers of natural ingredients for cosmetics are increasingly using quality management standards to assess the credibility of producers of natural ingredients for cosmetics. Adopting quality management standards gives you credibility. This shows your commitment to delivering high-quality ingredients and gives your company a positive image. Adopting quality management standards can also help demonstrate your compliance with mandatory requirements.

You should consider adopting quality standards in order to increase the quality of your baobab oil. Examples include ISO22000, ISO 9001:2015 and Food Safety System Certification (FSSC) 22000. Other common guidelines that you should follow include Good Agricultural and Collection Practices and Hazard Analysis & Critical Control Points. A Phytosanitary Certificate is also required by some European buyers.

Tip:

- Make sure you communicate the standards you meet in your marketing materials. This can give you a competitive advantage because buyers use these standards when assessing producers. An example of a successful exporter of baobab oil that does this well is Baobab Fruit Company Senegal.

Labelling and packaging

In addition to complying with the EU’s mandatory Classification, Labelling and Packaging (CLP) Regulation, you should consider meeting common additional labelling and packaging requirements that European buyers have. This includes listing the following on your product documentation and labels in English, unless asked otherwise:

- International Nomenclature Cosmetic Ingredient (INCI) name and product name

- Name and address of exporter

- Batch code

- Place of origin

- Date of manufacture

- Best before date

- Net weight

- Recommended storage conditions

- Organic certification number along with the name/code of the certifying inspection body if you export organic baobab oil.

European buyers of baobab oil demand high quality. Failing to package your baobab oil properly can lead to oxidation which can turn the oil rancid. This will likely result in buyers refusing to accept it. You should therefore consider preserving the quality of your baobab oil by doing the following with regard to packaging:

- Using polythene-lined boxes, plastic canisters or aluminium lined or lacquered steel containers respectively as they do not react with the components of baobab oil.

- Ensuring the packaging materials used are clean and dry before they are filled with baobab oil.

- Filling the headspace of packaging materials with gases such as nitrogen or carbon dioxide, as these do not react with the components of baobab oil.

- Storing your baobab oil in temperature conditions above 18 degrees in sealed packaging away from light, heat and humidity. A failure to do so can result to triglyceride rubbers developing which reduces the quality of the oil.

Baobab oil is usually exported in 5, 10 and 25 kg volume packaging. In addition, the quality of your baobab oil can be safeguarded by ensuring it is stored in a cool and dry place throughout its supply chain. So consider doing this because high-quality baobab oil is what European buyers demand.

Tips:

- Speak to buyers and find out if they have preferences or specific requirements regarding labelling and packaging. Also, consider meeting with them, as that is likely to increase your chances of accessing the European market.

- Inform your transport provider that your baobab oil needs to be kept cool and dry on its journey to reach the European market to preserve its quality.

- Consider recycling or re-using packaging materials, for example containers made of recyclable materials such as metal. This is because environmental sustainability is becoming increasingly important for European buyers.

- Ensure certified organic baobab oil and conventional baobab oil are physically separate to prevent contamination.

Payment and delivery terms

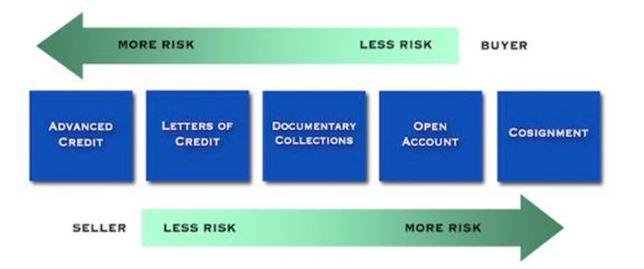

Payment and delivery terms are crucial to the quality of business relationships with European buyers. It is important that you assess your risk before negotiating these terms.

There are several methods of payment to choose from. Using Letters of Credit (LC) is however considered to be the safest payment term for both exporters and importers. Depending on their needs, exporters and importers can choose from several LC payment terms. These include: standby, revocable, irrevocable, revolving, transferable, un-transferable, back to back, red clause, green clause and export/import. As an exporter working towards minimising your risks whilst at the same time working towards meeting the needs of European buyers is what you should do.

Figure 2: Payment terms in international trade – Exporter and importer perspective

Source: score.org

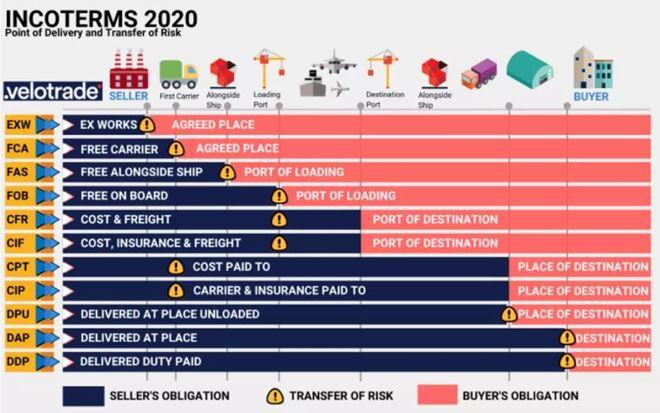

As an exporter, you should carefully consider the following with regard to delivery terms:

- Delivery time – Shorter delivery times are what European buyers prefer. Air freight is more reliable in terms of on time delivery, with it is also generally being faster compared to sea freight. The delivery times may be longer due to the global COVID-19 pandemic, because of forced quarantine measures and restrictions on the movement of goods, for example.

- Delivery volume/quantity of order – Larger volumes are often cheaper to transport by ship. However, as margins are reduced, volumes of air freight can become less expensive to transport.

- Cost of delivery method – For larger volumes it is estimated that air freight is generally 4-6 times more expensive than sea freight. If you increase volumes it is unlikely that prices of transporting your freight will increase significantly. Be aware, due to the global coronavirus crisis the cost of air freight has been increasing. However, this is likely to change once passenger flights are fully operational again.

Figure 3: Delivery Terms in International Trade

Source: velotrade.com

Note, there may be minimum volume requirements for baobab oil. You should also carefully consider the three key factors of delivery time, volume and cost when agreeing delivery terms with European buyers of baobab oil.

Tips:

- See the CBI study on organising your export of natural ingredients for cosmetics to Europe. It provides useful guidance on available payment terms used in this sector. This can give you guidance when entering the European market.

- Speak to your logistics provider about what COVID-19 means for you before agreeing delivery terms with European buyers.

- Be open minded, flexible and remember that there will be tensions and trade-offs with buyers, especially if you are doing business with them for the first time.

What are requirements for niche markets?

Natural and Organic cosmetics

There is a growing demand for certified raw materials on the European cosmetics market. A growing number of cosmetic products and raw materials are being certified according to natural and organic standards. The two leading organic & natural private standards for cosmetic ingredients are:

There are over 10 other natural and organic cosmetic standards in Europe; they include Demeter and Organic Farmers and Growers.

Fair trade is also becoming popular among European cosmetics manufacturers. This is because it pertains to various environmental and social attributes of sustainability, something European consumers are increasingly demanding. Examples of various fair-trade standards include:

- Fairtrade International

- Ecocert Fair Trade and Fair for Life

- FairWild which demonstrates sustainable collection, social responsibility and fairtrade principles

Figure 4: B’Ayoba certifications

Source: B’Ayoba.biz

Tips:

- Visit the NaTrue and COSMOS websites and review the information they provide on getting natural and / or organic certification for baobab oil. Following this, consider if there is a business case for you to get certification.

- Use the certification status you have obtained to your advantage. For example, by informing prospective European buyers of it and by using it in your marketing materials. Doing so is likely to make you more appealing to European buyers, making it easier for you to enter the European market.

- Visit and review the information available on the ITC Sustainability Map about certification schemes. This give you a greater knowledge and understanding of popular certification schemes on the European consumer market that cosmetic products and their natural ingredients fall under. This will help you make a more informed choice to see if there is a business case for you to get certification.

2. Through what channels can you get baobab oil on the European market?

The commercial production of baobab oil takes place in several African countries; they include Senegal, Zimbabwe, South Africa, Benin, Sudan and Kenya. Baobab oil is mainly used in the European cosmetics industry.

How is the end-market segmented?

This report focuses on the use of baobab oil in the cosmetics sector. The European market for baobab oil can be segmented into conventional, certified organic & sustainable sectors. On the European market, baobab oil is mainly used by the cosmetics industry. Figure 5 shows the market segmentation of baobab oil on the European cosmetics market. Baobab oil is not widely used in the European food industry and is not allowed for use in the natural health products industry.

Figure 5: Examples of baobab oil products in the European cosmetics market

Source: Marcus Z-pics/ Adobe Stock, ec.europa.eu

Cosmetic industry

The European cosmetics industry uses baobab oil because its properties are useful for a wide range of cosmetic products. The main commercial applications of baobab oil in the cosmetics industry are in body oils, face creams, moisturising lotions, massage oils, sun care products, bath oils, anti-ageing creams, face masks, shampoos, conditioners and nail moisturisers. The cosmetics sector uses both refined and unrefined baobab oil.

Conventional sector

The baobab oil used in this sector does not have any certification. It is mainly used in conventional personal care products. Conventional baobab oil is traded in larger volumes than certified oil.

Organic and sustainable sector

Organic and sustainably certified baobab oil is usually used in natural and organic personal care products. Certification schemes are seen as a sign of quality, meaning suppliers can charge a premium for organic and sustainable production methods.

Tips:

- See the CBI study Which trends offer opportunities or pose threats on the European natural ingredients for cosmetics markets for useful information about the European cosmetics industry. Here, you will find information on which trends you can take advantage of in order to increase your chances when approaching European buyers.

- Visit trade fairs to see whether the industry is open to your product, get market information and find potential buyers. Trade fairs will also give you the chance to speak to end-users and distributors, and to gauge your competition, especially the way they are marketing their products.

Through what channels does baobab oil end up on the European market?

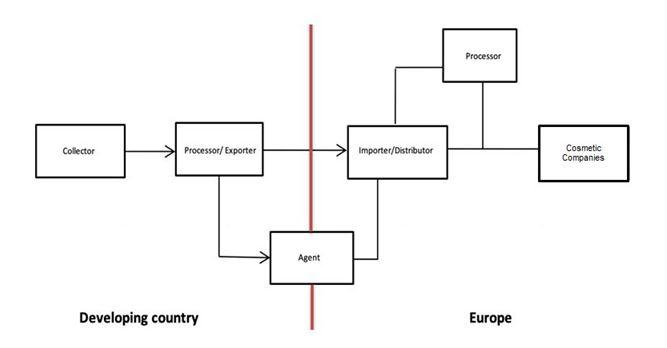

Figure 6 shows the export value chain for baobab oil on its journey to the European market. The processing and exporting of baobab oil can be combined and done by the same company. Baobab Fruit Company Senegal is a well-established Senegalese company and EcoProducts is a well-established South African company that does this.

Most baobab oil is exported as a raw material for international markets. There is also increasing demand for baobab oil in local markets in producing countries. There are more and more baobab finished products present on the local markets. It is expected that there will be more value addition happening in the local market. However, it will be difficult for these products to compete with finished products in Europe. Baobab oil is likely to remain traded as a raw material in the near future.

Figure 6: Export Value Chain for Baobab Oil

Source: Ecovia Intelligence

Importer / Distributor

As a processor/exporter of baobab oil, importers/distributors are the main entry points to the European baobab oil market. European importers/distributors usually deal in a wide range of natural ingredients. Their expertise is in the global sourcing of natural ingredients, ensuring quality and documentary and regulatory compliance, along with selling to processors and cosmetic manufacturers.

Leading importers/distributors of baobab oil on the European market include S.A.S. Phytexence, Henry Lamotte Oils GmbH and A & E Connock. A & E Connock trades and supplies organic baobab oil to European cosmetic companies.

Agent

An export agent is a firm or an individual that undertakes most of the exporting activities on behalf of an exporter, usually for a commission. Agents can be found in developing countries as well as in Europe; however it is not that common for companies to use agents in the European market. As an exporter from a developing country, you can work with agents who represent and act on your behalf on the European market.

Tips:

- Consider expanding your baobab oil product range. For example, besides offering conventional baobab oil, consider offering organic and/or Fairtrade baobab oil as well. This will help you find a wider range of customers. Other benefits of having a wider product range include giving you more attention on the market and making you stand out from your competition.

- Be prepared to send and continue sending consistently high-quality samples to prospective buyers, who will test them to assess whether you are a credible exporter of baobab oil. This is standard practice in the European cosmetics market.

What is the most interesting channel for you?

Importers/distributors are the most interesting channel for you as an exporter of baobab oil. This is because importers/distributors have expertise importing and distributing baobab oil on the European market, a good understanding of the European cosmetics market, and a wide range of customers. European importers/ distributors also have storage facilities and an established logistics network. This can be very helpful to small and medium-sized exporters of baobab oil in developing countries beginning to export to Europe.

Importers/distributors mainly demand baobab oil to be of consistently high quality; they also often have specific requirements concerning the composition of baobab oil. Other common buyer requirements that importers/distributors have include the demand for organic and/or fair-trade certified baobab oil. Importers/distributors make their products available on their company website and promote them on marketing materials such as product portfolios and catalogues.

Tip:

- See the CBI study tips for finding buyers on the European cosmetics market for useful information and guidance on finding buyers in channels that will allow you to enter the European market. Focus on importers/distributors, as they are your main entry point onto the European market.

3. What competition do you face on the European baobab oil market?

What countries are you competing with?

The Adisona digitate tree is native to Senegal, Zimbabwe, South Africa, Benin, Sudan and Kenya. This is a common key strength for all these countries. As native species are adapted to local environmental conditions, they require far less water, time and money to grow. Zimbabwe, South Africa, Ghana, Senegal, Benin and Sudan have ideal conditions for baobab to grow – this is another common strength for all of these countries.

Zimbabwe

Zimbabwe is the leading producer of baobab, and many companies are present there. These Zimbabwean companies can supply larger volumes of baobab oil, which is important if European buyers place large volume orders. The feedback from buyers is that Zimbabwean baobab oil is consistently of high quality. B’Ayoba is considered one of the largest exporters of baobab products to Europe. Zimbabwean baobab producers struggle with climate change and a lack of rainfall, as well as political instability and corruption in the country.

South Africa

South Africa is the second leading producer of baobab. Baobab oil from Africa is considered of high quality. European buyers consider South African exporters reliable and capable of delivering on time. Communication and doing business with South African companies is comparatively easier than with companies from other African countries. Baobab oil production in South Africa is an established industry. However, that industry does have its challenges, such as climate change and negative consequences of human development. Other challenges South Africa faces includes ageing infrastructure, poverty and social inequalities.

Ghana

Ghana is the third largest producer of baobab, and houses various companies that harvest and process baobab there. Ghana’s baobab industry is also developing, for example through schemes such as the planting of new baobab trees along with support from non-governmental organisations to develop the industry. This is one of Ghana’s key strengths. Ghana’s other strengths include an attractive business environment as well as a government that supports and develops the country’s agricultural industry. Some of the main challenges that Ghanaian exporters face include land degradation due to deforestation, pest damage that eventually destroys baobab trees, and infrastructure gaps in energy and transport.

Senegal

There are baobab oil suppliers in Senegal that have established business relationships with European buyers. According to industry feedback, European buyers are satisfied with the quality of baobab oil coming from Senegal. The industry is also supported by major investment projects, progress with regards to the business climate, governance and a strong track record of political stability. The main obstacles for the baobab industry in Senegal are climate change, urbanisation and deforestation of baobab forests to make way for the mining industry.

Benin

There is an established commercial baobab production industry in Benin, with several companies operating there. This is one of Benin’s key strengths. Another strength is its governments commitment to improving its infrastructure in the next few years. This commitment is likely to make it easier to export to the European market, for example through an airport development project that will help transport to Europe. The key challenges Benin’s baobab industry faces include dangerous harvesting techniques, time-consuming processing practices, an unfair supply chain putting growers at a disadvantage, a lack of market information, and climate change.

Sudan

One of Sudan’s key strengths is that there is large-scale production of baobab. However, Sudan’s baobab industry faces key challenges, including the limited availability of planting material, a lack of knowledge of management techniques, poor fruit processing technologies and a lack of well-organised supply chains with little knowledge about exporting. Other challenges Sudan faces are a lack of investment in infrastructure, a poor business environment, governance issues and climate change.

Tips:

- Find out if your country has programmes helping exporters like you harvest, cultivate, produce and/or export baobab oil. You can do this by contacting government ministries of trade in your country. They are likely to have information about this and are able to provide export assistance for your baobab oil.

- Consider joining the African Baobab Alliance because they offer a range of assistance to exporters of baobab products in developing countries. Examples of the assistance offered include help in meeting quality standards.

What companies are you competing with?

There are a number of companies successfully exporting baobab oil to the European market. These companies position themselves as being able to deliver high-quality baobab oil in accordance with both the common European buyer requirements, as well as requirements for niche markets.

Established companies – including the companies selected below – usually have a professional website with well-prepared content. Their websites have sections informing prospective buyers about the companies themselves, how they source and process their baobab oil, along with technical details and the certifications they hold, accompanied by professionally taken photographs.

Zimbabwean companies

Leading producer B’Ayoba exports high-quality baobab oil. It has an in-house microbiology lab where it ensures high quality is maintained. The company sources baobab from certified organic producers who they audit every year to ensure high product quality. This is another of its key strengths. B’Ayoba’s commitment to producing ethically and sustainably harvested baobab, which is later processed into oil in partnership with rural producer communities around Zimbabwe is another of its key strengths. B’Ayoba baobab products are organic, UEBT and Fair Wild certified.

Senegalese companies

One of Baobab Fruit Company Senegal’s key strengths is its ability to export high-quality, traceable and socially responsible baobab oil to the cosmetic industry. It achieves this by operating under strict international procedures. Its ability to export high-quality European Union (EU) Organic, NaTrue and HACCP certified baobab oil is another of the company’s key strengths. Baonane SARL and BAOBAB des Saveurs are two other established Senegalese companies that successfully export baobab oil to Europe.

South African companies

One of EcoProducts’s key strengths is the high quality of the baobab oil it exports. It achieves this through its strict quality management system, with its production facilities being FSSC 22 000 quality management certified. The company exports EU Organic certified baobab oil that is produced in a socially responsible way by communities from the poorest and most underdeveloped parts of southern Africa. This is a key strength. The company’s baobab oil is also Fair Wild certified, demonstrating its commitment to upholding environmental standards.

Tips:

- Consider acquiring certification, such as FSSC 22000 certification, that proves the quality of your baobab oil.

- Consider acquiring certification that proves you meet and uphold organic, social and environmental standards, as these are becoming increasingly popular on the European market. For example, European Union (EU) Organic, NaTrue, Ecocert Organic, Ecocert Fair Trade, Fairtrade, Fair for Life and Fair Wild certifications.

- Ensure you have an online presence and your website is up-to-date. Prospective European buyers frequently use the internet to find and assess prospective companies of baobab oil for cosmetics before doing business with them.

What products are you competing with?

Argan oil

Argan oil is a product that competes with baobab oil, as they share beneficial properties such as antioxidant and anti-inflammatory properties. This is one of its major strengths. Key benefits of argan oil include providing protection from sun damage, moisturising the skin, and treating several skin conditions. Argan oils anti-ageing properties are also a key benefit. Formulators are also more familiar with argan oil, as it has a well-established supply chain and is widely used – another one of its strengths. A major disadvantage of argan oil is its high price. It is often referred to as ‘liquid gold’. As baobab oil is also priced slightly higher, the properties and fatty acid composition are deciding factors when choosing between argan oil and baobab oil.

Figure 7: Argan oil

Source: vandycandy/ Adobe Stock

Moringa Oil

Moringa oil can be used as a substitute to baobab oil because of the benefits that it offers to cosmetic formulators. Moringa oil’s benefits include its anti-inflammatory properties, its position as a rich source of vitamins A, C and E and antioxidants, as well as its ability to combat premature aging and dull skin.

Other benefits include its long shelf life, its ability to deliver nutrients deep into the skin and its status as an effective moisturiser for hair and skin. As such, moringa oil can definitely be seen as a competing ingredient to baobab oil. However, the impact of the global COVID-19 pandemic is having a negative effect on the moringa market, as it is creating challenges for its supply chains.

Marula oil

Marula oil is extracted from either the marula nut or the soft kernel seeds of the fruit. It has a wide range of applications. In the European market, marula oil is mainly used in cosmetics. The oil has anti-ageing applications, as it has 60 percent more antioxidants than argan, coconut, and many other all-natural oils. It can nourish, moisturize and improve skin elasticity. Marula oil is also non-oily and it absorbs quickly without a greasy feeling. It is often mixed with other oils, such as camellia oil.

Tips:

- Position yourself against competing products. Do so by highlighting the strengths of your company and your product. For example, highlight your baobab oil’s high quality – which you can prove by holding the right certification – as well your company’s Corporate Social Responsibility, if applicable. For an example of a South African company doing this well, look at EcoProducts.

- Build a marketing story for your baobab oil that places emphasis on its key strengths. For example, South African company EcoProducts does this by clearly informing prospective buyers about its baobab oil’s key strengths.

4. What are the prices for baobab oil on the European market?

The prices of baobab oil have been more or less stable in the last couple of years. The FOB market price of baobab oil is currently USD 20-40 per litre. Organic baobab oil is usually priced higher at about (FOB) USD 55-75 per kilogramme. In the future, the price of baobab will be affected by climate change, weather conditions and level of production.

The COVID-19 pandemic in spring 2020 interrupted the distribution and supply networks of baobab oil. Further waves of pandemics could spike the price for baobab oil. However, some buyers have agreed on fixed prices for the baobab oil they source from suppliers.

Tips:

- Be open to offering discounts to buyers who order your baobab oil in bulk. European buyers are used to discounts when placing larger orders. To avoid losses, ensure you include any discounts offered in your original price calculations so that you do not sell at a lower price than your costs.

- Certification schemes can enable you to charge a premium for your baobab oil. Make sure you can justify your price with relevant certifications.

This study was carried out on behalf of CBI by Ecovia Intelligence.

Please review our market information disclaimer.

Search

Enter search terms to find market research