Entering the European market for finance and accounting services

On the European market you need to comply with mandatory requirements and additional requirements that buyers may have. Working with a strategic partner is your most realistic channel for entering the European market. Competition is strong, you should differentiate on quality rather than purely on costs. Specialising is also a good way to reduce competition. In general, trust and reliability are the most important criteria for European companies that are looking for a finance and accounting outsourcing (FAO) partner.

Contents of this page

- What requirements and certifications are needed for finance and accounting services to be allowed on the European market?

- Through which channels can you get finance and accounting services on the European market?

- What competition do you face on the European finance and accounting services outsourcing market?

- What are the prices of finance and accounting services outsourcing?

1. What requirements and certifications are needed for finance and accounting services to be allowed on the European market?

This part of the study focuses on the market entry of finance and accounting outsourcing services. Find out more on market entry requirements for BPO and ITO in general (like the GDPR and the ePrivacy Directive) in our study about the requirements for outsourcing services on the European market.

New legislation is always being drafted. Listing or knowing all the regulations would be impossible, so this chapter just discusses the most common requirements.

What are mandatory requirements?

Mandatory requirements can be legal or non-legal. Even if you do not have to comply by law, they are considered minimum requirements for entering the European market. Mandatory requirements for finance and accounting outsourcing concern company reporting and the GDPR.

European rules on company reporting

The European Commission manages rules on the financial information that European companies must prepare and disclose. The goal is to have access to comparable and high-quality financial information that gives a true and fair view of a company’s situation.

The European legislation on financial company reporting includes:

- Legislation on financial reporting;

- Corporate sustainability reporting;

- Transparency requirements for listed companies;

- Public country-by-country reporting (CbCR).

The European Commission is working on financial reporting standards. At the moment these standards are not active yet, but it is important to keep an eye on the developments.

All the above examples are legal requirements, so if your service falls into a category for which these requirements apply then you must comply.

Tips:

- To provide good finance and accounting services to European companies, you should be familiar with European legislation, and finance and accounting rules that are specific for your target country.

- To learn more, go to ICAEW. The ICAEW provides a lot information, including accounting guides, economic forecasts, guides to doing business and information on the tax climate per country.

- For more specific information on outsourcing arrangements for the financial industry, check the website of the European Banking Authority.

- If you aim to become a certified public accountant for companies in the European Union, go to the Accountancy Europe website to learn about that process.

General Data Protection Regulation (GDPR)

The General Data Protection Regulation (GDPR) is designed to protect the privacy of individuals in Europe from data leaks. It is also part of the European Economic Area (EEA) Agreement. This means the GDPR is also enforced in Iceland, Liechtenstein and Norway. France has its own France Data Protection Act.

Under the GDPR, any company or individual that processes data is responsible for the protection of this data. While not all finance and accounting projects concern personal data, most of them do. Examples of personal data are names, email addresses, bank details, social media content, photos, and IP addresses.

It is expected that within the next few years, around 75% of the world’s population will be subject to regulations similar to the GDPR. This means that, by then, protecting data and privacy will not only be necessary in the EU but in most countries worldwide.

Tips:

- If you deal with personal data, study the GDPR’s European data protection rules and principles for a good understanding of what is allowed and what is not. For the situation in the UK after Brexit, check out the website of the Information Commissioner’s Office (ICO).

- Be aware of what data you store and where, so you can comply with potential consumer requests.

- Use the IDC’s GDPR Readiness Assessment to find out how compliant you are and what you may need to improve on. Audit your data to find out whether it is GDPR compliant. What data do you have, where and why? Did you or your client get explicit consent to use the data for this specific purpose?

- Read this article on navigating GDPR in Banking, Insurance and Financial Institutions to help you prepare.

What additional requirements and certifications to do buyers often have?

Additional requirements concern security, quality management and Corporate Social Responsibility (CSR).

Security

Data security is one of the main challenges for BPO service providers. This includes both data protection and recovery systems. Many European buyers expect you to implement an information security and management system, especially in industries where security is essential, such as finance and banking, healthcare or mobile applications. Although there is no specific legislation on this, the ISO 27000-series contains common standards and guidelines for information security.

Tips:

- Make sure you have effective security processes and systems in place, from business continuity and disaster recovery to virus protection.

- Ask your buyer to what extent they require you to implement a security management system like the ISO 27001 standard.

- Consider obtaining the ISO/IEC 27701:2019 certification. To do so, you will need to either have an existing ISO 27001 certification or implement ISO 27001 and ISO 27701 together as a single implementation audit.

Quality management

Some European buyers only do business with companies that have a specific quality management system in place. Although it does not automatically guarantee good-quality finance and accounting services, it proves that you have a repeatable process and that you are a serious company that values standardisation.

A common quality management system is ISO 9001:2015. ISO certifications that apply to financial services include ISO 21188:2018 and ISO 20038:2017.

Consult the website of the IFRS Foundation. The foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally-accepted accounting and sustainability disclosure standards. Their standards are developed by our 2 standard-setting boards: the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

Tip:

- Check if you can apply for financial support to achieve quality certification. Contact your national business process association (such as BPESA in South Africa or IBPAP in the Philippines), the International Business Process Management Association, or a business support organisation in your country responsible for export promotion.

Corporate Social Responsibility (CSR)

Most European buyers of BPO services will require – or at least appreciate – certification relating to Corporate Social Responsibility. You can read about why CSR is important and how you can implement it in the following 2 documents: 'Tips to go green' and 'Tips to become a socially-responsible supplier'.

Important upcoming Green Deal legislation includes the Corporate Sustainability Due Diligence Directive (CSDDD) and the Forced Labour Regulation. In February 2022, the European Commission adopted a proposal for a CSDDD. This means that larger companies have to identify and – where necessary – prevent, end or reduce any negative impacts of their activities on human rights and the environment. Both in the company’s own operations and in its value chains. This means that the new rules may apply to you indirectly via your buyers.

In September 2022, the European Commission proposed a new Forced Labour Regulation. Complementing the CSDDD, this regulation bans products made with forced labour from the EU market.

As these proposed laws have yet to be finalised and approved, their exact implications are not yet clear. Before they can enter into force, they must be formally approved by the European Council. Nevertheless, you should familiarise yourself with the proposals and be prepared for their rollout.

Tips:

- Read more about the CSDDD.

- For details on the Forced Labour Regulation, check out the questions and answers and factsheet.

- Stay up to date on the proposed rollout of the new CSDDD and the Forced Labour Regulation.

What are the requirements for niche markets?

On the European market for FAO, requirements vary per segment, industry, technology and even country. Different industry-specific standards, rules, and regulations exist for education, healthcare and so on. Please check the specific requirements when planning to offer your services to a specific industry, country, or segment.

By segment

Payment-related services standard

The PCI Security Standards Council is a global forum for the payment industry. It maintains, updates and promotes the Payment Card Industry Security Standards. If you are working with payment-related services and (aim to) offer outsourcing services to the European market, check their standards overview and complete their Self-Assessment tool. This will help you get more insight into the standards for payment-related services.

By industry

Different industries set different requirements. In healthcare, for example, for the real estate business or the automotive industry.

By technology

Requirements concerning specific technology are the Artificial Intelligence (AI) Act and cyber security for consumer internet of things requirements.

By country

Each European country has specific regulations for finance and accounting. To provide finance and accounting services on the European market, you should know and understand the regulations in your European target market.

For other country-specific information, please check the government websites. For example, if you plan to export to Germany, check the differences between the IFRS and the German General Accounting Standards.

Tips:

- If you (aim to) specialise in particular sectors, find out which certifications are relevant. When considering a particular quality certification, ask yourself 3 questions before working out the details: is it good for my company? Is it good for my clients? Does it have marketing value?

- Learn from your clients and monitor potential clients to see what requirements they find important. Perhaps you can work on certifications or social goals together.

- Check which sector-specific standards or codes are available for your product (for example, by asking your sector association or your buyer) and to what extent your buyers want you to implement them.

- You can find more country-specific information on websites of F&A associations like ICAEW in the UK. Those websites provide a lot of information, including accounting guides, economic forecasts, guides to doing business and information on the tax climate per country.

2. Through which channels can you get finance and accounting services on the European market?

The European market for FAO can be divided into horizontal and vertical market segments. You can access these segments through several different market channels. The most realistic market channels for you are subcontracting through a European strategic partner or possibly through online platforms.

How is the end market segmented?

The European FAO market is large. All European companies are potential buyers of finance and accounting services because they all have to deal with financial transactions and their country’s tax system. However, some segments are more interesting to focus on than others.

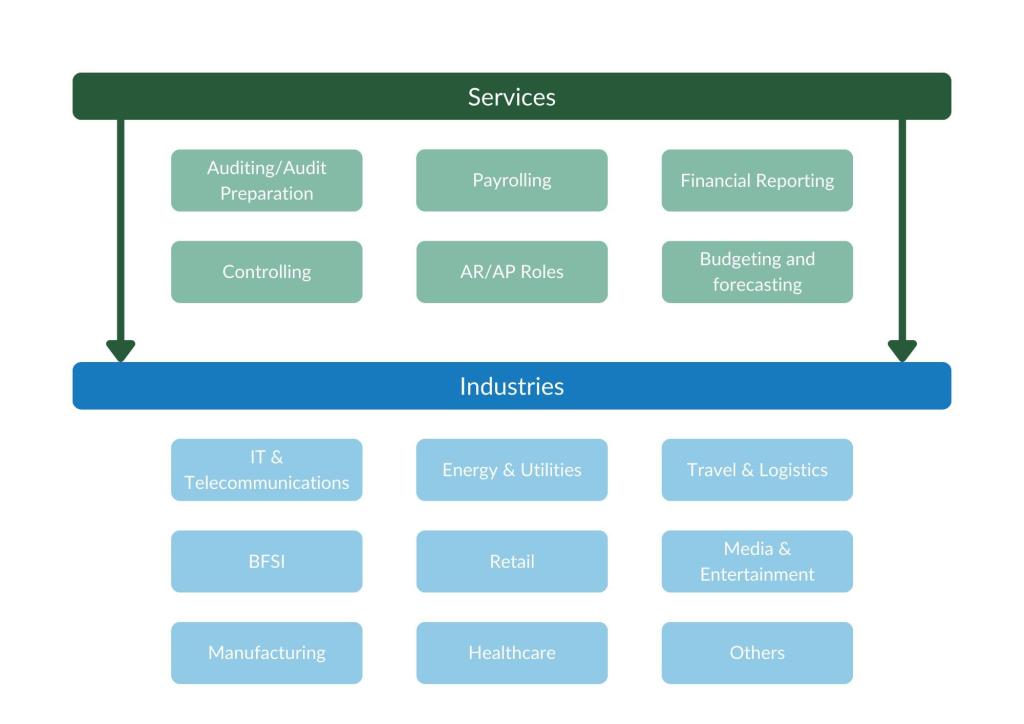

Figure 1: Finance and accounting outsourcing market segmentation

Source: Globally Cool

The largest horizontal markets within finance and accounting services are payroll and AR/AP roles. Most finance and accounting service providers offer more than one of the services mentioned in Figure 1. It is recommended that you do the same, since most European companies prefer working with service providers that can offer multiple (or all) services. Type of industry

Source: Grand View Research

Type of industry

The largest vertical markets for finance and accounting services include IT & Telecommunications, Banking, Financial Services and Insurance (BFSI), and manufacturing.

Example

As a finance and accounting outsourcing service provider, you offer your expertise to an IT company located in Scandinavia. Your services include managing the company's financial records, ensuring compliance with Scandinavian accounting standards, and preparing accurate financial reports. Additionally, you assist in payroll processing for the company's employees, handling tax filings in accordance with local regulations, and providing strategic financial advice to support the company's growth goals in the Scandinavian market. By tailoring your services to meet the specific needs of the IT industry in Scandinavia, you help the company maintain financial transparency, optimise its operations, and navigate the complexities of the regional business environment effectively.

Tips:

- Start with offering relatively standard, transaction-intensive processes. When you have established a solid relationship with your European partner, you can include more knowledge-intensive processes.

- Specialise in finance and accounting services for a specific industry or niche market segment to strengthen your value proposition. European companies prefer service providers with expertise in a specific service or industry. Look at some industry-specific examples here.

Through which channels do finance and accounting services end up on the end-market?

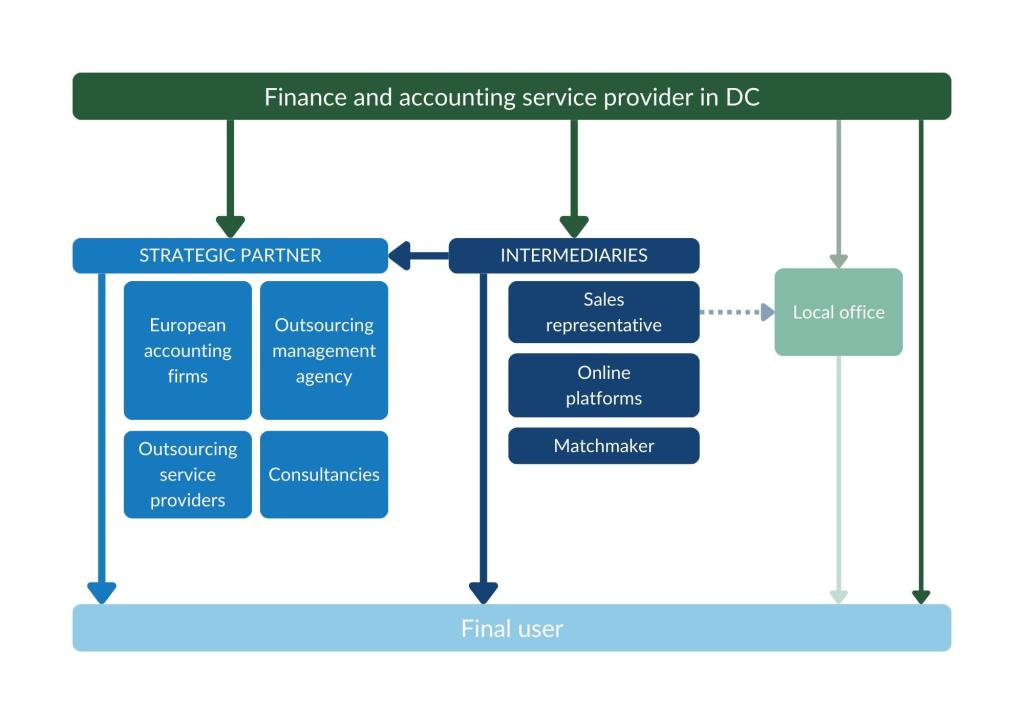

Figure 3 provides an overview of the trade channels you can use to enter the European market. This structure is very similar in every European country. Your most realistic market entry channel is to work with a strategic partner. They can help you find end users, or they find subcontracting partners for you. Becoming a subcontractor means European companies subcontract assignments to you that end user companies have contracted to them.

Figure 3: Trade structure for outsourcing finance and accounting services in the European market

Source: Globally Cool

Strategic partner

Working with a strategic partner is your most realistic market entry channel. They could be European accounting firms, outsourcing management agencies, outsourcing service providers or consultancies.

A provider that is similar to your company would be most suitable.

The relationship between a strategic partner and a subcontracted supplier (you) is generally characterised by:

- Trust;

- Dependence on each other;

- A structured relationship (functions, tasks, communication and procedures);

- Potentially limited marketing visibility and market access opportunities for the subcontracted supplier;

- No intellectual property (IP) rights, or a loss of IP rights for the subcontracted supplier;

- When there is no guaranteed amount of work, work orders are on an if/when-needed basis.

Please note that when you work with a strategic partner, they communicate with the final user of the finance and accounting service you offer. You are merely a subcontractor. The service provider (you) will not appear in marketing communications of the strategic partner. You will be referred to as ‘delivery centre’.

You can find a strategic partner either directly or by working with an intermediary. An intermediary is a good option because many European companies prefer to deal with a local contact person.

Tips:

- Attend leading (online) European trade fairs such as Accountex and the Future of Finance. These events enable you to meet potential customers and competitors and to stay up to date on the latest developments, technologies and tools.

- Do your homework and select events that fit your profile. Make a list of relevant events using trade event directories, such as 10Times and UK Exhibitions, and update it regularly.

- Use industry associations to find potential customers in Europe, such as the Association of Practising Accountants in the United Kingdom (UK), Deutscher BuchprüferVerband in Germany and Nederlandse Beroepsorganisatie van Accountants in the Netherlands.

- Use outsourcing associations to find potential customers, such as the Global Sourcing Association, the German Outsourcing Association and Sourcing Nederland.

Intermediary

You can work with an intermediary to find a buyer. This is different from working with a strategic partner where the final user of your services will most likely not know your name, because you are ‘just’ the subcontractor. However, you can use an intermediary to find a strategic partner. Examples of intermediaries are sales representatives, online platforms and matchmakers.

Sales representatives

These are more involved in the sales process than matchmakers. When working with a sales representative:

- The sales representative contacts prospects for you;

- The sales representative also makes the sales and sometimes manages projects to a certain degree;

- You pay a retainer and success fee (which can be expensive), or a fixed monthly fee;

- The sales representative can have multiple clients or work exclusively for you.

A good sales representative has a large, relevant network, so they do not make cold calls. Their success fee is often a percentage of the projects they bring in. Hiring a sales representative will increase your expenses, but you will be free to focus on your core business and search for other markets yourself.

Online platform

Electronic marketplaces are a cheap marketing tool that may make direct sales easier. They can also help you find companies to work for. Possibly as an independent consultant (someone from your team), or as a subcontracting team. These platforms used to focus on freelancers but are increasingly suitable for SMEs.

Matchmaker

A matchmaker is a person or company with many relevant contacts in a specific market segment or industry. As an intermediary, they are a “door opener” and not an agent to make cold calls or send cold emails. You have to properly inform your matchmaker about your company. They speak with many potential customers and often create long lists of potential outsourcing providers. The more information they have on your company and the better they understand your capabilities, the more they can spread the word about you.

If you work with a matchmaker:

- The matchmaker makes appointments with prospects for you;

- The presentation and sales process remains in your own hands;

- You pay a retainer and success fee (which can be expensive);

- The matchmaker usually has multiple clients;

- You need to set clear expectations and goals (and exit criteria) to measure their performance.

A retainer and success fee structure can be expensive. While the success fee depends on what the intermediary has delivered, you must pay the retainer (usually a fixed monthly payment) regardless of their performance. Together, they should provide a strong motivation for the intermediary to deliver: the retainer should be high enough to cover some of the costs, but low enough to encourage delivery. A properly drafted contract, by a lawyer, is a must!

You also need to determine an exit strategy in the contract, with a clearly defined period after which the contract can be terminated without any further consequences. This period is usually not longer than 3 or 4 months, after which the contract will be evaluated and can be terminated or prolonged. For this period, there should be clearly defined delivery expectations and targets for the consultant/matchmaker (such as the number of relevant contacts, meetings and leads). You could also negotiate a trial period.

Tips:

- Be cautious if intermediaries only ask a success fee for their work, because either they are excellent at their job, or they are desperate and may not (be able to) deliver. You should also be cautious if intermediaries want to work for you part-time besides their regular job, because they are often so busy that they do not deliver.

- When contracting an intermediary, involve a good lawyer who knows the applicable law of the country where the intermediary resides and has experience with this type of contracting. Pay special attention to exit clauses, success criteria, deliverables and payments.

- Try to avoid limitations to your marketing coverage and activities in your contracts.

- Some food for thought: although convenient, your uncle who lives in Germany might not be the best intermediary for your company.

Local office

Ideally, you should establish a local office in your European target market. You can also choose to open an office in one of Europe’s nearshoring destinations, which is generally cheaper.

A local presence makes it easier to build long-term relationships with customers through personal contact. It also increases your credibility, builds trust and allows you to retain complete control over your marketing and sales activities. However, this is very difficult in practice, as it requires a lot of experience and large investments. Most companies in developing countries are too small and/or do not have the financial strength or enough verified market opportunities for this.

Tips:

- Be aware that establishing a local sales office is very costly and you need a strong financial position.

- Consider establishing your own office if you have already established a client base in the target market, or if you have a well-founded indication of the demand for your services/products. If you decide to establish an office, involve your sales representative.

- Look for alternatives to lower your costs, such as business incubators or government incentives to bring your business to a particular country/region.

Direct sales

You can also try to sell your finance and accounting services directly to European end users. Many European companies are looking for cost reduction and delivery capacity, which developing countries can often provide. This is one of your unique selling points (or at least a competitive selling point).

Direct sales require experience in the European market and are most suitable for relatively large providers that want to target large European end users. Your best bet is to focus on a small, underserved niche market. For most suppliers from developing countries, however, it is very challenging to sell finance and accounting services directly. Sometimes, they work together to make a direct sales offer. Having one or more existing customers in Europe will help, as references are a must for direct sales.

Tips:

- Combine offline and online promotion channels to develop as many contacts as possible. This maximises your chances of finding suitable partners/customers. Use social media platforms as a marketing tool. LinkedIn can be particularly useful for making initial contacts and conducting market research.

- Have a professional, high-quality company website, where you can present full, accurate and up-to-date details of your offering at low cost. Make it compatible with mobile devices and invest in Search Engine Marketing and Optimisation (SEM/SEO), so potential customers can easily find you online.

- Look for potential leads on online platforms like UpWork, Freelancer, Fiverr, Clutch, and pliXos.

What is the most interesting channel for you?

Your most common and most promising market entry channel is through a strategic partner. If you want to sell your finance and accounting services directly, you should focus on SMEs.

Selecting a channel depends on:

- Your type of company;

- The nature of your product or service;

- Your target market;

- The available resources for market entry.

Regardless of the channel you choose, your own marketing and promotion is a vital part of your market entry strategy, and you are responsible for it.

3. What competition do you face on the European finance and accounting services outsourcing market?

The market for FAO is quite competitive. European companies generally prefer outsourcing to providers within their own country (also known as home sourcing or just outsourcing). When they do outsource to companies abroad, they usually prefer nearshore locations because of proximity, language, cultural similarities and the minimal time difference.

Which countries are you competing with?

India, Brazil, Vietnam, Ireland, Poland and Czechia can be considered your strongest competition. This selection is based on their location, their BPO industry and the Global Services Location Index (GSLI).

The Global Services Location Index ranks ITO/BPO destinations by competitiveness across 4 categories: financial attractiveness, people skills and availability, business environment, and digital resonance. The selection criteria for the GSLI are weighted as follows: digital resonance 60%, business environment 20%, financial attractiveness 10%, and people and skills 10%.

In general, European companies prefer to outsource services to providers within the same country (also known as domestic outsourcing or onshore outsourcing). For more information on nearshoring versus offshoring, see our study on the European market potential for finance and accounting services.

For FAO services, these 6 countries can be considered your strongest competition: India, Vietnam, Philippines, Poland, Czechia and Sri Lanka. Even though some countries are large outsourcing destinations, it does not automatically make them your biggest competition. However, you can learn from them.

The Global Services Location Index (GSLI) ranks the competitiveness of ITO/BPO destinations based on financial attractiveness, people skills and availability, business environment and digital resonance.

Table 1: Global Services Location Index

| Financial attractiveness (35%) | People skills and availability (25%) | Business environment (25%) | Digital resonance (15%) |

| Compensation costs | ITO/BPO experience and skills | Country environment | Digital skills |

| Infrastructure costs | Labour force availability | Country infrastructure | Legal and cybersecurity |

| Tax and regulatory costs | Educational skills | Cultural adaptability | Corporate activity |

| Language skills | Security of IP | Outputs |

Source: Kearney

Source: Kearney

In general, European companies prefer to outsource services to providers within the same country (also known as domestic outsourcing or onshore outsourcing). For more information on nearshoring versus offshoring, see our study on the European market potential for finance and accounting services.

India – Mainly known as a cheap bulk destination

India continues to lead the Global Services Location Index. This is mainly due to the country’s unique combination of low-cost services and excellent English language skills, because when it comes to digital resonance, India is only in 22nd place.

India does not have the best reputation when it comes to quality or added value. It is mostly known as a low-cost, low-quality bulk destination. If they want to stay relevant in the FAO market, they have to improve.

Example: do not only compete on price

India was one of the countries that successfully catered to the initial surge in demand for ITO and BPO, and continues to rely on low-skilled workers who perform services that meet the traditional demand. However, with the current digital transformation, a gap has emerged between the demand for digitally savvy professionals and the skillset of the workforce being developed in India.

This illustrates that although offering competitive rates is important, you should not compete only on price. As relatively simple (and therefore cheap) tasks can be automated, your focus should be on excellent skills, knowledge and creativity, which have a higher value. Demonstrating your commitment to quality through references and quality management systems is key to building trust among potential European clients, especially when it comes to cyber security services.

Vietnam – Steady climber with a reliable reputation

Vietnam has steadily climbed in the GSLI, going from position 24 in 2017 to 20 in 2019 and reaching sixth place in 2021. The country has done this by lowering its infrastructure costs and improving the business environment. Vietnam has a large workforce of young and skilled professionals that can meet the demands for several types of finance and accounting services. And although Vietnamese generally have low English proficiency, most Vietnamese FAO specialists have intermediate to upper-intermediate English language skills.

The average costs of compensation and infrastructure combined with an attractive tax system and solid government investments in education and Information and Communication Technology (ICT) make Vietnam a very interesting FAO destination for European companies.

Poland – increasingly struggles to find skilled workers, potential subcontracting destination

Poland has a high concentration of centres providing IT as well as finance and accounting services. It is even estimated that these 2 specialisations account for half of all employment in the outsourcing market. Centres that provide HR services, banking, financial services and insurance (BFSI) and customer contact services are also strongly represented in Poland.

Poland currently ranks 13th in the GSLI, after climbing ten places from 2019 to 2021 and one more from 2021 to 2023, primarily due to its financial attractiveness and start-up activity. Polish people also score very high on English proficiency, making it relatively easy for European clients to communicate with them. This makes Poland a particularly strong competitor.

As its finance and accounting industry flourishes, Poland may increasingly need to turn to offshore partners to meet demand. With relatively high rates for finance and accounting services, Polish software companies can actually achieve significant cost savings by outsourcing some tasks or projects to you.

Philippines – Large workforce

The Philippines is an important outsourcing destination for finance and accounting services. They have access to a large, highly skilled talent pool, with almost 300,000 students enrolling in finance and accounting-related studies each year.

The Philippines can offer competitive pricing and are known for their strong work ethic. Philipinos also have good English skills, which makes them relatively easy to work with.

Tips:

- Compete on the quality of your services, rather than just on costs.

- Visit the websites of outsourcing associations, and finance and accounting associations in particular, to get a better understanding of competing countries. Examples are the central and eastern European Outsourcing Association (CEEOA) and the Ghana Export Promotion Authority (GEPA).

- There are also blogs online that compare finance and accounting outsourcing destinations, or outsourcing destinations in general, you can have a look and see how your country is performing.

Which companies are you competing with?

Examples of successful finance and accounting service providers from the abovementioned 6 countries are:

India

TopSource is a successful FAO provider from India. They have a good website that clearly states their services and also has an extensive FAQ section with the most frequently asked questions. You can find more FAO providers in India, and reviews of these companies, on the website of Clutch.

Vietnam

Most FAO service providers in Vietnam are subsidiaries of large international companies like Deloitte, KPMG and EY. But there are also smaller Vietnamese founded companies like SEOU Vietnam. Many smaller Vietnamese companies cater to the Chinese market. You can find more FAO providers in Vietnam, and reviews of these companies, on the website of Clutch.

Poland

There are numerous BPO providers in Poland, many of which operate in the FAO industry. One example is Getsix. They stay up to date with legal developments, providing tax and legal advice. Their team consists of accountants, HR specialists, lawyers, tax consultants, and IT experts. They ensure high-quality service for international and domestic clients. You can find more FAO providers in Poland, and reviews of these companies, on the website of Clutch.

Tips:

- Use the services of your national export promotion agency and actively participate in the creation of export strategies.

- Search company databases to find more competing companies. These databases can be free, like company.info, paid databases provided through chambers of commerce (such as the Dutch Kamer van Koophandel), or commercial databases like Bold Data.

Which products are you competing with?

There is no product to compete with in finance and accounting services, as the product is the service. At the same time, every company in Europe must deal with financial tasks that could be outsourced to a company like yours.

So the real question is: What makes one service provider different from another? What helps you to stay competitive? The answer is: security infrastructure, available capacity, references, language skills, reliability, communication, quality management, vertical and/or horizontal market focus, among other things.

Automation is a competitor

If anything can be seen as competition in the FAO sector, it is automation. Automation has led to fewer outsourcing of routine finance and accounting tasks such as data entry or transaction processing. However, there is increasing need for more value-added finance and accounting services. European companies therefore might outsource more strategic functions such as financial analysis, compliance management, or risk assessment, where human judgment and specialised skills are crucial.

Source: Gartner

Figure 5 shows that most industries are now using finance and accounting software. Software adoption is higher among larger companies than mid-size or small companies. In 2024, the most popular accounting software are NetSuite, Quickbooks, Sage, Xero, Fresh Books and Oracle.

The search for automation is expected to grow, so the threat of automation will increase. Opportunities exist if you can combine your services with some level of automation and if you can offer added value.

Tips:

- Focus on services that are difficult to automate or offer services/solutions that already contain some level of automation.

- Reduce the threat posed by automation by offering consistent, high-quality products/services, compliance and reliability. You should follow developments in new technologies and models. Build capabilities in these areas to avoid being replaced by providers with newer technologies.

4. What are the prices of finance and accounting services outsourcing?

Finance and accounting services outsourcing is a relative commodity, therefore the market is a bit more price sensitive than other BPO markets. But like in all markets, the price has to be right and competitive.

Nearshoring countries want to keep their prices competitive

Nearshoring countries are quickly losing their advantage of offering cost savings, because the prices for finance and accounting services have grown very fast over the last 5 years.

Source: Auxis

*data based on USA statistics, but can be applied to western and northern European countries as well

As you can see in figure 1, the average costs for these 4 positions rose by almost 30% from 2019 to 2022. These situations are even worse in larger markets such as London, Frankfurt and Amsterdam. Within the next few years, finance and accounting salaries are expected to grow. This is because there is a large accountant shortage in Europe.

Prices in nearshoring countries are also rising. This makes service providers in these countries less competitive than offshore service providers, which makes European companies more open to outsourcing to more remote destinations. You can also choose to form subcontracting partnerships with these nearshoring providers or to compete with them.

European companies prefer to outsource services to providers within the same country. When outsourcing abroad, they prefer providers in nearshore locations because of language, proximity, cultural similarities, and minimal time difference. Europeans increasingly expect finance and accounting experts to be available and responsive 24/7, which means some overlap in business hours between the 2 companies is desirable.

Traditionally, the buyer markets for finance and accounting services are western and northern European countries. The most popular nearshoring locations for buyers in these countries are central and eastern European (CEE) countries such as Poland, Bulgaria and Romania. Not only do these countries offer the usual nearshoring benefits, but they are also members of the European Union. So their contracts and payments are governed and protected by the same European legislation as in the buyers’ countries.

Tips:

- Limit the possible disadvantages of being offshore. Provide excellent communications, availability in the required time zone, and good security and privacy measures.

- Differentiate yourself from domestic and nearshore providers to remain competitive. Emphasise how you are different in your marketing message. Do not compete only on price, but also analyse what other advantages you can offer, such as access to skills or specialised industry expertise.

- Partner up with nearshore service providers, for example in CEE countries that may be looking for cheaper providers with available personnel. Many service providers in developing countries have not yet recognised this opportunity.

How to determine your price

Labour expenses, technology investments, financial reporting and analysis are fundamental components of the cost structure for outsourcing accounting services. Other aspects also contribute to the price, such as bill payment and coding, along with many additional services like accounting bookkeeping support, invoicing and collection, and budgeting and cash flow forecasting reports.

Example

XYZ Accounting, a German-based accounting firm, offers outsourcing accounting services tailored to their clients' needs. Their basic package, priced between €400 and €500 per month, includes monthly financial reports and better financial insights. Additional services such as weekly check-ins with a dedicated team, payroll services, bill payment and general ledger/chart of accounts coding are available for €2,000 to €2,500 per month, depending on the selected services.

In Europe, getting the pricing right is very important, especially in the FAO industry where demand drives the market. FAO operates in a competitive environment where price plays a big role. Buyers hold the power because they have many service providers to choose from around the world, all offering similar services. With more countries entering the outsourcing scene, buyers have even more options. However, switching providers can be costly and risky, which can limit the buyer's ability to easily change service providers.

In finance and accounting services, the most commonly used pricing models are:

- Full-time equivalent-based pricing (FTE: generally 8 hours per day, 5 days per week);

- Transaction-based pricing;

- Outcome-based pricing. .

If you want to determine the average prices, you need to look at the exact services you want to calculate a price for, because finance and accounting services are a very diverse industry.

Traditional FAO

All services are processed on the site of the outsourcing provider. They use their own software application environment. The service provider can provide tools to give the customer access to the data and financial reports. For example, through their customer extranet.

Hybrid FAO

With this solution, the service provider and the customer use the software application environment together. They sign a Service Level Agreement (SLA), which defines which tasks will be done by the customer and which ones by the service provider.

FAO on a remote system

The service provider uses the software environment provided by the customer (for example SAP). The documents and information needed for processing are provided by the customer.

If you focus on a niche or non-commodity market, European buyers are often less price sensitive.

Tips:

- Check the cost and wages of people in your sector on websites like Payscale, a global database for salary profiles.

- Check out online sources that help you price your accounting services; they can help you get the price that you are worth. Go beyond setting the right price and work out your pricing strategy. This could include your preferred pricing model (and your clients’ preferred pricing model), payment terms and expectations, and how and when you offer discounts.

- Create the “ideal” client persona to help you tailor your offer. An example of a client persona is: “a finance and accounting service provider with fewer than 200 staff members, in the Munich area, specialised in accounting for the healthcare sector”. Check out online resources which can help you writing the right client persona for you.

Globally Cool carried out this study in partnership with Laszlo Klucs on behalf of CBI.

Please review our market information disclaimer.

Search

Enter search terms to find market research