Entering the European market for baobab

To enter the European market for baobab you must meet the mandatory requirements set by the European Union. Ensuring consistent quality is key and having organic certification is important in this market. Importers and distributors are the most important channels to enter the market. You will face competition from several strong existing suppliers and from competing products on the European market.

Contents of this page

1. What requirements must baobab products comply with to be allowed on the European market?

What are mandatory requirements?

As an exporter of baobab from a developing country, your baobab can only be exported for the European natural health product market if you comply with the European Union’s (EU) mandatory legal requirements for natural ingredients for health products. Non-compliance can prevent your baobab from entering the European market.

If your baobab is used in food supplements, you must comply with the following legislation.

Table 1: Legislative requirements for food supplements, and implications for baobab powder

| Legislative requirements | Implications for baobab powder |

| European General Food Law, which requires all foods marketed in the EU to be safe and traceable. | Traceability is based on the ‘one step back-one step forward’ principle; you need to trace your baobab throughout the value chain. |

| Food safety, which includes requirements on Maximum Residue Levels (MRLs), contaminants in food and microbiological contamination of food, food hygiene as outlined in the EU’s Hazard Analysis and Critical Control Points (HACCP). | Baobab is usually tested for heavy metals such as Lead, Mercury, Cadmium and Lead. The maximum levels are set by Regulation (EC) No 466/2001 (amended by EC/78/2005). The maximum levels of Cadmium and Mercury are set at 0.05 mg/kg and for Mercury 0.5mg/kg wet weight. The maximum level of Lead and the standard for Lead is set at 0.1 mg/kg wet weight. It is important to send European buyers uncontaminated baobab or baobab that has heavy metals within the set maximum levels, as they test baobab regularly. Failing to do so may end business relationships with them because buyers expect high quality. |

| EU food supplement legislation, which lays down requirements on the composition and labelling of supplements. | |

| National positive lists for botanicals that show whether an ingredient is allowed in food supplements. Examples include BELFRIT (Belgium, France and Italy) and Germany. | Baobab is an established ingredient for food supplements, as it is listed in several positive lists, such as BELFRIT and the Pflanzenliste (Germany). |

| Novel Food legislation, according to which consumer safety of ingredients that were not consumed within the EU before 15 May 1997 must be assured. | Baobab dried fruit pulp is an established ingredient listed on the Union list of authorised novel foods of the European Union (EU). You must therefore comply with the Novel Food Regulation. This means that your baobab must meet the specifications listed in Table 2 below. |

For baobab dried fruit pulp the specification requirements according to the Novel Food Regulation include:

Table 2: Specifications of baobab fruit pulp

| Authorised Novel Food | Specifications |

Baobab (Adansonia digitata) dried fruit Pulp | Description/Definition: Baobab (Adansonia digitata) fruits are harvested from trees. The hard shells are cracked open and the pulp is separated from the seeds and the shell. This is milled, separated into coarse and fine lots (particle size 3 to 600 μ) and then packaged. Typical nutritional components: Moisture (loss on drying) (g/100 g): 11.1-12.0 Analytical specifications: Foreign matter: Not more than 0.2% |

Source: eur-lex.europa.eu

Tips:

- Check for common causes of border rejection and product withdrawals on the EU’s Rapid Alert System for Food and Feed database. Examples for baobab include contaminants, mycotoxins and unauthorised food ingredients.

- Be ready to demonstrate traceability by documenting your value chain.

- See the CBI study ‘What requirements must natural ingredients for health products comply with to be allowed on the European market?’. This study provides further guidance on mandatory as well as broader market entry requirements for this sector.

- Visit the Access2Markets Portal (previously known as the EU Trade Helpdesk) for more information on import rules and taxes in the European Union.

- Contact Open Trade Gate Sweden if you have specific questions about rules and requirements in Sweden and the European Union.

Access and Benefit-Sharing (ABS)

You should check whether you need to establish Access and Benefit Sharing (ABS) agreements for your baobab. These ‘mutually agreed terms’ detail the terms and conditions of access and use of genetic resources and/or traditional knowledge and supply of raw materials. European companies must comply with ABS legislation in sourcing countries. They will expect you to be aware of and compliant with your country’s regulations on this topic.

Sustainable sourcing is important to buyers, as they are facing supply shortages for an ever-increasing number of cultivated and, especially, wild-collected species. You must demonstrate sustainable sourcing by implementing Good Agricultural and Collection Practices (GACP). Although only mandatory for herbal medicinal products, this is also crucial for wild-collected ingredients used in food supplements like baobab.

Tips:

- Visit the Convention of Biological Diversity (CBD) website for useful information on ABS, including country profiles.

- Put a procedure in place to check whether ABS applies. To begin with, contact the competent authorities in your country.

- For production of raw plant materials check the Guideline on GACP for Starting Materials of Herbal Origin (GACP). These are based on the WHO GACP Guidelines.

Documentation

European buyers of baobab expect exporters to provide them with well-structured and organised product and company documentation. This documentation helps to prove you meet their requirements, such as specific quality specifications. For example, a buyer stated in an interview that “we require a lot of documentation from the suppliers to make sure that goods meet our specifications”. Additionally, when asked about the need to have documents, a buyer said that “we need to have these”, with another buyer stating: “yes, 100 percent”.

So provide documentation, as it gives you an advantage when trying to establish yourself on the European market, based on which you can develop long-lasting trading relationships with buyers. Additionally, doing so makes you look organised and well prepared for business.

European buyers of baobab for health products usually expect exporters to provide them with a Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA). Table 2 shows what is included in the SDS, TDS and CoA, to help you prepare these three pieces of documentation.

Table 3: What is contained in the Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA)

| Safety Data Sheet (SDS) | Technical Data Sheet (TDS) | Certificate of Analysis (CoA) that matches |

| Product name, description and classification | Product name, description and classification | Specifications mentioned in the TDS |

| Hazard identification | Quality that you guarantee to supply | Pre-shipment samples approved by buyer |

| Information on safety measures | Information on applications | Contractual agreements with buyer |

| Certificates |

Ensure you have well-prepared SDS, TDS and CoA, respectively, for your baobab and have them ready for European buyers. Additionally, when approaching buyers, inform them of the documentation you have.

Tips:

- Ensure your documentation is up to date and always readily available, as European buyers expect this.

- Review examples of technical documentation for organic baobab powder, such as the Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA).

- For a full list of documents required, consult Access2Markets. There you can select your specific product code and read about requirements depending on the end-market segment. Be aware that all requirements for a specific product are listed: you should analyse which requirements apply to your specific market or application.

- See the CBI workbook for preparing a technical dossier and technical documents for a cosmetic ingredient for more information on documentation. Several documentation requirements, such as Technical and Safety Data Sheets, will be similar for health ingredients.

What additional requirements do buyers often have?

Quality requirements

Quality is important to European buyers of baobab. According to one buyer, the “most important factor is quality”, while another buyer stated that exporters “need to meet our standards, and our quality standards are the main things”.

European buyers measure the quality of baobab in terms of colour, mesh, moisture content, nutritional profile and microbiological composition. In addition, they want to ensure that baobab powder is not adulterated, for example with cheaper powders such as maltodextrin, to save costs. One baobab trader stated that quality issues in baobab mainly stem from a lack of quality control as processing is not centralised and there is a lack of food safety experts involved in processing.

The use of baobab is based on its composition. Therefore, European buyers have specific requirements regarding composition and nutritional profile. The quality of baobab is often measured against the standards from the 2008 Novel Food application (see Table 2). Harvesting, processing and packaging all influence the nutritional profile of baobab powder.

Buyers expect well-structured company and product documentation. Having documentation gives you an advantage when seeking to enter the European market, as it gives buyers proof that your baobab meets their specifications and is of high quality. Buyers will usually request a Certificate of Analysis to verify that your baobab meets their quality requirements.

Before deciding whether to do business with you, European buyers usually require samples to see if your product meets their requirements and to ensure it is not adulterated or contaminated. For example, a buyer commented: “we undertake testing of samples, so suppliers have to be able to supply us with free samples”. You should therefore always send buyers high-quality samples, as that is likely to increase your chances of entering the European market.

European buyers routinely test products they buy, usually on a per batch basis, to ensure that products meet their quality requirements and are not adulterated or contaminated. For example, one buyer stated that “we undertake very stringent testing here”, with another buyer commenting: “we analyse in full detail… we need the best quality, and that’s why we need to do this”.

One buyer who “undertakes a lot of analysis” said that “basic analyses are microbiology, pesticides and heavy metals… but then beyond that, we test for things like glyphosate, mycotoxins or moisture content”. Explaining the process, the buyer stated that “we get multiple samples per batch and have them analysed in a lab before we even look to purchase… and when it arrives we do exactly the same process”, following which “we make a judgement call on the basis of that analysis”.

So always ensure that all products you send to your buyers meet their quality requirements and are not adulterated or contaminated. If you fail to do so, buyers will probably reject the product they ordered, you will bear the financial consequences, and your business relationship with them will probably end.

Baobab of a consistently high quality is important to European buyers, as it is key to the manufacturing of natural health products. The importance of quality in the health products sector is expected to increase in the future. To minimise variations in quality, you can also develop Standard Operating Procedures (SOPs), which include instructions on how to conduct specific activities in production.

Tips:

- Standardise, and minimise significant variations in, your product quality. Develop SOPs and train collectors and processing staff. Use incentives to ensure that they follow your specifications on harvesting and post-harvesting processes, such as a higher price for higher quality raw materials.

- Work together with a local university or laboratory to test your baobab. They can help you determine the chemical composition of your product. You should then include this information in your product documentation.

- Inform your buyer about any substances that you add to your product for preservation. Clearly indicate this in your product documentation. If you fail to do so, buyers may see this as adulteration.

- Only agree to meet specific requirements of European buyers if you can actually meet them. After all, failing to do so could end your business relationship with them.

- Make sure you have up-to-date documentation that is readily available, as buyers will use documentation to assess the quality of your product.

Quality management standards

European buyers of natural ingredients for health products increasingly use quality management standards when assessing the credibility of prospective exporters. These are in addition to the mandatory HACCP standards. Adopting quality management standards has several advantages; it gives your company credibility, as it shows your commitment to delivering high-quality products, and it boosts your image. It also helps to prove that you comply with mandatory requirements.

So, consider adopting quality management standards, as this will help you to enter the European market. Examples include:

- International Organization for Standardization (ISO) 22000 food safety management system certification;

- ISO 9001:2015 quality management systems certification (only mandatory for herbal medicinal products);

- Food Safety System Certification (FSSC) 22000.

Tips:

- Carefully consider the need to comply with the above standards and certifications. Verify whether your buyer truly demands compliance, whether compliance will facilitate market access or offer you a better price, or whether it will benefit your company’s supply security or internal processes. Also determine whether you can gain your buyer’s trust in another way.

- Display certification sought by buyers on your website and marketing materials because it gives you an advantage, as buyers use standards to assess exporters.

Organic ingredients

Across Europe there is growing consumer demand for organic products, a trend expected to continue. Many buyers are therefore demanding organic ingredients for their natural health products. For example, when asked about the need for organic certification, a European buyer of baobab replied that “organic certification is always needed”, with another buyer stating: “yes 100%, I don’t think any client would buy from us if it was not organically certified”. Another buyer said: “the vast majority of things we buy are organic, so they would need to be organic certified”.

Additionally, according to one buyer: “there isn’t really a market in the EU for non-organic baobab” and “if somebody came onto the market with non-organic baobab, they wouldn’t really have a chance because they would be competing against everybody else that are only selling organic”. So as an exporter of baobab, consider getting organic certification, as it will increase your chances of entering the European market.

To market your natural ingredients as organic on the European market, you must meet European Union regulations. You can find information on EU organic certification on the IFOAM website. Several certification agencies can help you with the conversion process to organic production. Once certified, many buyers will request a Certification of Inspection (COI). If you don’t have a COI, you cannot trade your baobab as organic. Although the UK left the European Union in January 2021, the EU has agreed to recognise the UK as equivalent for organics until 31 December 2023. Demand for certified ingredients for health products on the European market is expected to continue growing in the future. As an exporter of baobab from a developing country, you should consider organic certification when targeting the European market. European buyers will increasingly demand high-quality ingredients.

Figure 1: The EU organic certification logo

Source: ec.europa.eu (2022)

Tips:

- Consider converting to organic production methods and getting certification because of growing demand for organic health products.

- Ensure you have a Certification of Inspection (COI) that is up-to-date with the latest changes made by the EU, which came into force on 1 January 2022. This is because it is a mandatory requirement if you want to trade organic baobab on the European market.

- Inform prospective buyers if you already have a COI. You should also display it and the organic certification logo on your company website and marketing materials. This will make your company more appealing to buyers. B’Ayoba, EcoProducts and Baobab Fruit Company Senegal are examples of companies in developing countries doing this.

- Consult the ITC Sustainability Map for a full overview of certification schemes used in this sector.

European Green Deal

In 2019, the European Commission launched the European Green Deal (EGD). The EGD is a package of actions to reduce greenhouse gas emissions and to minimise the use of resources while achieving economic growth. This means that products sold in the EU market will need to meet higher sustainability standards.

Laws are being discussed that will make European manufacturers more explicitly responsible for explaining where and how they produce their products and what impacts these have on people and the environment. This might mean that you need to put more rigorous traceability systems in place to be able to deliver the information your buyers demand of you.

- Start gathering supply chain traceability information and consider sharing this information with your buyers so that, together, you can identify and address potential gaps. You can refer to this briefing from Proforest for more information on how to obtain traceability in your supply base and what types of information your buyers are looking for.

- See the CBI study ‘The EU Green Deal – How will it impact my business?’ for more information on the EU Green Deal and its implications.

Labelling requirements

To export your baobab to the European market you must comply with the following labelling requirements:

- The name, address and telephone number of supplier

- Product name and identification, including CAS (Chemical Abstracts Service) number

- Batch code

- Country of origin or place of provenance

- Date of manufacture

- Best-before date

- Net weight

- Storage conditions or conditions of use

For organic baobab, you must include the name and/or code of the inspection body and the certification number. Label your products in English, unless your buyer wants you to use a different language.

- Set up a registration system for individual batches of your baobab, whether it is a blend or not. Mark them accordingly to ensure traceability.

- Check the section on labelling and packaging guidelines in Access2Markets for further information about labelling requirements. The information is presented under ‘product requirements’.

Packaging requirements

Packaging must be safe for consumer health and for the environment. Specific packaging requirements may differ per buyer and per product. Your packaging will need to maintain product quality and prevent contamination. Buyers therefore prefer a high-quality product across all orders in suitable packaging as per order volumes. For example, in a high-density polyethylene (HDPE) kraft paper bag that can hold 25 kilograms for an order of that size. There are some general requirements you will have to take into account. These include the following:

- Always ask your buyer for their specific packaging requirements.

- If you produce powdered baobab, package your product in waterproof material. For example, use paper bags lined with plastic. Preferably use an eco-friendly lining (such as bio-degradable or recyclable lining). Importers have been steadily banning certain packaging materials for sustainability reasons and to reduce costs associated with the purchasing and disposal of packaging. Using biodegradable packaging materials can be a market opportunity and, for some buyers, it may even be a requirement.

- Store bags or containers in a dry, cool place to prevent quality deterioration.

- If you offer organic-certified baobab, physically separate it from baobab that is not certified.

Figure 2: Example of packaging

Source: Baobab the Superfruit (2022)

Tips:

- Only agree to meet specific packaging requirements of European buyers if you can meet them. Failing to do so could end your business relationship with them.

- Consider using recycled and/or recyclable packaging materials, as environmental sustainability is becoming increasingly important to European buyers. Read the guide on packaging to reduce environmental impacts for information and guidance on ways to do this.

Payment terms

There are several methods of payment. However, for both importers and exporters, Letters of Credit (LC) are considered the safest payment term. An LC lets both parties contact a neutral arbitrator, usually a bank, to resolve any issues. For the exporter, the chosen bank is a guarantor of full payment once goods have been dispatched. Stand-by LCs are frequently used in international trade as they provide security to both importers and exporters who have little trading experience with each another.

Other payment terms include cash in advance, documentary collections and open account.

Tips:

- Conduct risk assessments of the available payment terms before trading with European buyers to help minimise your risks.

- See the CBI study on organising your export of natural ingredients for health products to Europe, which provides guidance on payment terms used in this sector.

Delivery terms

When agreeing delivery terms with European buyers, you must carefully consider delivery time, volume/quantity of order and costs. European buyers generally prefer shorter delivery times. Air cargo is often faster than sea freight, but also more expensive. Sea freight is useful for high-volume shipments, where you will be required to fill a container-load. Since the global COVID-19 pandemic, transportation costs and delays have remained a challenge for exporters.

The global COVID-19 pandemic has created logistical challenges for exporters in developing countries. Delays and higher transport costs are two key challenges exporters face. For example, a European importer of baobab commented that “transportation, was very difficult” as “there were delays”, with another buyer commenting: “the transportation cost has increased”. Challenges for exporters are expected to continue for the foreseeable future as different states and governments around the world tackle COVID-19 with various measures.

The International Chamber of Commerce has developed a set of international commercial terms (Incoterms). These provide guidance on delivery terms and other trade aspects such as packaging or preparing a Certificate of Origin. Your transport method is also part of these Incoterms and can influence your decisions about the price and contract that you offer.

The Incoterms also specify responsibilities regarding insurance and risk of the transport. You can take out shipment insurance to protect your products during the entire journey from you to your customer. Commonly covered risks include theft and damages. You will need to agree with your buyer who is responsible for the insurance.

Tips:

- Inform your logistics provider about any special transport conditions for your baobab throughout the import-export process. The quality of your products could deteriorate before they reach your buyer if you cannot assure the right transport conditions.

- Visit the Freightos website to use the Freightos freight calculator to get international freight rate price information for transporting freight by ship and air. Doing so will allow you to make a more informed decision before agreeing delivery terms with buyers.

- Speak to your logistics provider about the implications of COVID-19 before you agree delivery terms with European buyers. This is because delivery times could be longer due to lockdown and quarantine measures.

- See the CBI study on tips for organising your export of natural ingredients for health products to Europe, which provides guidance on delivery terms used in the sector.

- Consult the website of the International Chamber of Commerce for more information on Incoterms.

What are the requirements for niche markets?

Meeting environmental and social standards

European consumers and retailers are increasingly putting pressure on companies to ensure that their products are made according to environmental and social standards. European buyers of baobab are therefore requesting suppliers meet environmental and social standards. Regarding social standards, for example, a buyer commented: “we’ve got a lot of customers who require it… it gives us a bit of legitimacy and it’s something we value ethically”. However, for small-scale producers meeting environmental and social standards is often too costly.

Meeting environmental and social standards is often part of a company’s policy and strategy. For example, when asked about the importance of meeting social standards, a European buyer commented: “we want to build a long-term relationship with our partners and that is why it is important that they earn fair money for their work, the value of their work”. Buyers have also stated that they use environmental and social standards in their marketing stories.

As an exporter, one way you can do this is by gaining verification and certifications that prove you meet environmental and social standards. With regard to environmental sustainability, consider meeting UNCTAD BioTrade Initiative and implement the BioTrade Principles, alongside FairWild Standards. To prove you meet social standards, acquire FLO Fairtrade certification or meet Fair for Life standards.

Figure 3: Logos of environmental and fair trade certifications

Source: Fair for Life, Fairtrade International and FairWild (2022)

Tips:

- Acquire verification and certifications that prove your baobab for health products meets environmental and social standards. Doing so will help you find opportunities in the European market, particularly if demand for natural ingredients is predicted to increase over the coming years.

- Inform prospective buyers about certification you have proving that you meet environmental and social standards and display this on your company website and marketing materials. This will make you more appealing to European buyers. B’Ayoba and EcoProducts are examples of two companies in developing countries doing this. See the CBI study ‘What is the current offer in social certifications and how will it develop?’ for more information and tips on social sustainability standards.

- Consult the ITC Standards Map for a full overview of certification schemes used in this sector.

2. Through what channels can you get baobab on the European market?

The commercial production of baobab is concentrated to African countries, including Senegal, Zimbabwe, South Africa, Benin and Sudan. On the European market, baobab is used in the food supplement and food industries.

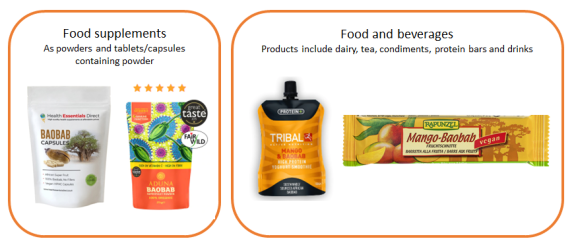

How is the end-market segmented?

The European market for baobab can be segmented by end user for food supplements and food industry. Figure 4 gives examples of baobab products in the European market by end-user segments.

Figure 4: End market segmentation for baobab products

Source: ProFound

Food supplements

According to Bullet Line Market Research Reports, the baobab powder market in Western Europe is expected to grow by a compound annual growth rate of 6.3% in terms of value and 2.6% in terms of volume until 2027. In the European health products market, organic baobab is most common.

Baobab in powdered form is used in food supplements. In this sector, new R&D and product development are key. Manufacturers are interested in sourcing new ingredients so as to differentiate themselves on the market and improve margins. Although food supplements are often based on traditional European recipes, more and more companies are showing innovation in adding new ingredients which are unfamiliar as supplements in Europe. In general, the UK and France are more dynamic in terms of product introductions than Germany or Italy.

Europe has many food supplement manufacturers. In addition to several large multinational players, many local players exist as well. Examples of manufacturers include Pharma Nord (Denmark), A. Vogel group (Switzerland), Abtei (Germany), Purasana (Belgium), Naturando (Italy), Natures Aid (UK) and Simply Supplements (UK).

Baobab has various nutritional properties. Baobab has high levels of vitamin C, phosphorus, calcium, fibre, carbohydrates, protein, potassium and lipids. Baobab also has a range of active properties, including anti-inflammatory, antioxidant, and anti-microbial properties. Aduna is a European company selling baobab powder because of its nutritional benefits.

Food industry

Baobab powder is used by the food industry because of its nutritional qualities and flavour. It is added to a wide range of products, ranging from candy bars to smoothies. Baobab is usually used in powdered or pulp forms in the food sector.

Tips:

- Familiarise yourself with baobab’s nutritional profile and the beneficial health properties it offers to the health product industry. Learning this is important because these are two of baobab’s key selling points; prospective European buyers often ask questions about this.

- Look for credible literature sources on the benefits of baobab. Use these references in your product documentation and marketing materials. You can find various scientific studies on platforms such as sciencedirect.com, NCBI and Google Scholar.

- See the CBI study on which trends offer opportunities or pose threats in the European natural ingredients for health products market. This study gives useful information about the European health products market, as well as information to increase your chances of market access.

- Visit trade fairs to see if the industry is receptive to your product, get market information, and find potential buyers. Trade fairs will also give you the chance to speak to end-users and distributors, and to gauge your competition, especially the way they are marketing their products. See the CBI study on tips for finding buyers in the natural ingredients for health products sector for an overview of trade fairs in this sector.

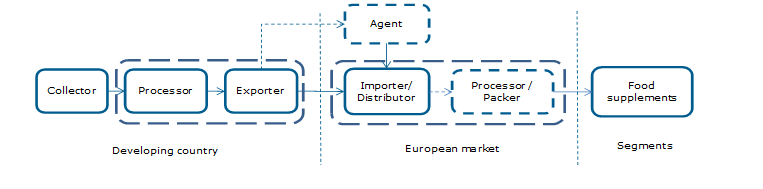

Through what channels does baobab end up on the end-market?

Figure 5 shows the export value chain for baobab on its journey to reach the European market. Baobab fruits are often harvested by women in rural communities. The figure below shows that the processing and export of baobab fruits are commonly combined in one and the same company. Baobab fruit processing is limited to de-shelling the fruit, separating seeds, fruit pulp and fibrous material, cleaning and milling.

Baobab powder needs little further processing in Europe. For the health market, European importers limit processing to packing the powder in consumer packaging, under their own or their customers’ labels.

Figure 5: Export value chain of baobab

Source: ProFound

Processors

European processors often source baobab directly from developing countries, as it provides them with greater transparency and control over product quality. Processors such as Yeo Valley and Alara source their baobab from importers.

Importer/Distributor

The majority of baobab enters the European market through importers. European importers/distributors often travel to developing countries to personally meet their suppliers of baobab when assessing their credibility as potential trading partners. Import volumes in this channel range from tens of kilogram to hundreds of tonnes.

French company Nexira is an important importer/distributor of baobab in Europe. It deals with organic baobab powder. Other importers/distributors of baobab in the European market include Tradin Organic, Green Origins and Organic Herb Trading Company.

Agent

An export agent is a firm or an individual that undertakes most of the exporting activities on behalf of an exporter, usually for a commission. In contrast to importers/distributors, agents do not buy products themselves but contact potential customers on your behalf to sell your products to. Agents can be found in developing countries as well as in Europe; however it is not that common for companies to use agents in the European market. As an exporter from a developing country, you can work with agents who represent and act on your behalf on the European market.

Tips:

- Be prepared to send high-quality samples to prospective buyers, who will test them when assessing whether you are a credible exporter of baobab. Doing so will increase your appeal and therefore give you an advantage when it comes to entering the European market.

- Consider expanding your baobab product range by including organic baobab powder, for example, as this will help you find a wider range of customers as some importer/distributors only import organic products. Other benefits of having a wider product range include it giving you more attention on the market, thus making you stand out from your competition.

- Be prepared to meet prospective buyers who are interested in directly sourcing baobab from you if you are able to supply larger tonne volumes.

What is the most interesting channel for you?

For you as an exporter of baobab, importers/distributors are the most interesting channel. This is because importers/distributors have expertise importing and distributing baobab in the European market. They also have a good understanding of the European health products market and a wide range of customers. Importers of baobab in Europe also have storage facilities and an established logistics network. This can be very helpful to small and medium-sized exporters of baobab in developing countries who are just starting to export to Europe.

If you have the human resources/staff available, you could supply end-product manufacturers directly and get a better price. To supply these players directly, you must have impeccable company and product documentation, and you need to ensure a consistent quality and quantity. Moreover, you will need high-quality logistics systems so you can deliver smaller quantities at short notice. You also need to convince manufacturers to add another supplier instead of using an existing supplier, which will be difficult.

Tips:

- See the CBI study on tips for finding buyers in the natural ingredients for health products sector for useful information and guidance on finding buyers in channels through which you can enter the European market. Particularly importers/distributors, who are your main entry point into the European market.

- Visit trade fairs to test if the industry is open to your product, get market information and find potential buyers. Trade fairs will also give you an opportunity to speak to end-users and distributors, and to assess your competitors, especially the way they are marketing their products. See the CBI study on tips for finding buyers in the natural ingredients for health products sector for an overview of trade fairs in this sector. Examples include Vitafoods, Nutraceuticals Europe, and Health Ingredients Europe.

3. What competition do you face on the European baobab market?

What countries are you competing with?

The Adisona digitata tree is native to Senegal, Zimbabwe, South Africa, Ghana, Benin and Sudan, with this being a common strength across all of these countries. Senegal, Zimbabwe, South Africa, Benin, Sudan and Kenya have ideal conditions for baobab to grow, which is a second common strength across all of these countries.

Zimbabwe

Zimbabwe is one of the leading producers of baobab in the world. The Forestry Commission of Zimbabwe selected Baobab as the tree of the year in 2021 to increase awareness for the country’s 5 million baobab trees. The country has an established commercial baobab production industry with several companies operating there, which is one of its key strengths. It could therefore become easier for Zimbabwean producers to export baobab to the European market. This is important if European buyers want to place large orders.

Zimbabwean baobab producers struggle with climate change, a lack of rainfall, the deforestation of baobab trees, as well as political instability and corruption in the country. Other challenges Zimbabwe faces include a fragile economy and underinvestment in infrastructure, which can make it difficult to export.

South Africa

South Africa is another leading producer of baobab. Baobab trees are concentrated in the province of Limpopo. South Africa is a continental economic and political powerhouse, and the country has sophisticated infrastructure and business capabilities. This is important when it comes to exporting to foreign markets. However, the South African baobab industry faces challenges such as climate change and negative consequences of human development. Other challenges South Africa faces includes ageing infrastructure, poverty and inequalities.

European buyers generally have a favourable perception of South Africa. When asked about their experience of importing baobab from South Africa, one buyer commented: “quite a lot of it is done very well; I don’t think there’s been any particular problems with it… it’s been quite an easy process”.

Ghana

Ghana is another large producer of baobab and has several companies harvesting and processing baobab. For example, British company Aduna works with 900 producers in Upper East Ghana to harvest their baobab fruits, with a further 200 women being employed at their processing centre. Ghana’s baobab industry is also developing, for example through schemes such as the planting of new baobab trees along with support from non-governmental organisations to develop the industry. An example of this is the NGO ORGIIS, which is involved in an organic baobab value chain project.

Ghana’s other strengths include an attractive business environment as well as its government supporting and developing the country’s agricultural industry. This is important when exporting to foreign markets. As such, it may become easier for Ghanaian exporters to export baobab to the European market. However, the Ghanaian baobab industry does face certain challenges, including land degradation due to deforestation, pests damaging and eventually destroying baobab trees, and infrastructure gaps in energy and transport.

Senegal

Senegal is another large producer of baobab. The country has an established commercial baobab production industry with several companies operating there. Senegal’s other strengths include implementation of major investment projects, progress on business climate and governance and a strong track record of political stability. As such, it could become easier for Senegalese producers to export baobab to the European market.

However, Senegal’s baobab industry also faces key challenges such as climate change, urbanisation and population growth along with deforestation of baobab forests to make way for the mining industry. Other challenges Senegal faces include inadequate energy and transport infrastructure.

European buyers generally have a favourable perception of Senegal. A buyer of Senegalese baobab powder commented that their experience has been good because “quality is very good”, as the company exporting it is a reliable business partner. However, COVID-19 has created challenges for Senegalese exporters, particularly in transportation, which is leading to delays; something also noted by a European buyer.

Benin

An established commercial baobab production industry with several companies operating is one of Benin’s key strengths. Benin’s other strength is its governments commitment to improving its infrastructure in the next few years, such as realizing major road infrastructure projects.

It could become easier for Beninese producers to export baobab to the European market. However, a study from 2021 indicates Benin’s baobab industry faces key challenges which include dangerous harvesting techniques, time-consuming processing practices, an unfair supply chain that puts growers at a disadvantage and a lack of market information along with climate change. Other challenges Benin faces include poor infrastructure and corruption. These challenges are likely to negatively affect European perception of Benin.

Sudan

One of Sudan’s key strengths is its large production of baobab, meaning it may become easier for Sudanese producers to export baobab to Europe. However, Sudan’s baobab industry also faces key challenges such as the limited availability of planting material, a lack of knowledge of management techniques, poor fruit processing technologies and a lack of well-organized supply chains which have little knowledge about exporting. Therefore, a project funded by the German government supports Sudanese baobab powder producers with sustainable production and modern processing technologies.

Other challenges Sudan faces include a lack of investment in infrastructure, a poor business environment, governance issues and climate change. These are likely to negatively affect European buyer perception of Sudan.

Tips:

- Find out if your country has programmes helping exporters like you harvest, cultivate and/or export your baobab. You can do this by contacting governmental ministries of trade in your country because they are likely to have information about this and can help you export your baobab.

- Consider joining the African Baobab Alliance because they offer a range of assistance to exporters of baobab from developing countries like you.

- Emphasise the strengths of your country. For example, if your country has sophisticated infrastructure and business capabilities, highlight this to European buyers because they are strengths that make it easier to export to the European market.

- Compare your products and company with those of competitors from other supplying countries. You can use the ITC Trade Map to find exporters per country, and compare market segments, prices, quality and target specific countries.

What companies are you competing with?

Several companies successfully export baobab to the European market. These companies market themselves as being able to deliver high-quality baobab in accordance with common European buyer requirements and requirements for niche markets.

Established companies, such as the selected companies highlighted below, have a professional website containing well-prepared content. Their websites have sections explaining to prospective buyers who they are, how they source and process their baobab oil, as well as the relevant technical details and the certifications they hold, accompanied by professional photographs. As a result, European buyers are likely to have a favourable perception of these companies.

Zimbabwean companies

B’Ayoba is an established Zimbabwean company exporting baobab to the European market. B’Ayoba recently merged with EcoProducts from South Africa to form Baobab Exports. You can read more about EcoProducts below. This merger has increased the company’s capacity and strengthened its position on the European market. Baobab Exports is a good example of a company that helps build awareness of baobab through its website and newsletters. Here, importers can find a product development guide and examples of applications of baobab in immune protection related to COVID-19.

B’Ayoba’s key strengths include:

- Commitment to exporting high-quality baobab products, which it ensures through its in-house microbiology lab where quality is constantly monitored.

- Auditing its baobab producers every year, thus ensuring product quality.

- The certified organic production of its baobab. Commitment to producing ethically and sustainably harvested baobab products in partnership with rural producer communities around Zimbabwe.

- Their Baobab products have FairWild and UEBT certification, which demonstrates their commitment and ability to uphold environmental standards.

South African companies

EcoProducts is a well-established South African company exporting baobab products to the European market. It has merged with Zimbabwean company B’Ayoba into Baobab Exports. EcoProducts’ key strengths include:

- Commitment to exporting high quality baobab products through its strict quality management system. For example, EcoProducts’s production facilities are FSSC 22000 certified.

- Ability to export European Union (EU) Organic certified baobab products.

- Commitment to producing socially responsible baobab products originating directly from communities living in the poorest and most underdeveloped parts of southern Africa.

- Its baobab products having FairWild certification which demonstrates their commitment to upholding environmental standards.

Senegalese companies

Many established companies export baobab to the European market. Baobab Fruit Company Senegal is one such Senegalese company. Baobab Fruit Company Senegal’s key strengths include:

- Commitment to exporting quality, safe, traceable and socially responsible baobab to the food industries which it achieves through operating under strict international procedures.

- Ability to export high-quality European Union (EU) Organic certified baobab which is also HACCP certified.

- Ability to provide detailed information about its baobab products on its website, specifically technical details.

Another company exporting baobab to the European market is Baonane. Its key strengths include:

- Ability to export Fairtrade-certified and organic-certified baobab to EU, US and Canadian markets.

- Wide range of processed products from the baobab tree fruit on offer such as oil and oilcake, giving the company more visibility on the market and making it stand out from the competition.

- Ability to provide detailed information, especially technical details, about its baobab products on its website.

- Strong partnership with business support organisation FoodSen since 2021. FoodSen provides training, certification and market development services.

Other companies

Other companies also export baobab from other developing countries. Superfruit Baobab and Atacora are two Beninese companies doing so. Another is the Sudanese company Baobab Land.

Tips:

- Ensure you always provide European buyers of baobab for natural health products with the finest quality products because this is something they expect.

- Consider acquiring certification that proves the high quality of your baobab products, as it will make you appealing to buyers.

- Consider acquiring certification that proves you meet and uphold social and environmental standards, something which is becoming increasingly popular on the European market. For example, Ecocert Fair Trade, Fair for Life, Fair Wild, UEBT and ABS certification.

- Consider acquiring organic certification for your baobab products, for example European Union (EU) Organic certification. Especially since organic is very important if you want to sell your baobab on the European market.

- Ensure you have a professional up-to-date website with well-prepared content that clearly informs prospective buyers of your key strengths. For example, the certification you hold showing the quality of your products along with your commitment to upholding social and environmental standards.

What products are you competing with?

Moringa, spirulina and chlorella, acerola cherry and maca have been identified as competitors of baobab. All these products have a healthy nutritional profile like baobab and are marketed as ‘superfoods’ and healthy nutrition across Europe.

Moringa

The moringa plant is native to regions of northern India and Pakistan. India is the world’s largest supplier of moringa. However European importers have strong quality concerns about Indian supplies, which is a major weakness. However, one of the moringa plant’s strengths is that it is now found across tropical zones in Africa, Asia, islands in the Pacific and the Caribbean, and South America, and it is cultivated in many areas of the world too.

Moringa is becoming increasingly popular on the European market for food supplements because of its wide range of health benefits, which is a key strength. Health benefits of moringa include it being an excellent source of vitamins and minerals and rich in antioxidants. The European market for moringa remains underdeveloped. However, the European food supplement market and global moringa products market are both expected to increase respectively in the next few years. Moringa could therefore potentially be a greater threat to baobab in the future.

Figure 6: Moringa

Source: Rostovtsevayu / Shutterstock.com

Spirulina and chlorella

Edible algae, such as spirulina and chlorella, is a niche market that is predicted to grow as European consumers become more aware of the nutritional benefits of seaweed. Edible seaweed is divided into several categories such as red, green and brown algae. In recent years, there has been increasing demand for green algae spirulina and blue-green algae chlorella because of their health benefits. Spirulina and chlorella are therefore competing products to baobab.

Health benefits of spirulina include a high amount of omega-3 fatty acids, riboflavin, thiamine, iron, and copper. Health benefits of chlorella include a high amount of riboflavin, thiamine, iron, and copper. Spirulina and chlorella therefore pose a threat to baobab.

Figure 7: Chlorella tablets and powder

Source: Jiri Hera / Shutterstock.com

Acerola cherry

Acerola cherry is native to tropical regions of the Western Hemisphere in countries such as Mexico, Puerto Rico, Dominican Republic, Haiti and Brazil. Acerola is most well-known for being extremely rich in vitamin C. This is a key reason why it is used in health products. Other benefits of acerola cherry powder include the fact that it is a good source of vitamins and minerals and rich in antioxidants. Currently, acerola cherry powder is a niche product. However, as demand for immunity-boosting products is growing, acerola could become a more powerful competitor to baobab due to its high vitamin C content.

Figure 8: Acerola cherry

Source: Photoongraphy / Shutterstock.com

Maca

According to industry sources, maca has a nutritional profile similar to that of baobab, particularly its high vitamin C content. Maca is native to Peru, which is where it is mainly cultivated. It is also cultivated in the high Andes of Bolivia and to small extent in Brazil. Maca is commonly available in a powdered form or as a supplement.

Maca is known for being nutritionally rich, as it is a good source of several essential vitamins and minerals, including vitamin C, copper and iron; key reasons why it is used in health products. The European market for maca is expected to increase in the coming years. This is driven by rising awareness of maca’s health benefits, as well as its high accessibility, its derivative products, and the popularity of health and nutritional supplements. Therefore, maca poses a threat to baobab.

Figure 9: Maca powder

Source: pxhere.com

Tips:

- Position yourself against competing products, by highlighting the strengths of your company and baobab to European buyers. For example, its high quality, rich nutritional profile and positive health benefits, as well as any popular certifications your company has.

- Familiarise yourself with products competing with baobab that are available on the European market; do this by reading the CBI studies on moringa and the edible seaweeds spirulina and chlorella.

- Use your baobab strengths as an opportunity to persuade European buyers to purchase it from you.

- Build a marketing story for your baobab which places emphasis on its key strengths. B’Ayoba is a Zimbabwean company that does this, as it clearly informs prospective buyers about its baobab products strengths for the health market.

4. What are the prices for baobab on the European market?

Feedback from industry sources indicates that baobab prices will remain relatively stable. The FOB (Free on Board) market price of baobab powder is currently USD 12-13 per kilogramme for small volumes according to a European baobab importer.

Interviews with European buyers and importers of baobab suggest that the market price of baobab has increased since the global COVID-19 pandemic due to the disruption it has caused to supply chains. Key aspects of this are higher transportation costs and delays in receiving orders. For example, an importer of baobab commented that “the transportation cost has increased”. The disruption to supply chains is expected to continue because of lockdown and quarantine measures introduced during the COVID-19 pandemic.

Baobab prices have been fluctuating in the past, depending on available supplies. For example, the prices of baobab decreased slightly in 2014 and 2015 because of increased production. In 2018 the prices increased slightly because of lack of supply and unfavourable weather conditions.

Tips:

- Factor in the implications of COVID-19, particularly increased delivery costs, in your price calculations. If you don’t do so, you could end up with financial loses.

- Monitor the price development of baobab from other countries. If you cannot compete with prices from other countries, make sure the quality of your baobab is high. This is how you can set yourself apart from your competitors.

- Certification schemes can enable you to charge a premium for your baobab. Ensure you can justify your price with relevant certifications.

This study was carried out on behalf of CBI by ProFound - Advisers In Development.

Please review our market information disclaimer.

Search

Enter search terms to find market research