Entering the European market for beeswax

Beeswax is a traditional and popular ingredient in the European cosmetics market. It is known for its natural, emollient properties and versatility in product formulations. To enter this market, suppliers need to be aware of specific requirements, including correct documentation and quality standards. It is also important to understand the competition, as there are many suppliers and alternative products. Highlighting the transparency and sustainability of your beeswax is important to European buyers.

Contents of this page

1. What requirements and certifications must beeswax meet to be allowed on the European market?

As a product of animal origin, beeswax has to comply with strict rules regarding public and animal health. To export beeswax to Europe, you need to be aware of the regulations and provide thorough product documentation. Beeswax suppliers should also emphasise eco-friendly practices to gain a competitive edge in the market, such as organic beekeeping and sustainable harvesting methods.

What are mandatory requirements?

The key legislation you need to be aware of to meet mandatory requirements on safety and due diligence are listed below.

Regulation on Cosmetic Products

Regulation (EC) 1223/2009, or European cosmetics legislation, sets out rules to ensure the safety of cosmetic products. It aims to protect human health and the proper functioning of the internal cosmetics market. Specific mandatory requirements for cosmetic ingredients can be found in the cosmetics legislation for final products. This regulation also contains annexes that list more than 1,600 ingredients that are prohibited or restricted in cosmetic products sold in the European Union (EU). Beeswax is not included in these annexes. This means beeswax can be used in cosmetic products sold in the EU, provided that it complies with the general safety and labelling requirements outlined in the regulation.

A non-exhaustive guide to the minimum requirements for cosmetic ingredients that manufacturers have to abide by is given in Annex I of the Cosmetics Regulation. Before a cosmetic product is placed on the EU market, European legislation requires manufacturers prepare a Cosmetic Product Safety Report. This document requires data on the composition and quality and safety parameters of the ingredients used. Annex I guides what you need to comply with to sell to European importers as an exporter of beeswax. Suppliers need to provide well-structured product documentation on the physical-chemical composition, the presence of impurities, microbiological quality and a toxicological profile. Required detailed documentation includes:

- Technical Data Sheet – TDS (e.g. Gustav Heess TDS)

- Certificates of Analysis – CoA (e.g. The Soap Kitchen’s CoA)

- Safety Data Sheets – SDS (e.g. The Soap Kitchen’s MSDS)

- Organic certification, where applicable

- Certificate of origin (if requested)

Health rules as regards animal by-products not intended for human consumption

Regulation (EU) No 142/2011 sets out rules regarding health and animal by-products not intended for human consumption. It ensures that animal by-products and products derived from animals that are not used in food production are handled, processed and disposed of in a way that protects public, animal and environmental health.

Article 25 of the regulation prohibits the import and transit of honeycomb beeswax into and through the EU. Beeswax also needs to be produced in accordance with the requirements of Annex XIV, Chapter II for apiculture by-products. Beeswax, for purposes other than apiculture and feeding, can only be imported if it has been refined before being imported or if it has been processed in accordance with Chapter III of Annex IV.

For beeswax used for purposes other than apiculture and animal feed, such as for cosmetic purposes, imports from third countries are permitted. This is not the case for beeswax intended for human consumption or pharmaceuticals, where only a few authorised countries are allowed to export. If you wish to supply beeswax to industries other than the cosmetics industry, consult Regulation (EU) 2021/405. This regulation lists the third countries allowed to import certain animals and goods intended for human consumption. You should also consult Regulation (EU) 2022/2293, which lists the third countries that have approved control plans for pharmacologically active substances.

In addition to country approval, products of animal origin not intended for human consumption can only be imported into the EU if they have been dispatched from and obtained or prepared in approved establishments. European importers are required to check that the establishments are on the correct list. The published lists of establishments are derived from TRACES-NT data.

Regulation (EU) 2022/2293 also requires animal product imports to be accompanied by a commercial document and health certificates signed by an official veterinarian, employed by the competent authority, in the exporting third country.

All consignments must be accompanied by a ‘commercial document’. Exporters should arrange for their importers to work with the Ministry of Animal Health in the importing country and the border inspection post (BIP) through which their consignments enter the EU. They should do this to determine the acceptability of the form and content (including a description of the refining process) of the commercial document prior to shipment. The importer should also verify that the BIP accepts that the consignment is not intended for human or animal consumption or for use in apiculture. There is currently no ‘standard’ EU format for commercial documents. However, the commercial document must include the following information:

- Description of the material and the animal species of origin;

- Category of the material. According to Regulation (EC) 1069/2009, beeswax must only be derived from Category 3 materials;

- Quantity of the material;

- Place of dispatch of the material;

- Name and address of the consignor. This facility must be approved under Regulation (EU) 142/2011 and listed in TRACES;

- Name and address of the consignee, and

- Description or verification of the refinement process the beeswax underwent.

Health certificates aim to ensure that imported products are fit for export to the EU. There are different models of certificates, depending on the type of product concerned, its intended use and other specific conditions. Chapter 13 of Annex XV sets out the model health certificate for apiculture by-products intended for apiculture to be imported into the EU. However, in the case of beeswax intended for uses other than animal feed, the Regulation only requires imports to be accompanied by a commercial document that certifies that the beeswax has been refined or processed.

Lists of products of animal origin and by-products subject to official health controls at border control posts

Regulation (EU) 2021/632 defines the products of animal origin and animal by-products subject to official border controls. This regulation is part of the broader framework that ensures imports into the EU meet strict safety and hygiene standards, protecting public and animal health.

Beeswax is subject to official controls at border control posts. Regulation (EU) 2021/632 applies to all waxes, including waxes in natural combs, raw beeswax, processed and refined waxes, whether bleached, coloured or not.

Tips:

- Check the European Commission’s Access2Markets tool to find out more about beeswax import tariffs and requirements specific to your country and your target market.

- Read the general guidance on EU imports of live animals and animal products from third countries to learn more about legal requirements for beeswax.

Additional requirements

European buyers often have requirements beyond legal obligations. These often concern minimal quality requirements for products. Others relate to quality management, sustainable and ethical business practices, and packaging requirements.

Quality requirements

High-quality beeswax should be natural and free from contaminants, pesticide residues, impurities and adulteration. In Europe, it is common practice to filter beeswax to remove impurities, ensuring a clean and pure final product. Regular testing is conducted to ensure compliance with safety standards.

High-quality beeswax should also have certain physical and chemical characteristics. For example, its colour should range from yellow to nearly white, depending on its origin and processing. Dark or off-coloured beeswax may indicate contamination or excessive heating during processing. This can decrease its quality.

The table below lists other characteristics that are often expected in Europe.

Table 1: Sensory, physical and chemical properties of beeswax

| Parameter | Properties |

| Colour | Yellow to white |

| Odour | Honey-like odour |

| Consistency | Solid body at room temperature, softens from 35˚C |

| Melting point | 61–66˚C |

| Density | 0.95–0.965 |

| Solubility | Insoluble in water, soluble at high temperatures in ether, chloroform, acetone and benzene |

| Refractive index | 1.44–1.445 |

| Acid number | 18–23 |

| Ester index | 70–90 |

| Saponification number | 87–104 |

| Hydrocarbon content | Max. 14.5% for Apis mellifera and 13.8% for African species |

Source: ProFound based on Produire Bio, 2019

Quality management standards

European buyers often prefer suppliers who follow recognised quality management standards. These practices help ensure product safety and consistency. They improve your credibility as an exporter and show your commitment to providing high-quality ingredients. They also help to show you are compliant with mandatory requirements.

European buyers of beeswax for cosmetics expect suppliers to follow Hazard Analysis & Critical Control Points (HACCP) principles in their processing facilities to ensure product safety.

Sustainability requirements

Beeswax is often considered a sustainable ingredient because it is a natural by-product of beekeeping, a practice that can support biodiversity. Unlike synthetic waxes, beeswax is biodegradable, renewable, produced without harmful chemicals and has a low carbon footprint. However, the decline in the number of beehives in Europe due to threats like intensive agriculture, climate change and chemical/pesticide use has caught the attention of many Europeans.

Consumers and policymakers are more aware of the need to source honey and beeswax sustainably and to hold suppliers accountable for their environmental impact. European importers like Walter Lang (Germany) and Rowse also want to avoid being held responsible for mass bee deaths through their sourcing practices. There is, therefore, growing demand and scrutiny for sustainable practices like organic beekeeping, the avoidance overharvesting honey and beeswax, providing bees with sufficient forage and managing hives to prevent the spread of disease. Pressure from EU regulators and consumers is expected to increase over the next ten years, forcing more companies to adopt sustainability measures.

In addition, European buyers of natural ingredients for cosmetics face growing pressure from EU legislation to make sure their supply chains are sustainable and transparent. The most important emerging developments to be aware of are the European Green Deal and the corporate sustainability due diligence directive.

Both proposals will indirectly affect you if you do business with European companies. Partly because of these developments, one of the primary considerations for European buyers is the presence of a transparent supply chain that can be easily traced. Buyers want guarantees that the products they buy can be traced back to the source to ensure good social and environmental practices along the chain.

Suppliers should show good Corporate Social Responsibility (CSR) practices, such as developing a code of conduct and improving performance in key areas. Ways of improving CSR include making better working conditions in supply chains and limiting damage to the environment. Take a look at social responsibility and sustainability platforms like the Supplier Ethical Data Exchange (SEDEX). These platforms provide tools and guidance for suppliers and organisations to operate ethically and to source responsibly. They also facilitate sharing this information with potential customers. Thus, adopting CSR practices can help you meet buyer expectations.

Labelling requirements

Beeswax suppliers need to include product documentation and labelling to comply with the various requirements. The aim of the labelling requirements is to ensure safety, and to provide information on the product related to the content, composition, safe use, special precautions and other specific details. Labelling must include:

- Product/International Nomenclature Cosmetic Ingredient (INCI) name

- Chemical Abstracts Service (CAS) number

- Batch code or number

- Place of origin

- Name and address of exporter

- Date of manufacture

- Best before date

- Net weight or volume

- Recommended storage conditions

- Organic certification number, plus name/code of certifying inspection body if you export organic-certified beeswax

Label your products in English unless your buyer wants you to use another language.

Packaging requirements

Packaging requirements for beeswax in Europe focus on keeping products clean and safe from moisture and heat during transport and storage.

Specific requirements vary between buyers, so the most important thing is to ask them and to use the agreed packaging. Generally, beeswax is exported in small blocks of less than 25 kg wrapped in special paper or plastic film. EU importers prefer to receive blocks of beeswax uncovered, without jute or polyethylene bags, as these stick to the beeswax if it melts during transport. Instead, the blocks are placed in stainless steel containers. Other metals will affect the quality of the beeswax. Do not forget to include labels with important information in your packaging.

Note that importers often sell beeswax as pellets or flakes, which make it easier for manufacturers and formulators to handle and measure.

Figure 1: Beeswax blocks ready for packaging and trade on customer request

Source: Vara-Group, 2020

Tips:

- Read the CBI workbook for preparing a technical dossier for cosmetic ingredients to learn more about preparing technical documents.

- Speak to European buyers to find out if they have any preferences or requirements regarding labelling and packaging.

What are the requirements for niche markets?

The main niche market is organic certified beeswax. You can only sell your product as organic beeswax if you meet specific requirements. The EU Organic Regulation details the requirements you have to comply with to label and sell your beeswax as such. While the extra requirements may increase production costs, you are likely to sell the beeswax at a better price.

Organic beeswax

To market beeswax as organic in the EU, it must comply with Regulation (EU) 2018/848. This regulation establishes the principles and requirements for organic production, related certification and the use of indications referring to organic production. EU organic regulation applies to several products, including beeswax. It is aimed at every operator in every stage in the supply chain, at production, preparation and distribution.

EU organic regulation has transitioned from an ‘equivalence’ system to a ‘compliance’ system for importing organic products. This means that companies from developing countries now need to adhere to and meet all the requirements of the EU organic regulation. While this regulation is already in force in the EU, controls in developing countries are only just beginning. Starting from 1 January 2025, certificates confirming compliance with regulation 2018/848 will be necessary for organic imports from most developing countries into the EU and Switzerland.

This change will have a significant impact on beekeepers in developing countries who want to export organic products to the EU from 2025. The expectation is that this will affect small producer groups. Every exporter needs to take relevant practical measures to ensure compliance with the Regulation. You need to understand the requirements and demonstrate production and control to equivalent strict standards. To export your beeswax, you also need to be inspected and certified by control authorities or bodies. Regulation (EU) 2021/2325 lists the recognised control authorities and bodies of developing countries and ‘equivalent’ countries (i.e. countries with which there are agreements for the import of organic products).

Tips:

- Before you certify your products, find out if there is a market for them. Can you earn back your investment? Talk with potential buyers about whether they are interested in certified beeswax.

- Share your product’s story with buyers whether certified or not. This story can be about its origin, production practices, sustainability projects and the like. EU buyers place great value on products’ stories.

- Put in place a traceability system and keep samples for each of your suppliers so they can trace the origin of the beeswax just in case quality problems arise.

2. Through which channels can you get beeswax on the European market?

To get beeswax onto the European cosmetics market, you can use standard channels for cosmetic ingredients. These include selling to distributors that specialise in natural ingredients and working with importers that supply raw materials to the cosmetics industry.

How is the end-market segmented?

The end market for beeswax is segmented into several categories based on its use in industry. Key segments include the cosmetics industry (40% market share) and the pharmaceutical industry (30% market share).

Beeswax is also used in the food industry as a glazing agent in packaging and in the production of candles and polishes (20% market share). This diverse range of applications drives demand across multiple sectors.

For cosmetics, beeswax is segmented into various categories based on the product type and application. In terms of product type, one can categorise beeswax as raw or processed. Processed beeswax is often bleached or refined.

In terms of application, the end market for cosmetics can be divided into five main product categories: skincare, toiletries, hair care products, fragrances/perfumes and decorative cosmetics.

Source: Cosmetics Europe & Euromonitor International, 2023

Beeswax is mainly found in the skincare cosmetics segment. This is the largest segment in the European cosmetics market. It dominates 29% of the market and recorded its third highest growth (10%) between 2022 and 2023. Beeswax is commonly used in skincare products, like creams, lotions and lip balms, due to its skin conditioning and emollient properties.

Beeswax is also used in hair care (mainly hair waxes and conditioners) and make-up segments (mainly in lipsticks, mascara and other colour cosmetics), although to a lesser extent.

Tips:

- Look at trade fair catalogues (e.g. in-cosmetics) and websites that specialise in promoting ingredients (e.g. SpecialChem) to find potential buyers.

- Learn more about the beneficial properties that beeswax offers the cosmetics industry, such as its properties for binding, emulsion stabilisation, skin conditioning and viscosity control.

Through which channels does a product end up on the end-market?

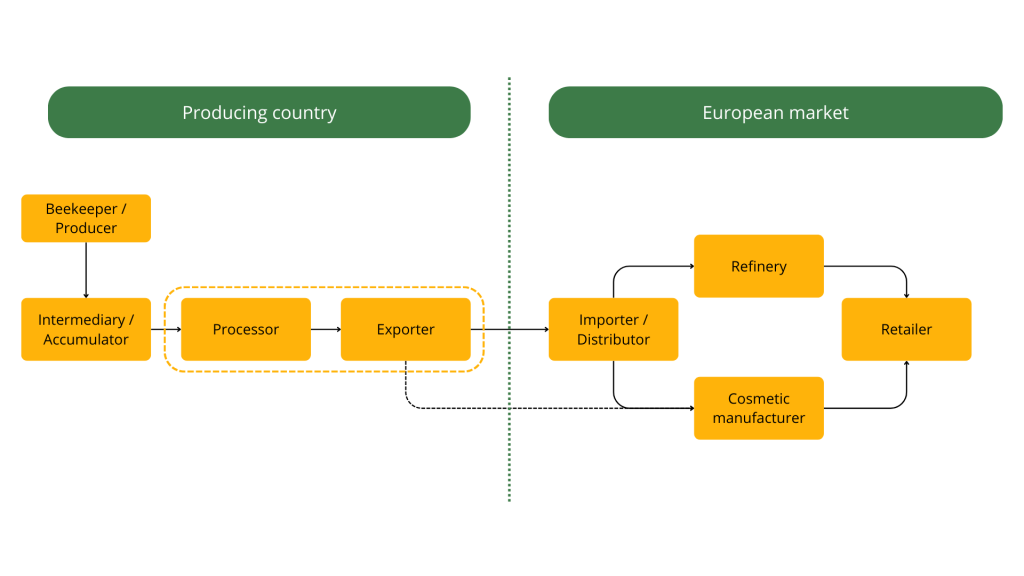

The figure below shows the export value chain for beeswax. The channels through which beeswax reaches the end market involve multiple steps between production and distribution, particularly in the cosmetics industry. Semi-processing and exporting in countries of origin are often done within the same company. Currently, most beeswax enters the European market through importers and distributors. It is rare for exporters of beeswax oil to sell directly to European manufacturers.

Figure 3: Main European distribution channels for beeswax

Source: ProFound, 2024

Importers and Distributors

Importers and distributors are your main target customers. They make cosmetic ingredients available on the EU market, buying them directly from exporters, often in large quantities. Distributors work as intermediaries in the supply chain and as downstream entities in the distribution channel. They check the quality of the wax to ensure it meets EU standards. They also refine it themselves or through refiners before selling it to cosmetic manufacturers for their products. Exporters should still carry out their own checks before exporting.

European distributors and importers that already trade beeswax include the following companies.

Koster Keunen – This is a Dutch company that specialises in refining and distributing natural and synthetic waxes, including beeswax. The company is a major supplier to the cosmetics, pharmaceutical and food industries. Koster Keunen has a large product range, and its innovative approach to wax technology sets it apart on the market.

The company is strongly committed to sustainability, offering certified organic and fair-trade waxes. They have also established a sustainable beeswax supply chain in West Africa and have their own facility in Togo. Koster Keunen works closely with local beekeepers to improve practices, ensure fair pricing and maintain full traceability.

Figure 4: Solidarity Sourcing project of the partnership between L’Oréal, Koster Keunen and FairMatch

Source: WWF, 2022

Gustav Heess – This is a German company renowned for producing and supplying high-quality vegetable oils and waxes to the cosmetic, pharmaceutical and food industries. The company focuses on sustainability and traceability, ensuring that its products meet strict quality standards. Gustav Heess’ unique selling point is its vertical integration. It controls the entire supply chain from sourcing raw materials to processing, which guarantees consistent product quality and supply reliability.

Refinery

In Europe, beeswax often undergoes further processing to meet cosmetic industry standards. Refining is commonly carried out in Europe. This includes bleaching and filtering beeswax. Some importers also act as refiners. Some importers use toll refining services from some refineries instead. Refiners sometimes package the refined oil for retail sales in smaller packages, as requested by manufacturers or brands. Examples of refiners include AAK (Sweden), ZOR, Special Refining Company (the Netherlands) and Natura-Tec (France).

Cosmetics Manufacturer

Manufacturers are companies that manufacture cosmetic products and market them under their name or brand. Most cosmetic manufacturers source raw materials from refiners, distributors and wholesalers of cosmetic ingredients. Sometimes, the brand recommends suppliers to the manufacturer, especially in the case of suppliers that have a special relationship with the brand. It is not common for small exporters from developing countries to supply manufacturers directly.

Cosmetic manufacturers use beeswax in products for lips and eyes. Manufacturers in Europe that already use beeswax in their beauty products include Lush, L’Oréal, Uriage, Bee Cosmetics and Burt’s Bees.

What is the most interesting channel for you?

European importers and distributors are your most important entry point into the market. Distributors will usually arrange for refining before selling to cosmetics manufacturers. The most successful way to access markets is by creating a network of distributors in different European countries.

Tips:

- Check the websites of potential buyers to find out if they work with organic certified ingredients. Buyers that do not are unlikely to pay more for certification.

- Visit and participate in trade fairs to test market receptivity, get market information and find potential business partners. The most relevant trade fairs in Europe are in-cosmetics (a travelling trade fair), Beyond Beauty (France) and SANA (Italy). Vivaness is an interesting trade fair (Germany) for organic producers.

- See our studies on finding buyers for natural ingredients for cosmetics for more information.

3. What competition do you face on the European beeswax market?

The growing demand for plant-based alternatives is putting pressure on beeswax suppliers. It is another important source of competition. To succeed in this market, you need to know who your competitors are and make your product stand out.

Which countries are you competing with?

There are several suppliers of beeswax around the world. China is the biggest competitor as it is the main global producer and exporter. Other countries with significant exports to Europe include Vietnam, Tanzania and Togo.

China

China is the dominant player in the global beeswax market, largely due to its large beekeeping industry that supports high production volumes. This large-scale production enables China to offer beeswax at highly competitive prices, making it the preferred choice for many European importers.

China is the largest beeswax exporter in the world. In 2023, Chinese world exports amounted to 7,798 tonnes of beeswax and other insect waxes. Germany and the United States of America (USA) were its largest markets. During the same year, 4,216 tonnes were exported directly to Europe. This represents 54% of all Chinese exports. Historically, Chinese global exports have remained stable, averaging around 9,400 tonnes annually between 2019 and 2022. However, there was a notable 19% decline in exports in the 2022–2023 period, mainly due to reduced demand from large European markets.

China’s reputation in the beeswax industry has been damaged by concerns over its beekeeping practices. The widespread use of pesticides, lack of transparency and the absence of rigorous quality control measures have led to Chinese beeswax being seen as less trustworthy than other sources. Issues with adulterated beeswax from China with residues of pesticides and varroacides are constantly raised.

Nevertheless, China’s ability to produce and export large quantities of beeswax keeps it at the forefront of the global market, posing significant competition to other suppliers.

Source: ITC Trade Map, 2024

Vietnam

Vietnam has rapidly emerged as a major competitor in the global beeswax market. It was the third largest exporter in 2023, exporting 1,112 tonnes of beeswax and other insect waxes. In the same year, 664 tonnes were exported directly to Europe, representing 59% of total Vietnamese exports. Between 2019 and 2023, Vietnamese beeswax exports grew by an average rate of 18% per year, highlighting the country’s growing importance. The growth of Vietnam’s beekeeping industry, supported by favourable climatic conditions, has enabled year-round production. This means it can ensure a consistent and high-quality supply. Major importers of Vietnamese beeswax include the USA, Germany, Japan and the Netherlands. These markets all value the reliability and quality of Vietnamese products.

Vietnam's beekeeping sector comprises nearly 40,000 beekeeping households and a large number of processing and export businesses. These have helped establish Vietnamese honey and beeswax as trusted products in the EU, Japan and South Korea. This concentrated yet growing export market has positioned Vietnam as a strong competitor, particularly where there is strong demand for high-quality natural ingredients. The combination of quality, reliability, consistency and expanding production capacity makes Vietnam a key player in the beeswax industry.

Tanzania

Tanzania is a significant player in the global beeswax market. It ranked as the fourth largest non-European exporter, exporting 440 tonnes in 2023. During the same year, 133 tonnes were exported directly to Europe, representing 30% of all Tanzanian exports. Tanzanian beeswax exports saw an average annual decrease of -8.7% between 2019 and 2023. However, this trend was marked by fluctuations rather than a steady decline. Tanzania’s unique advantage is its organic and sustainably harvested beeswax, which appeals to markets like Japan, the USA, Germany, Poland and Denmark. As the eighth largest producer of beeswax in the world, producing 1,898 tonnes in 2022, Tanzania offers high-purity beeswax, often sourced from wild bees, which contributes to its organic certification.

The Tanzanian beekeeping sector is vital to the economy. It employs around two million rural people and produces 34,000 tonnes of honey and nearly 9,200 tonnes of beeswax every year. The country is Africa’s largest supplier to the EU. It is currently focusing on expanding its beekeeping industry to increase revenue from by-products like beeswax, propolis and royal jelly. The favourable climate and diverse ecosystems provide ideal conditions for thriving bee colonies, making Tanzania a key exporter on the global beeswax market. The government’s efforts, supported by international projects like those from ITC and the Belgian Development Agency ENABEL, aim to improve the sector, enhancing export competitiveness and driving inclusive economic growth.

Figure 6: Tanzanian focus on expanding its beekeeping industry

Source: CGTN Africa, 2024

Togo

Togo has emerged as a significant player in the global beeswax market. It ranked as the seventh largest exporter, exporting 384 tonnes in 2023. In that year, 94 tonnes were exported to Europe directly, representing 25% of total exports from Togo. This growth is notable, considering that Togo did not record any beeswax exports in 2019. However, exports grew by an impressive 14% annually between 2020 and 2023. The country’s exports are concentrated in four key markets: the USA, the Netherlands, China and the United Kingdom.

Togo’s relevance in the beeswax industry is bolstered by initiatives that focus on sustainable and traceable supply chains. Collaborations with international partners have improved beekeeping practices, ensuring that Togolese beeswax meets the stringent quality and sustainability standards demanded by European markets. This makes Togo a competitive player in the beeswax industry.

Beekeeping is becoming an increasingly important source of livelihood in Togo, particularly in the central forest region. Nationally, over 2,033 beekeeping professionals were registered in 2021, reflecting the sector's expansion. The production of beeswax has seen significant growth, with beeswax production increasing from 4.6 tonnes to 5.3 tonnes in 2020/2021. This growth highlights Togolese farmers’ growing interest in beekeeping as a means to diversify their income sources.

Supporting this development, the international NGO ‘Vétérinaires Sans Frontières Suisse’ has been active in Togo since 2002, helping to professionalise the beekeeping sector. Historically, beeswax was often discarded as waste after honey extraction. However, with improved practices and market access, beeswax has become a valuable product that contributes to the country’s economy.

Which companies are you competing with?

The companies in the sections below are examples of beeswax exporters from the main source countries outside Europe.

Cangzhou Senlin Wax Industry (China)

Cangzhou Senlin Wax Industry is a Chinese company that specialises in the production and export of multiple types of wax. The company exports its products to various international markets, including Europe, where it is an authorised establishment listed in the TRACES system for EU exports. Cangzhou Senlin Wax Industry maintains high quality standards. The company aligns with Good Manufacturing Practices (GMP) standards and ISO9001:2000 certification, making it a reliable supplier.

Daklak Honeybee Joint Stock Company (Vietnam)

Daklak Honeybee JSC is a leading Vietnamese company that specialises in the production and export of high-quality beeswax and honey products. The company exports to various international markets, such as the USA, Canada, Japan, Korea and Europe. It is an authorised establishment listed in the TRACES system for EU exports. Daklak Honeybee is committed to maintaining quality certifications like HACCP, ISO and HALAL. These certifications ensure its products meet global quality and safety standards. Their dedication to quality and sustainability has made them a trusted supplier in the beeswax industry.

Fidahussein & Co (Tanzania)

Fidahussein & Co. is a Tanzanian company based in Dar-es-Salaam. The company offers a range of services, including agricultural exports, bonded warehousing, property development and transport. In terms of agricultural exports, it works with multiple products, including fruit, cocoa, oilseeds, spices, honey and beeswax. Fidahussein & Co works closely with local farmers to produce high-quality honey and beeswax. It supports farmers’ children, refurbishes farmers’ housing, trains them in best practices and invests in land. Most of its honey and beeswax are exported to Asia and Europe. It is currently recognised as an authorised exporter in the TRACES system for EU compliance.

Which products are you competing with?

Beeswax is a popular natural ingredient in the cosmetics industry thanks to its moisturising and protective properties. Beeswax competes with other plant-based waxes, such as candelilla wax, soy wax and sunflower wax, all of which are vegan-friendly alternatives. These waxes have similar uses in cosmetics, such as providing texture and stability, making them popular amongst consumers.

Candelilla Wax

Candelilla wax is derived from the leaves and stems of the Euphorbia Cerifera plant native to Mexico. It is renowned for its high melting point (68–73˚C) and firm texture, making it ideal for products like lipsticks. Candelilla wax is composed of hydrocarbons, esters, fatty acids and resins.

It serves as the main vegan substitute for beeswax. This is thanks to its excellent consistency, stability, skin conditioning properties and emollient, and film-forming abilities. With a natural deep yellow colour and pleasant scent, candelilla wax is commonly used to add hardness and gloss in cosmetics like lotions, hair waxes and lip balms. Its texture closely resembles that of beeswax, making it the most popular vegan alternative. While beeswax provides a stronger barrier and thicker texture, candelilla wax is lighter and offers a glossy finish.

In terms of pricing, the wholesale price of candelilla wax is over €30 per kilogram. This is more expensive than beeswax.

Soy Wax

Soy wax is a natural, vegetable-based wax made from soybean oil. It has a smooth texture and excellent adhesive properties. This makes it ideal for use in candles, skincare products and cosmetics due to its smooth texture and lower melting point compared to beeswax. It is known for its skin conditioning, emollient, humectant, skin conditioning and viscosity-controlling properties.

Unlike beeswax, which is not vegan, soy wax is entirely plant-based. This makes it a popular choice for vegan and environmentally conscious consumers. While soy wax is softer and more pliable, with a creamy consistency, beeswax is firmer and provides greater stability and binding properties. Both waxes have emollient qualities, but beeswax excels in forming a protective barrier on the skin. This makes it ideal for balms and salves, while soy wax is better suited for softer, spreadable products, like lotions and creams.

In terms of pricing, the average wholesale price of soy wax is €8 per kilogram, which is much cheaper than beeswax.

Sunflower Wax

Sunflower wax is a natural, plant-based wax extracted from sunflower seeds. It is composed of very long chains of fatty esters. Like candelilla wax, sunflower wax has a high melting point (74–77˚C). This makes it ideal for lipsticks, balms, mascara and other firm cosmetic products. It has similar characteristics to beeswax, such as being emollient and skin conditioning, enhancing texture and providing a protective barrier in skincare products.

It is valued for its smooth texture, non-greasy feel and ability to provide structure and stability in formulations while also being vegan friendly. Compared to beeswax, sunflower wax is harder and more brittle. It offers less flexibility in terms of product texture. However, as it has a non-sticky skin feel and is relatively colourless and odourless, it is a good substitute for beeswax.

In terms of pricing, the average wholesale price of sunflower wax is more expensive than beeswax at €30 per kilogram.

4. What are the prices of beeswax on the European market?

The prices for beeswax on the European market can vary significantly depending on factors like origin, quality and certification. Overall, the average wholesale price of beeswax in Europe ranges from €8 to €15 per kilogram. Typically, beeswax from major suppliers like China is priced more competitively, often costing around €5 per kilogram, with lower prices being associated with bulk purchases.

Demand for natural and sustainable ingredients leads to higher costs too. For instance, beeswax that is organic certified can attract a significant premium, especially in markets like Germany, where consumers are increasingly willing to pay more for products that align with their environmental and ethical values.

In general, industry sources indicate that prices are being driven up by a global shortage of high quality, pesticide-free, low residue beeswax. Major honey producers, like Argentina and Mexico, are not large wax suppliers as beekeepers prioritise honey production. Additionally, beeswax from these regions has faced quality issues due to contamination with agrochemicals and adulterants.

Table 2: Price breakdown of beeswax

| Link in the value chain | Form | Volume (kg) | Average price |

| Retail price of organic beeswax | Pellets | 1 | €38 |

| Wholesale price for refined beeswax | Granules or pellets | 1 | €11–18 |

| Wholesale price for beeswax | Blocks | 1 | €8–12 |

| Import price for beeswax | Blocks | 1 | €6–8 |

Source: ProFound, 2024

ProFound – Advisers In Development carried out this study in partnership with Fair Venture Consulting on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research