9 tips on how to find buyers in the European natural ingredients for health products market

The European demand for natural ingredients for health products is growing. To benefit from it, you need to define your product offer clearly, understand its potential, identify your preferred target market and develop an export strategy. Only then can you start looking for buyers. This study contains tips on where to find European buyers for your products.

Contents of this page

- Define your offer and understand its value proposition

- Identify your target market

- Target the right buyers through selection criteria

- Use databases to create a list of potential buyers

- Use the reach and information of sector associations

- Go to sector trade fairs

- Invest in online marketing

- Use your existing network

- Contact trade promotion agencies, embassies and chambers of commerce

1. Define your offer and understand its value proposition

Before you can find potential buyers, you need to know and be able to explain what your company offers. This means having a full description of your product and understanding its value proposition. Knowing the value of your products makes it easier to target potential buyers and interest them in buying from you.

To understand your product’s potential, you should know its exact botanical name. There are many varieties and growing areas, so knowing which ingredient you handle is the first step. Then, you should analyse the composition of the beneficial compounds in your product. What properties does your product have, and how is it different from other strains on the market? For instance, if your ginger is more pungent than other species on the market, what does this mean? How can this be best used in products? You can search on websites like ResearchGate to find similar product analyses from other regions.

Once you know what you are selling, it is important to record this well. European buyers of natural ingredients need exporters to provide well-structured and organised product and company documentation. Buyers use these documents to make sure that you meet requirements and specifications. Having all your papers in order will convince buyers that your product complies with European Union (EU) requirements and is safe for consumption. Buyers usually expect exporters to provide them with a Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA).

Besides the phytochemicals in your product that may make it stand out, you should think about other aspects that set you and your product apart from your competitors. For example, if your product is produced in a social and sustainable way, you can include storytelling as added value.

Look at Baobab Exports for an example of a company that has invested in knowing what they sell. They have created an extensive information sheet on their baobab products, including information on applications, health attributes and composition.

Tips:

- Contact the closest university with a botanical department in your country to help you define your product classification and the botanical name of your ingredient.

- Collaborate with local universities and accredited laboratories to conduct a phytochemical analysis of your products.

- Design your value proposition so it reflects market demands. A good value proposition should let potential buyers know exactly what they want to know when looking for suppliers.

- Highlight the parts of your value proposition that align with potential buyers’ interests.

- Always have up-to-date and reliable data about your company, the growers you source from and your product range. This includes up-to-date certifications, information about the number of producers in your network, and production volumes and availability, among other things.

2. Identify your target market

Before starting your search for European buyers, it is important to understand your target market. Consumption patterns and preferences for health products vary significantly across European. The presence of product formulators and health manufacturers, their sourcing practices and trade levels are different between different European countries.

Depending on the product you sell, you can start to ask what markets and channels present the most opportunities for your product. What kind of products are sold, where and who manufactures them?

You can find answers to these questions by conducting market research. This helps you understand and select the right export markets for your products. It will also help you to set specific and realistic sales objectives. Moreover, potential buyers appreciate it if you are knowledgeable about the market, and this can contribute to buyers being interested in your product.

Your market research could include the following elements:

- Trade flows and structure: find out in which countries the demand for your ingredient is highest. Note that there is a lack of detailed statistical data on the production and trade of specific natural ingredients. Most products are separated into broader product categories, making finding specific information on trade flows occasionally very challenging.

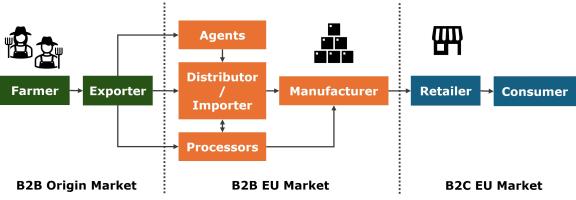

- Market channels: look into how the distribution of your product is organised in the European market. Before being sold as an end-product to consumers, your ingredient may be traded between importers, wholesalers, distributors, processors, manufacturers and retailers. Get to know your product’s most common trade route so you can select the right type of company to sell your product to. This also helps you understand your buyer’s clients and their requirements.

- Market trends: look for up-to-date information on what is happening with the product you offer. Look into new uses, players, regulations or changing consumer demands.

- Market segments: identify segments that use your products. Understand how your ingredients can be applied. Natural ingredients are often used in a range of health products. They could be used in immunity support or dietary supplements, for instance. Look for trends in product types. If specific market segments are growing rapidly, this indicates more demand for the raw materials used in those segments.

- Competition: get to know your competition. You should know who they are, how their product is similar or different to yours and who they sell to.

Figure 1: Market channels

Source: ProFound, 2024

Tips:

- Review the CBI study What is the demand for natural ingredients for health products on the European market? for information on EU markets with high potential for natural ingredients for health products.

- Read about trends in the European natural ingredients for health products market on our website to find more information on developments in the sector.

- Learn about opportunities for specific products in the European market from the CBI’s product studies. For instance, refer to our studies on aloe vera, ayurvedic ingredients, baobab, chlorella and spirulina, essential oils, frankincense, hibiscus, immune-boosting botanicals, moringa, mulberries, plant proteins

3. Target the right buyers through selection criteria

Once you know what you are selling and what the market is like, you can start identifying your ideal buyer profile. This means you must find out as much as possible about a buyer to select the most promising ones. You can make a good start by visiting their website to find information on the following points.

- Type of buyer: are they an importer, processor, distributor, final product manufacturer or retailer?

- Location and market: see what countries the company operates in and what markets are supplied to and sourced from.

- Size and scope: be aware that large companies usually trade in large volumes while small companies trade in niche markets and low volumes.

- Demand: find out whether they buy raw materials or processed products.

- Product range: is the buyer specialised in certain products or does it deal with a wide range of products? Check whether they trade in the ingredients you want to sell.

- Philosophy, values and mission: read about their focus on social equity or biodiversity and check to see if this matches your business philosophy.

- Practices and certification requirements: understand what certification standards are used and what specific requirements are listed.

Use the information you find to select buyers that fit your criteria. For example, when selecting buyers based on type, importers and distributors are often your best bet as they often trade a broad range of products and product varieties. You should also be aware that these companies vary in size and product range. Some may specialise by focusing on one segment, a limited product offer or only trade ingredients with specific certifications. If the type of buyer does not fit well with what you offer, you should take them off your list.

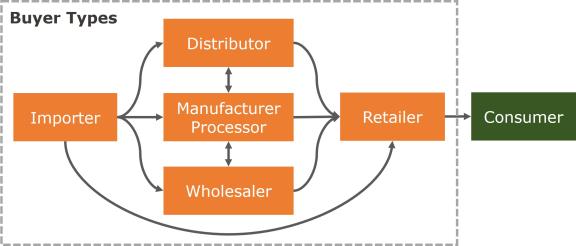

Figure 2: Trade flows between buyer types

Source: ProFound, 2024

You can target large, diversified companies if you offer a high-quality product that meets volume and delivery requirements. Examples include importers like the Martin Bauer Group (Germany) and distributors like IMCD (the Netherlands). These companies may demand additional requirements from their suppliers (for example, audits and certifications). Larger buyers often prefer dealing with companies that offer reliable sourcing of large, well-documented quantities to limit their number of suppliers.

Another option is to supply processors and end-product manufacturers directly if you can match their demands. Examples of these processors include Greentech (France) and Indena (Italy). The upside of supplying to processors is that they will often pay better prices for your products. However, your company and product documentation must be perfect, and you should ensure consistent quality and quantity to be interesting to this type of buyer. Your logistics also have to be well organised and enable short-notice delivery. On top of this, you need to have a solid proposal to compel manufacturers to start buying your products instead of sourcing from existing suppliers.

If you are a smaller supplier, trading with smaller processors and specialised importers can be more accessible. Smaller buyers often require lower quantities although they are still interested in high quality. Organic Herb Trading Co (UK) is an example of a company like this. It works with producers directly, building long-term partnerships and focusing on ethical trade and organic-certified ingredients.

No matter who you sell to, you should always know the general European buyer’s requirements before contacting buyers. The general buyer requirements are the laws and regulations that products and processes have to meet throughout Europe. European buyers will not be interested in your product if you cannot meet these basic requirements.

Tips:

- Spend time selecting potential buyers who fit your offer well to optimise time investment. You should only start contacting buyers after making the selection.

- Only contact suitable companies. Identify the right contact person and introduce your company and offer. Make sure your message is specific to the company you want to contact. For example, mention something you noticed about the company or their product range.

- Make sure you can meet large buyers’ demands for additional services before you target them. Can you meet their needs in terms of quantity, delivery schedules, documentation, financial reporting, auditing, price and quality?

- Familiarise yourself with the legal and additional requirements that European buyers of natural ingredients often have. Refer to the CBI study that describes all requirements for natural ingredients for health products on the European market to learn more about them.

4. Use databases to create a list of potential buyers

A good way to create a list of potential buyers is by looking through online databases and marketplaces. You can create lists of potential customers by searching through databases and marketplaces, filtering out the buyers that do not meet your buyer profile.

Trade databases

Online trade databases have functions that make searching for buyers of a specific product or from a particular country easy. While some of these databases can be accessed for free, many require payment. Keep in mind that no database is complete, not even paid databases. This means there is no guarantee you will be able to find the buyers you target in every database.

Popular databases include:

- Europages is a directory of European companies. It allows you to search by sector and enter key search terms (for example, ‘natural ingredients’ or ‘health products’). You can filter results by selecting the company type of your interest (for example ‘agent’, ‘wholesaler’ or ‘distributor’).

- WLW is the leading German B2B online company database. You can search for companies and filter results according to your specifications. Search in English and German to find more potential buyers.

- Kompass is a large, global database of companies. You can use it for free by entering a product name or category and filtering results based on location or company type. You need to pay for a subscription to access the more sophisticated functions.

- GreenTrade.net is a marketplace for organic products. The marketplace has 2 directories in which companies can offer to sell or buy products in specific categories, such as medicinal and aromatic plants or raw materials and supplements. In addition to looking for buyers, you can also register your company in the seller’s directory.

Trade fair exhibitor databases

You can also use online trade fair exhibitor databases to find potential product buyers. They usually contain links to exhibitors’ company profiles, contact details and information on the products they are interested in. You can often search for specific products, product categories, target countries and types of companies. For example, look at the BIOFACH exhibitors page and the FI Europe exhibitor list. See the tip Go to sector trade fairs below for more information on trade fairs.

Another way to find potential buyers is through the customer databases of certification bodies. For example, you can find a list of FairWild-certified operators and ingredients in the FairWild database. You should also check the UEBT member list (a non-profit association that promotes ethical sourcing of ingredients from biodiversity) and the certified operators list of Fair for Life to find lists of actors certified according to their respective standards.

Tips:

- Use company databases to compile lists of potential buyers, but ensure they are the right fit for you before you contact them. This will help make the process more effective and prevent you from wasting time and resources. See the tip Target the right buyers through selection criteria for more information on deciding what buyer is right for you.

- Search through databases in English and the language of your target market to find more relevant buyers.

- Check the reliability of databases before using them. Some fraudulent companies sell fake databases. When receiving database offers through email, determine whether emails are legitimate or sent by fraudulent companies. This can be done, for example, by checking a company’s online presence, and looking for impersonal greetings, poor presentation, spelling and grammar.

- Use the filter options in databases to find the most relevant companies quickly.

5. Use the reach and information of sector associations

Connect with Europe’s sector associations because they are valuable sources of information. Sector associations play an essential role in EU regulations and legislation. They actively participate in research and corporate social responsibility (CSR) programmes. They may also provide country-specific and sector-specific information vital to your market research. They also publish updates on regulations on their website.

National and European associations also provide access to valuable contacts for natural ingredient suppliers. Many European buyers are members of sector associations, and most associations provide member lists that you can use to look for buyers.

Significant European sector associations include:

- European Federation of Associations of Health Product Manufacturers (EHPM) represents specialist health product manufacturers and national associations. It develops regulations for the health product industry.

- Food Supplements Europe represents the interests of the European food supplement industry and aims to ensure that future EU legislation and policy reflects the interests of this sector. Its members include national associations and private companies.

- The European Federation of Pharmaceutical Industries and Associations (EFPIA) represents 1,900 companies in the European pharmaceutical industry. You can find its members on their website, both companies and national associations.

- European Federation for Complementary and Alternative Medicine (EFCAM) represents Europe’s complementary and alternative medicine (CAM) sector. You can find a list of members on the EFCAM website.

- The International Federation of Organic Agriculture Movements (IFOAM) is the umbrella organisation for the organic agriculture movement. You can find information on organic regulations and a list of members on their website.

Table 1 describes national associations for the health products sector in selected countries. Some of the listed websites are only in their respective association’s national language. You can use your web browser’s translate function if so.

Table 1: National associations in the health products sector in Europe

| Country | Association | Summary | Member List |

| Belgium | BE-SUP (Food Supplements Industry Federation) | Represents and promotes the Belgian food supplement industry. | Members |

| France | SYNADIET (Union of Food Supplements) | Represents the interests of companies in the French food supplements industry, supports the industry’s growth and coordinates industry action. You can also find publications on the NIHP sector in France, its developments and legislation on its website. | Members |

| Germany | BDHI (Federal Association of Industrial and Commercial Companies for Pharmaceuticals, Health Food, Dietary Supplements and Cosmetics) | Protects the interests of German manufacturers and distributors of food supplements and other industries. The association does not list its members but offers a list of business contacts. | N/A |

| The Netherlands | NPN (Natural and health products) | Promotes the interests of manufacturers, raw material suppliers, wholesalers, importers and distributors of nutritional supplements in the Netherlands. The website shares data on the Dutch food supplements market. |

|

| Poland | KRSiO (Council for Supplements and Nutritional Foods) | Represents the interests of producers of dietary supplements and functional foods in Poland. | Members |

| United Kingdom | HFMA (Health Food Manufacturers Association) | Represents the interests of the UK’s natural health industry at all legislative, regulatory and Parliamentary levels. | Members |

| Italy | Integratori & Salute | Supports the industry in Italy and promotes consumer health. | Members |

| Spain | AFEPADI (Association of Health Food and Supplements) | Represents, manages and defends the interests of Spain's food and food supplement industries. | Members |

Source: compiled by ProFound, 2024

Tips:

- Regularly check association websites for updates on sector trends, regulations and innovations in the health products industry.

- Subscribe to associations’ newsletters if they offer them.

- Review each association’s members list as they often provide potential buyers you can target. Check potential buyers’ websites to see if they are a good match, and only reach out if they are.

- Take your time to find the right buyer; research your opportunities and engage with business partners who match your company’s philosophy and who you feel comfortable doing business with. When contacting a buyer, identify a contact person, keep your emails short, relevant and concise, while also giving complete and accurate information.

- Do not send impersonal emails with unsolicited information. This may harm your reputation as a supplier.

6. Go to sector trade fairs

Trade fairs are excellent for meeting and connecting with European buyers. Going to trade fairs gives you the chance to meet new potential business partners while learning about sector trends, developments and competition at the same time. Another benefit of attending fairs is that you will receive direct feedback from others on your company and products.

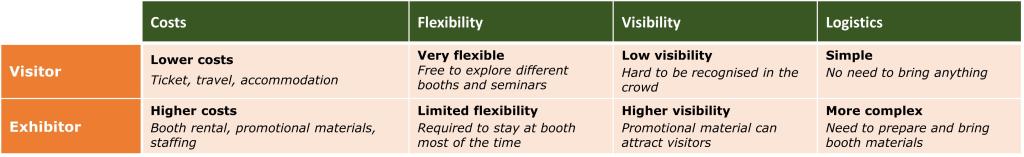

You usually have 2 options when going to trade fairs: to go as a visitor or an exhibitor. As a visitor, you attend trade fairs to explore and gather information. You can visit various booths to learn about new products, trends and developments, and try to create new business opportunities. As an exhibitor, you showcase what you offer in a booth. This allows you to set up displays, presentations or demonstrations to attract fair visitors. You interact with visitors who are attracted to your booth directly, potentially leading to new contacts and business opportunities. Participating in a trade fair can require a large investment, especially if you exhibit at a physical fair. If the costs to exhibit are too high for your company, you should consider joining the fair as a visitor instead.

Figure 3: Pros and cons of attending a trade fair as a visitor or an exhibitor

Source: ProFound, 2024

Trade fair preparation

Proper preparation is crucial when attending a trade fair. Preparation starts with finding the right trade fair, determining your budget and planning, developing your sales and marketing strategy, and setting strategic goals for the fair. You must choose the right product offer for the trade fair you want to participate in and ensure you bring all relevant product and company documentation. While at the trade fair, you must be ready to explain how your products differ from your competition.

Set up meetings with potential buyers beforehand to increase the chance of making sales through trade fairs. Try to identify potential buyers for your products and contact them before the fair to set up a meeting during the fair. You can make the most of your time by setting up these meetings before the fair.

Remember that if you decide to exhibit at a trade fair, you need to spend significant time arranging practicalities, stand design and logistics.

Figure 4: Impression of the Vitafoods Trade Fair

Source: ProFound, 2020

During and after attending a trade fair

You can do several things during the trade fair to make your participation more successful:

- Take care of your appearance: you should dress appropriately and be professional and polite.

- Actively engage with visitors and exhibitors: be proactive in engaging in conversations with people who might be interesting for your business. Ask questions, express interest and listen carefully to other attendees’ interests.

- Take notes: keep a notebook to write down important information, contacts and insights during conversations and presentations.

- Attend presentations: attend relevant seminars to learn about the sector and meet others interested in the same industry.

- Join study tours: visitors can sign up for study tours organised by different organisations. Study tours will guide you around trade fairs and direct you to potentially interesting business contacts.

After the trade fair, you need to follow up on any leads. You can send more information or arrange follow-up meetings depending on what you discussed. You must stay connected with your new contacts, which might lead to new business opportunities.

List of trade fairs per region

Some of the leading trade fairs that focus on ingredients for health products are:

- Vitafoods is an international trade fair based in Geneva, Switzerland. It is a leading trade fair for final products and ingredients in supplements, fortified food and herbal medicines.

- Health Ingredients Europe is a travelling trade fair combined with Food Ingredients Europe. It is a leading European trade fair for supplements and herbal medicine ingredients.

- Nutraceuticals Europe is an important European trade fair and congress in Barcelona, Spain, for functional ingredients, novel foods and finished products, such as food supplements and pharmaceutical products. You can network with companies in the sector and attend seminars to expand your knowledge.

- BIOFACH is the world’s biggest trade show for organic products, held annually in Nuremberg, Germany. The fair focuses on organic food, but you can also network with companies in the health product industry. BIOFACH is combined with the VIVANESS cosmetics trade fair.

- Natural & Organic Products Europe (NOPE) in London, UK, and its Scandinavian edition, Ecolife Scandinavia in Malmö, Sweden, are trade shows that focus on natural and organic finished products. These innovative trade shows are very interesting for learning and networking with end-product manufacturers.

Alternatively, you can visit trade shows in your region to save costs. It is also an excellent opportunity to find background information on your new target market and to present your company to potential customers directly. However, be aware that not many European buyers may visit the trade shows in your region.

Important trade shows in Asia include:

- Vitafoods Asia in Bangkok, Thailand, is one of Asia’s largest trade shows of nutraceuticals, where you can find buyers and suppliers of food and health ingredients. The show is co-organised with Food Ingredients Asia.

- Healthplex Expo is one of the leading trade shows for nutraceuticals in China. You can network with buyers, distributors and manufacturers of food and health ingredients, as well as finished products.

- BIOFACH South East Asia, BIOFACH India and BIOFACH China are the Asian versions of the European BIOFACH trade fair. These trade fairs focus on the organic food sectors in their respective markets.

Important African trade fairs include:

- Africa Health is one of the most prominent African trade fairs in the healthcare sector. The fair includes companies from 8 product categories, including Wellness and prevention and Healthcare and general services.

- Organic & Natural Products Expo Africa in Johannesburg, South Africa, is organised by the Organic & Natural Products Portal Africa. This trade fair caters to trade buyers and direct consumers of organic and natural products, including ingredients, raw materials, health foods and supplements.

Important trade fairs in Latin America include:

- Food Ingredients South America in Brazil is Latin America’s leading trade fair for food ingredients. You can meet with companies working with functional food, natural and organic ingredients, plant and herb extracts, nutraceuticals and probiotics.

- BIOFACH Brazil is the leading trade fair for organic products in Latin America. The trade fair is combined with Naturaltech, which focuses on natural food products, supplements and health products.

Tips:

- Select the right trade fair for your products. You should be able to answer questions like the following. What type of products are you bringing? Which market segment are they used in? Are your products certified as organic? Does the trade fair focus on innovation? Can you find many new or innovative products there? Is the trade fair open to brands outside Europe or does it focus on European companies?

- Plan to set aside the money required to attend trade fairs at least one year in advance. Attending trade fairs is expensive, especially for small to medium-sized suppliers in emerging market economies.

- Make sure you can be found on the trade fair’s online platform. After COVID-19, many European trade fairs set up online versions of their trade fairs where you can find and connect with other exhibitors.

- Ensure your promotional materials and company and product documentation are up to date and presentable before you attend the trade show. This will help you create an excellent first impression.

- Contact export-promoting agencies to help you participate in trade fairs; they can offer financial and technical support. Examples of export-promoting agencies include NAEB (Rwanda) and PromPerú.

7. Invest in online marketing

A strong online presence is an excellent way to attract potential buyers’ attention. Investing time and resources in building an online presence will increase your visibility, leading to more business in the long term. Additionally, having a well-designed website or social media content can help new buyers trust you.

Website

Websites are an essential element of your product marketing. Buyers associate high-quality websites with modern and professional organisations. In general, a good website should contain:

- A company profile with contact details and mission statement.

- A well-presented product range – ideally with product descriptions, specifications and pictures.

- A competitive advantage statement (for example, quality specification, certifications or delivery reliability).

- Information on production, processing and facilities.

- Information on certifications and quality management systems.

- Information on sustainability practices and Corporate Social Responsibility.

The content on your website needs to be concise, well ordered and grammatically correct. Professional photographs of products, your team and production facilities can add a sense of credibility. Another great option is to add a video of your company and products. You can also include brochures, presentations, and product catalogues on your website.

The CPX Peru website showcases a professional looking website for an exporter of healthy, organic natural products. The company clearly states its mission, vision and production processes. CPX also includes information on benefits and product applications.

Social Media

Social media is another way to connect with buyers. Social media is a useful way to post company activity updates. European buyers may use online social networks to communicate with potential suppliers.

You need to be reachable and communicate professionally to attract and retain buyers’ interest through social networks. It is essential to have a professional profile that highlights your unique selling points and reliability. Being active by sharing relevant content, joining discussions and showing a good understanding of the sector’s needs can increase your visibility and attract potential buyers.

The most commonly used social media in Europe include:

- LinkedIn: European companies use LinkedIn to connect with potential suppliers, look into their backgrounds and communicate. LinkedIn also serves as a platform for sharing industry insights and staying updated on market trends.

- Facebook: European companies occasionally use Facebook for networking and finding new suppliers but much less so than LinkedIn.

- Instagram: Buyers use Instagram in a similar way to Facebook; both platforms are more commonly used for business-to-consumer promotion.

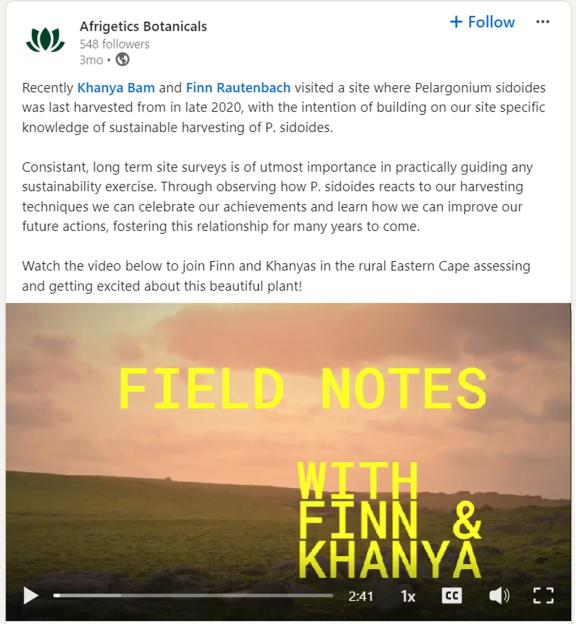

Look to Afrigetics (South Africa) to see how it promotes itself through its online social media presence. The company uses its LinkedIn account to share meaningful and purposeful stories about the sustainable trade of Pelargonium, its key product, rather than selling it. According to the company’s owner, people are more likely to connect with you through powerful and authentic storytelling rather than pushing for sales. Afrigetics creates content, such as blogs and videos of production, and shares posts of European manufacturers working with the ingredient.

Figure 5: Example LinkedIn posts

Source: Afrigetics, 2024

Tips:

- Learn about search engine optimisation (SEO) to generate more traffic to your website. You can find helpful information on various blogs and websites. You can also find online courses on platforms like Udemy and LinkedIn.

- If you do not have the resources to improve your website in-house, use websites like Fiverr and Upwork to hire this expertise at affordable rates.

- Ensure you have an attractive and up-to-date website. Poorly managed websites can harm your business prospects.

- Determine which social media platform you want to use, based, for example, on which platforms your buyers use. Create and update social media accounts regularly on platforms like LinkedIn. You can also use social media to keep in touch with existing buyers and find out what your business partners and competitors are doing.

- Use your online presence to direct buyers to your e-commerce page if you have one. Read the CBI’s Tips to go digital to learn about engaging in e-commerce.

8. Use your existing network

When looking for European buyers for your natural ingredients, your existing network can be a valuable asset. The main benefit of using your network is that you can build upon existing relationships and trust.

Start by reaching out to your current network, including past clients, suppliers and industry colleagues. Let them know about your expansion into the European market and inquire if they have any connections or recommendations.

You can also ask around the associations and trade groups you may be part of. These organisations often have members with international connections, including potential buyers in Europe. Attend events, participate in discussions and search the online platforms these associations provide to network with European buyers.

Do not hesitate to ask your existing contacts for introductions or referrals to European buyers they may know. Personal recommendations are often very important in business. Your contacts may be willing to vouch for you or connect you with relevant business relations.

Tips:

- Be clear and specific when reaching out to existing contacts. Communicate your intention to expand into the European market and the type of buyers you are looking for. Provide specific details about your products and the value you offer to potential European buyers.

- Show appreciation for your contacts’ assistance. You could do so by thanking them, sharing industry insights, giving referrals to their business or offering discounts on future purchases. This will strengthen your relationship.

- Do not be discouraged by a lack of response. Be persistent and follow up with your contacts regularly.

9. Contact trade promotion agencies, embassies and chambers of commerce

Trade promotion agencies, embassies and chambers of commerce can be a valuable source of support and information for your European export activities. These organisations offer help and advice on buyer requirements, quality issues, legislative frameworks, certification and market developments. This information can be helpful when choosing which buyers to target and how to approach them.

Some organisations also organise matchmaking programmes, trade missions, coaching programmes and training courses for exporters. These programmes offer many tools to help you access the European market, for example, connecting you with potential buyers or supporting trade fair participation. Joining these programmes can help you gain valuable skills and information on accessing the European market and finding buyers.

Examples of helpful support organisations include:

- Centre for the Promotion of Imports from Developing Countries (CBI)

- Import Promotion Desk (IPD)

- Open Trade Gate Sweden (OTGS)

- Swiss Import Promotion Programme (SIPPO)

- International Trade Centre (ITC)

- Enterprise Europe Network (EEN) – Check whether your country has a local EEN contact point.

Trade development associations in your country can also help you find new business contacts and contacts with institutions that promote trade within Europe. They often organise export support programmes. These are good places to meet other exporters and expand your network. Examples of organisations with successful export support programmes include:

- Uganda Export Promotion Board (EUPB) – Uganda

- PromPeru – Peru

- Trade Development Authority of Pakistan (TDAP) – Pakistan

- Directorate General for National Export Development (DGNED) – Indonesia

- Department: Trade, Industry and Competition (DTIC) – South Africa

- Agricultural Export Council (AEC) – Egypt

Tips:

- Visit events organised by trade development associations and meet with other exporters. Learn from them. Discuss and share experiences on trading channels, legislative requirements, buyer requirements and logistics.

- Look at international and European trade promotion organisations to find a matchmaking or trade support programme. They primarily target small and medium-sized enterprises in selected partner countries that want to export their products.

- Connect with business support organisations and trade promotion associations in your home country or region.

- Study relevant sector information published by trade promotion agencies, embassies and chambers of commerce, as it can help you increase your chances of successfully entering the European market.

- Visit the Eurochambers website for a complete list of Chambers of Commerce in Europe. You must check the solvency of your potential customers on the Chambers of Commerce websites.

ProFound – Advisers in Development carried out this study on behalf of the CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research