Entering the European market for hibiscus

To enter the European market for hibiscus, you must meet the mandatory requirements set by the European Union (EU). Also consider meeting the common additional requirements that European buyers and niche markets have, as they will help you to enter the European market. The European market for hibiscus is divided into three segments, with separate channels you can enter through. You will face competition from other hibiscus suppliers, as well as competing products when entering the European market.

Contents of this page

1. What requirements must hibiscus for natural health products comply with to be allowed on the European market?

What are mandatory requirements?

As an exporter in a developing country, you can only export hibiscus to the European natural health product market if you are compliant with the European Union’s mandatory legal requirements for natural ingredients for health products. Non-compliance will result in your hibiscus not entering the European market.

If your hibiscus is used in food supplements, you must comply with:

- EU food supplement legislation;

- European General Food Law;

- Maximum Residue Levels (MRLs) for pesticides, contaminants in food and microbiological contamination of food, and food hygiene as outlined in the EU’s Hazard Analysis and Critical Control Points;

- Some European countries are signatories to harmonised lists of natural ingredients for food supplements such as BELFRIT. Other European countries are following them despite not being signatories. The branch, flower, leaf and seed of hibiscus sabdariffa are listed on the BELFRIT and the German positive list, so inform prospective European buyers about this.

There have been several registered food safety issues with hibiscus caused by contamination in the EU’s Rapid Alert System for Food and Feed. This has resulted in it not being allowed to enter the European market. You must therefore ensure your hibiscus is always uncontaminated.

If your hibiscus is used in herbal medicinal products, you must comply with:

- EU Directive 2004/24/EC – requires all herbal medicinal products to obtain an authorisation to market within the EU

- EU Directive 2003/94/EC - Principles and guidelines of good manufacturing practice in respect of medicinal products for human use and investigational medicinal products for human use

- Rules governing medicinal products in the EU

There are several other requirements for hibiscus. It must also comply with:

- Good Agricultural and Collection Practices (GACP) for raw plant materials

- Good Manufacturing Practices (GMP) for extracts or active substances used as starting materials

Tips:

- If you are looking to enter the European medical products market, familiarise yourself with the Marketing Authorisation procedure for medical products sold on the European market. This is because the marketing of medical products is strictly regulated in the EU.

- See the CBI study ‘What requirements must natural ingredients for health products comply with to be allowed on the European market?’. This study provides further guidance on mandatory as well as broader market entry requirements for this sector.

- Visit the Access to markets Portal (previously known as the EU Trade Helpdesk) for more information on import rules and taxes in the European Union.

- Contact Open Trade Gate Sweden if you have specific questions regarding rules and requirements in Sweden and the European Union.

Convention on Biological Diversity (CBD)/Access and Benefit-Sharing (ABS)

To export hibiscus to the European market you must comply with the requirements on using plant resources agreed under international treaties and protocols within the Convention on Biological Diversity (CBD). This is because the CBD is a part of EU law. Additionally, it is likely your own country is also a signatory, meaning you need to comply to meet your national laws.

The Nagoya Protocol’s Access and Benefit-Sharing (ABS) provides guidelines for accessing and utilising genetic resources and traditional knowledge, as well as the fair and equitable sharing of benefits. Similar to the CBD, European companies need to comply with ABS legislation. ABS is also likely to be a part of your country’s regulations. As an exporter of hibiscus to the natural health product sector, make sure you abide by ABS.

Tip:

- Visit the CBD website as it provides useful information on CBD and ABS, including country profiles.

Documentation

European buyers of hibiscus expect exporters to provide them with well-structured and organised product and company documentation. This documentation helps to prove you meet their requirements, such as specific quality specifications.

For example, a buyer stated in an interview that “documentation is important”, with another buyer stating, “we need technical sheets… we need all certificates and analysis, and all documents for import”. So provide documentation, as it gives you an advantage when trying to establish yourself on the European market, based on which you can develop long-lasting trading relationships with buyers. Additionally, doing so makes you look organised and well prepared for business.

European buyers of hibiscus for health products usually expect exporters to provide them with a Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA). Table 1 shows what is contained in the SDS, TDS and CoA, to help you prepare these three pieces of documentation.

Table 1: What is contained in the Safety Data Sheet (SDS), Technical Data Sheet (TDS) and Certificate of Analysis (CoA)

| Safety Data Sheet (SDS) | Technical Data Sheet (TDS) | Certificate of Analysis (CoA) that matches |

| Product description | Product description | Data mentioned in the TDS |

| Product classification | Product classification | Pre-shipment samples approved by buyer |

| Hazard identification | Quality analysis | Contractual agreements with buyer |

| Information on safety measures | Information on applications | |

| Certificates |

Ensure you have a well-prepared SDS, TDS and CoA respectively for your hibiscus and have them ready for European buyers. Additionally, when approaching buyers, inform them of any documentation you have.

Tips:

- Ensure your documentation is up to date and always readily available, as European buyers expect this.

- Review examples of technical documentation for hibiscus, such as Technical Data Sheet (TDS).

What additional requirements do buyers often have?

Quality requirements

Quality is important to European buyers of hibiscus. According to one buyer, “ultimately really it comes back to quality… quality, quality, quality… we need to be convinced that this partner is able to provide the quality”.

Quality requirements will vary according to buyer. One buyer stated “there is a whole range of things” concerning quality requirements they have. Quality requirements can cover the colour, taste, impurity count and moisture content. Speak to European buyers to find out their specific requirements, and try your utmost to meet them.

Buyers expect hibiscus not to be contaminated. This is because contaminated hibiscus suggests poor quality and lack of compliance with compulsory regulations. European buyers interviewed for this study have informed us that they pay particularly close attention to heavy metals, pesticides and microbiological contamination. Contamination by other foreign matter also suggests poor quality. For example, one buyer stated, “there cannot be any sand which arises from desert countries”.

To verify quality at origin, the Sudanese Standards and Metrology Organization developed standards and measurements for hibiscus, which Sundanese exporters of hibiscus should meet.

Buyers expect well-structured company and product documentation, as it gives them proof that your hibiscus meets their specifications and is of high quality. For example, a good quality analysis contained in a Technical Data Sheet and Certificate of Analysis can prove that your hibiscus is of high quality. One buyer stated: “if the analysis of the supplier is not good, we are not even going to bother… but if the supplier already has a good analysis, then we are interested”. So provide buyers with documentation proving quality.

Before deciding whether to do business with you, European buyers usually require samples to see if your product meets their requirements and to ensure it is not adulterated or contaminated. You should therefore always send buyers high-quality samples that can be consistently delivered, as that is likely to increase your chances of entering the European market.

European buyers routinely test products they buy, usually on a per-batch basis, to ensure that products meet their quality requirements and are not adulterated or contaminated. For example, when asked whether they test their hibiscus every time they receive it one buyer stated, “yeah sure, when we receive it, we do test and analysis in a laboratory”. And another buyer stated “sure, yes, every batch”.

So always ensure that all products you send to your buyers meet their quality requirements and are not adulterated or contaminated. If you fail to do so, buyers will probably reject the product they ordered, you will bear the financial consequences, and your business relationship with them will probably end.

The importance of quality is likely to increase in the health products sector in the coming years. Quality is very important to European health product manufacturers, who want to ensure they meet consumers’ needs.

Tip:

- Only agree to specific requirements of European buyers if you can meet those requirements, because failing to do so could end your business relationship with them.

Quality management standards

European buyers of natural ingredients for health products increasingly use quality management standards when assessing the credibility of prospective exporters. Adopting quality management standards has several advantages; it gives your company credibility, as it shows your commitment to delivering high-quality products, and it boosts your image. It also helps to prove that you comply with mandatory requirements.

So consider adopting quality management standards, as this will help you to enter the European market. Examples include:

- International Organization for Standardization (ISO) 2200 food safety management system certification;

- ISO 9001:2015 quality management systems certification;

- Food Safety System Certification (FSSC) 2220; and

- Compliance with Hazard Analysis and Critical Control Points (HAACP).

- British Retail Consortium Global Standard for Food Safety (BRCGS) certification.

Figure 1: Examples of certification and standards

Source: Various

Tips:

- Let European buyers know if you have certifications they seek, as that increases your appeal.

- Display certifications sought by buyers on your website and marketing materials. That will give you an advantage when seeking to enter the European market. An example of a company in a developing country that does this is United for Import & Export.

Labelling and packaging requirements

To export your hibiscus to the European market you must comply with the following labelling requirements:

- The name, address and telephone number of supplier

- Product name

- Batch code

- Country of origin or place of provenance

- Date of manufacture

- Best-before date

- Weight

- Storage conditions or conditions of use

For organic hibiscus, you must include the name and/or code of the inspection body and the certification number.

European buyers demand hibiscus of the highest quality. If you fail to package your product correctly, its quality will probably decline. This may lead to buyers rejecting the product they ordered, and negative financial consequences for you, and it could also end your business relationship with them. So consider preserving the quality of your hibiscus by using appropriate packaging materials and complying with general requirements. This includes taking the following steps:

- Use packaging materials that do not react with your hibiscus. Because if you use packaging materials that are reactive to your hibiscus, its quality will decline.

- Use clean packaging materials. Because if you use packaging materials that are contaminated, with bacteria for example, your hibiscus will probably also be contaminated and its quality will then decline.

- Ensure hibiscus is stored in cool, dry conditions away from direct sunlight.

- Ensure that certified organic hibiscus is physically separated from conventional hibiscus to prevent contamination.

Packaging requirements often differ from buyer to buyer. For example, one buyer revealed that for them it is “important that we do not have more than 25 kilograms in a bag”. Another buyer stated hibiscus in “20 kilo bags with woven plastic material” are their specific packaging requirements. So speak to European buyers to find out their specific requirements and consider meeting those requirements.

Hibiscus of a consistently high quality is important to European buyers, as it is key to the manufacturing of natural health products. Buyers therefore prefer a high-quality product across all orders in suitable packaging as per order volumes. For example, in a polypropylene woven fabric material bag that can hold 25 kilograms for an order of that size.

The European Union is committed to environmental sustainability and sustainable growth, something it has made clear in its Circular Economy Action Plan and the European Green Deal. It has set key priorities, such as reducing waste and increasing recyclability.

The EU is therefore putting increasing pressure on European businesses to reduce their waste and increase recyclability through targets and policies. So environmental sustainability is becoming more important to European buyers – a trend that is expected to continue. You should therefore consider using recycled and/or recyclable packaging materials.

Figure 2: Examples of packaging

Source: Various

Tips:

- Check the section on labelling and packaging guidelines in Access2Markets for further information about labelling requirements. The information is presented under ‘product requirements’.

- Only agree to meet specific packaging requirements of European buyers if you can meet them. Failing to do so could end your business relationship with them.

- Consider using recycled and/or recyclable packaging materials, as environmental sustainability is becoming increasingly important to European buyers. Read the guide on packaging to reduce environmental impacts for information and guidance on ways to do this.

Payment terms

Payment is central to all trade and it presents risks to everyone involved. Before trading with European buyers, do risk assessments of the available payment terms. As an exporter of hibiscus, try and minimise your risks while working to meet the needs of European buyers.

There are several methods of payment. However, for both importers and exporters, Letters of Credit (LC) are considered the safest payment term. This is because an LC lets both parties contact a neutral arbitrator, usually a bank, to resolve any issues. For the exporter, the chosen bank is a guarantor of full payment as long as goods have been dispatched. In such instances, to avoid further losses, exporters should find new buyers and pay for the return of dispatched goods.

Based upon their needs, importers and exporters can choose from several LC payment terms. These include standby, revocable, irrevocable, revolving, transferable, un-transferable, back to back, red clause, green clause and export/import. For exporters, standby LC is considered the safest, with it being frequently used in international trade. This is because it provides security to both importers and exporters who have little trading experience with each other. Other payment terms include cash in advance, documentary collections and open account.

Tips:

- Minimise your risks by assessing the credibility of buyers and choosing the most suitable payment terms for you while working to meet the needs of European buyers.

- See the CBI study on organising your export of natural ingredients for health products to Europe, which provides guidance on available payment terms used in the sector.

Delivery terms

When agreeing delivery terms with European buyers, you must carefully consider three important factors: delivery time, volume and cost. Failure to meet agreed delivery terms could result in the end of your trading relationship with European buyers.

- Delivery time - European buyers prefer shorter delivery times. Air cargo is usually faster than sea freight. Air freight is also more reliable in terms of on time delivery. Please note that the global COVID-19 pandemic has generally increased delivery times.

- Delivery volume/quantity of order – Larger quantities are often cheaper to ship by sea. With lower volumes, air freight can be less expensive, as margins get smaller.

- Cost of delivery method - It is estimated that sea freight is usually 4-6 times cheaper than air freight. This applies to larger volumes. It is not likely that the price of your cargo will increase substantially if you increase the volume. Please note that the cost of air freight has increased due to the COVID-19 pandemic, although this is likely to change once passenger flights are fully operational again.

The global COVID-19 pandemic has created logistical challenges for exporters in developing countries. Delays and higher transport costs as well as shortages are key challenges exporters face. For example, a European importer of hibiscus commented that “the problem is for the import itself, delivery time is very long”. Another buyer stated, “we have shortages… mainly caused by missing containers and less freight options”.

Challenges for exporters are expected to continue for the foreseeable future as different states and governments around the world tackle COVID-19 with various measures.

Tips:

- Keep in mind the three important factors of delivery time, volume and cost when determining which delivery terms are the most suitable for your business. Remember there will be tensions and trade-offs, particularly when you are doing business for the first time with a European buyer.

- Visit the Freightos website to use the Freightos freight calculator to get international freight rate price information for transporting freight by ship and air. Doing so will allow you to make a more informed decision before agreeing delivery terms with buyers.

- Speak to your logistics provider about the implications of COVID-19 before you agree delivery terms with European buyers. This is because delivery times could be longer due to lockdown and quarantine measures.

- See the CBI study on tips for organising your export of natural ingredients for health products to Europe, which provides guidance on delivery terms used in the sector.

What are the requirements for niche markets?

Organic ingredients

Across Europe there is growing consumer demand for organic products, a trend expected to continue. Many buyers are therefore demanding organic ingredients for their natural health products. For example, when asked about the need for organic certification, a European buyer of hibiscus replied that “I think these kinds of products, you can only sell with an organic certification… I think it is a basic requirement at this point”.

So as an exporter of hibiscus, consider getting organic certification, as it will increase your chances of entering the European market. To market your natural ingredients as organic on the European market, you must meet European Union regulations. You can find information on EU organic certification on the IFOAM website. Several certification agencies can help you with the conversion process to organic production.

Once certified, many buyers will request a Certification of Inspection (COI). If you don’t have a COI, you cannot trade your hibiscus as organic. Although the UK left the European Union in January 2021, the EU has agreed to recognise the UK as equivalent for organics until 31 December 2023. Demand for certified ingredients for health products on the European market is expected to continue growing in the future.

Figure 3: EU organic logo

Source: ec.europa.eu

Tips:

- Consider converting to organic production methods and getting certification because of growing demand for organic health products.

- Ensure your organic documentation is up-to-date with changes made by the EU. This is because being up-to-date with changes is a mandatory requirement if you want to trade organic hibiscus on the European market.

- Inform prospective buyers if you already have a COI. You should also display it and the organic certification logo on your company website and marketing materials. This will make your company more appealing to buyers. United for Import & Export is an example of a company in a developing country doing this.

- Consult the ITC Sustainability Map for a full overview of certification schemes used in this sector.

Meeting environmental and social standards

In recent years, there is growing consumer awareness and demand for environmentally friendly products, and this trend is set to continue. This is encouraging European buyers seek ethically sourced ingredients, something that is likely to become more important in the future. European buyers of hibiscus are therefore requesting suppliers meet environmental and social standards. Regarding social standards, when asked if Fairtrade certification is important, a European buyer with forty years of industry experience answered “yes”.

As an exporter, one way you can do this is by gaining certifications that prove you meet environmental and social standards. With regard to environmental sustainability, consider meeting UNCTAD BioTrade Initiative and implement the BioTrade Principles, alongside FairWild Standards. To prove you meet social standards, acquire FLO Fairtrade certification or meet FairForLife standards. However, for small-scale producers meeting environmental and social standards is often too costly. You should therefore consider if there is a business case for certification.

Figure 4: Logos of fairtrade certifications

Source: Various

Tips:

- Acquire certifications that prove your hibiscus for health products meets environmental and social standards. Doing so will help you find opportunities in the European market.

- Inform prospective buyers about certification you have proving that you meet environmental and social standards and display this on your company website and marketing materials. This will make you more appealing to European buyers. United for Import & Export is an example of company in a developing country doing this.

- Consider if there is a business case for your hibiscus to meet environmental and social standards, particularly when demand for natural ingredients is predicted to increase over the coming years.

2. Through what channels can you get hibiscus on the European market?

The commercial production of hibiscus takes place in several countries around the world, including China, Thailand, Sudan, Egypt, Nigeria and India. In the European market, hibiscus is used in the food industry, natural health products industry, and cosmetics industry.

How is the end-market segmented?

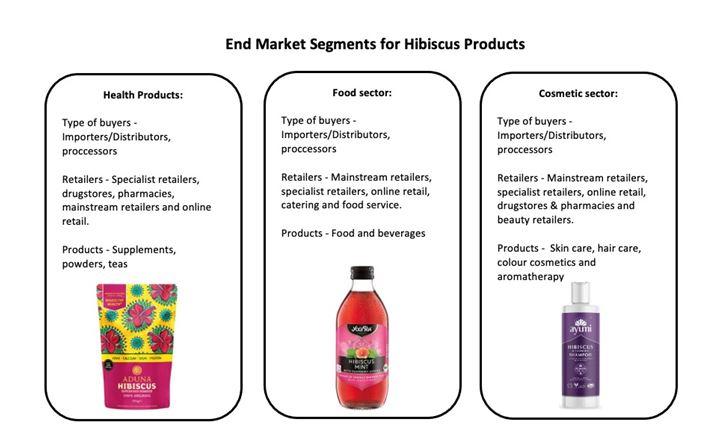

The European market for hibiscus can be segmented by end-user markets: health products, foods, and cosmetic products. Figure 5 gives examples of hibiscus products in the European market by end-user segments.

Figure 5: Examples of hibiscus products in the European market

Source: Various

Health products industry

According to Grand View Research, the global hibiscus flower powder market size was estimated at USD 113.3 million in 2019. It is forecast that the market will grow at a compound annual growth rate of 7.2 percent from 2020 to 2027. Over this period, the organic segment is expected to grow the fastest.

Hibiscus is used in health products because of its nutritional qualities. Hibiscus has a high content of vitamin C and iron, and is also a good source of calcium, fibre and plant protein. Hibiscus also has a range of active properties, including a good source of antioxidants and having the ability to enhance the immune system, reduce fatigue and high blood pressure, as well as supporting gut health. Aduna is a European company selling hibiscus powder on of its nutritional benefits.

As an exporter of hibiscus in a developing country, you must provide European buyers with a product of the highest quality, as this is essential to the manufacturing of natural health products. You must therefore ensure your hibiscus in not contaminated because contaminated hibiscus suggests poor quality. European buyers interviewed for this study informed us that they pay particularly close attention to heavy metals, pesticides and microbiological contamination, as well as contamination by other foreign matter.

Speak to buyers to find out if they have specific requirements concerning hibiscus nutritional qualities and consider meeting those requirements. Organic hibiscus is becoming popular in the European health products market, something confirmed by buyers interviewed for this study, so consider acquiring organic certification. Information on acquiring organic certification can be found below ‘What are the requirements for niche markets’ under the ‘organic ingredients’ section of this study.

Food industry

Hibiscus is used by the food industry as a colourant and for its flavour and texture. It is added to a wide range of food and beverage products, ranging from juice, jam, sauces, puddings, and cocktails.

Cosmetic industry

Hibiscus is used by the cosmetic industry for its anti-ageing, antioxidant and moisturising properties. It is also used as a colourant and for its scent.

This study focuses on hibiscus used in the natural health products sector.

Tips:

- Familiarise yourself with hibiscus’ nutritional profile and the beneficial health properties it offers to the health product industry. Learning this is important because these are two of hibiscus’ key selling points; prospective European buyers often ask questions about this.

- See the CBI study on which trends offer opportunities or pose threats in the European natural ingredients for health products market. This study gives useful information about the European health products market, as well as information to increase your chances of market access.

- Visit trade fairs to see if the industry is receptive to your product, get market information, and find potential buyers. Trade fairs will also give you the chance to speak to end-users and distributors, and to gauge your competition, especially the way they are marketing their products. See the CBI study on tips for finding buyers in the natural ingredients for health products sector for an overview of trade fairs in this sector.

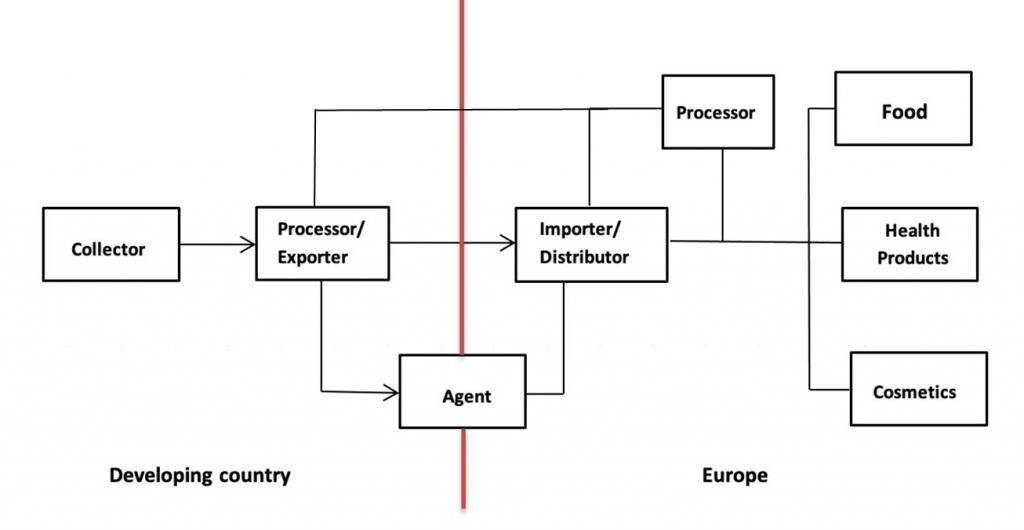

Through what channels does hibiscus end up on the end-market?

Figure 6 shows the export value chain for hibiscus on its journey to reach the European market. Hibiscus enters the European market as flowers, in a powdered and/or liquid form.

European Processors

European processors often source hibiscus directly from developing countries, as it provides them with greater control over product quality. Processors can also source their hibiscus from importers.

Importer/Distributor

The majority of hibiscus is imported into the European market by importers. European importers/distributors often travel to developing countries to personally meet their suppliers of hibiscus when assessing their credibility as potential trading partners.

Indeed, one European buyer of hibiscus stated: “we work very closely with our partners and our producers, we will try to get a personal feel of themselves… at the very least we go and inspect the partner personally, so there is always a personal visit on site that happens… we always want to go directly to the producer”.

The German company E.H. Worlée & Co. is an important importer/distributor of hibiscus in Europe. It deals with conventional, organic and fairtrade hibiscus. Other importers/distributors of hibiscus in the European market include Africrops, Organic Herb Trading Company and Tradin Organic. Import volumes in this channel range from tens of kilogram to hundreds of tonnes.

Agent

An export agent is a firm or an individual that undertakes most of the exporting activities on behalf of an exporter, usually for a commission. Agents can be found in developing countries, as well as in Europe; however it is not that common for companies to use agents in the European market. As an exporter from a developing country, you can work with agents who represent and act on your behalf on the European market.

Figure 6: Export value chain hibiscus

Source: Ecovia Intelligence

Tips:

- Be prepared to send high-quality samples to prospective buyers, who will test them when assessing whether you are a credible exporter of hibiscus. Doing so will increase your appeal and therefore give you an advantage when it comes to entering the European market. This is because buyers of hibiscus for health products require high-quality hibiscus.

- Consider expanding your hibiscus product range by including organic hibiscus as this will help you find a wider range of customers as some importer/distributors only import organic products. There are other benefits of having a wider product range, such as giving you more attention on the market, thus making you stand out from your competitors.

- Be prepared to meet prospective buyers who are interested in directly sourcing hibiscus from you if you are able to supply large volumes.

What is the most interesting channel for you?

As an exporter of hibiscus in a developing country, importers/distributors are the most interesting channel for you. This is because importers/distributors have expertise importing and distributing hibiscus in the European market. They also have a good understanding of the European health products market and a wide range of customers. Importers of hibiscus in Europe also have storage facilities and an established logistics network. This can be very helpful to small and medium-sized exporters of hibiscus in developing countries who are just starting to export to Europe.

Importers/distributors usually focus on requirements such as the minimum volume requirements, speedy delivery and quality of products. It is important to note that you may be required to supply larger volumes, which may be difficult if you are a small to medium-sized enterprise. Examples of importers/distributors include Africrops, E.H. Worlée & Co., Organic Herb Trading Company and Tradin Organic.

Tips:

- See the CBI study on tips for finding buyers in the natural ingredients for health products sector for an overview of trade fairs in this sector. This study provides guidance on how you can find buyers for the channel you are targeting.

- Visit trade shows to connect with European buyers. You can use this opportunity to get contact details and network with buyers that source hibiscus. Examples include Vitafoods, Nutraceuticals Europe, and Health Ingredients Europe.

3. What competition do you face on the European hibiscus market?

What countries are you competing with?

China, Thailand, Sudan, Egypt, Nigeria and India are important producers of hibiscus. Key strengths shared by these countries include them having an established hibiscus production industry and them having the ideal climatic conditions for harvesting and cultivating hibiscus.

China

China is one of the leading producers of hibiscus in the world. The country has an established commercial hibiscus production industry with several companies operating there, which is one of its key strengths. This is important to European buyers requiring larger volumes and continuity of supply. It could therefore become easier for Chinese producers to export hibiscus to the European market.

However, according to industry sources, Chinese hibiscus is viewed as being less reliable and reputable because of lower quality control practices. This is a key challenge facing Chinese producers, as buyers may choose to source hibiscus from other countries that are able to supply higher quality products.

Thailand

Thailand is another leading producer of hibiscus, with it controlling much of global supply. Thailand has been investing heavily is hibiscus production, which is generating superior product quality. This is important to European buyers seeking a quality product and those requiring larger volumes and continuity of supply.

However, Thailand’s humid climate can be a challenge for hibiscus producers as it can affect production and product quality. Thailand is a member of the regional trading bloc ASEAN. A recent study found 99% of EU business community members are either looking to expand or maintain their current level of trade and investment within ASEAN. This suggests European companies perceive Thailand favourably.

Sudan

Sudan is another leading producer of hibiscus. Sudan has a long history of cultivating hibiscus and an established commercial hibiscus production industry. Sudan is known for producing good quality hibiscus. This is one of Sudan’s key strengths, because good product quality is important to European buyers. However, production volumes are low. Buyers may require large volumes and continuity of supply can lead to a low perception of Sudan compared to other countries.

European buyers generally perceive Sudan favourably. For example when asked how they view Sudanese exporters of hibiscus one buyer interviewed for this study answered “very positively” because with “Sudanese hibiscus we found it had the best flavour”. Other buyers also perceive Sudan favourably with reasons given for this including being able to provide a good quality product, as well as being reliable and responsible.

Egypt

With a long history of cultivation, Egypt is an important supplier of hibiscus. Hibiscus cultivation is well suited for the Egyptian environment because it can be cultivated in dry areas and does not require large amounts of water. In recent years, the Egyptian government has been developing the country’s agricultural sector through heavy capital investment and land reform schemes. These are some of Egypt’s key strengths.

European buyers generally perceive Egypt positively. Indeed, when one buyer was asked how they view exporters of hibiscus from Egypt they answered “positively”. When asked about their experiences of importing hibiscus from Egypt another buyer stated: “from Egypt, it is good… because it is a good quality”.

Nigeria

Nigeria is an important producer of hibiscus. Nigeria is well-suited to hibiscus production, with it growing in parts of the country all-year round, and with some states cultivating it in large quantities. The Nigerian Export Promotion Council is developing Nigeria’s hibiscus industry, for example by providing 5,000 farmers with improved hibiscus seeds. These are some of Nigeria’s key strengths.

However, challenges facing the Nigerian hibiscus industry include concerns over product quality, fungal and bacterial disease and a lack of infrastructure. In the past there have been quality issues with Nigerian hibiscus. However, European buyers interviewed for this study view Nigeria positively with them reporting positive experiences of importing from Nigeria. For example, when asked how they perceive Nigerian exporters of hibiscus one buyer answered: “I think a lot of them are reliable and responsible, and have good quality”.

India

India is a major hibiscus growing country due to its warm temperate, subtropical and tropical regions. India’s strengths include government policies, low costs, along with the development of rural areas. It could therefore become easier for Indian producers to export hibiscus to the European market.

However, a lack of knowledge amongst farmers and outdated technology are challenges facing the Indian hibiscus industry. European buyers have a favourable perception of India because English is widely spoken there and because of the reliability of Indian exporters.

Tips:

- Find out if your country has programmes helping exporters like you cultivate hibiscus, as well as helping with export. You can do this by contacting government ministries of trade in your country, because they are likely to have information about this along with providing assistance helping you export your hibiscus.

- Find out if there are trade associations in your country, and if there are, consider joining trade associations in your country who could help you export hibiscus. For example, the Association of Hibiscus Flower Exporters Nigeria is an association that promotes and organises the export of hibiscus from Nigeria.

- Position yourself against competing countries. For example, producers in countries offering higher quality hibiscus compared to countries where there have been quality concerns should inform European buyers about this. This is because doing so makes them more appealing to buyers.

What companies are you competing with?

Many established companies export hibiscus to the European market. These companies market themselves as being able to deliver high quality hibiscus that meets common European buyer requirements, as well as requirements for niche markets. Thus, these companies look reputable and have credibility in the European market.

A professional website with well-prepared content is something established companies have. The two example companies in this section both have this. Their websites will include sections informing prospective buyers about the companies themselves, technical details of its products, as well as the certifications they hold, accompanied by professionally taken photographs. As a result, European buyers look positively at these companies.

Egyptian companies

United for Import & Export is an established company exporting hibiscus to the European market. One of its key strengths is its commitment to exporting high-quality hibiscus through its strict quality management system, with it having ISO 2200 food safety management system certification. Another of its key strengths is its ability to export high-quality European Union organic certified hibiscus. Its commitment to upholding social standards, as verified by Fairtrade certification, is another of the company’s key strengths.

Indian companies

Marudhar Impex is an established company exporting hibiscus powder to the European market. The company exports high-quality hibiscus powder, which it proves through the ISO 2200 food safety management system certification it holds. It also conforms to World Health Organisation Good Manufacturing Practices, which it proves through the certification it holds. These are two of Marudhar Impex’s key strengths. The company’s ability to export high-quality European Union certified organic hibiscus powder is another of its key strengths.

Tips:

- Consider acquiring certification that proves the high quality of your hibiscus. For example, having ISO 2200 food safety management system certification and Good Manufacturing Practice certification.

- Consider acquiring certification that proves you meet and uphold organic and social standards. For example, European Union (EU) Organic and Fairtrade certification.

- Ensure that you have an online presence and that your website is up-to-date. This is because European buyers frequently use the internet to find and assess exporters of hibiscus for natural health products before doing business with them.

What products are you competing with?

Moringa

Moringa is a competing product to hibiscus. The moringa plant is native to regions of northern India and Pakistan. India is the world’s largest supplier of moringa. However, European importers have strong quality concerns about Indian supplies, which is a major weakness. Moringa plants can be found across tropical zones in Africa, Asia, islands in the Pacific and the Caribbean, and South America, and it is cultivated in many areas of the world too.

Moringa is becoming increasingly popular in the European market for food supplements because of its wide range of health benefits, which is a key strength. Health benefits of moringa include it being an excellent source of vitamins and minerals and rich in antioxidants. Moringa is also sold in a powdered form, which usually has a lower wholesale price (FOB) than hibiscus. Although the European market for moringa remains underdeveloped, the European food supplement market is expected to continue to grow in the coming years. Moringa could therefore potentially be a greater threat to hibiscus in the future.

Figure 7: Moringa

Source: Rostovtsevayu / Shutterstock.com

Matcha

Matcha is popularly consumed as an herbal tea throughout the world because of its health benefits, as it contains high levels of antioxidants and boosts brain function. Matcha is well-established in the European market. Since hibiscus is known to most European consumers as a form of tea, it is sometimes called the “next matcha tea”. This is due to its high antioxidant content. Matcha presents a threat to hibiscus because of its nutritional properties and pleasant colour.

Baobab

Baobab comes mainly from the African continent. Baobab is high in vitamin C, phosphorus, calcium, fibre, carbohydrates, protein, potassium and lipids. It is usually marketed as a powder, which is made of baobab fruit. Baobab has anti-malarial, anti-inflammatory, antioxidant and anti-microbial properties. Baobab is becoming increasingly popular in the European food supplements and functional food market because of its beneficial properties. However, baobab powder has a higher wholesale price (FOB) than hibiscus.

Hibiscus also comes from tropical countries, including some in Africa. It has a high vitamin C content and it is known to enhance immune system, reduce fatigue and support gut health. It is considered to be a source of calcium, iron, fibre and plant protein. Hibiscus is also sold in a form of powder and can be added to meals, smoothies, cereals and drinks. Baobab poses a threat to hibiscus because of its similar nutritional properties and health benefits, as well as its growing popularity in Europe.

Figure 8: Baobab

Source: pxhere

What are the prices for hibiscus on the European market?

The prices of hibiscus have been more or less stable in the last few years. The market price of hibiscus petals is around EUR 7-8 per kilogram (FOB). Organic hibiscus is sold at about EUR 10 per kilogram (FOB). The COVID-19 pandemic in 2020 interrupted the distribution and supply networks of hibiscus. However, this has not had any substantial effect on the market price of hibiscus.

Tips:

- Be flexible with prices when buyers request large volumes. You can offer them a discount once you establish a relationship with them.

- Certification schemes allow you to charge a premium for your hibiscus. Ensure you can justify your price with relevant certifications.

This study was carried out on behalf of CBI by Ecovia Intelligence.

Please review our market information disclaimer.

Search

Enter search terms to find market research