Entering the European market for essential oils

To enter the European market for essential oils, you must meet the mandatory requirements set by the European Union. At the same time, also consider meeting the common additional requirements European buyers have as this will help you to enter the European market. The European market for essential oils is segmented into four segments, with separate channels you can enter through. When entering the European market, you will face competition from other companies in your country, other country markets, and competing products. Prices of essential oils vary according to product quality and availability.

Contents of this page

- What requirements and certifications must essential oils for health products comply with to be allowed on the European market?

- What additional buyer requirements do buyers often have?

- Through what channels can you get essential oils on the European market?

- What competition do you face on the European essential oils market?

- What are the prices for essential oils on the European market?

1. What requirements and certifications must essential oils for health products comply with to be allowed on the European market?

What are mandatory requirements?

If your essential oils are used in herbal medicinal products, you must comply with EU legislation (Directive 2004/24/EC). You must also comply with “The rules governing medicinal products in the EU” which state what marketing claims medicinal products can make.

The European Medicines Agency (EMA) is the agency responsible for the scientific evaluation, supervision and safety monitoring of medicines in EU member states. The EMA has a series of standards for the most widely used established ingredients for herbal medicinal products known as community herbal monographs. If you are a producer of an established ingredient you must comply with the EMA’s monographs.

When essential oils are used in the aromatherapy sector, you need to comply with the mandatory regulations for cosmetics ingredients:

- The Cosmetics Regulation (EC 1223/2009) is the central regulatory framework for cosmetic products for the European market, covering the safety and effectiveness of cosmetic products. It is especially advisable to focus on Chapter 3: Safety Assessment, Product Information File.

- Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH). This is a regulation of the European Union; its aim is to improve the protection of human health and the environment from the risks that can be posed by chemicals.

- EU Commission Regulation (EU) No 655/2013 requires claims for a cosmetic product (explicit or implicit) to be supported by sufficient and provable evidence.

- The EU has packaging and labelling requirements for chemicals based on the Globally Harmonised System of Classification and Labelling of Chemicals (GHS) outlined in its Classification, Labelling and Packaging (CLP) Regulation (EC) 1272/2008.

According to the CLP Regulation, labelling should include the following:

- The name, address and telephone number of the supplier;

- The nominal quantity of a substance or mixture in packages made available to the general public (unless this quantity is specified elsewhere on the package);

- Product identifiers;

- Where applicable, hazard pictograms, signal words, hazard statements, precautionary statements and supplemental information required by other legislation.

Figure 1: Hazard labels for frankincense oil – flammable, harmful and environmental hazard pictograms

Figure 2: Hazard labels for geranium oil – corrosive, health hazard, harmful and environmental hazard pictograms

Figure 3: Hazard labels for patchouli oil – health hazard and environmental hazard pictograms

Figure 4: Hazard labels for nutmeg oil – flammable, health hazard, harmful and environmental hazard pictograms

If your essential oil is used in aromatherapy products, the CLP Regulation requires you to package your essential oil in such a way that its content cannot escape. Your packaging must therefore be strong, solid and resistant to damage from its contents. If your essential oil is supplied to the general public, it must not attract or arouse the curiosity of children or mislead customers. Packaging must not have a similar presentation or a design used for foodstuff, animal feedstuff or medicinal or cosmetic products.

Tips:

- See the import and marketing requirements for medicinal products for human use under pharmaceutical and cosmetic products on Access2Markets for an overview of requirements you must abide by if your essential oil is used in herbal medicinal products.

- Make sure you keep up to date on the EU fragrance allergens labelling updates. The labelling is currently open to public consultation and the outcome may have an effect on you as an exporter of essential oils for aromatherapy.

- Contact Open Trade Gate Sweden if you have specific questions regarding rules and requirements in Sweden and the European Union.

- Familiarise yourself with the comprehensive guidance on CLP provided by the European Chemicals Agency (ECHA). Doing so will give you useful information about a mandatory requirement you must comply with to enter the European market.

Protection of Biodiversity and Species

The Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES), also known as the Washington Convention, is a multilateral treaty. It aims to ensure that international trade in specimens of wild animals and plants do not threaten their survival. CITES is becoming more important in Europe and other regions, and has become a part of the EU law under Regulation No 338/97.

If your essential oil is extracted from species registered under Annex A and Annex B of EU Regulation (EC) No 338/97 then you must obtain an export permit from your country’s CITES authority to trade it on the European market. Osyris lanceolata, more commonly known as African sandalwood from Burundi, Ethiopia, Kenya, Rwanda, Uganda and Tanzania is an example of a species protected under CITES.

Tips:

- Visit the CITES website to learn more about CITES. Doing so will give you a better understanding of expected legal requirements.

- Determine whether your essential oil for natural health products requires import and export permits to enter the European market. Do this by finding out the Latin name of the plant you extract your essential oil from and checking if it is listed under CITE’s Annexes. For example, frankincense’s Latin name is boswellia caterii / sacra.

- Obtain an export permit for your essential oil if you need one to enter the European market. Do this by contacting the relevant CITES authority in your country. Be aware that you might need an import permit for the country you are importing to. If that is the case, contact local authorities for further assistance.

- Regularly check for updates to EU Regulation No 338/97. You can do this by visiting the EUR-Lex database of the European Union.

Convention on Biological Diversity (CBD) / Access and Benefit-Sharing (ABS)

To export essential oils to the European market you must comply with the requirements on using plant resources agreed under international treaties and protocols within the Convention on Biological Diversity (CBD). This is because the CBD is a part of EU law. Additionally, it is likely your own country is also a signatory, meaning you need to comply to meet your national laws.

The Nagoya Protocol’s Access and Benefit-Sharing (ABS) provides guidelines for accessing and utilising genetic resources and traditional knowledge, as well as the fair and equitable sharing of benefits. Similar to the CBD, European companies need to comply with ABS legislation. ABS is also likely to be a part of your country’s regulations. As an exporter of essential oil to the natural health product sector, make sure you abide by ABS.

In recent years, there is growing consumer awareness and demand for more environmentally-friendly products, and this trend is set to continue. This is leading European buyers to seek ethically sourced ingredients, something which is likely to become more important in the future.

Tips:

- Visit the CBD website as it provides useful information on CBD and ABS. For example, the country profile function provides information on your country’s position on CBD and ABS, giving you more knowledge about exporting from your country.

- Consider ethically sourcing your essential oil because this is something European buyers are increasingly seeking.

2. What additional buyer requirements do buyers often have?

Quality requirements

European buyers have additional buyer requirements which go further than mandatory legislation and standards for essential oils for health products. Specific quality requirements for essential oil concern its consistent composition and chemical profile, as this allows buyers to determine its quality. So consider speaking to buyers and finding out what their specifications are concerning composition and chemical profile. Following this, consider meeting their specifications, as doing so is likely to increase your chances of entering the European market.

For example, frankincense essential oil is based on the resin that it is extracted from, which should have a crystalline consistency similar to gum. For other essential oils such as geranium, patchouli and nutmeg, the International Organization for Standardisation (ISO) has developed quality standards.

Essential oils used for health products have to be pure and not adulterated with chemicals or other substances. Buyers regularly test imported essential oils for any impurities. Annex I to the International Fragrance Association IFRA Standards provides indicative levels of restricted substances in essential oils. This list is non-exhaustive and is meant to be used as a guideline.

Tips:

- You should meet the quality standards of European buyers. For example, for essential oils used in fragrances, buyers may have requirements in accordance with International Fragrance Association (IFRA) standards.

- Inform prospective buyers about the standards you meet and certifications you have, and make reference to this in your marketing materials. This will make you more appealing to buyers.

Quality management standards

European buyers of natural ingredients for health products are increasingly using quality management standards when assessing the credibility of prospective exporters. Adopting quality management standards gives you credibility because it shows your commitment to delivering high-quality ingredients. It also gives your company a favourable image. Adopting quality management standards can also help to show your compliance with mandatory requirements.

Examples of quality management standards include Good Agricultural and Collection Practices (GACP) and Good Manufacturing Practices (GMP) developed by the European Federation for Cosmetic Ingredients, which show the good quality of your essential oils.

Also, consider adopting quality standards concerning production methods. Examples of quality standards that you can adopt are International Organization for Standardization (ISO) 22000 and ISO 9001:2015, as well as Food Safety System Certification (FSSC) 22000. You should also consider following guidelines outlined in Hazard Analysis & Critical Control Points. Other examples include the British Retail Consortium Global Standard for Food Safety (BRCGS) and International Food Safety (IFS) certification.

Tip:

- Inform European buyers of the standards you meet and display them on your website and marketing materials. This will give you an advantage, as buyers look at standards when assessing exporters.

Technical Documentation

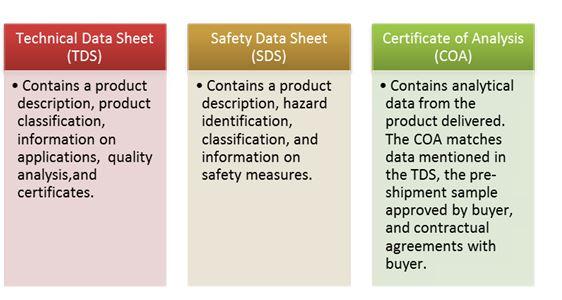

European buyers of essential oils request that exporters provide them with well-structured and organised product and company documentation. This is because documentation can prove you meet their requirements such as quality specifications. This will be the basis of developing long-lasting trading relationships with European buyers. In addition, it makes you look organised and well prepared to do business with European buyers.

For example, a buyer stated in an interview that “we require a lot of documentation from the suppliers to make sure that goods meet our specifications”. Additionally, when asked about the need to have documentation, a buyer said that “documentation is important”, with another buyer stating, “we need to have these” and another buyer stating, “yes, 100 percent”. The technical dossier should include a Technical Data Sheet (TDS), a Safety Data Sheet (SDS) and a Certificate of Analysis (COA).

Figure 5: Technical Documentation Description

Source: Ecovia Intelligence

Tips:

- Review this examples of technical documentation, such as Safety Data Sheet (SDS) for nutmeg oil, Technical Data Sheet (TDS) for geranium oil, Certificate of Analysis for patchouli oil.

- Consider acquiring SDS, TDS and CoA for your essential oil and have them ready for European buyers. Additionally, if you already have them, inform European buyers of this when you approach them

- See the CBI Study on buyers’ requirements when exporting natural ingredients for health products. Here, you can find more information on mandatory and additional requirements that you need to abide by as an exporter of natural ingredients for health products to Europe.

Labelling and packaging

Along with complying with the EU’s mandatory Classification, Labelling and Packaging (CLP) requirements as set out in Regulation (EC) 1272/2008, you should meet other common additional labelling and packaging requirements that European buyers have. This includes listing the following on your product documentation and labels in English unless asked otherwise:

- International Nomenclature Cosmetic Ingredient (INCI) name and product name;

- Name and address of exporter;

- Batch code;

- Place of origin;

- Date of manufacture;

- Best-before date;

- Net weight;

- Recommended storage conditions;

- Organic certification number along with the name/code of the certifying inspection body if you export organic essential oil.

European buyers require good-quality essential oils, so consider preserving the quality of your essential oils by doing the following when it comes to packaging:

- Using aluminium, lined or lacquered steel containers, as they do not react with the components in essential oils;

- Ensuring packaging materials such as drums are clean and dry before essential oils are put into them;

- Filling the headspace of packaging materials such as containers with gasses that do not react with components in essential oils. Examples of gases include carbon dioxide and nitrogen.

Additionally, the quality of your essential oils can be preserved in other ways. These include ensuring your essential oils are kept at an appropriate temperature throughout the supply chain and storing them in a dry place.

Tips:

- Speak to European buyers and find out if they have preferences as well as specific requirements concerning labelling and packaging.

- Inform your logistics provider that your essential oils need to be kept in a cool and dry place on their way to the European market, as this will preserve their quality.

- Consider recycling or re-using packaging materials, for example by using containers made of recyclable materials, such as metal. This is because environmental sustainability is becoming increasingly important to buyers.

- Ensure certified organic essential oils and conventional essential oils are physically separate to prevent contamination.

Payment terms

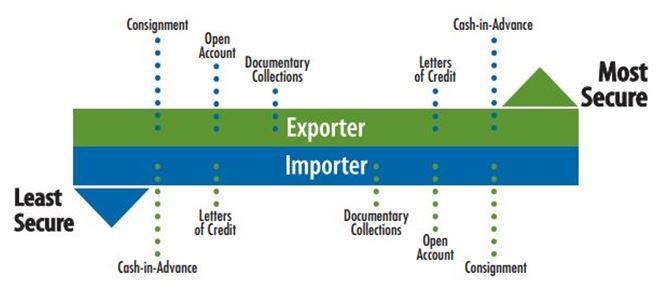

Payment is central to all trade and presents risks to all parties involved. Before trading with European buyers do risk assessments of the available payment terms. As an exporter of essential oils, minimise your risks while working to meet the needs of European buyers.

There are various payment methods that you can use when trading with European buyers. These include Letters of Credit (LC), cash in advance, documentary collections and open account or combinations. European buyers often try to minimise their risks and will try to negotiate payment terms that are favourable for them. They prefer to make the payment upon inspection of essential. There are several factors that you need to take into account when negotiating payment terms. These include length of the contract, size of the order and length of a business relationship.

Figure 6: Payment risk diagram

Source: trade.gov

Tips:

- Be open to negotiating discounts with your potential buyers. This may help you establish long-term partnerships with European buyers.

- Be flexible and show willingness to negotiate favourable payment terms for buyers. Make sure you do due diligence on your potential buyers to ensure that they have the resources to pay for your stevia.

- See the CBI study on organising your export of natural ingredients for health products to Europe for guidance on available payment terms used in this sector.

Delivery terms

When agreeing delivery terms with European buyers you must carefully consider three important factors: delivery time, volume and cost. This is because failure to meet agreed delivery terms could end your trading relationship with European buyers.

- Delivery time - As an exporter, you should understand that European buyers prefer shorter delivery times. Air cargo is usually faster than sea freight. Air freight is also more reliable in regards to on time delivery.

- Delivery volume/quantity of order - The volume of order is an important factor to take into consideration when choosing a mode of transport. Larger quantities are often cheaper to ship by sea. With lower volumes air freight can be less expensive, as margins get smaller.

- Cost of delivery method - It is estimated that sea freight is usually 4-6 times cheaper than air freight. This applies to larger volumes. It is not likely that price of your cargo will increase substantially, if you increase the volume.

European buyers usually arrange transport of essential oils themselves. However, there is some variation between buyers.

Figure 7: Incoterms

Source: velotrade.com

Tips:

- Learn about Incoterms. This knowledge will help you when negotiating payment and delivery terms with your potential buyers.

- See the CBI study on organising your export of natural ingredients for health products to Europe. This is because it provides guidance on delivery terms used in this sector.

What are the requirements for niche markets?

Organic and fair trade

In Europe, there is growing consumer demand for organic products. As such, many buyers are demanding organic ingredients for their natural health products. As an exporter of essential oils from a developing country, you should consider getting organic certification for your essential oils. In order to market your essential oils as organic on the European market you must meet European Union regulations. You can find information on the EU organic certification on the EU organics website.

As an exporter of essential oils from developing countries you can get various certifications that pertain to environmental and social standards. These include:

- UNCTAD BioTrade Initiative BioTrade Principles and Criteria

- FLO Fairtrade, FLO Fairtrade and FairForLife standards

- FairWild

Tips:

- Inform prospective European buyers if your essential oil already meets environmental and social standards. Doing so gives you a competitive advantage on your journey to reach the European market.

- Consider if there is a business case for investing it meeting environmental and social standards, particularly when its demand is predicted to increase over the coming years.

- Consider converting to organic production methods and getting certification because of growing demand for organic health products.

- Ensure you have a Certificate of Inspection (COI) that is up to date with the latest changes made by the EU, which came into force on 3 February 2020. This is a mandatory requirement if you want to trade organic ingredients in the European market.

- Consult the Standards Map for a full overview of certification schemes in the sector. It provides useful information about certification schemes in the sector.

3. Through what channels can you get essential oils on the European market?

In the European market, essential oils such as frankincense, geranium, patchouli and nutmeg oil are mainly used in the food, cosmetics and health product industries. Essential oils mainly enter the European market through importers/distributors. The prices of essential oils depend on various factors, such as yields, supply and demand. Niche essential oils present a better opportunity for exporters of essential oils in developing countries.

How is the end-market segmented?

The European market for essential oil can be segmented by end-user industries. These include the food, cosmetics and health product sectors respectively. Review Figure 5 gives examples of essential oil products in the European market by end-user segments.

Figure 8: Examples of essential oil products in the European market

Source: Various

Food industry

The food and beverage industry uses essential oils as flavourings. Essential oils are mostly used as an alternative to herbs and juices, as they provide a stronger flavour whilst limiting the use of herbs. The food industry uses frankincense essential oil as an edible ingredient and patchouli essential oil as an additive in low concentrations to flavour food and beverages. Nutmeg essential oil is used by the food industry as a flavouring and as a replacer to ground nutmeg because it does not leave any particles. The food industry uses geranium essential oil as a flavouring.

Cosmetics

The cosmetics industry uses essential oils in personal care products as fragrances. They are becoming popular as natural alternatives to synthetic fragrances in product formulations. For example, frankincense essential oil provides a fresh, woody, balsamic and slightly spicy and fruity scent. The cosmetics industry also uses essential oils in its products as active ingredients because of their properties. For example, frankincense essential oil is used for its anti-ageing properties and ability to reduce acne and blemish along with being a remedy for scars, wounds, eczema and stretch marks. Nutmeg essential oil is used because of the rich, sweet and spicy scent it provides. The cosmetics industry uses geranium oil in soaps and cosmetics, such as creams and perfumes because of its uplifting floral scent.

Health products

Essential oils are used in the aromatherapy sector. There are various ways in which essential oils are used by consumers, as well as by the professional sector. Geranium essential oil is used as an aromatherapy product because of benefits it provides such as reducing feelings of stress, anxiety and tension. Frankincense essential oil is used to relieve stress and anxiety, reduce pain and inflammation, boost the immune system and can help fight cancer. Nutmeg essential oil is used as an aromatherapy product as its benefits include providing stress relief and calming digestive issues.

Essential oils are also used as active ingredients because of their properties. For example, patchouli essential oil provides health product formulators with its anti-fungal, anti-inflammatory and antiseptic properties. Nutmeg oil is also used in cough syrup. The application of essential oils is limited by regulations and technology. However, in France a regulation was introduced by the French Directorate General for Competition, Consumption and Fraud Prevention in 2018 that allows some essential oils to be administered orally in food supplements.

In 2019, French ingredients company Robertet introduced a technology that enables it to encapsulate powdered essential oils for supplements. This also increases the potential for the application of essential oils in food supplements.

This study deals with essential oils used in the natural health products sector, as aromatherapy, herbal medicine, supplements and pharmaceuticals. It is estimated that this sector accounts for about 20 percent of the essential oils market in Europe. The application also differs depends on specific essential oils.

Importers are the leading channel for this sector. However, some large fragrance and flavouring companies, such as Aromatech and IFF source essential oils directly and they supply essential oils to bottlers and essential oils manufacturers.

Tips:

- See the CBI study Which trends offer opportunities and pose threats in the European natural ingredients for health product markets. This will give you useful information about the European health product segment, and is likely to increase your chances of entering the market.

- Visit trade fairs to test if the industry is open to your product, get market information, and find potential buyers. They will also give you the chance to speak to end-users, distributors and gauge your competition, especially how they are marketing their products. See the CBI study Tips for finding buyers in the natural ingredients for health products sector for an overview of trade fairs in this sector.

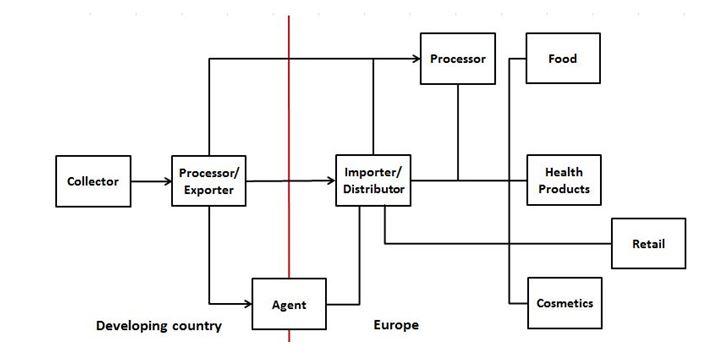

Through what channels does essential oil end up on the end-market?

Figure 9 shows the export value chain for essential oil on its journey to reach the European market. Essential oil can be produced from various plant sources, such as resins, leaves, flowers, fruits, bark and woods. They are usually extracted by steam distillation, but they can also be extracted by water distillation, solvent extraction, and floral extraction. The extraction method largely depends on the raw materials being extracted. Essential oil enters the European market in a liquid form.

Figure 9: Export Value Chain of Essential Oil

Source: Ecovia Intelligence

Importer/Distributor

As an exporter in a developing country, the main entry points to the European essential oil market are importers/distributors. European importers/distributors often trade a wide range of natural ingredients. Their expertise is in the global sourcing of natural ingredients, ensuring quality and documentary and regulatory compliance along with selling to processors and natural health products manufacturers.

Elixens is a leading importer/distributor of essential oils in the European market, having a range of essential oils that meet international standards. Other leading importers/distributors of essential oils in the European market include Atriplex GmbH, IMCD and Cornelius.

Some importers/distributors specialise in trading and supplying organic essential oils to European natural health product companies; SanaBio GmbH is one such company. Essential oils also come into the European market as finished natural health products. For example, Jiangxi Baolin Natural Flavor Co is a Chinese company exporting geranium essential oil to the European market as a bottled essential oil, particularly as an aromatherapy product.

Agent

An export agent is a firm or an individual that undertakes most of the exporting activities on behalf of an exporter, usually for a commission. Agents can be found in developing countries as well as in Europe; however, it is not that common for companies to use agents in the European market. As an exporter from a developing country, you can work with agents who represent and act on your behalf on the European market.

Processors

European processors also directly source essential oils from developing countries through sourcing projects. The German company Primavera does this through various sourcing projects for its essential oils that are sourced from developing countries. For example, it sources lemongrass, palmarosa and tulsi essential oils from Nepal. European buyers often travel to developing countries to personally meet their collectors when assessing their credibility as potential trading partners. Import volumes for this channel are larger, usually in tonnes.

Tips:

- Consider expanding your essential oils portfolio by including organic essential oils, for example. This will help you find a wider range of customers. Other benefits of having a wider portfolio include it giving you more attention on the market, thus making you stand out from your competition.

- Be prepared to meet prospective buyers who are interested in directly sourcing baobab from your country if you are able to supply larger volumes in tonnes.

What is the most interesting channel for you?

As an exporter of essential oils, importers/distributors are the most interesting channel for you. This is because importers/distributors have expertise importing and distributing natural ingredients, as well as integrated supply chains. Due to their wider customer base, importers/distributors often require a range of essential oils, meaning they often require a wider portfolio of essential oils.

Importers/distributors of essential oils in Europe have experience in marketing and sales of essential oils in the European market. They can also offer you help with storage facilities. It is important that you target European importer/distributors as they offer advantages that might be helpful to you as a small and medium-sized enterprise.

Tips:

- Carefully asses which is the most interesting channel for you before entering the European market.

- See the CBI study Tips for finding buyers in the natural ingredients for health products sector for useful information and guidance on finding buyers in channels you can enter the European market through. Particularly, importers/distributors who are your main entry point into the European market.

4. What competition do you face on the European essential oils market?

What countries are you competing with?

Somalia

The boswellia caterii tree from which frankincense oil is extracted is native to Somalia, as it offers the ideal weather conditions for its growth. However, the Somalian frankincense industry faces challenges, such as climate change and overharvesting. Long supply chain result in lower profit margins for frankincense harvesters and cultivators. Harvesting frankincense sap is highly dangerous, as most of the trees grow in rocky areas, such as Cal Madow Mountains in Somaliland.

Overharvesting of boswellia trees in Somalia are likely to result in declining harvests and therefore undersupply of frankincense oil in the near future. Suppliers of essential oils from developing countries need to make sure that they follow sustainable production practices. European buyers increasingly put more and more importance on sustainable and ethical sourcing.

Oman

There is a well-established commercial production of frankincense in Oman. The industry is supported by its government. For example, in recent years, Omani authorities have planted more than 600 trees from which frankincense oil is extracted and have implemented research and development projects to support the frankincense industry. Studies show that the density of Boswellia sacra trees in the Dhofar region has decreased substantially in the last few years. Other obstacles include droughts and overharvesting. It is important that suppliers of frankincense from developing countries avoid overharvesting of boswellia trees.

Malaysia

Malaysia has an established commercial patchouli production industry. Even though patchouli is not a seasonal crop and can provide regular income throughout the year, fluctuating prices and unstable harvests are making Malaysian farmers switch to other profitable crops. The patchouli market is affected by limited supply and fluctuating prices. Suppliers of essential oils from developing countries could take advantage of this imbalance. However, they need to factor in potential risks related to production of patchouli.

India

India has an established commercial patchouli production industry as it is extensively cultivated there. This is one of India’s key strengths. Another strengths are is that India has ideal climate conditions for patchouli to grow, and the fact that the Indian government supports the agricultural industry and more specifically the patchouli industry. For example, in recent years, India’s National Horticulture Board has worked to develop the Indian patchouli industry through development projects.

As such, it may become easier for Indian producers to export patchouli to the European market. However, the Indian patchouli industry also faces challenges such as include climate change, unproductive forest plantations, poor availability of improved genetic material, and poor management. Other challenges India faces include negligence of its agricultural industry, declining natural resources and disruption of land.

Indonesia

The myristica fragrans tree from which nutmeg oil is extracted is native to the Moluccas Island, Indonesia. The country has a well-established commercial nutmeg production industry, which accounts for around 80 percent of global nutmeg oil production.

The Indonesian Ministry of Agriculture, in partnership with the EU, has a Trade Support Programme to identify and enhance the quality of Indonesian nutmeg products through improving the production process, transportation, and testing capabilities. The United Nations Conference on Trade and Development (UNCTAD) also supports the Indonesian nutmeg industry through its nutmeg project in Indonesia’s Acheh region.

The Indonesian nutmeg industry also faces challenges, such as concerns that Indonesian nutmeg products contain aflatoxins. These are toxic metabolites produced by certain fungi in nutmeg caused by poor hygiene conditions during the drying and storage processes. This has led some importing countries to reject Indonesia’s nutmeg products.

Indonesia is the world largest producer of patchouli. Indonesian patchouli oil is considered the highest quality. The country supplies around 80-90 percent of the global production. Most of the patchouli supply comes from Aceh and Sulawesi. In recent years, there has been a decrease in patchouli farmers and land area, which has negatively affected the market price of patchouli at the farmer level and global supply.

China

China is an important producer of essential oils, including geranium oil. The production of geranium continues to develop. China’s key strengths include good levels of infrastructure and a strong government investment programme for developing the country further. Chinese geranium oil has a specific composition and smell. However, the Chinese geranium industry does face challenges, including quality.

Small and medium-sized exporters of essential oils from developing countries should pay attention to different types of rose geranium present on the market. The climate and quality of the soil are vital factors in the production. Egyptian geranium oil and geranium Bourbon from Reunion are considered to be of a better quality. While Chinese suppliers can supply larger quantities, exporters from developing countries can compete by supplying higher quality geranium oil.

Tips:

- Find out if your country has programmes helping exporters like you harvest and / or cultivate, process and export your essential oil. You can do this by contacting governmental ministries of trade in your country because they often have information about this along with providing assistance to help you export your essential oil. See CBI study on tips for finding buyers on the European market as it provides a list of export programs helping exporters like you enter the European market.

- Make sure you uphold sustainability production methods. This is crucial for natural essential oils coming from developing countries, as European buyers put a lot of emphasis on traceability and sustainable sourcing of their raw materials.

What companies are you competing with?

Omani companies

Many companies export frankincense oil to the European market; Enfleurage Middle East Frankincense Distillery is one such company in Oman. Enfleurage Middle East Frankincense Distillery’s major strength is its website, which contains professional and well-prepared content supported by professional photography. The website includes well-prepared sections clearly informing prospective buyers about the company itself, where its frankincense is sourced from and how it extracts frankincense oil from boswellia caterii trees native to Oman.

Indian companies

Falcon is an Indian company exporting patchouli oil to the European market. One of Falcon’s key strengths is the emphasis it places on exporting high-quality patchouli oil, which they test. Falcon’s other strength is its website, which contains professional and informative content that is well-prepared. For example, Falcon provides simple and easy to read information about its quality policy, infrastructure and available packaging options.

Indonesian companies

Van Aroma is an Indonesian company exporting nutmeg oil to the European market. One of Van Aroma’s key strengths is the emphasis it places on exporting high-quality nutmeg oil that is tested in its advanced facilities. Another of Van Aroma’s key strengths concerns certification; it has the Food Safety System Certification 22000 certification, which shows the high quality of its nutmeg oil. It shows the processing of its nutmeg oil has taken place in an environment where there is a quality management system in place. Van Aroma also provides prospective buyers with important technical documentation such as Technical Data Sheets and Safety Data Sheets; another key strength.

Another of Van Aroma’s strengths is its website, which contains professional and well-prepared content supported by professional photography. It includes well-prepared sections clearly informing prospective buyers about the company itself, its facilities, the certifications it has and what it offers in considerable detail. For example, Van Aroma informs prospective buyers how it processes its nutmeg oil from when the nutmeg is sown all the way to when it is distilled in the company’s factory.

Tips:

- Consider obtaining certification, such as FSSC 22000 certification, that proves the quality of your essential oil. Doing so gives you an advantage when you are seeking to enter the European market.

- Ensure you have a professional website with well-prepared content, which clearly informs prospective buyers of your key strengths. For example, who you are, the emphasis you place on exporting essential oil of the highest quality, facilities and certification you have and what you offer.

What products are you competing with?

Essential oils do not really have any real competition from other natural ingredients for health products. Essential oils have unique properties and applications, for example in the aromatherapy sector. Each essential oil has specific properties and its own scent. As such, it is difficult to substitute individual essential oils with other ingredients.

Since this study mainly focuses on frankincense, geranium, nutmeg and patchouli, it is not possible to indicate competing products. Each of these oils are used in health products because their unique properties.

Tips:

- Familiarise yourself with products competing with your essential oil that are available on the European market. Learn about their strengths and weaknesses and how you essential oils can fit in and meet the demands of European consumers.

- Consider expanding your portfolio of essential oils. This can give you an advantage when approaching European buyers.

- Use the unique characteristics of your essential oils to persuade European buyers to purchase it from you. For example, with regard to frankincense, its ability to relieve stress and anxiety, reduce pain and inflammation, boost the immune system, and can help fight cancer.

5. What are the prices for essential oils on the European market?

There is a big difference between prices of individual essential oils. In the case of frankincense, the market price has been increasing steadily. This is due to an undersupply of frankincense oil and increasing demand on the global market. The FOB prices of frankincense range between USD 800-950 per litre. It is expected that the price will increase further in the near future.

The price of patchouli differs according to its quality. Patchouli prices are steady at the moment, with there being a lack of supply on the open market. Patchouli prices are affected by climatic conditions, particularly an excessive monsoon season, which can result in flash floods and crop damage. This is something Indonesia, which dominates the global patchouli market, experienced in 2020. The Free On Board market price of patchouli is USD 55-70 per litre.

Nutmeg oil is priced at around USD 70-85 (FOB) per kilogramme, while geranium oil is priced at about USD 85 (FOB) per kilogram. Geranium oil prices decreased slightly in the last year as a result of increased supply. It is difficult to predict future price movement as price of essential oils, such as nutmeg and geranium, are influenced by factors, such as weather conditions and yields, production levels and demand.

Niche essential oils are more attractive for exporters in developing countries. This is because there is a strong price competition for commodity essential oils, such as orange and peppermint. Large suppliers, such as China and Brazil, are pushing prices down as they increase production volumes. Exporters of essential oils in developing countries should focus on high-value niche essential oils that are native to developing countries.

European buyers and importers of essential oils have reported that the market price of essential oils increased in 2020 as a result of the global COVID-19 pandemic causing disruption to supply chains. In particular, transportation costs increased and there were delays in receiving orders.

Tips:

- Visit online trading platforms such as Alibaba to stay up to date with prices your competitors have set for essential oils. Doing so provides you with useful knowledge when deciding prices to set for your essential oil.

- Ensure your prices reflect the quality levels and delivery conditions, with failure potentially leading to financial costs. For example, higher quality essential oils require more processing compared to essential oils of lower quality. Factor this in your pricing.

- Be flexible with price when buyers order larger qualities. You can offer them a discount once you establish a relationship with them.

This study was carried out on behalf of CBI by Ecovia Intelligence.

Please review our market information disclaimer.

Search

Enter search terms to find market research