Entering the European market for moringa oil for cosmetics

The European market has the world’s most robust and protective legal framework regarding the regulation of cosmetic products. This legislation also contains minimum requirements for cosmetic ingredients like moringa oil. If you want to export your product, you must consider the legal and additional buyer requirements on quality and packaging. Usually, the main entry channel is through European distributors. Meeting additional requirements and demands of buyers will help you compete with other products and other companies targeting Europe.

Contents of this page

- What requirements and certifications must moringa oil comply with to be allowed on the European market for cosmetics?

- Through what channels can you get moringa oil in the European cosmetics market?

- What competition do you face in the European moringa oil market?

- What are the prices for moringa oil on the European market?

1. What requirements and certifications must moringa oil comply with to be allowed on the European market for cosmetics?

You can only export moringa oil to the European Union (EU) if you meet the strict EU requirements. For a complete overview of these standards, refer to our study on buyer requirements for cosmetic ingredients for cosmetics or consult the specific requirements for your product in Access2Markets by the European Commission.

Buyer requirements can be divided into:

- Mandatory requirements: Legal and optional requirements you must meet to enter the market;

- Additional requirements: Those you need to meet to stay relevant in the market;

- Niche requirements: Applying to specific niche markets.

Legal and optional requirements

European cosmetics legislation (Regulation (EC) 1223/2009) establishes rules to ensure the safety of cosmetic products, aiming at the protection of human health and the proper functioning of the internal cosmetics market. Specific mandatory requirements for cosmetic ingredients are found within the cosmetics legislation for final products. In addition, this regulation contains annexes with more than 1,600 ingredients that are prohibited or restricted in cosmetic products sold in the EU. Restricted ingredients are subject to conditions of use and warnings as well as a maximum concentration in the ready-for-use preparation. Neither moringa nor moringa oil are included in this list of annexes.

Before placing a cosmetic product on the EU market, European legislation requires manufacturers to prepare a Cosmetic Product Safety Report. These documents require data on the composition and other quality and safety parameters of the ingredients used. Suppliers therefore need to provide well-structured product documentation on the physical and chemical composition, including the presence of impurities, the microbiological quality, and the toxicological profile. This data will act as an insurance to buyers. Required detailed documentation includes:

- Technical Data Sheet (TDS);

- Certificates of Analysis (CoA);

- Safety Data Sheets (SDS);

- Genetically Modified Organism (GMO) certificate (if requested); and

- Certificate of origin (if requested).

Registration, Evaluation, and Authorisation of Chemicals (REACH)

Registration, Evaluation, and Authorisation of Chemicals (REACH) (Regulation (EC) 1907/2006) was implemented to ensure a high level of protection of human health and the environment from chemicals manufactured and used in the European Union. Cosmetic ingredients (including natural ingredients) are chemicals, and if they fall within the scope of REACH, they need to be registered with the European Chemicals Agency (ECHA) by the importer or manufacturer. Registration applies to importers and manufacturers of non-exempt substances who import or manufacture more than 1 tonne per year.Moringa oil is exempt from registration regardless of the quantities imported or manufactured because it is considered a non-chemically modified vegetable oil. A key aspect of REACH is that it contains the requirements for Safety Data Sheets. Both EU and non-EU companies must have a Safety Data Sheet to transport substances and natural ingredients.

Classification, Labelling, and Packaging of Chemicals (CLP)

The Classification, Labelling, and Packaging of Chemicals regulation (CLP) aims to ensure that the hazards presented by chemicals are clearly communicated to workers and consumers in the EU through classification and labelling of chemicals. The regulation requires European manufacturers and importers to classify, label, and package hazardous chemicals appropriately in their substances and mixtures before placing them on the market. CLP is the legislation derived from the UN Globally Harmonised System of Classification, Labelling of Chemicals (GHS). Most countries have established their own similar legislation based on GHS. Hazard labels and safety data sheets are used to communicate the presence of a hazard to the user. CLP sets detailed criteria for the labelling elements.

Tips:

- Refer to our study on buyer requirements for natural ingredients for cosmetics to read about all requirements that suppliers must satisfy.

- See our workbook on preparing a technical dossier for cosmetic ingredients for more information and tips on documentation requirements.

- Give buyers detailed information on composition, quality, traceability, and sustainability. You need to show where your product comes from and where it is processed.

- Work together with a local university department or laboratory to determine the composition of your moringa oil. You need to include this in your product documentation.

- Avoid adulteration (intentional addition of undeclared substances to a product). Strict controls are in place in most countries to detect potential adulterants. European buyers generally send samples to laboratories to analyse their purity. If there are undeclared substances in your product, it is very likely they will be detected. In case of detection, the product becomes useless for the buyer, you will not be paid, and you can lose your business and your reputation.

Additional requirements

Moringa oil is often exported as crude oil to be further processed or refined in Europe. Such secondary processing normally occurs in Europe due to the high quality and equipment requirements. However, under the right business conditions, suppliers with their own refining facilities in the country of origin will benefit from the added value of selling refined moringa oil, although this is not common.

Quality requirements

European importers demand consistent quality. It is important for suppliers to monitor the quality of moringa seeds before they are processed. All processors need to ensure that the quality of the moringa seeds and storage of the oil keeps the quality parameters at the required levels.

High-quality moringa oil is characterised by:

- A clear or pale-yellow colour (which may vary depending on the processing method);

- A light and nutty aroma; if it is strong, it may be rancid;

- An oleic acid content between 65-80%;

- A low peroxide value, below 10 meq O2/kg;

- Low moisture content, usually below 0.1%.

Importers will check the quality of pre-shipment samples as well as the quality of the delivered order to ensure that they match the specifications and CoA sent in by the supplier. It is very important that the samples match your own documentation and the agreed specification. Undeclared substances or prohibited substances in your samples or a mismatch with your CoA will cause major problems, and if it concerns your order delivery, then there is a high risk that you will not be paid unless the justification is approved by the buyer.

Quality management standards

European buyers of moringa oil for cosmetics often expect suppliers to follow Hazard Analysis & Critical Control Points (HACCP) principles in their processing facilities to ensure product safety for cosmetic applications. Note that HACCP is required for suppliers wishing to deliver primary processed food-grade moringa oil.

Good Manufacturing Practices (GMP) are not obligatory for cosmetic ingredient producers, but compliance can provide a competitive advantage. The European Federation for Cosmetic Ingredients has developed guidelines to help producers implement GMP in their companies. It also offers its own certification scheme. Following basic practices of GMP, as well as HACCP, will help you to deliver a good and reliable level of quality.

On top of that, some European buyers of cosmetic ingredients want suppliers to follow more complete safety standards. These are often the same standards as those used by the food industry. Examples of these (food) safety management systems include:

- ISO 22000, food safety management system certification;

- Food Safety System Certification (FSSC22000), based on ISO 22000 and aimed specifically at food manufacturers.

Sustainability

European buyers face increasing pressure from EU legislation to make sure their supply chains are sustainable and transparent. The most important emerging developments to be aware of are the European Green Deal and the corporate sustainability due diligence directive. Both proposals will indirectly affect you if you are doing business with European companies.

Partly because of these developments, 1 of the primary considerations for European buyers is the presence of a transparent supply chain that can be easily traced. Buyers want guarantees that the product they buy can be traced back to the source to ensure good social and environmental practices along the chain.

Suppliers should show good Corporate Social Responsibility practices, such as developing a code of conduct and improving performance in key areas (for example, improving working conditions in supply chains and limiting damage to the environment). Have a look at social responsibility and sustainability platforms such as the Supplier Ethical Data Exchange (SEDEX). These platforms provide tools and guidance for suppliers and organisations to operate ethically and to source responsibly. They also facilitate the sharing of this information with potential customers. These are now becoming standard requirements, and hence without them most buyers will not be interested in you.

Labelling requirements

Suppliers of moringa oil need to include product documentation and labelling to meet legal and buyer requirements. Labelling must include:

- Product name/ International Nomenclature Cosmetic Ingredient (INCI) name;

- Chemical Abstracts Service (CAS) number;

- Batch code or number;

- Place of origin;

- Name and address of exporter;

- Date of manufacture;

- Best before date;

- Net weight or volume;

- Recommended storage conditions;

- Organic certification number, along with the name/code of the certifying inspection body if you export organic-certified moringa oil.

Label your products in English, unless your buyer wants you to use a different language.

Packaging requirements

European companies often import already processed moringa oil because it adds value locally and is easier to transport. Moringa seeds are rarely exported to Europe as raw material.

European buyers have their own packaging requirements to preserve the product quality. In general, moringa oil is transported in UN grade steel or HDPE drums (180-190 kg) and aluminium cans (5.5/21.5 kg).

Moringa oil can easily be stored for a long time without having to worry about deterioration. This is especially true for cold-pressed oil. Moringa oil has a very long shelf life (3-5 years from the date of pressing) and is very resistant to oxidative degradation, with an OSI of 130 hours. Flushing the headspace with nitrogen will extend the shelf life.

Figure 1: Example of moringa oil packaging

Source: Shutterstock, 2023

Tips:

- Always ask your buyer for their specific packaging requirements. In addition, make sure to store your containers in a dry, cool place to prevent quality deterioration.

- Re-use or recycle packaging materials, for example, use containers made of recyclable material.

- See the Codex Alimentarius for named vegetable oils for good general information about quality standards for oils.

- Check our study on tips for organising exports for information on international payment terms and customs policy.

- Read our study on the impact of the European Green Deal on exporters and suppliers.

Requirements for niche markets

Consumer concerns about environmental and social issues are stimulating European buyers to become stricter in their requirements for the sustainability of production. Most buyers want to know the ethical story (community support, biodiversity preservation) of an ingredient so that they can then translate this back to their customers. Buyers are increasingly looking for ingredients with voluntary standards and certifications, especially in niche markets where the certification of sustainable practices is a buyer requirement.

Natural cosmetics is the largest and most important niche market. The definition of natural and organic cosmetics is based on private sector standards, namely NaTrue, Cosmos or ISO16128. Natural ingredients and raw materials can be COSMOS-certified if they comply with a specific organic content, while non-organic ingredients can only apply for COSMOS approval. The same applies to the NaTrue standard, according to which a raw material can be NaTrue-certified or approved depending on whether it comes from organic agriculture or not.

Organic is another important niche market closely related to the natural cosmetics market. To market moringa oil in the EU as an organic ingredient, producers need to implement organic farming techniques and have their facilities audited by an accredited certifier. Requirements on organic production and labelling are specified in the EU Regulation 848/2018. Relevant standards in the organic cosmetics market include NaTrue, Cosmos, Soil Association Organic, BDIH Certified Natural Cosmetics, and ICEA Eco Bio cosmetics. Specifically for ingredients, BDIH requires raw materials of plant origin to be organic certified, while ICEA demands ingredients of natural origin from certified organic agriculture.

Certified fair trade production is a small niche market in terms of cosmetic ingredients. It covers important issues like human and workers’ rights, community well-being, and local development. European cosmetics manufacturers are becoming increasingly interested in social responsibility and transparent and sustainable supply chains. Fairtrade International is the leading standard-setting organisation for fair trade. FLO-Cert is the certifying body for Fairtrade. Currently, 13 moringa suppliers from India, Sri Lanka and Egypt are Fairtrade-certified. Another fair trade standard available on the European market is Ecocert’s Fair for Life. Currently, there are 2 moringa oil suppliers with Fair for Life certification.

Although many buyers in the European cosmetics market value an organic certificate for the ingredients, applying for organic certification is not interesting for every producer. Only SMEs in developing countries who can deal with certification, conversion and administrative costs should get certified. This applies mostly to producers supplying considerable volumes, those able to share costs with cooperative members/organic buyers, or those who produce organic already by default.

Small producers, for whom private certification standards are too expensive or not necessary, can also opt for alternative self-certifiable standards such as ISO 16128 standard part I and part II. These minimum standards allow new market entrants to show their company’s capabilities.

Tips:

- Consult the databases of COSMOS and NATRUE to learn more about the products, ingredients and companies that have been certified or approved.

- Find out if there is a market for your products before you certify them. Although buyers value an organic certificate for the ingredients, applying for organic certification is not interesting for every producer. Only SMEs in developing countries who can deal with certification, conversion and administrative costs should get certified. This applies mostly to producers supplying considerable volumes, those able to share costs with cooperative members/organic buyers, or those who produce organic already by default.

- Learn more about fair trade certifications and standards in our study on the offer of social certifications.

2. Through what channels can you get moringa oil in the European cosmetics market?

In the European cosmetics market, moringa oil is mainly used in skincare products. Moringa oil enters the European market mostly through importers/distributors who buy directly from exporters.

How is the end market segmented?

In terms of industry use, the end market for cosmetics can be divided into 5 main product categories: skincare, toiletries, hair care products, fragrances/perfumes, and decorative cosmetics.

Source: Cosmetic, Toiletry & Perfumery Association (CTPA), 2022

Moringa oil is mainly found in the skincare cosmetics segment. Skincare is the largest segment in the European cosmetics market. It dominates almost 30% of the market and recorded the third-highest growth (6.4%) between 2021 and 2022. Moringa oil is commonly used in skincare products due to its skin conditioning and emollient properties. It is marketed as a moisturizing, hydrating, and cleansing product.

Another important segment for moringa oil is hair care products. Some cosmetics manufacturers already use moringa oil in shampoos, conditioners, and hair masks. This segment dominates 18% of Europe’s cosmetics market. Between 2021 and 2022, the hair care segment recorded a growth rate of 4.9%.

Tips:

- Study trade fair catalogues (for example, in-cosmetics), as well as websites that specialise in promoting ingredients (for example, SpecialChem) to find potential buyers in each segment.

- Familiarise yourself with the beneficial properties that moringa oil offers the cosmetics industry, such as its emollient and skin conditioning properties.

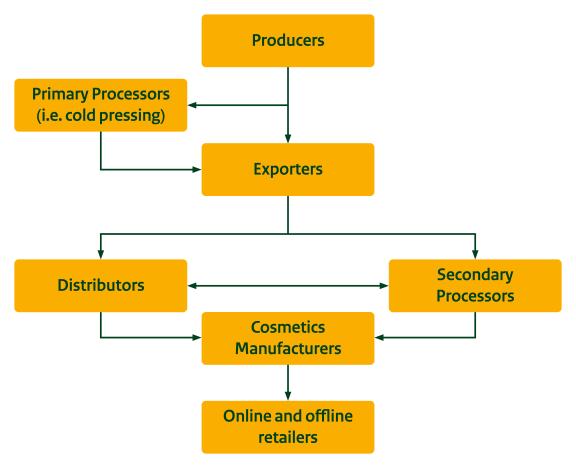

Through what channels does moringa oil end up on the end market?

In Europe, trade is relatively concentrated, with few players responsible for the import of large amounts of vegetable oils, including moringa oil. Currently, the majority of moringa oil enters the European market through importers/distributors.

Figure 3: Main European distribution channels for moringa oil

Source: ProFound, 2023

Importers/Distributors

These companies make cosmetic ingredients available on the EU market. Distributors are often the main importers, sourcing their moringa oil directly from exporters. Distributors work as intermediaries in the supply chain and as a downstream entity in the distribution channel. Distributors supply the oil directly to cosmetics manufacturers for certain products.

Some examples of European distributors/importers already selling moringa oil include:

O&3 – British company distributing natural oils, butters, and waxes all over Europe. It has 3 production facilities in the UK and a supply facility in Poland. O&3 offers moringa oil in a variety of formats: cold-pressed, refined and Cosmos-certified organic. The company sources moringa from Kenya and India.

DKSH - Spanish distribution company that develops its activities through 4 business lines: speciality chemicals, personal care, pharmaceutical and food & beverage. It is a recognised distributor of innovative ingredients and formulations for the personal care and cosmetics industry. They supply Natrue-certified moringa oil.

Unifect – British supplier of cosmetic ingredients. Offers a portfolio of over 2000 different products, including moringa oil. The company sources organic moringa seed oil directly from Zuplex, a company based in South Africa. Unifect’s moringa oil has Halaal, vegan and not-tested-on-animals certifications.

Sigma Oil Seeds – Dutch producer and supplier of oils, fats, and proteins. The company partners with a local community in Mozambique, from where it sources dried moringa seeds. Sigma Oil ships the seeds to Europe and presses them into oil in its own oil mill in the Netherlands. Sigma Oil offers organic-certified and conventional moringa oil.

Kupanda – Medium-sized vegetable oil refiner and trader based in Cyprus. Kupanda sells virgin and refined moringa oil made with seeds sourced from a company in Malawi. This company sells Cosmos-approved ingredients in Asia-Pacific, the Americas, Europe, the Middle East and Africa. In Europe, it has distributors in France, the UK, Spain, Italy, the Netherlands, Belgium, Germany, Poland, and Ukraine.

Henry Lamotte Oils – German company leading the supply and production of oils, waxes, seed flours and oleoresins. Henry Lamotte supplies customers in the foodstuffs, pharmaceutical, cosmetics, animal feed and chemical-technical industries. This company offers 100% natural moringa oil with Natrue certification.

Secondary Processors

Secondary processing of moringa primarily takes place in Europe because of the high European quality requirements and the need to have advanced equipment in place. Cold-pressed moringa oil could be used in cosmetic products directly, as little further refinement is required in terms of its colour, odour, or stability. However, depending on the specifications of the cosmetics manufacturer, secondary processing could be requested. Refiners (such as AAK, ZOR, Special Refining Company and Natura-Tec) source moringa oil from European distributors or directly from exporters and specialise in adding value to ingredients. For plant-based oils, this is usually done through common refining methods such as filtration, interesterification and hydrogenation.

Cosmetics Manufacturers

Manufacturers are companies that manufacture cosmetic products and market them under their name or brand. Most cosmetics manufacturers source their raw materials from refiners, distributors, and wholesalers of cosmetic ingredients. It is not common for small exporters from developing countries to supply refiners and manufacturers directly.

A few cosmetics manufacturers import moringa oil directly from the source, seeking to guarantee a transparent supply chain and share information on sustainability with consumers. Since the volumes demanded are moderate, direct sourcing is feasible. However, buyers supplying directly from producers may have higher expectations for quality since there is no intermediary processing stage.

According to different industry players interviewed at the In-Cosmetics fair, moringa oil is most in demand among specialised buyers. These are usually buyers interested in premium-quality, cold-pressed moringa oil. Some examples of manufacturers who are already using moringa oil in their beauty products are The Body Shop, Logona, Moricare, Nuxe, N&B Natural is Better, Sole Toscana, and Arrival. Most of these manufacturers offer products that are certified as natural and organic.

What is the most interesting channel for you?

European importers/distributors are your most important entry point into the market. Distributors will usually arrange for refining before selling to cosmetics manufacturers for certain products. Generally speaking, the most successful way to access markets is creating a network of distributors in different European countries, not supplying directly.

Tips:

- Consider linking up with producers if you cannot produce sufficient quantity and quality of moringa oil yourself.

- Target European ingredient importers or refiners that specialise in small, speciality oils if you can produce moringa oil with a unique selling point.

- Check the websites of buyers to find out if they work with certified ingredients. Buyers that do not, are unlikely to pay a premium for certification.

- Visit and participate in trade fairs to test market receptivity, get market information, and find potential business partners. The most relevant trade fairs in Europe are in-cosmetics (travelling trade fair), Beyond Beauty (Paris, France) and SANA (Bologna, Italy). For organic producers, Vivaness is an interesting trade fair (Nuremberg, Germany).

- See our studies on finding buyers for natural ingredients for cosmetics for more information.

3. What competition do you face in the European moringa oil market?

There are many suppliers of moringa oil from developing countries around the world, while the market for moringa oil is small. The European moringa oil market is competitive, with low barriers to entry for new competitors, so suppliers need to study the existing competition and find ways to differentiate and add value to attract the attention of the small number of buyers and be able to sell their product.

Which countries are you competing with?

Moringa is cultivated in several countries and can be sourced from multiple origins. Given the lack of regional and national data on moringa production and trade, it is not possible to know exactly which are the main exporters of moringa oil and which quantities are exported to Europe.

It is estimated that India accounts for around 80% of the world's moringa supply. In addition to India, other countries such as South Africa, Ghana, Mozambique, Kenya, Uganda, Zambia, Philippines, Pakistan, Brazil, and Peru have important commercial moringa production industries.

India is the major producer and exporter of moringa

India is the main producer of moringa products in the world. Moringa is 1 of India’s most famous vegetable crops. The country’s strong market position is linked to its long tradition of consuming moringa for nutritional and medicinal uses. India’s national government, as well as its individual states, also actively support the country’s moringa industry.

In India, most moringa is produced on large plantations as a conventional ingredient. Large-scale production makes it possible to sell the product at low prices. Organic certification provides opportunities for non-Indian suppliers to avoid direct competition on price.

India is also the main exporter of moringa worldwide, supplying about 80% of global demand. In 2022, India exported 26,075 tonnes (€79 million) of vegetable oils (HS code 151590), according to ITC Trade Map. In the period from 2018 to 2022, exports of Indian vegetable oils increased by 5.5% in volume and 19% in value. The main export destination was the USA. Among the top 10 importing countries, 4 European countries stand out: Italy, the UK, the Netherlands, and Spain. Total Indian exports of vegetable oils to Europe amounted to 14,221 tonnes and reached a value of €27 million. Between 2018 and 2022, Indian exports of vegetable oils to Europe grew 11% in volume and 17% in value.

South Africa has a strong domestic moringa sector

South Africa has a relatively strong internal moringa sector. Several parts of South Africa have ideal climatic, agricultural and environmental conditions for moringa cultivation. South African exporters benefit from their domestic market for moringa products as they can grow their business on sales to South African consumers before targeting the more demanding European market.

Many stakeholders in South Africa are members of the Moringa Development Association of South Africa. This association has been working with South Africa’s Department of Science and Innovation to develop the country’s moringa industry, by establishing moringa farms and training farmers.

In 2022, South Africa exported 3,385 tonnes (€8.9 million) of vegetable oils, including moringa oil in some proportion. The exported volume of vegetable oils grew at an average rate of 28% each year between 2018 and 2022. The main export destination was the USA. Germany, Italy, and Spain were among the top 10 importers of vegetable oils from South Africa. Moreover, Germany was the third largest importer with an import value of €1.5 million and a total imported volume of 346 tonnes.

During the same year, South Africa exported 677 tonnes (€2.6 million) to Europe. This represents a growth of 9.7% in volume and 8.7% in value compared to 2018.

Major efforts in Ghana and Zambia to cultivate moringa

Ghana and Zambia are important producers of moringa. In these countries, 2 different moringa cultivation systems stand out: large-scale plantations with intensive cultivation and extensive cultivation systems with smallholder farmers. As is the case in much of Africa, smallholder production of moringa and wild collection is more common than large plantations.

Both countries are committed to the cultivation of moringa and the development of its industry. Ghana’s government as well as Non-Governmental Organisations (NGOs) are supporting and developing the country’s moringa industry and helping farmers cultivate moringa. The Zambian government is also focusing on moringa production as part of its plans to develop the country’s economy. In addition, the NGO CELIM Zambia is leading a project that aims to plant around 75,500 moringa trees, as well as providing farmers with practical training on cultivating moringa successfully.

In 2019, Ghana exported 38,319 tonnes of fixed vegetable oils, valued at €65 million. This represents an average annual drop of 19% since 2015, when exports reached 89,922 (€62 million). However, the value of exports remained somehow constant even with the lower exported quantities. In fact, it grew at an average rate of 1.4% each year. The top 3 destinations for Ghana’s vegetable oils exports were Denmark, Belgium, and the Netherlands.

There is currently no data available on Zambian imports of vegetable oils or moringa oil to Europe. However, the country is known to have several leading Moringa producers and processors.

Development potential of moringa production in Kenya

Kenya has an established commercial moringa production industry that is continuing to develop. In Kenya, moringa is also widely consumed by local communities.

In recent years, several organisations have supported Kenyan farmers grow moringa. For example, the International Tree Foundation NGO helped farmers plant more than 25,000 moringa trees and provided training in moringa cultivation. There is a potential for further development of moringa production in the country.

According to ITC Trade Map data, Kenya exported 10,123 tonnes (€44 million) in 2022, corresponding to an average growth rate of 30% in volume and 42% in value compared to 2018. Spain and Italy were, respectively, the largest and third largest importers of vegetable oils from Kenya. Other major European importers were Portugal, France, Germany, the Netherlands, and Belgium. In 2022, Kenya sourced 6,522 tonnes of vegetable oils (€31 million) to Europe, growing 54% compared to the volume exported in 2018.

Tips:

- Look out for programmes in your country helping exporters to harvest, cultivate, process and/or export moringa. You can do this by contacting government ministries of trade or chambers of commerce in your country.

- Consider joining national organisations that help cultivate, process and export moringa. An example is the Moringa Development Association of South Africa.

Which companies are you competing with?

An increasing number of cosmetics manufacturers are using moringa oil and its derivatives in their products. Increased demand creates opportunities for trade, but also foresees increased competition in this market. High demand tends to increase supply and provide an incentive for new market entrants.

To stand out with your company and product on the market, you need to find your unique selling point. You can do this with marketing stories, organic and/or fair-trade certifications, Corporate Social Responsibility policies, and excellent traceability, among others.

Indian companies

Ekologie Forte is an Indian company specialising in the production, processing and marketing of certified organic food, food ingredients, cosmetic ingredients and feed ingredients. The company has a wide network of suppliers in India, located in Maharashtra, Madhya Pradesh, Orissa and Jharkhand. The company supplies organic cosmetic ingredients such as moringa oil, castor oil, amaranth seed oil and others.

Ekologie Forte has 2 national brands of organic products consisting of 60 different certified dry food products. Since 2016 it has been exporting a range of organic products and ingredients to international brands. The company has a sales office in Germany.

Grenera Nutrients Private Limited is 1 of India’s leading bulk moringa suppliers and manufacturers of organic moringa products. The company has 300 acres of organic-certified farms in the southern region of India. It works with small farmers to harvest moringa leaves, fruits and seeds. Grenera produces 20-30 tonnes of moringa powder, tea, moringa oil, and other value-added products every month. The company has numerous certifications, including USDA organic, Good Manufacturing Practices, and India Organic. Grenera exports most of its products around the world, including European countries such as the UK, France, Spain, and Germany.

South African companies

Zuplex is a South African based manufacturer of active ingredients for cosmetics and supplier of a wide range of botanicals such as vegetable oils. The company sources cosmetic oils such as moringa oil from an extensive network of African suppliers. All cosmetic ingredients are Cosmos-approved and Halaal-certified. The company sells its ingredients on the international market and has distributors in key markets in Europe, Asia, and the USA.

Ghanese and Zambian companies

Moringa Connect is a Ghanaian supplier of cold-pressed moringa seed oil. It buys moringa from farmers. It provides high quality inputs (seeds, fertiliser) and training to farmers. The company also pays high prices per kilo. Moringa Connect do centralised processing and supply beauty companies all around the world. It even has its own line of skin and body care products called True Moringa.

Moringa Connect has a Geographic Information System (GIS) mapping system which allows it to trace batches back to producers. In addition, the company has an organic farm with the largest solar-powered irrigation system in West Africa.

Moringa Initiative is 1 of Africa’s most recognised moringa suppliers. This family-owned company is dedicated to supplying high quality moringa products. Moringa is organically grown and processed on its own farm in Zambia. Moringa Initiative supplies moringa in bulk to both local and international markets. The company has a head office and a producing/processing farm based in Zambia. It also has an export and distribution centre based in South Africa.

Kenyan and Ugandan companies

Fairoils EPZ Limited is headquartered in Nairobi. It is a major supplier of essential oils and vegetable oils, offering more than 50 different oils. Fairoils has a sales office in Belgium and supplies leading global brands.

Fairoils sells virgin and refined organic-certified moringa oil sourced from Uganda and Kenya. This company has 8 projects with small-scale farmers in Kenya and Madagascar. Fairoils aims to help producers access resources, to build farmers’ skills and to guarantee them a secure and reliable income. The Lunga Lunga project is implemented on the Kenyan Coast and involves 998 smallholder farmers engaged in cultivation. This project focuses on 6 main crops, including moringa.

Moo Me Gen Oils of Hope is a company based in Otuke (Uganda) that produces cold pressed oils for cosmetics and personal care products. It mainly produces nilotica shea butter and moringa seed oil. This company buys from local communities and pays fair rates. It also works to ensure sustainable and environmentally friendly production, using sustainable methods for plant cultivation. It is currently working with digital solutions to provide better traceability.

Moo Me Gen is an important supplier in local markets. It has also exported ingredients to the UK and Germany. In addition, it has its own line of skincare and wellness products, which can be found in some shops in Germany and the UK.

Tips:

- Consider having a range or at least other products to share the costs of business. In the case of moringa, it is possible to have a moringa leaf powder business and an oil production business. You can also produce moringa oil along with other oilseeds, considering that most oils can be produced using the same equipment. For example, Fairoils in Kenya produces several vegetable oils including moringa, avocado, baobab, macadamia, and so on.

- Organise your supply chain to differentiate your company on the market. Make sure that your supplies are traceable and well-documented. Prepare detailed documentation on product, technical, safety and efficacy data, as well as professional samples. Increase your capacity for safety testing and monitoring to do so.

- Give your suppliers clear standards on the collection and/or processing of seeds you buy from them in your own specifications. In addition, establish clear agreements on the amount and quality of shea nuts you buy from your suppliers that match your specifications and supply contracts.

- See our study on tips for doing business for more information and tips.

Which products are you competing with?

The European cosmetics industry is highly competitive and driven by innovations. Manufacturers are looking for new oils that have special properties or have a high marketing value. Potential substitutes for moringa oil are mainly exotic African vegetable oils with similar moisturizing qualities and cosmetics applications, such as baobab, marula and argan oil.

Argan and marula oils are cheaper alternatives. However, moringa cultivation is still of interest to suppliers, as the trees are drought-resistant, resilient to climate change, and fast-growing (which can make them cheaper to grow). In addition, there is a strong association of moringa with health and wellbeing among consumers, which creates interesting market opportunities for moringa oil.

Table 1: Example of product substitution for moringa oil

|

|

Moringa oil |

Argan oil |

Marula oil |

Baobab oil |

|

Properties |

Skin conditioning, emollient, antioxidant, and anti-ageing properties Contains vitamins A and E. |

Skin conditioning, emollient, antioxidant, anti-ageing, and anti-inflammatory properties. Contains vitamin E. |

Hair conditioning, humectant, antioxidant, and anti-ageing properties. Contains vitamin E. |

Skin conditioning, hair conditioning, emollient and antioxidant properties. |

|

Fatty acid profile |

Palmitic acid <10.5% Stearic acid <12% Oleic acid 65-80% Linoleic acid <22% Arachidic acid <2% |

Palmitic acid 10-16% Palmitoleic acid <5% Stearic acid 2.5-6.5% Oleic acid 45-55% Linoleic acid 26-35% Linolenic acid <1% |

Palmitic acid <8% Stearic acid <8% Oleic acid 48-62% Linoleic acid 27-47% |

Palmitic acid 18-30% Stearic acid 2-9% Oleic acid 30-40% Linoleic acid 25-35% |

|

Main uses |

Skin moisturizers, serums, anti-ageing treatments, facial cleansers and creams, UV protection daily care and hair conditioners |

Serums, hair masks, hand, and nail creams |

Shampoo, hair conditioner, facial moisturizer, skin lotion, nail treatments |

Body oils and scrubs, face creams, moisturizing lotions, sun care products, anti-ageing creams, shampoos, and conditioners |

|

Price |

Price varies around €63 per kg. Moringa oil has a long shelf life of up to 3-5 years. |

Price for argan oil varies around €42 per kg. Argan oil has a shelf life of 1-2 years.

|

1 kg of marula oil costs over €52 . Storage life of up to 2 years without being opened. Up to 1 year after opening. |

Price for organic baobab oil is over €60 euro per kg. Has a shelf life of up to 2 years. |

Source: ProFound, 2023

Tips:

- Differentiate your product by excellence in terms of Corporate Social Responsibility (CSR), sustainability, and traceability, or by providing additional services compared to your competitors.

- Investigate and show how moringa oil can substitute other oils and butter, by comparing the properties of moringa oil and its alternatives.

- Build and communicate the strong marketing story of moringa, focusing on traditional use and benefits to local communities.

4. What are the prices for moringa oil on the European market?

The price for moringa oil depends mainly on quality and fluctuating demand from Europe and USA, as well as other Asian markets. Wholesale prices for moringa oil range from €24 per kg (according to Indiamart) to €63 (according to The Soap Kitchen) per kg with an average price of over €40.

Retail prices are much higher. Products of 30ml and 50ml of moringa oil can cost over €20.

Organic and fair-trade certification can add value to moringa oil for cosmetics. A price premium can be paid by European companies that are interested in organic ingredients as well as social and environmental responsibility practices. For large lots of organic certified moringa oil, import prices vary between €20-30 per litre, while import prices of small lots (< 1 tonne) can reach over €50 /litre.

Tips:

- Explore the possibility of obtaining certification schemes like organic and fair trade which are becoming increasingly popular on the European market. They may allow you to charge a premium for your moringa oil.

- Consider offering potential buyers discounts as this could help you establish long-term partnerships with them. To avoid losses, include discounts offered in your original price calculations so that you do not sell at a lower price than your costs.

ProFound – Advisers In Development and Fair Venture Consulting carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research