Entering the European market for contact centre services

On the European market, you need to comply with mandatory legal and other requirements, such as legislation on cold calling and the General Data Protection Regulation. Buyers may have additional requirements regarding issues such as quality management and corporate social responsibility, as well as industry-specific standards. European service providers, consultants/matchmakers and sales/marketing representatives are your most realistic market entry channels.

Contents of this page

- What requirements must contact centre services comply with to be allowed on the European market?

- Through what channels can you get contact centre services on the European market?

- What competition do you face on the European contact centre services outsourcing market?

- What are the prices for contact centre services outsourcing?

1. What requirements must contact centre services comply with to be allowed on the European market?

All contact centres should stay informed about the latest security and privacy policies, because they process and store a large amount of customer information (and most of it, in the cloud). Besides requirements that apply to all contact centres, there are requirement that vary per industry, per segment and even per country. Different industry-specific standards exist, for example, for financial and payment-related services. New legislation is always in the making.

As it would be impossible to list (or to know) all possible requirements, this chapter discusses the most common requirements. For more information, see our study about the requirements outsourcing services must comply with on the European market.

What are mandatory requirements?

Mandatory requirements are rules you have to follow even if you are located outside of the European union. For contact centre services this includes rules about privacy protection and cold calling.

Rules about privacy protection: GDPR and ePrivacy Directive

The new General Data Protection Regulation (GDPR) came into effect on 25 May 2018. It was designed to protect individuals in Europe from privacy and data breaches. It has since been incorporated into the European Economic Area (EEA) Agreement, which brings three of the European Free Trade Association (EFTA) states into the European single market. This means the new GDPR is also enforced in Iceland, Liechtenstein and Norway. And because the United Kingdom was still a part of the European Union when the GDPR was enforced, the regulation will be absorbed into the United Kingdom’s law.

These new rules were introduced to give people more control over their personal data and let businesses benefit from a level playing field, where the laws and regulations are the same in every country. The GDPR applies to all companies processing the personal data of individuals in Europe, regardless of the company’s location. This means it also applies to you directly.

The GDPR is very important in the contact centre industry, because data plays a big role in many of its activities. You must appoint a Data Protection Officer if your company’s “core activities involve processing of sensitive data on a large scale or involve large-scale, regular and systematic monitoring of individuals”. The main tasks of a Data Protection Officer include informing their company of its obligations under data protection legislation and monitoring compliance.

Tips:

- Read about contact centre-specific GDPR information, at what the GDPR means for your contact centre.

- Be aware of what data you store and where, to be able to comply with potential consumer requests.

- Use IDC’s GDPR Readiness Assessment to determine how compliant you are and what you may need to improve. Audit your current data to determine whether they are GDPR compliant. What data do you have, where and why? Did you or your client obtain explicit consent to use the data for this specific purpose?

- Set up clear consent request forms and privacy policies that inform customers how you process their personal data. For more information, see the GDPR consent guidance and Econsultancy’s GDPR: How to create best practice privacy notices.

- Keep records of your obtained consent, see ICO’s advice on how to record consent.

ePrivacy Directive

The ePrivacy Directive (2002/58/EC), commonly known as the ”cookie law”, contains specific regulations for data protection in the electric communications sector. For example, the directive prohibits unsolicited commercial electronic messages (“spam”). It contains strict rules on the use of cookies, and contact details may only be published with the subject’s consent.

A new ePrivacy Regulation was originally scheduled to enter into force along with the GDPR, but its implementation has since been delayed. The new regulation is intended to safeguard the confidentiality of electronic communications through stronger privacy rules. Unlike the current directive, it includes Internet-based voice and messaging technologies such as Skype, WhatsApp and Facebook Messenger. The latest draft was released in January 2021, the regulation is not expected to enter into force before 2023.

Tip:

- Read more about online privacy and safety on the website of the European Commission.

Rules about cold calling

Cold calling refers to the unsolicited approach of potential customers who you have not interacted with before and who are not expecting you to contact them. Some European countries have introduced strict national legislation to restrict cold calling. For example, cold calling is illegal in Germany and The Netherlands (from July 1st 2021) and can result in considerable fines. In many European countries, consumers and companies can opt out by registering with a do-not-call (Robinson) list. This means companies cannot contact them by phone, fax or SMS for direct marketing purposes.

For example:

- Belgium – Do Not Call Me

- Sweden – NIX-Telefon

- The United Kingdom – Telephone Preference Service (TPS)

Tip:

- Research the national regulations on cold calling in your European target country.

What additional requirements do buyers often have?

Additional requirements mostly concern Key Performance Indicators, security, quality and corporate social responsibility.

Key performance indicators

Key performance indicators (KPIs) are measured to determine the quality of a contact centre service provider. They are an important selection criterion for buyers.

Important KPIs that indicate the quality of a contact centre’s operations are:

- Customer satisfaction;

- Average response/queue time;

- Call abandonment rate/time;

- First-call resolution rate;

- IVR routing accuracy;

- Call duration;

- Call transfer rate;

- Cost of inbound/outbound calls.

Customer satisfaction is key, especially now that customers can easily share their reviews on social media. Low-quality solutions or a slow/no response to requests can damage a company’s reputation. This makes metrics like short response time and good resolution especially important for European companies.

Security

Data breaches are the biggest security concern for contact centres, especially contact centres that have moved to the cloud. Privacy control is another critical issue, especially for centres that handle private health information and credit card purchases. If one small part of a cloud service database is not designed properly, a single flaw in one client’s application could allow an attacker to get that client’s data as well as all other clients’ data.

Research by Cisco in 2021 revealed that in 2021, 70% of the contact centre executives find ‘security policy management, enforcement and customer data privacy’ to be one of the top challenges in contact centres.

Security includes both data protection and recovery systems. Many European buyers expect you to implement an information security and management system, especially in industries in which security is essential, such as finance and banking, healthcare or mobile applications. Although there is no specific legislation on this, the ISO 27000 series contains common standards and guidelines for information security.

Tips:

- Make sure you have effective security processes and systems in place, from business continuity and disaster recovery to virus protection.

- Ask your buyer to what extent they require you to implement a security management system like the ISO 27001 standard.

- Consider obtaining the ISO/IEC 27701:2019 certification. To do so, you will need to either have an existing ISO 27001 certification or implement ISO 27001 and ISO 27701 together as a single implementation audit.

Quality management

Some European buyers only do business with companies that have a quality management system in place. Such a system shows that you are well organised and able to deliver the required service quality. They include, for example, backup and recovery schemes, network and infrastructure security, communication plans and relocation options.

Obtaining ISO certification will help you do business in Europe. It shows your commitment to quality. If European companies can choose between ten different contact centre service providers of which one has an ISO certification, they will prefer the ISO certified company. Unless that company is twice as expensive.

ISO 18295

The voluntary standard ISO 18295 specifies service requirements for both in-house and outsourced customer contact centres. ISO 18295-1:2017 applies to you as a service provider, while ISO 18295-2:2017 provides requirements for clients using your services. The standard aims to increase customer satisfaction and generate cost efficiencies, while maintaining quality outcomes and effectiveness.

COPC

COPC is a performance management system for call centre and customer experience operations. The COPC CX Standard for Outsource Service Providers specifically applies to third-party service providers like you. The standard contains best practices to help you improve customer experience, consistently implement processes, metrics and targets, and effectively use customer feedback. COPC offers in-depth training, as well as certification options.

ISO 9001:2015

One of the best-known quality management standards is ISO 9001:2015. If you comply with ISO 9001:2015, you can obtain certification, which may give you a competitive advantage.

Corporate Social Responsibility

Corporate Social Responsibility (CSR) refers to companies taking responsibility for their impact on the world. Not only in the products or services they offer, but also when it comes to:

- consumer rights

- education and training of staff

- human rights

- health

- innovation

- the environment

- working conditions

CSR is becoming particularly important to large companies and governments in Northern and Western Europe. Many European companies involve their suppliers in their CSR policies. The importance of CSR in the Contact Centre market is debated, as the impact of small companies in this industry is often marginal.

Document your CSR policy

Having a well-documented CSR policy may give you a competitive advantage over companies without one. The ISO 26000 standard provides guidance on CSR. For small software companies, the most relevant and practical aspects of this standard are labour practices, fair operating practices and community involvement.

Become an impact sourcing destination

You can also match the CSR policy of your potential European buyer by becoming an impact sourcing destination. This is a relatively new term; it refers to a sourcing model that aims to improve the lives of people, families and communities through meaningful employment in ITO and BPO. This can be achieved either through outsourcing or by setting up remote or virtual teams using digital technology. Impact sourcing has good potential for companies that wish to make their business more socially responsible (buyers and sellers of contact centre services). And it can be a unique selling point (USP) for your business.

Tips:

- Show that you care about your impact on society by implementing your own CSR policy. Clearly communicate your commitment in your marketing activities. It can be a unique selling point (USP).

- Show you are a professional company by having good references, responding quickly, obtaining relevant industry certification, communicating regularly, offering constant quality, complying with contractual agreements, and having a good and stable management team to lead the outsourcing project.

- When considering a particular certification, ask yourself 3 questions before working out the details: is it good for my company? Is it good for my clients? Does it have marketing value?

- Check if you can apply for financial support to achieve quality certification. Contact your national industry association (such as the Contact Centre Association of Zimbabwe or the Contact Centre Association of Malaysia) or a business support organisation in your country responsible for general or BPO export promotion.

- Consult the ITC Sustainability Map for a full overview of certification schemes on sustainability in the sector.

What are the requirements for niche markets?

European buyers often require you to comply with a sector-specific and/or industry-specific standard or code of practice (if available).

Financial services

The European Banking Authority’s (EBA) guidelines on Outsourcing Arrangements took effect in 2019 and were last updated in April 2021. This law does not only apply to banks, building societies and investment firms, but also to payment institutions and electronic money institutions.

Payment-related services

The PCI Security Standards Council is a global forum for the payment industry. It maintains, evolves and promotes the Payment Card Industry Security Standards. If you are working with payment-related services and offer outsourcing services to the European market, or aim to do so, look at their standards overview and complete their Self-Assessment tool to get more insight into the standards for payment-related services.

Tips:

- Keep in mind that we have only mentioned some examples. The requirements for niche markets vary greatly because the contact centre market is very diverse, so you have to research your own situation, market and requirements.

- Other sources that might be helpful in your research are PCI Security Standards, ISO, SAP and the website of the European Commission.

- We advise you to check the exact rules that apply in your European target market. You can find an overview of country-specific measures that affect trade and which differ from the international standards on the ePing website.

2. Through what channels can you get contact centre services on the European market?

How is the end market segmented?

The easiest way to segment the contact centre market is by vertical market (type of industry) and by horizontal market (type of service). For contact centres, language is also an important factor. This can make individual European countries particularly attractive outsourcing destinations for some companies, and not for others.

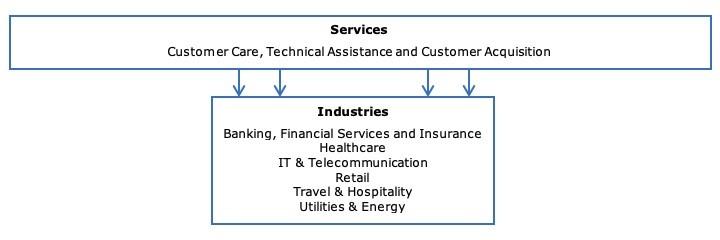

Figure 1: Horizontal and vertical market segments with opportunities for service providers

Horizontal markets

The largest horizontal markets within contact centre services are customer care, technical assistance, and customer acquisition. Most contact centre service providers offer all these activities. It is recommended that you do the same, since most European companies like to work with one service provider that can offer a complete package.

Vertical markets

Promising vertical markets for contact centre outsourcing services include Banking, Financial Services and Insurance (BFSI), Healthcare, IT and Telecommunications, Travel and Hospitality, Retail, and Utilities and Energy. These industries require a high volume of agents, diversity and scalability of the service offering and multilingual capabilities. A vertical industry is more interesting if it mainly involves business-to-consumer (B2C) rather than business-to-business (B2B) companies, as B2C includes more end customers who need contact.

Tips:

- Provide contact centre services for specific industries or niche markets. Focus on industries you are experienced in, or could easily develop expertise in. This offers you a competitive advantage.

- Clearly promote your specialisations. Do not advertise like you can do everything for everyone, because this does not help you to attract the right buyers.

Through what channels do contact centre services end up on the end market?

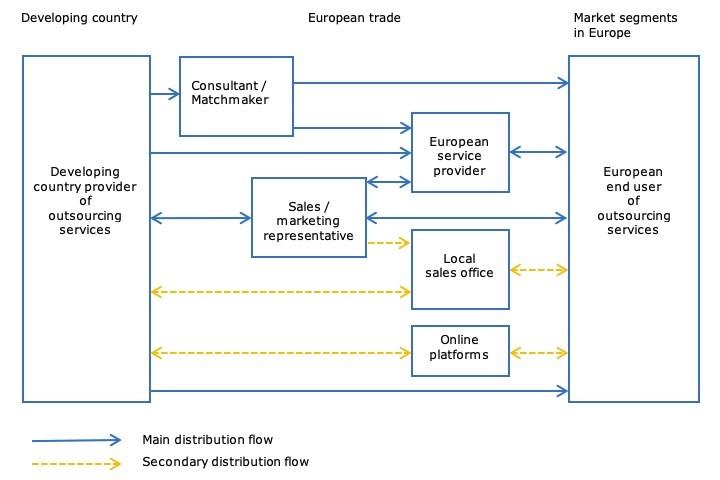

As a service provider in a developing country, you can use several trade channels to enter the European market. Figure 2 provides an overview of the trade structure for outsourcing. This structure is more or less the same in every European country.

Figure 2: Trade structure for outsourcing contact centre services in the European market

What is the most interesting channel for you?

Your most common and most promising market entry channels are European service providers, consultants/matchmakers, and direct sales. Another option is to work with a local sales office.

Selecting a channel depends on your type of company, the nature of your product or service, your target market and the available resources for market entry. You must understand that, regardless of the channel you choose, your own marketing and promotion is a vital part of your market entry strategy, for which you are responsible.

European service provider

Most contact centre service providers from developing countries find a European service provider either directly or by working together with a matchmaker and/or a sales representative. According to industry experts, subcontracting for European service providers is the most realistic market entry channel.

A European service provider that is similar to your company would be your most suitable contractor. Ideally, this contact centre service provider should offer similar contact centre solutions to yours and be active in similar industries. This can also be a chain of contact centre service providers that has offices in different countries.

The relationship between a European service provider and a subcontracted supplier is mostly characterised by:

- Trust;

- Interdependence;

- A structured relationship (functions, tasks, communication and procedures);

- Potentially limited marketing visibility and market access opportunities for the subcontracted supplier.

Within subcontracting, build-operate-transfer and virtual call centre constructions could also offer opportunities. In a build-operate-transfer construction, a service provider (this might be an offshore service provider) sets up, or ’builds’, a contact centre for a client, tailored to that client’s specific needs. When the contact centre is operational and running successfully, it is transferred to the client. Virtual call centres consist of agents in various locations across the world, who often work from home. This solution saves costs and offers 24/7 availability.

You can find a European service provider to partner up with either directly or by working together with a matchmaker and/or a sales representative. Because many European companies prefer to deal with a local contact person, an intermediary is a good option.

Tips:

- A good start is contacting contact centre service providers that already work in your country of interest.

- Use industry associations to find potential customers in Europe, such as CCA Global, CCV in Germany, CCMA in the Netherlands and CCMA in the United Kingdom.

- Use outsourcing associations to find potential customers, such as the Global Sourcing Association, the German Outsourcing Association and Sourcing Nederland.

- Attend leading online and offline European trade fairs such as CCW and the Call & Contact Centre Expo. At these events, you can meet potential customers and competitors, as well as stay up to date on the latest developments, technologies and tools.

Consultant/matchmaker

A consultant/matchmaker is a person or a company with a large number of relevant contacts in a specific market segment or industry. As an intermediary, they are a door opener, not an agent to make cold calls or send cold emails. Always properly inform your consultant/matchmaker about your company. They speak with many potential customers and are often involved in creating long lists of potential outsourcing providers. The more information they have about your company and the better they understand your capabilities, the more they can spread the word about you.

If you work with a consultant/matchmaker:

- The consultant/matchmaker makes appointments with prospects for you;

- The presentation and sales process remains in your own hands;

- You pay a retainer + success fee (which can be expensive);

- The consultant/matchmaker usually has multiple clients;

- You need to set clear expectations and objectives to measure their performance.

A retainer + success fee construction can be expensive. While the success fee depends on what the intermediary has delivered, you have to pay the retainer (usually a fixed monthly payment) regardless of their performance. Together, they should provide a strong motivation for the intermediary to deliver: the retainer should be high enough to cover some of the costs but low enough to encourage delivery. A properly drafted contract, by a lawyer, is a must!

You also need to determine an exit strategy in the contract, with a clearly defined period after which the contract can be terminated without any further consequences. This period is usually not longer than 3 or 4 months, after which the contract will be evaluated and can be terminated or prolonged. For this period, there should be clearly defined delivery expectations and targets for the consultant/matchmaker (such as the number of relevant contacts, meetings and leads). You could also negotiate a trial period.

Tips:

- When contracting an intermediary, involve a good lawyer who knows the applicable law of the country where the intermediary resides and has previous experience with this type of contracting. Pay special attention to exit clauses, success criteria, deliverables and payments.

- Try to avoid limitations to your marketing coverage and activities in your contracts.

- Some food for thought: although convenient, your uncle who lives in Germany might not be the best intermediary for your company.

Direct sales and online marketplaces

You can also try to sell your contact centre services directly to European end users. Many European companies are looking for cost reduction and delivery capacity, which developing countries can often provide. This is one of your unique selling points.

Direct sales require experience in the European market. This strategy is most suitable for relatively large providers that want to target large European end users. Your best bet is to focus on a small, underserved niche market. For most suppliers from developing countries, however, it is very challenging to sell contact centre services directly. Sometimes, they work together to make a direct sales offer. Having one or more existing customers in Europe will help, as references are a must when you want to enter this market through direct sales.

Tips:

- Combine offline and online promotion channels to develop as many contacts as possible. This maximises your chances of finding suitable partners/customers.

- Have a professional, high-quality company website, where you can present full, accurate and up-to-date details of your offering at low cost. Make it compatible with mobile devices and invest in Search Engine Marketing and Search Engine Optimisation, so potential customers can easily find you online.

- Use professional and other social media platforms as a marketing tool to reach potential customers. LinkedIn can be particularly useful for making initial contacts and conducting market research.

3. What competition do you face on the European contact centre services outsourcing market?

Which countries are you competing with?

India, Malaysia, Indonesia, the Philippines, Egypt, Poland and Bulgaria can be considered your strongest competition.

In general, European companies prefer to outsource services to providers within the same country (also known as homesourcing, or simply as outsourcing). When they do outsource to companies abroad, they generally prefer nearshore locations, because of proximity, language, cultural similarities, and the minimal time difference. For more information on nearshoring versus offshoring, see our study on the European demand for business process outsourcing.

The Global Services Location Index (GSLI) ranks the competitiveness of ITO/BPO destinations based on 4 categories: financial attractiveness, people skills and availability, business environment and digital resonance.

India

India continues to lead the Global Services Location Index for contact centre services, mainly due to the country’s unique combination of low-cost services, excellent English language skills and large talent pool. This attractive profile makes India a particularly strong contender on the contact centre services outsourcing market.

To stay ahead, the country needs to prepare for the shift from lower-skilled jobs that may be replaced by robots to more creative and highly skilled work. This applies to other low-cost countries as well.

Malaysia

Malaysia ranks 3rd in the GSLI, this is mainly due to its relatively highly educated work force, the size of the work force and the English language skills. They also have a relatively high score in digital resonance.

Indonesia

Indonesia is one place behind Malaysia (4th), but for different reasons. The workforce in Indonesia is a little less educated, the English-speaking skills are a little lower too, but they also have a large work force and are a slightly cheaper outsourcing destination. The main challenges for Indonesian contact centre service providers are internet infrastructure and language qualities.

Philippines

The Philippines is an important destination for contact centre services, it ranks 9th in the GSLI. It is the most financially attractive destination of the six highlighted countries (together with India). However, their digital resonance score is among the lowest. The Philippines are reaping the benefits of being a solid contact centre outsourcing destination because of the low costs and the large English-speaking workforce.

Egypt

Egypt ranks 15th in the GSLI. Their ranking went up significantly, mainly due to their government’s ‘Digital Egypt’ initiative. Also the English language skills have significantly improved in the past 10 years, where countries like India have hardly made any progress in that area. This makes Egypt a country to keep an eye on in the upcoming years.

European competition

In the outsourcing sector, competition from other European countries has always been strong. Especially from Central and Eastern European (CEE) countries and more recently also from the Baltic countries. Two important competitive countries from Europe for the Contact Centre industry are Poland and Bulgaria.

Poland saw a 10-point increase, primarily due to its financial attractiveness and start-up activities. They also remain important for the European contact centre industry because of their cultural and linguistic similarities. Poland is the highest scoring country from the CEE region (14th). Poland is an important contact centre outsourcing location for European companies, as the industry is maturing and can offer good-quality services.

Bulgaria is another high scoring country from the CEE region (17th). Bulgaria continues to be able to offer good language skills combined with relatively low wages. In the future, jobs demanding a higher degree of creativity and skills offer opportunities for these nearshore countries.

To fill the language gap, many Bulgarian companies hire residents (quite often students) from other European countries. This also applies to the other companies from the CEE region.

Tips:

- Compete on the quality of your services, rather than just on costs.

- Visit the websites of outsourcing associations and contact centre association to get a better understanding of competing countries. Examples are the Central and Eastern European Outsourcing Association (CEEOA), AIBEST (Bulgaria) and the Ghana Export Promotion Authority (GEPA).

Which companies are you competing with?

Examples of call centre service providers are:

GPG

GPG, Global Phoning Group, is an Eastern European company with offices in Moldova and Ukraine. It provides multilingual contact centre services, as well as other BPO and knowledge process (KPO) solutions. The company operates in 25 countries, offering more than 10 languages and professional domain knowledge of key industries such as retail, financial services, telecommunications and energy. GPG’s agents are available 24/7, and the company claims it has a cost reduction of up to 70%.

Cortex

Another nearshore contact centre provider is Cortex, based in Czechia. Cortex offers international call centre services, employing native speakers in 7 languages. The company differentiates itself on its commitment to CSR, describing its sustainably designed building. It also pays extra attention to offering an inclusive workplace, meaning it offers equal opportunities for all employees, regardless of their nationality, gender, family status and physical disposition.

SA Commercial

SA Commercial is an award-winning BPO company from South Africa with a strong CSR profile. It offers a training programme for young people. Its clear and easy-to-navigate website lists the company’s certifications, as well as its social media channels. The homepage includes a quote from the local Minister of Finance and Economic Opportunities, thanking SA Commercial for its assistance during the COVID-19 crisis. This is a good way to communicate that the company has demonstrated reliability and resilience during the pandemic.

Tip:

- Check the many lists available on the Internet of contact centre service providers that are performing well, such as Clutch’s top call centres and Business News Daily’s best call centres and answering services for businesses for 2022. Even though most of these contact centres are not located in your most competitive countries, you can still learn from their best practices.

Which products are you competing with?

In contact centre outsourcing services, the product is the service. This means that the real question here is: what makes one service provider different from another? The answer is: available capacity, references, language skills, flexibility, reliability, communication, quality management, security infrastructure, vertical and/or horizontal market focus and niche market orientation, among other things.

Automation is both a threat and an opportunity

Automation is the main substitute for contact centre outsourcing services. The search for automation is expected to grow, so the threat of automation will increase. Opportunities exist if you can combine your services with some level of automation. Other substitutes for service providers are:

- In-house departments;

- Captive centres;

- Backsourcing (moving outsourced services back home, often driven by automation).

Tip:

- For more in-depth information on automation in contact centre services outsourcing, see our study on the European market potential for contact centre services.

4. What are the prices for contact centre services outsourcing?

When trying to make a sale in Europe, it is important to offer the right price. The outsourcing market is a buyer’s market, driven by demand. Buyers set the conditions, as they can choose from a wide range of service providers worldwide offering similar services. As more countries are promoting outsourcing, this gives buyers even more options in outsourcing destinations and providers. At the same time, as long as the costs and risks of switching providers are high, this somewhat reduces the power of buyers who are already engaged with service providers.

A 2022 survey by the Call Centre Management Association revealed that most contact centres in Europe are raising the salaries in their contact centres by between 5 to 10%. But they are also debating whether that is enough to keep the employees on board. Finding and keeping the right people is one of the biggest problems in the contact centre industry.

The sector values the output much more than in the early days of contact centre services outsourcing. This is because of the growth in e-commerce, tracking of customer satisfaction and customer experience and retention rates (see also the Market Analysis part of this study), and companies are willing to pay more for that valuable output.

In contact centre services, the most used pricing models are full-time equivalent-based (FTE – generally 8 hours per day, 5 days per week), transaction-based and outcome-based pricing. Since contact centre services are a very diverse business, you must look at the exact services you want to develop a price for if you want to determine the average prices.

Tips:

- Look for pricing information on your particular product or service on specific websites, such as Worldwide Call Centers. Another way of determining the cost and wages of people in your sector is to look at the Payscale website.

- Go beyond setting the right price. Work out your pricing strategy, including your and your clients’ preferred pricing model, payment terms/expectations, how and when you provide discounts and so on.

- Create the “ideal” client persona to help you tailor your offer. For example: “a contact centre service provider with fewer than 200 staff members, in the Munich area, specialised in customer service in the travel sector”.

This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with Laszlo Klucs.

Please review our market information disclaimer.

Search

Enter search terms to find market research