Entering the European market for natural ingredients for stress & anxiety products in Europe

You need to comply with strict EU requirements to enter the European market for natural stress and anxiety product ingredients. The market contains several product categories, such as food supplements, herbal medicinal products, herbal teas and aromatherapy. Each has specific regulatory requirements. This makes it crucial to understand your market and your buyer’s requirements. Importers and distributors are usually the primary entry point.

Contents of this page

- What requirements and certifications must natural ingredients for Stress & Anxiety products meet to be allowed on the European market?

- Through which channels can you get natural ingredients for Stress & Anxiety products on the European market?

- What competition do you face on the European market for natural ingredients for Stress & Anxiety products?

- What are the prices of natural ingredients for Stress & Anxiety products in the European market?

1. What requirements and certifications must natural ingredients for Stress & Anxiety products meet to be allowed on the European market?

You can only export natural ingredients to European Union (EU) members if you comply with the EU’s strict requirements. For a full overview of these standards, refer to our study on buyer requirements for natural ingredients for health products or read the specific requirements for your product in Access2Markets by the European Commission.

Buyer requirements can be divided into:

- Mandatory requirements: legal requirements you have to meet to enter the market.

- Additional requirements: requirements you need to comply with to stay relevant.

- Niche requirements: requirements that apply to specific niche markets.

What are mandatory requirements?

Natural ingredients must be safe for human consumption when they enter the European market. This is why legal requirements are mainly about food safety, food hygiene and traceability. Food safety can be compromised by poor water quality, low fertiliser quality and overall poor cultivation management. You need to avoid specific sources of contamination, namely:

- Pesticides: consult the EU pesticide database for an overview of the maximum residue levels (MRLs) for each pesticide.

- Contaminants in food and microbiological contamination. Regulation (EU) 2023/915 sets maximum levels for certain contaminants in food, including mycotoxins, metals and processing contaminants. Regulation (EC) No 2073/2005 sets out food safety criteria for microbiological contaminants, such as Salmonella.

- The use of extraction solvents for foodstuffs and food ingredients is regulated by Directive 2009/32/EC. Annex I contains a list of the authorised extraction solvents for use in food and the conditions of use. For example, sulphur dioxide extraction is not authorised. Remember that extraction processes can amplify even minimal pesticide residues in your product. This means it is important to carefully monitor your laboratory tests to ensure you meet the MRLs.

For food supplements and herbal medicine ingredients, you need to comply with the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES). CITES regulates trade in and provides guidance on species for which trade is prohibited or restricted. CITES provides an overview of the plant and animal species that you cannot export or import (Appendix I) or where export and import is restricted (Appendix II).

You also need to determine whether the Nagoya Protocol of the Convention on Biological Diversity (CBD) applies and, if so, how. This protocol aims to make sure the benefits of genetic resources and traditional knowledge are shared fairly. It provides guidelines for accessing and using genetic resources and traditional knowledge in Access and Benefit Sharing (ABS) agreements.

Food supplements

If your natural ingredients are used in food supplements, you have to follow EU food supplement laws. These laws set requirements for the composition and labelling of supplements.

If your ingredient is considered a novel food, the Novel Food Regulation is also important. This regulation mandates that the safety of ingredients that were not consumed within the EU before 15 May 1997 must be assured. To determine whether your botanical qualifies as a novel food, consult the Novel Food Catalogue based on the Union List and ask experts to verify its historical use in the EU.

Note that national positive lists for botanicals determine whether your ingredient is already allowed in food supplements. Examples of positive lists include the BELFRIT (Belgium, France and Italy) and Germany lists. Annex III of Regulation 1925/2006 determines whether your product has been prohibited, restricted or is under scrutiny for use in the European Union.

Herbal medicine

If you target the herbal medicine market, you need to understand whether your ingredient is allowed on the market. This is because you cannot sell ingredients for herbal medicinal products if they are not officially accepted. The European Medicines Agency (EMA) is responsible for the testing, supervision and monitoring of the safety of medicines in EU Member States. The EMA has developed standards for the most commonly used and accepted ingredients for herbal medicinal products. These standards are called EU herbal monographs.

You can only export natural ingredients for herbal medicinal products if you follow European Union laws (Directive 2004/24/EC). You also need to meet the detailed quality, documentation, labelling, packaging, certification and tracking standards set in the rules that govern medicinal products in the EU.

If your ingredient is new to the European market, it should be registered as a ‘Traditional Herbal Medicinal Product’ (THMPD). Under Directive 2004/24/EC, the EU offers a simplified registration procedure for herbal substances and preparations that have long traditions of safe medicinal use in Europe.

Your ingredients also need to follow Good Agriculture and Collection Practices (GACP) for raw plant materials and Good Manufacturing Practices (GMP) if you supply active substances that are used as starting materials for medicinal products. GACP and GMP ensure that medicinal products meet all the identity, quality, effectiveness and safety requirements for medicinal-grade ingredients.

What additional requirements and certifications do buyers often have?

Buyers need proof of your product’s safety and that it meets the quality and sustainability requirements before they buy from you. If European companies or authorities find out that the safety of your product cannot be guaranteed, they will take the product off the market.

Quality requirements and documentation

Buyer specifications establish active ingredient content, moisture content, maximum residue levels, nutritional profile and composition. To show that you meet specifications, buyers need well-structured company and product information, including detailed technical data sheets. Buyers will also usually request a Certificate of Analysis to verify that your product meets their quality requirements.

To show that you meet buyers’ specifications, you need to develop well-structured company and product information. This means you should have the following documentation:

- Technical Data Sheet – TDS (e.g. Ashwagandha powder TDS)

- Certificates of analysis – CoA (e.g. Lemon balm oil CoA)

- Safety data sheet – SDS (e.g. Rhodiola rosea tincture SDS)

- GMO certificate (if requested – e.g. GM declaration on this ashwagandha root powder product specification)

- Certificate of origin (see this example)

Be aware that European buyers regularly test products they buy, usually on a per batch basis. They do this to ensure that products meet quality requirements and are not adulterated or contaminated. They will also test the samples that new suppliers provide. Many European buyers will lose interest if a new supplier delivers low-quality products. You have one chance to convince these buyers of your company and product. To keep the client, you need to supply this quality consistently. To minimise variations in quality, you could develop Standard Operating Procedures (SOPs), which include instructions on how to conduct specific activities in production.

Food safety management

In addition to the required HACCP standard, European food industries increasingly want suppliers to follow more complete food safety standards and food safety management systems. ISO 9001:2015 is an industry standard that sets out the expectations for quality management systems.

Examples of food safety management systems include ISO 22000, FSSC22000, IFS and BRCGS.

Sustainable practices

EU legislation is putting more and more pressure on European buyers to ensure their supply chains are transparent and traceable. This means buyers often look for transparent supply chains when selecting product suppliers. Buyers want guarantees that the products they buy match the product specifications and can be traced back to their source.

Buyers expect suppliers to provide them with all the necessary information. For exporters, this means it is important to have information on production and labour practices, as well as environmental issues. Implementing an environmental management system, such as ISO 14001, will help you improve environmental sustainability by improving resource use and reducing waste.

Labelling requirements

To export your ingredients to the European market, you have to comply with the following labelling requirements:

- Name, address and phone number of exporter

- Product name and identification, including Chemical Abstracts Service (CAS) number

- Batch code

- Place of origin

- Date of manufacture

- Best before date

- Net weight

- Recommended storage conditions

- Hazardous symbols (if applicable)

If you supply organic ingredients, your label needs to include the name and code of the inspection body, and certification number. Label your products in English unless your buyer wants you to use a different language.

Packaging requirements

Packaging must be safe for consumer health and the environment. Specific packaging requirements may differ per buyer and per product. Your packaging needs to maintain product quality and prevent contamination. There are some general requirements you will have to consider. These include:

- Always ask your buyer for their specific packaging requirements.

- Reuse or recycle packaging materials so you can meet the European Green Deal’s requirements. For example, use bags or containers of recyclable material, such as kraft paper for powders and metal for extracts.

- If you produce powdered ingredients, package them in waterproof materials. For example, use paper bags lined with plastic. Preferably use an eco-friendly lining (e.g. bio-degradable or recyclable lining).

- In the case of extracts, use containers made using a material that does not react with components of the extract (e.g. lacquered or lined steel, stainless steel or aluminium).

- Clean and dry the containers before filling them with ingredients to prevent contamination.

- Store bags or containers in a dry, cool place to prevent the quality deteriorating.

- If you offer organic ingredients, physically separate them from products that are not certified.

What are the requirements for niche markets?

Verifying and certifying sustainable production represents being able to sell to a niche market, which can add value to your product.

- Organic production: Organic certification acts as a quality control system and can help improve your quality and traceability. Regulation (EC) 2018/848 sets down the rules for organic production and labelling in Europe. Refer to this list of recognised control bodies and control authorities issued by the EU to ensure that you work with officially recognised accredited certifiers.

- Verification and/or certification of sustainable production: This includes standards for environmental sustainability like UNCTAD BioTrade Initiative and FairWild. Examples of social sustainability include Fairtrade International, Fair for Life and Union for Ethical BioTrade.

- Implementing rules based on ISO 26000 guidance on social responsibility.

- Implementing an environmental management system based on ISO 14001.

Figure 1: Examples of certification standards for sustainable production

Source: various certification standards

Tips:

- Standardise and minimise significant variations in your product quality. Develop Standard Operating Procedures (SOPs) and train farm and processing staff. Always match these activities to your buyer’s requirements. Use incentives to ensure that your actions are in keeping with your harvesting and post-harvest process specifications. It is important to monitor these practices to maintain product quality throughout the harvest and post-harvest stages.

- Ensure that you can get enough return on your investments when improving quality. Carry out quality improvements according to your buyer’s specifications. Explore what they are willing to pay for.

- Consider working with a university to test your product’s properties. They can help determine your product’s nutritional content and composition, which should be included in your product documentation.

2. Through which channels can you get natural ingredients for Stress & Anxiety products on the European market?

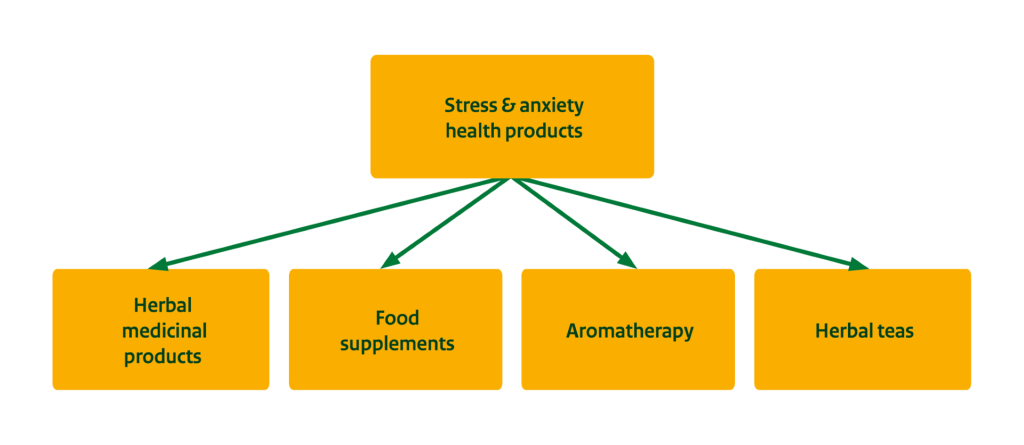

Importers and distributors are probably your primary entry point. They handle a wide range of ingredients and ensure compliance with European standards. They often serve as intermediaries between processors and end-product manufacturers. Stress and anxiety products span several categories, including food supplements, herbal medicinal products, herbal teas and aromatherapy. Each has its own regulatory requirements.

How is the end market segmented?

The end market for natural ingredients for health products can be segmented into two main segments: 1) Herbal medicine and 2) Food supplements. Knowing your segment is important as there are big differences in legislation, quality parameters and certification requirements.

- Herbal medicinal products: Innovation and new product introductions in Europe are quite limited in this segment. Key products like valerian and chamomile have a long history of use and consumer trust. Due to legislative hurdles and established supplier-buyer relationships in the market, it is challenging for new botanicals to compete. Examples of herbal medicine product manufacturers in Europe include Salus Haus, Schwabe (Germany) and Tilman (Belgium).

- Food supplements: Supplements often contain lower concentrations of the same active ingredients used in herbal medicinal products. They are also aimed at milder stress and anxiety conditions. Almost all supplement manufacturers offer stress and anxiety relieving health products. Although food supplements are often based on traditional recipes, more companies are adding new ingredients to supplements. Examples include Purasana (Belgium), FutuNatura (Italy), Nature’s Aid and Simply Supplements (UK).

Food supplements are a faster-growing market than herbal medicine products. In the herbal medicine segment, product development and innovation are difficult. Existing products are well established and have proven effectiveness and consumer trust. The food supplement segment has more room for innovation and new entrants.

Herbal teas and aromatherapy are also growing markets.

- Aromatherapy: CBI’s study on exporting essential oils for aromatherapy to Europe provides examples of essential oils. Companies that sell aromatherapy products in Europe include Farfalla Essentials Ltd. (Switzerland), Primavera Life (Germany) and Neal’s Yard Remedies (UK).

- Herbal teas typically have low concentrations of ingredients. The popularity of herbal teas is steadily growing throughout Europe. A 2021 survey in the UK revealed that eight out of ten people turn to tea when they feel stressed, and 58% find that tea helps them relax. Chamomile tea and lavender tea are the most popular.

Figure 2: End-market segments for stress and anxiety health products

Source: ProFound, 2024

Figure 3: Various stress-relief products (from left to right): essential oil, herbal tea, food supplement, herbal medicinal product

Sources: Neals Yard Remedies, NutraTea, Sunday Natural, Kalms, 2024

Tips:

- Read CBI’s study on trends in the European market. It offers useful information about the European health products market and how to increase your chances of market access.

- Inform buyers on how your ingredients can help consumers to improve their health and wellbeing. Focus on the nutritional or health aspects of your ingredients. Do not make medical claims. More information on EU regulations regarding claims can be found on the European Commission’s website.

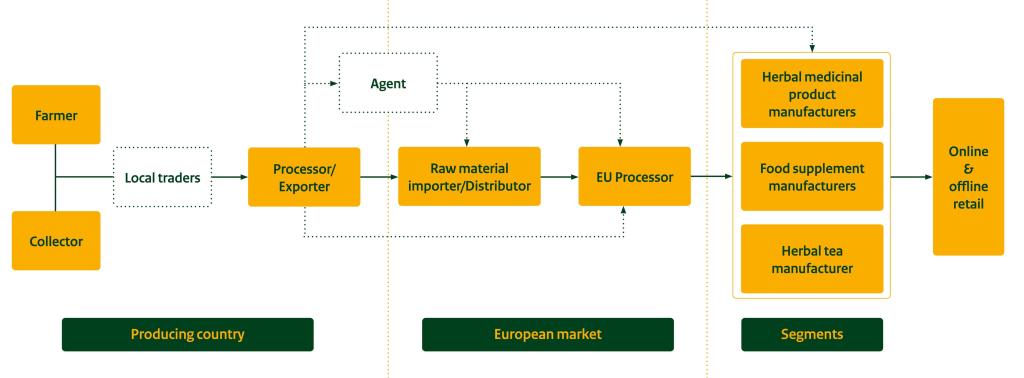

Through which channels does a product end up on the end-market?

The figure below shows a simplified value chain for natural ingredients. Plants can be cultivated or collected in the wild. Typically, exporters perform processing activities, sourcing raw materials either through local traders or directly from farmers or collectors.

Figure 4: Market channels for natural ingredients for health products

Source: ProFound, 2024

Importers/Distributors

European importers and distributorsare your most important entry point. They can trade in up to 500 species. Some supply a wide variety of conventional, organic and Fairtrade ingredient lines. Their clients include processors and cosmetic, supplement, food and herbal medicine product manufacturers.

Importers typically focus on establishing and maintaining strong relationships with suppliers to ensure a consistent and reliable supply of raw materials. They implement quality control measures to ensure imported ingredients meet the required standards and comply with relevant regulations, often conducting laboratory testing. Importers handle all necessary documentation.

Specialisation is becoming less common, but some European players:

- Focus on only one sector. For example, they only supply ingredients for food supplements, herbal medicine products or cosmetics.

- Limit their product offering. For example, they only produce extracts or active principles or offer ingredients from a particular region.

- Focus on certified ingredients, such as organic, FairWild and other labels.

European companies that source ingredients from emerging economies include:

- Extractors and traders, such as the Martin Bauer Group (Germany)

- Distributors, such as IMCD (the Netherlands)

- Specialised organic importers, such as Organic Herb Trading Co (UK) and Tradin Organic (Netherlands)

Agent

Export agents are firms or individuals that undertake most of the exporting activities on behalf of an exporter, usually for a commission. In contrast to importers and distributors, agents do not buy products themselves. Instead, they contact potential customers on your behalf to sell your products. Agents can be found in producing countries and in Europe. As an exporter from a producing country, you can work with agents who represent and act on your behalf on the European market. You can look for commercial agents on the Internationally United Commercial Agents and Brokers (IUCAB) website.

Processor and Manufacturer

Europe has a large processing industry. These companies mainly buy their raw materials from importers and distributors. Processing varies from basic processing to the isolation and modification of specific molecules. Processors sell ingredients to end-product manufacturers, sometimes via ingredient distributors.

However, they also increasingly source key ingredients directly. They do this to guarantee quality, price and sustainable supply for ingredients with high supply risks. These can be ingredients used in high-volume end-products, with high-risk supply situations or with crucial active components.

If you have enough staff to guarantee a consistent level of service, you can consider supplying processors and end-product manufacturers directly and get a better price. To supply these players directly, you need to have well-developed company and product documentation, and you need to ensure consistent quality and quantity. You also need adequate logistics so you can deliver small quantities at short notice if needed. You need to convince manufacturers to expand their supplier network instead of using existing suppliers.

It may be easier to trade through smaller processors if you are a small supplier. They often require lower quantities and are still important to the industry. Moreover, the quantities required for many less-traded medicinal and aromatic plant (MAP) species are and will continue to be limited.

Indena (Italy) and Greentech (France) directly import raw materials from origin.

What is the most interesting channel for you?

Importers and distributors are most likely the most interesting channel for you. Note that European importers and distributors are becoming bigger and more powerful. This means they can demand additional services from their suppliers (e.g. audits and certifications) at lower prices. Large buyers also want to limit the number of suppliers they source from by focusing on those that offer reliable (large) quantities and (documented) qualities.

If you can show you are a viable partner and offer high-quality products that meet volume and delivery requirements, these companies can offer good market entry opportunities. For exporters of smaller volumes that do not have a marketing and sales team, it could be better to work with smaller importers or agents who can represent you in the market.

Tips:

- Find buyers that match your business philosophy and export capacities in terms of quality, volume and certification. For more tips on finding the right buyer, read our study on finding buyers in Europe.

- Make sure that you can meet large buyers’ demands for additional services before you target them. Can you meet their demands regarding quantity, delivery schedules, documentation, financial reporting and auditing, price and quality?

3. What competition do you face on the European market for natural ingredients for Stress & Anxiety products?

Major suppliers that supply a wide range of botanicals include China, India, Egypt and European countries such as France. These countries compete supply botanicals and have substantial processing industries. This enables them to offer value-added ingredients like botanical extracts. These extracts generally contain higher concentrations of active ingredients or nutrients, enhancing their appeal. Competition comes from synthetic alternatives, vitamins, minerals and amino acids. Species like valerian, passionflower and chamomile have a competitive edge due to consumers’ familiarity with them.

Which countries are you competing with?

A wide range of botanicals are used in stress and anxiety products, which means competition can come from many different processing countries, such as China, India and France. You may also face competition from countries with strong medicinal plant production, such as Egypt.

India

India is one of the largest global suppliers of botanicals used in the nutraceutical industry. Its strengths include its rich herbal medicine heritage (Ayurveda), abundant ingredient availability, robust processing industry, strong manufacturing expertise and high-quality clinical research. India also has strong governmental support for the production and export of botanicals, coupled with generally low production costs.

In 2023, India was the largest supplier of MAPs to Europe, accounting for over 12% of the EU’s import value. India ranked as the third-largest non-EU supplier of botanical extracts in the same year, with a 6.9% share of the total EU import value, behind China and the USA. Key botanicals for stress and anxiety products from India include ashwagandha, valerian, passionflower, tulsi (holy basil) and chamomile.

India also faces challenges, such as concerns over quality, consistency and adulteration. The EU’s Rapid Alert System for Food and Feed (RASFF) has reported multiple instances of the presence of pesticide residues and ethylene oxide in spices, food supplements and ashwagandha. This system tracks food safety risks flagged by national authorities across Europe.

China

China produces several botanicals, including ginseng and ginkgo biloba, used in European food supplements for mental health symptoms. It has also become a major player in the global chamomile market. China is also an important supplier of L-theanine, a plant-based compound commonly found in tea leaves and used in stress and anxiety products.

In 2023, China was the leading supplier of botanical extracts to the EU by value, indicating the high-value nature of its exports. Chinese processors also handle non-native species, enhancing its competitive edge.

The country’s ability to offer high volumes at low prices, particularly for mechanised products, ensures a stable supply that meets quality, delivery and safety standards. Supported by the government, investments in agricultural technology and market price programmes, China is a significant competitor for any exporting country. However, Chinese producers also face challenges, including quality control concerns and reported non-compliance.

Egypt

Egypt, with its long-standing tradition of botanical cultivation, is a significant supplier of MAPs including hibiscus, mint, marjoram and chamomile. Chamomile is interesting for the stress and anxiety product market. Mint is also used in herbal teas to soothe inner tension. The Egyptian MAP sector relies on small-scale farmers.

In 2023, Egypt was the fourth largest non-EU MAP supplier to Europe, after India, the USA and China. EU imports from Egypt amounted to 3.6% of total import values. Imports registered an average annual growth of 7.4% between 2019 and 2023. This growth is supported by government investments and land reforms aimed at strengthening the agricultural sector. However, Egyptian producers face sustainability challenges, such as recurring pesticide issues and reliance on polluted Nile water due to limited access to treated alternatives.

France

Several European countries cultivate MAPs, including Albania, Bulgaria and Poland. France is important due to its cultivation of specific botanicals used in stress and anxiety products.

France’s cultivation of MAPs and fragrance plants is relatively small but thriving. The production of these plants is highly diverse and adapts to trends and market demands, using traditional skills and benefiting from modern techniques and high-value processing. The sector is supported by a very strong research network and a processing and manufacturing industry.

France mainly produces clary sage, lavender, lemon balm and passionflower. Clary sage and lavender are often used in aromatherapy for their relaxing properties. What sets France apart is its emphasis on high-quality, organic ingredients.

Tips:

- Find out if your country has programmes to help exporters improve the harvest, cultivation, processing and exporting of MAPs or botanical extracts. You can do this by contacting your local chamber of commerce or government trade ministry.

- Help manufacturers build their story by documenting your product and company’s unique value proposition. You can base this on your country’s image, your sustainable wild collection, how you support communities and the traditional uses of your product. This will also add to your own marketing efforts. Final manufacturers can use this information to market the end product in Europe.

- If you only produce MAPs on a small scale, engage with local processors to sell your products. You can also cooperate with other farmers to share investment costs for processing equipment or get large enough to export the product as a powder.

Which companies are you competing with?

Many established companies export MAPs and extracts to the European market. For new suppliers who want to access the European market, it is important to learn from successful companies.

India

Cultivator’s was founded in 1988. It is a major supplier of herbs, botanicals, spices, nutraceuticals, supplements and oils to the international market. It is certified as organic, Fair for Life and Fairwild. Its processing facility holds quality and food safety management certificates, such as BRCGS, ISO22000 and ISO9001. Cultivator’s has an in-house testing laboratory that complies with international standards. They have distribution warehouses in Bulgaria and Spain. This enables it to supply its clients quickly.

Arjuna Natural is a leading manufacturer of standardised botanical extracts with over 30 years of experience. Arjuna Natural produces speciality, branded ingredients and standardised ingredients. It has implemented stringent quality control for raw materials. Other strengths include its CSR policy and its manufacturing practices meet international standards. The company also has an in-house team of experienced scientists that has developed over 100 patents. They also have a global sales and distribution network.

Ixoreal Biomed is a nutraceutical company with offices in the United States and India. The company was established with one purpose: to promote the awareness and use of ashwagandha. It works with only one product: KSM-66 Ashwagandha. Its supply chain and production are fully vertically integrated. This gives them full product traceability. The company also implements several social impact projects at the production level. The production and company are organic certified. They also hold a range of quality and food safety certifications, such as FSC22000, BRCGS, SQF, ISO9001 and ISO22001. They are also For Life-certified, guaranteeing corporate social responsibility.

China

Better World Naturals is a subsidiary of the global flavour manufacturer Huabao. It specialises in high-quality botanical food and supplement solutions. The company has a transparent, vertically integrated supply chain. Better World Naturals offers a wide range of products, including natural colours, functional ingredients, antioxidants and sweeteners. Key strengths include its robust traceability system, advanced R&D lab, facilities, and quality and food safety management certifications. Better World Naturals also specifies the health benefits targeted by its functional ingredients.

Green Spring Shop offers a wide selection of products, such as standard herb extracts, fruit powders and antioxidants derived from natural ingredients. The company operates a large factory with advanced extraction technology. It is certified under ISO 9001 for quality management. Green Spring Shop showcases its expertise by publishing knowledge articles and industry news on its website. The company ensures full transparency by providing full documentation. This includes Technical Data Sheets (TDS), Safety Data Sheets (SDS), Certificates of Analysis (COA) and composition sheets developed by its in-house testing facilities.

FocusHerb is another Chinese supplier of botanical and plant extracts. It sells to customers in the health food, nutraceutical, cosmetics and pharmaceutical industries worldwide. FocusHerb is organic-certified and has several quality system certifications, including ISO9001 and ISO22000.

Egypt

United for Import & Export exports a variety of botanicals to the European market, including chamomile, spearmint and lemon balm. The company has a strict quality management system that complies with the ISO 22000 food safety management standard. This helps to ensure they export high-quality products. The company also holds organic, Fairtrade and Rainforest Alliance certifications, and it regularly conducts chemical analyses to maintain product integrity.

Apotec Bay offers an extensive range of products, including essential oils and extracts for the food, beverage, nutraceutical and beauty markets. The company handles small and large quantities of raw materials. It holds organic certifications for both the EU and US markets. Apotec Bay is also certified under ISO 22000 for food safety management and ISO 9001:2015 for quality management. Its key strengths include its advanced extraction equipment and a plant laboratory that conducts tests throughout the production cycle.

France

Oriane Nature is a producer and processor of MAPs, essential oils, hydrolats and vegetable oils. Its product line is organic-certified, and they are working towards obtaining Fairtrade certification for several products. It collaborates closely with laboratories to maintain high quality and to improve know-how. It has two subsidiaries (IB Arôme in Morocco and Orianagri in France), which enables it to expand its product portfolio. Its close relationship with the subsidiaries means Oriane can offer high-quality products that meet high traceability standards.

Nateva is a French company that cultivates and sells dried and fresh plants, both in their natural state and processed. It also manufactures plant extracts, essential oils, floral waters and food supplements, all from organic production. Nateva is strongly committed to corporate social responsibility, and it maintains very high-quality standards for its products. The company holds organic and Fair for Life certification, reflecting its dedication to sustainable and ethical practices.

Tips:

- Build long-term and sustainable trade relationships with your buyers. Trust is necessary from both sides: suppliers and buyers. Respond promptly and always follow up. A good website with information on your company, products and certifications can help with this. For instance, take a look at the website of Arjuna Natural to learn from the type of information they publish.

- Supply consistent quality and quantity at stable prices. This will support the development of a solid supplier and buyer relationship.

- Align quality improvements to your product with buyers’ requirements, specifications and their willingness to pay for them. Quality improvements can be costly, and you need to ensure there is potential for adequate return on investment.

Which products are you competing with?

The category of stress and anxiety-relief botanicals is competitive. There are numerous options that have similar health benefits. In this category, certain species, such as valerian, passionflower, and chamomile, have a competitive edge due to their established presence and consumer familiarity. You also compete with synthetic alternatives, vitamins, minerals, amino acids such as theanine and the hormone melatonin.

Synthetic alternatives

In Europe, most consumers primarily rely on prescribed non-herbal medicinal products to alleviate more severe stress, anxiety and depression in particular. These conventional medicines, which are based on chemical and synthesised compounds, have demonstrated as effective. General practitioners and specialists often prefer these treatments for their patients due to their reliability and efficacy. As a result, outside of a small niche of consumers who reject synthetic health solutions, herbal alternatives struggle to compete in this market.

Vitamins and minerals

Vitamins and minerals represent approximately half of all food supplements sold in many European markets. Magnesium, vitamin D and vitamin B are closely linked to stress relief and improved energy.

Many of these vitamins are synthetic. This offers advantages over botanicals, including lower production costs and greater stability. This stability also allows the vitamins and minerals to have longer shelf lives, to be added to foods in higher dosages and for formulation into smaller tablets.

Synthetic vitamins and minerals also have a competitive edge over botanicals because they can carry authorised health claims. These claims cannot be made for many botanical ingredients. This means food supplement brands that include vitamins or minerals can feature health claims on their products without any disclaimers. For example, magnesium is often used as a stress relief ingredient and has several approved health claims.

Tips:

- Build a marketing story for your ingredients that shows how it is different from competing products. You can use histories about the ancient use of your ingredient or its nutritional content, or you can refer to studies and results of clinical trials. For an example of how this can be done, look at the KSM-66 Ashwagandha (India) website.

- Do market research into potential substitute products. Find out how your ingredients compare in terms of nutritional profile, price, supply security, sustainability and the ease/costs of substitution. Make sure that you have these results when you talk to potential buyers.

- Communicating that the long-term use of your ingredients does not have negative health effects is an important marketing argument. However, you need to be able to substantiate product safety claims with scientific research.

- Diversify your product portfolio to reduce risks. The sales of some products heavily depends on current trends.

4. What are the prices of natural ingredients for Stress & Anxiety products in the European market?

The price of ingredients depends on several different aspects. These include the following.

- The product and its properties: Botanicals with popular properties that are linked to health benefits can sell for a higher price if these claims are sufficiently substantiated in testing.

- Compliance with quality standards: Botanicals that comply with quality standards from production and collection (e.g. Good Collection and Agricultural Practices for Medicinal Plants) through processing are likely to attain higher market values when the adequate market and buyer segment is targeted.

- Level of processing: Botanicals that are processed into extracts or branded ingredients fetch higher prices.

- Cost price: Raw material prices and processing costs.

- Exclusivity and novelty versus availability: Popular botanicals with limited availability can sell for higher prices.

- Certification: Certified botanicals can sell for higher prices if you can find buyers who are willing to pay.

- Buyer relations: The relationship between you and your client, and your negotiation skills.

Some prices are given below for organic lemon balm leaves to illustrate. It is important to note that these prices cannot be used for direct comparison because they represent different stages in the value chain and originate from different producing countries. The examples show the complexity of pricing in the market and highlight the influence of production processes on cost.

- Export prices for 20–99 kg packages, cultivated in China: $21.70 (USD) (about €20) per kg.

- Sales price on European market for small packs of lemon balm leaves cut, cultivated in Bulgaria (sold per 1 kg): £21.00 (about €25) per kg.

- Retail sales price on UK market of organic lemon balm leaves (used as tea), cultivated in Greece: €56 per kg.

The general price structure of natural ingredients for health products, considering different steps in the supply chain:

- Raw materials: 5–15%

- Processing: 5–15%

- Transport costs: 2–5%

- Import and processing in Europe: 15–30%

- Retail margin: 30–60%

Tips:

- Calculate your production costs with a detailed cost breakdown. Remember to include additional costs such as customs, loading/unloading, marketing, samples for chemical analysis and internal transport. Add your profit margin to the cost breakdown to find the selling price.

- When pricing your product, consider the maximum price that customers will be willing to pay, plus existing demand, your cost analysis and break-even analysis. Ensure the price reflects the quality and delivery conditions.

Lisanne Groothuis of ProFound – Advisers In Development carried out this study on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research