The European market potential for ximenia oil

Europe is the world’s largest importer of vegetable oils and third largest cosmetics market. It has a growing natural and organic segment. Consumer appreciation for natural cosmetic oils and established demand for skincare and dermo-cosmetic products in Europe offer opportunities for Ximenia oil in the market thanks to its benefits for the skin, particularly in France, Germany and the Netherlands. This demand is supported by the growing popularity of holistic beauty in Europe, which has increased demand for natural and multi-benefit products like Ximenia oil.

Contents of this page

1. Product description

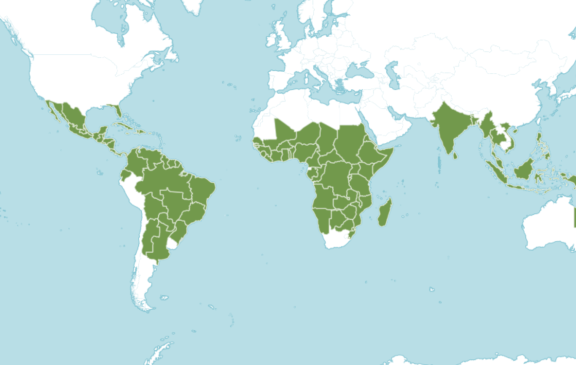

Ximenia Oil is a natural, lightweight, fixed oil obtained from the seeds of the Ximenia fruit tree. Ximenia americana, also commonly known as Sour Plum, Wild Plum and Monkey Plum, is a small tree or shrub found in low-altitude woodlands and grassland regions. The tree is found throughout Africa and South America, but it can also be found in other countries in Central America and Australasia. The tree produces dark reddish-brown fruits of a similar size to plums. When cut open, the fruit contains an edible, pale orange pulp and a large seed that is rich in oil. The oil is high in essential fatty acids, including omega-3, omega-6 and omega-9. It is also a good source of Ximenynic acid and vitamin E.

Figure 1: Global distribution of the Ximenia tree

Source: Royal Botanic Gardens, 2024

African tribes value Ximenia seed oil for its healing and beauty-enhancing properties. It is now extensively used in the beauty industry and is a highly valued ingredient in cosmetics due to its benefits for the skin and hair. It is associated with skin conditioning and emollient functions. The cold-pressed oil has a unique, rich, viscous texture, different to typical oils, and this makes it ideal for creating luxurious creams, lotions and balms.

Ximenia oil is easily absorbed by the skin and is suitable for all skin types, including sensitive skin. Being a light, non-comedogenic oil with anti-microbial properties, Ximenia Oil is reputed to calm acne-prone skin and to reduce other blemishes, including scarring. Due to its antioxidants and long fatty acid composition, Ximenia oil is known for its anti-ageing, nourishing and moisturising properties. It helps maintain healthy skin, strengthens the skin barrier, reduces inflammation and promotes collagen production while protecting the skin from free radical damage. Its highly emollient and deeply hydrating properties also make it beneficial for treating dry scalp and dandruff. Ximenia oil is also distinguished by its high Ximenynic fatty acid content. This sets it apart from other vegetable oils.

Ximenia oil is used in cosmetics in Europe as an emollient, conditioner, skin softener, in hair care, body care and soap. It is an excellent ingredient in the formulations of anti-aging face creams and serums, hair conditioners and pre-shampoo oil treatments, as well as in lipsticks and lubricants.

Figure 2: Examples of products with Ximenia oil in the European cosmetics market

Source: Wet n Wild & Drunk Elephant & Liz Earle, 2024

Table 1 lists the classification names and codes for Ximenia oil. These codes and ingredient names are used as product identifications in documentation (as listed in COSING and with the Chemical Abstracts Service number) and in trade (Harmonised System codes).

Table 1: Classification of Ximenia oil

| Source | Classification |

| International Nomenclature Cosmetic Ingredient (INCI) names, according to COSING (European Commission database with information on cosmetic substances and ingredients) | COSING lists the INCI names for multiple ingredients known as or derived from Ximenia oil, including:

|

| Chemical Abstract Service (CAS) number | 95193-67-2 |

| EINECS | 305-880-2 |

| Harmonised system (HS) codes | 1515.90 (other fixed vegetable fats and oils and their fractions, refined or not, not chemically modified) |

Source: ProFound, 2024

2. What makes Europe an interesting market for Ximenia oil?

The European consumer market is the second largest market for cosmetic products after the United States. Europe is also a major importer of natural ingredients and vegetable oils. The market for natural and organic products is well-established in Europe, with good growth projections, although it represents a small percentage of the total market.

Europe is one of the world’s largest markets for cosmetics

On a continental scale, Europe is the world’s third largest cosmetics market, worth €96 billion in 2023. In the same year, the European cosmetics market dominated at least 24% of the global cosmetics market, which was valued at around €525 billion. While the US leads the global market by annual revenue (€102 billion), the European market stands out in terms of per capita spending, estimated at €169 in 2023, according to Cosmetics Europe & Euromonitor International. European per capita spending has been increasing steadily since 2021, at an average annual rate of 8.3%.

Source: L’Oréal 2023 Annual Report

The cosmetics market is experiencing continuous and significant growth in both Eastern and Western Europe. Over the past five years, the European market has grown on average by 4.7% per year in value terms. In 2022 and 2023, the European market for cosmetics grew at an average rate of 7.5% and 9.1%, respectively, outpacing global market growth in both years. Annual growth is also now higher than it was in the years before the pandemic. This indicates that the industry is healthy and that the value of the market will continue to grow. In fact, the European market is expected to keep growing at an average annual rate of 2.1% between 2023 and 2027.

Source: CBI, 2024

Growing European imports of exotic vegetable oils from developing countries

Ximenia oil, like all of the exotic vegetable oils used in cosmetics, does not have its own HS code. Thus, trade statistics are only available in an aggregated form. Ximenia oil is part of a larger product group (HS code 151590) that contains other vegetable oils and fats, including exotic vegetable oils used in cosmetics. This latter group includes argan oil, Brazil nut oil, moringa oil, prickly pear oil, baobab oil and shea butter (see HS codes under the section ‘product description’).

Europe is the largest importer of vegetable oils (HS code 151590) in the world, well ahead of Asia and North America. According to the ITC Trade Map, European imports of vegetable oils amounted to 452,808 tonnes (€1,330 billion), making up 49% of global imports in 2023. Between 2019 and 2023, European imports of vegetable oils grew on average by 11% in value and 3.9% in volume per year. Europe had the second highest growth in the last five years, after North America. Meanwhile, global imports have decreased by -0.2%. Europe’s steady growth since 2020 suggests a positive trend for the coming years.

Source: ITC Trade Map, 2024

In 2023, €299 million of vegetable oils were sourced from developing countries, representing a 23% share of global import value. This share represents a decrease from 29% in 2020, likely due to fewer direct imports from these countries caused by high vegetable oil prices between 2020 and 2022. Although this share has decreased, Europe still controls a significant portion of global imports from developing countries and should be considered an important target market for vegetable oils, including Ximenia oil. The average annual growth rate of imports from developing countries was 6% between 2019 and 2023. Despite steady growth since 2019, there was a decrease of -6.7% in 2022 and 2023 when prices began to fall.

Source: ITC Trade Map, 2024

Europe is among the world’s largest markets for natural and organic cosmetics

At a continental level, Europe is one of the largest markets for natural and organic cosmetics. In recent years, the European cosmetics industry has been moving towards more sustainable and natural products. This shift has led to the rise of organic and eco-friendly personal care brands as consumers become more aware of the ingredients they use and their environmental impact. Ximenia oil, a natural product, fits well within this trend. Several Ximenia oil suppliers currently offer organic oil. This demonstrates the opportunities that this oil can tap into in the natural and organic segment.

Although natural and organic cosmetics still account for less than 5% of total cosmetics sales, the European natural cosmetic market is growing quickly due to the apparent benefits of natural cosmetics and their increasing availability in mainstream retail channels. Sales of natural and organic cosmetics have grown at an average of 7% per year over the past five years.

While 2023 was a tough year for organic beauty due to consumer price sensitivity and economic challenges, most brands expect growth. The sales of natural cosmetics are forecasted to grow steadily at an average rate of 5.7% per year over the next few years, reaching €3.23 billion by 2028. This will be driven by growing demand for clean and natural beauty products, focusing on eco-friendly options with plant-based ingredients and sustainable sourcing, as well as stricter measures against greenwashing.

Source: Statista, 2024

Skincare and hair care segments open up opportunities for ingredient innovation

Skincare is one of the best-performing categories in the European market. In 2023, the European skincare category was valued at €27.7 billion. According to Cosmetics Europe, this segment is the largest in the European market, dominating 29% of the total market, far beyond other segments like toiletries (24%) and hair care (18%). This is significant because the size of the skincare market is closely linked with the quantities of ingredients used to make skincare products.

The skincare segment grew by 10% between 2022 and 2023. While this growth seems impressive, it is lower than that of colour cosmetics and fragrances. However, the skincare segment offers several advantages and opportunities for natural ingredients. For one, it uses a much wider range of ingredients, with consumers typically using between four and six products in the segment. At the same time, skincare has been the main category for ingredient innovation. Ximenia oil’s emollient, moisturising and anti-microbial properties make it ideal for skincare innovation. It can be used in a range of products, such as face creams, moisturisers and serums, to deliver high-performance skincare benefits.

Hair care is also a new market. The hair category is growing in value, undergoing 8.1% growth between 2022 and 2023. This segment also has a strong focus on ingredient innovation, driven by the ‘skinification’ of hair, which means consumers are paying more attention to hair health. Ximenia oil fits well into the hair care segment, providing nourishment and hydration to the scalp. The amount of natural oil based ingredients used in hair care products is generally not as high as in skincare products. However, it helps marketeers who want to focus on the ingredient story include a wider range of products. Ximenia oil can be sold as an innovative ingredient in treatments, shampoos, conditioners and other products that aim to enhance hair health and vitality. Ximenia oil’s versatility creates opportunities in the European market.

Tips:

- See our study on the demand for natural cosmetic ingredients in Europe to find more information on relevant markets, sales, imports and potential products in the natural cosmetics segment.

- Check our study on tips for doing business. You can learn about specific features of European buyers and businesses that may help you increase your chances of exporting.

- Stay up to date with the latest developments in the skincare segment to identify new opportunities. You can read industry publications, such as Cosmetics Design Europe.

- When promoting your product, emphasise the fact that Ximenia oil is a new and innovative ingredient in the European market. European companies are always looking for unique products and ingredients, so highlighting this can give you an edge with buyers wanting something different.

3. Which European countries offer the most opportunities for Ximenia oil?

Western Europe continues to lead the European cosmetics market, accounting for around 80% of the annual market value. Germany is the largest European cosmetics market, followed by France and Italy. The UK market is expected to grow the fastest in the coming years. The Netherlands and Spain also stand out as suppliers to the rest of Europe, with large and growing imports of vegetable oils from developing countries.

France is Europe’s largest importer of vegetable oils like Ximenia oil

France is the second largest market in Europe for cosmetics and personal care products, with a market value of €13.7 billion in 2023, making up 14% of the European market. The French beauty and personal care market grew by 6.3% between 2022 and 2023. This is below the regional average. The market is forecasted to grow by over 2% annually in the next five years, increasing its value by almost €1.7 billion by 2028.

France has the largest number of SME cosmetics manufacturers per country. There were 1,917 in 2023, representing 21% of all SMEs in Europe. This is relevant because SME manufacturers are often drivers of innovation and lead the use of niche natural ingredients. The largest segments in the French market are skincare (31%), toiletries (25%) and fragrances (22%). Skincare was the second largest growing segment after fragrances, with a growth rate of 6.6% between 2022 and 2023. Hair care grew at a rate of 4.3% during the same period. France is also one of the top ten countries in terms of per capita consumption, with each French person consuming an estimated €202 in 2023.

France is the largest importer of vegetable oils in Europe, accounting for 16% of all European imports. In 2023, France imported 72,283 tonnes of vegetable oils worth €235 million. Imported volumes have remained steady over the last five years. Between 2019 and 2023, French imports grew by an average of 0.6% per year in volume, while the import value increased significantly at an average rate of 11% per year since 2019. In 2023, France imported €55 million worth of vegetable oils from developing countries, equal to 23% of the total import value. French imports from developing countries have been stable, showing a slight average growth of 0.7% per year since 2019.

Source: ITC Trade Map, 2024

France also has a growing market for organic and natural cosmetics. In 2023, the value of the natural cosmetics market in France reached €313 million, representing an average annual growth of 4.9% since 2018. The sector is expected to continue to grow, reaching a value of €394 million in 2028. This growth is driven by factors like the expansion of distribution channels, the increase in online customer reach and consumers’ desire for natural beauty and wellbeing. The French natural and organic cosmetics market is one of the largest in Europe. In 2022, 57% of French consumers used natural and/or organic personal and beauty products. France also has a large supply of these products. To date, there are 17,054 products with the COSMOS signature in France (the leading standard worldwide for organic and natural cosmetics), representing 48% of all products with this signature.

Source: Statista, 2024

Collectively, this means France is one of the most attractive markets for the export of Ximenia oil. Some industry sources consider France to have the most potential for Ximenia oil in Europe.

The Netherlands is the largest European importer of vegetable oils from developing countries

The Netherlands is one of the largest markets in Europe for cosmetics and personal care products, valued at €3.4 billion in 2023, with a 3.5% share of the European market. The Dutch beauty and personal care market is forecasted to grow by 2% annually over the next five years, increasing its market value by almost €200 million. The Netherlands also has a large number of SMEs; there were 401 in 2023.

The largest segments in the Dutch market are toiletries (27%), skincare (21%) and fragrances (19%). The skincare segment was the second-fastest growing, with an 8.6% increase between 2022 and 2023. Comparatively, hair care grew by 7.1% during the same period. The Netherlands is one of the top ten countries in terms of per capita consumption, with each Dutch person consuming an estimated €189 in 2023.

The Netherlands is the second largest importer of vegetable oils in Europe. In 2023, the Netherlands imported 63,851 tonnes of vegetable oils worth €157 million, accounting for 14% of total European imports. Between 2019 and 2023, Dutch imports grew on average by 4.4% per year in volume and 8.1% in value. In 2023, the Netherlands imported €80 million worth of vegetable oils from developing countries, accounting for more than half of the total import value. The Netherlands has the largest share of imports from developing economies of all European countries, and it has shown significant growth in recent years. Between 2019 and 2023, Dutch imports from developing economies grew by 12% per year on average. This growth remained steady, even during the pandemic, with a notable 22% increase between 2022 and 2023, suggesting a positive outlook.

Spanish imports of vegetable oils showed one of the highest growth rates in Europe

Spain is the fifth largest market for cosmetics and personal care products in Europe, valued at €10.4 billion in 2023, with an 11% share of the European market. The Spanish beauty and personal care market grew by 12% in 2023, exceeding the regional average and placing Spain in the top ten countries in terms of growth. The market is forecasted to grow between 1 and 2% annually over the next five years, increasing by almost €1.3 billion by 2028. Spain also has the fifth largest number of SMEs in 2023, with 642.

The largest segments in the Spanish market are skincare (33%), toiletries (21%) and fragrances (19%). The skincare segment was the fastest-growing between 2022 and 2023, with a growth rate of 14.3%, while hair care grew by 9.8%. In 2023, Spain had the third highest per capita consumption in Europe, with an estimated €216 per person.

Spain is also the fifth largest importer of vegetable oils. In 2023, Spain imported 35,187 tonnes of vegetable oils. These imports were worth €104 million and accounted for 7.8% of the total imported volume in Europe. Spain has one of the highest growth rates in imports in the region. Between 2019 and 2023, Spanish imports grew by 32% per year on average, while the import value grew at an average annual rate of 31% during the same period. In 2023, Spain imported €34 million worth of vegetable oils from developing countries, accounting for 32% of the total import value. This is one of the largest shares in Europe. Spanish imports of vegetable oils from developing economies showed remarkable growth over the last five years, growing on average by 25% per year between 2019 and 2023, more than doubling the imports recorded in 2019 (€14 million).

Italian imports of vegetable oils show significant growth

Italy is the third largest market in Europe for cosmetics and personal care products. It was valued at €12.5 billion in 2023, with a 13% share of the European market. The Italian beauty and personal care market grew by 9.4% in 2023, surpassing the regional average. However, no significant growth is expected over the next five years, with a projected decrease in market value of around €200 million by 2028.

Italy has the second largest number of SMEs in Europe, with 952 in 2023, representing 11% of all SMEs in Europe. The largest segments in the Italian market are skincare (36%) and decorative cosmetics (20%). Between 2022 and 2023, the skincare segment grew by 8.8%, and hair care grew by 5.5%. Italy was fourth in per capita consumption in 2023, with an estimated €212 per person.

In 2023, Italy imported 28,296 tonnes of vegetable oils worth €111 million, accounting for 6.2% of total European imports. Italian imports have undergone significant growth, with an average annual increase of 18% in volume and 29% in value between 2019 and 2023. In 2023, Italy imported €26 million worth of vegetable oils from developing countries, which accounted for 24% of the total import value. Imports from these economies showed significant growth, increasing at an average rate of 9.8% per year between 2019 and 2023.

The United Kingdom is a leading market for organic and natural cosmetics in Europe

The UK is the fourth largest market in Europe for cosmetics and personal care products, valued at €11 billion in 2023, with an 11% share of the European market. The UK beauty and personal care market grew by 9.7% in 2023, surpassing the regional average. It is expected to grow by more than 3.5% annually over the next five years, increasing its market value by almost €2.4 billion by 2028.

The UK is the third largest country in terms of the number of SMEs. With 880 SMEs in 2023, it represented 9.8% of the total SMEs in Europe. The largest segments in the UK market are toiletries (28%), skincare (25%) and fragrances (21%). The skincare segment was the fastest-growing, undergoing an 11.8% increase between 2022 and 2023. Hair care grew by 7.3% during the same period. Per capita consumption in the UK was €162 in 2023.

In 2023, the UK imported 22,057 tonnes of vegetable oils worth €55 million, accounting for 4.9% of total European imports. Between 2019 and 2023, UK imports grew at an average annual rate of 4.7%. In 2023, the UK imported €18 million worth of vegetable oils from developing countries, which accounted for 33% of the total import value. UK imports from these economies grew at an average rate of 5% per year between 2019 and 2023.

The UK is another leading market for organic and natural cosmetics in Europe. According to the Soil Association, the UK’s organic health and beauty market grew by an average of 9.5% per year over the past five years, growing from €103 million in 2018 to €162 million in 2023. This was the first year to see a downturn, linked to the cost-of-living crisis, the aftermath of the pandemic and the effects of Brexit. Despite this, the outlook for 2024 and beyond is positive. Many certified natural and organic brands expect growth in the coming years.

Source: Soil Association Certification, 2024

Germany is the largest cosmetics market in Europe

Germany is the largest national market for cosmetics and personal care products in Europe, with a market value of €15.9 billion in 2023. It makes up 17% of the European cosmetics market and is one of the largest countries in terms of SME cosmetics manufacturers, with 611 companies in 2023. This is relevant as SME manufacturers are often drivers of innovation.

The German beauty and personal care market grew by 11% between 2022 and 2023, surpassing the regional average and putting Germany among the top ten countries with the largest growth. The market is forecasted to grow by over 1% per year in the coming years, increasing by €1.8 billion by 2028. Germany is also one of the top ten countries in terms of per capita consumption, with each German consuming an estimated €187 in 2023.

The largest segments in the German market are toiletries (31%), hair care (23%) and skincare (21%). Skincare grew by 8.6% between 2022 and 2023, and hair care grew by 9.9%.

In 2023, Germany imported 17,110 tonnes (€84 million) of vegetable oils (HS code 151590), accounting for 3.8% of European imports. Between 2019 and 2023, German imports of vegetable oils decreased on average by 10.4% per year in volume and 6.2% in value. Germany imported almost €26 million in vegetable oils from developing countries, indicating that 30% of the import value is sourced from these areas. German imports from developing countries grew at an annual average rate of 3% between 2019 and 2022.

Germany is Europe’s most significant market for natural and organic cosmetics. More than 70% of German consumers consider sustainability when buying cosmetics and personal care products. In particular, the demand for products without parabens, silicones and microplastics has increased. More Germans choose natural and sustainable products over chemical ingredients. In 2022, 52% of German consumers reported using natural and/or organic personal and beauty care products. There is a significant supply of these products to the country, with 2,596 products having a COSMOS signature and being either natural or organic, and 3,932 NATRUE-certified products – the highest number of NATRUE-certified products per country in the world.

Germany’s natural cosmetics market is thriving thanks to growing consumer demand for sustainable beauty products. In 2024, the value of this market amounted to €342 million. Looking ahead, the market is forecast to grow at an average annual rate of 5.28% to reach €414 million by 2028.

Source: Statista, 2024

Tips:

- Focus on Western European countries because they import the most exotic vegetable oils (HS code 151590) and have the largest cosmetics markets.

- Be flexible in your offer to European customers. Do not get fixed on large minimum order quantities. Offer solutions that make you an attractive supplier and look to the long term.

- Consider obtaining NATRUE certification or approval for your Ximenia oil. Offering ingredients with these recognitions could be very valuable to potential buyers.

- Consider starting your customer search in countries with the most SME manufacturers. These manufacturers often work with niche retail brands that want innovative ingredients like Ximenia oil. Slowly broaden your search to include other potential buyers.

4. Which trends offer opportunities or pose threats in the European Ximenia oil market?

As the demand for holistic beauty and wellness grows, natural ingredients like Ximenia oil get more popular because of their natural origins and benefits. However, the rise of lab-grown ingredients poses a challenge to traditional oils. Producers of Ximenia oil should emphasise their unique benefits to stay competitive in the industry.

Holistic beauty drives demand for natural, multi-functional ingredients like Ximenia oil

Holistic beauty looks at beauty as a whole, including physical, mental, emotional and spiritual aspects. More and more people are interested in holistic beauty treatments that combine beauty and wellbeing. Many consumers link being healthy with feeling good and see beauty products as a way to achieve this. Due to this trend, 61% of industry experts believe that healthy living will strongly affect beauty sales in the next 12 months.

To illustrate the European case, the UK Soil Association says that consumers care more about the overall health benefits of products; not just how they look. In hair care, for example, more attention is now paid to scalp health, as stress can cause scalp problems. Ingredients often used in skincare are now also used in hair care as people are more interested in holistic hair wellness.

One current trend in wellness is mind-body beauty, in which mental wellbeing is linked to physical appearance. The health and wellness movement has made skin and hair care more popular, with more interest in natural and plant-based ingredients.

Ximenia oil fits well with the holistic beauty trend. It hydrates and nourishes the skin, and it has calming and anti-inflammatory effects that can help with stress-related skin issues. As more people look for products that support mental and physical health, the demand for natural ingredients will likely grow. The holistic approach to beauty, which focuses on overall health and wellbeing, makes Ximenia oil a great choice for skincare and hair care products. It meets the growing consumer demand for products that support holistic wellness.

The growing dermo-cosmetics market unlocks opportunities for Ximenia oil

The dermo-cosmetics market is growing, driven by consumers’ desire for health and safety and the rising prevalence of skin disorders. Factors like ageing, climate change and stress further fuel this interest. Additionally, dermatologists are prescribing dermo-cosmetics as a solution for specific skin problems, such as sensitive skin, eczema and acne. This has made them more popular. Ximenia oil’s multifunctional benefits and alignment with current consumer preferences highlight its potential for success in the dermo cosmetics market.

The dermo-cosmetics segment has grown significantly in recent years, consistently outperforming the overall cosmetics market. In 2023, the dermo cosmetics market grew by 13%. Even during the pandemic, this segment proved to be widespread and resilient to adverse effects. This suggests a very future for dermo-cosmetics.

Source: L’Oréal, 2023

Longevity has become the new term in the health and wellbeing trend. It is a major driver of demand for dermo-cosmetics. With the proportion of the global population aged 65+ growing at a significant rate. This, combined with the gross annual income of individuals aged 65 and older set to grow by 9% within the next five years, means there is a significant opportunity for businesses to target this population. This demographic shift highlights the potential for products that target ageing skin, which often requires specialised care.

Ximenia oil is known for its moisturising, anti-inflammatory and conditioning properties. With these qualities, it fits well into the expanding dermo-cosmetics market. Its ability to address specific skin issues, like dryness and irritation, makes it a valuable ingredient in products designed for sensitive skin, eczema and acne. The focus on longevity also presents an opportunity for Ximenia oil, as its beneficial properties can help address the specific skincare needs of the ageing population.

Afrika Botanicals is a South African supplier of carrier oils, including Ximenia oil. It has successfully identified and capitalised on the growing demand for dermo-cosmetic products. Afrika Botanicals proactively positions Ximenia oil as a natural solution for ageing skin, leveraging its moisturising, anti-inflammatory and conditioning properties. The company’s claims about Ximenia oil's ability to improve skin vitality and combat premature ageing demonstrate an awareness of the market’s growing focus on longevity. By promoting the stability and oxidation resistance of Ximenia oil, Afrika Botanicals uses the properties of Ximenia oil to answer the growing demand for targeted skincare solutions, particularly among the ageing population.

The rise of biotech cosmetic ingredients threatens the demand for traditionally sourced ingredients

Sustainability is very important in the European cosmetics market. Suppliers are increasingly expected to show that they are working to reduce negative environmental and social impacts. All companies in the supply chain should implement systems to measure and communicate their sustainability performance. This will become even more important with the rise of biotechnology in the development of cosmetic ingredients, with biotech companies using sustainability claims to attract ingredient buyers.

The cosmetics and skincare industry is turning to biotech ingredients grown in laboratories. These lab-made ingredients are often promoted as safer, more effective and even more sustainable than traditional ingredients derived from fruits, leaves, seeds and so forth. Advances in biotechnology have allowed scientists to create and improve natural compounds in controlled environments. This ensures that the final product is pure and consistent while avoiding extraction from nature and ensuring that the ingredients are renewable. This appeals to both manufacturers and consumers because it reduces the risk of contamination and ensures the product works the same way every time.

This trend poses a threat to traditional natural ingredients. As more actors in the industry become interested in lab-grown alternatives, there is a risk that these high-tech ingredients could overshadow the value of naturally sourced oils and have a negative effect on demand for natural oils. Some of the industry’s largest companies already invest in biotech and biomimetic ingredients believing that biotechnology anticipates sourcing challenges and prioritises ingredient quality.

Figure 13: Video: How biotechnology could change the face of cosmetics

Source: TODAY, 2023

Despite these challenges, it is important to remember natural ingredients’ unique benefits. Ximenia oil carries the richness of nature and reflects the environment in which it is grown. Lab-grown ingredients cannot replicate this connection to nature. Harvesting natural ingredients also supports local communities and helps preserve traditional knowledge and biodiversity.

To compete with the growing popularity of lab-grown ingredients, producers and exporters of natural oils must emphasise the broader benefits of their products, particularly potential social impact, by supporting rural economies. This is in addition to ensuring environmental sustainability. Suppliers should ensure traceability, transparency and sustainability to remain relevant in skincare and cosmetics. By highlighting these aspects, the industry can continue to show that naturally harvested oils are valuable, even with synthetic competition.

Tips:

- Educate potential buyers on the uses and benefits of Ximenia oil to help them promote it and to build interest in the European market. Capitalise on the high ximenynic acid content to add value and attract buyers.

- Read our study about trends for natural ingredients for cosmetics for more market trends and relevant information.

ProFound – Advisers In Development and Fair Venture Consulting carried out this study on behalf of the CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research