8 tips for organising your exports of natural cosmetic ingredients to Europe

Organising your exports correctly can make the difference between making a profit or a loss. You need a good understanding of practical matters regarding customs, tariffs, transport, payment terms and insurance. You also need to organise your export documents and address key sustainability issues, such as packaging and certification schemes.

Contents of this page

- Assess your export readiness

- Choose the right payment term in agreement with your buyer

- Get export insurance to mitigate trade risks

- Comply with European customs policy

- Select the most efficient way to organise international transport

- Use safe packaging with the required labelling

- Seek support from agencies and organisations that can help you organise your exports

- Understand buyer requirements for standards to nourish your business relationships

1. Assess your export readiness

To export to the European market, you need to be financially stable, and you often need an established presence in the local market too. Do not be surprised if your buyer checks this. Once the decision to purchase has been made, they will want to receive the goods on time and in full. It is best if you carry out your own export readiness assessment to understand your strengths and weaknesses. Determining your export readiness will help you increase your chances of success in the European market.

To assess export readiness, you should first conduct market research. This will help you identify target markets for your natural ingredients based on factors like demand and competition. You may also gain insights into market trends and entry barriers, among others. Websites like the Global Trade Atlas and the International Trade Centre Market Analysis Tools Portal provide data and tools to support your market research efforts.

Figure 1: Introductory video on the Export Potential Map tool to spot export opportunities for your natural ingredients

Source: International Trade Centre, 2023

Second, you must ensure that your natural ingredients are suitable for the target markets. Consider factors like regulatory compliance and buyers’ expectations. Conduct testing to determine if your ingredient needs any modifications or adaptations to meet market requirements. Collaborate with accredited laboratories like Eurofins and other laboratories in your own country so you have the technical data required to assess the quality of your product. Ask your buyer for a copy of the specifications for the product in question.

Additionally, you need robust logistics and supply chain management processes to handle international shipments efficiently. Select experienced freight forwarders, customs brokers and transportation providers for exporting natural ingredients. Websites like the International Federation of Freight Forwarders Association (FIATA) and World Customs Organisation (WCO) provide resources and information on customs procedures. Some buyers will recommend shipping lines, for example if they are buying on FOB basis (take a look at Incoterms in the tip on organising international transport).

It is crucial to complete the export readiness assessment with a feasibility study and evaluate the potential costs, revenues and risks associated with entering the target export markets. You should also develop a clear market entry strategy that outlines your target market, pricing, distribution channels and marketing approach.

Tips:

- Read the CBI study ‘What requirements must natural cosmetic ingredients comply with?’ for more information on European regulations and mandatory and voluntary requirements in the cosmetics sector.

- Assess your internal capacity for dealing with the complexities of international trade, including export regulations, customs procedures and foreign currency transactions.

- Develop business relationships with freight forwarders for bulk shipments by sea and by air and for samples.

- Visit trade fairs in Europe, such as In-Cosmetics Global, SCS Formulate and Cosmetics Business. These events focus on personal care ingredients, cosmetic product formulation and innovative technologies, bringing suppliers, formulators and manufacturers together. They can provide valuable insights into your export readiness and help you gain a better understanding of trends, buyer preferences and the market.

2. Choose the right payment term in agreement with your buyer

International trade relies on a variety of payment terms, each with its own advantages, disadvantages and risks for all parties involved. As an exporter of natural ingredients, it is crucial to understand each payment term and weigh their risks and advantages before agreeing on one. You should choose a payment term that minimises the potential risks you might be exposed to while also accommodating the buyer’s needs. Selecting the appropriate payment method is essential for establishing long-lasting relationships.

Here is a brief description of the most frequently used payment terms for importing and exporting natural ingredients to Europe.

Table 1: Most common payment terms used in the trade of natural ingredients for cosmetics

| Payment term | Description | Advantages | Disadvantages | Notes |

| Letters of Credit (LC) | Exporters and importers contact a neutral financial institution to resolve disputes, typically a bank. It guarantees the exporter full payment, provided the goods are dispatched and the agreed terms are met. |

|

| There are various types of LC payments. Exporters frequently use standby LCs in international trade. |

| Cash in Advance | Payment is received before delivery. Payments are often made through bank transfers or credit card transactions. Online escrow services are growing in popularity as they help to reduce the risk of fraud and ensure compliance with the terms of the agreement. |

|

| Useful when trading high-value natural ingredients with new European buyers, particularly those with weak credit ratings. However, avoid offering cash in advance as the only accepted payment term as this may deter potential buyers. |

| Open Accounts | Exporters deliver goods before receiving payment. |

|

| Only recommended where there is a high level of trust between the parties. Exporters should, however, consider purchasing insurance to protect from non-payment. |

| Documentary Collection | Allows exporters to use banks to collect their payment upon delivering the required documentation to buyers. |

|

| Requires caution in markets with political instability or in situations where there is a higher risk of non-payment by the buyer. |

Source: ProFound, 2023

Use this information to compare payment terms based on your specific circumstances. Consider factors like your buyer’s expectations, financial resources, available time, previous experience, competition, size and value of the transaction, and the level of risk you are willing to take.

To make an informed decision, you could consult a trade finance expert. They can guide you in navigating payment methods and mitigating their associated risks. Several international financial institutions offer assistance with exporting to European markets, such as HSBC, Deutsche Bank and BNP Paribas. If you are unsure of which payment term to use, you could also approach local banks, local chambers of commerce and trade promotion agencies for advice. Some international organisations, such as the International Chamber of Commerce, provide arbitration services in case of disputes. Trade associations, such as the International Federation of Essential Oils and Aroma Trades (IFEAT), also offer this service to their members.

Tips:

- Be flexible when negotiating payment methods with buyers. Importers often prefer the most secure payment terms for themselves, which is likely to be the open-account payment. Be willing to negotiate and only commit to what you can deliver. Consider using a combination of payment terms. For example, you can suggest using cash in advance for 50% of the fee and secure the other 50% through an LC or documentary collection.

- Ensure that your price includes the costs and risks of arranging the payment term.

- Customise payment methods based on the size of the delivery and type of contract. Use more secure payment methods for high-value natural ingredients or large transactions.

- Consider enrolling in an online training course on trade finance offered by the International Chamber of Commerce (ICC) Academy. These courses cost money, so you should first assess whether they are cost-effective and useful for you.

3. Get export insurance to mitigate trade risks

As part of the export process, you need to obtain insurance against potential risks associated with international trade. These risks can include non-payment by buyers, loss or damage of goods, political instability, natural disasters or economic crises. Having an insurance policy can save you from expenses and help you recover the monetary value of your property if anything goes wrong. This tip is especially relevant for large and high-value shipments.

Export credit insurance (ECI) is a common insurance policy for exporting natural ingredients. Its purpose is to protect you from issues like default payment risks if the buyer becomes insolvent or if they fail to pay within the agreed time. ECI can make you more competitive by allowing you to offer delayed payment terms to European buyers, which may improve your chances of winning a deal.

Export credit insurance prices vary depending on factors like risks involved in transport, the buyer’s risk profile, your history and annual turnover. Note that there are different export credit schemes including short-term insurance, single-buyer policy and multiple buyer policy.

To get ECI, locate export credit agencies, commercial banks or other financial institutions that provide ECI in your country. It is recommended to first consider your country’s government-owned export credit agency. You can search for local ECI providers on the International Credit Insurance and Surety Association (ICISA) website, on the Berne Union member list and on the Insurance Companies website.

You may also want to consider other commonly used types of insurance, such as:

- Marine cargo insurance – covers physical damage to goods throughout the entire journey to a customer, whether by road, rail, sea or air;

- Freight insurance – covers the risk of damage or loss during transport. If you have agreed to CIF Incoterms, you should consider applying for freight insurance; and

- Seller’s interest insurance – covers the risk that the buyer does not insure the goods during transport when FOB Incoterms have been agreed and is unable or unwilling to pay for damage or loss.

It is a good idea to contact your country’s government trade department for information on the best places to purchase reliable export insurance.

Tips:

- Speak with an insurance broker to have a better idea of what documentation is required to purchase insurance. The typical documentation includes basic information about your company, a copy of an invoice and your buyer’s name.

- Reassess your insurance needs and update your coverage as you expand and enter new markets.

- Carefully review what is covered by the insurance policy as it may not cover 100% of potential losses. The policy contract will state the terms and amount of insurance payment in case of damage.

4. Comply with European customs policy

To do business in Europe as an exporter of cosmetic ingredients, you have to comply with the European customs policy. Non-compliance could prevent access to the European market, result in financial penalties and possibly end your trading relationships with European importers.

The EU operates as a customs union, which means that it has a common external tariff on goods that enter from outside the EU. The EU Common Customs Tariff (CCT) applies to goods imported from outside the EU. However, the rates of duty vary depending on the type of goods and their origins, as defined in the EU’s Combined Nomenclature. Exporters to the EU can find information on tariffs, taxes and duties in the Access2Markets portal.

Table 2: Examples of Common Customs Tariffs (CCT) for natural ingredients for cosmetics

| HS code | Natural ingredient | Tariff |

| 15159060 | Other vegetable oils and their fractions, crude, for technical or industrial uses other than the manufacture of foodstuffs for human consumption | 5.1% |

| 33012991 | Other essential oils, deterpenated | 2.3% |

| 1302 | Vegetable saps and extracts of liquorice | 3.2% |

| 1513111020 | Coconut oil, crude, for technical or industrial uses other than the manufacture of foodstuffs | 2.5% |

| 33012490 | Essential oil of peppermint, deterpenated | 2.9% |

Source: Access2Markets – My Trade Assistant, 2023

Some EU Member States may have specific customs requirements for importing goods. There may be differences regarding custom procedures, documents, regulations and proof of origin. Consider seeking the services of customs brokers and freight forwarders to complete the customs process for you.

The EU has several trade agreements to create better trading opportunities and overcome barriers. Goods may be eligible for preferential tariff rates if they come from a country that has a trade agreement with the EU. Currently, several countries on the CBI country list have trade agreements with the EU. These countries include Algeria, Egypt, Ghana, Jordan, Lebanon, Morocco, Palestinian territories, Tunisia and Indonesia. Additionally, Kenya concluded negotiations with the EU in June 2023 and will soon have an Economic Partnership Agreement in place. Some of these trade agreements reduce import tariffs to 0%. This gives suppliers in those countries a commercial advantage.

Figure 2: State of play of EU trade agreements with third countries

Source: European Commission, 2023

Tips:

- Use the My Trade Assistant tool to find out which EU Common Customs Tariffs apply to your natural ingredients.

- Check if the country you are exporting to has any specific customs requirements. You can find this information by visiting customs offices in individual European countries.

- Consider seeking out the services of customs brokers and freight forwarders. The International Federation of Customs Brokers Associations can help you find customs brokers. Please note that this service usually has a cost.

- To learn about trading with the UK, refer to the importing and exporting section of Brexit: guidance for businesses. You can also use the Trade Tariff tool to find information on tariff rates that apply to goods imported into the UK. This is important as the UK officially left the EU so EU law no longer applies there.

5. Select the most efficient way to organise international transport

Natural ingredients can be exported to Europe by sea or air transport. The mode of transport chosen plays a critical role in exporters’ success, affecting delivery times, costs and the overall customer experience.

Unless you are stocking your own warehouse in Europe, choosing the optimal mode of transport is often done in consultation with the buyer. To ensure the success of your natural ingredients export business, consider the following factors:

- Delivery time – European buyers prefer shorter delivery times so they can meet market demands promptly. Air freight is often faster and more reliable than sea freight for on-time deliveries.

- Sustainability – sea freight is seen as a more sustainable alternative due to its smaller carbon footprint. Prioritise sustainability over other factors according to your buyer’s preferences.

- Volume of order – sea freight is usually more cost-effective for larger volumes while air freight can be more economical for small quantities.

- Delivery costs – shipping costs depend on various factors, including volume, distance, special requirements, market conditions and fuel prices. Air freight is typically more expensive than sea freight. You can collaborate closely with logistics providers and freight forwarders for accurate quotes and to understand the breakdown of costs for a specific route.

- Restrictions for hazardous materials – there is a long list of prohibited items for air freight, including all flammable materials, such as essential oils.

To optimise your shipping strategy, it is crucial to analyse this information and understand the trade-offs between the two modes of transport. Talk to freight forwarders in your country for advice.

Incoterms

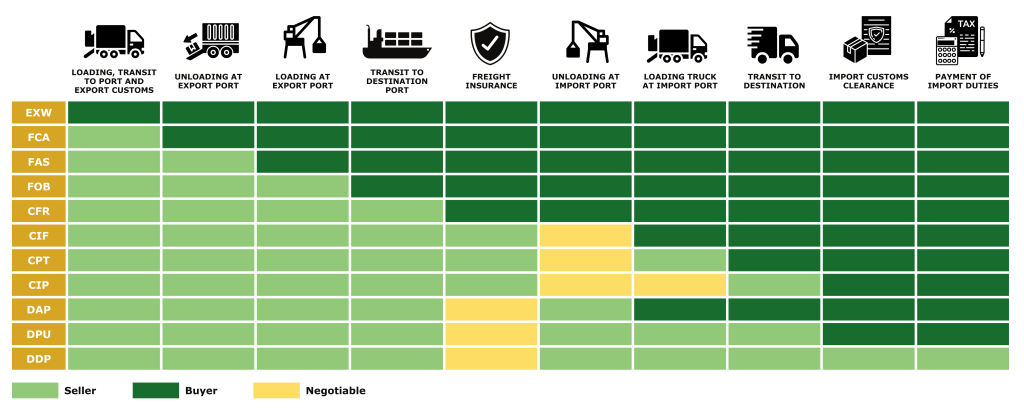

A critical element of international trade and transport is to use mutually agreed Incoterms with your customer. Incoterms were created by the International Chamber of Commerce. They define the buyer and seller’s responsibilities and obligations regarding the delivery of goods and the payment. You should include Incoterms when preparing quotes, negotiating purchase orders and organising transport.

There are several Incoterms, but the most commonly used ones are Free on Board (FOB) and Cost, Insurance and Freight (CIF). The FOB has the advantage of transferring responsibility for goods to the buyer as soon as they are placed on board the ship. This simplifies the process for exporters because it eliminates the need to insure goods after delivery to the specified port or to resolve customs issues. When negotiating with your buyer, aim to employ the Incoterms that provide the optimum customer service, and make sure you include all the costs for transport and import formalities in your price.

Figure 3: Incoterms and their related responsibilities for buyers and sellers

Source: ProFound, 2024

Tips:

- Estimate shipping costs with this free Freight Calculator and browse shipping companies’ websites, such as Searates, Maersk, Hapag-Lloyd and MSC.

- Inform your logistics provider of any special transportation and storage conditions that your natural ingredients need during the import-export process. Failure to do this can lead to your natural ingredients’ quality deteriorating before they reach the European importer. This can negatively affect your business relationships with your clients.

- Read and apply these tips on international transport to make informed transport decisions.

- Stay up to date with the latest developments. Refer to websites like Freightos and the World Shipping Council to find information on sea and air freight, including statistics/data on shipping and cost comparisons.

- Download the Incoterms 2020 app to learn more about these commercial trade terms.

6. Use safe packaging with the required labelling

To ensure that your goods arrive safely in optimal condition, it is crucial to package your products correctly. Good packaging practices not only safeguard product quality but also ensure compliance with regulations on hazards and on sustainability and help you to maintain a competitive edge in the European market. Invest in high-quality packaging materials that meet your importer’s requirements and can withstand transportation conditions while also reducing your environmental footprint.

Good packaging is crucial for preserving the quality of natural ingredients during transportation and storage. It shields against external factors, such as moisture, light and physical damage, which can alter product quality. Your packaging should include information on the units and weight of natural ingredients, as well as instructions for proper handling. The packaging must display relevant labels, symbols and texts related to the natural ingredients. Additionally, consider displaying your business logo and information on the packaging to promote your business.

It is important to consult with your buyer regarding packaging requirements to ensure compliance. Afterwards, coordinate with your logistics provider to maintain the quality of natural ingredients during transport.

The EU is committed to environmental sustainability, as stated in its Circular Economy Action Plan and the European Green Deal. The EU is implementing new regulations on sustainable packaging, with a growing commitment to environmentally friendly solutions. Recyclability and waste reduction are becoming priorities for the EU, with new restrictions on plastic use expected in the coming years. Spain has already introduced a 25% import tax on non-reusable plastic packaging. European businesses are facing pressure to align with environmental sustainability goals by increasing recyclability and reducing waste through targets and policies.

Exporters should strongly consider using recycled or recyclable packaging materials and minimise the use of plastic and other resource-intensive materials where possible. Explore options for using renewable, biodegradable and recyclable packaging. These can include innovative fibres such as algae, bamboo, wood paper and carton-based materials. Glass and metal may also work, but their weight may affect efforts to reduce freight weight to save fuel in transport.

Tips:

- Use UN-approved packaging if your natural ingredients are hazardous and have a UN number. Refer to the UN Recommendations on the Transport of Dangerous Goods for further information.

- Read our study ‘What requirements must natural ingredients for cosmetics comply with?’ to find detailed information on packaging requirements.

- Read this guide on packaging to reduce environmental impacts for information and guidance on ways to reduce your environmental impact.

- Read this report on Packaging Guidelines for Ocean Freight to discover possible solutions for your product and company.

7. Seek support from agencies and organisations that can help you organise your exports

There are numerous export agencies that offer specialised knowledge and support to exporters aiming to enter new markets. These agencies provide training, coaching, participation in trade fairs, business-matching services and more. Government and non-government agencies alike often provide free assistance. Collaborating with these agencies and organisations is highly recommended as you can improve your market knowledge, benefit from networking opportunities and increase your chances of successfully exporting to Europe.

Figure 4: Examples of organisations and agencies that provide support to natural ingredient exporters

Source: Various

European government agencies

- CBI – the Centre for the Promotion of Imports from Developing Countries is a Dutch government agency that helps exporters from developing countries who want to enter European markets for export. They provide different services like coaching, trade fair visits, training and market studies.

- IPD – the Import Promotion Desk helps importers and tour operators to find business partners from selected developing countries and emerging markets. IPD helps small and medium-sized enterprises (SMEs) in partner countries gain access to the EU market.

- OTGS – Open Trade Gate Sweden supports companies from developing countries to export to Sweden and the European Union. Exporters receive market information and assistance in understanding rules and procedures.

- SIPPO – the Swiss Import Promotion Programme’s overall objective is to integrate developing and transition countries into world trade by advising and supporting Business Support Organisations (BSOs).

- FINNPARTNERSHIP – the Finnpartnership programme promotes business between Finland and developing countries to positively affect development. It mainly provides services in Business Partnership Support and matchmaking.

Non-government agencies

- ITC – the International Trade Centre is a United Nations development trade agency that provides services like export management, supply chain management, packaging, marketing and branding. They also prepare informative articles and studies that offer guidance for BSOs and small firms.

- COLEAD – the Committee Linking Entrepreneurship-Agriculture-Development is a European organisation that promotes sustainable and inclusive agricultural trade and development. They offer a variety of services, including technical assistance, market access and development, standards compliance, institutional strengthening, networking and advocacy.

- AFRICROPS! – Africrops! GmbH specialises in sourcing, producing and exporting African botanical ingredients for the food, beverage, cosmetics and pharmaceutical industries. They focus on sustainable sourcing, processing and value addition, quality control and certification, as well as export and distribution.

To find more support organisations, look for government trade agencies in both the destination country and your own country. For example, the Nigerian Investment Promotion Commission supports Nigerian entrepreneurs who want to export their products.

Tips:

- Join trade associations as they often have partnerships with government agencies and NGOs, providing valuable networking opportunities and export promotion.

- Participate in international trade fairs and conferences related to cosmetics and natural ingredients. This will help you identify organisations that can support you.

- Establish an online presence. This will help BSOs and NGOs in the field of agriculture and international cooperation to identify you.

- Explore ITC’s SME Trade Academy platform for free resources on how to become a successful exporter of agricultural products.

8. Understand buyer requirements for standards to nourish your business relationships

Exporting natural ingredients to Europe requires an in-depth understanding of the regulations, standards and specific buyer requirements for this market. By investing time and resources into understanding the European cosmetics market standards, you will be better positioned in the European market.

To comply with mandatory requirements from buyers on safety and due diligence, exporters of cosmetic ingredients have to be aware of several EU regulations, including the Cosmetics Regulation, REACH and CLP. Non-compliance may result in access to the European market being denied. In addition to mandatory requirements, European buyers and cosmetics manufacturers also require compliance with quality management standards, such as the Hazard Analysis and Critical Control Point (HACCP) system adapted for cosmetics and the Good Manufacturing Practices (GMP) certification scheme.

Importers may have additional requirements, such as sustainably produced natural ingredients. Buyers are increasingly demanding organic and fair-trade certifications. This trend is driven by rising consumer demand for ethical and natural products, and it is expected to continue in the future. As an exporter, you should carry out activities that benefit both the planet and people, measure these activities and communicate them clearly. Although buyers value certificates, the costs of certification, conversion and administration can be prohibitive for some companies. There are widely recognised self-assessment systems that can serve as stepping stones to certification.

Figure 5: Examples of certification schemes that show your commitment to sustainable production

Source: Various

Tips:

- Read the CBI study on buyer requirements for natural cosmetic ingredients to learn more about regulations and mandatory requirements.

- Prepare a dossier with all additional standards and certifications that you meet. Be ready to show these documents when approaching European buyers.

- Talk to your buyer to better understand what their preferences are in terms of certification and how the market for specific certification schemes is generally developing.

- Check whether your potential buyer would be willing to invest in supporting you to achieve a certification standard. Some will be willing to do this if they are committed to entering into a long-term relationship with you.

ProFound – Advisers in Development carried out this study in partnership with Fair Venture Consulting on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research